We dove into the latest data for java leaders Starbucks, Dutch Bros., and Dunkin’ – to discover how each brand drove visits in Q2 2024 and explore coffee consumer visit patterns heading into the summer.

Key Takeaways:

- Since the week of May 6th, Starbucks’ summer promotions have driven consistent weekly year-over-year (YoY) visit increases, putting the chain's overall YoY foot traffic gains at 2.3% in Q2 2024.

- Also in Q2 2024, visits to Dutch Bros. increased 15.0% YoY, partly due to an expanding footprint. The brand also sustained YoY visit-per-location gains for most of H1, highlighting strong demand for the chain as it grows.

- Dunkin’s National Donut Day promotion on June 7th, 2024 proved to be a critical retail moment that sparked consecutive weeks of YoY foot traffic growth for the coffee leader.

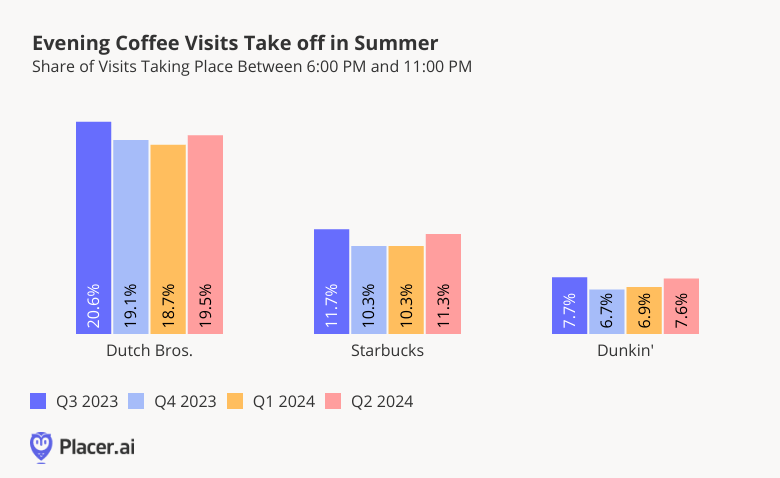

- All three coffee chains experience significant evening foot traffic upticks during the summer – positioning them for more evening visits as the summer gets into full swing.

Starbucks’ Promotions Provide Stable Visit Growth

Starbucks has been finding foot traffic success this summer with promotions that seem to be resonating with consumers. In May 2024, the chain launched 50% Off Fridays (beginning May 10th), special Monday Deal Drops (beginning May 13th), and limited-time only summer drinks. And in June, Starbucks’ promotions continued with a new Pairings Menu and a round of handcrafted iced beverages.

Since the week of May 6th, 2024, weekly traffic to Starbucks has been consistently elevated YoY – with visits up 2.3% YoY for Q2 2024 as a whole – indicating that Starbucks’ array of summer promotions are shoring up traffic to the chain.

Dutch Bros. Leans Into Expansion

Like Starbucks, Dutch Bros. ushered in the warm season with a special line-up of summer drinks in May 2024. But even before the launch of these seasonal promotions, the coffee powerhouse has been driving visits.

In Q2 2024, Dutch Bros.’ visits increased 15.0% YoY amidst ongoing fleet expansion. And throughout H1 2024, monthly visits-per-location increased YoY nearly across the board – surpassing the wider category average – indicating that Dutch Bros.’ growth is meeting robust demand.

In June 2024, Dutch Bros. saw 5.7% YoY visit-per-location growth, the chain’s largest increase of the year so far. With more planned expansions, an additional promotional drink release in July, and continued steps to advance mobile ordering and its rewards program, Dutch Bros. appears poised to drive growth in the back half of 2024 as well.

Dunkin’ Drives Foot Traffic With National Donut Day

Though indisputably a coffee chain, Dunkin’ is still donut-obsessed and celebrates the doughy treat every year on National Donut Day (this year, June 7th). Among its many promotional events this summer, Dunkin’ treated customers to a free donut with the purchase of a beverage on the big day. And the milestone turned out to be Dunkin’s busiest day of the year so far – driving a 28.4% foot traffic increase compared to the daily year-to-date average (January 1st to July 20th, 2024).

Indeed, National Donut Day seems to have kickstarted Dunkin’s busy summer. Following several weeks of flagging YoY visit performance in May – likely attributable in part to the chain’s strong May 2023 performance – Dunkin’ saw a YoY visit boost of 4.5% during the week of June 3rd, 2024. And subsequent weeks have seen a continuation of this positive momentum, as the chain continues to promote its summer fare.

Summer Nights Drive Visits to Coffee Chains

Starbucks, Dutch Bros., and Dunkin’ each do summer in their own way. But one thing all three chains have in common is an increase in evening visits during the summer months.

In Q3 2023, including the peak summer months of July and August, all three chains experienced significant upticks in evening visits (between 6:00 and 11:00 PM). During the winter months – Q4 2023 and Q1 2024 – the share of visits taking place in the evenings dropped for all three chains, before picking up again in Q2 2024.

A variety of factors may be behind this summer shift in coffee consumption. Consumers may be more likely to be out socializing during lazy summer evenings – when students are off and many Americans take vacation. Extended daylight hours in summer may also entice more consumers into an extra caffeine boost later in the day.

If last year’s Q3 evening coffee visit boost is any indication, Starbucks, Dunkin’, and Dutch Bros. may all be in for evening foot traffic increases as the summer wears on.

Full Steam Ahead

How will these coffee giants stay hot during the final stretch of summer and will they maintain their momentum going forward?

Visit Placer.ai to find out.

.svg)

.png)

.png)

.png)

.png)