Consumers continue to prioritize health and wellness, putting the fitness space in a strong position even as economic headwinds and value-seeking shape discretionary spending. With 2026 now underway – and the industry’s peak sign-up season in motion – we took a closer look at Planet Fitness, one of the category’s largest players, alongside broader fitness trends to put our finger on the pulse of fitness in 2026.

Planet Fitness Continues to Bulk Up

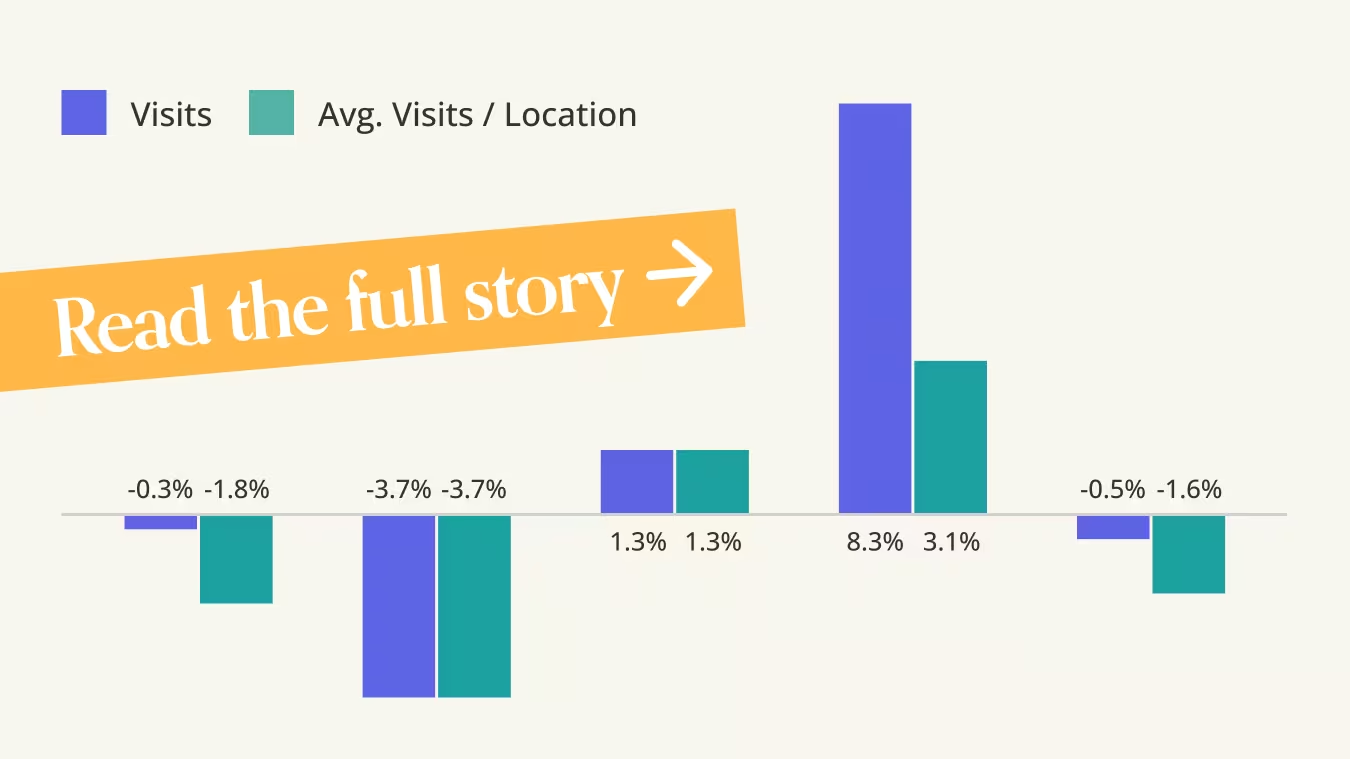

Through most of 2025, Planet Fitness – and the fitness category as a whole – maintained YoY monthly visit growth. February 2025 marked the lone dip in visits for both Planet Fitness and the broader category, likely driven by inclement weather that temporarily kept some consumers out of gyms.

And Planet Fitness’ growth outpaced the wider category nearly every month, with the chain's momentum likely reflecting continued expansion – part of its multi-year growth strategy. Planet Fitness’ average visits per location were also up YoY – aligned with overall category levels – suggesting new gyms are meeting incremental demand rather than redistributing existing traffic.

In January 2026, Planet Fitness continued to experience visit growth, perhaps as New Year’s resolution-driven sign-ups helped lift traffic. Combined with the chain’s ongoing unit expansion, this dynamic could support continued gains as the brand moves further into 2026.

Low-Priced Chains Flex Their Advantage

Planet Fitness’ recent gains may also reflect a broader shift within the fitness landscape toward low-priced membership models.

The chart below shows that since at least the start of 2024, visits to budget-friendly gym chains (monthly fees under $30) such as Planet Fitness have consistently outpaced those to mid-tier ($30-$60) and premium competitors ($60+).

But the divergence became more pronounced beginning in early 2025, when traffic growth of premium fitness chains fell off sharply while low-priced gyms continued to see visits accelerate. In a retail environment defined by heightened price sensitivity and value-seeking, lower-cost memberships appear to be resonating with consumers looking to manage discretionary spending while higher-cost concepts face mounting pressure.

Moreover, once a gym membership is paid for, price-conscious consumers could be leaning more heavily into fitness visits as a way to spend time outside the home without opening their wallets – especially as other “going out” activities have become more expensive.

Early 2026 Check-In: Visitor Reps Point to Mixed Momentum

As the fitness industry moves through the early months of 2026, one of the most telling indicators to watch is visitor frequency. During the peak sign-up season, this metric offers an early read on member engagement – and on whether new joiners are building habits that support longer-term retention.

In January 2026, visitor frequency to Planet Fitness held steady, even as several other analyzed gym chains saw slight declines. The dip elsewhere may be partly attributable to Storm Fern, which likely disrupted routines and temporarily curtailed gym visits across affected regions. Against that backdrop, Planet Fitness’ stable frequency stands out as a relative bright spot.

Still, with resolution-driven sign-ups typically extending through much of Q1, it may be too early to draw firm conclusions about full-year performance. As weather-related effects fade and new members settle into routines, frequency trends over the coming months should offer clearer insight into how the category – and Planet Fitness in particular – is positioned for the rest of 2026.

Another Year For Fitness

Planet Fitness’ ability to grow visits, sustain per-location demand, and hold visitor frequency steady early in 2026 suggests the brand is benefiting from both internal strategy and favorable category-level tailwinds. While it remains early in the year, the underlying trends indicate that low-cost fitness models, and Planet Fitness in particular, are well-positioned as consumers prioritize cost-effective ways to stay active.

Which gyms will grow in 2026? Visit Placer.ai/anchor to find out.

Placer.ai leverages a panel of tens of millions of devices and utilizes machine learning to make estimations for visits to locations across the US. The data is trusted by thousands of industry leaders who leverage Placer.ai for insights into foot traffic, demographic breakdowns, retail sale predictions, migration trends, site selection, and more.

.svg)

.png)

.png)

.png)

.png)