As inflation continues to squeeze household budgets, restaurants are turning to limited-time offers (LTOs) to attract cost-conscious consumers. These promotions help create buzz among patrons and drive foot traffic.

We take a closer look at several dining chains – Buffalo Wild Wings, Starbucks, Chili’s, and McDonald’s – to see how their recent LTOs were received by diners.

Buffalo Wild Wings: Unlimited Boneless Wings

Buffalo Wild Wings is no stranger to limited-time offers – the chicken-centric restaurant gave away free chicken wings after this year’s Superbowl went into overtime, marked National Beer Day with $5 beers, and offered a whole slew of March Madness deals.

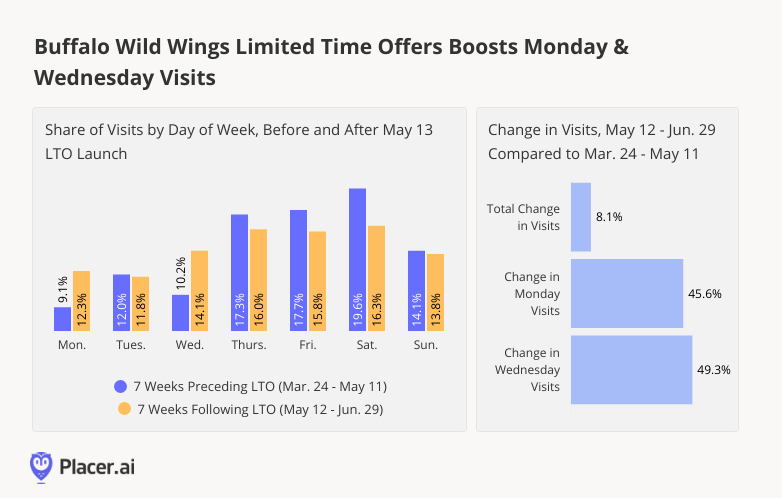

The chain’s recently introduced LTO – unlimited boneless wings every Monday and Wednesday for just $19.99 – launched on May 13th, and is slated to run through July 10th, 2024. And comparing visitation patterns during the seven-week period immediately following the launch (May 12th - June 29th, 2024) to those during the seven-week period preceding the launch (March 24th - May 11th, 2024), shows just how well-received this LTO has been.

Foot traffic to Buffalo Wild Wings rose 8.1% immediately after the launch, largely due to outsized Monday and Wednesday visit increases of 45.6% and 49.3%, respectively. And during the seven-week period following the introduction of the LTO, the chain’s share of Monday visits shot up from 9.1% to 12.3%, while its share of Wednesday visits increased from 10.2% to 14.1%.

Starbucks: Discount Fridays Boost Foot Traffic

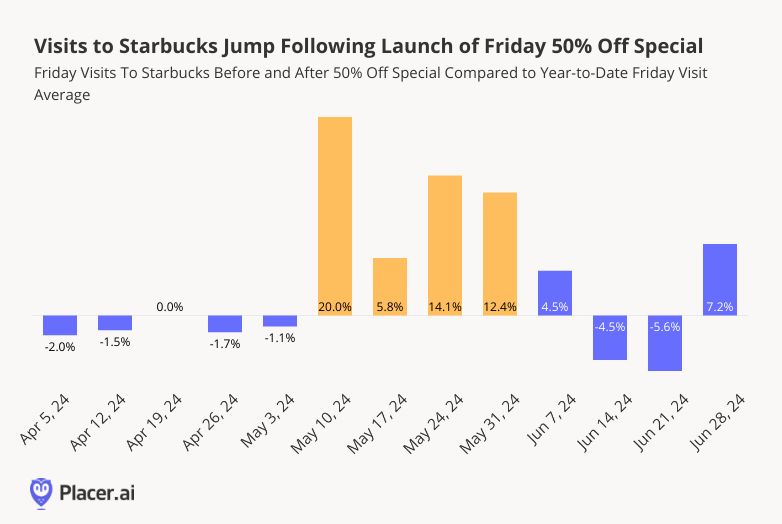

Starbucks has been leaning into value offerings – and in addition to its new “pairings” menu, the coffee giant also rolled out a limited-time 50% Friday discount exclusively for app users, which began on May 10th, 2024 and lasted through the month. Analyzing Starbucks’ visitation patterns shows that the promotion led to a significant increase in Friday foot traffic at Starbucks locations nationwide.

Compared to the year-to-date average, visits to Starbucks on Fridays following the launch experienced a noticeable increase in visits. Where the visits to Starbucks on Friday May 3rd, before the promotion launched, were 1.1% lower than the year-to-date (YtD) Friday visit average, visits on May 10th – when the promotion launched – jumped by 20.0% above the YTD visit average.

This special, which excluded hot brewed coffee and tea, seems to have met people’s desires for a refreshing afternoon or pre-weekend pick-me-up.

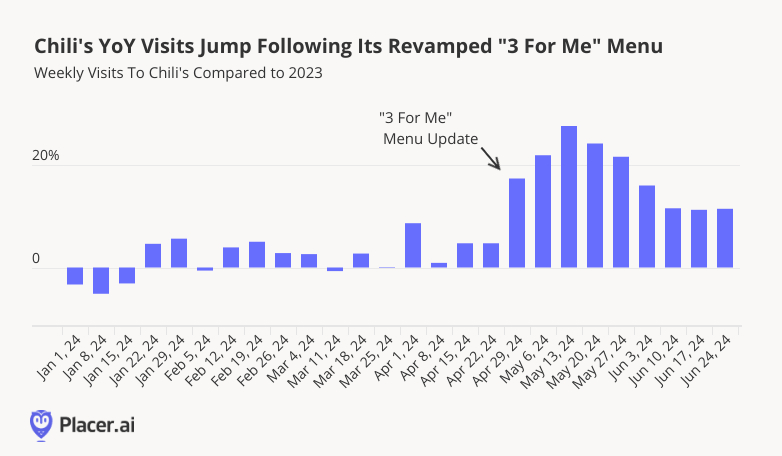

Chili’s Chicken Sandwich Captivates Customers

On April 29th, 2024, Chili's Grill & Bar revamped its "3 for Me" menu, which offers customers a customizable three-course meal at a value price – and weekly YoY visits to Chili’s have been strongly elevated ever since. Even before the updated menu roll out, YoY foot traffic to Chili’s was largely positive, reaching 8.6% in the week of April 1st, 2024. But since the kickoff, YoY visits have remained consistently higher – and have yet to taper off.

In addition to Chili’s new Big Smasher Burger, another menu item that seems to be driving excitement is its chicken sandwich – an offering that tends to increase foot traffic wherever it shows up.

McDonald’s Meal Deals Bring In The Visits

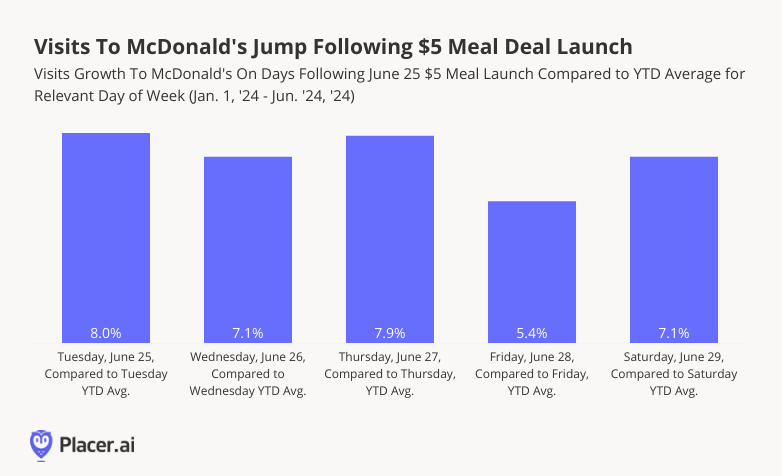

McDonald’s has also been a leader at boosting visits by offering limited edition sauces, drinks, and deals. And the chain’s most recent LTO leans hard on consumers’ recent affinity for value. On June 25th, 2024, the chain announced a $5 Meal Deal, which includes a McDouble or McChicken, 4-piece Chicken McNuggets, small fries, and a small soft drink.

These deeply discounted prices are likely to be particularly appealing to customers against the backdrop of McDonald’s rising menu prices, which have been significantly impacted by inflation. Indeed, foot traffic to the chain jumped following the $5 special launch, with visits to McDonald’s exceeding year-to-date daily visit averages.

The Tuesday of the launch – June 25th – was McDonald’s busiest Tuesday of the year thus far (outpaced since by July 2nd), drawing 8.0% more visits than the year-to-date Tuesday average. And similar patterns repeated across all days following the launch, signifying how well-received this special has been among McDonald’s fans.

Limited Time Deals & Steals

The foot traffic boosts provided by these limited-time-offers prove that, in times of inflationary pressure, a good deal can continue to bring visitors into a fast-food spot.

How will the dining value wars continue to play out in the months ahead?

Visit Placer.ai to find out.

.svg)

.png)

.png)

.png)

.png)

.avif)