Walmart and Target both ushered in new CEOs this month – but the two executives are starting from very different positions. Walmart is riding a wave of strength, supported by positive visitation trends and solid comparable sales growth, while Target continues to struggle to regain momentum amid softer demand. Recent foot traffic data reveals the distinct challenges – and opportunities – facing each leader as 2026 gets underway.

Walmart Continues to Thrive

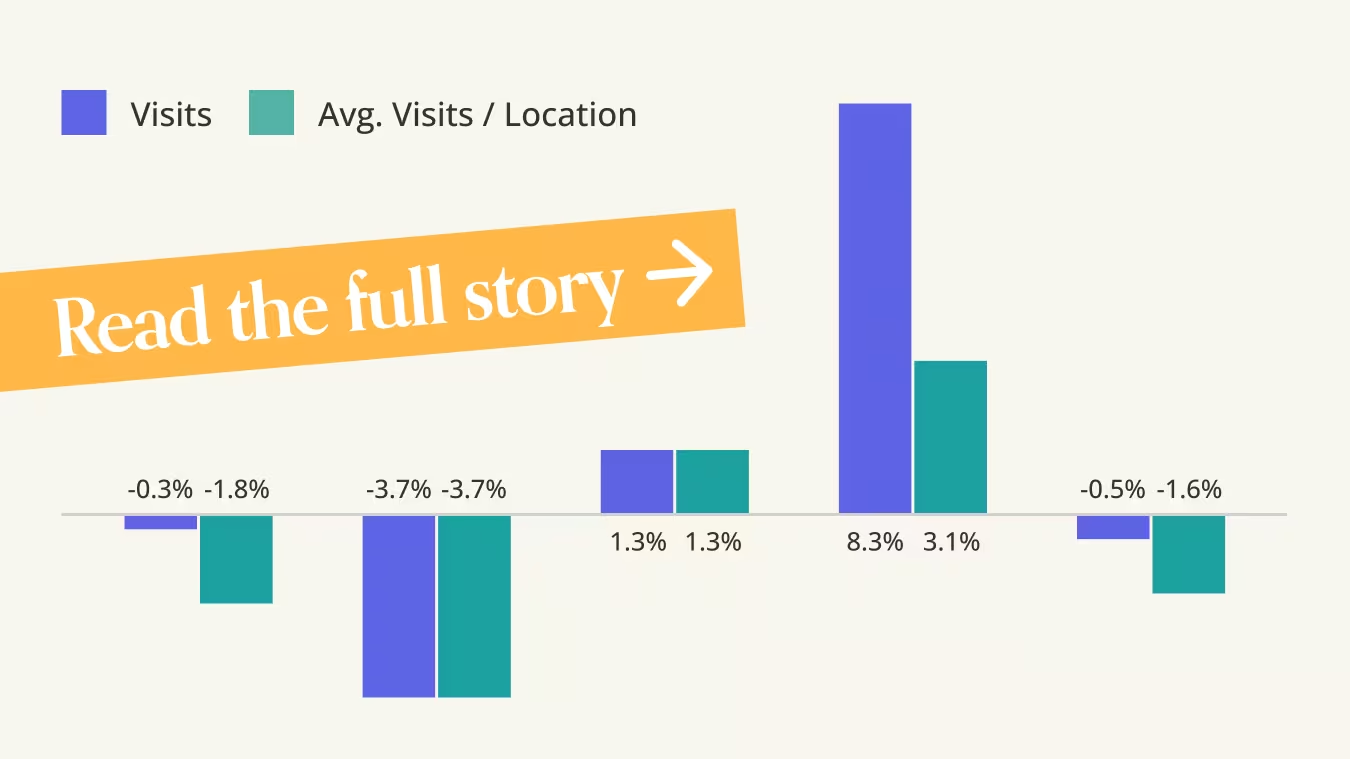

After a relatively modest summer, Walmart’s traffic strengthened meaningfully in the back half of 2025. The retailer closed Q4 with visits up 2.3% year over year (YoY) and that momentum accelerated further in January 2026 – helped in part by an additional Saturday on the calendar.

This traffic performance aligns with the strength Walmart has reported in recent quarters. For the 13-week period ending October 31st, 2025, the company posted 4.5% U.S. comparable sales growth, driven by both higher transactions and larger baskets. While e-commerce – up a robust 28% YoY – remained the primary growth engine, the positive traffic trends shown in the chart below also point to solid in-store demand.

Walmart’s recent performance puts new CEO John Furner in a position of strength. Traffic and sales gains support his focus on value, digital growth, and higher-margin revenue streams like advertising – though maintaining store performance and margins will be critical as those efforts scale.

Work Cut Out for New Target CEO

Target’s new CEO Michael Fiddelke faces a more complex reset. In its most recent earnings report, the retailer posted a 2.7% year-over-year decline in comparable sales, driven by a 3.8% drop in in-store comps as discretionary categories softened. Digital comps rose 2.4%, supported largely by same-day services, but that growth was not enough to offset store-level weakness.

Foot traffic data through the second half of 2025 reflects a similar dynamic, with YoY visit declines in every month except October and Q4 visits down 2.0%. While traffic ticked up in January 2026, that improvement was likely influenced at least in part by the extra Saturday this year and should be interpreted cautiously. For Target, the data suggests that a sustained recovery will depend on the effectiveness of Fiddelke’s turnaround strategy, which centers on sharper merchandising curation and improvements to the guest experience.

Weekends Reveal the Core Disconnect

Target’s renewed focus on merchandising curation and the in-store experience appears aimed at reengaging discretionary shoppers – and a closer look at weekday versus weekend traffic suggests this focus is well aligned with where the retailer is seeing the most pressure. While Walmart posted relatively consistent visit trends across weekdays and weekends in 2025, reinforcing the resilience of its essentials-driven model, Target experienced a much steeper YoY decline on weekends.

Because weekends likely capture more browsing-oriented, discretionary trips at Target, the disproportionate weakness during these periods may highlight where the retailer is most exposed. And these traffic patterns help explain why improvements to assortment and the in-store experience have become central to efforts to rebuild momentum.

A Tale of Two Starting Lines

As 2026 begins, Walmart is building on strength. Traffic gains, balanced visit patterns, and sales growth suggest the retailer is entering the year with momentum – and optionality.

Target, meanwhile, remains more exposed to discretionary demand, where trips are easier to defer and harder to win back. Until those visits return in a more consistent way – particularly on weekends – the gap between the two retailers is likely to persist.

For more data-driven retail analyses, follow Placer.ai/anchor.

Placer.ai leverages a panel of tens of millions of devices and utilizes machine learning to make estimations for visits to locations across the US. The data is trusted by thousands of industry leaders who leverage Placer.ai for insights into foot traffic, demographic breakdowns, retail sale predictions, migration trends, site selection, and more.

.svg)

.png)

.png)

.png)

.png)