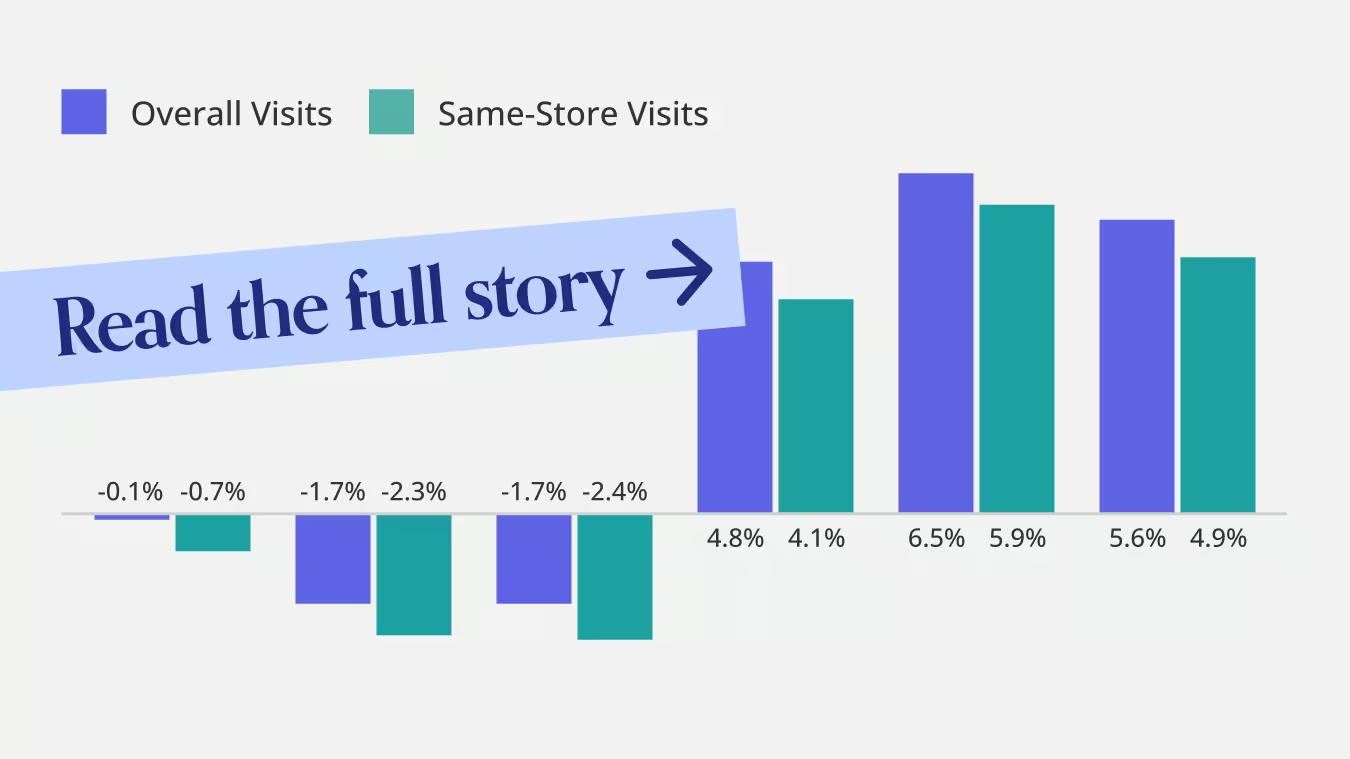

McDonald’s Builds Visit Momentum Heading Into 2026

McDonald’s ended 2025 with clear visit momentum, reversing earlier softness and posting steady gains in the back half of the year. Same-store visits followed a similar trajectory, indicating that growth was driven by stronger underlying demand rather than unit expansion. This late-year rebound positions McDonald’s with solid visit momentum heading into 2026, suggesting improving consumer engagement as the year closed.

Higher-Frequency Diners Drive McDonald’s Visit Growth

Some of the visit growth is likely due to the chain's popular Q4 LTOs – but diving deeper into the visit frequency data suggests that McDonald’s long-term investment in its loyalty program is also playing a part. The company's launch of MyMcDonald’s Rewards in 2021 seems to have succeeded in shifting traffic toward higher-frequency, incremental visits rather than relying on new customer acquisition.

Compared to pre-loyalty levels in H2 2019, a growing share of McDonald’s visits now comes from diners visiting an average of 4+ times per month, with the share of visits from consumers visiting the chain an average of 8+ times per month showing the most dramatic growth. Grouping YoY visit trends by visit frequency also shows that visits from high-frequency diners grew the most compared to H2 2024 and H2 2019. This dynamic points to a core benefit of loyalty-led growth: driving incremental visits from existing customers is typically far more efficient than acquiring new ones, especially in a mature, highly penetrated category like quick service restaurants.

McDonald’s executives have been explicit that loyalty is designed to increase frequency, not just enrollment. The continued growth of the program through 2025 – including deeper integration with value offers and digital ordering – suggests McDonald’s is still finding room to extract incremental visits from an already loyal base.

What McDonald’s Loyalty Strategy Signals for Other Restaurant Chains

For other restaurant chains, McDonald’s experience points to the value of using loyalty as a lever for incremental growth, particularly once a customer has already been acquired. While many QSR brands continue to drive expansion by entering new markets or opening additional locations, McDonald’s data illustrates how meaningful gains can also come from increasing visit frequency among existing customers. Even without McDonald’s scale, the underlying strategy is broadly applicable: converting first-time or occasional visitors into higher-frequency customers can serve as a complementary – and often more efficient – path to growth alongside physical expansion.

Will these lessons shape the QSR space in 2026? Visit Placer.ai/anchor to find out.

Placer.ai leverages a panel of tens of millions of devices and utilizes machine learning to make estimations for visits to locations across the US. The data is trusted by thousands of industry leaders who leverage Placer.ai for insights into foot traffic, demographic breakdowns, retail sale predictions, migration trends, site selection, and more.

.svg)

.png)

.png)

.png)

.png)