With summer winding down (sigh!) and undergrads nationwide heading back to campus, we dove into the data to explore consumer behavior in college towns – where students and other university-affiliated communities make up a substantial share of the overall population.

Once again, we focused our analysis on nine CBSAs dominated by the comings and goings of a university-centered community – including Ithaca, NY (Cornell University); State College, PA (Penn State); Bloomington, IN (Indiana University); Lawrence, KS (University of Kansas); College Station-Bryan, TX (Texas A&M); Columbia, MO (University of Missouri); Champaign-Urbana, IL (University of Illinois); Ann Arbor, MI (University of Michigan); and Gainesville, FL (University of Florida). How does college life impact local retail performance? And what lies ahead for popular back-to-college shopping destinations as the school year begins?

We dove into the data to find out.

Retail Giants Thrive in College Towns

Retail giants Target and Walmart have been thriving in recent months. And nowhere has this been more true than in college towns, where the two behemoths are popular destinations for college students. Nationwide, college students make up just small percentages of the chains’ customer bases. But in college towns, the picture is very different.

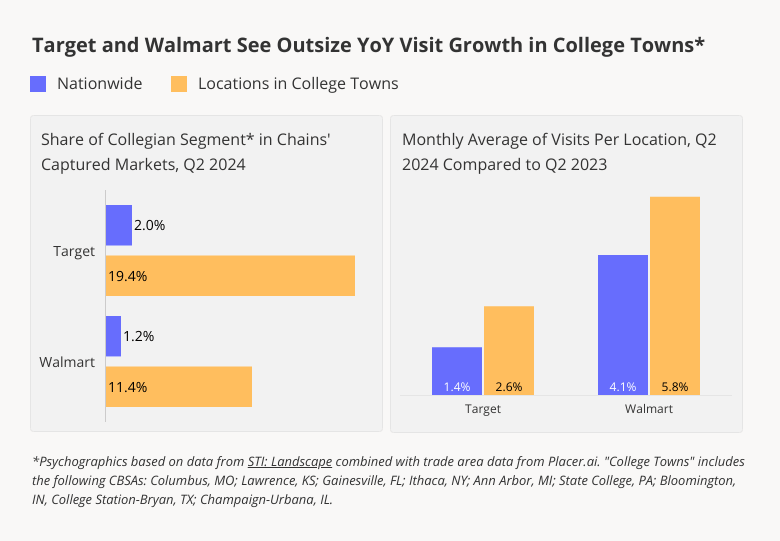

In Q2 2024, STI: Landscape’s “Collegian” segment – a group encompassing currently enrolled college students living both on and off campus – made up a remarkable 19.4% of Target’s captured markets in the analyzed CBSAs. Though Walmart’s audiences in these cities included smaller shares of undergrads, the coveted demographic comprised an impressive 11.4% of its local captured markets.

And superstore locations in the analyzed college towns experienced higher-than-average YoY visit growth in Q2 – showcasing the power of this demographic to drive retail success. Target, for example, saw a 2.6% YoY increase in average monthly visits per location in college towns – compared to 1.4% nationwide. And Walmart followed a similar pattern, with average monthly visits per location up 5.8% in college towns, compared to 4.1% nationwide.

Back-to-College August Rush

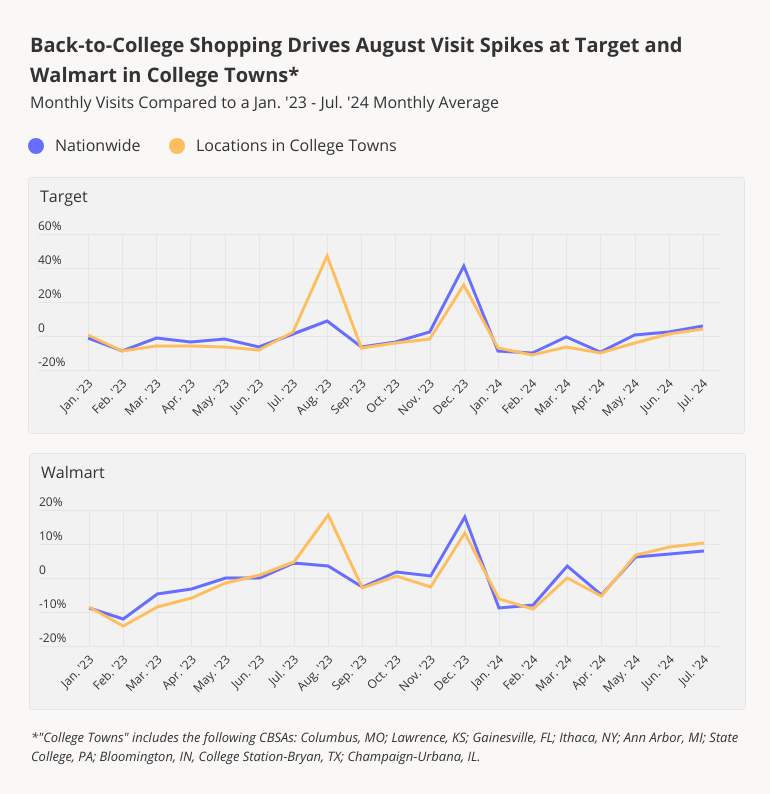

With a strong Q2 2024 under their belts, Target and Walmart both appear poised to enjoy an even stronger back-to-college shopping season. And a look at seasonal fluctuations in visits to the two retailers shows just how important the summer shopping scramble is for retailers in these CBSAs.

Nationwide, Target experiences its biggest monthly visit spike in December, when consumers throughout the country fill up their carts with holiday fare and gifts for loved ones. But in college towns, Target’s August visit spike is even bigger than its December one – as students load up on everything from dorm furniture to school supplies. Walmart, too, experiences a college-town August visit bump outpacing the one seen in the run-up to Christmas.

Filling Up on Goodies

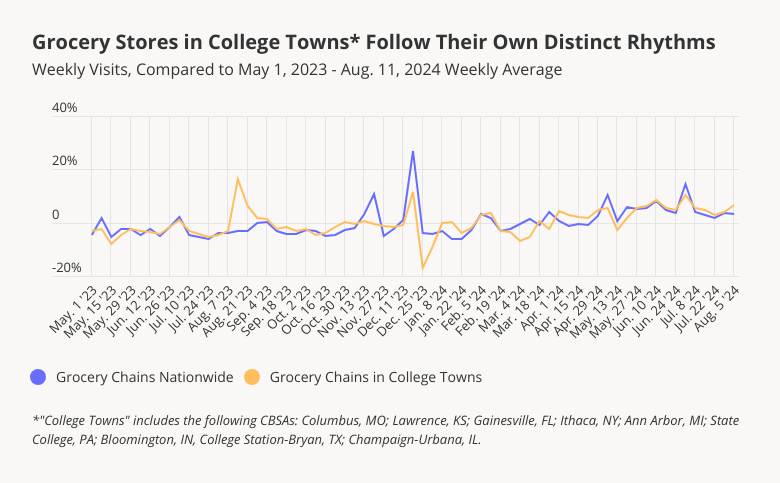

College students may eat many of their meals on campus – but they also frequent grocery stores, whether to pick up snacks or to buy ingredients for off-campus, home-cooked meals. And like superstores, grocery chains in college towns follow unique seasonal rhythms of their own.

Nationwide, grocery stores tend to see weekly visits peak in November and December. But in college towns, these holiday retail milestones carry less weight, as many collegians head home for Thanksgiving and Christmas. Instead, weekly grocery store foot traffic in these CBSAs reaches its high point in August, when collegians likely converge on stores all at once as they head back to campus.

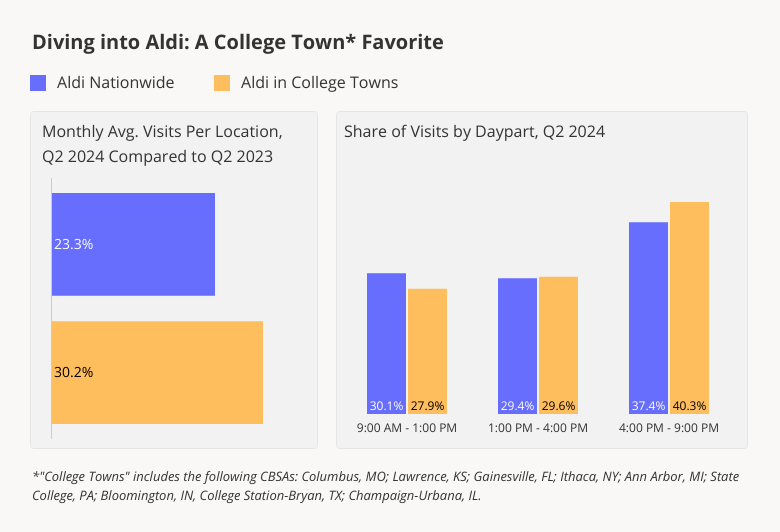

Evening Snacks at Aldi

And taking a closer look at value grocer Aldi – which features locations in all nine analyzed CBSAs – highlights other differences in the shopping habits of college town residents. Aldi has been crushing it in recent months, ranking high on the Placer 100 Retail & Dining Index visit growth lists throughout the summer. Like Target and Walmart, the discount supermarket enjoyed even greater visit-per-location growth in college towns than in other areas of the country.

And comparing Aldi visitation patterns in the analyzed CBSAs to those nationwide shows that in college towns, shoppers tend to do their grocery shopping later in the day. In Q2 2024, some 40.3% of visits to Aldi in college towns took place between 4:00 PM and 8:00 PM – compared to just 37.4% nationwide. And on the flip side, just 27.9% of college town Aldi visits took place in the morning, compared to 30.1% nationwide. Whether because they’re busy attending classes, or because they prefer to (ahem) sleep in, college students appear less likely than others to visit grocery stores in the morning.

Looking Ahead

Americans spend billions of dollars each year on back-to-college shopping – and this year is shaping up to be no different. For superstores and grocery chains in college towns, recent strong performance offers plenty of reason for optimism as the August shopping bonanza continues.

For more data-driven retail analyses, follow Placer.ai.

.svg)

.png)

.png)

.png)

.png)