After reaching new heights in October 2024, how did the office recovery fare in November? We dove into the data to find out.

Two Steps Forward, One Step Back…

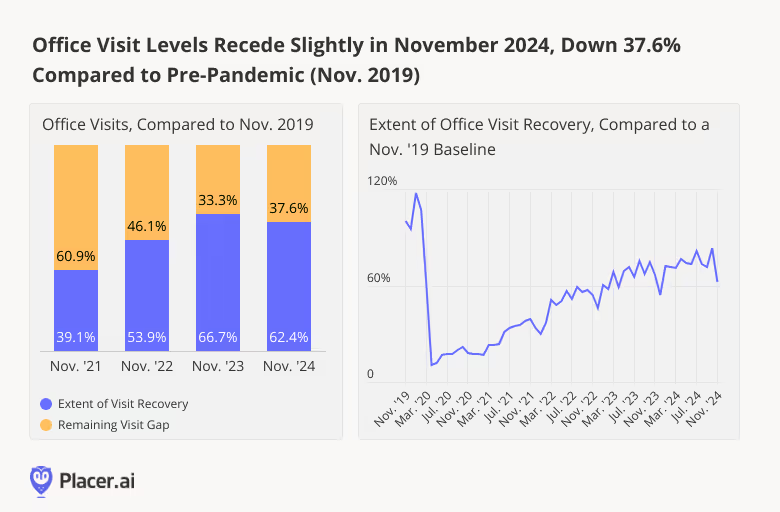

In November 2024, visits to office buildings nationwide were 62.4% of what they were in November 2019, down from 66.7% in November 2023. This marks the most substantial drop in office foot traffic since January 2024 – and a sharp decline from October 2024.

But though significant, November’s downturn is likely a reflection of this year’s record-breaking Thanksgiving travel rather than of any real office recovery slowdown. Millions of Americans took to the skies and roads to spend the holiday with loved ones. And with remote work making it easier than ever before for professionals to plug in from virtually anywhere, many likely extended their trips without taking extra days off – leading to fewer office visits in the days leading up to the holiday.

Miami and New York Continue to Lead in Post-Pandemic Recovery

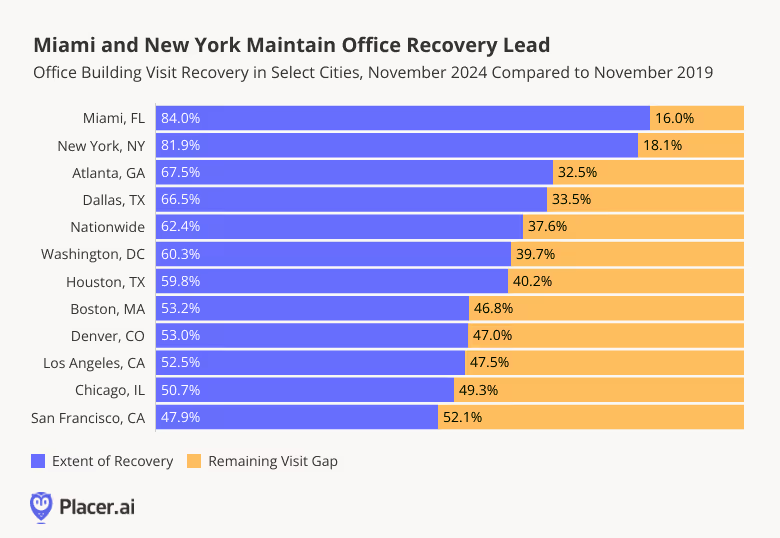

Taking a look at regional trends, Miami continued to outshine other cities in November 2024, with visits at 84.0% of pre-pandemic levels – perhaps due in part to strict return-to-office (RTO) policies implemented by major players within the city’s growing tech and finance sector. New York came in second with recovery at 81.9%, while San Francisco continued to lag behind other major cities. But with major projects like the September 2024 grand opening of the revamped Transamerica Pyramid set to revitalize the city’s Financial District, more accelerated recovery may be ahead for this West Coast hub.

Miami and San Francisco Buck the (YoY) Trend

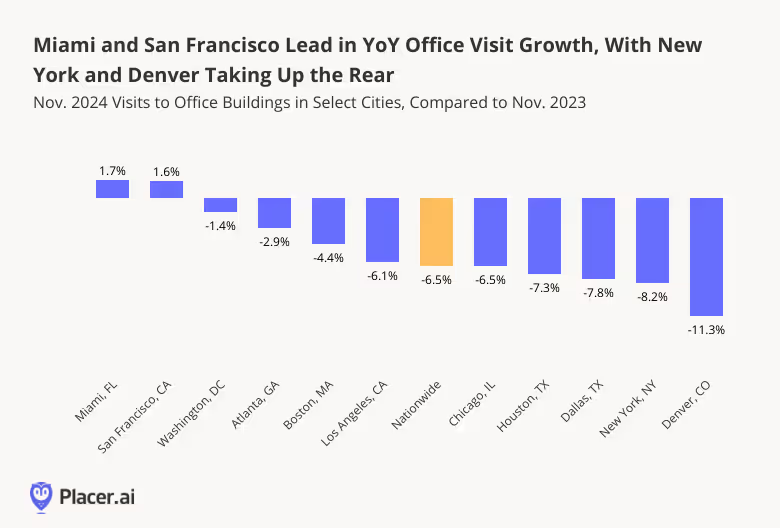

Indeed, San Francisco was among November 2024’s regional leaders for year over year (YoY) office visit growth. Nationwide, office building foot traffic was down 6.5% YoY. But in San Francisco, visits increased 1.6% – likely bolstered by recent RTO mandates from major local employers like Salesforce. The city’s temperate climate may also have played a role in encouraging residents to stay local for the holidays. Miami, too – a popular holiday destination in its own right – saw visits increase 1.7% YoY.

Denver, meanwhile, experienced its fourth snowiest November on record, which may have contributed to a larger portion of its workforce embracing remote work during the month – and an 11.3% YoY visit decline. And in New York, extended “workcations” by remote-capable finance employees, as well as potential disruptions in public transit and increased congestion during the holiday season, may have fueled a larger-than-average drop. Given the Big Apple’s strong overall recovery trajectory, we will likely see a rebound to more robust YoY growth by January, when the holiday season winds down.

Looking Ahead

While Thanksgiving travel created a temporary headwind for office recovery, cities like Miami and San Francisco demonstrate that the story is far from uniform. And looking ahead to the coming months, the office recovery still appears poised to continue apace.

For more data-driven office recovery analyses, follow Placer.ai.

.svg)

.png)

.png)

.png)

.png)

.avif)