How did Mother’s Day (May 12th, 2024) impact retail and dining foot traffic this year? We dove into the data to find out.

The Hallmark Holiday

Urban legends notwithstanding, Mother’s Day wasn’t actually created by the greeting card industry. But the occasion hasn’t become known as the “Hallmark holiday” for nothing. Every year in the run-up to Mother’s Day, shoppers descend on the chain to purchase everything from cards to candy.

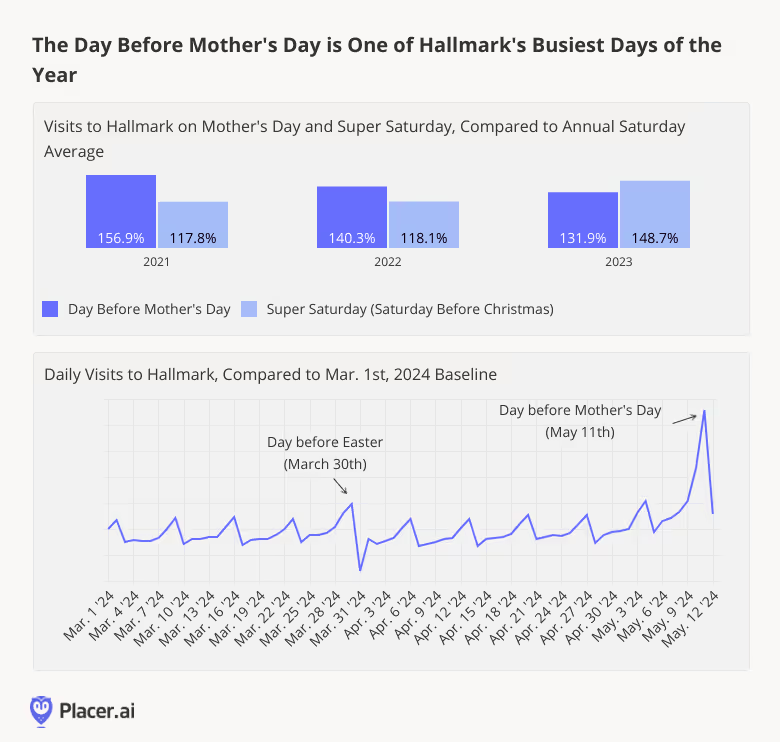

Most years, the day before Mother’s Day is Hallmark’s busiest day of the year, with Super Saturday (the Saturday before Christmas) a not-so-close second. In 2023, Mother’s Day was edged out by Super Saturday, which converged with Christmas Eve Eve to create a pre-holiday shopping bonanza for the ages.

And this year is shaping up to be no different: On May 11th, 2024 (the day before Mother’s Day), Hallmark experienced a major visit spike – leaving all other Saturdays, including the Saturday before Easter, in the dust.

A Variety of Retail Categories Benefit From Mother’s Day

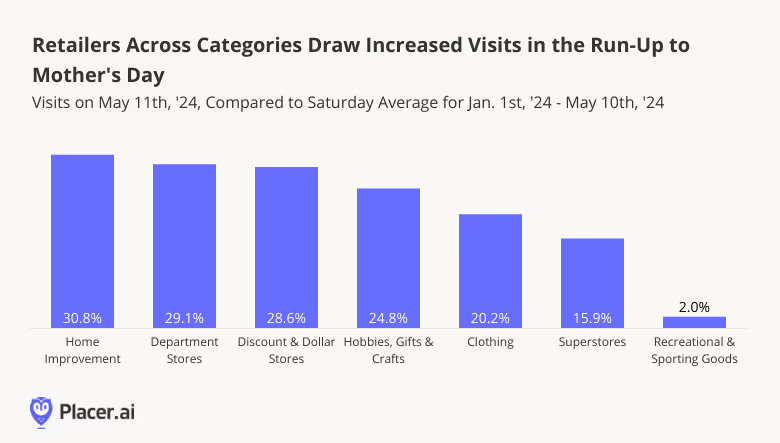

But greeting card retailers like Hallmark aren’t the only ones to benefit from Mother’s Day. A look at foot traffic to major industries on May 11th, 2024 shows that retailers across segments – from Home Improvement chains to Superstores – enjoy substantial visit boosts on the day before Mother’s Day. (Recreational & Sporting Goods, not so much).

For Home Improvement, Department Stores, Hobbies, Gifts & Crafts, and Clothing, May 11th, 2024 was the busiest day of the year so far, while for Discount & Dollar Stores and Superstores it was superseded only by March 30th – the day before Easter.

Going Out to Eat: Only the Best for Mom

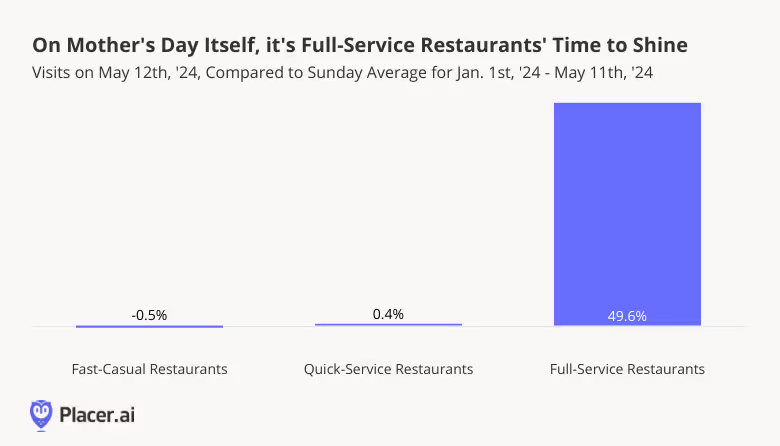

While the day before Mother’s Day is an important retail milestone, Mother’s Day itself is an occasion for treating mom to a nice meal out. And though grabbing a bite at a fast food joint or fast-casual fave is lots of fun – it decidedly isn’t the Mother’s Day vibe. A special occasion calls for a splurge, and Mother’s Day is Full-Service Restaurants’ time to shine.

On May 12th, 2024, Quick-Service and Fast-Casual Restaurants received about the same number of visits as on an average Sunday this year. But Full-Service Restaurants saw visits skyrocket – outperforming an average Sunday by 49.6%.

A Day for Olive Garden

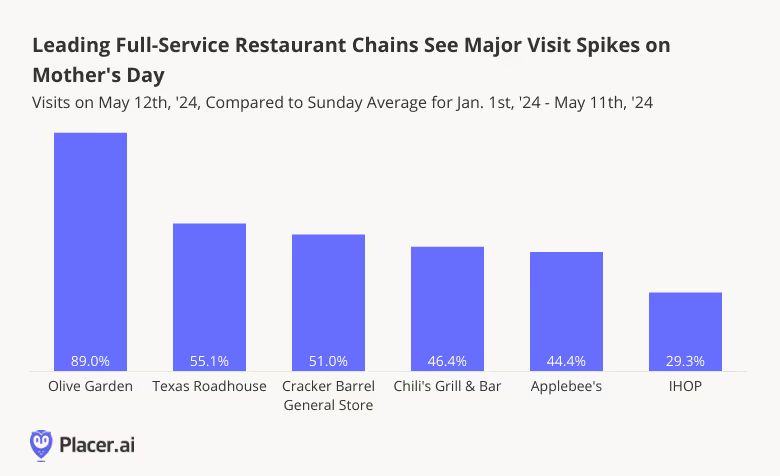

And drilling down into the data for six of Mother’s Day’s busiest Full-Service Restaurant chains shows Olive Garden emerging as a major holiday winner – with 89.0% more visits on May 12th, 2024 than on an average Sunday this year. Olive Garden drew more visits this Mother’s Day than on any other day since the beginning of the year – with Valentine’s Day (February 14th, 2024) coming in a close second.

But the Italian-American cuisine giant certainly isn’t the only FSR to enjoy a substantial visit boost on the big day: Texas Roadhouse, Cracker Barrel General Store, Chili’s Grill & Bar, Applebee’s, and IHOP saw respective May 12th visit increases of 55.1%, 51.0%, 46.4%, 44.4%, and 29.3%, compared to an average Sunday.

Final Thoughts

Mother’s Day comes but once a year – and grateful offspring nationwide show their appreciation with gifts and celebratory meals, generating boons for businesses across categories.

With Father’s Day right around the corner, what kind of impact will Dad’s big day have on retail and restaurant visits? Will Recreational & Sporting Goods brands have their day in the sun?

For more data-driven retail and dining insights, follow placer.ai.

.svg)

.png)

.png)

.png)

.png)