The fitness industry has experienced steady growth in recent years, propelled by consumers’ prioritization of health and wellness – and gyms across the country are benefiting.

So with 2024 underway, we dove into the data to examine the segment’s performance during the first months of the year. Did Fitness’ strong January showing persist beyond the season of new year’s resolutions? And how did major gym chains – including Planet Fitness, Life Time, Crunch Fitness, and EōS – perform in Q1 2024 relative to last year?

Let’s Get Physical

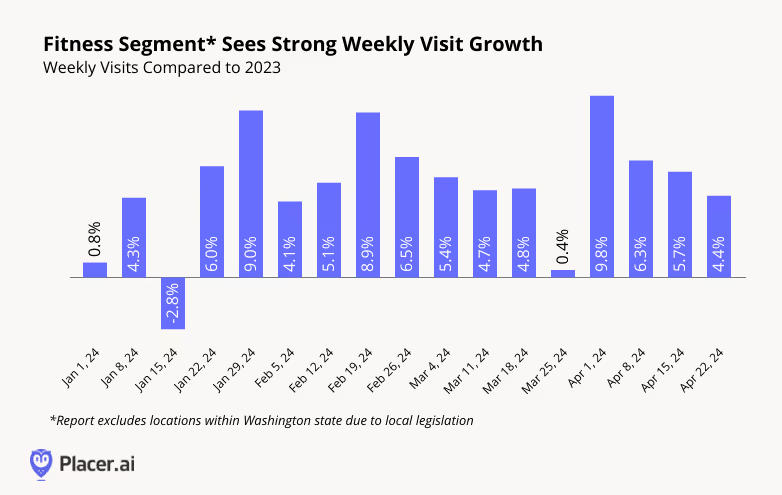

Fitness has been a consistent success story over the past few years, and the category is showing no signs of slowing down. Year-over-year (YoY) visits to the industry were up nearly every week between January and April 2024, with the sole exception of the week of January 15th, when an Arctic blast saw many people hunkering down indoors. And visits remained slightly elevated even during the week of March 25th, when Easter celebrations likely distracted many people from their gym goals – an impressive feat given the comparison to a non-holiday week in 2023.

Flexing Into 2024

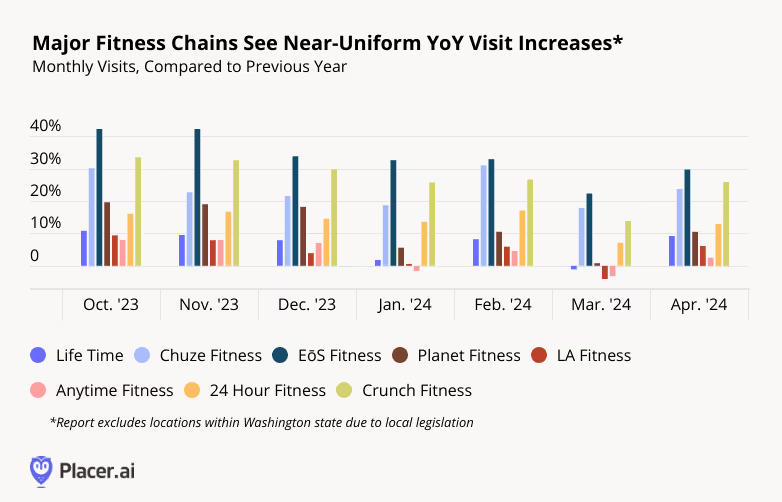

Drilling down into visit trends for eight major fitness chains shows that in today’s robust fitness environment, there’s enough demand to sustain a variety of chains: Both premium and mid-range options like Life Time and LA Fitness as well as more affordable choices like Planet Fitness and Crunch Fitness saw visits increase or remain steady for most of Q1 – and all saw YoY visit bumps in April.

Getting Pumped

Some gym-goers hit the gym several times a week and spend hours working out, while others have a more relaxed get-in-shape schedule. And analyzing leading chains’ visitation patterns shows that gyms are finding success by catering to fitness buffs’ varying preferences.

Perhaps unsurprisingly, the data reveals a strong correlation between a chain’s share of frequent visitors (i.e. those visiting the gym eight or more times in a month), and a chain’s share of visitors staying longer than 90 minutes. While some clubs, including Life Time and EōS appear to attract highly dedicated gym-goers, others, including Planet Fitness and Anytime Fitness, seem to draw more casual visitors.

The fact that both fitness chains attracting frequent visitors for longer workouts and gyms that cater to more casual exercisers who spend less time in the gym during each session are seeing positive visitation trends indicates that there are plenty of models for fitness success in 2024.

The Final Weigh-In

One thing seems clear – interest in gyms is not going away anytime soon. Visits continue to show YoY growth, and the industry is full of options for every kind of fitness enthusiast. Whether opting for occasional visits or adhering to a structured workout regimen – there’s something for everyone.

To stay ahead of the latest retail and fitness developments, visit placer.ai/blog.

.svg)

.png)

.png)

.png)

.png)