The fast-casual space has been having a moment – with rising QSR prices leading many diners to embrace an upgraded experience. So with Q2 2024 in the rearview mirror, we dove into the data to check in with two fast-casual restaurant chains that have been doing particularly well: Chipotle and sweetgreen. How did their Q2 performance compare to that of the wider fast-casual segment? And what is it, exactly, that they are doing right?

We dove into the data to find out.

Key Takeaways:

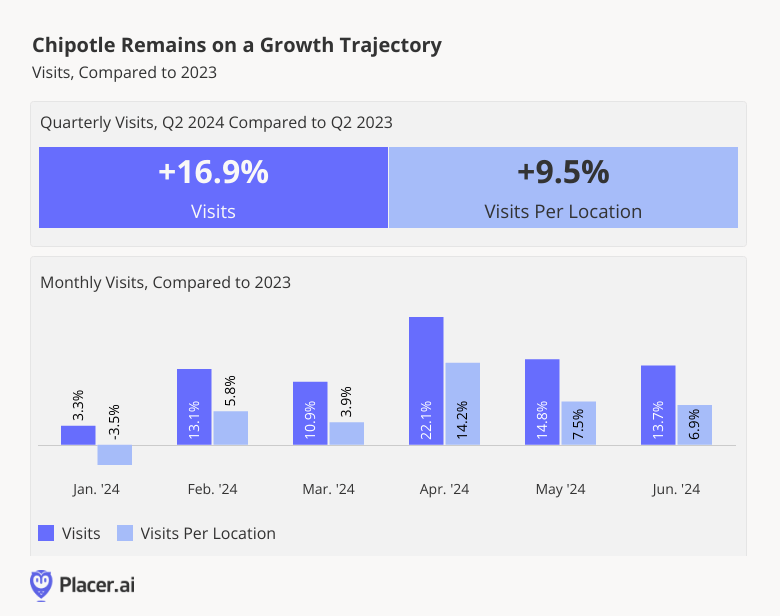

- In Q2 2024, Chipotle saw year over year (YoY) increases in both overall visits (16.9%) and visits per location (9.5%) – outperforming the wider fast-casual segment on both metrics.

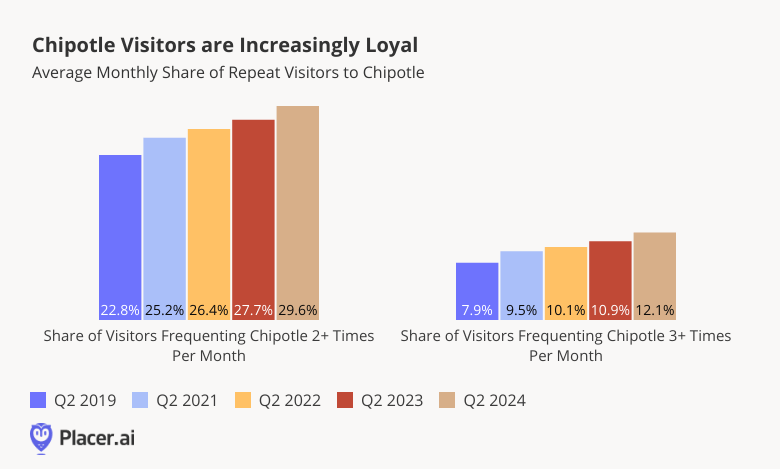

- Chipotle’s growth is likely due in part to the growing loyalty of its customer base – which has increased significantly each year since 2019.

- Sweetgreen also performed exceptionally well in Q2 2024, with visits and visits per location up a respective 19.9% and 5.9%.

- Sweetgreen is finding success by leaning into what it does best – drawing the weekday lunchtime crowd.

Chipotle Rocks Q2 2024

In the first quarter of 2024, Chipotle reported a 14.1% YoY increase in total revenue, and a 7.0% increase in comparable restaurant sales. And the chain isn’t showing any signs of slowing down. In Q2 2024, Chipotle saw YoY chain-wide foot traffic growth of 16.9%. And while some of this increase was undoubtedly due to the chain’s continued expansion – Chipotle added some 247 U.S. restaurants over the past year – the average number of visits to each of Chipotle’s restaurants also increased by an impressive 9.5%. By way of comparison, fast-casual restaurants experienced average quarterly YoY visit growth of just 4.2%, and visit-per-location growth of 2.9%.

Leaning Into Loyalty

One factor that appears to be contributing to Chipotle’s remarkable visit growth is its repeat customer base – which is growing more loyal with every passing year. Between Q2 2019 and Q2 2024, the share of visitors frequenting a Chipotle at least twice a month increased from 22.8% to 29.6%, while the share of visitors frequenting a Chipotle at least three times a month grew from 7.9% to 12.1%.

This rise in loyalty has taken place against the backdrop of Chipotle’s growing loyalty program – Chipotle Rewards – which launched in Q1 2019 and today boasts more than 40 million members. The program, which lets members earn points for every dollar spent, offers diners access to personalized deals and a range of special promotions – like free delivery on National Burrito Day. (Before you ask, foot traffic data shows that National Burrito Day, which fell on Thursday, April 4th, 2024 wasn’t just a day for ordering online: It was Chipotle’s busiest Thursday of the year so far, with visits up 19.7% compared to a regular Thursday). This April, Chipotle also partnered with Tekken 8 to offer diners in-game currency in exchange for orders – with special perks for Rewards members.

Sweetgreen’s Growing Momentum

Another eatery that has been performing remarkably well in 2024 is sweetgreen – the fast-casual restaurant known for its healthy, fresh food. During Q2 2024, visits to sweetgreen were up a remarkable 19.9% YoY, a reflection of the chain’s growing footprint. But foot traffic data shows that there is more than enough demand to sustain sweetgreen’s accelerated expansion – over the analyzed period, the average number of visits to each sweetgreen location also increased by 5.9%.

A Lunchtime Fave

A look at the hourly distribution of visits to sweetgreen shows that though the chain has made inroads into the dinner daypart, lunchtime remains its prime time to shine – especially on weekdays.

During the first half of 2024, 24.9% of weekday visits to sweetgreen took place between noon and 2:00 PM – compared to just 21.7% for the wider fast-casual category. But while sweetgreen, popular among the in-office crowd, drew a greater share of lunchtime visitors on weekdays, the fast-casual segment as a whole drew a greater share of lunchtime visitors on the weekends. Indeed, on Saturdays and Sundays, the share of lunchtime sweetgreen visitors dropped to 22.7%, while the share of fast-casual lunchtime visitors increased to 22.2%.

Still, suppertime is also a popular daypart for the salad chain on weekdays – with 20.0% of Monday - Friday visits taking place between 6:00 and 8:00 PM. As sweetgreen continues to lean into steaks and other dinner fare, it will be interesting to see if the restaurant begins to capture even more evening traffic.

Looking Ahead

Chipotle’s and sweetgreen’s strong quarter positions them well for further growth as the year wears on. Will Chipotle’s loyalty continue to increase? And will sweetgreen double down on dinner?

Follow Placer.ai’s data-driven restaurant analyses to find out.

.svg)

.png)

.png)

.png)

.png)