Traffic Performance Reveals Divergent Growth Trajectories

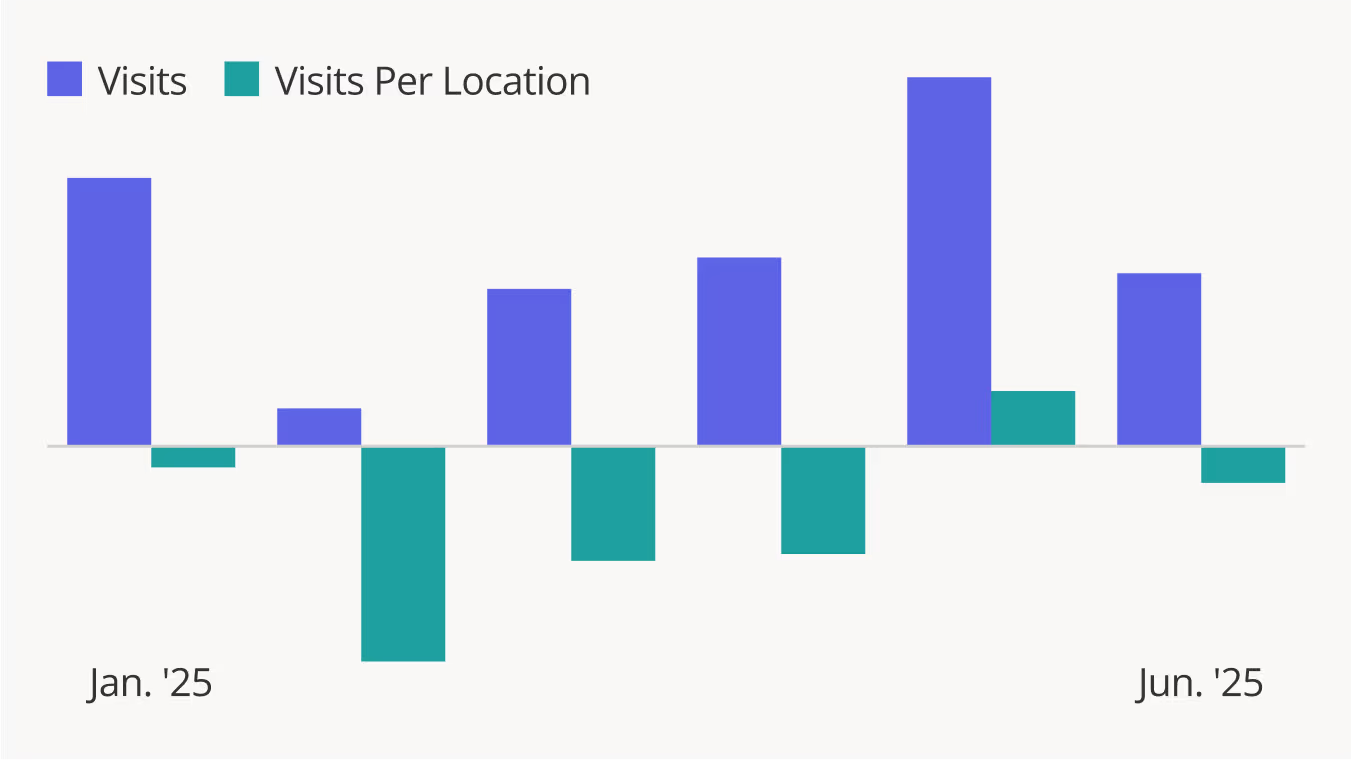

Shake Shack traffic increased an impressive 13.7% year-over-year (YoY) in Q2 2025 while average visits per venue held relatively steady at -1.7% – indicating that the chain's aggressive expansion strategy is capturing new market share without cannibalizing existing locations.

Meanwhile, although Q2 2025 visits to Wingstop were up 3.6%, the chain's average visits per venue declined 6.3% – which may suggest that discretionary dining brands serving lower-income consumers may be experiencing pressure from tightening household budgets.

Demographic Differences Between Wingstop & Shake Shack

Analyzing trade area demographic data reveals that Wingstop's captured market has a median household income of $69.5K – significantly lower than Shake Shack's $97.0K. Wingstop's trade area also includes a much higher proportion of households with children.

Wingstop attracts families with tighter budgets who must stretch their dining dollars further, which likely contributed to the decline in average visits per venue during this period of economic uncertainty. Meanwhile, Shake Shack's appeals to higher-income consumers with more discretionary spending power could explain the chain's impressive visit strength despite the ongoing headwinds.

Small Shifts in Visitor Loyalty

Looking at the change in visit frequency compared to 2024 also suggests that Wingstop is feeling the impact of its visitors' tighter budgets.

Wingstop still maintains a significant advantage in customer loyalty, with 16.8% to 18.1% repeat monthly visitors in H1 2025 compared to Shake Shack's 10.5% to 11.4%. But comparing these numbers to 2024 reveals that Wingstop's share of repeat visitors has declined slightly since 2024, while Shake Shack has posted modest monthly gains throughout H1 2025.

This shift suggests that budget-conscious families may be reducing their regular Wingstop visits to save money, while Shake Shack's strategic expansion is bringing locations closer to customers which could be driving increased repeat visitation.

Wingstop's Well-Positioned For Long-Term Resilience

Despite facing economic headwinds, Wingstop's continued positive visit growth and superior customer loyalty metrics demonstrate the brand's strong fundamentals and deep connection with its core family demographic.

As economic conditions stabilize, Wingstop's established customer base and proven appeal to budget-conscious families positions the chain for a strong rebound, particularly given that families with children represent a large and resilient market segment that will likely return to regular dining patterns when household budgets recover.

Visit Placer.ai/anchor for the latest data-driven dining insights.

.svg)

.png)

.png)

.png)

.png)

.avif)