CVS and Walgreens are the two leading brick-and-mortar pharmacy chains, controlling together over 40% of the U.S. prescription drug market. And although the companies have been rightsizing their physical footprint over the past couple of years, CVS and Walgreens together still operate over 18,000 locations throughout the country.

And while the two chains may sometimes appear interchangeable, diving into the demographic differences between CVS and Walgreens’ trade areas indicates that each brand serves a slightly different audience.

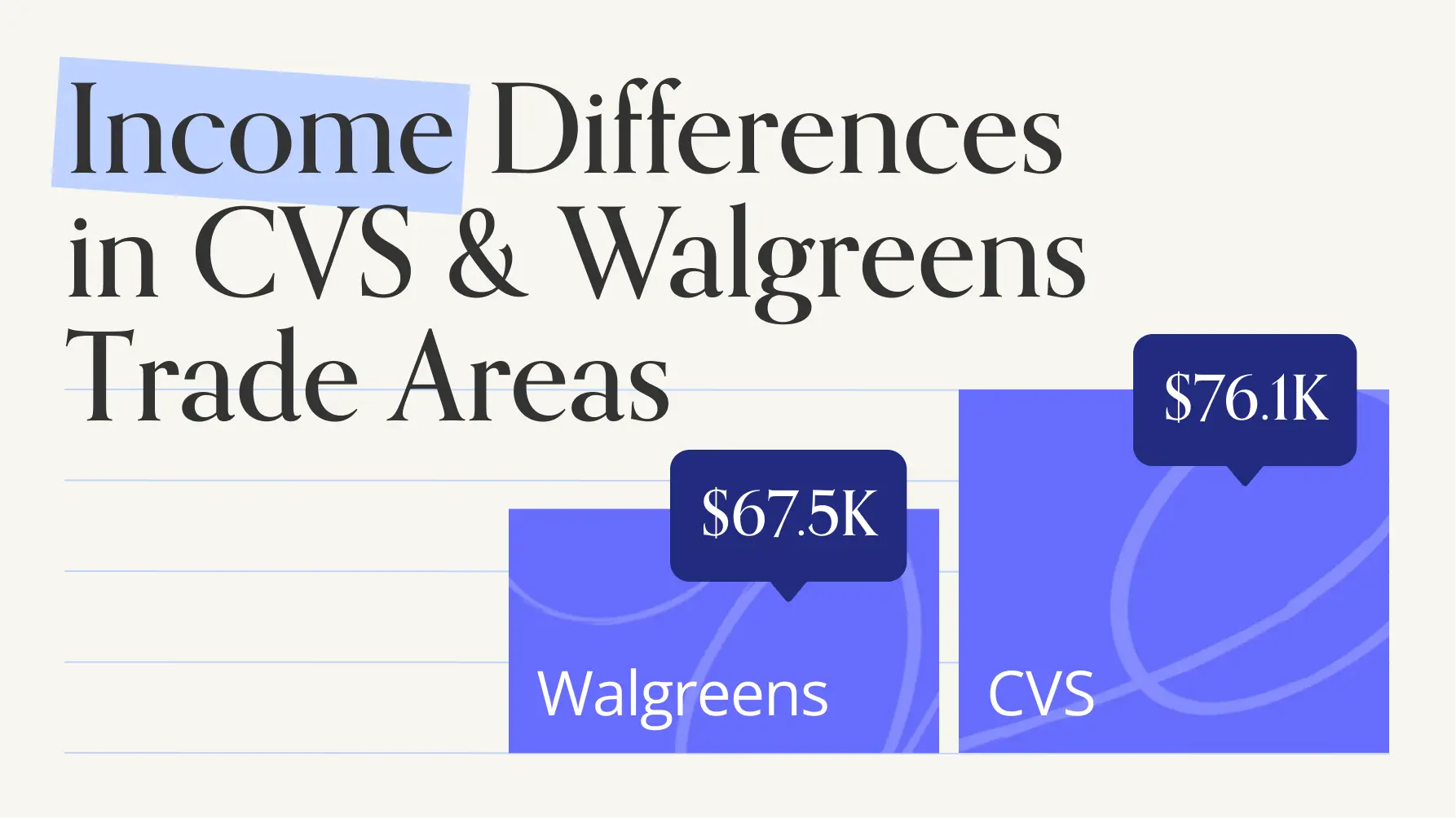

Differences in Visitor Income

A chain’s potential market looks at the Census Block Groups – CBGs – where visitors to a chain come from, weighted according to the population of each CBG. And since both CVS and Walgreens operate in all 50 states and often have locations in the same town or city, the makeup of the two chains’ potential market trade area is remarkably similar – indicating that both chains have the potential to reach the same types of households.

But diving into the captured market (the trade area of each chain weighted according to the actual number of visits from each CBG) reveals a major difference in trade area median household income (HHI). Although both chains have the potential to attract visitors with a median HHI of around $70.0K, visitors to CVS come from CBGs with a median HHI of $76K – meaning that visitors to CVS tend to come from the more affluent neighborhoods within CVS’s potential trade area. Walgreens visitors, on the other hand, come from CBGs with a median HHI of $67.5K, which is lower than the median HHI in the brand’s potential market, and indicates that Walgreens visitors tend to come from the less affluent neighborhood within the company’s trade area.

.avif)

CVS Attracts Larger Households, While Walgreens Serves More Singles

The two pharmacy leaders also seem to attract different shares of singles and families, although the differences are not as pronounced as the differences in median HHI.

CVS and Walgreens have equal shares of one-person & non-family households in their trade areas, but the share of this segment in Walgreens’ captured market is slightly larger than in CVS’ captured market. Still, for both brands, one-person and non-family households are slightly underrepresented in the captured market relative to the potential market, indicating that singles across the board are perhaps slightly less likely to visit brick-and-mortar pharmacy chains.

On the other hand, both CVS and Walgreens had more families (households with four or more children) in their captured market than in their potential market – although the share of this segment in CVS’ captured market was slightly higher than in Walgreens’.

.avif)

CVS Appeals to Families

CVS’ relative popularity with family segments also comes through when looking at the psychographic makeup of its trade area. When compared to Walgreens, CVS’s captured market included larger shares of three out of four family-oriented segments analyzed by the Spatial.ai: PersonaLive dataset – Ultra Wealthy Families, Wealthy Suburban Families, and Near-Urban Diverse Families. Walgreens’ captured market did include larger shares of Upper Suburban Diverse Families, but the difference was minimal – 9.8% for Walgreens compared to 9.5% for CVS.

.avif)

Differences and Overlaps between CVS and Walgreens Visitors

CVS and Walgreens carry a very similar product selection, and the two chains’ nearly identical potential trade area makeup indicates that both brands’ locations have the potential to reach the same types of customers. But diving into CVS and Walgreens’ captured market reveals some differences between the two chains’ audiences – CVS tends to attract more affluent visitors, while Walgreens seems slightly more popular among singles.

For more data-driven retail insights, visit placer.ai/blog.

.svg)

.png)

.png)

.png)

.png)