Super Saturday, one of the busiest shopping days of the year, sees stores bustling with last-minute shoppers searching for gifts and holiday essentials. But how did this year's event measure up – and what trends and surprises emerged? We analyzed the data to find out.

A Super-Charged Milestone

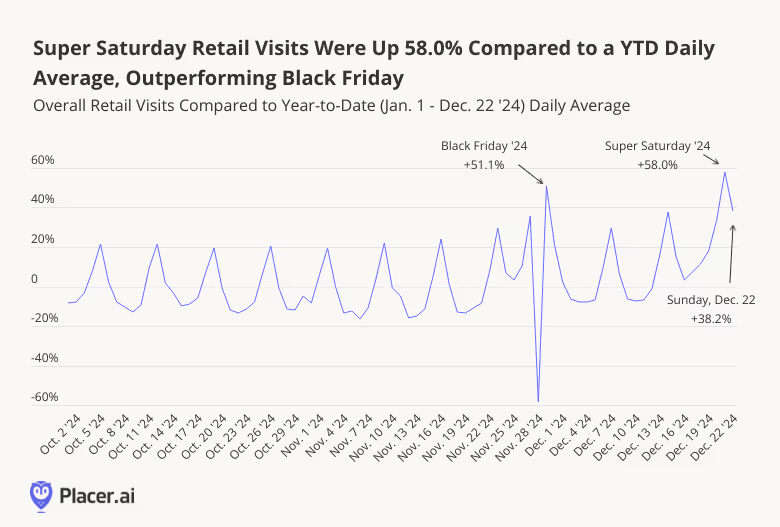

On December 21st, 2024 retail foot traffic across the U.S. surged by 58.0% compared to the year-to-date daily average – reaffirming Super Saturday’s status as the ultimate day for eleventh-hour gift shopping. And in another sign that holiday season shopping has evolved into a multi-day affair, the pre-Christmas milestone once again outpaced Black Friday, with the shopping momentum extending throughout the weekend.

Despite this year’s strong performance, 2024’s Super Saturday spike didn’t quite match last year’s extraordinary showing (+74.4% above the 2023 daily average) – a predictable shortfall, given 2023’s unique confluence of circumstances, when Super Saturday coincided with “Christmas Eve Eve” (December 23rd). But with Sunday’s strong consumer turnout this year, and Monday, December 23rd offering even more opportunities for consumers to hit the stores, 2024’s pre-Christmas traffic could well surpass last year’s final tally.

Coast to Coast

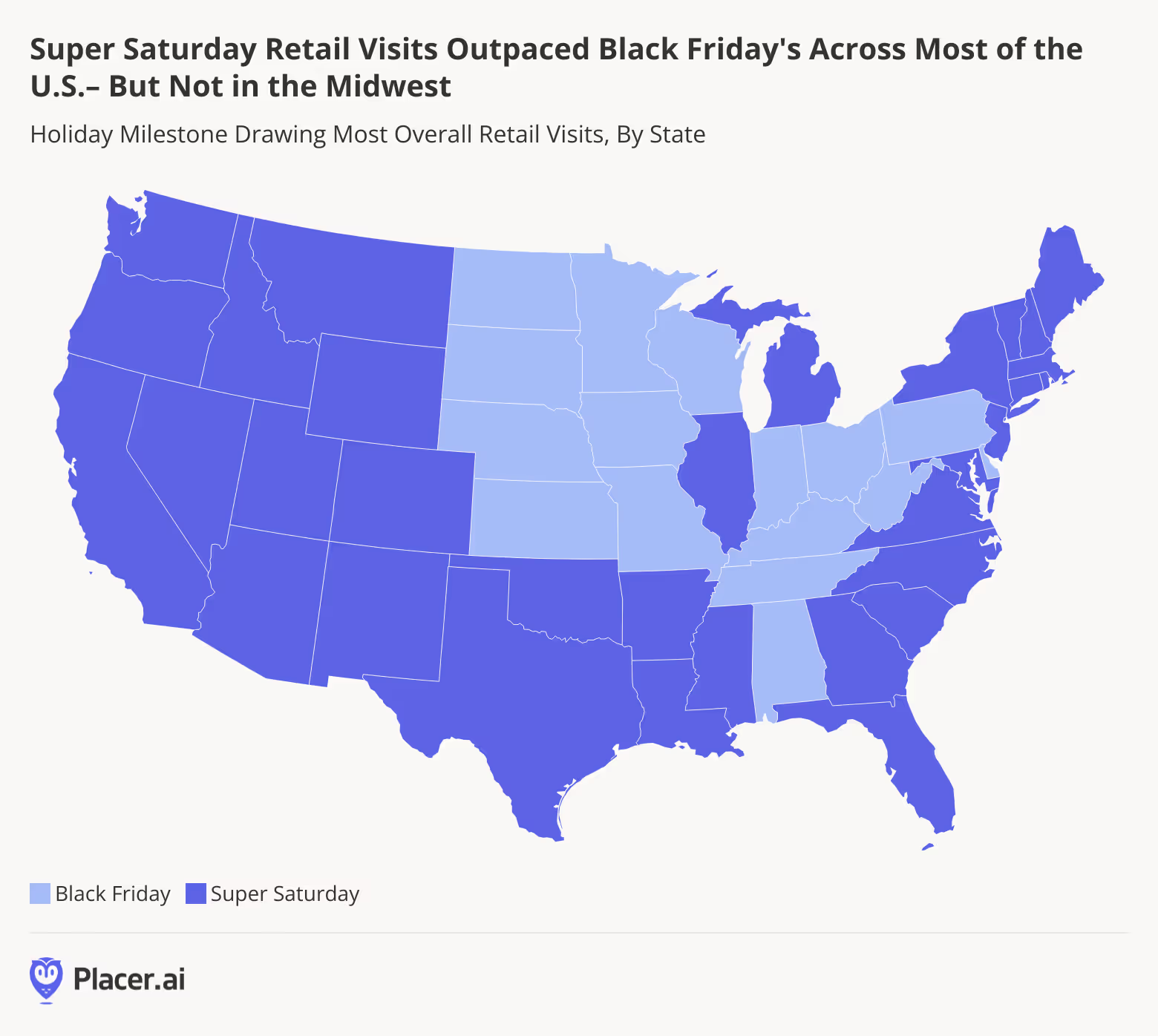

Though Super Saturday outperformed Black Friday nationwide, the resonance of the milestone varied by region. In most of the Midwest – a traditional Black Friday hot spot – as well as Pennsylvania, Delaware, West Virginia, Kentucky, Alabama, and Tennessee, Black Friday drew bigger visit spikes than the Saturday before Christmas. But in the majority of states, including major Pacific and Mountain region markets, Super Saturday visits outpaced the post-Thanksgiving frenzy.

The Department Store Surprise

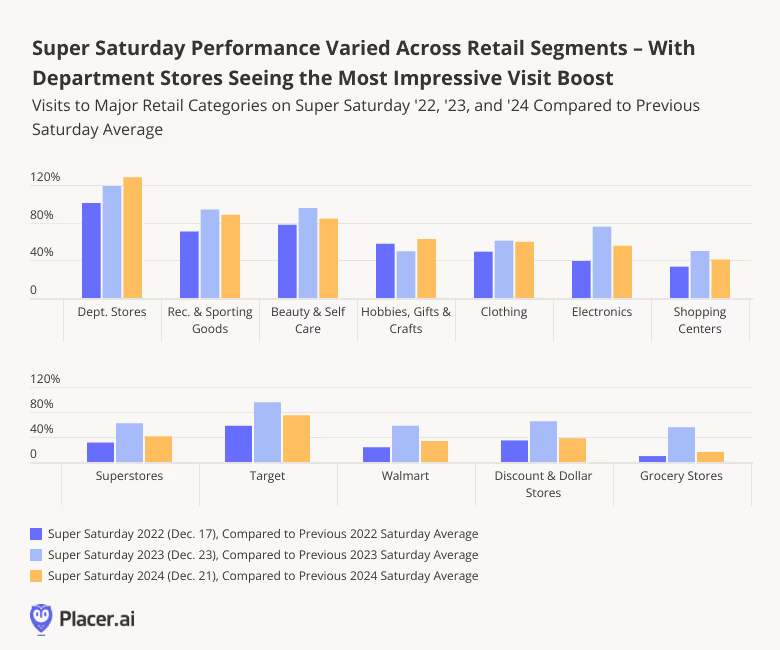

Diving into specific retail categories shows that Super Saturday’s impact also differed across segments.

Department stores emerged in 2024 as clear Super Saturday winners, with December 21st visits to the category soaring a remarkable 128.7% compared to an average Saturday this year – up from 119.4% in 2023 and 101.1% in 2022. Recreational & sporting goods, beauty & self care, hobbies, gifts & crafts, clothing, and shopping centers also delivered impressive Super Saturday performances, with relative visit boosts approaching, or in some cases even exceeding those seen last year.

Superstores, discount & dollar stores, and grocery stores, for their parts – all food-oriented segments that typically see significant visit boosts on the day before Christmas Eve – were especially impacted by last year’s Super Saturday/December 23rd “double whammy”. So unsurprisingly, their Super Saturday visit boosts were noticeably smaller this year. Electronics stores also saw a more moderate Super Saturday boost in 2024, perhaps due to this year’s more extended window for online shopping between Super Saturday and Christmas.

Still, all the analyzed categories saw bigger relative Super Saturday visit peaks than in 2022, when the milestone fell a full week before Christmas (December 17th), leaving shoppers plenty of time to place orders online or hit the stores during the following week.

Brands See YoY Visit Growth

Indeed, despite competing with last year’s “double whammy”, several department store brands saw significant year-over-year (YoY) Super Saturday visit growth – including Nordstrom (8.8%), Bloomingdales (4.7%), and JCPenney (1.3%). And the fun wasn’t limited to the department store sector: Other important gift-buying destinations, such as Ollie’s Bargain Outlet (7.3%), T.J. Maxx (4.6%), and Five Below (4.2%), also saw substantial YoY foot traffic increases – underscoring retail’s resilience in what remains a challenging environment.

More Than Just an Encore

While Black Friday remains the traditional kickoff for the holiday shopping frenzy, Super Saturday has carved out a prestigious role of its own. With strong national foot traffic, standout regional performances, and category-specific surprises, it’s clear that Super Saturday is more than just an encore – it’s a headliner in its own right. How will retail foot traffic continue to unfold during the tail end of 2024?

Follow Placer.ai’s data driven retail analyses to find out.

.svg)

.png)

.png)

.png)

.png)