How did the brick-and-mortar divisions of Walmart, Target, and other leading retailers perform this holiday season? Which days drove the most visits, and how did foot traffic performance this year compare to 2022? We dove into the data to find out.

General 2023 Holiday Season Trends

Looking at daily visits to Target, Walmart, mid-tier department stores (including Macy’s, JCPenney, Kohl’s Belk, and Dillard’s), luxury department stores (including Saks Fifth Avenue, Neiman Marcus, Bloomingdale’s, and Nordstrom) and Best Buy reveals several common trends.

In all cases, retail visits began to creep up over the days leading up to Thanksgiving (Monday through Wednesday) as consumers took advantage of early Black Friday discounts. And the visit increase on Black Friday 2023 relative to the Q4 daily average was larger than in 2022 – perhaps thanks to budget-conscious consumers holding out for the steep discounts offered the day after Thanksgiving. The Christmas Eve Eve (December 23rd) and Super Saturday spikes were also particularly pronounced in 2023, likely thanks to the combination of both retail events falling on the same day this year.

All retailers and retail segments analyzed also saw smaller surges on Boxing Day (December 26th) 2023 when compared to 2022, likely due to calendar differences. Christmas fell on a Sunday in 2022, so December 26th was declared a federal holiday in lieu of December 25th, and many private-sector employers likely gave time off as well – giving consumers the opportunity to hit the stores and enjoy after-Christmas sales. But Boxing Day still drove visit peaks across the board in 2023 (albeit not smaller peaks than in 2022) – indicating that Boxing Day is now a U.S. phenomenon as well.

December 27th, 28th, and 29th saw a greater increase relative to the daily Q4 average in 2023 compared to 2022, culminating in a larger New Years Eve Eve (December 30th) spike. The December 30th surge may be because this year’s December 30th fell on a Saturday, which is a major shopping day in its own right. But the increase in the days prior to New Years Eve Eve, when after-Christmas sales were in full force, could indicate that consumers are still particularly attune to sales events.

Still, despite the similarities across retail categories, foot traffic data also reveals some important differences between the segments.

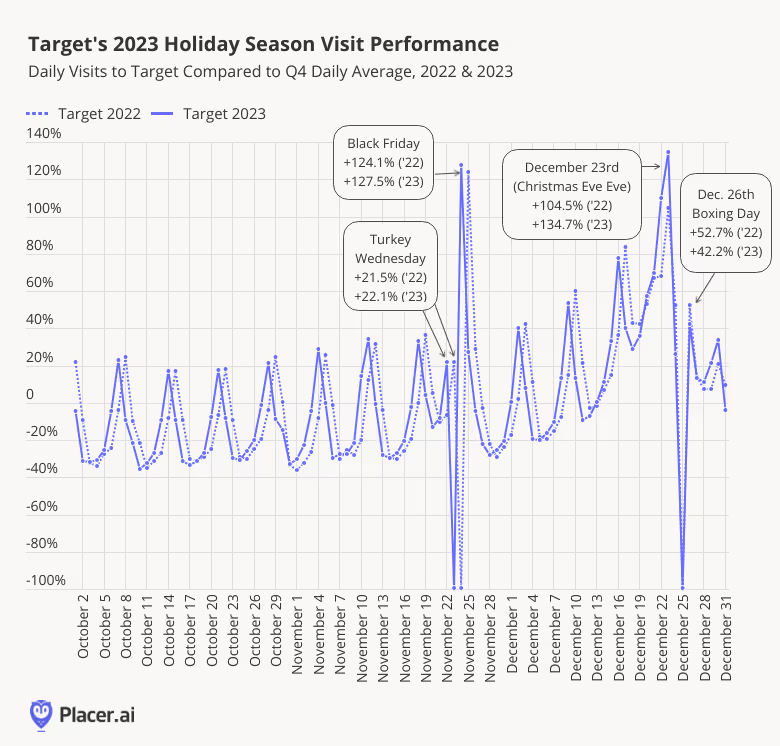

Target’s Major December Visit Build-Up

Visits to Target began to increase in November 2023 relative to October as the retailer offered “Four Weeks of Early Black Friday Deals,” starting October 29th. And like the other categories analyzed, Target saw its first small visit peak of the season on the Wednesday before Thanksgiving (also known as Turkey Wednesday thanks to the massive Grocery visit spikes on the day). Visits on the day before Thanksgiving were up by 21.5% and 22.1%, in 2022 and 2023, respectively, despite foot traffic on an average Wednesday tends to be lower than the Q4 daily average – indicating that “Turkey Wednesday” also holds retail significance for grocery-adjacent categories.

Visits then spiked on Black Friday and returned to seasonally normal levels on Saturday. Throughout December, foot traffic continued to swell, with every week exceeding the previous week’s visit performance. The intensity of the visit growth picked up the week before Christmas, with Christmas Eve Eve/Super Saturday seeing a significant jump. Finally, Target visits on Boxing Day and the week following Christmas also exceeded the Q4 daily average as consumers took advantage of end-of-season sales and looked for festive attire for their New Year’s Eve celebrations.

Walmart’s Grocery Offerings Drive Its Holiday Visit Patterns

The holiday season visit pattern at Walmart differs from those at Target in several instances. The superstore’s Turkey Visit spike was significantly more pronounced than Target’s, likely thanks to Walmart’s more extensive grocery offerings. Walmart also saw smaller spikes on Black Friday – perhaps due to the retailer’s famous “everyday low prices,” which may reduce the appeal of specific sales events. The Christmas Eve Eve/Super Saturday surge were also lower than for Target, but the Super Saturday increase relative to Black Friday spike was more pronounced, with some consumers probably visiting Walmart for last-minute groceries ahead of their Christmas dinners.

.avif)

Luxury Department Stores Visit Trends Influenced by Calendar Differences

Visits to luxury department stores (Saks Fifth Avenue, Neiman Marcus, Nordstrom, and Bloomingdale’s) followed the general retail foot traffic trends, with larger peaks on Black Friday and on Christmas Eve Eve/Super Saturday in 2023 compared to 2022. Boxing Day 2023 drove a smaller visit spike relative to last year, but foot traffic was still 98.2% higher than the Q4 2023 daily average – indicating that the day is still emerging as an important retail milestone, especially for pricier segments.

.avif)

Different End of Year Trends for Mid-Tier and Luxury Department Stores

Mid-tier department stores (Macy’s, Kohl’s, JCPenney, Belk, and Dillard’s) saw more significant spikes on Black Friday and Christmas Eve Eve/Super Saturday, and smaller spikes on Boxing Day. Luxury’s department stores’ biggest post-Christmas visit peak was on Boxing Day, but mid-tier department stores experienced their largest end-of-year increase on New Year’s Eve Eve (December 30th).

.avif)

Retail Milestones Drive Massive Visit Surges for Best Buy

Best Buy saw the strongest Q4 visit spike on Black Friday out of all the retailers and retail segments analyzed, with foot traffic up a whopping 510.9% compared to its Q4 2023 daily average. The electronics leader also had the largest Christmas Eve Eve/Super Saturday bump – with visits up 188.1% – and Boxing Day boost, with traffic up 112.9% compared to the Q4 daily average. The visit surges over the holiday season’s retail milestones indicate that demand for electronics remains strong – even as some consumers may be putting off large purchases due to economic headwinds.

.avif)

The holiday season drove significant retail foot traffic across categories, with every segment displaying its own unique Q4 visitation pattern. How will these sectors perform in the year ahead?

Visit placer.ai/blog to find out.

.svg)

.png)

.png)

.png)

.png)