With Q3 2024 in the rearview mirror, we dove into the data to check in with two smoothie and bowl spots that are firmly in expansion mode – Playa Bowls and Tropical Smoothie Cafe. What lies behind their smashing success? And what awaits them in Q4?

We dove into the data to find out.

Smooth(ie) Sailing

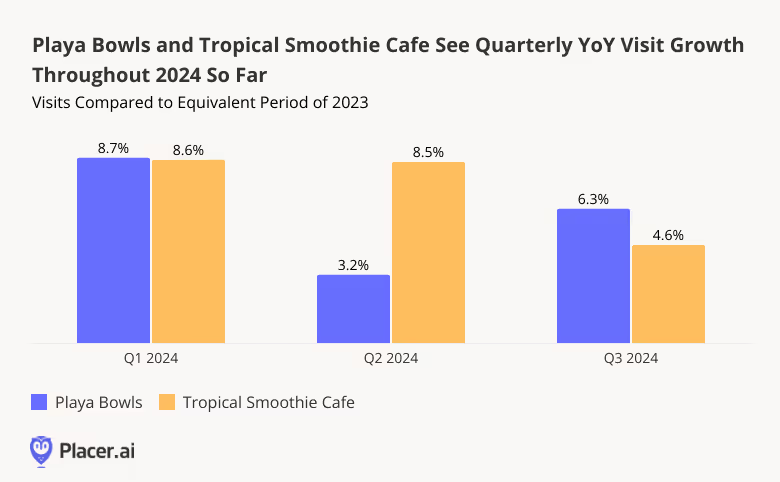

Looking first at quarterly YoY visit trends shows both Playa Bowls and Tropical Smoothie Cafe experiencing substantial year-over-year visit growth during the first three quarters of 2024 – driven in part by their rapidly growing fleets. In Q1 2024, Playa Bowls – recently acquired by Sycamore Partners – saw a YoY foot traffic jump of 8.7%. And Tropical Smoothie Cafe, acquired by Blackstone this year, saw a YoY visit boost of 8.7%. For both chains, this positive trajectory continued, though at a more moderate pace, through Q3 2024.

Juice in a Jiffy

What's behind the fast expansion and visit growth of these smoothie leaders? With high food prices still weighing on consumers, and health still top of mind for many, brands that provide nutritious, affordable indulgences are poised to win. Those that do so while meeting the rising demand for quick and convenient dining options are especially well-positioned to thrive.

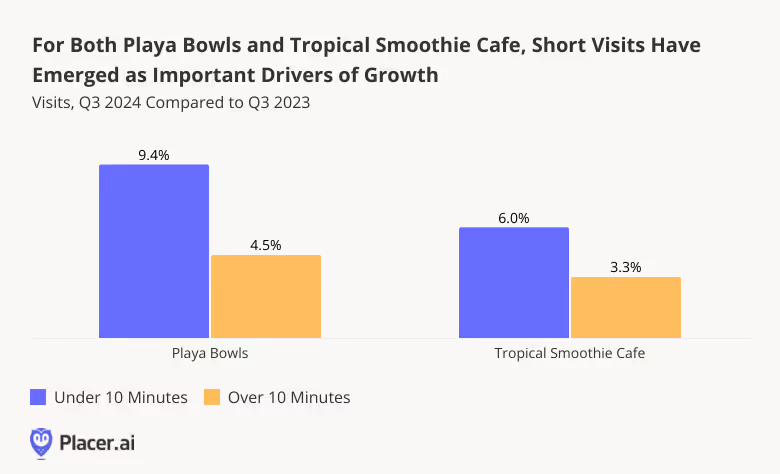

And drilling down deeper into the data for Playa Bowls and Tropical Smoothie Cafe shows that the two chains’ outsize success is being fueled, in large part, by customers dropping by for a quick pick-me-up on the go, rather than a sit-down meal.

In Q3 2024, the number of short visits to Playa Bowls (i.e. those lasting less than 10 minutes) increased 9.4% YoY, while longer visits increased just 4.5%. (In Q3 2024, short visits accounted for 31.2% of visits to Playa Bowls, compared with 30.3% in Q3 2023). This suggests that robust demand for off-premises dining has emerged as a major driver of growth for the brand.

A similar trend emerged at Tropical Smoothie Cafe, where nearly half of all Q3 2024 visits (48.4%) lasted less than 10 minutes – likely due to the chain’s ubiquitous drive-thrus. Short visits to Tropical Smoothie Cafe increased 6.0% YoY in Q3, while more extended visits increased 3.3%.

Bowled Over by Offers

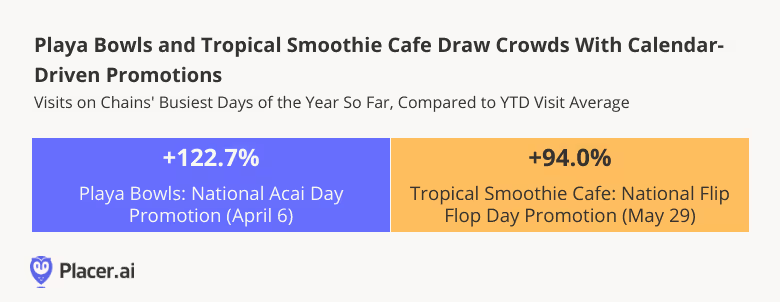

Playa Bowls and Tropical Smoothie Cafe have also fueled success by marking special calendar days with limited-time promotions.

For Playa Bowls, for example, the busiest day of 2024 so far was April 6th – National Acai Day – when the juice bar offered rewards members $5 off any acai bowl. The promotion was wildly successful, fueling a remarkable 122.7% visit surge compared to a year-to-date (January to September) daily average.

For Tropical Smoothie Cafe, it was National Flip Flop Day (yes, that’s a thing) that drew major crowds this year. On May 29th, 2024, the brand marked the occasion with free Island Punch Smoothies for guests who visited participating locations while wearing flip flops. And the promotion was a hit, generating enough excitement to drive a 94.0% visit spike for the brand.

Superfruit Surge

Successful harnessing of the growing demand for convenient, healthy, and affordable off-premises dining options together with unbeatable limited-time promotions have helped propel growth for both Playa Bowls and Tropical Smoothie Cafe.

Will visits to the two chains continue to surge in the months ahead?

Follow Placer.ai’s data driven dining analyses to find out.

This blog includes data from Placer.ai Data Version 2.1, which introduces a new dynamic model that stabilizes daily fluctuations in the panel, improving accuracy and alignment with external ground truth sources.

.svg)

.png)

.png)

.png)

.png)