In recent years, Americans have gotten serious about fitness. Even as consumers tightened their purse strings, they found room in their budgets for the ultimate affordable indulgence: A (relatively) low-cost gym membership that, once paid, offers customers unlimited access to club facilities.

How did Planet Fitness, the nation’s largest value gym perform in Q3 2024? We dove into the data to find out.

Still Sprinting Ahead

Planet Fitness has been on a roll. In Q2 2024, the chain reported a 4.2% system-wide increase in same store sales and the addition of 18 new gyms to its fleet. (Though Planet Fitness operates clubs outside the U.S., the vast majority of its some 2600 locations are domestic).

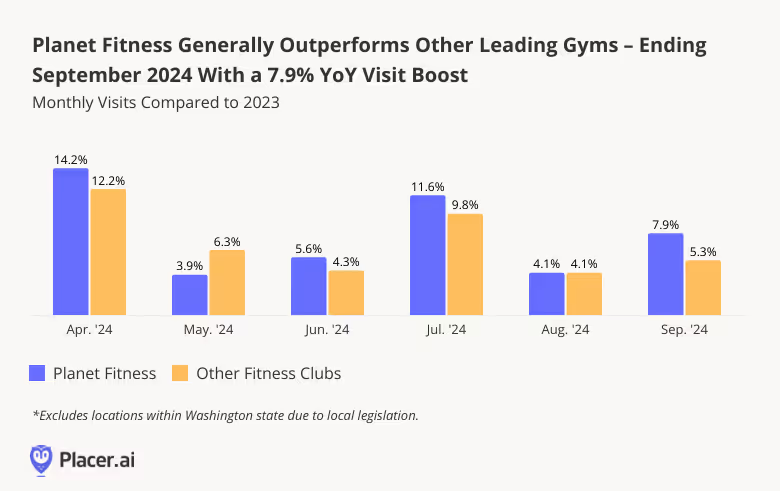

Foot traffic data shows that the chain continued to thrive through Q3, with year-over-year (YoY) monthly visit upticks ranging from 4.1% to 11.6% – outperforming the wider industry. And while the value gym giant finally raised the price of its basic membership this summer for the first time in more than thirty years, the move does not seem to have dented Planet Fitness’ growth trajectory – though it’s still early days.

Hardcore Gym Enthusiasts Do the Heavy Lifting

Planet Fitness takes pains to emphasize its commitment to being a “Judgement Free Zone” – and casual gym-goers make up a significant portion of its visitor base. In Q3 2024, 44.3% of visitors hit the club, on average, less than twice a month.

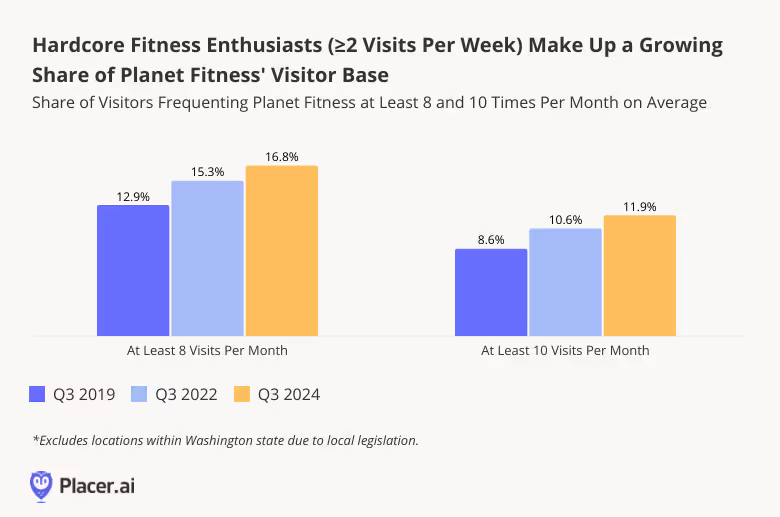

But Planet Fitness also has a significant – and growing – share of die-hard gym buffs who visit the club at least eight or ten times a month - i.e. at least twice a week. In Q3 2024, a full 16.8% of visitors to Planet Fitness came to the gym at least eight times a month on average – up from just 12.9% in 2019 and 15.3% in 2022. And 11.9% visited the chain ten or more times a month – up from 8.6% in 2019 and 10.6% in 2022.

Though casual visitors are also important for any fitness club’s bottom line, a strong and thriving community of highly committed members is an important foundation for future growth.

Regional Frequency Roundup

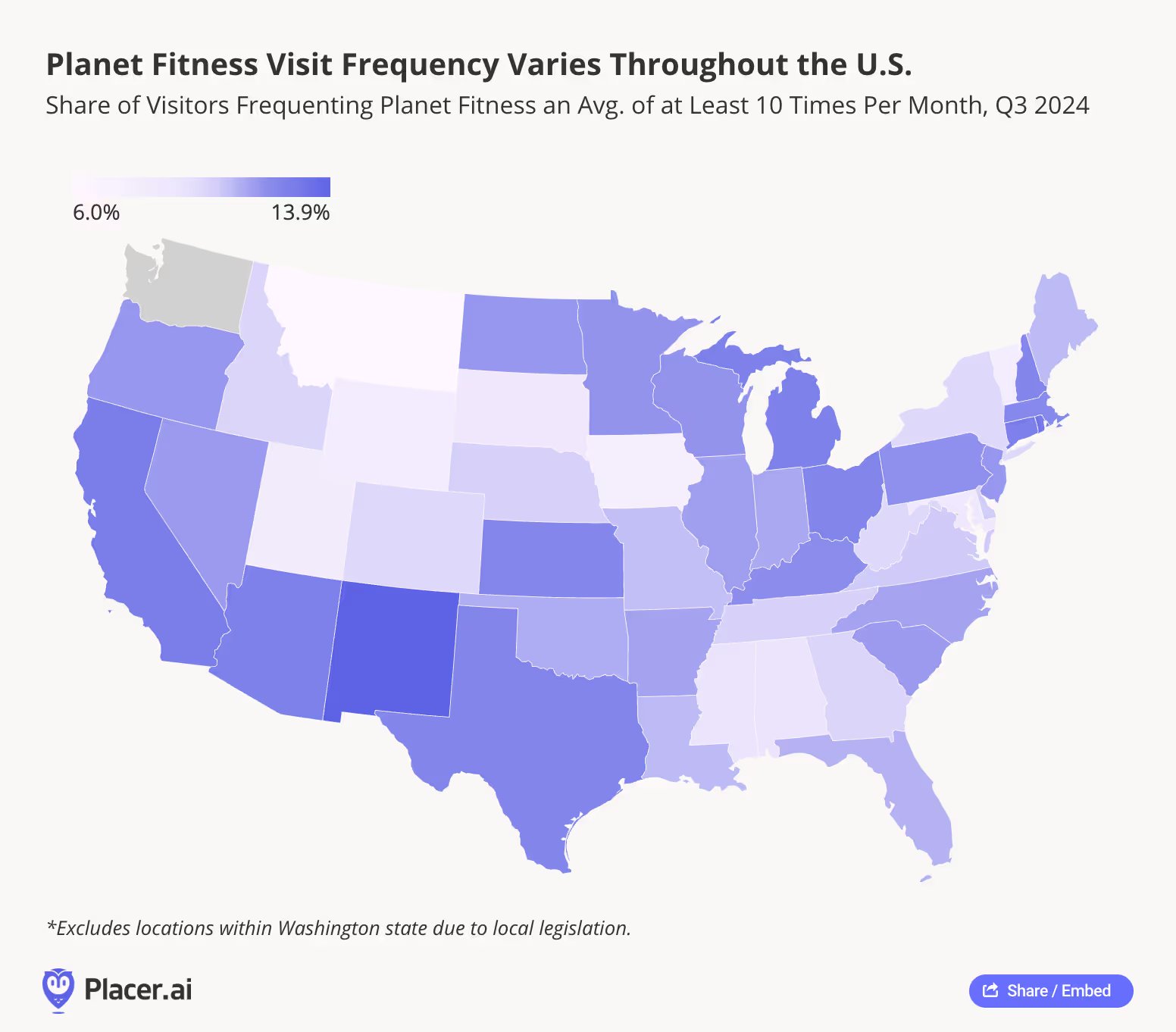

Gym visit frequency, however, varies throughout the United States. Analyzing the share of highly committed visitors to Planet Fitness reveals significant differences between states.

New Mexico led the pack in Q3 with 13.9% of visitors frequenting the gym, on average, at least ten times a month – followed by Rhode Island (13.1%) and California (12.7%). On the other end of the spectrum lay Montana, where just 6.0% of club goers were highly committed visitors in Q3, followed by Iowa (7.7%) and Vermont (8.0%).

This data highlights how gym engagement can be influenced by regional factors such as lifestyle, climate, and access to alternative fitness options – suggesting that Planet Fitness and similar chains may benefit from tailoring their marketing and membership strategies to local trends and preferences.

Rep and Repeat

The holiday season isn’t a particularly busy one for gyms – which usually see traffic begin to slow down in September before picking up again in the new year. But if Planet Fitness’ solid September 2024 performance is any indication, the chain may be in for a busier fourth quarter this year than last. Will Planet Fitness continue to deliver as the year draws to a close?

Follow Placer.ai’s data-driven analyses to find out.

This blog includes data from Placer.ai Data Version 2.1, which introduces a new dynamic model that stabilizes daily fluctuations in the panel, improving accuracy and alignment with external ground truth sources.

.svg)

.png)

.png)

.png)

.png)