How did Petco and PetSmart, the two big-box leaders of the pet sector, fare in early 2024? We dove into the data to find out.

Key Takeaways

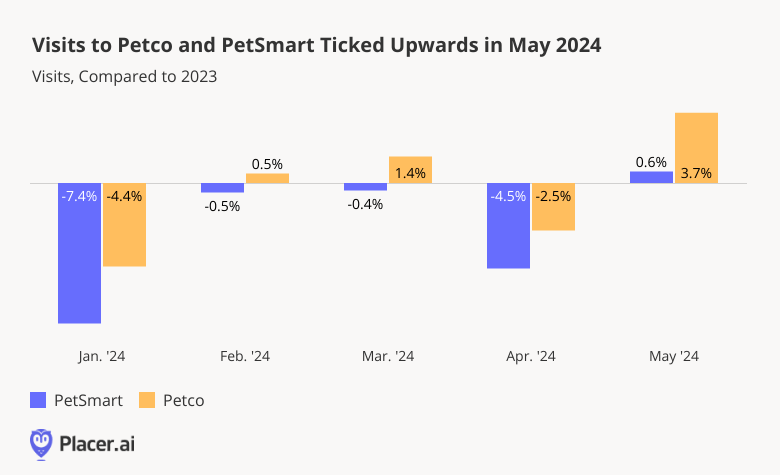

- Petco has been outperforming PetSmart in year-over-year (YoY) visits since January 2024. Both brands finished off Q1 (January - March 2024) with minor YoY visit lags of 0.8% and 2.8%, respectively. But in May, visits to the two brands began to perk up – with Petco experiencing a 3.7% YoY foot traffic boost and PetSmart seeing a slight uptick of 0.6%.

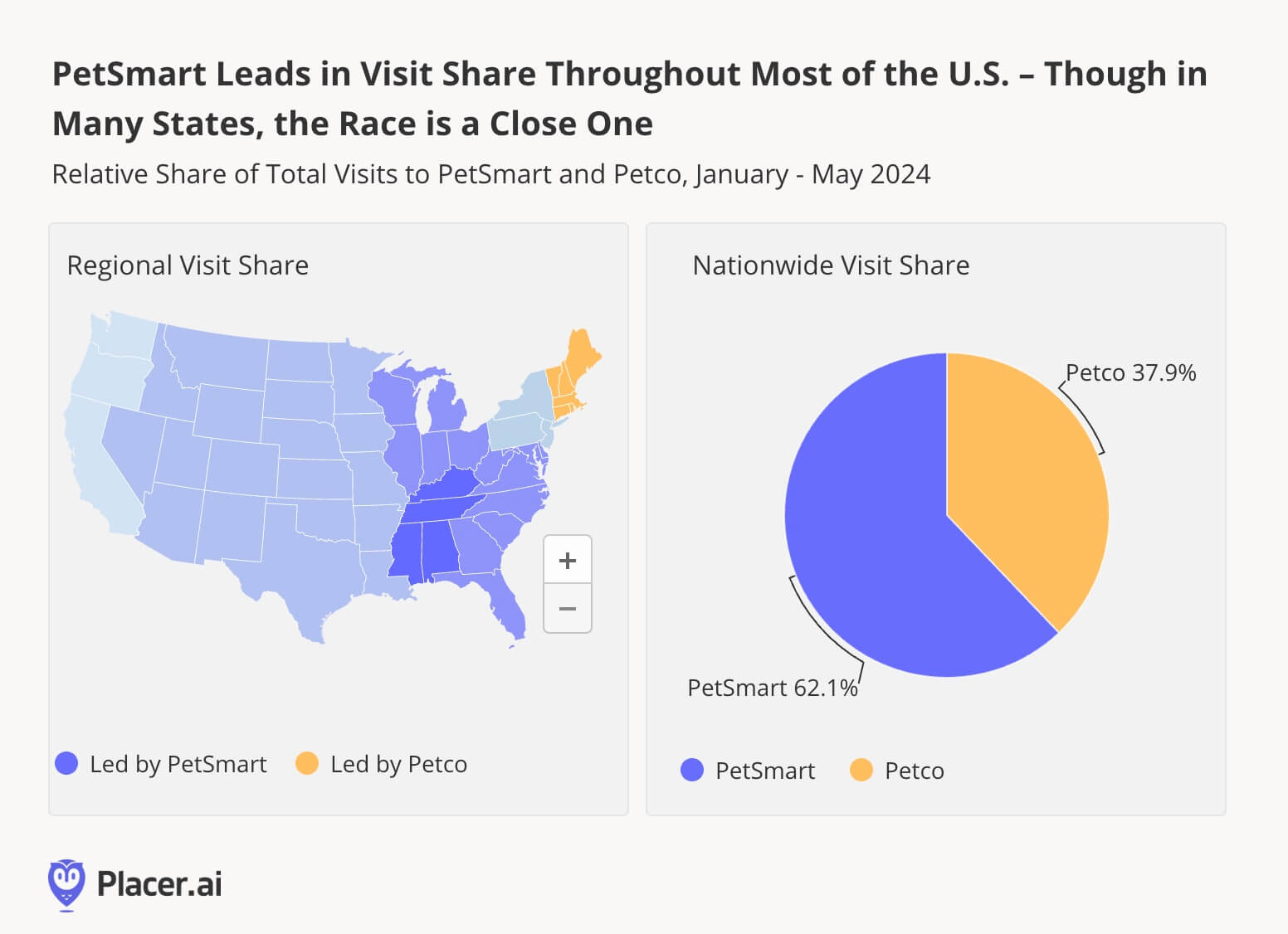

- Still, PetSmart draws more overall visits than Petco: Between January and May 2024, PetSmart drew 62.1% of total foot traffic to the two category leaders, while Petco drew 37.9%.

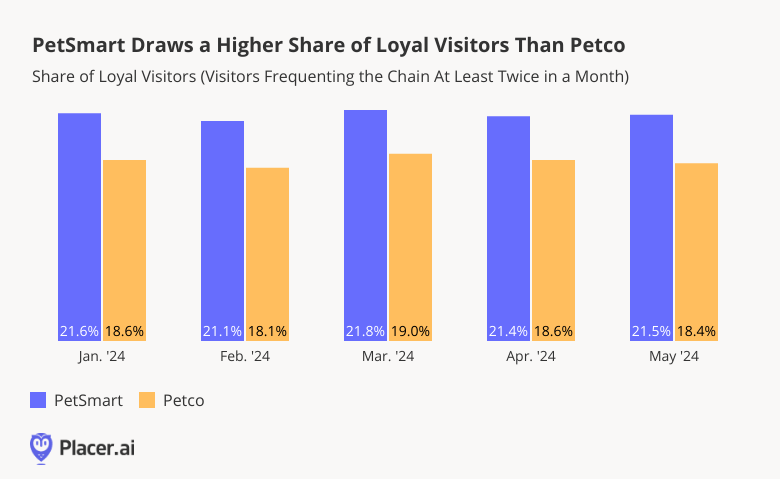

- Though PetSmart’s greater visit overall share is partially due to its larger fleet, visitation data shows that the chain also boasts a particularly loyal customer base.

Dogged Determination

In recent months, Inflation and sagging consumer confidence have taken their toll on the pet supplies industry, which relies at least partially on discretionary spending, and in its Q1 2024 earnings report, Petco reported a minor YoY drop in revenue. But while Petco saw YoY visit dips in January and April – softened by minor upticks in February and March – visits increased 3.7% YoY in May.

PetSmart, for its part, experienced even more consistent YoY visit lags in early 2024. But like its competitor, the pet supplies giant also saw signs of a potential softening or even reversal of this trend in May. And for both chains, May’s positive showing may be a sign of even better things to come heading into summer.

PetSmart: The Top Dog Nationwide

But while Petco led PetSmart in YoY visit performance in early 2024, PetSmart hasn’t relinquished its position as the most-visited pet store chain in the country. Between January and May 2024, 62.1% of total foot traffic to the two chains went to PetSmart, compared to just 37.9% for Petco, and PetSmart was the top-visited chain in most regions nationwide.

Still, drilling down into statewide-level data reveals a more complex picture. In New England, Petco was the dominant player in early 2024. And in the Pacific region, the two chains were neck in neck.

PetSmart’s visit share lead is partially driven by its larger fleet. But foot traffic data shows that other factors are likely at play as well.

PetSmart Leads in Loyalty

Indeed, though both chains boast loyal visitor bases, PetSmart customers generate more repeat visits than Petco ones – a factor likely further contributing to PetSmart’s increased visit share.

During the first part of 2024, some 21.1% to 21.8% of PetSmart visitors visited the chain at least twice each month – compared to 18.1% to 19.0% for Petco. PetSmart’s enhanced loyalty may be driven in part by the greater selection in-house pet services offered by the chain.

Cool Cats Heading Into Summer

Pet store visits tend to be seasonal – December is generally the industry’s busiest month of the year, followed by March and July. Do Petco’s and PetSmart’s May upticks herald strong July peaks this year?

Follow Placer.ai’s data driven retail analyses to find out.

.svg)

.png)

.png)

.png)

.png)