As cars get more expensive, demand for repairs rises – and auto part chains are reaping the benefits. We analyzed the visit data for four leading auto part chains – AutoZone, O'Reilly Auto Parts, NAPA Auto Parts and Advance Auto Parts – and dove into O’Reilly Auto Parts’ recent growth to understand what may be driving success in this flourishing segment.

Could 2024 Be the Year of Auto Parts?

Auto parts chains are having a moment. With vehicle prices significantly higher than before COVID, many consumers would rather fix their cars than purchase new ones. At the same time, inflation has begun to subside, leaving people with more room in their budgets for non-essential maintenance and repairs.

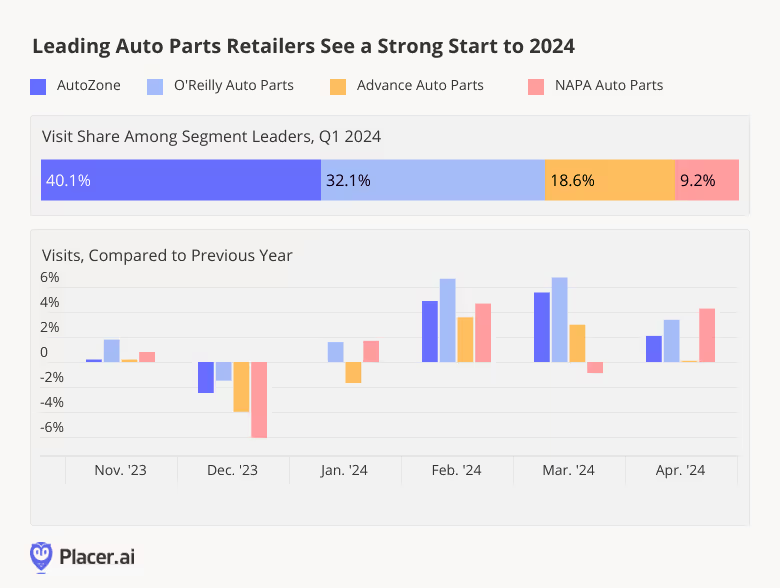

Following a drop in December 2023, YoY visits to AutoZone, O’Reilly Auto Parts, Advance Auto Parts, and NAPA Auto Parts began to pick up in January 2024 – despite unusually cold and stormy weather that left many consumers hunkered down at home. And between February and April, YoY visits to the four chains remained nearly uniformly elevated.

On a quarterly basis, O’Reilly Auto Parts saw the biggest YoY visit increase, despite lapping a strong 2023. The chain, which drew 32.1% of total visits to the four brands in Q1, saw quarterly YoY foot traffic increase by 5.1%. AutoZone, which received 40.1% of quarterly visits to the four chains, saw quarterly YoY visits increase by 3.5%. And Advance Auto Parts and NAPA Auto Parts both saw quarterly YoY visits increase by 1.7%.

O’Reilly’s Successful Loyalty Program

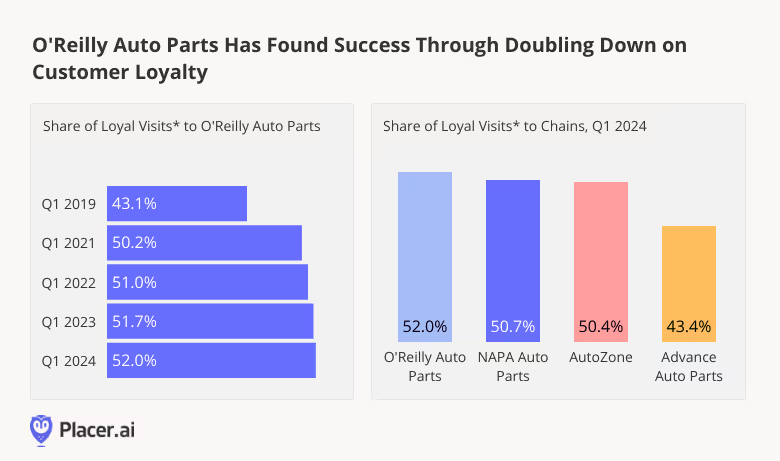

One strategy that has likely helped O’Reilly Auto Parts stay ahead of the pack is its much-touted loyalty program, recently ranked by Newsweek as one of the best in the nation.

Location intelligence shows that since COVID, O’Reilly Auto Parts has seen a steady increase in the loyalty of its customer base. And in April 2024, O’Reilly Auto Parts boasted the most loyal customer base of the four analyzed chains – with 52.0% of visits made by individuals that frequented the chain at least twice during the month. But other auto chains, including AutoZone, also enjoyed significant shares of visits by repeat customers – showing that there’s plenty of room at the top in the auto parts space.

Auto Parts Promising Year

The auto parts industry is poised for success in 2024, with leading chains like O'Reilly Auto Parts, AutoZone, Advance Auto Parts, and NAPA Auto Parts demonstrating resilience and growth. How will these chains continue to perform as the year wears on?

Visit placer.ai to find out.

.svg)

.png)

.png)

.png)

.png)