Not Crumbling Under Any Pressure

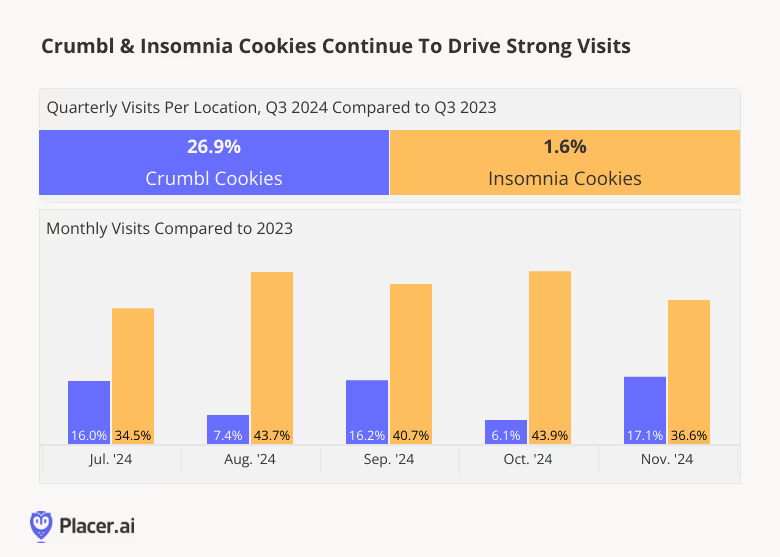

Insomnia Cookies, one of the first companies to innovate in the cookie retail space, is known for its late opening hours and classic cookie flavors. The company started in 2003 by selling fresh-baked cookies to college students and now operates over 300 locations globally. Meanwhile, Crumbl Cookies – known for its celebrity collaborations and intensely loyal social media fanbase – came onto the scene in 2017 and has since grown to over 1,000 franchised locations.

Both chains are expanding, and diving into the foot traffic data reveals that overall visits as well as average visits per location are still growing for both chains – indicating that the cookie craze is still going strong.

Craving Cookie Dough

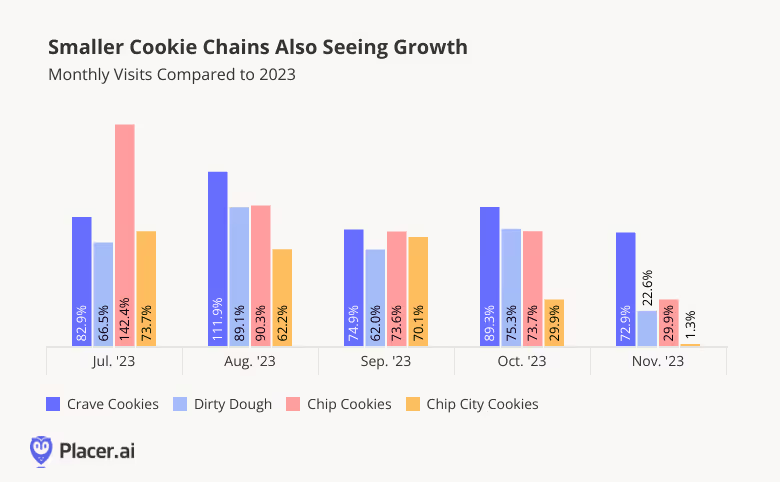

Analyzing visit growth at smaller cookie chains also highlights the strong demand for creative cookie concepts. Crave Cookies (established in 2022), Dirty Dough (2018), Chip Cookies (2016), and Chip City Cookies (2017) are all enjoying strong foot traffic growth relative to 2023, thanks in part to ongoing expansions. Like Crumbl and Insomnia, Crave Cookies, Dirty Dough, Chip Cookies, and Chip City Cookies are all growing their fleet – and the steady stream of store openings has driven consistent YoY visit growth.

The increasing visits to both the larger chains and the smaller cookie brands suggests that the demand for cookies has yet to peak and is likely to continue in 2025. And with these chains still looking to grow, how can location analytics uncover the best opportunities for growth?

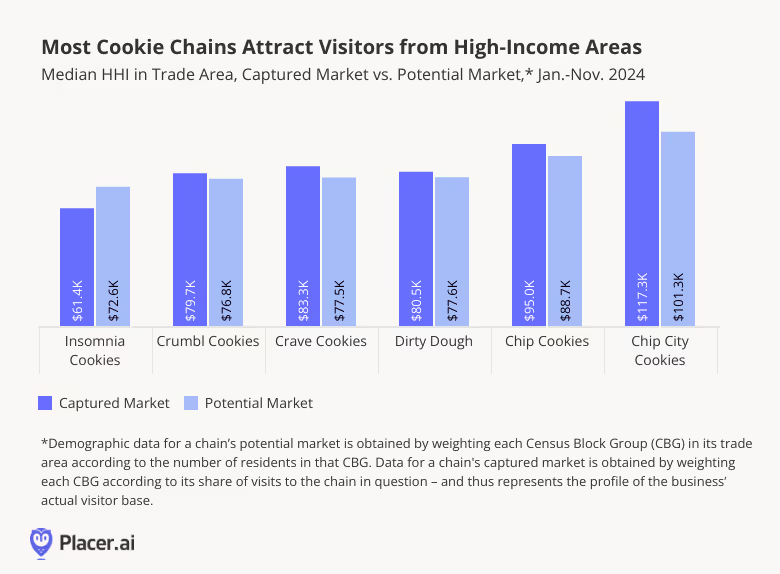

Cookies Resonate With Higher-Income Families

A closer look at the demographic makeup of visitors to the analyzed cookie chains suggests that some of these chains’ consistently strong performance may be due to the relative affluence of their consumer base: The STI: PopStats dataset reveals that all of the chains' captured markets – with the exception of Insomnia Cookies – have higher shares of wealthy consumer segments than their potential one. (A chain’s potential market is obtained by weighting each Census Block Group (CBG) in its trade area according to population size, thus reflecting the overall makeup of the chain’s trade area. A business’ captured market, on the other hand, is obtained by weighting each CBG according to its share of visits to the chain in question – and thus represents the profile of its actual visitor base).

Among the analyzed chains, Chip City Cookies attracted visitors from the highest-income areas, with a captured market median HHI of $117.3K – $16.0K higher than its potential market median HHI of $101.3K. Crumbl, Crave, Dirty Dough, Chip, and Chip City also drew visitors from higher-income areas relative to their potential market median HHI.

In contrast, Insomnia Cookies was the only chain with a lower median HHI in its captured market relative to its potential market, likely reflecting its positioning as a late-night snack option for college students.

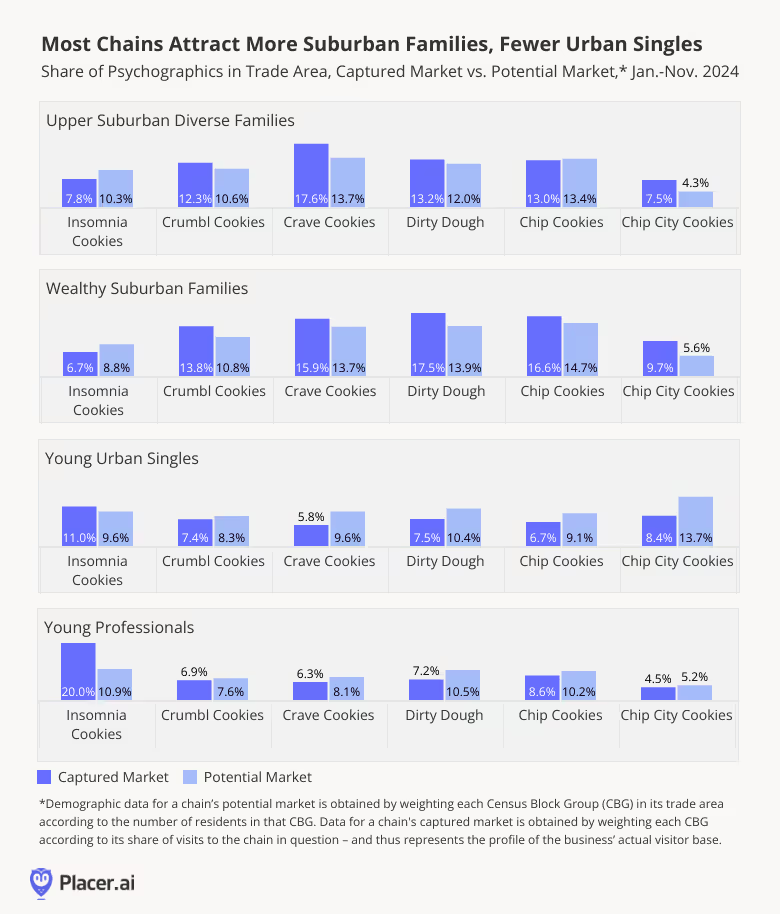

Suburban Families Favor Cookie Chains

The relatively high-income of cookie consumers may be partially due to the chains’ popularity with suburban segments: According to the Spatial.ai: PersonaLive dataset, almost all the analyzed chains saw a higher share of “Upper Suburban Diverse Families” and “Wealthy Suburban Families” in their captured markets compared to their potential market. Meanwhile, the shares of “Young Urban Singles” and “Young Professionals” were lower across nearly all the analyzed chains’ captured market relative to their potential markets.

And once again, Insomnia Cookies stood out – the company’s captured market included an outsized share of “Young Professionals” and “Young Urban Singles,” perhaps due to the company's positioning as a late-night college campus favorite.

Taken together, this data suggests that, unless a chain is focused on acquiring a specific audience segment – like Insomnia did when targeting younger, less affluent consumers such as college students – most cookie chains are most likely to thrive in affluent suburban markets.

To The Last Crumb

The enjoyment provided by a sweet treat is universal – but will these cookie chains retain their edge as the dessert shop market grows increasingly crowded?

Visit Placer.ai to keep up-to-date with the latest data-driven dining insights.

.svg)

.png)

.png)

.png)

.png)