Last year was marked by inflation and consumer cutbacks as shoppers adjusted to price hikes across key retail and dining categories. But despite the challenges, many categories and retailers not only weathered the storm but positively thrived under the ongoing headwinds.

Now, with a new year offering fresh opportunities for growth, what are the retail and dining segments positioned for success in 2024? We dove into the data to find out.

1. Specialty Grocery

Last year’s high grocery prices led to a surge in foot traffic to affordable supermarket chains – but food-away-from-home inflation also seems to have driven visits to high-end grocers. Visits to chains such as New York-based Uncle Giuseppe’s, Illinois-based Cermak Fresh Market, and California-based Lazy Acres saw consistent year-over-year (YoY) visit increases as consumers sought specialty ingredients to recreate restaurant-quality dishes at home. Rising interest in sustainability, natural products, and organic ingredients – especially among Gen-Z – likely helped drive traffic growth as well.

But the success of specialty grocers isn’t just coming from singles willing to splurge on the latest influencer-backed food trend – trade area demographic data reveals that families with children are overrepresented in the captured market trade area of all three specialty grocers analyzed. With restaurant prices likely increasing slightly in 2024, consumers looking to feed their families tasty dishes without breaking the bank – or shoppers feeding the growing demand for natural food products – will likely keep visits to specialty grocers high in the coming year.

.avif)

2. Healthy Dining Concepts

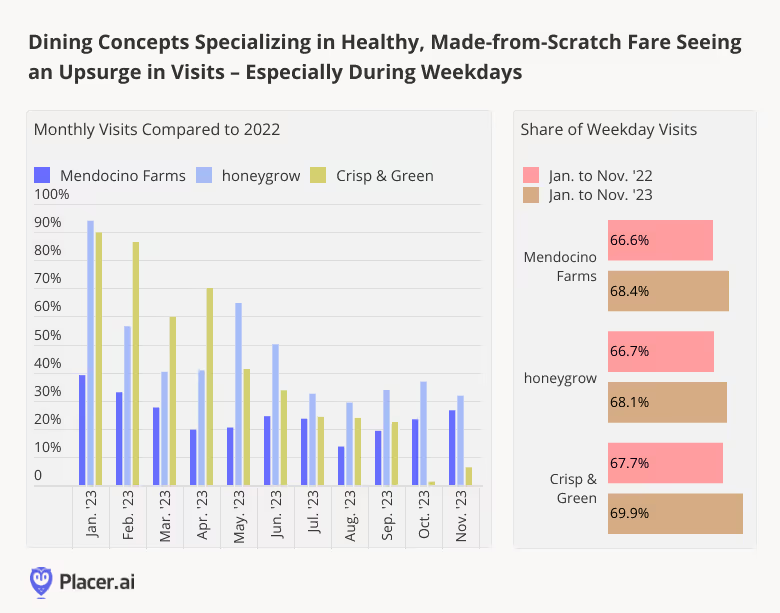

Along with the rise in specialty grocers selling natural and organic ingredients, restaurants focusing on whole, healthy foods are also seeing a boost – and the segment is positioned for further growth in 2024. Consumers are flocking to concepts such as Mendocino Farms, honeygrow, and Crisp & Green that boast fresh ingredients and made-from-scratch dishes – and these chains are all expanding to meet the growing demand.

Visits to healthy dining concepts are no longer reserved for special occasions – weekday foot traffic is also on the rise, with all three dining brands analyzed seeing a YoY rise in the share of Monday to Friday visits. With employees slowly but surely returning to the office and looking to grab a nutritious lunch mid-day or meet up with friends for a balanced dinner on their way home, demand for health-focused dining concepts is likely to continue growing in 2024.

3. Fried Chicken Chains

Dave’s Hot Chicken was one of 2023’s biggest dining success stories, and the chain was not the only fried chicken franchise attracting significant foot traffic. Raising Cane’s, which has been on a roll for several years, and Huey Magoo’s Chicken Tenders – which serves grilled chicken and other fare alongside its signature fried tenders – are also taking the country by storm.

Foot traffic to the chains surged in 2023, driven in part by aggressive expansions. But zooming into November 2023 data reveals that average visits per venue are also up YoY, despite all three brands’ much larger store fleets – indicating that the fried chicken boom is meeting a ready demand. It seems, then, that while some diners will favor healthy foods in the new year, other consumers are likely to continue driving visits to fried chicken chains in 2024.

.avif)

4. Affordable Luxuries

Fried chicken isn’t the only indulgence positioned to thrive in 2024. Other affordable luxuries raked in visits last year and are likely to continue seeing growth in the year ahead.

Although inflation appears to be cooling, prices across many goods and services still remain elevated, with some shoppers still putting off large purchases. But consumers are willing to splurge on small treats that won’t break the bank, and tasty snacks and food items – from craft doughnuts to gourmet deli sandwiches to specialty coffee concoctions – could provide the perfect affordable and guilt-free pick-me-up. Parlor Doughnuts, Pickleman’s Gourmet Cafe, and Dutch Bros. Coffee are some of the chains that benefited from this trend in 2023 and will likely continue to grow in the new year.

The trade areas of the three chains analyzed all include a larger-than-average share of “non-family households” – people living with unrelated individuals. As high housing costs continue to lead more U.S. adults to live with roommates, the number of consumers looking to escape their daily grind with an affordable indulgence is likely to increase in 2024 – and drive even larger visit surges to chains offering budget-friendly treats.

.avif)

5. Personal Grooming & Self Care

Non-comestible affordable indulgence such as tanning salons, hair-removal parlors, and eyelash salons are also seeing a rise in visits that will likely continue in the coming year. Deka Lash, Tan Republic, Glo Tanning, and LaserAway are some of the chains that saw their YoY visits increase significantly in 2023, and the growth does not appear to be slowing down.

All four chains’ trade areas included a larger share of Gen-Z visitors (aged 18-24) than the share of 18-24 year olds nationwide. And since, despite inflation, younger shoppers tend to spend more than the average American on beauty and self care – and Gen Z’s spending power is only expected to grow in the coming year – personal grooming chains are well positioned to succeed even further in 2024.

.avif)

6. Themed Fitness Concepts

Another personal care-adjacent segment slated for growth in 2024 is themed fitness. Gyms and studios that focus on a particular type of activity or fitness regimen – such as climbing, yoga, pilates, or HIIT are seeing their visits skyrocket, with both the number of monthly visits and the average visit frequency on the rise YoY.

The rising popularity of themed fitness concepts may be aided by the sense of community fostered by many of these chains. Touchstone Climbing organizes meetup groups geared towards specific audiences, while F45 Training prides itself on facilitating a sense of purpose and belonging among its members. And yoga and pilates classes have long been recognized for their capacity for connection-building.

With loneliness on the rise and many consumers looking to incorporate a fun, social element into their fitness routines, the demand for themed fitness concepts will likely keep on growing in 2024.

.avif)

7. Upscale Apparel

Cost-effectiveness does not necessarily mean cheap. And while some retail segments to watch in 2024 stand out for their low price points, other segments that offer consumers a particularly strong value proposition also appear well positioned to thrive in the coming year. Chains such as Theory, Anthropologie, and Marine Layer all saw YoY increases in monthly visits every month of 2023, perhaps aided by the “quiet luxury” trend that drove demand for high-quality, non-ostentatious fashion. And while these brands may not offer the cheapest price, the focus on good craftsmanship and premium fabrics may help consumers feel better about shelling out a little more for each item.

All three brands analyzed have a significant presence in California. Diving into their captured market in the Golden State reveals that visitors to these upscale apparel retailers tend to be wealthier and are more likely to live alone when compared to the average California resident. So even as many companies look to cater to the increasing share of budget-conscious consumers, other retailers willing to invest in quality materials and offer a premium customer experience can still thrive in 2024 by meeting the needs of more affluent audiences.

.avif)

Many Ways to Succeed in 2024

From healthy foods to fried fare, and from affordable treats to higher-priced apparel, the diversity of retail and dining segments to watch in 2024 highlights the many opportunities for success in the coming year. Where will visits skyrocket? Which brands will hit it out of the park?

Visit placer.ai/blog to find out.

.svg)

.png)

.png)

.png)

.png)