How did the home improvement and decor segments fare in the first months of 2024? We checked in with some of the categories’ biggest names – including Home Depot, Lowe’s, Tractor Supply Co., Harbor Freight Tools, Homesense, HomeGoods, and At Home – to see what Q1 portends for their performance the rest of the year.

Tide Turning For Major Home Improvement Chains

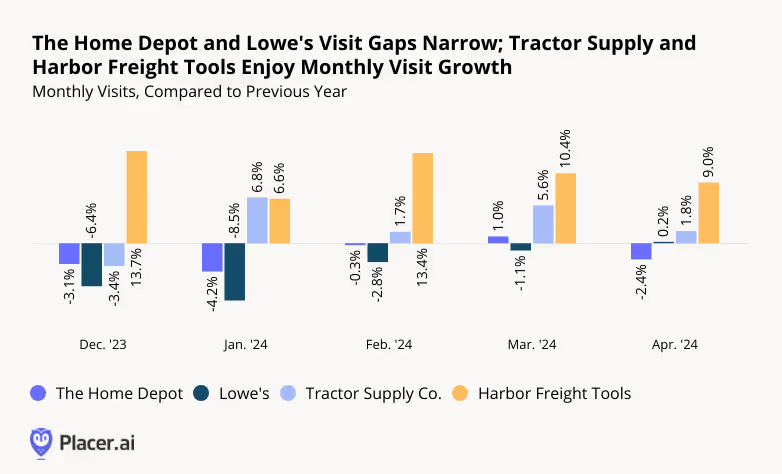

Last year was a challenging one for the home improvement space – as consumers cut back on discretionary spending and put pricey renovations on hold. But Q1 2024 visit data suggests that the category may be ready for a comeback. Throughout Q1 2024, Lowe’s saw its monthly visit gap narrow steadily – and in April 2024 saw the first YoY visit uptick the chain has experienced since 2021. And YoY visits to Home Depot were down just 0.3% in February 2024 and up 1.0% in March. Though Home Depot saw a minor visit gap emerge once again in April, the home improvement powerhouse appears to be on solid footing heading into the spring season.

While Home Depot and Lowe’s are rebounding, other home improvement chains are thriving. Discount chain Harbor Freight Tools continued to grow its footprint – and its visits – by expanding into new markets and cementing its role as a go-to destination for inexpensive home maintenance supplies. And farming essentials retailer Tractor Supply Co. also increased its store count together with its traffic. By occupying somewhat less discretionary niches, these two retailers have managed to avoid some of the headwinds plaguing the category.

More Decor

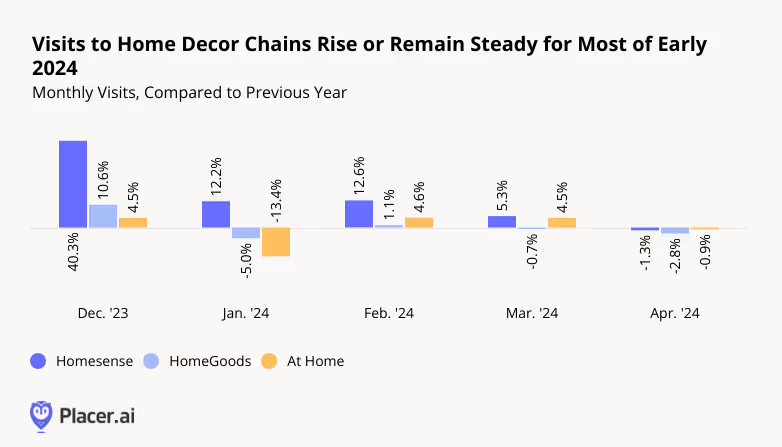

The home decor segment, including brands like Homesense, HomeGoods (both owned by parent company TJX Companies), and At Home, offers consumers a way to enhance their living spaces while avoiding the high costs associated with renovations or moving. And in Q1 2024, shoppers leaned into the category’s offerings.

Despite lapping a strong 2023, Homesense – which recently decided to close its ecommerce channel and focus on offline expansion – saw YoY visit growth throughout Q1. And though inclement weather weighed on HomeGoods’ and At Home’s January performance, YoY visits to the two brands increased or remained stable in February and March. In April 2024, all three chains held steady with slight YoY visit gaps – no small feat given the category’s largely discretionary nature.

Home Decor: An Affluent Consumer Base

Indeed, diving into the demographics of visitors to Homesense, HomeGoods, and At Home reveals that it is more affluent consumers that are driving visits to the three chains. Each chain's potential market* boasts a median household income (HHI) close to or above the nationwide median of $76.1K/year. But the median HHI of each chain’s captured market is notably higher – suggesting it is the wealthiest consumer segments in each chain’s trade area that are visiting the brands.

*A chain’s potential market refers to the population residing in a given trade area, where the Census Block Groups (CBGs) making up the trade area are weighted to reflect the number of households in each CBG. A chain’s captured market weighs each CBG according to the actual number of visits originating to the chain from that CBG.

.avif)

Final Thoughts

Home improvement and decor chains have seen their shares of ups and downs over the past few years, from pandemic highs to inflationary lows. And while some players thrived in Q1 2024, others weathered headwinds while maintaining their equilibrium. How will the space continue to fare as 2024 progresses?

Follow Placer.ai to find out.

.svg)

.png)

.png)

.png)

.png)