How did the Placer 100 Index for Retail & Dining fare in June 2024? We dove into the data to find out.

Retail and Dining: A Positive Start to Summer

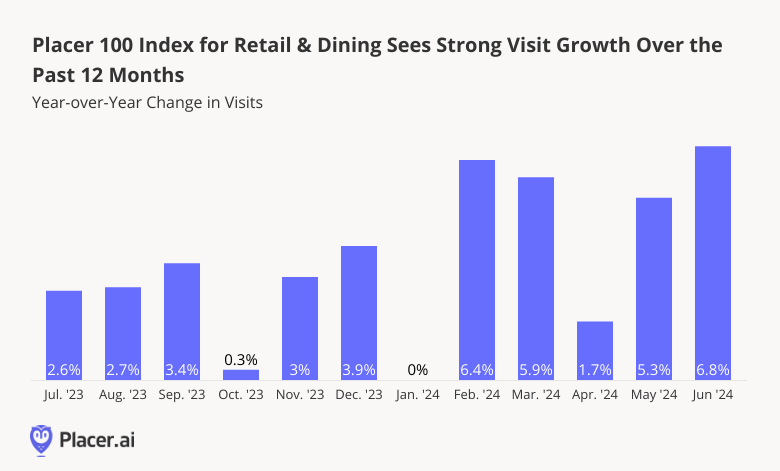

As the first half of the year comes to a close, retail and dining visits continue to demonstrate resilience. Analyzing the YoY foot traffic performance of the Placer 100 Index for Retail and Dining highlights this positive trend, with June visits increasing 6.8% relative to June 2023. This growth follows May 2024's YoY visit growth of 5.3%.

This upward visitation pattern shows that despite continued concerns, consumers are feeling cautiously optimistic about the current economic climate. With back-to-school shopping set to ramp up over the next two months, retail visits may well continue on their upward trajectory.

June’s Grocery Dominance

Drilling down deeper into the data highlights the priority shoppers continue to place on value – with bargain retailers claiming many of the top spots for YoY visit growth. Grocery stores were also major winners in June 2024, likely buoyed by consumers seeking to cut costs by making more of their food at home.

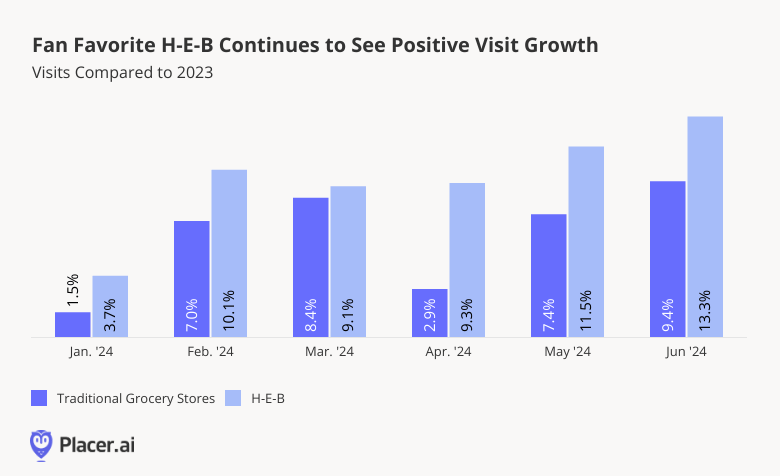

Three grocery chains ranked among June 2024’s top YoY visit performers: Aldi (28.4%), Trader Joe’s (17.4%) and H-E-B (13.3%). These chains, as well as three others – Food Lion Grocery Store, ShopRite, and Walmart Neighborhood Market – were also among the top performing chains for YoY visits per location.

H-E-B: A June Grocery Winner

Within the already-strong grocery segment, one chain – H-E-B – continues to prove its staying power. Despite being concentrated in Texas, the chain consistently ranks as one of the most popular grocery chains in the country, as evidenced by its consistently elevated foot traffic.

Since January 2024, YoY visits to H-E-B have increased substantially – outperforming the wider traditional grocery sector. Though very much a full-service supermarket, H-E-B’s foot traffic growth has been more akin to that seen by budget-oriented, limited assortment chains like Aldi and Trader Joe's.

Short Visits Lead The Way

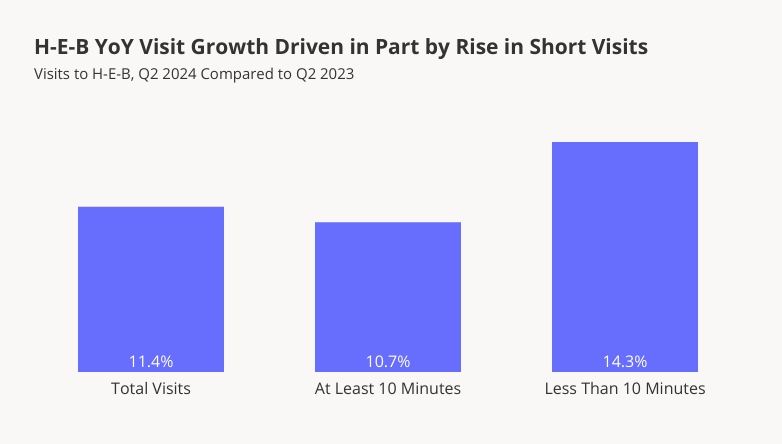

One factor that may be contributing to H-E-B’s ongoing success is its growing role as a purveyor of takeout and inexpensive prepared food options. Many of H-E-B’s grocery stores have in-store restaurants – and the chain also offers a variety of other ready meals and snacks.

The focus on takeout and convenience food seems to be a solid move for H-E-B, as evidenced by the chain’s YoY increase in short visits – i.e., those lasting under ten minutes. In Q2 2024, short visits to H-E-B increased by 14.3% compared to Q2 2023, while over the same period, longer visits increased by a more modest 10.7%. Some of these quick-stop visitors may be dropping by to grab a snack or to-go meal.

In recognition of the growing demand for quick-stop grocery and prepared food options, H-E-B has also been making inroads into the c-store space, with a chain of twelve convenience stores recently rebranded as H-E-B Fresh Bites. And as a grocer with its finger on the pulse of what shoppers want, H-E-B appears poised for further success.

Strong Positioning Ahead Of Back-To-School Season

As the summer gets underway, retail and dining visitation patterns remain strong – with value chains and grocery retailers leading the way. How will these trends continue to play out throughout the summer?

Visit Placer.ai to find out.

.svg)

.png)

.png)

.png)

.png)