Last summer’s touring sensations Taylor Swift and Beyonce held concerts that will remain in the hearts of many. With thousands in attendance, both live tours were absolute juggernauts. It was like an adrenaline shot for the performing arts category after COVID-induced closures. Remember the days of drive-in concerts as a panacea? While these two reigning Queens of Music took top billing, there are hundreds of local venues around the country that cater to smaller audiences at a time but are no less impactful on their communities. These are the heart and soul for local plays, musicals, symphonies, operas, touring bands, and art exhibitions. Fundraisers are often held at community performance venues, and they can be incubators for performers to move on to a larger stage.

Placer recently attended the California Presenters Conference, which includes representatives from California, Oregon, Washington, Nevada, Arizona, New Mexico, and Texas. Programming directors, events managers, and community liaisons all met to share best practices, challenges, and successes. One box office manager, Jonathan Lizardo of the Lisa Smith Wengler Center for the Arts at Pepperdine University, noted that “Nostalgia” was an important theme at his performing arts center, with a recent live show of the Animaniacs in Concert proving to be a hit with adults and kids alike. In this case, his patrons were seeking some escapism and levity in their lives. On the other end of the spectrum, the arts can also be a powerful way to engage the audience in more serious issues, as one panel on Responding to Global Conflict at arts venues drew a crowd. Another topic of interest was the importance of engaging youth with the arts, through school-sponsored visits or after school enrichment. Many University performing arts centers reps were also in attendance, such as USC Vision and Voices, Stanford Live, Caltech Presents, and Seattle University.

Placer’s presentation touched on macrotrends around discretionary spend, examples of venue attendance around the US, an analysis of the visitation trends, audience profile, and economic impact of Taylor Swift’s US tour, and in depth look at a select group of performing arts centers in Arizona to see the role that they play in their community.

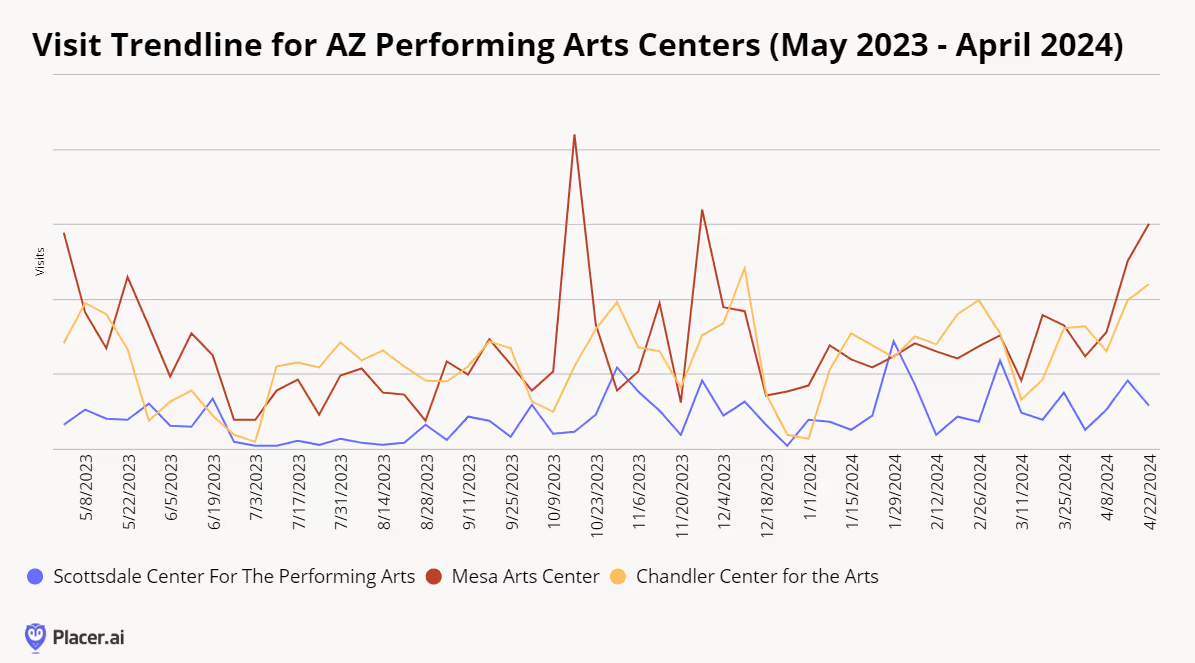

Mesa Arts Center has had the highest overall visitation in the past 12 months. Located in Mesa, AZ, it encompasses over 210,000 sq ft and was completed in 2005 at the cost of $95 million. In addition to four performance venues, it is also home to Mesa Contemporary Arts Museum. Programming is suited to a multitude of interests, including National Geographic Live, Broadway, classical music, popular music, ethnic artists, western artists, and dance. It also offers Art Studio for visual arts classes; Opportunities for Ages 55+ such as flamenco classes; and Festivals and Events, such as Dia de Los Muertos. Within the theaters complex, there are four theaters--the 1,570-seat Tom and Janet Ikeda Theater, 550-seat Virginia G. Piper Repertory Theater, 200-seatNesbitt/Elliott Playhouse, and the 99-seat Anita Cox Farnsworth Studio.

The Chandler Center for the Arts recently celebrated its 35th season. Upcoming performances include ballet like Coppelia or live music, such as Billy Joel’s The Stranger. Entertaining acts such as Stomp, Piano Battle, and Cirque du Soleil will also make their way over during the 2024-2025 season. Located in downtown Chandler, the venue includes three dynamic performance spaces (the 1,500-seat Main Stage, the 350-seat Hal Bogle Theatre, and the 250-seat Recital Hall) as well as two extensive art galleries (The Gallery at CCA and Vision Gallery).

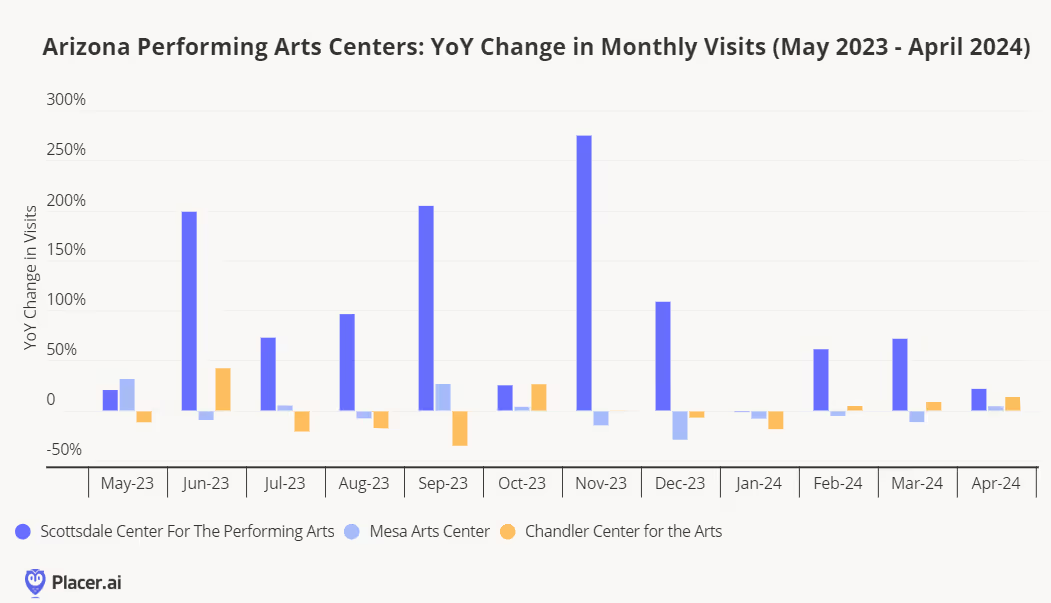

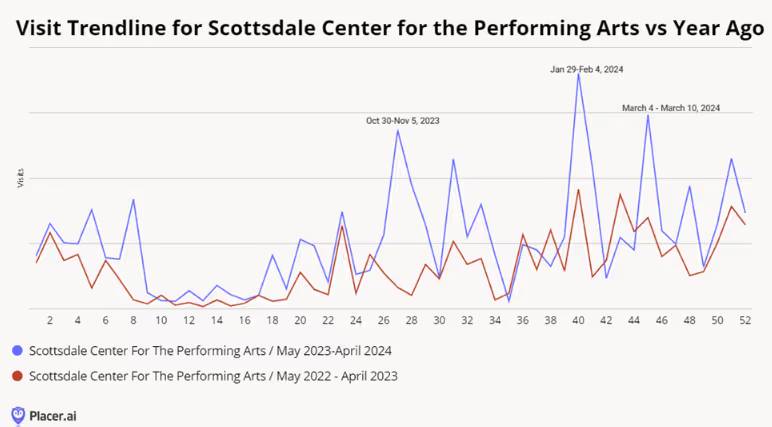

While Scottsdale Center for the Performing Arts had the fewest absolute visits in the past 12 months, its year-over-year variance increase has been the highest.

What might account for the difference, one might wonder. Fortunately, Placer data enables one to compare a venue against itself in order to highlight differences from one year to the next. According to the 2023-2024 calendar, it appears that Hubbard Street Dance Chicago playing 2 nights in a row, was a hit with the audience during the week of Jan 29-Feb 4.

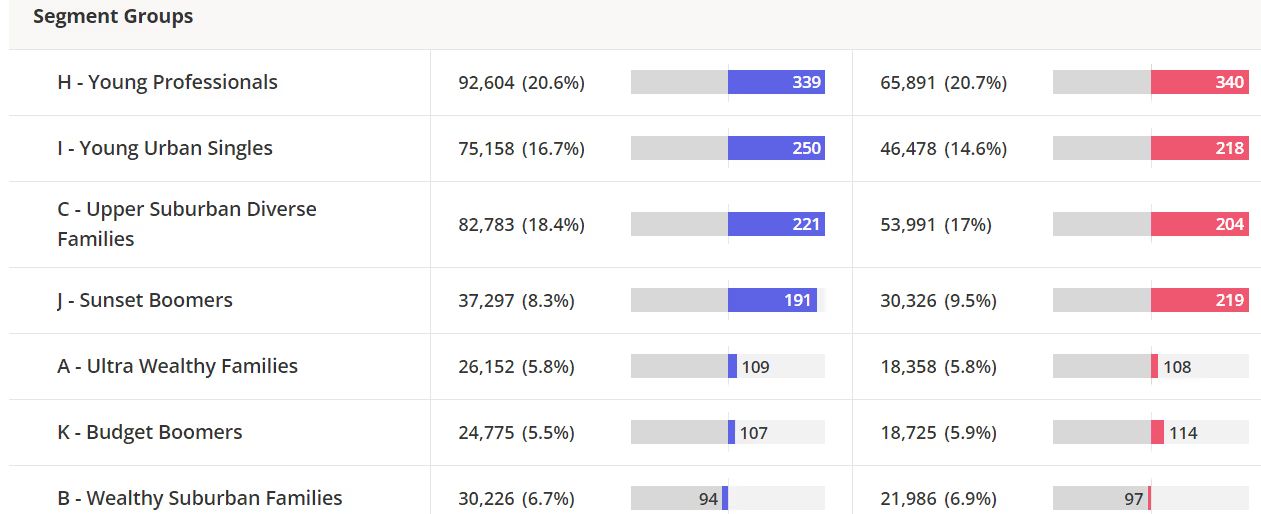

It appears the increase in visits cannot be attributed to a single segment. In fact, visits across multiple segments increased year-over-year when comparing May 2023 - April 2024 (blue) vs. May 2022-April 2023 (red) per Spatial.ai PersonaLive.

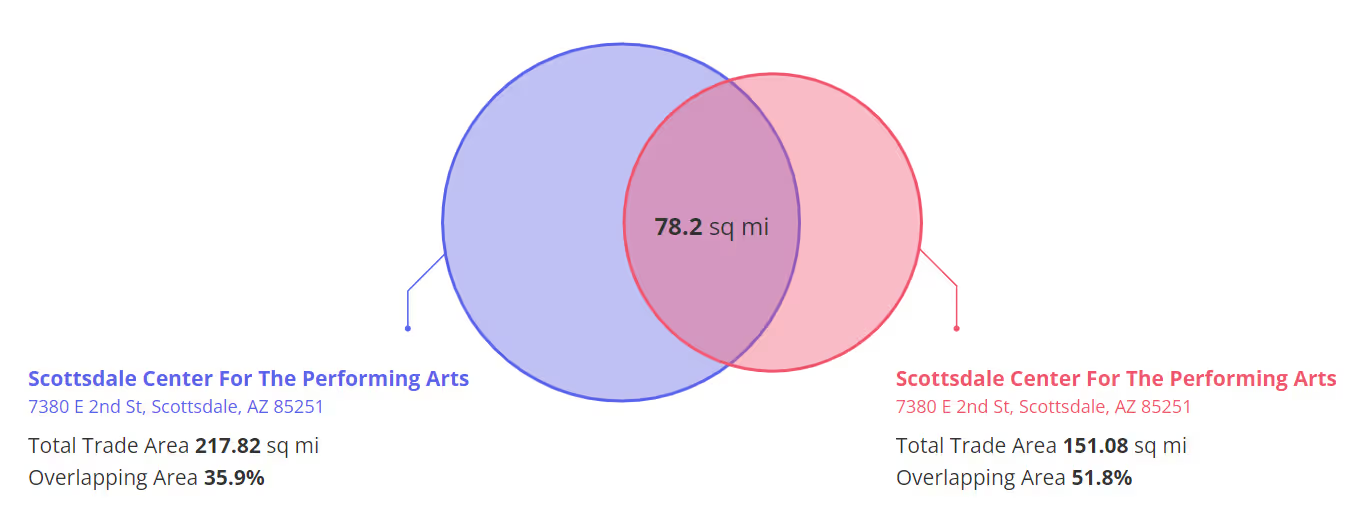

The most recent 12 months also attracted visits from a much larger trade area.

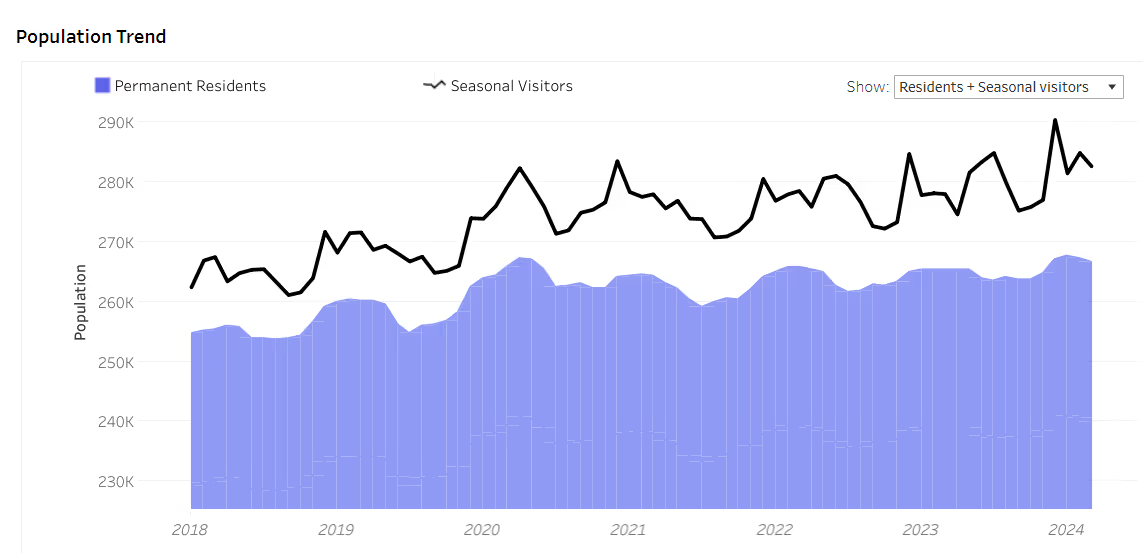

Migration may also be a factor in the increase of visits to the Scottsdale Performing Arts Center. Placer’s Migration Dashboard is noting an increase in both residents and seasonal visitors over the years.

.svg)

.png)

.png)

.png)

.png)