The festive season is upon us, making it the perfect time to focus on a retail category that truly shines in Q4 2024: gifting, books, and paper. Despite the digital age, consumers continue to show a strong preference for shopping for these items in-store and still value tangible versions of these products. However, as discretionary retail faces challenges in meeting consumer expectations, has this category managed to capture consumer excitement and deliver delight amidst competing distractions and purchase priorities?

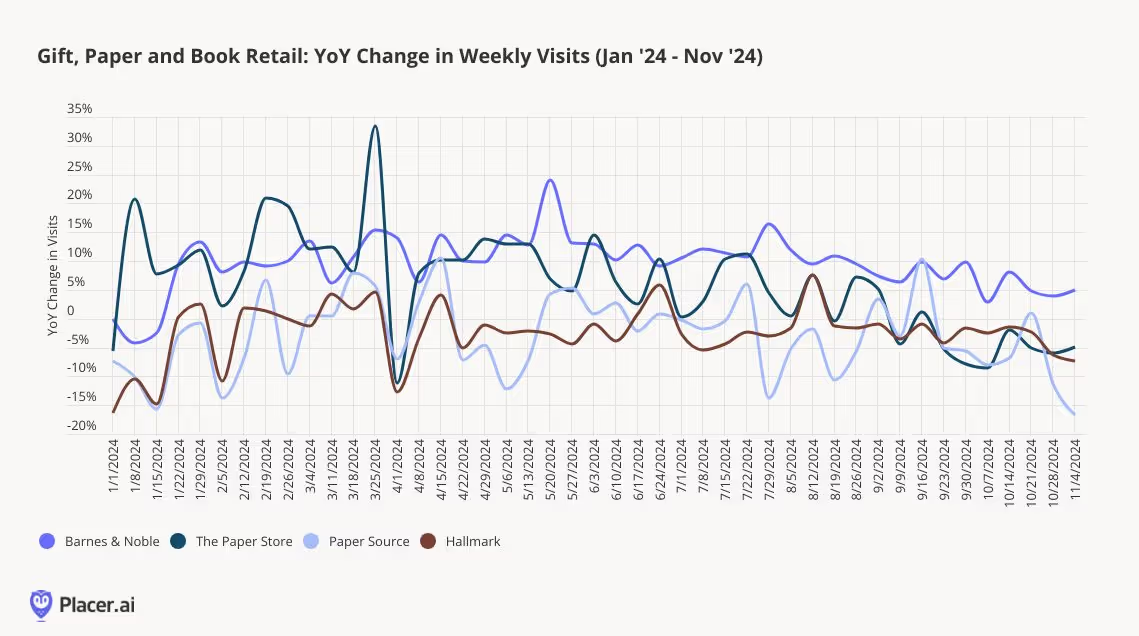

The book, paper, and gift market has experienced mixed performance among retailers this year, but even those facing year-over-year traffic declines have opportunities to improve. Barnes & Noble continues to set the standard, particularly in a category that was among the first to face e-commerce disruption; compared to 2019, visits are up 7% in 2024 despite a smaller store footprint. Paper Source is down 2% year-over-year in visits but is maintaining trends consistent with 2023. Similarly, Hallmark stores have seen a 2% decline in traffic year-to-date, though this aligns with a 5% reduction in store count. Notably, The Paper Store, a Northeastern chain of Hallmark Gold Crown stores, has outperformed the broader Hallmark brand by positioning itself more as a gift-first retailer, with cards and stationery playing a secondary role.

The book, paper, and gift market has experienced mixed performance among retailers this year, but even those facing year-over-year traffic declines have opportunities to improve. Barnes & Noble continues to set the standard, particularly in a category that was among the first to face e-commerce disruption; compared to 2019, visits are up 7% in 2024 despite a smaller store footprint. Paper Source is down 2% year-over-year in visits but is maintaining trends consistent with 2023. Similarly, Hallmark stores have seen a 2% decline in traffic year-to-date, though this aligns with a 5% reduction in store count. Notably, The Paper Store, a Northeastern chain of Hallmark Gold Crown stores, has outperformed the broader Hallmark brand by positioning itself more as a gift-first retailer, with cards and stationery playing a secondary role.

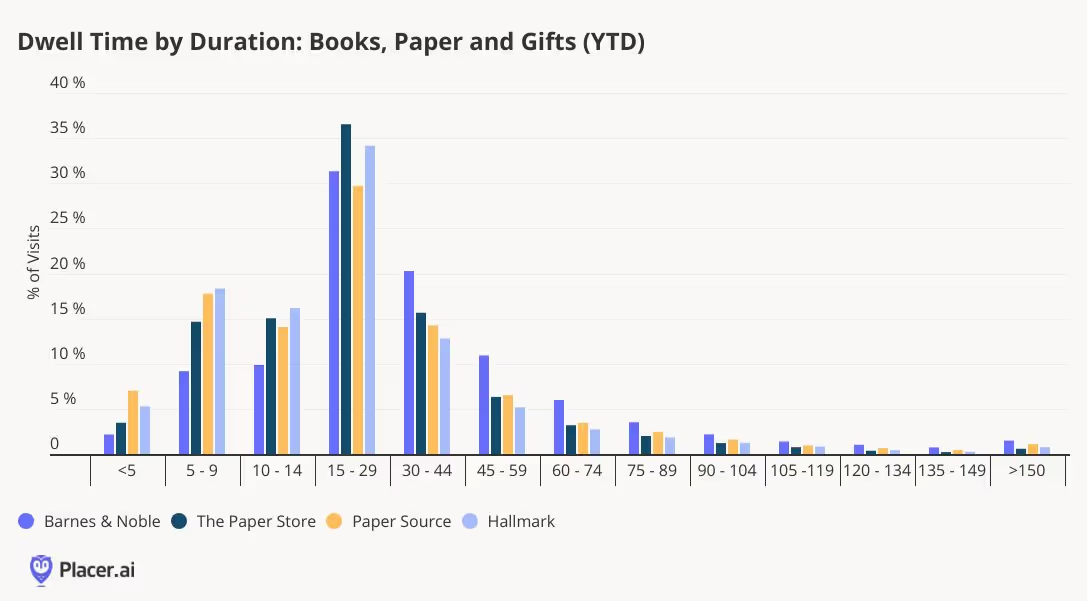

Barnes & Noble's consistent and sustainable traffic growth can be attributed to several successful initiatives. The retailer has expanded its product categories, doubled down on gifting, strengthened its position as a third space, and tapped into consumers' enduring love for books—all of which have set it apart in a challenging discretionary retail landscape. The effectiveness of these efforts is reflected in the chain's dwell time, which averages 37 minutes—nearly 10 minutes longer than any of the other chains reviewed—and excels at keeping visitors in-store for over 30 minutes.

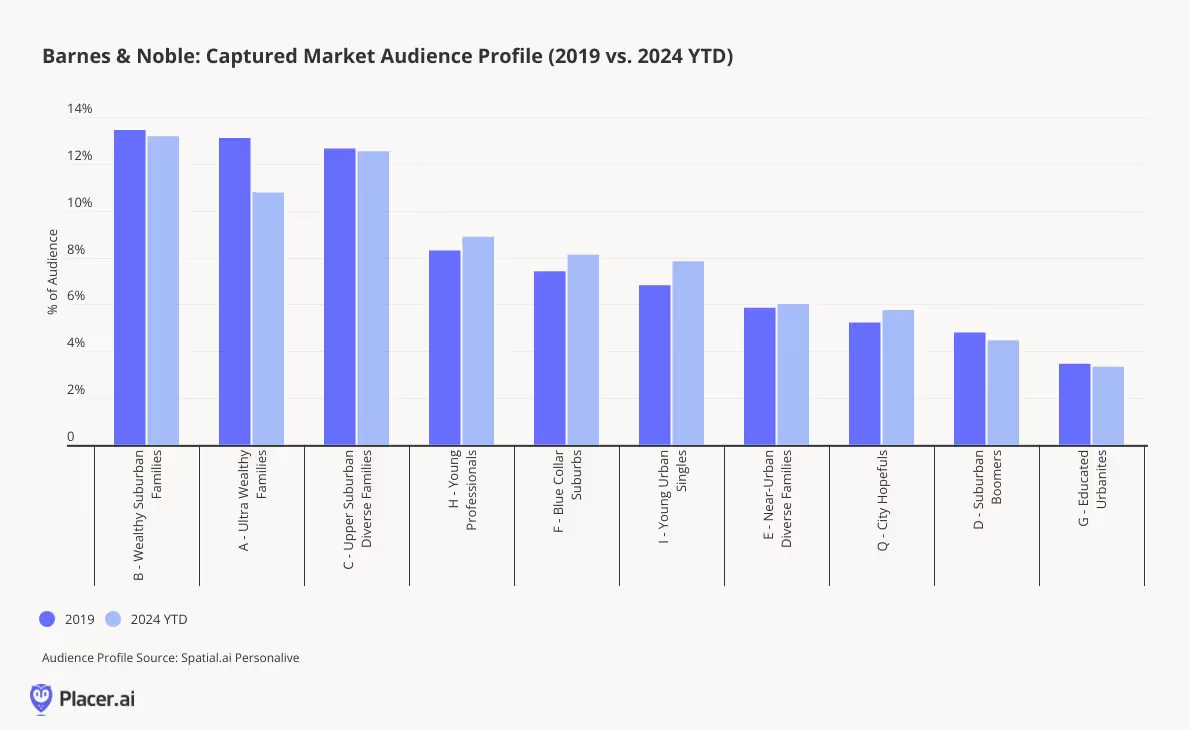

Barnes & Noble has done an impressive job of evolving its visitor demographics over time, particularly in the face of the digital revolution and the disruption of the book category. The success of specialty retailers often reflects broader cultural movements and shifts in consumer preferences, and Barnes & Noble is no exception. According to PersonaLive customer segments, the chain has significantly increased its penetration of younger consumer segments, such as Young Professionals and Young Urban Singles, when comparing 2024 year-to-date with 2019. Factors contributing to this trend could include the rise of book club culture among younger cohorts, the appeal of working from the in-store café, and an expanded assortment of gifts and paper products for special occasions.

This focus on younger consumers seems to be paying off. In 2024, 6% of Barnes & Noble visitors also shopped at a Hallmark location, although only 1% visited Paper Source, its sister brand. The integration of Paper Source shop-in-shops within Barnes & Noble locations may be cannibalizing cross-visitation between the two standalone chains.

As for Paper Source, it shares many of the elements driving Barnes & Noble's success but faces challenges in fully unlocking its potential. One key differentiator is its invitation business, but as consumers increasingly turn to digital platforms like Facebook or Paperless Post for invitations, even the booming wedding market hasn’t been enough to significantly drive growth.

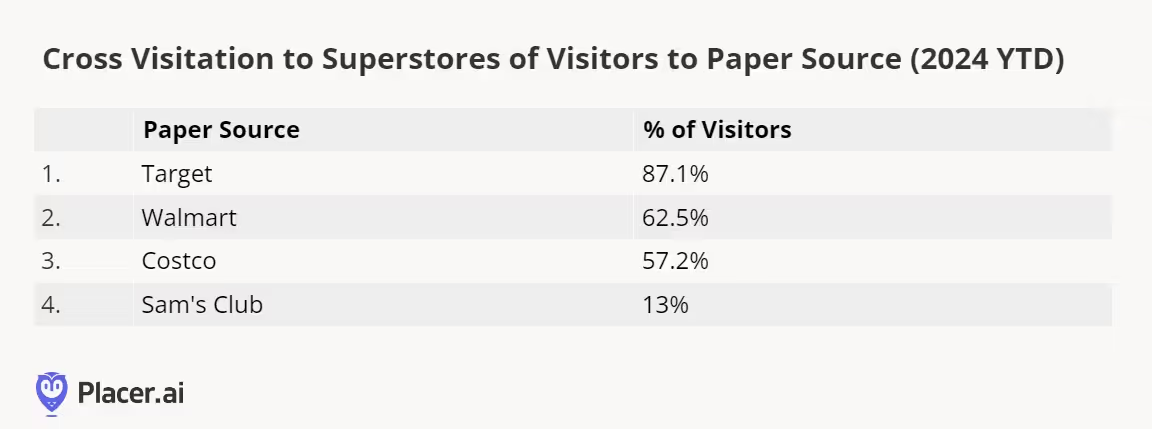

A significant challenge for Paper Source comes from competition within the superstore category. This year, 87% of Paper Source visitors also shopped at Target, and 63% visited Walmart. Both retailers have invested heavily in expanding their party supplies, cards, and gifting assortments, making it more convenient for shoppers to purchase these items during a single trip, rather than visiting a separate specialty store.

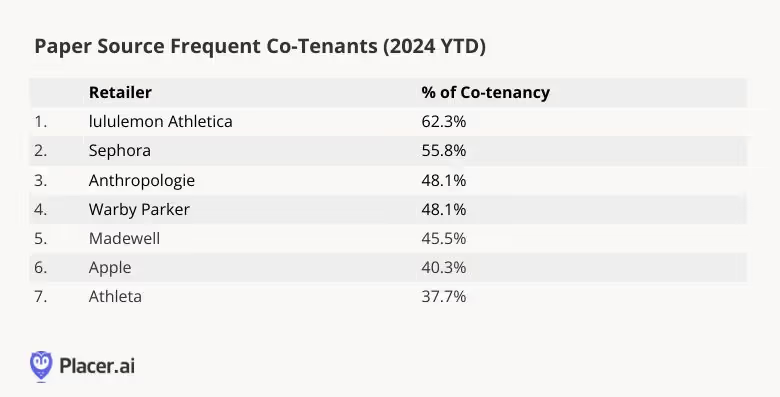

Paper Source has a strong demographic foundation to build upon as it works toward stabilization. According to PersonaLive, the chain significantly outperforms Barnes & Noble in visitation percentages among Ultra Wealthy Families, Young Professionals, and Educated Urbanites, with Ultra Wealthy Families accounting for nearly a quarter of its visitors. Its frequent co-tenants reflect similar socio-economic patterns, aligning with successful specialty chains that appeal to wealthier shoppers, such as lululemon, Sephora, Anthropologie, Warby Parker, Madewell, and Apple. With these favorable dynamics in place, Paper Source has an opportunity to thrive—success may depend on effective messaging and marketing to this affluent customer base.

The differences between Hallmark stores and The Paper Store highlight contrasting strategies: one chain has successfully expanded its product offerings to capture a more engaged audience, while the other remains closely tied to the traditional paper category and has struggled to do the same. There is little overlap in visitation between the two chains, suggesting that consumers may perceive The Paper Store as entirely separate from Hallmark, despite its status as a Gold Crown retailer.

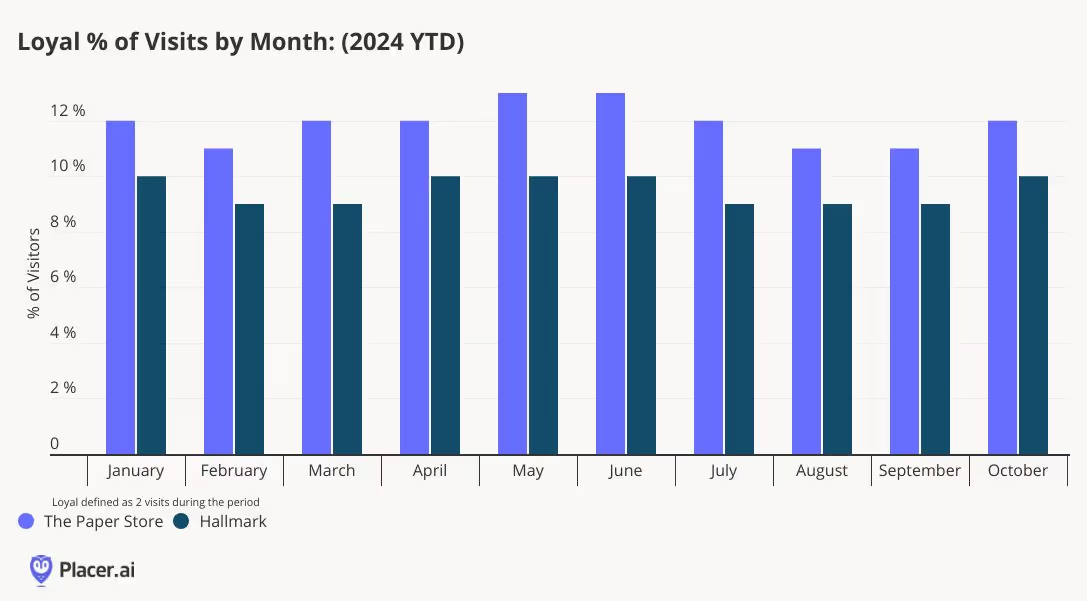

The Paper Store’s elevated and expanded assortment has fostered stronger loyalty among its visitors compared to the Hallmark chain. In 2024, loyal visitors—defined as those visiting twice per month—accounted for 12% of The Paper Store’s visitors, 2 percentage points higher than Hallmark. Additionally, The Paper Store serves more as a destination, with 37% of visitors heading home afterward, also 2 points higher than Hallmark. By expanding its product categories and curating localized selections, The Paper Store has successfully differentiated itself from the traditional Hallmark model, a strategy that could benefit the national chain as well.

The gifting, book, and paper retail category demonstrates varied consumer behavior across chains. The success of Barnes & Noble and The Paper Store underscores the importance of expanding product assortments to attract visits, as consumers increasingly seek convenience by consolidating their purchases in fewer trips. While consumers may tolerate more frequent visits for essential retail, in specialty retail, convenience and variety are critical. The category’s overall resilience suggests that consumers still have discretionary spending power for the right products at the right time, offering hope for retailers still refining their approach.

.svg)

.png)

.png)

.png)

.png)