Over the past two weeks, the home industry has been abuzz with news from the remnants of Bed Bath & Beyond. A retailer that stood as the leader among specialty players continues to try and find new life in physical retail despite the closure of the original chain and its subsidiaries. After a year back in business, buybuy BABY, under new management, announced that it would be closing its 10 reopened locations.

Over at Beyond Inc., the new holding company for Overstock.com and the newly reformed Bed Bath & Beyond brand, they announced new partnerships with both Kirkland’s and The Container Store. The former partnership is going to help bring the brand back to physical retail with the creation of five Bed Bath & Beyond “neighborhood” small format stores, with locations to be announced; stores will be scouted, developed and operated by Kirkland’s. In the partnership with The Container Store, Beyond Inc. made a financial investment in the retailer and will allow The Container Store to leverage the brand’s assets, name, assortment and data; shop-in-shops also appear to be a part of this new partnership.

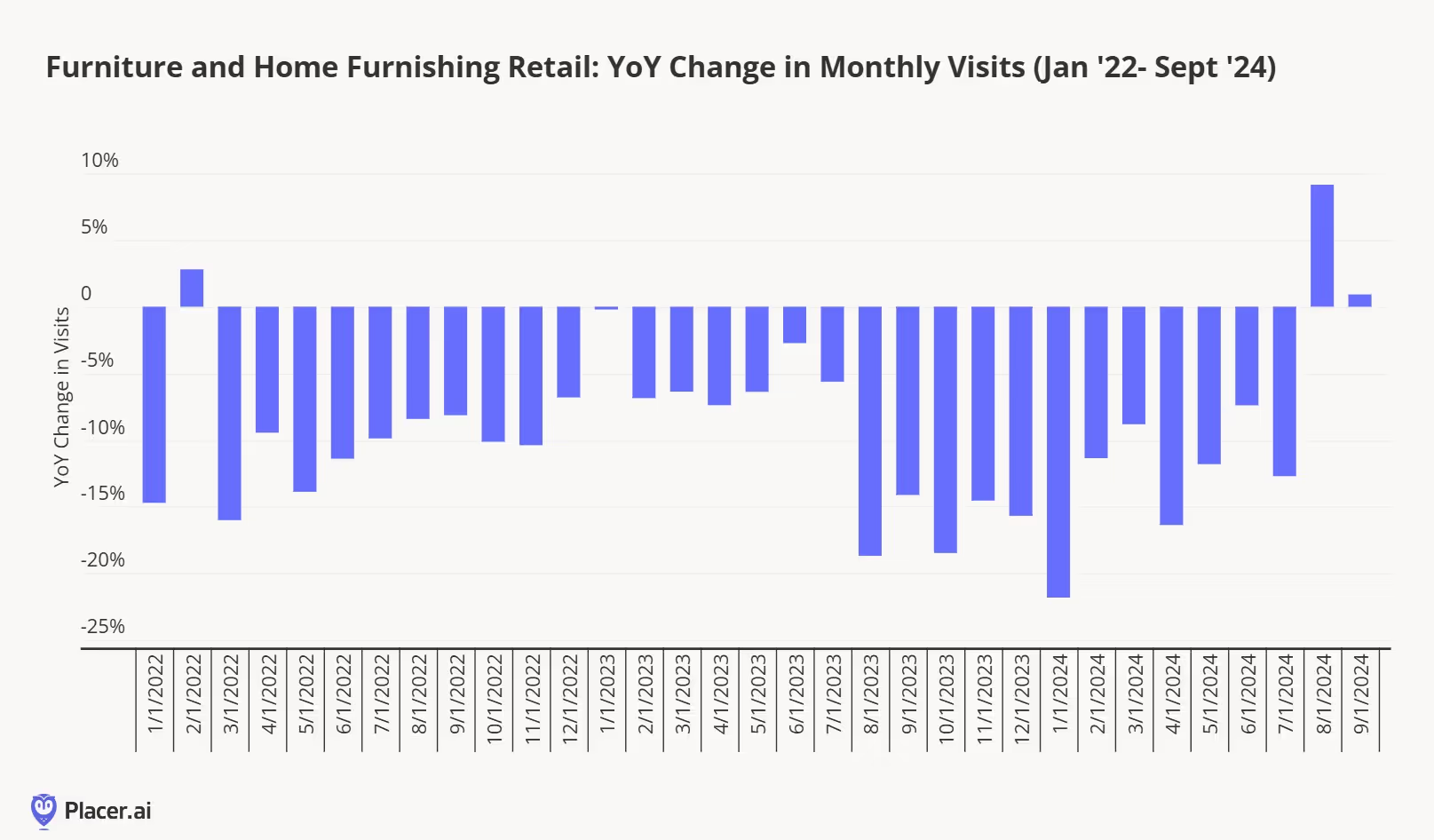

The home industry has been incredibly challenged in the post-pandemic period (below). However, as the category became further consolidated over the past few years, these new partnerships could help to revitalize all three brands, all of which have a strong brand identity with consumers. These partnerships also allow the brands to harness their strengths to benefit multiple banners.

How closely aligned are these brands? Kirkland’s tends to focus on furniture and furnishings, The Container Store handles all things organization, and the Bed Bath & Beyond brand name still carries weight as the undisputed leader in all things home.

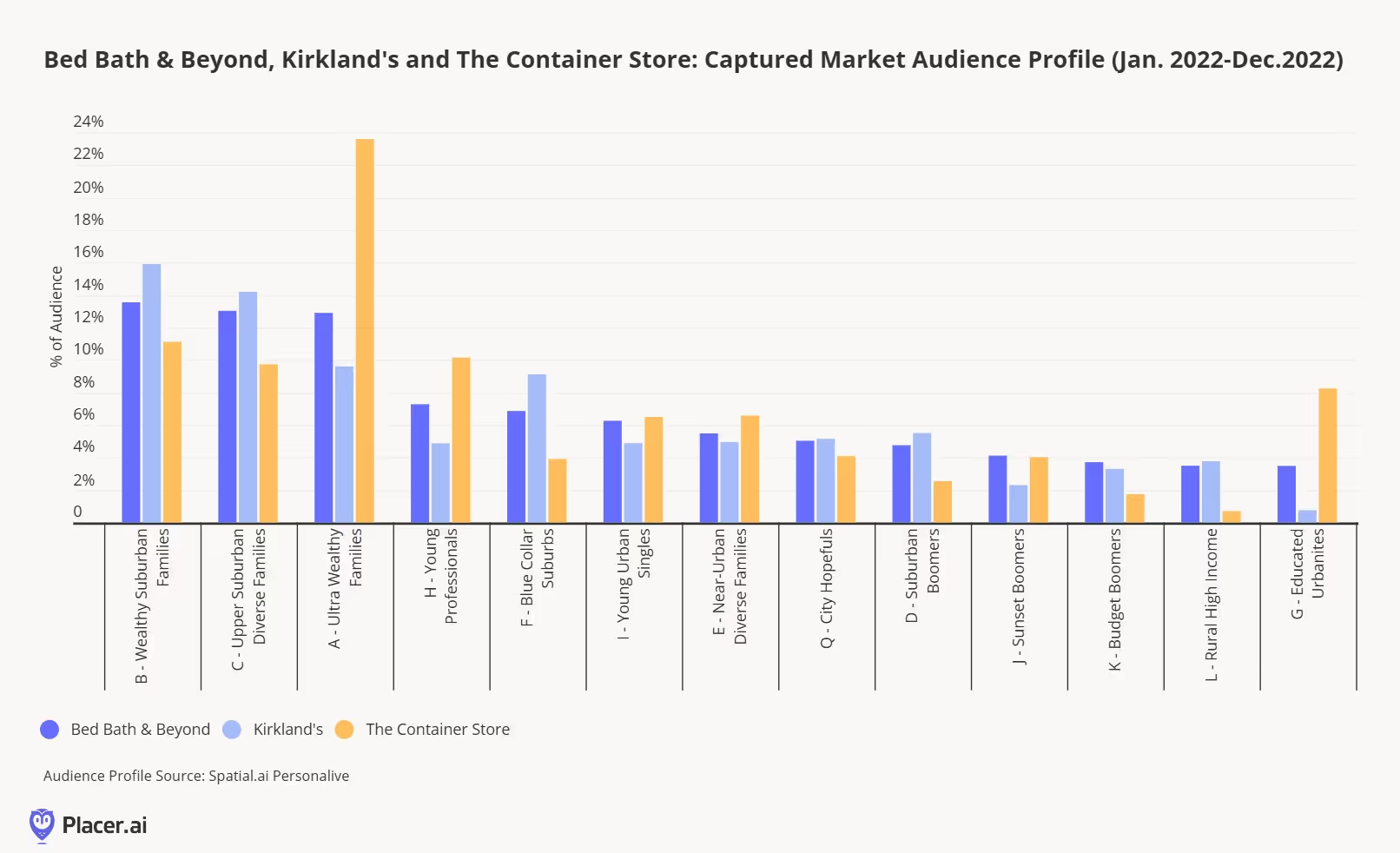

Looking at PersonaLive’s demographic and psychographic segmentation of visitors to all three brands in 2022, before Bed Bath & Beyond’s closure the next year, there are some clear alignments and also opportunities to reach new visitors through the partnerships. Kirkland outperformed Bed Bath & Beyond with suburban cohorts such as Wealthy Suburban Families, Upper Suburban Diverse Families and Blue Collar Suburbs.

Through the lens of The Container Store, it provides a lot more opportunity for Beyond Inc. to reach higher concentrations of visitors from segments such as Ultra Wealthy Families, Educated Urbanites and Young Professionals. Looking at the partnerships with both Kirkland’s and the Container Store as a collective strategy, Beyond Inc. can capitalize on the migration to suburban communities by consumers and higher income households with the new brand.

Another positive sign for the partnerships is the high levels of cross visitation between the retailers before the closing of Bed Bath & Beyond. In 2022, Bed Bath & Beyond’s final full year of operation, 20% of visitors to Kirkland’s and almost a quarter of visitors to The Container Store cross visited Bed Bath & Beyond.

In theory, both partnerships will allow Bed Bath & Beyond to return to physical retail in alignment with both consumers and the current retail landscape. Industry specific retailers and incredibly important to the health and long term success of the industry, and the idea of welcoming back a beloved brand is exciting. It should be interesting to see the new small format stores and installations as the debut and look at the impacts of the partnership on the broader home category.

.svg)

.png)

.png)

.png)

.png)