Last year’s holiday shopping season was an impactful one, with many categories seeing record-breaking sales and visits. And perhaps no category benefits from Q4 peaks quite like department stores, which see major foot traffic spikes on Black Friday and in the run-up to Christmas.

So with Q4 2024 seemingly primed to be another strong season, we took a look at department store visitation patterns this year and during previous holiday seasons to see what might lie ahead for the category in the coming weeks.

Predictable Seasonal Patterns

The holiday shopping calendar often begins as early as October, as consumers start preparing for Halloween before shifting their focus to Thanksgiving, Black Friday, and Christmas. This time of year tends to be one of the busiest for many retailers, as it encompasses a variety of shopping needs, including gifts and seasonal celebrations.

And one retail category that sees major visit increases every holiday season is department stores. Chains like Nordstrom, Macy’s, and Bloomingdale’s experience substantial spikes in visits throughout Q4 as shoppers flock to their locations to take advantage of sales and find gifts for their loved ones.

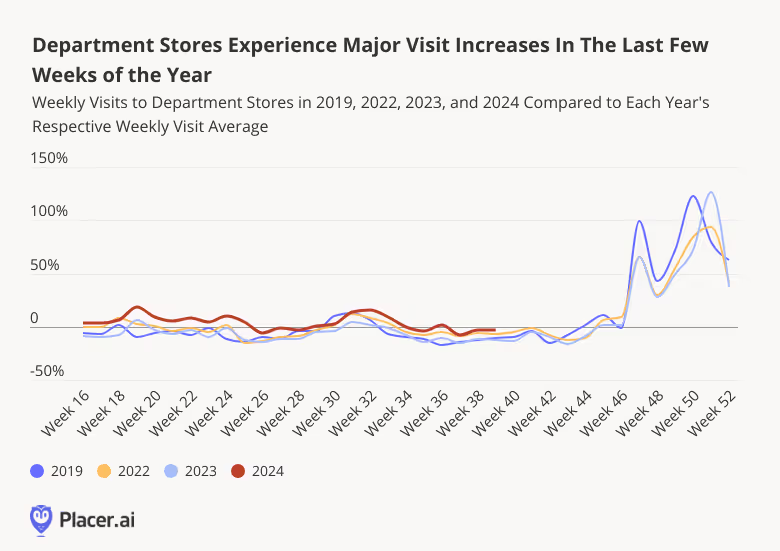

And though consumers’ holiday shopping behavior varies somewhat each year, analyzing weekly fluctuations in visits to department stores reveals some predictable patterns. Every year, visits to department stores see modest increases during major retail events like Valentine’s Day, Mother’s Day, and back-to-school shopping season – before surging during the week of Black Friday (week 47) and then again in the run-up to Christmas. During the week of last year’s Black Friday, for example, department store visits soared 65.2% above the 2023 weekly average – only to go even higher (122.8%) during the week before Christmas (week 51).

Nordstrom Picks Up The Pace

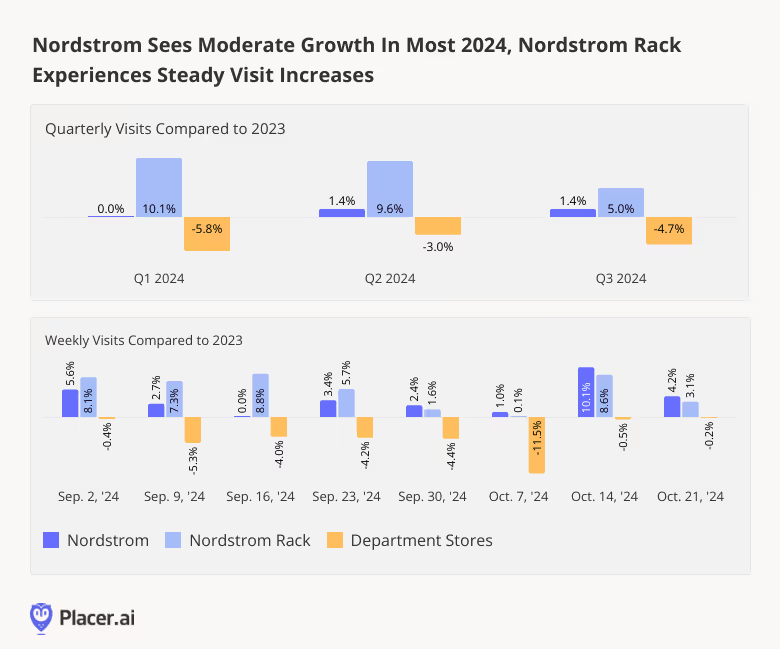

Nordstrom is one department store that seems poised to enjoy a particularly robust holiday shopping season this year. The chain, which operates more than 90 of its namesake stores, also has an off-price banner – Nordstrom Rack – with over 250 locations. And both brands have enjoyed stable visit growth since April 2024 – with quarterly YoY visits to Nordstrom and Nordstrom Rack elevated by 1.4% and 9.6%, respectively, in Q2 2024, and by 1.4% and 5.0%, respectively, in Q3 2024. By contrast, the wider department store category sustained consistent YoY visit gaps.

Drilling down deeper into weekly visit data shows that this positive trend continued into October. And while Nordstrom Rack – which is firmly in expansion mode – outperformed Nordstrom’s traditional stores through September, this trend reversed slightly in October, as the holiday season grew closer. With Black Friday just around the corner, both chains seem well positioned to continue driving visits to their respective stores.

Macy’s “Bold New Chapter” in Play?

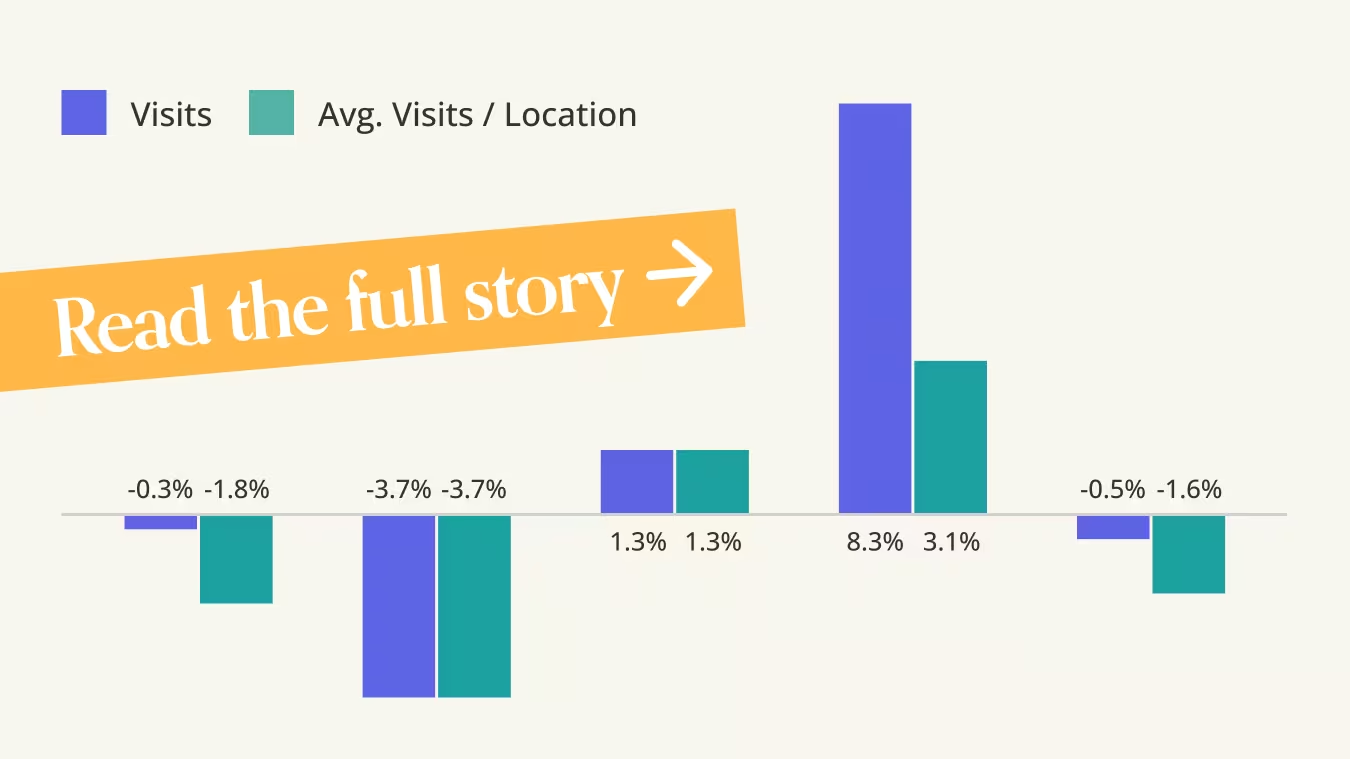

Macy’s Inc., for its part, is doubling down on its “Bold New Chapter” – a turnaround strategy involving a significant trimming of the company’s traditional Macy’s portfolio and the addition of several Bloomingdale’s and small-format stores. In August, Macy’s announced its intention to increase to 55 the number of Macy’s locations slated for closure by the end of 2024. And though the plan’s implementation is still in early stages, foot traffic data suggests that both Macy’s and Bloomingdale’s are holding their own.

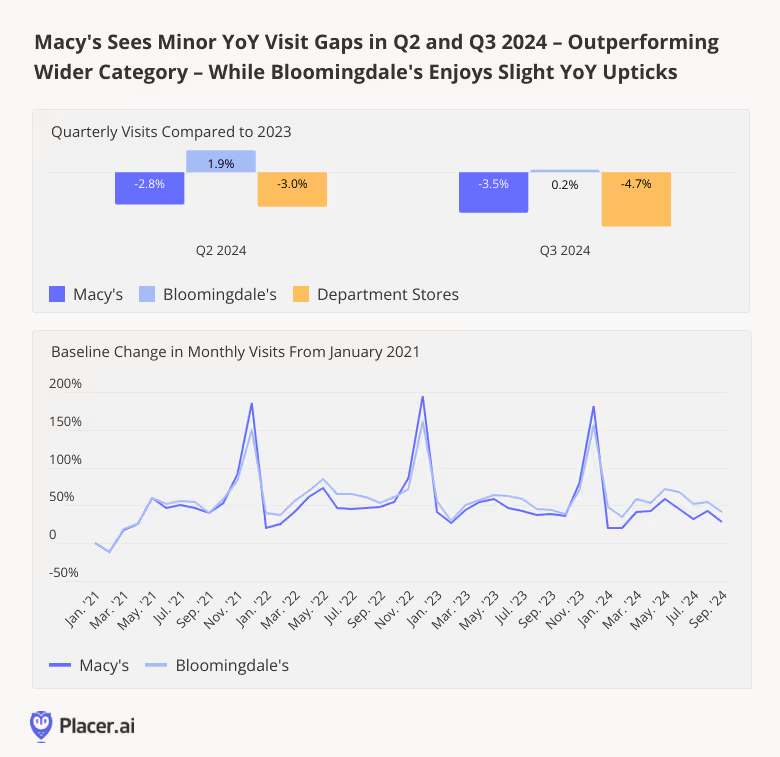

In Q2 and Q3 2024, Macy’s sustained minor YoY visit gaps – 2.8% and 3.5%, respectively – slightly outperforming the broader category. Meanwhile, Macy’s high-end Bloomingdale’s brand saw a YoY visit uptick of 1.9% in Q2, while Q3 visits remained flat compared to 2023. And given the huge monthly visit spikes both chains experience each year in November and December, Macy’s and Bloomingdale’s appear well positioned to once again experience a surge in foot traffic as the holiday season begins.

Final Thoughts

If previous years are any indication, department stores should be getting ready for significant foot traffic increases as the holidays quickly approach. Will improving consumer sentiment and cooling inflation lead to visit increases at department stores, or will consumers decide to take it easy this year?

Visit Placer.ai to keep up with the latest data-driven retail insights.

.svg)

.png)

.png)

.png)

.png)

.avif)