Recreational retailers – from hobby shops to arts and crafts retailers and bookstores – can play a role in fostering creativity and community.

We took a closer look at several players in the space – including Barnes & Noble, Half Price Books, Hobby Lobby, and Michaes – to see how they are faring as 2024 draws to a close.

Bookstores: A New Chapter

One of the biggest challenges traditional brick-and-mortar retailers have faced in recent decades is the rise of online shopping, especially from Amazon – ironically, a company that started as a book retailer. Yet, in 2024, brick-and-mortar bookstores are defying expectations and thriving. Nearly every month this year, chains like Barnes & Noble and Half Price Books have seen more foot traffic at their stores than in 2023.

Despite closing several locations over the past year, Half Price Books experienced significant YoY visit increases between May and August 2024 – with only July seeing a YoY lag likely reflective of the chain’s substantial July 2023 seasonal uptick. Meanwhile, Barnes & Noble – which has been expanding its fleet – saw YoY foot traffic increases ranging from 8.0% to 17.2% throughout the analyzed period. Both chains finished off the summer with impressive 14.3% (Barnes & Noble) and 10.3% (Half Price Books) YoY boosts.

Analyzing monthly fluctuations in visits to the two chains relative to a January 1, 2021 baseline shows just how important both the summer and holiday seasons are for the two bookstores. As brands that cater to both families and college students (see below), Barnes & Noble and Half Price Books see significant annual summer visit upticks in July and August – likely boosted by back-to-school shopping. But particularly for Barnes & Noble, the real magic happens during the holiday season, when people flock to the chain in search of gifts for loved ones.

Bookstores’ strong performance shows that consumers are voting with their feet – embracing the special – and irreplaceable –reading and browsing experience provided by brick-and-mortar stores. And with a strong summer under their belts, Barnes & Noble and Half Price books have every reason to expect a highly successful Q4 2024.

Reading Into The Demographics

Diving into trade area demographics shows that both Barnes & Noble and Half Price Books appeal to diverse audiences – outperforming nationwide baselines for everything from “Wealthy Suburban Families” to “Young Professionals” (a segment group that includes college students) and “Blue Collar Suburbs”. Still, there are differences between the two chains – offering opportunities for the retailers to tailor their marketing strategies to align with their respective visitors.

Barnes & Noble’s captured market trade area, for example, features a higher share of the middle-class “Near Urban Diverse Families” segment group – while that of Half Price Books features higher shares of the other analyzed segments. The chains’ different audiences can help them strategically curate their book assortments and offer a more tailored experience for their customers – a strategy that Barnes & Noble has placed at the center of its blueprint for growth.

Hobby Stores: Redesigning Their Futures

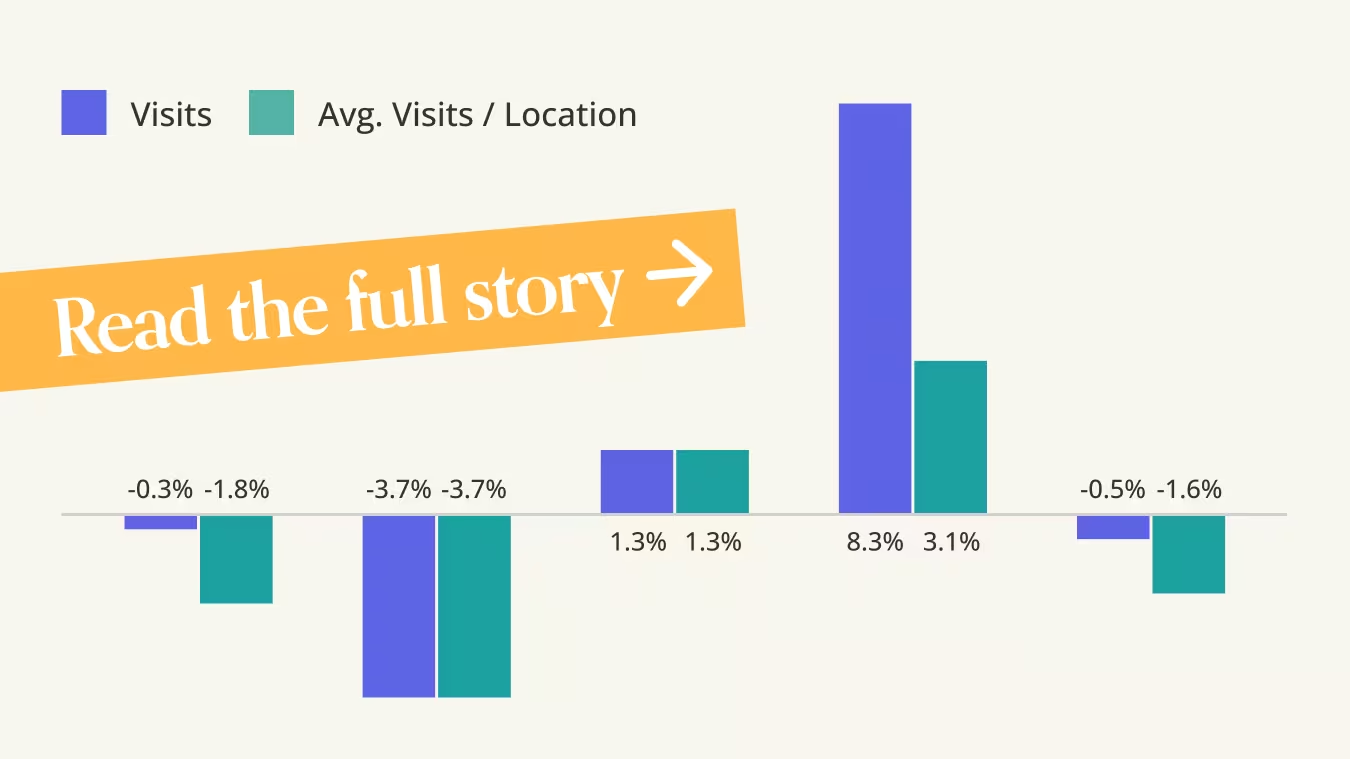

While bookstores have thrived in 2024, craft stores have faced a more mixed performance. Hobby Lobby and Michaels both experienced varying YoY foot traffic trends, with monthly visits tracking closely with 2023’s. Still, August 2024 visits were elevated by 7.9% and 6.0% at Hobby Lobby and Michaels, proving the significance of the back-to-school season.

Summer Sales Boosts

Weekly visit data further highlights the significant impact of the back-to-school season on craft retailers – which offer both classroom decor and school supplies. As the shopping season kicked in, Hobby Lobby and Michaels both experienced notable increases in foot traffic compared to their year-to-date (YTD) averages.

The week of September 2, 2024 in particular was a strong one across both chains, with visits surging to their highest levels relative to the YTD average. Hobby Lobby experienced an 18.3% surge in visits and Michaels grew by 15.9%. This data emphasizes the critical role seasonality plays in driving traffic to craft retailers, particularly during key periods like back-to-school, when customers are stocking up on supplies. And since the category usually sees its biggest monthly spike during the holiday season (December 2023 visits to Hobby Lobby were 57.7% higher than the 2023 monthly visit average and 52.1% higher at Michaels), the chains seem poised to see more visitors in the coming months. October visits will also likely rise for the two chains, as customers go on the hunt for fall decor.

Crafting Visitation Growth

Hobby and recreational stores have shown resilience and adaptability in 2024, with strong seasonal peaks and diverse customer bases fueling their visits. With the holiday season fast approaching, these companies seem set to continue experiencing foot traffic boosts for the rest of the year.

Visit Placer.ai to keep up with the latest data-driven retail news.

This blog includes data from Placer.ai Data Version 2.1, which introduces a new dynamic model that stabilizes daily fluctuations in the panel, improving accuracy and alignment with external ground truth sources.

.svg)

.png)

.png)

.png)

.png)