Darden Restaurants, Inc. is a major player in the restaurant industry, operating restaurants across a wide range of dining styles and price points. Recently, Darden announced plans to acquire Tex-Mex chain Chuy’s, a move that would add some 100 new locations across 16 states to the Darden portfolio.

We took a closer look at how the dining brand has performed over the past few months, and dug deeper into what impact the Chuy’s acquisition might have on Darden.

Year-Over-Year Visit Growth

Darden's 2024 performance has been strong, with only three months – January, April, and July – showing YoY visit declines. January’s 2.9% decline was likely driven by unseasonably cold weather, while Easter weekend shifted visits across multiple retail categories in April 2024. And though July visits experienced a modest dip of 0.5% YoY, the drop was quickly offset by a 5.1% YoY increase in August.

This trend points to a recovery in consumer dining behavior, particularly in the full-service restaurant sector, where growth is being driven by consumers opting for higher-quality dining experiences over fast food options.

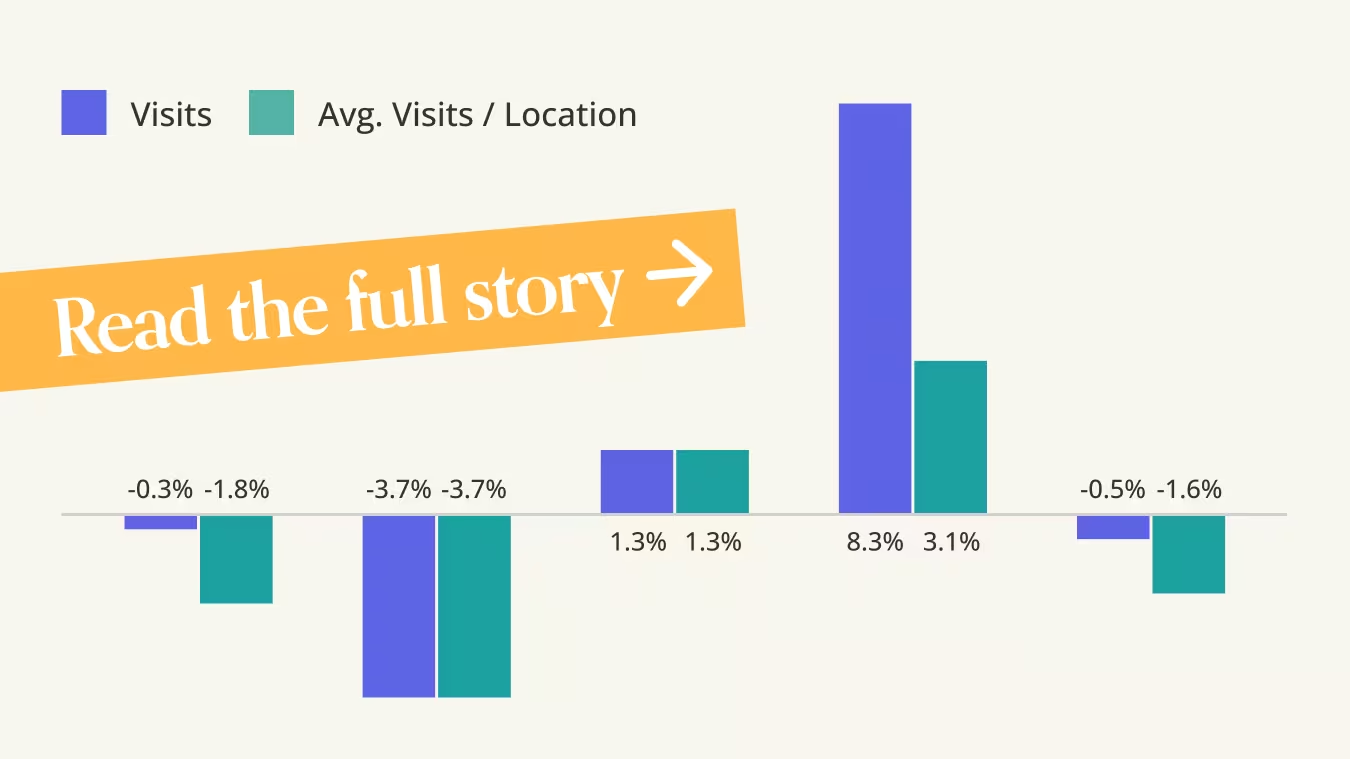

Monthly Visits to Darden’s Largest Brands

Darden owns and operates nearly 2,000 restaurants nationwide. Its three core brands – Olive Garden, LongHorn Steakhouse, and Cheddar’s Scratch Kitchen make up the bulk of these locations.

All three restaurant chains enjoyed overall positive momentum over the past few months, with LongHorn emerging as a standout performer. The chain saw its foot traffic increase in all months analyzed, with August 2024 visits elevated by 10.4% YoY.

Cheddar’s Scratch Kitchen and Olive Garden, too, experienced growth in all but two of the analyzed months, with August 2024 visits elevated by 3.1% and 6.9%, respectively, YoY. These trends point to consistent – and perhaps growing – consumer demand, a solid position as the holiday season approaches.

Expanding Footprint and Target Demographics

In July 2024, Darden announced its intention to acquire Chuy’s, an Austin-based Tex-Mex chain, a move that could add 101 stores to Darden’s already extensive portfolio. And while the acquisition is still pending, digging into the demographic and psychographic data offers some insight into what might make Chuy’s at home with the Darden family.

One defining factor of Darden’s restaurant portfolio might be its range – the chain offers dining options that appeal to people across a variety of income brackets. Its core brands – Cheddar’s Scratch Kitchen, Longhorn Steakhouse, and Olive Garden – cater to a customer base with household incomes similar to the nationwide median of $76.1K. But Darden’s broader portfolio includes several chains that appeal to wealthier patrons – visitors to Eddie V’s Prime Seafood, for example, came from trade areas where the median household income (HHI) was $105K.

Chuy’s visitor base, meanwhile, hails from trade areas with a median HHI of $86.2K. So the addition might help the restaurant group build on its core audience while appealing to higher-income diners who may be looking to “trade down” to a more casual, affordable meal without compromising on quality. This alignment allows Chuy’s to seamlessly fit within Darden's strategy, providing a diverse range of dining experiences while expanding its reach into higher-income markets.

Attracting Younger Diners

Darden’s acquisition of Chuy’s also appears to be a strategic play to attract younger diners, a segment that continues to drive interest in Mexican and Teex-Mex cuisine. And examining the demographics of visitors across all Darden brands reveals that Chuy’s is particularly popular among “Young Professionals”, with 9.4% of its diners coming from trade areas classified as such by the Spatial.ai: PersonaLive dataset.

As young diners continue to be a category of interest for Darden, the Chuy’s acquisition may be the ticket to Darden maintaining its visit dominance in the coming years.

Final Thoughts

Darden continues to drive foot traffic across its wide portfolio of brands, offering something for every kind of diner. With plans to expand its core audience underway, will the restaurant group continue to improve its monthly visits?

Visit Placer.ai to keep up with the latest data-driven dining news.

This blog includes data from Placer.ai Data Version 2.1, which introduces a new dynamic model that stabilizes daily fluctuations in the panel, improving accuracy and alignment with external ground truth sources.

.svg)

.png)

.png)

.png)

.png)