Ahead of Toyota’s August 1st earnings call, we dove into the data to explore Q2 2024 visitation patterns at Toyota dealerships nationwide. How did year-over-year (YoY) foot traffic to Toyota showrooms perform in Q2 2024 – and what happened in June 2024, when the CDK Global outage caused paralysis across the industry? Who are the customers driving growth for Toyota – and what lies in store for the brand in the months ahead?

We dove into the data to find out.

Bustling Dealerships

During the second quarter of 2024, Toyota subsidiary TMNA (Toyota Motor North America, Inc.) reported a remarkable 9.2% year-over-year (YoY) increase in U.S. Toyota vehicle sales, buoyed by rising demand for hybrid cars. (The company also owns the luxury Lexus line).

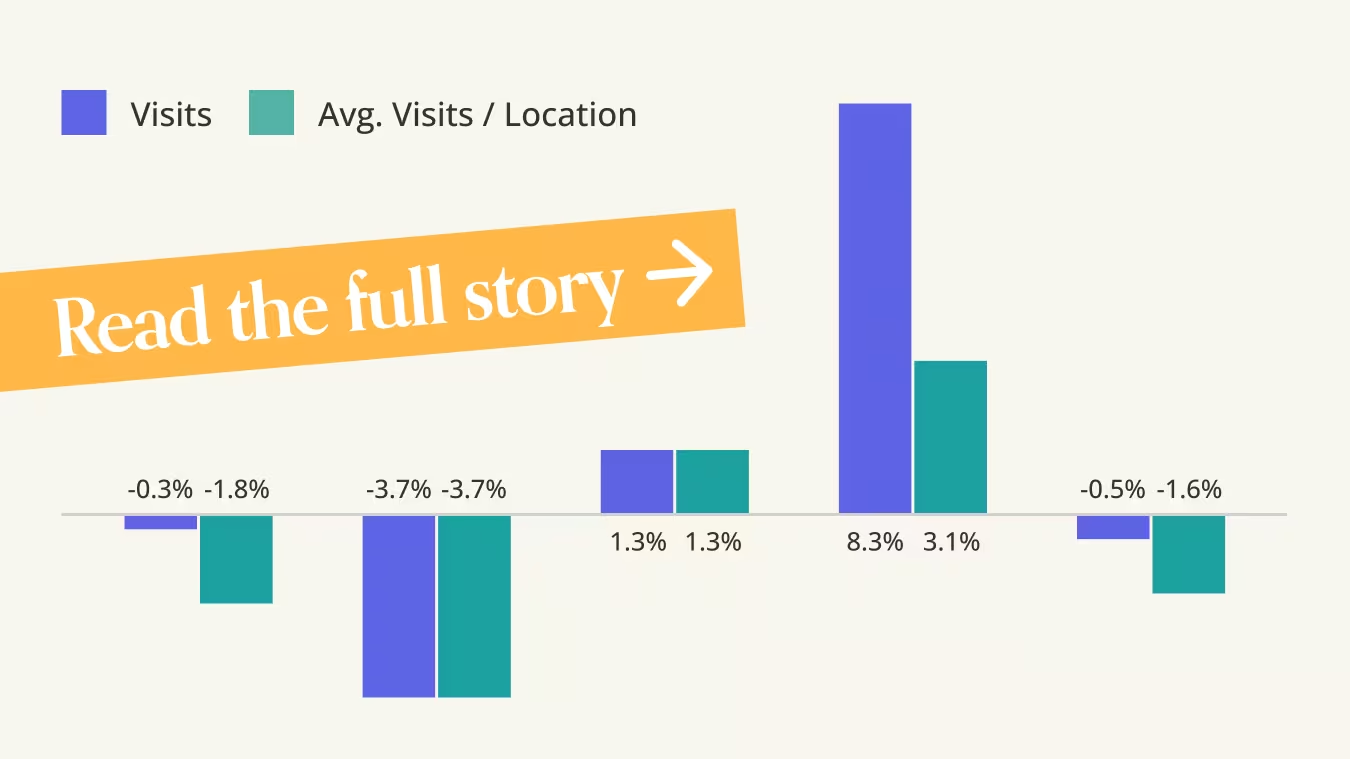

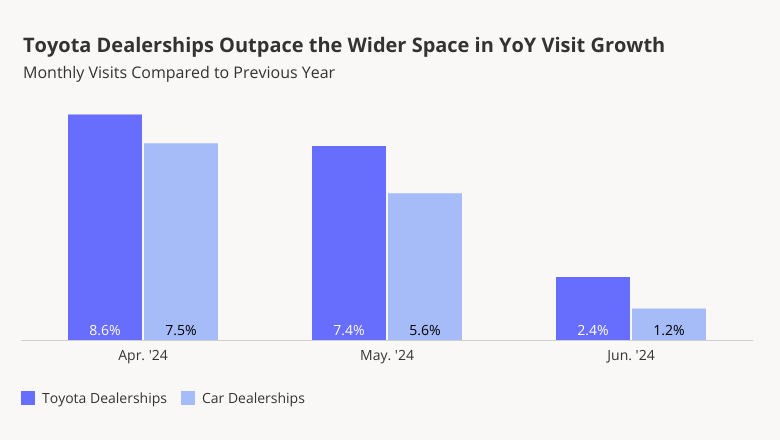

And foot traffic data shows that U.S. Toyota dealerships have indeed been significantly busier in Q2 2024 than in Q2 2023, outperforming the wider space. Apart from the regular portion of repair and maintenance visits, the auto brand’s YoY visit growth also reflects an increase in interested buyers. In April and May 2024, Toyota dealerships saw respective YoY visit boosts of 8.6% and 7.4%. And though the pace of YoY foot traffic growth to dealerships dropped in June 2024 – likely due in part to the CDK outage – the brand appears poised for continued visit success throughout the rest of the year.

Four Wheels for Everyone

Toyota’s outsize success is likely due, in part, to its broad appeal – amongst everyone from price-conscious families seeking to maximize reliability and fuel efficiency to more affluent consumers that place a high premium on style. Toyota’s Certified Used Vehicles offering also draws in customers looking for trustworthy, pre-owned cars.

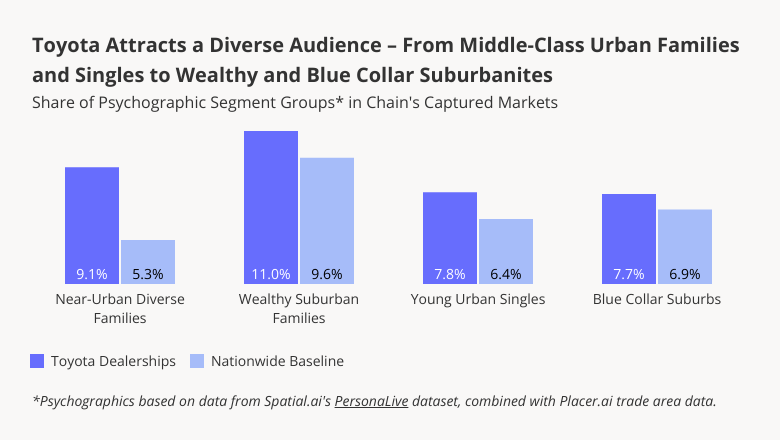

Analyzing Toyota dealerships’ captured markets with psychographics from Spatial.ai’s PersonaLive shows that their trade areas are economically diverse. Toyota attracts customers from areas with higher-than-average shares of both middle and working-class families, as well as more affluent ones. And Young Urban Singles are also more likely than average to visit Toyota dealerships.

An Increasingly Affluent Audience

Still, in Q2 2024, Toyota dealerships attracted a slightly more affluent consumer than average. The median household income (HHI) of the dealerships’ captured markets was $77.0K, just above the nationwide baseline of $76.1K. And looking at changes in Toyota’s audience over time also shows that the median HHI of its customer base has increased steadily over the past few years – rebounding to, and even exceeding, pre-pandemic levels. In the face of high interest rates, consumers with less room in their budgets may be cutting back on visits to car dealerships. And Toyota’s hybrid first strategy may also be increasing its appeal among more affluent car owners, who are more likely to purchase hybrid vehicles.

Looking Ahead

Will Toyota continue to thrive in the months ahead? And how will its customer base continue to evolve as inflation stabilizes and interest rates eventually come down?

Follow Placer.ai’s data-driven retail analyses to find out.

.svg)

.png)

.png)

.png)

.png)