In this packed Placer Bytes we dive into Walmart and Target ahead of their earnings, break down surges from Home Depot and Lowe’s, and analyze the potential of AMC and theatres to drive a bounceback post-COVID.

Supercharged Supercenters

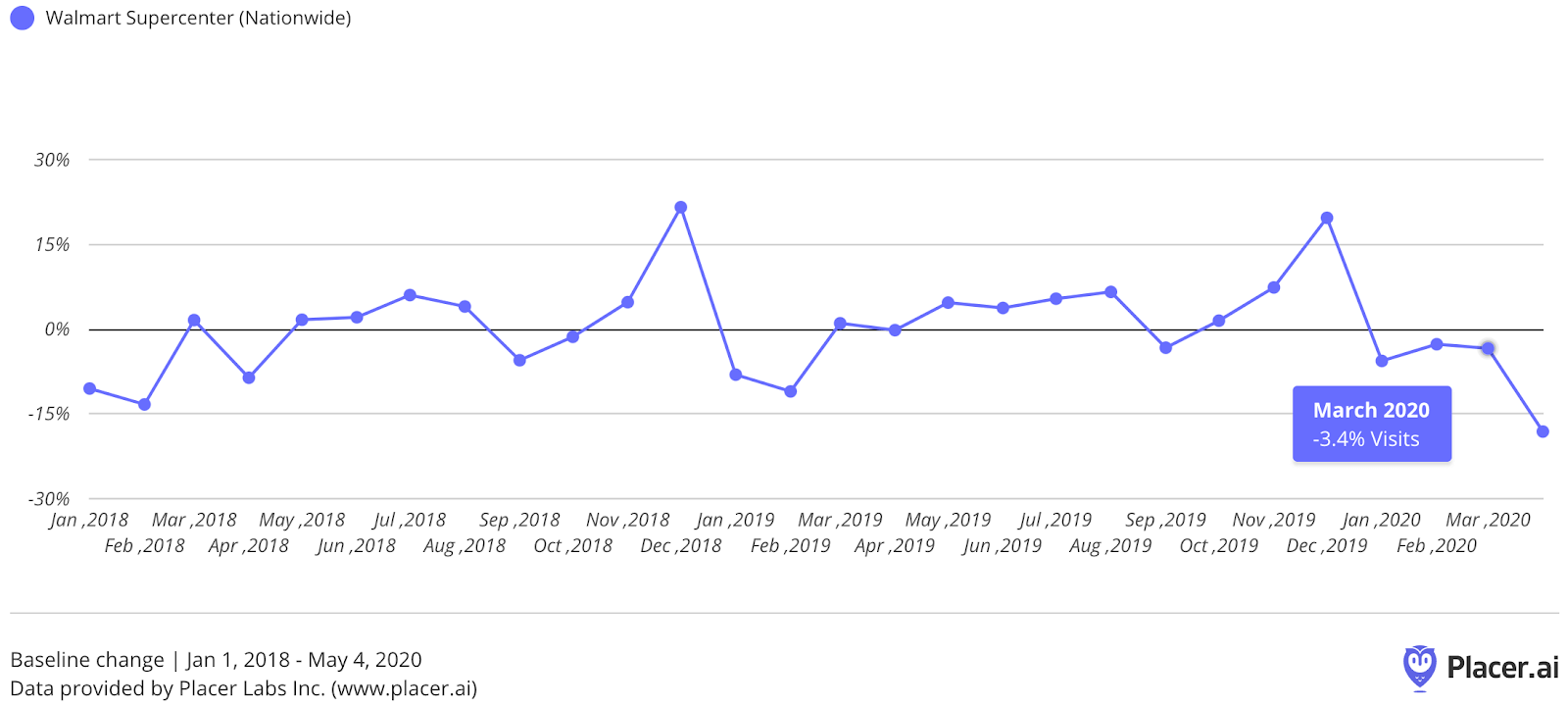

Walmart and Target have been two of the more significant retailers to track during the pandemic because of their essential retail status. While both saw significant year-over-year growth from 2018 to 2019 in Q1, that visit growth turned to a decline in 2020 as a result of the pandemic. Yet, the picture is far more complex than a simple decline.

While Walmart saw a 4.8% overall decline in visits to supercenters, the brand’s strength may never have been more on display. Visits in February were up 8.3% year over year, and the first two weeks of March showed year-over-year growth of 6.7% and 15% respectively. The visit rates for those weeks were so strong that since 2018, only the holiday shopping season, Easter and July 4th holiday weeks drove more visits.

Critically, much of the declines in visits were because of restrictions that Walmart self-imposed in order to protect employees and customers. And even with these restrictions, March visits were only down 4.4% and April visits, an entire month impacted by these regulations, were down just 17.9%. Obviously, gains are better than losses, but it is hard to see these relative declines as anything other than a massive testament to Walmart’s strength, especially considering its use of curbside pickup and delivery as secondary channels to augment these ‘losses’. And with restrictions easing, daily visits are rapidly returning to normal levels with the week from April 27th through May 3rd seeing a year-over-year decline of less than 6%.

Even more, this doesn’t take into account the exceptional growth Sam’s Club has been experiencing with an overall jump of 7.3% year over year in Q1. This was highlighted by increases of 11.9% and 16.4% in February and March with April bringing in a decline of just 7.1%. Considering the membership model the brand employs, there is no reason to think this growth will not buoy future months to drive even greater success in the Sam’s Club turnaround.

Target too felt the extremes of the pandemic even more intensely with an overall visit decline in Q1 of 11.3%. This was marked by a similar trend as Walmart where February visits were up 10.6% year over year followed by a March and April with 11.7% and 31.0% declines.

Yet, all signs point to Target’s own restrictions as the primary cause of declines as opposed to any reduction in consumer demand. In fact, with restrictions easing, Target has seen daily visits return to year-over-year growth for the first time in months. Visits on the 4th, 5th, 6th, and 7th of May were up 4.3%, 3.6%, 4.9%, and 5.1% respectively for the first days of growth since mid-March.

Home Improvement Surges

As we analyzed recently, the home improvement sector is surging. Even with self-imposed restrictions, Home Depot only dropped 0.5% in visits in Q1 2020 compared to the same period in 2019, and Lowe’s actually increased by 9.1%. There are many potential explanations including a greater focus by Lowe’s on DIY users, while Home Depot is more targeted for contractors with larger basket sizes, as well as differing levels of self-imposed restrictions. Even geographic distribution situated Home Depot more in harder-hit areas like New York.

But what is clear is that this trend is showing no signs of slowing down. On May 2nd, Home Depot had visits come in 119.9% higher than the daily average for the period from January 2018 through May 4th, 2020, the highest single day of visits apart from Black Friday 2019 during that period.

And if the orientation towards more professional users is true, then this could lead to a big increase in actual transactions. With May generally serving as the annual peak for Home Depot, the coming months could be especially valuable for the brand.

Lowe’s is seeing the jump continue as well with visits for that same Saturday rising 201.6% above the baseline for the same period, the highest single day of visits since the start of 2018.

This may actually change the face of the competition between the two brands. For the first time since 2017, the beginning of our data, Lowe’s is seeing visits that actually outpace Home Depot. While easing restrictions could potentially provide support, Lowe’s is also well positioned for the coming months. Recessions are generally friendly to brands with a DIY orientation as fixing up takes a priority over buying new.

AMC’s Future

It is certainly reasonable to be down on theatres considering the current environment. In the age of social distancing and with concerns of a return of COVID-19 in the winter, the idea of grouping together with dozens of other people in a closed environment for several hours may be less than palatable for many. And the data is not particularly glowing with visits seeing an overall dip in traffic between 2018 and 2019 of just over 8%.

But, there are signs of hope. While the overall decrease between 2018 and 2019 was over 8%, the decrease in H2 was only 3%, showing a slowing pace of decline. And this continued into 2020 when the YoY visit drop was just 1.8% in January and February compared to the same months in 2019. Now, March visits obviously shrank dramatically 78.7% year-over-year as much of the month happened under social distancing regulations that shut down theatres across the country.

So, the big question is whether the positive momentum, year-over-year growth in January of nearly 1% and slower declines in late 2019, can serve as a foundation to recover post-COVID-19. The simple answer is that it will be difficult to drive consumer trust. However, there are things working in favor of theatres. Economic uncertainty tends to privilege theatres as a cost-conscious way of going out, and having had people stuck at home for months could push for more outings.

However, they will need to focus on experience. In recent months, more people have become more comfortable with Netflix as their entertainment resource, and convincing them to get out of the house to see a movie will center around providing something unique and special. Whether it be partnerships with local restaurants to create the full night out, repurposing parking lots for drive-in, or even showing sporting events, creativity will be key to driving a rapid return.

Check back in with Placer.ai for more insights.