Insights into the physical world anchored in location analytics

INSIDER

Report

10 Top Brands to Watch in 2026Meet the ten retail and dining powerhouses, including H-E-B, Walmart, and Dave’s Hot Chicken, redefining success and winning consumer loyalty in 2026.

Placer Research

January 12, 2026

Industry Trends

Year-Over-Year Visits to Grocery Stores by State

Executive Insights

Executive Insights

What it Takes to Win at Grocery in 2026The Kroger Co, is a leading player in the grocery store space, operating its epon lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu

Erich Kahner

Feb 2, 2026

3 minutes

Article

Article

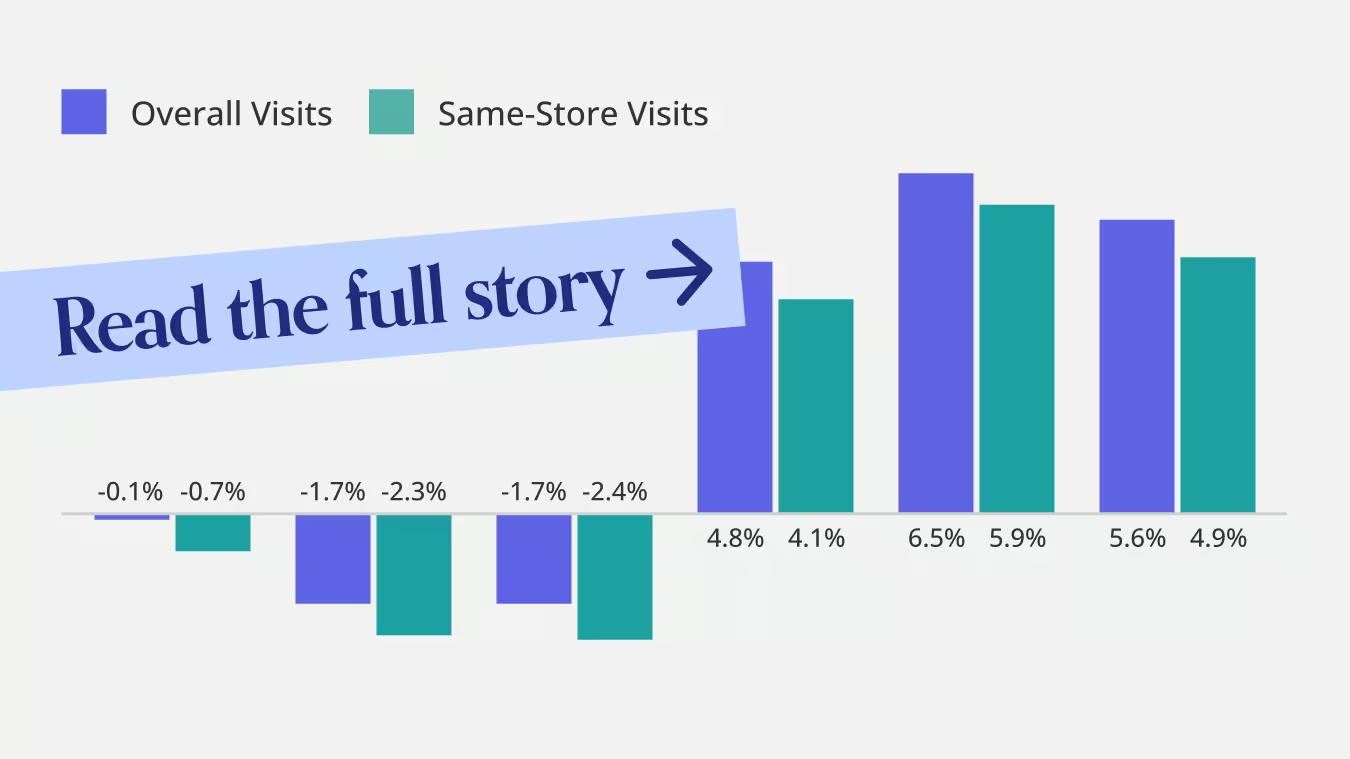

Yum! Brands Navigates QSR Headwinds in Q4The Kroger Co, is a leading player in the grocery store space, operating its epon lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu

Ezra Carmel

Jan 30, 2026

2 minutes

Article

Article

The Demand-Side Story Behind Saks Global’s BankruptcyThe Kroger Co, is a leading player in the grocery store space, operating its epon lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu

Shira Petrack

Jan 29, 2026

2 minutes

Executive Insights

Executive Insights

Visiting the Great OutdoorsThe Kroger Co, is a leading player in the grocery store space, operating its epon lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu

Caroline Wu

Jan 28, 2026

3 minutes

Latest Articles

_texasroadhouse_dine.png)

Article

Q4 2025 FSR Trends Emphasize Strategy, Value, and Footprint DisciplineShira Petrack

January 26, 2026

3 minutes

Article

Chipotle’s Growth Is No Longer Just About New RestaurantsLila Margalit

January 22, 2026

3 minutes

Article

What Other QSR Brands Can Learn From McDonald’s Loyalty StrategyShira Petrack

January 21, 2026

3 minutes

Article

Opportunity vs. Operational Reality in Dollar Tree's 99 Cents Only AcquisitionShira Petrack

January 20, 2026

3 minutes

.avif)

Article

Which Gym Is Right For You in 2026?Using AI-powered location analytics, we reveal which gyms are less crowded at peak times, skew younger or older, and attract the most singles.

Ezra Carmel

January 16, 2026

4 minutes

Article

Placer.ai December 2025 Office Index: ‘Tis the Season to WFHLila Margalit

January 12, 2026

3 minutes

.png)

.png)

.png)

.png)

.avif)

.png)

.png)

.svg)