Insights into the physical world anchored in location analytics

INSIDER

Report

Office Attendance Drivers in 2026: The New Rules of Showing UpDive into the data to learn how convenience-driven behaviors are impacting the office recovery – and how stakeholders from employers to office owners and local retailers can best adapt.

Placer Research

February 5, 2026

Industry Trends

Year-Over-Year Visits to Grocery Stores by State

Article

Article

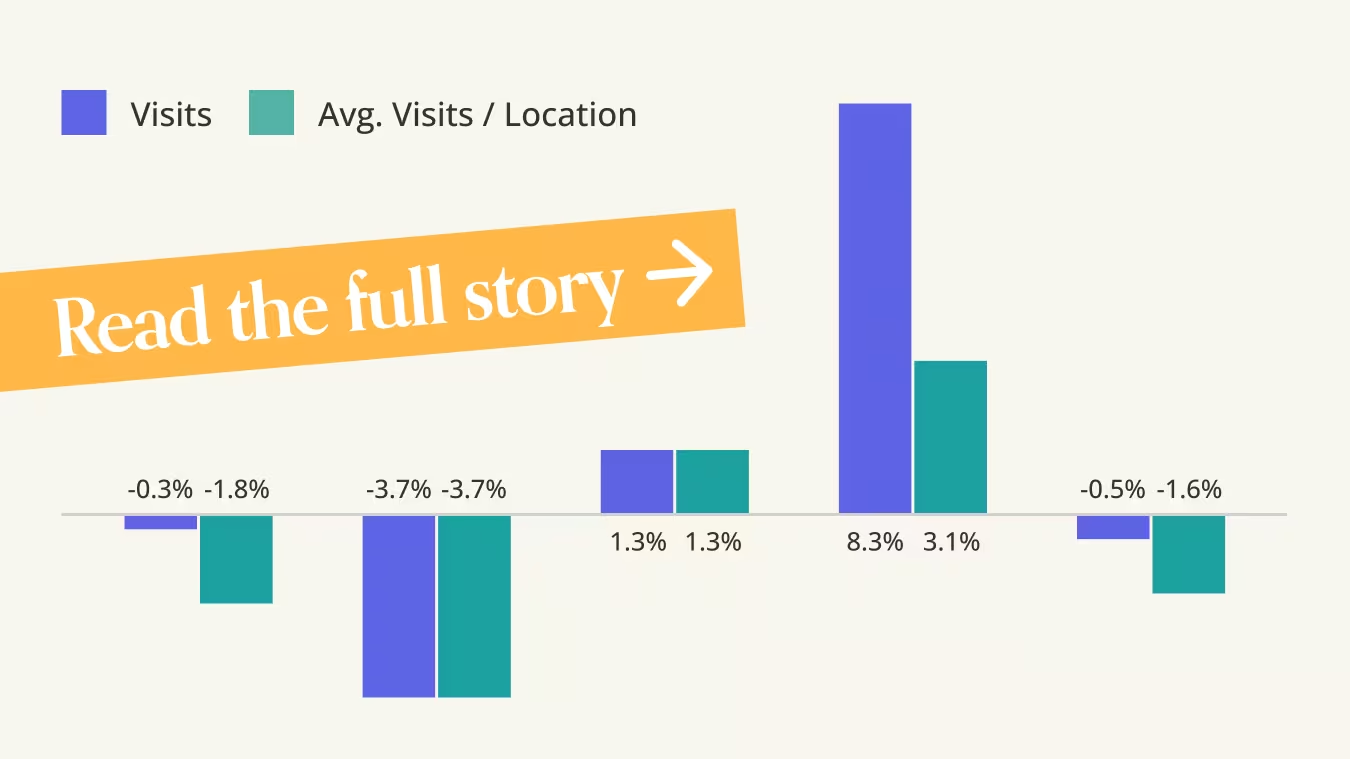

RBI Brands: Where Do The Chains Stand After Q4?The Kroger Co, is a leading player in the grocery store space, operating its epon lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu

Ezra Carmel

Feb 6, 2026

1 minute

Executive Insights

Executive Insights

World Cup ConnectionsThe Kroger Co, is a leading player in the grocery store space, operating its epon lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu

Kevin Ching

Feb 6, 2026

3 minutes

Article

Article

Dutch Bros’ Grounds for Success in 2026The Kroger Co, is a leading player in the grocery store space, operating its epon lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu

Ezra Carmel

Feb 5, 2026

2 minutes

Article

Article

Higher-End Bloomin' Concepts Outperformed in Q4 2025The Kroger Co, is a leading player in the grocery store space, operating its epon lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu

Shira Petrack

Feb 4, 2026

2 minutes

_texasroadhouse_dine.png)

Article

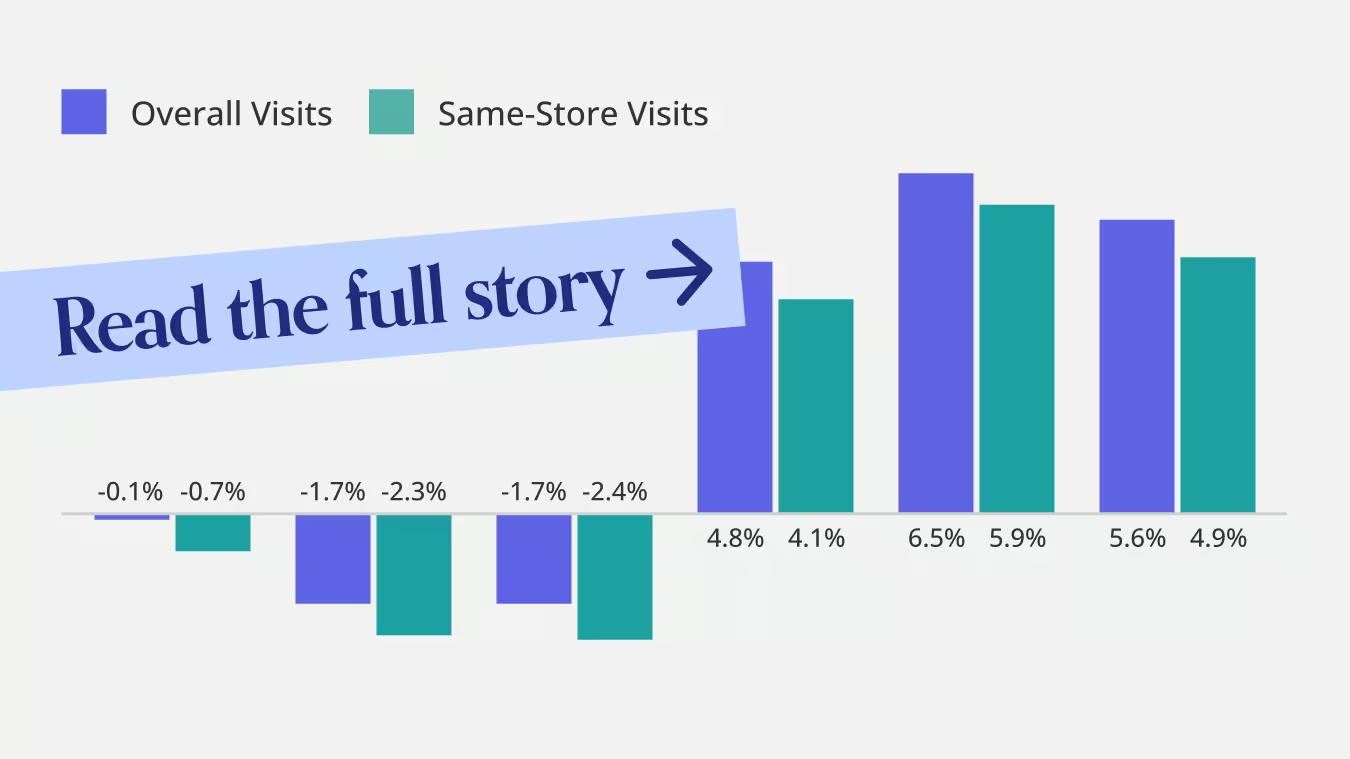

Q4 2025 FSR Trends Emphasize Strategy, Value, and Footprint DisciplineShira Petrack

January 26, 2026

3 minutes

Article

Chipotle’s Growth Is No Longer Just About New RestaurantsLila Margalit

January 22, 2026

3 minutes

Article

What Other QSR Brands Can Learn From McDonald’s Loyalty StrategyShira Petrack

January 21, 2026

3 minutes

Article

Opportunity vs. Operational Reality in Dollar Tree's 99 Cents Only AcquisitionShira Petrack

January 20, 2026

3 minutes

.png)

.png)

.png)

.png)

.avif)

.avif)

.png)

.svg)