.svg)

.png)

.png)

.png)

.png)

Last summer’s touring sensations Taylor Swift and Beyonce held concerts that will remain in the hearts of many. With thousands in attendance, both live tours were absolute juggernauts. It was like an adrenaline shot for the performing arts category after COVID-induced closures. Remember the days of drive-in concerts as a panacea? While these two reigning Queens of Music took top billing, there are hundreds of local venues around the country that cater to smaller audiences at a time but are no less impactful on their communities. These are the heart and soul for local plays, musicals, symphonies, operas, touring bands, and art exhibitions. Fundraisers are often held at community performance venues, and they can be incubators for performers to move on to a larger stage.

Placer recently attended the California Presenters Conference, which includes representatives from California, Oregon, Washington, Nevada, Arizona, New Mexico, and Texas. Programming directors, events managers, and community liaisons all met to share best practices, challenges, and successes. One box office manager, Jonathan Lizardo of the Lisa Smith Wengler Center for the Arts at Pepperdine University, noted that “Nostalgia” was an important theme at his performing arts center, with a recent live show of the Animaniacs in Concert proving to be a hit with adults and kids alike. In this case, his patrons were seeking some escapism and levity in their lives. On the other end of the spectrum, the arts can also be a powerful way to engage the audience in more serious issues, as one panel on Responding to Global Conflict at arts venues drew a crowd. Another topic of interest was the importance of engaging youth with the arts, through school-sponsored visits or after school enrichment. Many University performing arts centers reps were also in attendance, such as USC Vision and Voices, Stanford Live, Caltech Presents, and Seattle University.

Placer’s presentation touched on macrotrends around discretionary spend, examples of venue attendance around the US, an analysis of the visitation trends, audience profile, and economic impact of Taylor Swift’s US tour, and in depth look at a select group of performing arts centers in Arizona to see the role that they play in their community.

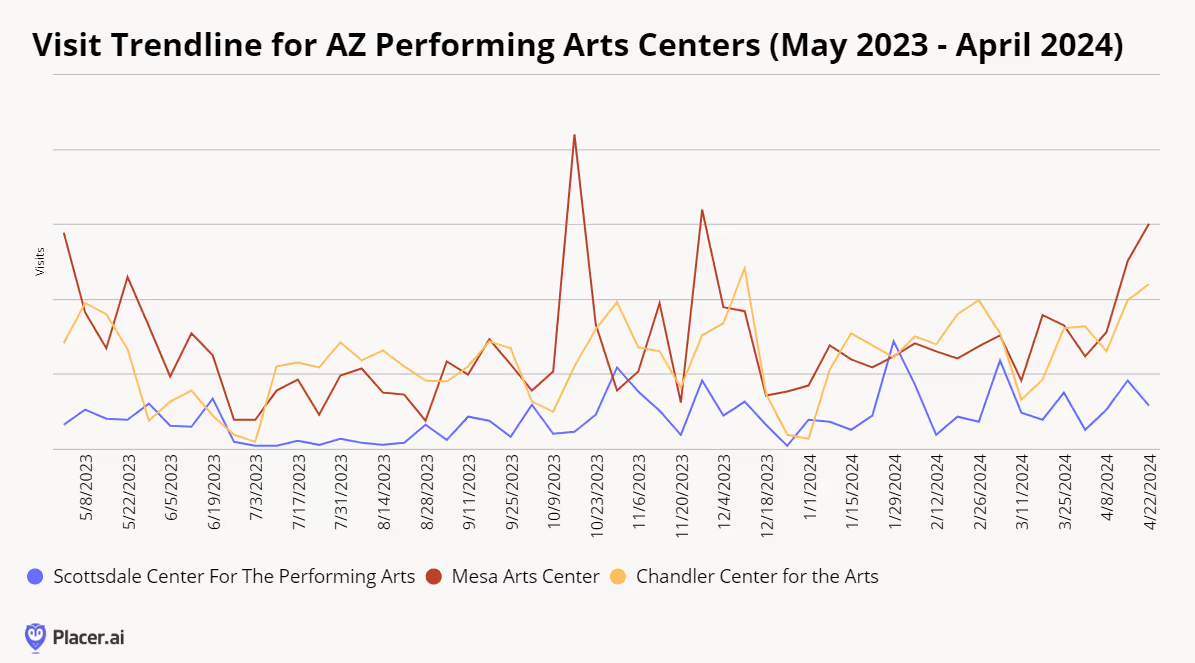

Mesa Arts Center has had the highest overall visitation in the past 12 months. Located in Mesa, AZ, it encompasses over 210,000 sq ft and was completed in 2005 at the cost of $95 million. In addition to four performance venues, it is also home to Mesa Contemporary Arts Museum. Programming is suited to a multitude of interests, including National Geographic Live, Broadway, classical music, popular music, ethnic artists, western artists, and dance. It also offers Art Studio for visual arts classes; Opportunities for Ages 55+ such as flamenco classes; and Festivals and Events, such as Dia de Los Muertos. Within the theaters complex, there are four theaters--the 1,570-seat Tom and Janet Ikeda Theater, 550-seat Virginia G. Piper Repertory Theater, 200-seatNesbitt/Elliott Playhouse, and the 99-seat Anita Cox Farnsworth Studio.

The Chandler Center for the Arts recently celebrated its 35th season. Upcoming performances include ballet like Coppelia or live music, such as Billy Joel’s The Stranger. Entertaining acts such as Stomp, Piano Battle, and Cirque du Soleil will also make their way over during the 2024-2025 season. Located in downtown Chandler, the venue includes three dynamic performance spaces (the 1,500-seat Main Stage, the 350-seat Hal Bogle Theatre, and the 250-seat Recital Hall) as well as two extensive art galleries (The Gallery at CCA and Vision Gallery).

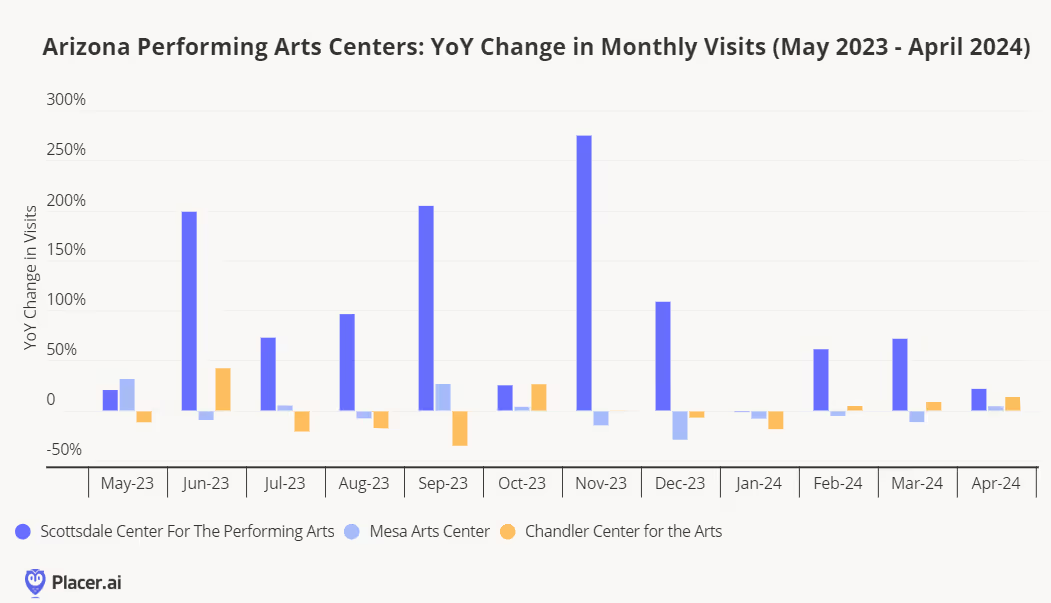

While Scottsdale Center for the Performing Arts had the fewest absolute visits in the past 12 months, its year-over-year variance increase has been the highest.

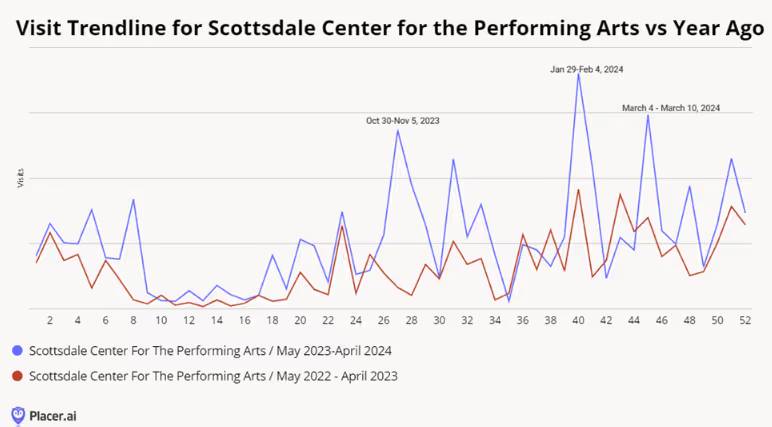

What might account for the difference, one might wonder. Fortunately, Placer data enables one to compare a venue against itself in order to highlight differences from one year to the next. According to the 2023-2024 calendar, it appears that Hubbard Street Dance Chicago playing 2 nights in a row, was a hit with the audience during the week of Jan 29-Feb 4.

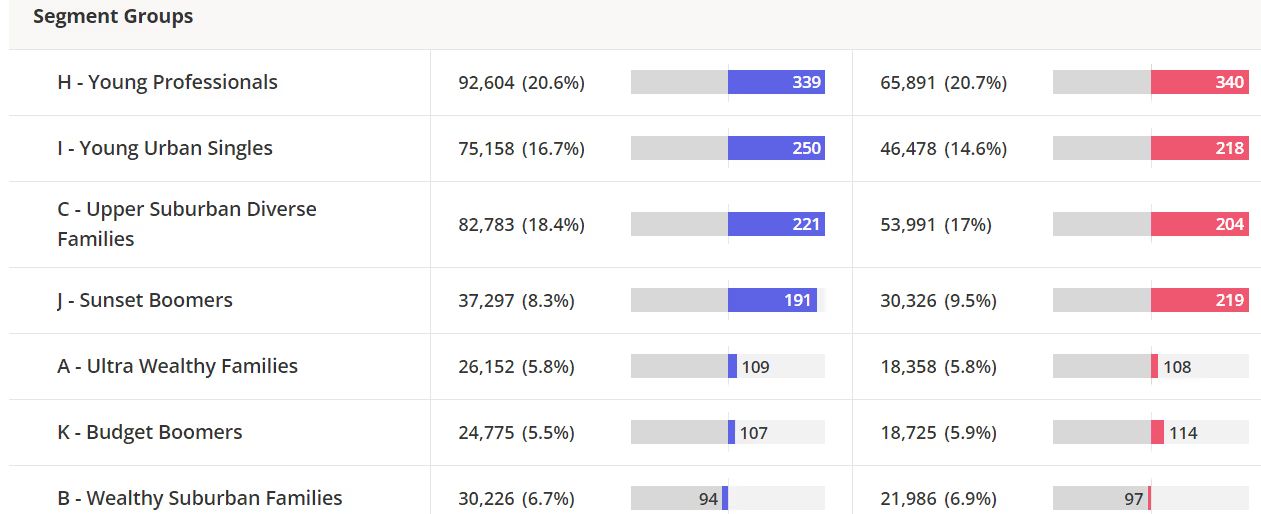

It appears the increase in visits cannot be attributed to a single segment. In fact, visits across multiple segments increased year-over-year when comparing May 2023 - April 2024 (blue) vs. May 2022-April 2023 (red) per Spatial.ai PersonaLive.

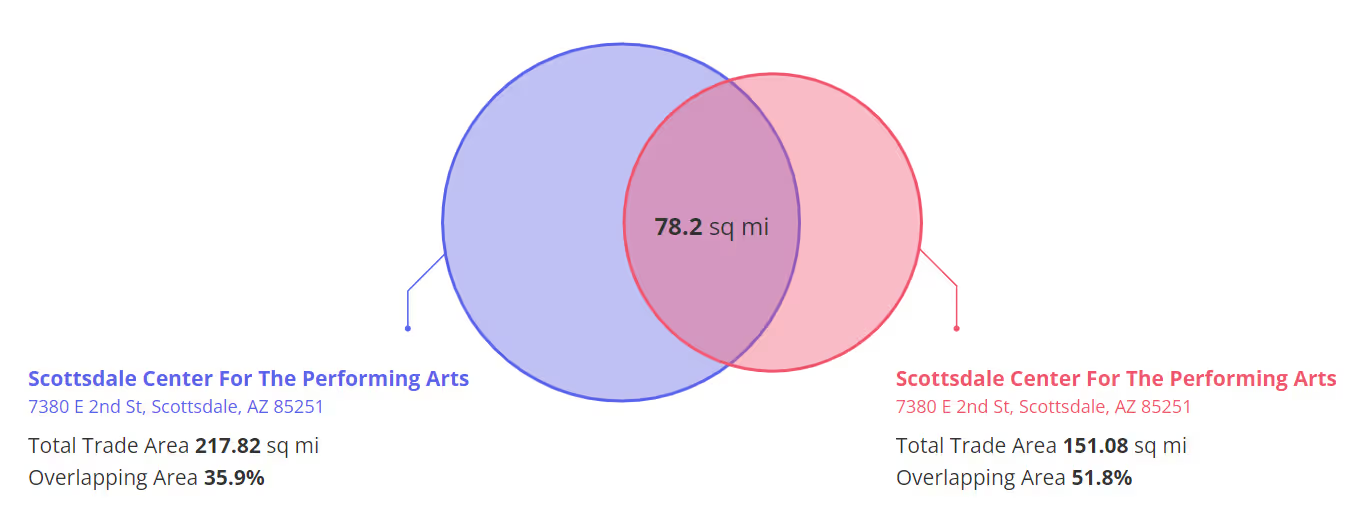

The most recent 12 months also attracted visits from a much larger trade area.

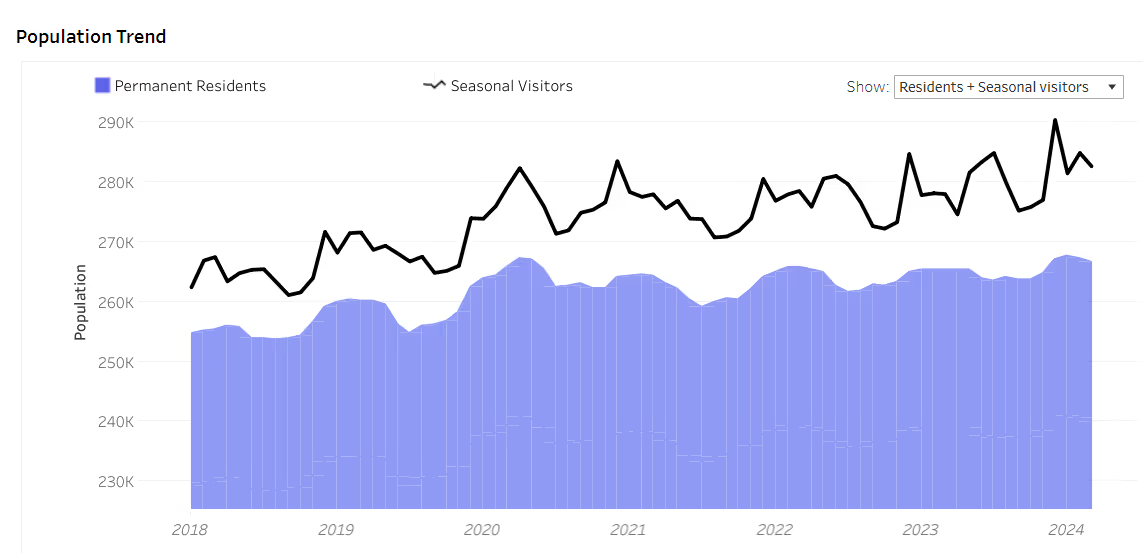

Migration may also be a factor in the increase of visits to the Scottsdale Performing Arts Center. Placer’s Migration Dashboard is noting an increase in both residents and seasonal visitors over the years.

Eatertainment chains – entertainment concepts that combine dining and play – are thriving in the current experience economy. We dove into the data for game and restaurant chains Dave & Buster’s and Main Event Entertainment (acquired by Dave & Buster’s in 2022) to better understand how eatertainment is driving success in 2024.

The past few years have been challenging ones for restaurants. But eatertainment has a special draw – and since November 2023, both Dave & Buster’s and Main Event Entertainment have seen mainly positive YoY visit growth.

In January 2024, visits slowed in the wake of extreme weather that rocked much of the country and led many would-be diners to stay home. But in February and March 2024 things picked up again, with the two chains seeing YoY visit growth ranging from 4.6% to 10.6%.

Again in April 2024, both Dave & Buster’s and Main Event Entertainment experienced minor visit gaps. But a closer look at weekly visits reveals that this was largely due to a calendar shift: April 2024 had one fewer Saturday than April 2023 – the chains' busiest day of the week by far. (In Q1 2024, Saturdays accounted for 33.8% of total visits to Main Event Entertainment and 33.3% of visits to Dave & Buster’s). And during nearly every individual week of April 2024, the brands maintained strongly positive momentum.

Dave & Buster’s and Main Event Entertainment recent visit growth has been partly fueled by the two chains’ growing store counts. And a deeper dive into how the chains’ visitation patterns have evolved since COVID shows why they are well-positioned for continued expansion – and success.

One factor likely contributing to the eatertainment brands’ strength is the increasing loyalty of their visitors. Dave & Buster’s leveled up its rewards program in 2021 – and has been upping its loyalty game ever since. Members can access special deals, like the chain’s recent 50% off food promotion, and earn points by playing games or ordering off the menu. Main Event, too, keeps customers coming back with a variety of promotions, from Monday Night Madness to Kids Eat Free Tuesdays – a particularly attractive offer for the chain’s family-oriented audience.

And since 2019, both chains have seen a steady increase in the share of visits made by customers frequenting the chain at least twice a month.

In addition, both Dave & Buster’s and Main Event appear to be finding success by leaning into the evening daypart.

Back in 2019, Main Event introduced a late-night menu and announced that all of its stores would be open until at least 12:00 AM – and even later on Fridays and Saturdays. (Even before that, some of its stores were open during the wee hours). Dave & Buster’s has also taken steps to increase its night-time business with special late-night deals and happy hours.

And location analytics indicates that this strategy is bearing fruit. Over the past several years, both brands have experienced an increase in their share of late-night visits (i.e. those taking place between 9:00 PM and 2:00 AM). And in Q1 2024, Dave & Buster’s and Main Event saw 23.9% and 27.3% of their total visits during the late-night daypart, respectively.

While it might be assumed that at-home entertainment and the "Netflix effect" pose a threat to eatertainment chains (particularly during the evening hours, as there is more content than ever to get home to), the data suggests that many consumers are staying out late for social dining and entertainment.

Demand for dining and social experiences continues to grow. As consumer behavior and demographics evolve, how will these eatertainment chains perform and which new concepts may rise to prominence as 2024 progresses?

Visit Placer.ai to find out.

In this blog, we dive into the latest location analytics and demographic data for luxury retailers and high-end department stores and take a closer look at consumer behavior in the upscale shopping space.

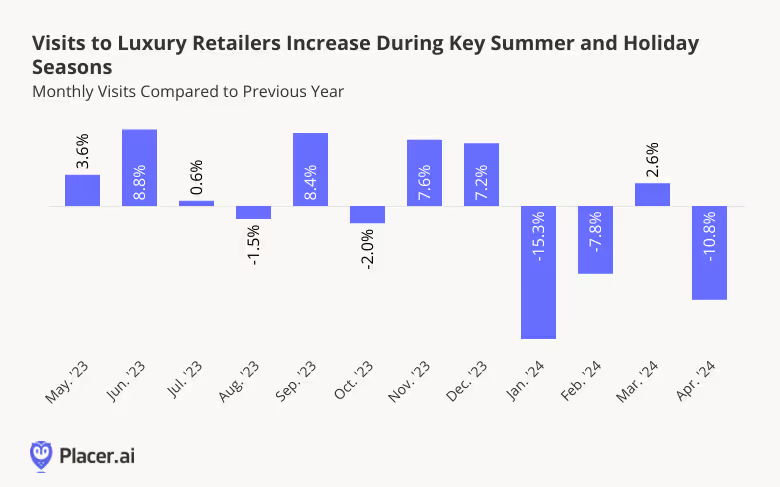

Over the past year, the Placer.ai Luxury Retail Index – including brands like Louis Vuitton, Tiffany & Co., and Chanel – saw year-over-year (YoY) foot traffic growth during crucial shopping seasons. May and June 2023 had significant increases in YoY visits, perhaps due to an influx of recreational shoppers on summer vacation, and July saw an uptick as well. YoY visits peaked again in November and December, likely reflecting the popularity of upscale retail corridors during the all-important holiday shopping season.

Some of this strength may be a result of affluent consumers refocusing their shopping on the U.S.: In 2022, many high-income shoppers chose to purchase big-ticket items abroad due to various economic benefits. But by 2023, demand for domestic luxury retail appeared to rebound, as some upscale retail clients “repatriated” their discretionary dollars.

To be sure, visit gaps re-emerged in some months of early 2024 – though these are partly attributable to factors like January’s unusually stormy weather and an April calendar shift. (April 2024 had one fewer Saturday than April 2023, providing less opportunity for visits in the highly discretionary category). But March 2024 also saw YoY visit growth. And given how well luxury retailers performed during their busiest months of year, the category may very well rally once again heading into the summer.

Recent location intelligence also offers encouraging signs from the high-end department store space.

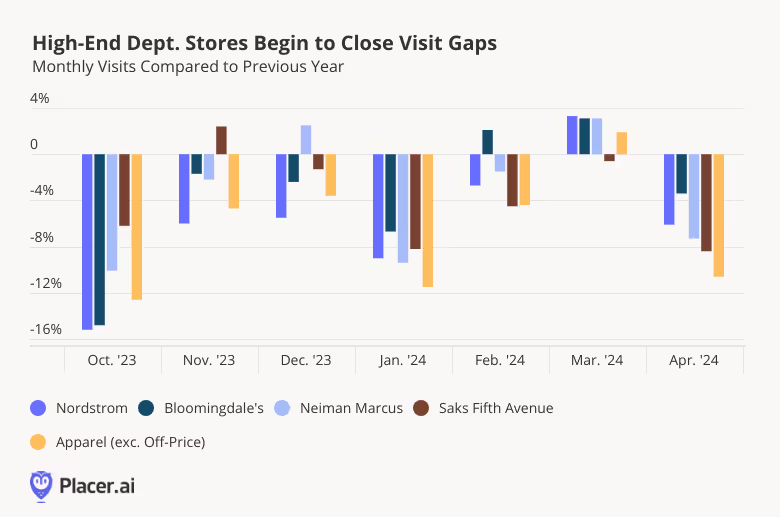

Like luxury retailers, high-end department stores saw narrowing visit gaps during the peak holiday shopping season – with Saks Fifth Avenue seeing a YoY uptick in November 2024, and Neiman Marcus seeing one in December.

In March 2024, YoY traffic turned positive for Nordstrom (3.3%), Bloomingdale’s (3.1%), and Neiman Marcus (3.1%), while Saks Fifth Avenue had just a -0.6% visit gap. And although April 2024 was a challenging month for the retailers, perhaps due in part to the calendar shift mentioned above, all four upscale department stores outperformed the traditional apparel category – another indication that high-end department stores may be poised for a comeback.

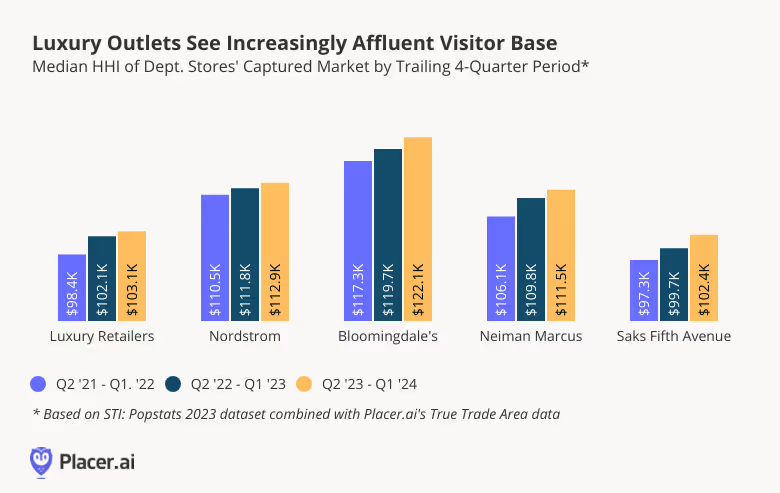

Analyzing demographic changes in the captured markets of both luxury brands and high-end department stores indicates that increasingly affluent consumers are the main drivers of visits to the segment. (A chain’s captured market is obtained by weighting each Census Block Group (CBG) in its trade area according to the CBG’s share of visits to the chain – and so reflects the population that actually visits the chain in practice).

Over the last four quarters, visitors to luxury retailers and high-end department stores came from areas with higher median household incomes (HHIs) than in previous years. For example, during the period between Q2 2023 and Q1 2024, the median HHI of Bloomingdale’s captured market was $122.1K, an increase from $119.7K between April 2022 and March 2023, and $117.3K from April 2021 to March 2022.

In the face of recent inflationary pressures, aspirational luxury shoppers (who tend to be slightly less affluent) are likely quicker to adjust their behavior and trade down to more affordable brands. Meanwhile, prestige luxury shoppers – those with the highest incomes – tend to be relatively resilient, and so are able to continue shopping at their favorite luxury brands, driving up the HHI in these retailers’ trade areas.

Luxury retailers and high-end department stores have had recent foot traffic successes, while their clientele has become increasingly affluent. Will these brands continue their upward visit trajectories – and how will they leverage affluent foot traffic going forward?

Visit Placer.ai to find out.

Discretionary retail has faced its fair share of headwinds over the past few years, from pandemic-related restrictions to inflation. And while prices have stabilized, subdued consumer confidence continues to weigh on non-essential segments. But even in this challenging environment, some companies, like Ulta Beauty, are continuing to see visit growth, while others, like Gap Inc. and its portfolio of apparel brands, are making a comeback.

With Q2 2024 well underway, we take a look at the foot traffic patterns for these companies to see how they are faring.

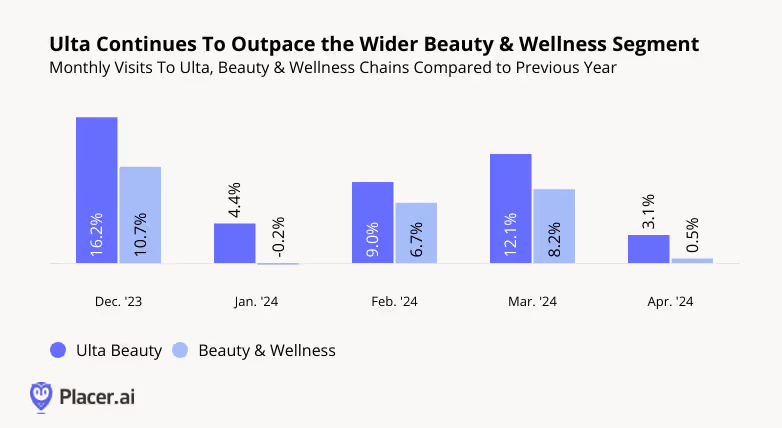

In 2020, Placer.ai predicted that Ulta Beauty would be an unstoppable force in beauty retail – and the chain has impressed ever since. Over the past several years, Ulta has been on a consistent upward visit trajectory, propelled by strong demand for affordable luxuries (the so-called “Lipstick Effect”), and consumer interest in self-care.

And though the pace of Ulta’s tremendous YoY visit growth has moderated somewhat in recent months, the beauty giant continues to thrive – drawing even more visitors in early 2024 than during the equivalent period of last year. Between January and April 2024, YoY visits to the beauty retailer remained consistently elevated, outperforming the wider Beauty & Wellness space.

The fashion segment has experienced rising prices and persistent inflation over the past few years, leading to a new era of discount and thrift shopping. And iconic apparel retailers like Gap Inc – operator of Gap, Old Navy, Athleta, and Banana Republic – have not been immune to the challenges facing the category.

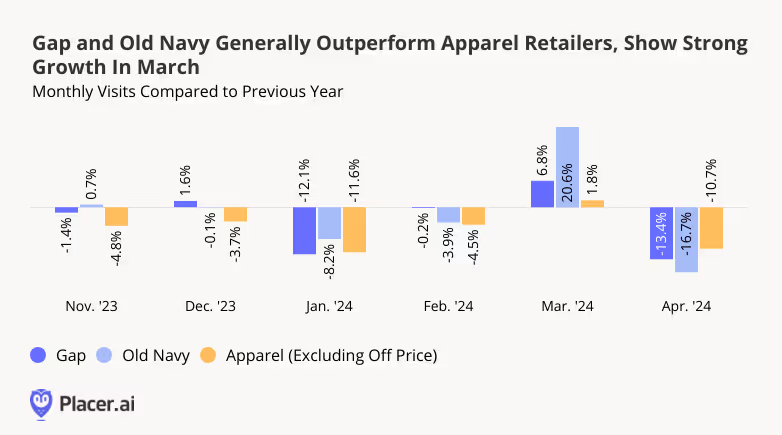

But through a combination of high-profile hirings and revitalized branding efforts, Gap Inc. has been readying itself for a comeback. In Q4 2023, the retailer announced stronger-than-expected results, driven primarily by Gap and Old Navy. And recent foot traffic to the company’s largest brands provides further evidence that its turnaround efforts may be starting to bear fruit.

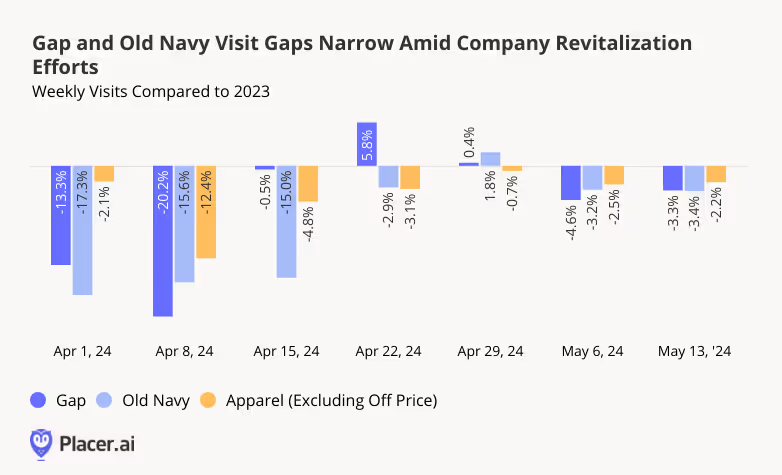

During the all-important November and December shopping season last year, Gap and Old Navy saw YoY visits hold steady or increase, outpacing the wider Apparel space. In January 2024, visits to the two chains declined in the wake of an Arctic blast that kept many shoppers at home. But in February, Gap enjoyed a 0.7% YoY visit bump, while Old Navy saw just a mild drop – less than that of the overall Apparel category. In March 2024, both Gap and Old Navy enjoyed strong YoY visit growth, far outperforming overall Apparel – likely driven by sales events held by each brand. And though April saw YoY visits decline once again, with the two chains falling behind Apparel, drilling down into weekly data offers a different perspective.

Both Gap and Old Navy started off April with lackluster YoY performance, perhaps due in part to the comparison to an early April 2023 that included Easter weekend. But towards the end of April and beginning of May, Gap and Old Navy’s’ visit gaps narrowed – with some weeks seeing positive YoY visit growth, and with the two chains once again either nearly on par with, or outperforming, overall Apparel.

Gap Inc. itself is bullish about what the next year holds in store, with big names like Zak Posen joining the Gap family in hopes of propelling the company forward. Though it may be premature to declare an end to the troubles that have plagued the clothier in recent years, early 2024 foot traffic provides further evidence that the company is heading in the right direction.

Ulta continues to experience visit growth, highlighting Beauty’s enduring appeal. Meanwhile, Gap and Old Navy are witnessing narrowed visit gaps and some weekly visit growth.

Is the Apparel segment making a comeback? Can the Beauty segment sustain its positive momentum indefinitely?

Visit Placer.ai to keep up to date with the latest retail developments.

We dove into the data to check in with specialty discount chains Ollie’s Bargain Outlet and Five Below. How did they fare in early 2024? And what can the two brands’ recent performance tell us about what lies in store for them in the months ahead?

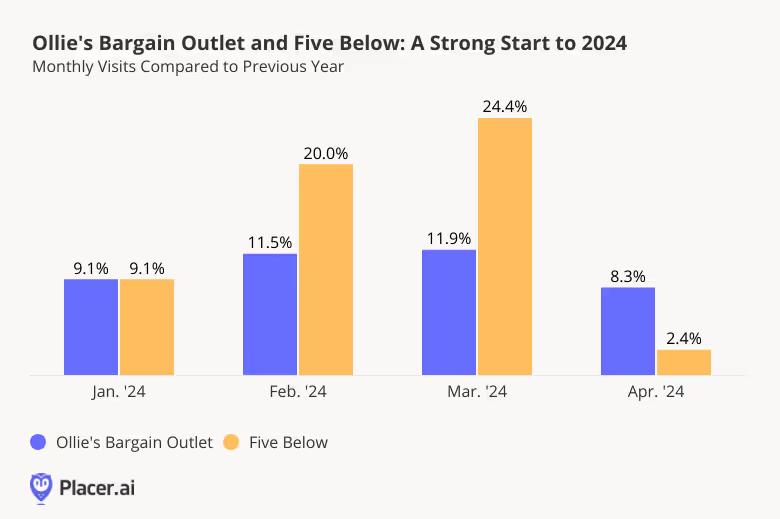

A quest for bargains and the promise of unexpected finds have kept Discount & Dollar Store shoppers coming so far in 2024. Despite lapping a strong 2023, foot traffic to Ollie’s Bargain Outlet and Five Below remained consistently above last year’s levels between January and April 2024, partly due to the chains’ continued expansions.

Though both chains draw Easter shoppers with special seasonal offerings, Five Below’s primary focus on low-ticket recreational merchandise makes it a natural destination for shoppers eager to fill their baskets with candy and other inexpensive holiday items. And Q1 2024 foot traffic to the chain appeared to be shaped by Easter shopping patterns. The brand’s YoY visits increased significantly in February with the roll-out of holiday wares, and the Saturday before Easter (March 30th, 2024) saw a sizable foot traffic boost that was 38.7% above the chainwide average for Saturdays in Q1 2024 – contributing to the month’s elevated visits overall. This pull-forward in demand, together with the comparison to an April 2023 that included Easter Sunday, at least partially explains Five Below’s more modest visit growth in April.

For both Ollie’s and Five Below, strong traffic since the beginning of the year indicates continued YoY gains may be expected in the months ahead.

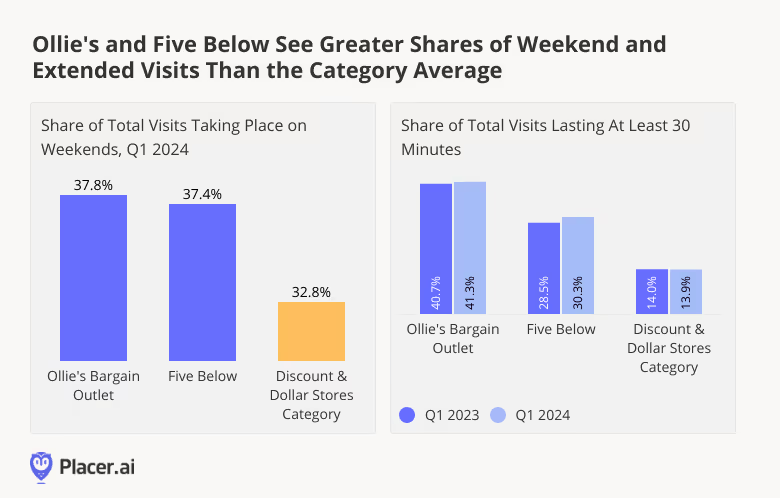

In addition to YoY visit growth in the early months of 2024, Ollie’s and Five Below are seeing elevated weekend visits and an increase in longer visits, indicative of a robust treasure-hunting culture that is driving demand.

In Q1 2024, 37.8% of visits to Ollie’s and 37.4% of Five Below’s visits occurred on weekends, while weekend visits accounted for only 32.8% of visits to the wider Discount & Dollar Store category. This is likely due to Ollie’s and Five Below’s growing notoriety as destinations for treasure hunting – a pastime perhaps preferred at the end of the work week when schedules are more flexible.

Meanwhile, the share of visits lasting over 30 minutes in Q1 2024 increased for both brands YoY, even as it slightly declined for the category as a whole. This indicates that shoppers drawn to Ollie’s and Five Below’s recreational vibes spent even more time browsing the aisles in Q1 2024 than they did last year. Ollie’s closeout buying model and shifting array of steeply discounted brand name merchandise is especially conducive to the thrill of the hunt – and the chain saw a remarkable 41.3% of visits lasting more than half an hour in Q1.

Ollie’s Bargain Outlet and Five Below continue to demonstrate their consumer appeal in 2024. As the brands expand, holidays prove to be retail highlights while a culture of treasure hunting has shown its capacity to drive consistent traffic.

For more data-driven retail insights, visit Placer.ai.

In the spirit of retail quarterly earnings season, it has been eye-opening to see the disparity in performances, especially among specialty retailers. This week, Urban Outfitters, Inc. (URBN) reported first quarter earnings, with comparable dollar sales up 4.6%, a strong growth number compared to many in the industry. Urban Outfitters, Inc. benefitted from a diversified retail portfolio, with the growth stemming from its Anthropologie, Free People and Nuuly brands, both in-store and online, while its namesake brand continues to be challenged over the past few years. As far as specialty apparel retailers go, the company has done a fantastic job of creating retail experiences that are unique and irreplaceable for their customers, and finding true competitors of its brands proves difficult.

Looking at Q1 2024 traffic performance, Free People and Anthropologie led the way, echoing the earnings release. Free People visits, excluding FP Movement, grew 8% year-over-year and Anthropologie saw an increase in traffic of 5% year-over-year. Urban Outfitters, on the other hand, actually saw traffic levels beat sales performance, with traffic flat compared to Q1 2023.

Anthropologie, despite retail and economic headwinds, has tightened up its value proposition to consumers and has a clear vision of its target shopper. Using Spatial.ai’s PersonaLive segmentation (as shown below), Anthropologie attracted the most visits from Ultra Wealthy Families in Q1 2024, followed by Young Professionals and Sunset Boomers. Compared to the other portfolio brands, Anthropologie attracts a higher median income consumer and over indexes with more mature consumers, two groups that have higher levels of spending power in today’s economy and haven’t decidedly altered their retail habits as much as middle- and lower-income shoppers. Anthropologie has clearly benefited from the strength of its visitors, and its curated multi-category retail experience that has shielded the chain from the struggles of other home furnishing and apparel retailers. It will be interesting to watch if the brand is able to continue to maintain its success through the remainder of the year if economic conditions become further challenged.

Free People appeals to a consumer somewhat in the middle of both Anthropologie and Urban Outfitters, and has been able to capitalize on Anthropologie’s success and hedge against Urban Outfitters’ struggles. Free People’s design sense makes it a crowd-favorite but also a source for many “dupes” on other retail platforms; however, the influx of similar designs haven’t seen to slow their momentum. FP Movement, the brand’s athleisure line that also has stand alone retail locations, has been another lever for growth. Using Placer.ai to look at three FP movement locations compared to the Free People chain, FP movement grew visits faster than the parent brand, and also had a higher dwell time. Urban Outfitters, Inc. disclosed that dollar sales for Free People were up almost 18% in Q1 2024, but the company doesn't break out sales between FP Movement and Free People. There are some risks with the athleisure market, as brands face softening performance and consumers shift away from more discretionary apparel categories. FP movement has created core and in-demand silhouettes that drive traffic, but with fashion trends, that may not be enough to sustain long-term visit growth.

Finally, there’s the lackluster performance from the namesake brand. Younger adults have so many retail options at their fingertips that retailers who cater to these consumers can often be lost in the shuffle, especially with so much competition coming from online and offline retail. Urban Outfitters long curated a distinct look and feel, as well as a mix of national brands and private labels that differentiated it from competitors; with retailers in similar price bands like Abercrombie & Fitch staging a comeback, Urban Outfitters has lost its footing. Looking into the consumer segments using Spatial.ai’s PersonaLive, Educated Urbanites and Young Professionals top Urban Outfitters segmentation; price-sensitivity could be making younger shoppers more discerning in their apparel purchases. Off-price may also be a factor here and provide higher levels of competition for the customer base. Urban Outfitters holds a lot of brand value, and if the brand is able to right size assortments and value in the short term, there could be upside to bring it closer to its sister brands.

Compared to most of the specialty retail narratives out in the market, Urban Outfitters, Inc. has a lot of positive momentum with a few of its brands. Nuuly, its subscription rental service, was also called out as a positive highlight of the quarter, and learnings about consumer preferences through that service could help to inform the go-forward strategies at Anthropologie, Free People and Urban Outfitters. There is a lot to celebrate as it relates to its discretionary retail fleet, despite the challenges at the namesake brand, and proves that specialty retail that still feels “special” has consumers' lasting attention.

1. Idaho and South Carolina have emerged as significant domestic migration magnets over the past four years. Between January 2021 and 2025, both states gained over 3.0% of their populations through domestic migration. Other Mountain and Sun Belt states – including Nevada, Montana, and Florida – also drew significant inflow, while California, New York, and Illinois experienced the greatest outmigration.

2. Interstate migration cooled noticeably in 2024. During the 12-month period ending January 2025, California, New York and Illinois saw their outflows slow dramatically, while domestic migration hotspots like Georgia, Texas, and Florida saw inflows flatten to zero. A similar cooling trend emerged on a CBSA level.

3. Still, some states continued to see notable relocation activity over the past year. In 2024, Idaho, South Carolina, and North Dakota drew the most relocators relative to their populations. And among the nation’s ten largest states, North Carolina led with an inflow of 0.4%.

4. Phoenix remained a rare bright spot among the nation’s ten largest metro areas. The CBSA was the only major analyzed hub to maintain positive net domestic migration through 2024.

Over the past several years, the United States has experienced significant domestic migration shifts, driven by factors like remote work, housing affordability, and regional economic opportunities. As some areas reap the benefits of population inflows, others grapple with outflows tied to higher living costs and evolving workplace dynamics.

This report dives into the location analytics to explore where Americans have moved since 2021 – and how these patterns began to change in 2024.

Since 2021, Americans have flocked toward warmer climates, expansive natural scenery, and more affordable housing options – particularly in the Mountain and Sun Belt states.

Between January 2021 and January 2025, South Carolina led the nation in positive net domestic migration – drawing an influx of newcomers equivalent to 3.6% of its January 2025 population. (This metric is referred to as a state’s “net migrated percent of population.”) Next in line was Idaho with a 3.4% net migrated percent of population, followed by Nevada, (2.8%), Montana (2.8%), Florida (2.1%), South Dakota (2.1%), Wyoming (2.0%), North Carolina (2.0%), and Tennessee (1.9%). Texas saw positive net migration of just 0.9% during the same period. However, the Lone Star State’s large overall population means a substantial number of newcomers in absolute terms.

Meanwhile, California (-2.2%), New York (-2.1%), and Illinois (-1.9%) experienced the greatest outflows relative to their populations. This exodus was driven largely by soaring housing costs and the rise of remote work, which lowered barriers to moving out of high-priced areas.

Between January 2024 and January 2025, many of the same broad patterns persisted, but at a more moderate clip – suggesting a stabilization of domestic migration nationwide. This leveling off could reflect factors such as rising mortgage interest rates, which dampened home buying and selling, as well as the increased push for employees to return to the office.

Still, South Carolina (+0.6%) and Idaho (+0.6%) remained among the top inflow states. The two hotspots were joined – and slightly surpassed – by North Dakota (+0.8%), where even modest waves of newcomers make a big impact due to the state’s lower population base. A wealth of affordable housing and a strong job market have positioned North Dakota as a particularly attractive destination for U.S. relocators in recent years. And Microsoft and Amazon’s establishment of major presences around Fargo has strengthened the region’s economy.

Meanwhile, California (-0.3%), New York (-0.2%), and Illinois (-0.1%) continued to post negative net migration, but at a markedly slower rate than in prior years. And notably, several states that had been struggling with outflow, such as Michigan, Minnesota, Virginia, Ohio, and Oregon, began showing minor positive inflow during the same 12-month window. As home affordability erodes in pandemic-era hot spots like the Mountain states and Sun Belt, these areas may emerge as new destinations for Americans seeking lower costs of living.

Zooming in on the ten most populous U.S. states offers an even clearer picture of how domestic migration patterns have stabilized over the past year. The graph below shows a side-by-side comparison of domestic migration patterns during the 36-month period ending January 2024 and the 12-month period ending January 2025.

California, New York, and Illinois saw population outflows slow dramatically during the 12 months ending January 2025 – while domestic migration magnets such as Georgia, Texas, and Florida saw inflow flatten to zero. Meanwhile, Ohio, Michigan, and Pennsylvania flipped from slightly negative to slightly positive net migration – incremental upticks that could signal a possible turnaround.

The only “Big Ten” pandemic-era migration magnet to maintain strong inflow in 2024 was North Carolina – which saw a 0.4% influx in 2024 as a result of interstate moves.

A closer look at the top four states receiving outmigration from California and New York (October 2020 to October 2024) reveals that residents leaving both states tended to settle in nearby areas or in Florida.

Among those leaving New York, 37.4% ended up in neighboring states – 21.1% moved to New Jersey, 9.2% to Pennsylvania, and 7.1% to Connecticut. But an astonishing 28.8% decamped all the way to the Sunshine State, trading the Northeast’s colder climate for Florida sunshine.

Similarly, 20.1% of California leavers chose to stay nearby, moving to Nevada (11.5%) or Arizona (8.6%). Another 19.1% moved to Texas, and 8.0% moved to Florida, making it the fourth-largest destination for Californians.

Zooming in on CBSA-level data – focusing on the nation’s ten largest metropolitan areas, all with over five million people – reveals a similar picture of slowing domestic migration over the last year.

Los Angeles, New York, Chicago, and Washington, D.C. – four cities that experienced notable population outflows between January 2021 and January 2024 – saw those outflows flatten considerably. For these metros, this leveling-off may serve as a promising sign that the waves of departures seen in recent years may have begun to subside. Conversely, Houston and Dallas, which both welcomed positive net migration between January 2021 and January 2024, registered zero-net domestic migration in 2024. Atlanta, for its part, remained flat in both of the analyzed periods.

In Miami, however, outmigration persisted at a substantial rate. Despite Florida’s overall status as a domestic migration magnet, Miami lost 2.6% of its population to domestic net migration between January 2020 and January 2024 – and another 1.0% between January 2024 and January 2025. As one of Florida’s most expensive housing markets, Miami may be losing some residents to other parts of the state or elsewhere in the region. Meanwhile, Philadelphia, which lost 0.3% of its population to net domestic migration between January 2021 and January 2024, continued losing residents at a slightly faster pace in 2024 – another 0.3% just last year.

Of the ten biggest CBSAs nationwide, only Phoenix continued to see a net domestic migration gain through 2024 (+0.2%). This highlights the CBSA’s continued draw as a (relative) relocation hotspot even in 2024’s cooling market.

Who are the domestic relocators heading to Phoenix?

From October 2020 to October 2024, the top five metro areas sending residents to the Phoenix CBSA each registered median household incomes (HHIs) of $73K to $98K – surpassing Phoenix’s own median of $72K. This suggests that many of those moving in are arriving from wealthier, often more expensive metro areas – for whom even Phoenix’s high-priced market may offer more affordable living.

Overall, domestic migration patterns appear to have cooled in 2024, reflecting economic and societal trends that have slowed the rush from pricey coastal hubs to more affordable regions. Yet states like South Carolina, Idaho, and North Dakota – as well as metro areas like Phoenix – continue to attract new arrivals, paving the way for evolving regional demographics in the years to come.

In today’s retail landscape, consumer behavior is influenced by a multitude of factors, directly impacting the success of products and brands. This report explores the latest trends in value perception, shopping behavior, and media consumption that impact which brands consumers are most likely to engage with – and how.

In the apparel space, consumers continue to prioritize value and unique merchandise.

Analysis of visits to various apparel categories reveals a steady increase in the share of visits going to off-price retailers and thrift stores at the expense of traditional apparel chains.

And the popularity of off-price chains and thrift stores appears to be widespread across multiple audience segments. Analyzing trade area data with the Experian: Mosaic psychographic dataset reveals a clear preference for second-hand retailers among both younger (ages 25-30) and older (51+) consumer segments. Meanwhile, middle-class parents aged 36-45 with teenagers – the “Family Union” segment – are significantly more likely to shop at off-price apparel stores, highlighting their emphasis on buying new, while saving both time and money.

This suggests that the powerful blend of treasure-hunting and deep value, central to both the off-price and thrift experiences, is driving traffic from a variety of audiences, and that other industries could benefit from combining affordability with the allure of unique products.

Diving deeper into the location intelligence for the apparel space further highlights thrift and off-price’s broad appeal – and that a combination of quality and price motivates consumers to visit different retailers.

Between 2019 and 2024, the share of Bloomingdale’s, Saks Fifth Avenue, Neiman Marcus, and Nordstrom visitors that also visited a Goodwill or Ross Dress for Less increased significantly.

And while this could mean that the current economic climate is causing some higher-income consumers to trade down to lower-priced retailers, it could also be that consumers are prioritizing sustainability and seeking value in terms of “bang for their buck” – shopping a combination of retailers depending on the cost versus quality considerations for each purchase.

Consumers increasingly expect to shop on their own terms, opting for a more flexible shopping experience that blurs the lines between traditional retail channels and categories.

Superstores and warehouse stores, for example, often evoke the image of navigating aisle after aisle of nearly every product imaginable – a time-consuming endeavor given the sheer size of their stores. But the latest location intelligence shows that more consumers are turning to these retailers for super-quick shopping trips.

Between 2019 and 2024, the share of visits lasting less than ten minutes at Target, Walmart, BJ’s Wholesale Club, Sam’s Club, and to a lesser extent Costco, rose steadily – perhaps due to increased use of flexible BOPIS (buy online, pick-up in-store) and curbside pick-up options. These stores may also be seeing a rise in consumers popping in to grab just a few items as-needed or to cherry-pick particular deals to complement their larger online shopping orders.

This trend highlights the demand for frictionless store experiences that allow visitors to conveniently shop or pick up orders even at large physical retailers.

And the breaking down of traditional retail silos isn’t limited to big-box chains. Diving into the data for quick service restaurants (QSR), fast casual chains, and grocery stores indicates that more consumers are also looking for new ways to grab a convenient bite.

Since 2019, grocery stores have been claiming an increasingly large share of the midday short visit pie – i.e. visits between 11:00 AM 3:00 PM lasting less than ten minutes – at the expense of QSR chains. This suggests that consumers seeking quick and affordable lunches are increasingly turning to grocery stores to pick up a few items or take advantage of self-service food bars. Notably, the rise in supermarket lunching hasn’t come at the expense of fast-casual restaurants, which have also upped their quick-service games – and have seen a small increase in their share of the quick lunchtime crowd over the past five years.

While some of QSR’s relative decline in short lunchtime visits could be due to discontent with rising fast-food prices, it’s clear that an increasing share of consumers see grocery and fast-casual chains as viable options during the lunch rush.

In 2025, tapping into hot trends and creating viral moments are among the most powerful tools for amplifying promotions and driving foot traffic to physical stores.

Retailers across categories have successfully harnessed the power of pop culture collaborations to generate excitement – and visits – by leaning into trending themes. On October 8th, 2024, for example, Wendy’s launched its epic Krabby Patty Collab, inspired by the beloved SpongeBob franchise. And during the week of the offering, the chain experienced a remarkable 21.5% increase in foot traffic compared to an average week that year.

Similarly, Crumbl – adept at creating buzz through manufactured scarcity – sparked a frenzy with the debut of its exclusive Olivia Rodrigo GUTS cookie. Initially available only at select locations near the artist’s concert venues, the cookie was launched nationwide for a limited time from August 19th to 24th, 2024. This buzz-driven release resulted in a 27.7% traffic surge during the week of the launch, as fans rushed to get a taste of the star-studded treat.

And it’s not just dining chains benefiting from these pop-culture moments. On February 16th, 2025, Bath & Body Works launched a Disney Princess-inspired fragrance line, perfect for fans of Cinderella, Ariel, Belle, Jasmine, Moana, and Tiana. The collaboration resonated, fueling a 23.2% visit spike for the chain.

While tapping into existing pop-culture trends has the ability to drive traffic, so does creating a new one. Analysis of movie theater visits on National Popcorn Day (Sunday, January 19th, 2025) shows how initiating a trend can spur social media engagement and impact in-person traffic to physical retail spaces.

National Popcorn Day was a successful promotional holiday across the movie theater industry in 2025. Both Regal Cinemas and AMC Theatres offered popcorn-based promotions on the day, but Cinemark’s “Bring Your Own Bucket” campaign, in particular, appears to have spurred a significant foot traffic boost during the event.

Visits to Cinemark on National Popcorn Day in 2025 increased 57.5% relative to the Sunday visit average for January and February 2025, as movie-goers showed off their out-of-the-bucket popcorn receptacles on social media. Clearly, by starting a trend that invited creativity and expression, Cinemark was able to amplify the impact of its National Popcorn Day promotion.

Location intelligence illuminates some of the key trends shaping consumer behavior in 2025. The data reveals that value-driven shopping, demand for flexibility across touchpoints, and the power of unique retail moments have the power to drive consumer engagement and the success of retail categories, brands, and products.

Placer.ai observes a panel of mobile devices in order to extrapolate and generate visitation insights for a variety of locations across the U.S. This panel covers only visitors from within the United States and does not represent or take into account international visitors.

Downtown districts in the nation’s major cities attract domestic travelers all year long with their iconic sights, lively entertainment, and diverse dining offerings. But each hub follows its own rhythm, shaped by distinct seasonal peaks and dips in visitor flow.

This white paper examines downtown hotel visitation patterns in four of the nation’s most popular destinations for domestic tourists: Miami, Chicago, New York, and Los Angeles. Focusing on 20 downtown hotels in each city, the analysis explores seasonal variations in domestic travel, city-specific dynamics, and differentiating factors.

Domestic tourism has rebounded strongly in recent years, and hotels in Miami and Chicago have been the biggest beneficiaries. In 2024, visits to analyzed hotels in each of these cities’ downtown areas grew by 8.9% and 7.4%, respectively, compared to 2023. Meanwhile, hotels in downtown and midtown Manhattan saw a more modest 2.0% increase, while Los Angeles experienced a slight year-over-year (YoY) decline in downtown hotel visits.

One factor that may be driving Miami and Chicago’s stronger performance is their higher proportion of long-distance visitors, defined as those visiting from over 250 miles away. Miami remains a top destination for snowbirds and spring breakers, while Chicago serves as a cultural and entertainment hub for the sprawling Midwest. These long-distance leisure travelers may be more likely to splurge on downtown hotel stays during their trips, helping drive hotel visit growth in the two cities.

By contrast, hotels in the Los Angeles and Manhattan city centers drew lower shares of domestic travelers coming from less than 250 miles away. These shorter-haul domestic tourists may be less likely to splurge on downtown hotels than those taking longer vacations. Both cities are also surrounded by numerous regional getaway options that can draw long-haul leisure travelers away from their downtown cores.

Each of the four analyzed cities has its own unique ebbs and flows – and city center hotel visits reflect these patterns. Miami, with its warm, sunny climate, experiences influxes of tourists during the winter and spring, with March seeing the biggest jump in downtown hotel visits last year (13.0% above the monthly visit average). Chicago, which thrives in the summer with its many festivals and events, saw its biggest downtown hotel visit bump in August. Meanwhile, Manhattan experienced a major uptick in December, likely fueled by holiday tourism and New Year celebrations, and Los Angeles visits were highest in the summertime.

What drives these seasonal visit peaks? Miami has long been a top tourism destination, especially in early spring, when snowbirds and spring breakers flock to the city for sun and relaxation. In recent years, the city has seen a rise in short-term domestic tourism, suggesting that the city is becoming increasingly popular for weekend getaways. According to the Placer.ai Tourism Dashboard, the share of domestic tourists staying just one or two nights grew from 71.7% in March 2022 to 78.3% in March 2024.

This shift aligns with an impressive increase in the magnitude of downtown Miami’s springtime hotel visit peak: In March 2022, visits to downtown hotels were 5.0% above the monthly average for the year, a share that more than doubled by 2024 to 12.9%.

These numbers may mean that more people are choosing to head to Miami for a quick break from the cold – and staying in downtown hotels to make the most of their short getaway.

Chicago’s major August visit spike was likely driven by the Windy City’s impressive lineup of major summer festivals, from Lollapalooza to the Chicago Air and Water Show, which draw thousands of attendees from across the country.

Lollapalooza fueled the largest visit spike to the city – between Thursday, August 1st and Sunday, August 4th, visits to downtown Chicago hotels surged between 51.1% and 63.8% above 2024 daily averages for those days of the week. The Air and Water Show and the Chicago Jazz Festival also generated significant hotel visit increases – highlighting the boost these events bring to the city’s tourism and hospitality sector.

The Big Apple draws a diverse mix of visitors throughout the year. But in December – the city’s peak tourist season – visitors pour in from all over the country to skate in Rockefeller Center, browse Fifth Avenue’s festive window displays and experience the city’s unique holiday magic.

And analyzing data from hotels in midtown and downtown Manhattan reveals a striking shift in the types of visitors who stay in the heart of NYC during the holiday season. While visitors from other urban centers dominated downtown hotel stays throughout most of the year – accounting for 47.9% of visits from January to November 2024 – their share dropped to 42.0% in December 2024. Meanwhile, the share of guests from suburban areas and small towns rose from 37.3% to 41.0%, and the share of guests from rural and semi-rural areas nearly doubled, from 3.5% to 6.1%.

These patterns suggest that, though Manhattan typically attracts a wide range of visitors, the holiday season is uniquely appealing to tourists from smaller towns and suburban areas. Understanding these trends can provide crucial context for hotels and civic stakeholders alike as they work to maximize the opportunities presented by the city’s December visit surge.

Los Angeles hotels also experience significant demographic shifts during peak season. In July, visits to downtown LA hotels surged by 15.3% relative to the 2024 monthly visit average. And a closer look at audience segmentation data suggests a corresponding surge in the share of "Flourishing Families" – an Experian: Mosaic segment consisting of affluent, middle-aged households with children. Throughout the year, "Flourishing Families" comprised between 7.7% and 8.7% of the census block groups (CBGs) driving visits to downtown LA hotels. But in July, this share jumped to 9.9%.

These families may be taking advantage of summer vacations to enjoy Los Angeles’ cultural attractions and entertainment. Hotels and city stakeholders who understand the appeal the city holds for this demographic can better cater to them through family-friendly promotions and strategic marketing efforts to target these households.

Downtowns are making a comeback – and hotels in the heart of the nation’s major tourist hubs are reaping the benefits. By understanding who frequents these downtown hotels and when, local businesses and civic leaders can optimize their resource management and strategic planning to make the most of these opportunities.