Insights into the physical world anchored in location analytics

INSIDER

Report

10 Top Brands to Watch in 2026Meet the ten retail and dining powerhouses, including H-E-B, Walmart, and Dave’s Hot Chicken, redefining success and winning consumer loyalty in 2026.

Placer Research

January 12, 2026

Industry Trends

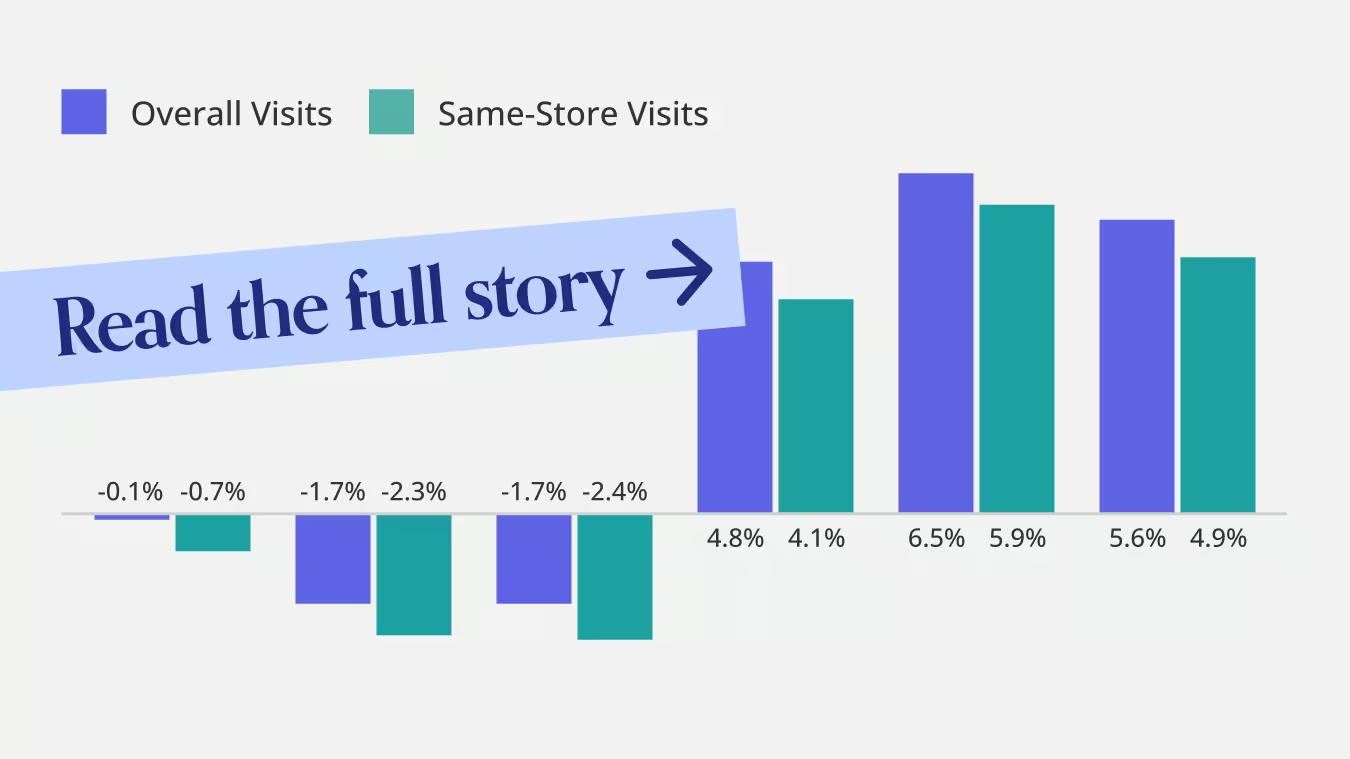

Year-Over-Year Visits to Grocery Stores by State

Article

Article

What Other QSR Brands Can Learn From McDonald’s Loyalty StrategyThe Kroger Co, is a leading player in the grocery store space, operating its epon lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu

Shira Petrack

Jan 21, 2026

3 minutes

Article

Article

Opportunity vs. Operational Reality in Dollar Tree's 99 Cents Only AcquisitionThe Kroger Co, is a leading player in the grocery store space, operating its epon lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu

Shira Petrack

Jan 20, 2026

3 minutes

Article

.avif)

Article

Which Gym Is Right For You in 2026?The Kroger Co, is a leading player in the grocery store space, operating its epon lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu

Ezra Carmel

Jan 16, 2026

4 minutes

Article

Article

Placer.ai Overall Retail, E-Commerce Distribution, Industrial Manufacturing Index, December 2025The Kroger Co, is a leading player in the grocery store space, operating its epon lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu

Lila Margalit

Jan 15, 2026

2 minutes

Latest Videos

Webinar

Why Customers Are Obsessed with Dutch BrosThe Kroger Co, is a leading player in the grocery store space, operating its epon lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu

January 20, 2026

Weekly Brief

This grocery store has become a hot destination spot.The Kroger Co, is a leading player in the grocery store space, operating its epon lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu

January 14, 2026

Weekly Brief

Grocery's Favorite Holiday Is...The Kroger Co, is a leading player in the grocery store space, operating its epon lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu

November 18, 2025

Weekly Brief

This #retailer is a must watch this holiday season.The Kroger Co, is a leading player in the grocery store space, operating its epon lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu

November 13, 2025

Latest Articles

Article

Placer.ai December 2025 Office Index: ‘Tis the Season to WFHLila Margalit

January 12, 2026

3 minutes

.avif)

Article

Placer.ai December 2025 Mall Index: Recapping 2025 Shopping Center TrendsShira Petrack

January 7, 2026

4 minutes

Article

7 Brew's Rapid Rise 7 Brew Coffee’s explosive expansion is driving strong traffic growth per location, outpacing rivals and reshaping the drive-thru coffee market.

Shira Petrack

December 31, 2025

2 minutes

Article

Value, Bifurcation, and Self-Gifting During the 2025 Holiday SeasonShira Petrack

December 30, 2025

4 minutes

Article

Dutch Bros Sets Its Sights on the Breakfast RushDutch Bros is targeting the morning daypart to boost same-store growth. By expanding its food menu, the brand aims to capture the breakfast demand currently led by Dunkin’ and Starbucks.

Ezra Carmel

December 29, 2025

3 minutes

.png)

.png)

.png)

.png)

.png)

.png)

.svg)