.svg)

.png)

.png)

.png)

.png)

Summer 2024 has seen fierce competition among fast food and dining chains, with many embracing limited-time offers (LTOs) to attract customers and drive visits. As restaurant price wars continue unabated, these promotions are proving crucial in keeping consumer interest alive.

We dove into the visit performance of four brands – McDonald’s, Burger King, Taco Bell, and Smoothie King – to see how their LTOs are driving visits.

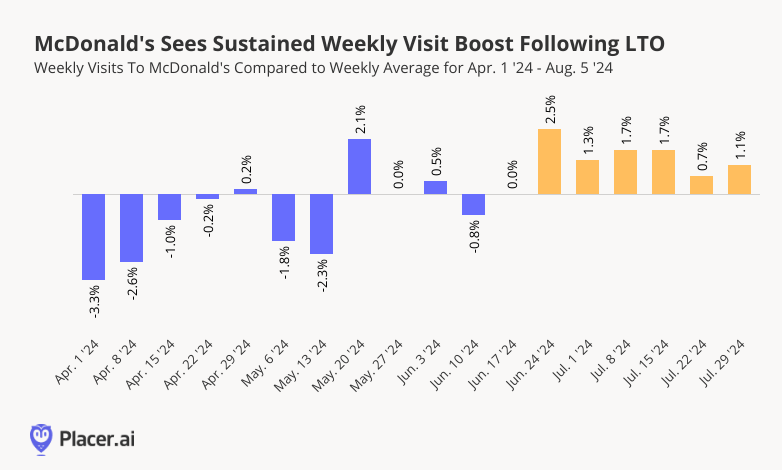

On June 25th, 2024, McDonald’s launched a limited-time offer, allowing customers to purchase a McDouble or McChicken, a 4-piece Chicken McNuggets, small fries, and a small soft drink for just $5. Originally intended to run for about a month, the promotion was so successful that it was extended through August. Foot traffic began to trend upwards following the promotion’s launch, with visits during the week of June 24th up 2.5% compared to the chain’s weekly average between April 1st and August 5th. And foot traffic to McDonald’s has remained consistently elevated in the weeks since.

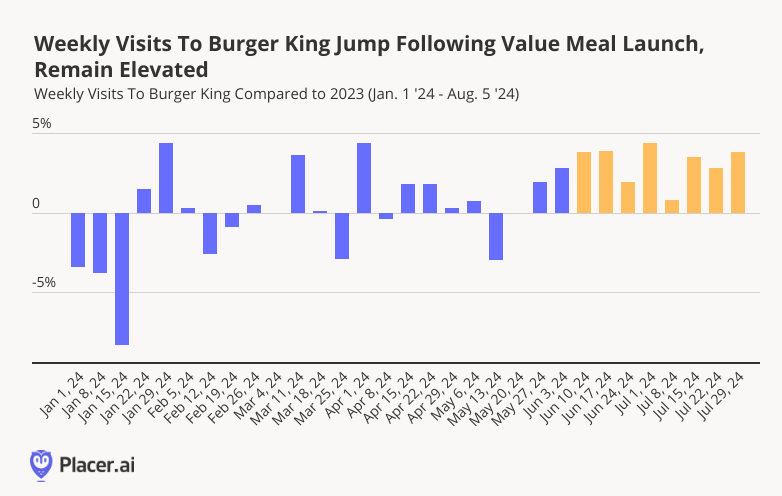

Like McDonald’s, Burger King has also been leaning into value-driven promotions, launching the "$5 Your Way" value meal on June 10th, 2024. And the promotion seems to be driving visits in a significant way. While weekly YoY visits to the chain have fluctuated throughout 2024, they jumped 3.8% YoY during the week of June 10th, and have remained consistently elevated since. Burger King, recognizing the power of the value meal, has chosen to keep the special running until October.

And following its recent rightsizing efforts, Burger King isn’t resting on its laurels. Building on the success of its $5 value meal, the chain also launched a limited-time, extra-spicy menu update on July 18th. This new offering appears to have helped keep visits elevated: After waning slightly during the week of July 8th, foot traffic to Burger King picked up once again during the week of the launch.

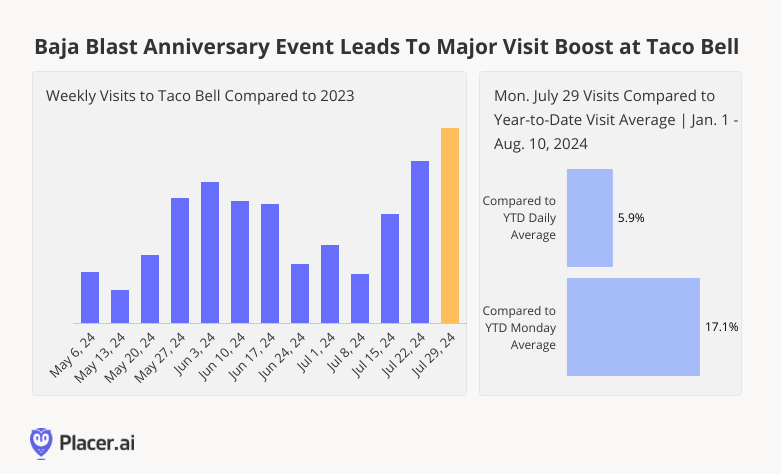

Tex-Mex favorite Taco Bell kicked off the 20th anniversary of its popular lime-flavored drink, Baja Blast, with a special "Bajaversary" promotion on July 29th, 2024, offering free drinks and freezes both in-store and on the app. The deal seems to have resonated strongly with customers, with visits growing by 12.3% year-over-year (YoY) for the week of July 29th. Daily visits also experienced a major increase – on the day of the special, visits surged by 17.1% compared to the YTD Monday visit average and were 5.9% higher than the overall YTD visit average.

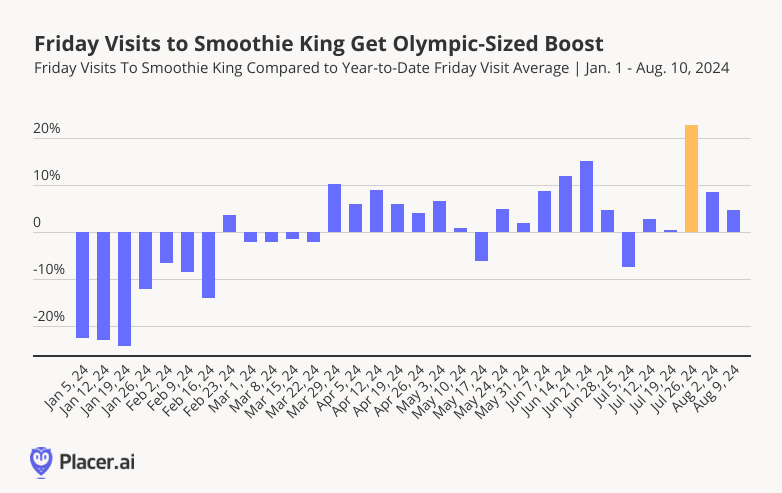

The Summer Olympics were a major event, with millions of viewers tuning in to watch athletes at their best. And many fast food chains jumped on the Olympics bandwagon, offering discounts, deals, and limited-time menu items inspired by the event.

Smoothie King, known for its health-focused beverages, was one such brand with an Olympics special. The chain offered 32-oz smoothies for just $5 on Friday, July 26th, 2024, to coincide with the Olympic kickoff. The deal ran for one day only and fueled a significant foot traffic boost. Visits to Smoothie King on July 26th were 22.9% higher than the YTD Friday visit average – highlighting the effectiveness of well-timed, event-based offers.

For now at least, it seems that LTOs – particularly those focused on offering diners more bang for their buck – are reigning supreme in the fast-food space.

Will these promotions continue to drive foot traffic and maintain customer engagement?

Visit Placer.ai for the latest data-driven dining news.

With Q3 2024 underway, we checked in with beauty chains Ulta Beauty and Sally Beauty Supply, owned by Sally Beauty Holdings, Inc. How did they fare in the first half of the year? And what are some of the factors driving their success?

We dove into the data to find out.

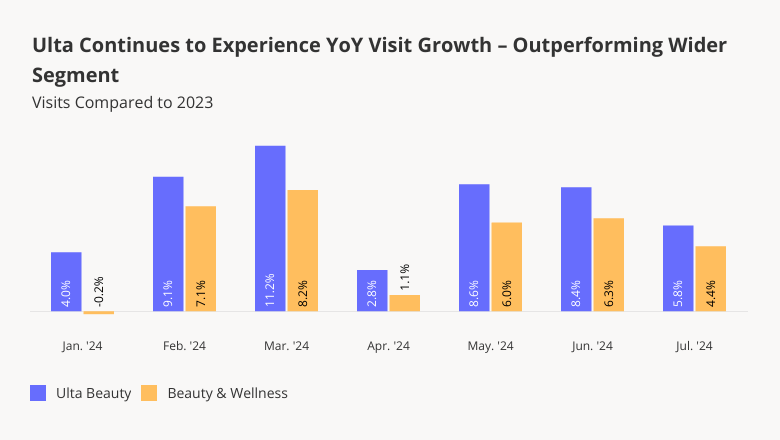

Ulta Beauty thrived in 2022 and 2023, propelled by the lipstick effect – which sees consumers splurging on low-cost indulgences when times are tight – and by the post-pandemic consumer obsession with wellness. And though the beauty giant’s visit growth has moderated somewhat in recent months, it continues to see year-over-year (YoY) foot traffic growth.

Between January and July 2024, Ulta consistently outperformed the wider beauty segment, with monthly YoY visit increases ranging between 2.8% and 11.2%. On a quarterly basis, visits to the chain jumped 6.6% YoY in Q2 2024. Though some of Ulta’s visit growth can be attributed to the chain’s growing store count, the average number of visits to each Ulta location also increased 4.6% YoY in Q2 2024.

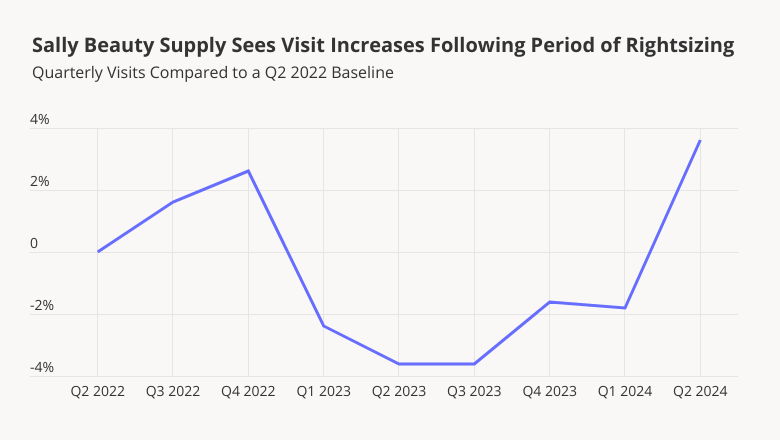

Sally Beauty Supply – the hair care-oriented beauty chain with more than 3,100 stores nationwide – is another beauty brand to watch this year. In 2022, Sally Beauty announced a store optimization plan that included the shuttering of more than 300 stores. And foot traffic data shows that the chain’s rightsizing efforts are paying off.

Comparing quarterly visits to Sally Beauty to a Q2 2022 baseline shows that after declining throughout 2023, overall visits to the chain have begun to pick up once again – with Q2 2024 foot traffic up 3.6%.

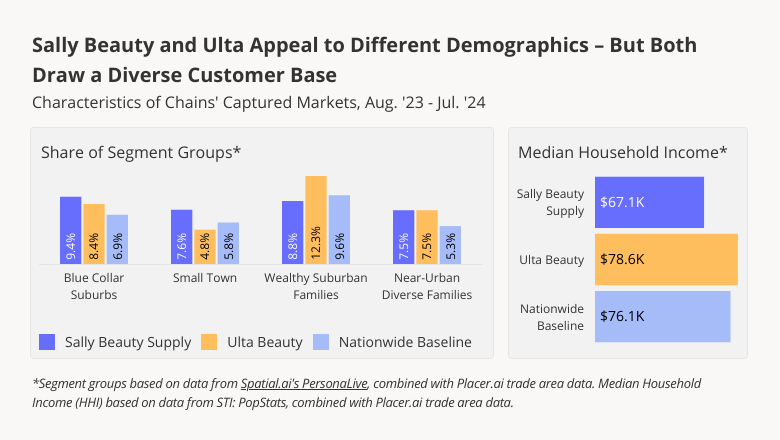

One factor that appears to be driving success for both Ulta and Sally Beauty is their unusually broad appeal. Analyzing the two chains’ captured markets with data from Spatial.ai’s PersonaLive and STI: PopStats shows that though there are differences between Ulta and Sally Beauty’s captured markets, both brands draw large shares of customers from across demographic groups.

Overall, the median household income of Ulta’s captured market is higher than that of Sally Beauty – $78.6K, compared to $67.1K. Ulta’s distinct mix of prestige and budget products is especially likely to draw Wealthy Suburban Families, while Sally Beauty’s offerings hold special appeal for Small Towns.

But both brands’ captured markets include higher-than-average shares of the Blue Collar Suburbs and Near-Urban Diverse Families segment groups – showing that despite their differences, Ulta and Sally Beauty both boast diverse customer bases.

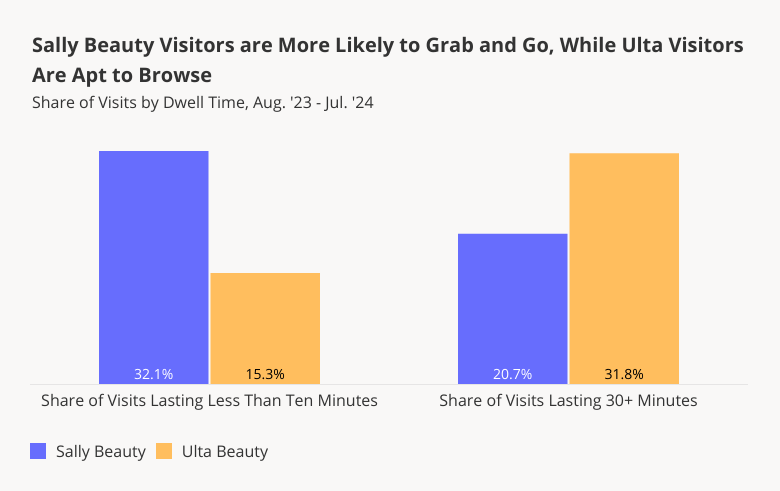

Still, visitors interact with the two beauty chains differently. During the 12-month period ending in July 2024, some 32.1% of visits to Sally Beauty lasted less than 10 minutes – compared to just 15.3% of visits to Ulta.

Sally Beauty’s far greater share of visits under ten minutes may be partly a result of its hair-focused product mix. In Q2 2024, some 64.8% of Sally Beauty’s net sales were in the hair color and care segments, while just 8.1% were in skincare and cosmetics. Ulta’s offerings, by contrast, are very much centered on cosmetics. And while shoppers buying hair care products may be more likely to take advantage of options like BOPIS (buy online, pick up in-store), those on the hunt for makeup may be more intent on trying out products and browsing in-store. Beauty professionals, who make up a larger share of Sally Beauty’s customer base than that of Ulta’s, may also be more inclined to use this service.

On the flip side, Ulta drew a much higher share of extended visits (30+ minutes) during the analyzed period – 31.8%, compared to 20.7% for Sally Beauty. In addition to browsing the aisles and trying new products, many Ulta customers likely remain longer in-store to avail themselves of the chain’s varied in-store salon services.

Ulta and Sally Beauty have different offerings – and serve different customer bases. But the success and broad appeal of both brands shows that in the beauty space of 2024, there’s plenty of room at the top.

For more data-driven insights, visit Placer.ai.

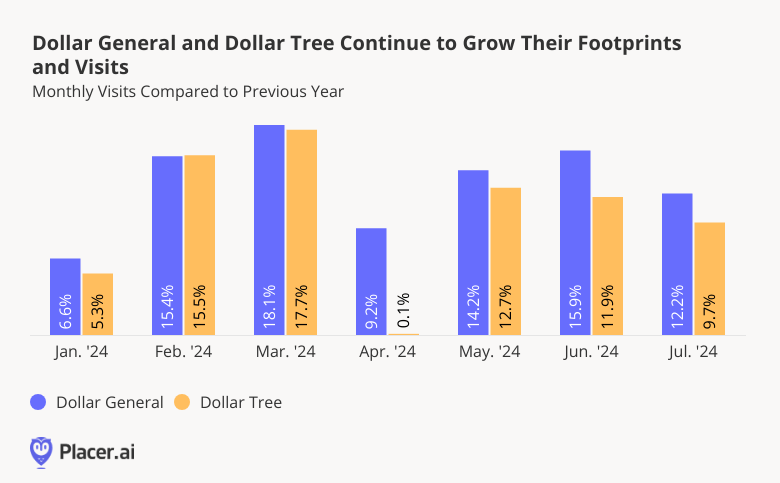

Discount & dollar stores had a strong Q2 2024, as consumers continued to prioritize value amid persistent high prices. We dove into the data for category leaders Dollar General and Dollar Tree to take a closer look at the drivers of these chains’ most recent success.

Dollar General – the nation’s largest dollar store player – opened nearly 200 stores last quarter, surpassing 20,000 U.S. locations. And Dollar Tree, the second-biggest dollar store chain by real estate footprint, stands at over 8,300 locations, including more than 100 new additions in the first months of 2024.

These chains’ significant fleet expansions continue to fuel foot traffic growth. Both Dollar General and Dollar Tree saw consistently positive YoY visit growth during the first seven months of 2024. Only in April 2024 did Dollar Tree’s YoY foot traffic appear to falter, likely as a result of decreased YoY demand for its traditional holiday merch due to an Easter calendar shift.

On a quarterly basis, YoY visits to Dollar General and Dollar Tree in Q2 2024 rose 13.1% and 8.4%, respectively. Over the same period, the two chains also experienced YoY increases in the average number of visits to each of their locations (10.3% for Dollar General and 3.7% for Dollar Tree), indicating that visits to individual stores remained robust as the brands grew.

And both brands plan on continuing to expand in the near future. Dollar General expects to open a total of 730 new stores in 2024, while Dollar Tree announced the takeover of 170 99 Cents Only Stores to complement the banner’s other openings. These strategic initiatives should continue to drive foot traffic gains for both brands in the coming months.

What’s behind Dollar General and Dollar Tree’s visit success? A look at changes in visitor interaction with the two chains suggests that for both dollar leaders, rising customer loyalty has played an important role.

Since July 2022, the share of visitors frequenting the two brands on a regular basis has been on an upward trajectory. In July 2024, 35.5% of Dollar General visitors frequented the chain at least three times during the month – up from 34.1% in July 2022. This increase in visitor frequency may be due in part to Dollar General’s inroads into the grocery space – giving consumers even more of a reason to visit the chain for daily essentials on a regular basis.

And though Dollar Tree’s somewhat more modest fleet drives a slightly smaller share of repeat visitors, it too has seen an increase in frequent visitors while investing in diversified offerings at various price-points – including consumables. In July 2024, 16.6% of Dollar Tree’s visitors also visited the chain at least three times, up from 13.9% in July 2022.

For both chains, visitor frequency is driven in part by seasonality, with loyalty upticks in December and May, likely driven by holiday season and Mother’s Day shoppers. Still, Dollar Tree, which remains a more traditional dollar store than Dollar General, experiences more dramatic seasonal visit peaks than its prime competitor – and its loyalty also follows a more pronounced seasonal pattern.

With the biggest players in the discount & dollar category seemingly going strong, will the second half of 2024 bring even more success to this retail space?

Visit Placer.ai to find out.

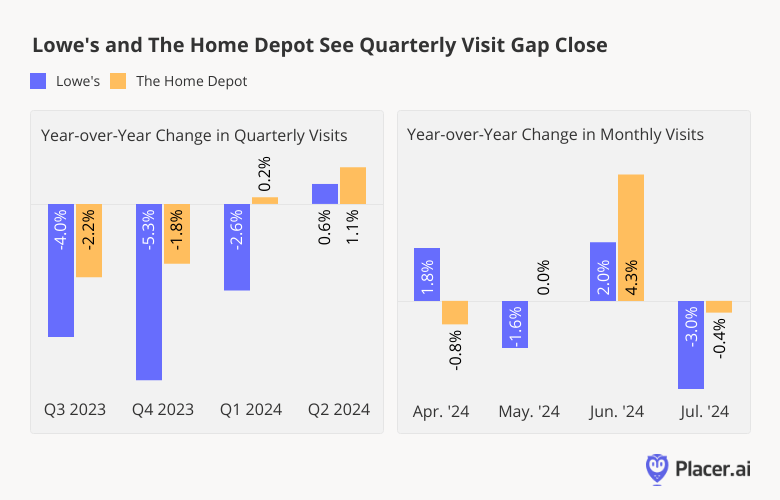

Midway through 2024, foot traffic to Lowe’s and Home Depot – the leaders in the home improvement space – is climbing. What’s driving these retailers’ recent visit growth? We dove into the data to find out.

After a meteoric rise in foot traffic during the pandemic, the home improvement segment has experienced a turbulent few years – one of the primary reasons being a cool housing market that has curbed demand for projects. But after a significant period of consistent YoY visit gaps, visits to Lowe’s and Home Depot in 2024 appear to be matching and even slightly surpassing 2023 levels.

Between Q3 2023 and Q2 2024, Lowe’s and Home Depot both saw their YoY visit gaps gradually narrow and then close – finishing out Q2 with modest YoY gains. This turnaround may have been partly due to modest lifts in new home sales at the start of 2024 compared to 2023 – spurring an uptick in home improvement projects in the following months.

And though YoY visits to both retailers experienced a decline in July 2024 – perhaps due to May and June’s YoY declines in new and existing home sales – recent indications that the housing market may be heating up may bode well for the home improvement category in the second half of 2024 and beyond.

In addition to an increase in YoY visits, the resurgence of cross-shopping behavior between Home Depot and Lowe’s further suggests that a turnaround may be unfolding in the home improvement space. Location analytics shows that during recent home improvement booms, cross shopping between the two retailers was common, perhaps as judicious consumers taking on large projects looked to explore their options.

In Q2 of 2020 and 2021 – periods of strong foot traffic for both retailers – a large share of Lowe’s visitors also visited Home Depot. And although Lowe’s maintains a smaller retail footprint than Home Depot, many of Home Depot’s visitors visited a Lowe’s store as well.

But in the years that followed, economic headwinds led many consumers to defer their projects, and cross-shopping behavior began to moderate. In Q2 2023, only 48.8% of visitors to Lowe’s also visited Home Depot, and just 44.8% of Home Depot’s visitors visited Lowe’s.

However, in Q2 2024, consumers’ home improvement cross-shopping showed signs of a potential change of course. During the period, cross shopping between the brands climbed to 51.5% for Lowe’s and 45.7% for Home Depot. A return to in-store comparison shopping could mean that consumers are again taking on higher-stakes home improvement projects, which justify a visit to both retailers.

After an extended period of YoY visit gaps, foot traffic to the home improvement leaders is on the rise. Will Lowe’s and Home Depot continue to build on these positive visitation trends?

Visit Placer.ai to find out.

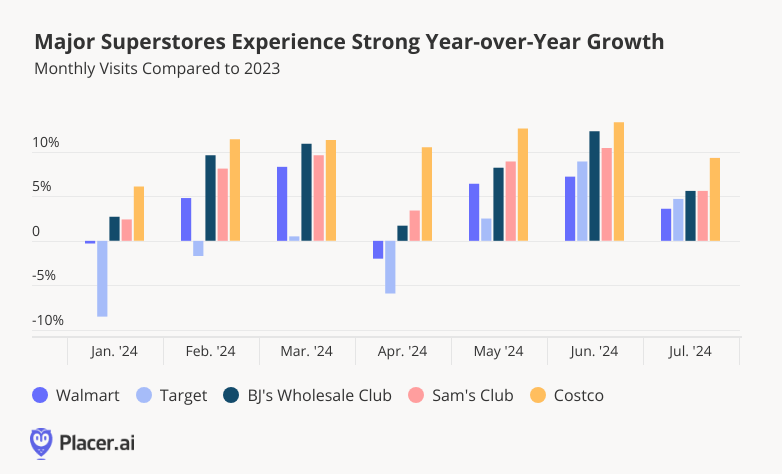

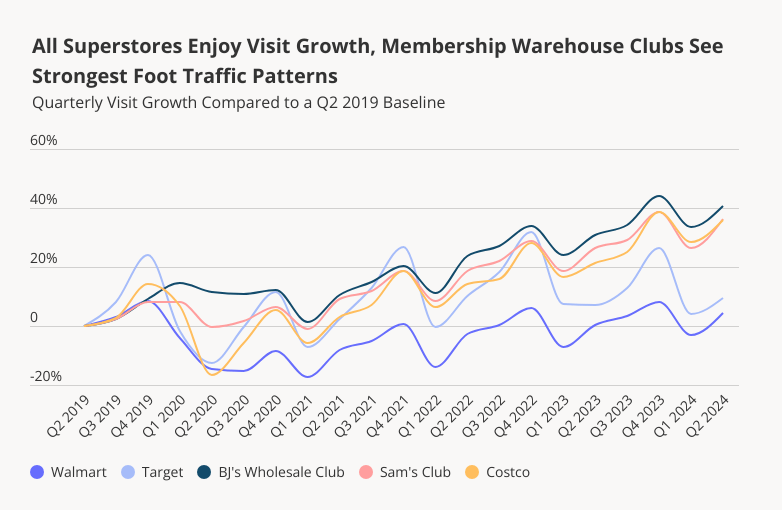

With H2 2024 underway, we took a look at the foot traffic performance of superstores Walmart and Target, and membership warehouse clubs BJ’s Wholesale Club, Sam’s Club, and Costco. How did foot traffic compare to 2023’s visitation patterns? And what special events helped propel visits?

Superstores have been thriving – with YoY visits to retail giants Walmart and Target elevated consistently since May 2024. And though Target had a slower start to the year, YoY foot traffic to the chain picked up in Q2, and the retailer has been flourishing since. (Target and Walmart's April 2024 YoY foot traffic drops are likely attributable in part to calendar shifts: April 2023 had one more weekend than April 2024 – and one of them was Easter.)

Membership warehouse clubs have been faring even better, with Costco leading the pack in Q2. BJ’s and Sam’s Club also experienced strong visit growth, with July visits elevated by 5.6% YoY for both brands.

A closer look at the baseline change in quarterly visits since Q2 2019 further highlights the strong positioning of superstores and wholesale clubs in 2024. All five retailers drew more visits in Q2 2024 than they did pre-pandemic (Q2 2019).

But these visit increases have not been equally distributed across the retailers: While all of them experienced growth relative to a Q2 2019 baseline, membership warehouse visits have been outpacing those of superstores on a consistent basis since Q1 2023. As prime destinations for inexpensive, bulk buying, the segment has likely been buoyed by families and younger consumers seeking ways to save money on groceries and other basics amid high prices.

But superstores have also been having a moment. And one factor which may have contributed to Target’s Q2 2024 turnaround is its doubling down on loyalty: In April 2024, the chain revamped its Target Circle Rewards, adding, among other things, a new paid tier called Target Circle 360.

A key benefit of Target’s loyalty program, which is free to join for the regular tiers, is access to deep discounts during Target Circle Week. This year, the big sales event took place between July 7th and 13th – and examining foot traffic trends to the chain reveals that the promotion fueled a major visit boost: During the week of July 8th, weekly visits to Target were the highest they’ve been since the start of the year, and 6.8% higher than 2024’s weekly visit average. This year’s Circle Week visits also outperformed last year’s by 8.7%.

This demonstrates how the revamped loyalty program and exclusive sales events are successfully driving more customers to Target stores. And other retailers are taking note, with Walmart debuting its own major summer sales events and Costco and Sam’s Club battling it out for the most affordable prices – a major win for shoppers nationwide.

Superstores enjoyed elevated visitation patterns in Q2 2024. Will the superstore and wholesale club price wars continue? And with back-to-school shopping well underway, and the holiday shopping season quickly approaching, how will these retailers continue to perform?

Visit Placer.ai to keep up with the latest data-driven retail news.

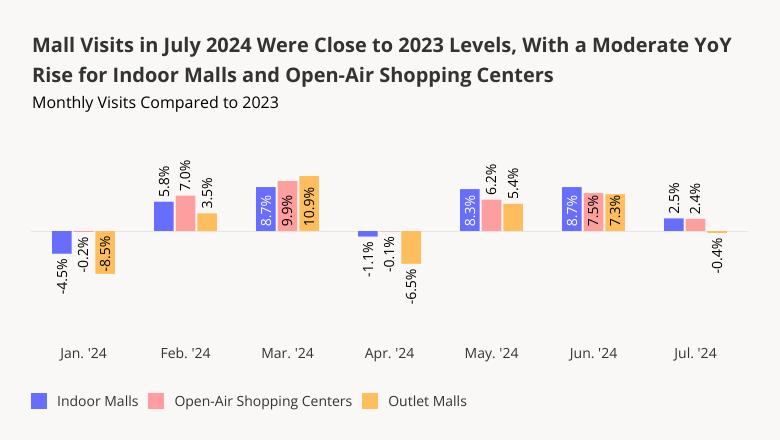

Summer is underway, and malls are still bustling. In July 2024, visits to indoor malls and open-air shopping centers were up 2.5% and 2.4%, respectively, compared to the equivalent period of 2023. Though these year-over-year (YoY) increases were more moderate than the significant jumps observed in May and June, they underscore the segment’s continued solid positioning. Outlet malls, for their parts, saw a slight 0.4% decline in mall visits compared to July 2023.

At first glance, July’s softer numbers – particularly for outlet malls – may appear to herald the start of a retail and mall visit summer slow-down. But zooming into weekly visit data offers further context that can shed light on what may lie ahead in the coming months.

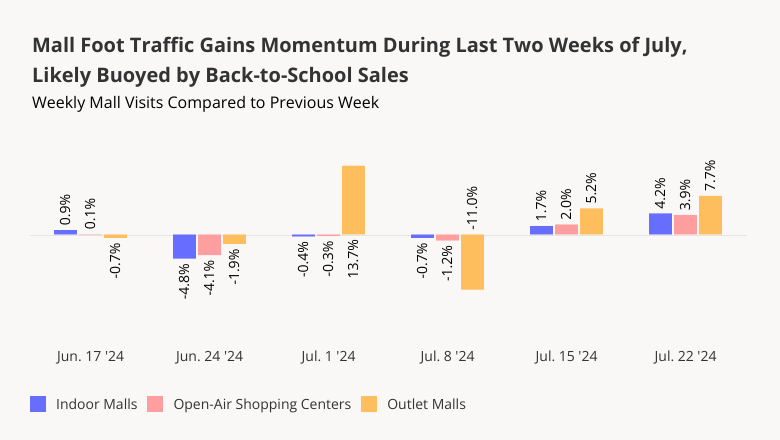

Analyzing week-over-week (WoW) visit trends shows that during the last two weeks of June and the first two weeks of July, all three mall indexes saw visits either decline or hold steady from week to week. The one notable exception was outlet malls – which experienced an impressive and sudden 13.7% WoW surge in visits to outlet malls during the first week of July, driven by the segment's exceptional Independence Day draw. Outlet malls’ subsequent WoW visit drop also reflects this exceptional Fourth of July peak.

The final two weeks of July showed a change in visit trajectory, with all three mall segments experiencing growing WoW visit gains as traffic picked up towards the end of the month. This upward trend can likely be attributed to the back-to-school season getting into full swing, with sales typically running from mid to late July through August and into mid-September.

Here too, the late July WoW visit gains were strongest for outlet malls – perhaps showcasing consumers' prioritization of budget shopping ahead of the new school year.

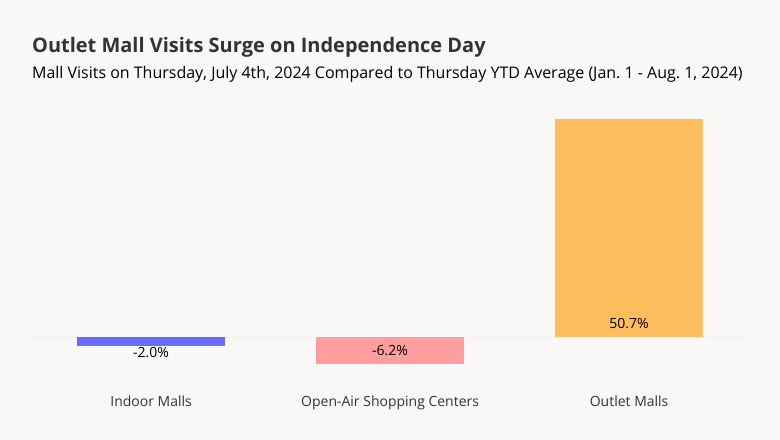

The Placer.ai Mall Index has frequently highlighted the power of special calendar milestones to drive significant shopping center visit spikes. And Independence Day is no exception.

On July 4th, shoppers nationwide flock to stores for holiday deals, often after enjoying hotdogs, hamburgers, and other festive treats. But though all three mall types have shops that are open on the holiday, it is outlet malls that really draw the crowds. On July 4th, 2024, visits to outlet malls shot up 50.7% compared to an average YTD Thursday. Foot traffic to indoor malls and open-air shopping centers, on the other hand, remained below levels usually seen on Thursdays.

Between Fourth of July sales and a long, summer holiday weekend, many consumers chose to spend their time off this year driving out to outlet malls and browsing their offerings to find the best deals.

Between the Fourth of July and back-to-school shopping, July was yet another busy month across shopping malls nationwide. But how will malls continue to fare in August as school goes back into session and summer vacationers go back to work?

Follow our blog at Placer.ai to find out.

1. Market Divergence: While San Francisco's return-to-office trends have stabilized, Los Angeles is increasingly lagging behind national averages with office visits down 46.6% compared to pre-pandemic levels as of June 2025.

2. Commuter Pattern Shifts: Los Angeles faces a persistent decline in out-of-market commuters while San Francisco's share of out-of-market commuters has recovered slightly, indicating deeper structural challenges in LA's office market recovery.

3. Visit vs. Visitor Gap: Unlike other markets where increased visits per worker offset declining visitor numbers, Los Angeles saw both metrics decline year-over-year, suggesting fundamental workforce retention issues.

4. Century City Exception: Century City emerges as LA's strongest office submarket with visits only 28.1% below pre-pandemic levels, driven by its premium amenities and strategic location adjacent to Westfield Century City shopping center.

5. Demographic Advantage: Century City's success may stem from its success in attracting affluent, educated young professionals who value lifestyle integration and are more likely to maintain consistent office attendance in hybrid work arrangements.

While return-to-office trends have stabilized in many markets nationwide, Los Angeles and San Francisco face unique challenges that set them apart from national patterns. This report examines the divergent trajectories of these two major West Coast markets, with particular focus on Los Angeles' ongoing struggles and the emergence of one specific submarket that bucks broader trends.

Through analysis of commuter patterns, demographic shifts, and localized performance data, we explore how factors ranging from out-of-market workforce changes to amenity-driven location advantages are reshaping the competitive landscape for office real estate in Southern California.

Both Los Angeles and San Francisco continue to significantly underperform the national office occupancy average. In June 2025, average nationwide visits to office buildings were 30.5% below January 2019 levels, compared to a 46.6% and 46.4% decline in visits to Los Angeles and San Francisco offices, respectively.

While both cities now show similar RTO rates, they arrived there through different trajectories. San Francisco has consistently lagged behind national return-to-office levels since pandemic restrictions first lifted.

Los Angeles, however, initially mirrored nationwide trends before its office market began diverging and falling behind around mid-2022.

The decline in office visits in Los Angeles and San Francisco can be partly attributed to fewer out-of-market commuters. Both cities saw significant drops in the percentage of employees who live outside the city but commute to work between H1 2019 and H1 2023.

However, here too, the two cities diverged in recent years: San Francisco's share of out-of-market commuters relative to local employees rebounded between 2023 and 2024, while Los Angeles' continued to decline – another indication that LA's RTO is decelerating as San Francisco stabilizes.

Like in other markets, Los Angeles saw a larger drop in office visits than in office visitors when comparing current trends to pre-pandemic levels. This is consistent with the shift to hybrid work arrangements, where many of the workers who returned to the office are coming in less frequently than before the pandemic, leading to a larger drop in visits compared to the drop in visitors.

But looking at the trajectory of RTO more recently shows that in most markets – including San Francisco – office visits are up year-over-year (YoY) while visitor numbers are down. This suggests that the workers slated to return to the office have already done so, and increasing the numbers of visits per visitor is now the path towards increased office occupancy.

In Los Angeles, visits also outperformed visitors – but both figures were down YoY (the gap in visits was smaller than the gap in visitors). So while the visitors who did head to the office in LA in Q2 2025 clocked in more visits per person compared to Q2 2024, the increase in visits per visitor was not enough to offset the decline in office visitors.

While Los Angeles may be lagging in terms of its overall office recovery, the city does have pockets of strength – most notably Century City. In Q2 2025, the number of inbound commuters visiting the neighborhood was just 24.7% lower than it was in Q2 2019 and higher (+1.0%) than last year's levels.

According to Colliers' Q2 2025 report, Century City accounts for 27% of year-to-date leasing activity in West Los Angeles – more than double any other submarket – and commands the highest asking rental rates. The area benefits from Trophy and Class A office towers that may create a flight-to-quality dynamic where tenants migrate from urban core locations to this Westside submarket.

The submarket's success is likely bolstered by its strategic location adjacent to Westfield Century City shopping center – visit data reveals that 45% of weekday commuters to Century City also visited Westfield Century City during Q2 2025. The convenience of accessing the mall's extensive retail, dining, and entertainment options during lunch breaks or after work may encourage employees to come into the office more frequently.

Perhaps thanks to its strategic locations and amenities-rich office buildings, Century City succeeds in attracting relatively affluent office workers.

Century City's office submarket has a higher median trade area household income (HHI) than either mid-Wilshire or Downtown LA. The neighborhood also attracts significant shares of the "Educated Urbanite" Spatial.ai: PersonaLive segment – defined as "well educated young singles living in dense urban areas working relatively high paying jobs".

This demographic typically has fewer family obligations and greater flexibility in their work arrangements, making them more likely to embrace hybrid schedules that include regular office attendance. Affluent singles also tend to value the lifestyle amenities and networking opportunities that come with working in a premium office environment like Century City: This demographic is often in career-building phases where in-person collaboration and visibility matter more, driving consistent office utilization that helps sustain the submarket's performance even as other LA office areas struggle with lower occupancy rates.

The higher disposable income of this audience also aligns well with the submarket's upscale retail and dining options at nearby Westfield Century City, creating a mutually reinforcing ecosystem where the office environment and surrounding amenities cater to their preferences.

As the broader Los Angeles market grapples with a shrinking commuter base and declining office utilization, the performance gap between premium, amenity-rich locations and traditional office districts is likely to widen. For investors and tenants alike, these trends underscore the growing importance of location quality, demographic targeting, and lifestyle integration in determining long-term office market viability across Southern California.

Century City's success – anchored by its affluent, career-focused workforce and integrated lifestyle amenities – can offer a blueprint for office market resilience in the hybrid work era.

1. Appetite for offline retail & dining is stronger than ever. Both retail and dining visits were higher in H1 2025 than they were pre-pandemic.

2. Consumers are willing to go the extra mile for the perfect product or brand. The era of one-stop-shops may be waning, as many consumers now prefer to visit multiple chains or stores to score the perfect product match for every item on their shopping list.

3. Value – and value perception – gives chains a clear advantage. Value-oriented retail and dining segments have seen their visits skyrocket since the pandemic.

4. Consumer behavior has bifurcated toward budget and premium options. This trend is driving strength at the ends of the spectrum while putting pressure on many middle-market players.

5. The out-of-home entertainment landscape has been fundamentally altered. Eatertainment and museums have stabilized at a different set point than pre-COVID, while movie theater traffic trends are now characterized by box-office-driven volatility.

6. Hybrid work permanently reshaped office utilization. Visits to office buildings nationwide are still 33.3% below 2019 levels, despite RTO efforts.

The first half of 2025 marked five years since the onset of the pandemic – an event that continues to impact retail, dining, entertainment, and office visitation trends today.

This report analyzes visitation patterns in the first half of 2025 compared to H1 2019 and H1 2024 to identify some of the lasting shifts in consumer behavior over the past five years. What is driving consumers to stores and dining venues? Which categories are stabilizing at a higher visit point? Where have the traffic declines stalled? And which segments are still in flux? Read the report to find out.

In the first half of 2025, visits to both the retail and dining segments were consistently higher than they were in 2019. In both the dining and the retail space, the increases compared to pre-COVID were probably driven by significant expansions from major players, including Costco, Chick-fil-A, Raising Cane's, and Dutch Bros, which offset the numerous retail and dining closures of recent years.

The overall increase in visits indicates that, despite the ubiquity of online marketplaces and delivery services, consumer appetite for offline retail and dining remains strong – whether to browse in store, eat on-premises, collect a BOPIS order, or pick up takeaway.

A closer look at the chart above also reveals that, while both retail and dining visits have exceeded pre-pandemic levels, retail visit growth has slightly outpaced the dining traffic increase.

The larger volume of retail visits could be due to a shift in consumer behavior – from favoring convenience to prioritizing the perfect product match and exhibiting a willingness to visit multiple chains to benefit from each store's signature offering. Indeed, zooming into the superstore and grocery sector shows an increase in cross-shopping since COVID, with a larger share of visitors to major grocery chains regularly visiting superstores and wholesale clubs. It seems, then, that many consumers are no longer looking for a one-stop-shop where they can buy everything at once. Instead, shoppers may be heading to the grocery stores for some things, the dollar store for other items, and the wholesale club for a third set of products.

This trend also explains the success of limited assortment grocers in recent years – shoppers are willing to visit these stores to pick up their favorite snack or a particularly cheap store-branded basic, knowing that this will be just one of several stops on their grocery run.

Diving into the traffic data by retail category reveals that much of the growth in retail visits since COVID can be attributed to the surge in visits to value-oriented categories, such as discount & dollar stores, value grocery stores, and off-price apparel. This period has been defined by an endless array of economic obstacles like inflation, recession concerns, gas price spikes, and tariffs that all trigger an orientation to value. The shift also speaks to an ability of these categories to capitalize on swings – consumers who visited value-oriented retailers to cut costs in the short term likely continued visiting those chains even after their economic situation stabilized.

Some of the visit increases are due to the aggressive expansion strategies of leaders in those categories – including Dollar General and Dollar Tree, Aldi, and all the off-price leaders. But the dramatic increase in traffic – around 30% for all three categories since H1 2019 – also highlights the strong appetite for value-oriented offerings among today's consumers. And zooming into YoY trends shows that the visit growth is still ongoing, indicating that the demand for value has not yet reached a ceiling.

While affordable pricing has clearly driven success for value retailers, offering low prices isn't a guaranteed path to growth. Although traffic to beauty and wellness chains remains significantly higher than in 2019, this growth has now plateaued – even top performers like Ulta saw slight YoY declines following their post-pandemic surge – despite the relatively affordable price points found at these chains.

Some of the beauty visit declines likely stems from consumers cutting discretionary spending – but off-price apparel's ongoing success in the same non-essential category suggests budget constraints aren't the full story. Instead, the plateauing of beauty and drugstore visits while off-price apparel visits boom may be due to the difference in value perception: Off-price retailers are inherently associated with savings, while drugstores and beauty retailers, despite carrying affordable items, lack that same value-driven brand positioning. This may suggest that in today's market, perceived value matters as much as actual affordability.

Another indicator of the importance of value perception is the decline in visits to chains selling bigger-ticket items – both home furnishing chains and electronic stores saw double-digit drops in traffic since H1 2019.

And looking at YoY trends shows that visits here have stabilized – like in the beauty and drugstore categories – suggesting that these sectors have reached a new baseline that reflects permanently shifted consumer priorities around discretionary spending.

A major post-pandemic consumer trend has been the bifurcation of consumer spending – with high-end chains and discount retailers thriving while the middle falls behind. This trend is particularly evident in the apparel space – although off-price visits have taken off since 2019 (as illustrated in the earlier graph) overall apparel traffic declined dramatically – while luxury apparel traffic is 7.6% higher than in 2019.

Dining traffic trends also illustrate this shift: Categories that typically offer lower price points such as QSR, fast casual, and coffee have expanded significantly since 2019, as has the upscale & fine dining segment. But casual dining – which includes classic full-service chains such as Red Lobster, Applebee's, and TGI Fridays – has seen its footprint shrink in recent years as consumers trade down to lower-priced options or visit higher-end venues for special occasions.

Chili's has been a major exception to the casual dining downturn, largely driven by the chain's success in cementing its value-perception among consumers – suggesting that casual dining chains can still shine in the current climate by positioning themselves as leaders in value.

Consumers' current value orientation seems to be having an impact beyond the retail and dining space: When budgets are tight, spending money in one place means having less money to spend in another – and recent data suggests that the consumer resilience in retail and dining may be coming at the expense of travel – or perhaps experiences more generally.

While airport visits from domestic travelers were up compared to pre-COVID, diving into the data reveals that the growth is mostly driven by frequent travelers visiting airports two or more times in a month. Meanwhile, the number of more casual travelers – those visiting airports no more than once a month – is lower than it was in 2019.

This may suggest that – despite consumers' self-reported preferences for "memorable, shareable moments" – at least some Americans are actually de-prioritizing experiences in the first half of 2025, and choosing instead to spend their budgets in retail and dining venues.

The out of home entertainment landscape has also undergone a significant change since COVID – and the sector seems to have settled into a new equilibrium, though for part of the sector, the equilibrium is marked by consistent volatility.

Eatertainment chains – led by significant expansions from venues like Top Golf – saw a 5.5% visit increase compared to pre-pandemic levels, though YoY growth remained modest at 1.1%. On the other hand, H1 2025 museum traffic fell 10.9% below 2019 levels with flat YoY performance (+0.2%). The minimal year-over-year changes in both categories suggest that these entertainment segments have found their new post-COVID equilibrium.

The rise of eatertainment alongside the drop in museum visits may also reflect the intense focus on value for today's consumers. Museums in 2025 offer essentially the same value proposition that they offered in 2019 – and for some, that value proposition may no longer justify the entrance fee. But eatertainment has gained popularity in recent years as a format that offers consumers more bang for their buck relative to stand-alone dining or entertainment venues – which makes it the perfect candidate for success in today's value-driven consumer landscape.

But movie theaters traffic trends are still evolving – even accounting for venue closures, visits in H1 2025 were well below H1 2019 levels. But compared to 2024, movie traffic was also up – buoyed by the release of several blockbusters that drove audiences back to cinemas in the first half of 2025. So while the segment is still far from its pre-COVID baseline, movie theaters retain the potential for significant traffic spikes when compelling content drives consumer demand.

The blockbuster-driven YoY increase can perhaps also be linked to consumers' spending caution. With budgets tight, movie-goers may want to make sure that they're spending time and money on films they are sure to enjoy – taking fewer risks than they did in 2019, when movie tickets and concession prices were lower and consumers were less budget-conscious.

H1 2025 also brought some moderate good news on the return to office (RTO) front, with YoY visits nationwide up 2.1% and most offices seeing YoY office visit increases – perhaps due to the plethora of RTO mandates from major companies. But comparing office visitation levels to pre pandemic levels highlights the way left to go – nationwide visits were 33.3% below H1 2019 levels in H1 2025, with even RTO leaders New York and Miami still seeing 11.9% and 16.1% visit gaps, respectively.

So while the data suggests that the office recovery story is still being written – with visits inching up slowly – the substantial gap from pre-pandemic levels suggests that remote and hybrid work models have fundamentally reshaped office utilization patterns.

Five years post-pandemic, consumer behavior across the retail, dining, entertainment, and office spaces has crystallized into distinct new patterns.

Traffic to retail and dining venues now surpasses pre-pandemic levels, driven primarily by value-focused segments. But retail and dining segments that cater to higher income consumers –such as luxury apparel and fine dining – have also stabilized at a higher level, highlighting the bifurcation of consumer behavior that has emerged in recent years. Entertainment formats show more variability – while eatertainment traffic has settled above and museums below 2019 levels, and movie theaters still seeking stability. Office spaces remain the laggard, with visits well below pre-pandemic levels despite corporate return-to-office initiatives showing modest impact.

It seems, then, that the new consumer landscape rewards businesses that can clearly articulate their value proposition to attract consumers' increasingly selective spending and time allocation – or offer a premium product or experience catering to higher-income audiences.

.avif)

1. Overall dining traffic is mostly flat, but growth is concentrated in specific areas.

While nationwide dining visits were nearly unchanged in early 2025, western states like Utah, Idaho, and Nevada showed moderate growth, while states in the Midwest and South, along with Washington D.C., saw declines.

2. Fine dining and coffee chains are growing through expansion, not just busier locations.

These two segments were the only ones to see an increase in total visits, but their visits-per-location actually decreased, indicating that opening new stores is the primary driver of their growth.

3. Higher-income diners are driving the growth in resilient categories.

The segments that saw visit growth—fine dining and coffee—also attracted customers with the highest median household incomes, suggesting that affluent consumers are still spending on dining despite economic headwinds.

4. Remote work continues to reshape dining habits.

The share of suburban customers at fine dining establishments has increased since 2019, while it has decreased for coffee chains. This reflects a shift towards "destination" dining closer to home and away from commute-based coffee runs.

5. Limited-service restaurants own the weekdays; full-service restaurants win the weekend.

QSR, fast casual, and coffee chains see the majority of their traffic from Monday to Friday, whereas casual and fine dining see a significant spike in visits on weekends.

6. Each dining segment dominates a specific time of day.

Consumer visits are highly predictable by the hour: coffee leads in the early morning, fast casual peaks at lunch, casual dining takes the afternoon, fine dining owns the dinner slot, and QSR captures the late-night crowd.

Overall dining visits held relatively steady in the first five months of 2025, with year-over-year (YoY) visits to the category down 0.5% for January to May 2025 compared to the same period in 2024. Most of the country saw slight declines (less than 2.0%), though some states and districts experienced larger drops: Washington, D.C, saw the largest visit gap (-3.6% YoY), followed by Kansas and North Dakota (-2.9%), Arkansas (-2.8%), Missouri and Kentucky (-2.6%), Oklahoma (-2.1%), and Louisiana (-2.0%).

Still, there were several pockets of moderate dining strength, specifically in the west of the United States. January to May 2025 dining visits in Utah, Idaho, and Nevada increased 1.8% to 2.4% YoY, while the coastal states saw traffic rise 0.6% (California) to 1.2% (Washington). Vermont also saw a slight increase in dining visits (+1.9%).

Diving into visit trends by dining segment shows that fine dining and coffee saw the strongest overall visit trends, with visits to the segments up 1.3% and 2.6% YoY, respectively, between January and May 2025. But visits per location trends were negative for both segments – a decline of 0.8% YoY for fine dining and 1.8% for coffee during the period – suggesting that much of the visit strength is due to expansions rather than more crowded restaurants and coffee shops.

In contrast, full-service casual dining saw overall visits decrease by 1.5%, while visits per location remained stable (+0.2%) YoY between January and May 2025. Several casual dining chains have rightsized in the past twelve months – including Red Lobster, TGI Fridays, and Outback Steakhouse – which impacted overall visit numbers. But the data seems to show that their rightsizing was effective, as the remaining locations successfully absorbed the traffic and maintained performance levels from the previous year. And the monthly data also provides much reason for optimism, with May traffic up both overall and on a visit per location basis – suggesting that the casual dining segment is well positioned for growth in the second half of 2025.

Meanwhile, QSR and fast casual chains saw similar minor visits per venue dips (-1.5% and -1.2%, respectively). At the same time, QSR also saw an overall visit dip (-0.8%) while traffic to fast casual chains increased slightly (+0.3%) – suggesting that the fast casual segment is expanding more aggressively than QSR. But the two segments decoupled somewhat in May, with overall traffic and visits per venue to fast casual chains up YoY while traffic remained flat and visits per venue fell slightly for QSR – perhaps due to the relatively greater affluence of fast casual's consumer base.

Analyzing the income levels of visitors to the various dining segments over time shows that each segment followed a slightly different trend – and the differences in visitor income may help explain some of the current traffic patterns.

The only three segments with YoY visit growth – casual dining, fine dining, and coffee – also had the highest captured market median household income (HHI). Although the median HHI in the captured market of upscale and fine dining chains fell after COVID, it has risen back steadily over time and now stands at $98.0K – slightly higher than the $97.1K median HHI between January to May 2019. This may explain the segment's resilience in the face of wider consumer headwinds. Meanwhile, the median HHI at fast casual and coffee chains has fallen slightly, perhaps due to aggressive expansions in the space – including Dave's Hot Chicken and Dutch Bros – which likely broadened the reach of the segments, driving visits up and trade area median HHI down.

Like fine dining, casual dining also saw its trade area median HHI increase slightly over time – but the segment has still been facing visit dips. This could mean that, even though consumers trading down to casual dining may have boosted the trade area median HHI for the segment, it still might not have been enough to make up for the customers lost to tighter budgets.

The QSR segment saw its trade area median HHI remain remarkably steady – and visits to the segment have also been quite consistent – staying between $70.6K and $70.9K between 2019 and 2025 – which may explain why the segment's visits remained relatively stable YoY.

Diving into the psychographic segmentation shows that, although the fine dining segment attracted visitors from the highest-income areas between January and May 2025, fast casual chains drew the highest share of visitors from suburban areas, followed by casual dining and coffee. QSR attracted the smallest share of suburban visitors, with just 30.5% of the category's captured market between January and May 2025 belonging to Spatial.ai: PersonaLive suburban segments.

But looking at the data since 2019 reveals small but significant changes in the shares of suburban audiences in some categories' captured markets. And although the percentage changes are slight, these represent hundreds of thousands of diners every year.

The data shows that shares of suburban segments in the captured markets of fine dining chains have increased, while their share in the captured market of coffee chains has decreased. The shares of suburban visitors to QSR, fast casual, and casual chains have remained relatively steady.

This may suggest that the COVID-19 pandemic and the subsequent rise of remote and hybrid work models are still impacting consumer dining habits, benefiting destination-worthy experiences in suburban locales such as fine dining chains while reducing the necessity of daily coffee runs that were often tied to commuting and office work. Meanwhile, the stability in QSR, fast casual, and casual dining segments could indicate that these categories continue to meet consistent suburban demand for convenience and everyday dining, largely unaffected by the redistribution seen in the fine dining and coffee sectors.

Although QSR, fast casual, casual dining, fine dining, and coffee all fall under the wider dining umbrella, the data shows distinct consumer behavior patterns regarding visits to these five categories.

Limited service segments, including QSR, fast casual, and coffee tend to see higher shares of visits on weekdays, while full service segments – casual dining and fine dining – receive higher shares of weekend visits. Diving deeper shows that QSR has the largest share of weekday visits, with 72.3% of traffic coming in between Monday and Friday, followed by fast casual (69.8% of visits on weekdays) and coffee (69.4% of visits on weekdays.) Looking at trends within the work week shows that QSR receives a slightly larger visit share between Monday and Thursday compared to the other limited service segments. Meanwhile, coffee seems to receive the smallest share of Friday visits – 16.3% compared to 17.0% for fast casual and 17.2% for QSR.

On the full-service side, casual dining and fine dining chains have relatively similar shares of weekend visits (39.0% and 38.8%, respectively), but fine dining also sees an uptick of visits on Fridays (with 19.1% of weekly visits) as consumers choose to start the weekend on a festive note.

Hourly visit patterns also show variability between the segments. Coffee is the unsurprising leader of early visits, with 14.6% of visits taking place before 8 AM and, almost two-thirds (64.9%) of visits taking place before 2 PM. Fast casual leads the lunch rush (29.4% of visits between 11 AM and 2 PM), casual dining chains receive the largest share of afternoon (2 PM to 5 PM) visits, and fine dining chains receive the largest share of dinner visits, with almost 70% of visits taking place between 5 PM and 11 PM. QSR leads the late night visit share – 4.1% of visits take place between 11 PM and 5 AM – followed by casual dining chains (3.2% late night and overnight visit share), likely due to the popularity of 24-hour diners.

This suggests that each dining segment effectively "owns" a different part of the day, from the morning coffee ritual and the quick lunch break to the leisurely evening meal and late-night cravings.

An analysis of average visit duration also reveals a small but lasting shift in post-pandemic dining behavior. Between January and May 2025, the average dwell time for nearly every dining segment was shorter than during the same period in 2019. This efficiency trend is evident across limited-service categories like QSR, fast casual, and coffee shops, suggesting a continued emphasis on speed and convenience.

The one notable exception to this trend is upscale and fine dining, where the average visit duration has actually increased compared to pre-COVID levels. This may suggest that, while visits to most segments have become more transactional, consumers are treating fine dining more as an extended, deliberate experience, reinforcing its position as a destination-worthy occasion.