.svg)

.png)

.png)

.png)

.png)

Last summer’s touring sensations Taylor Swift and Beyonce held concerts that will remain in the hearts of many. With thousands in attendance, both live tours were absolute juggernauts. It was like an adrenaline shot for the performing arts category after COVID-induced closures. Remember the days of drive-in concerts as a panacea? While these two reigning Queens of Music took top billing, there are hundreds of local venues around the country that cater to smaller audiences at a time but are no less impactful on their communities. These are the heart and soul for local plays, musicals, symphonies, operas, touring bands, and art exhibitions. Fundraisers are often held at community performance venues, and they can be incubators for performers to move on to a larger stage.

Placer recently attended the California Presenters Conference, which includes representatives from California, Oregon, Washington, Nevada, Arizona, New Mexico, and Texas. Programming directors, events managers, and community liaisons all met to share best practices, challenges, and successes. One box office manager, Jonathan Lizardo of the Lisa Smith Wengler Center for the Arts at Pepperdine University, noted that “Nostalgia” was an important theme at his performing arts center, with a recent live show of the Animaniacs in Concert proving to be a hit with adults and kids alike. In this case, his patrons were seeking some escapism and levity in their lives. On the other end of the spectrum, the arts can also be a powerful way to engage the audience in more serious issues, as one panel on Responding to Global Conflict at arts venues drew a crowd. Another topic of interest was the importance of engaging youth with the arts, through school-sponsored visits or after school enrichment. Many University performing arts centers reps were also in attendance, such as USC Vision and Voices, Stanford Live, Caltech Presents, and Seattle University.

Placer’s presentation touched on macrotrends around discretionary spend, examples of venue attendance around the US, an analysis of the visitation trends, audience profile, and economic impact of Taylor Swift’s US tour, and in depth look at a select group of performing arts centers in Arizona to see the role that they play in their community.

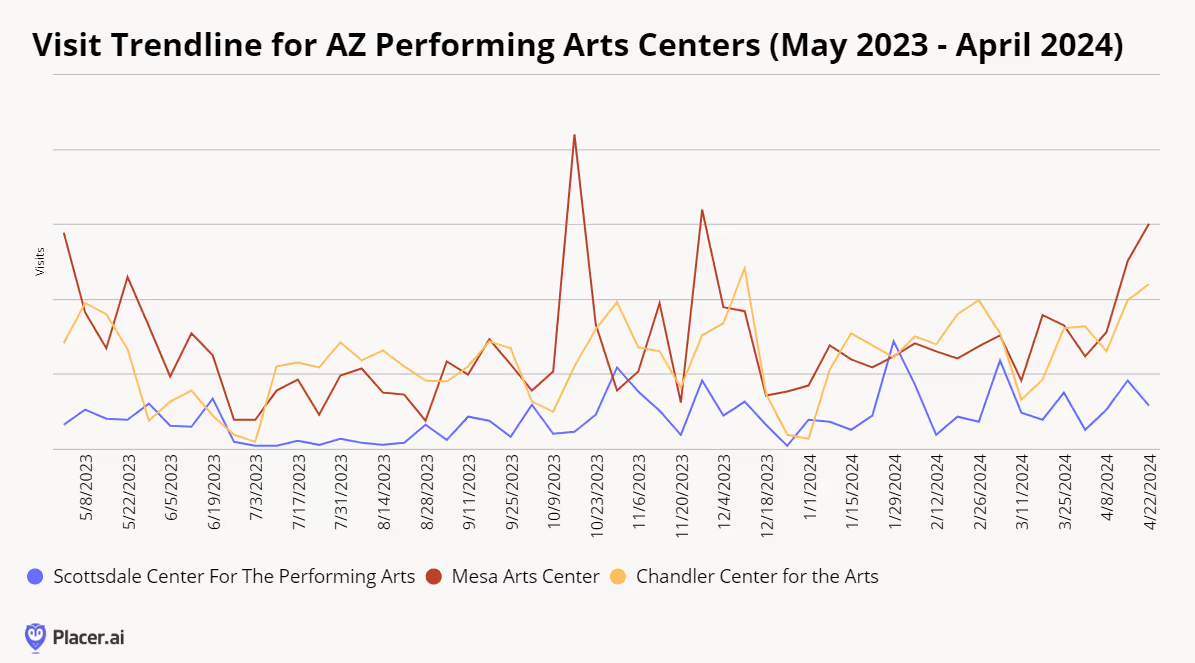

Mesa Arts Center has had the highest overall visitation in the past 12 months. Located in Mesa, AZ, it encompasses over 210,000 sq ft and was completed in 2005 at the cost of $95 million. In addition to four performance venues, it is also home to Mesa Contemporary Arts Museum. Programming is suited to a multitude of interests, including National Geographic Live, Broadway, classical music, popular music, ethnic artists, western artists, and dance. It also offers Art Studio for visual arts classes; Opportunities for Ages 55+ such as flamenco classes; and Festivals and Events, such as Dia de Los Muertos. Within the theaters complex, there are four theaters--the 1,570-seat Tom and Janet Ikeda Theater, 550-seat Virginia G. Piper Repertory Theater, 200-seatNesbitt/Elliott Playhouse, and the 99-seat Anita Cox Farnsworth Studio.

The Chandler Center for the Arts recently celebrated its 35th season. Upcoming performances include ballet like Coppelia or live music, such as Billy Joel’s The Stranger. Entertaining acts such as Stomp, Piano Battle, and Cirque du Soleil will also make their way over during the 2024-2025 season. Located in downtown Chandler, the venue includes three dynamic performance spaces (the 1,500-seat Main Stage, the 350-seat Hal Bogle Theatre, and the 250-seat Recital Hall) as well as two extensive art galleries (The Gallery at CCA and Vision Gallery).

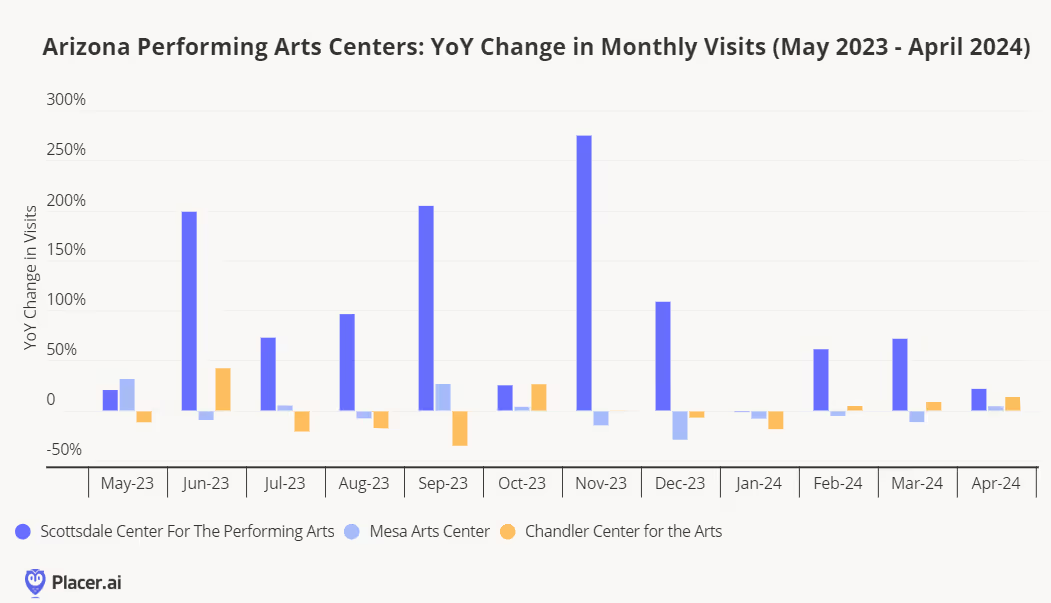

While Scottsdale Center for the Performing Arts had the fewest absolute visits in the past 12 months, its year-over-year variance increase has been the highest.

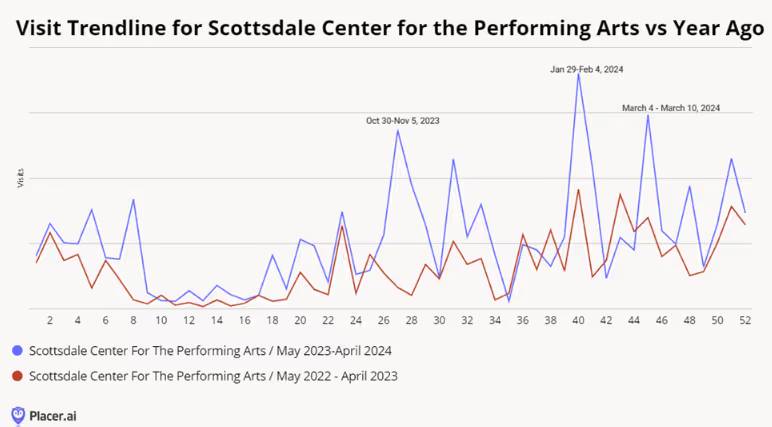

What might account for the difference, one might wonder. Fortunately, Placer data enables one to compare a venue against itself in order to highlight differences from one year to the next. According to the 2023-2024 calendar, it appears that Hubbard Street Dance Chicago playing 2 nights in a row, was a hit with the audience during the week of Jan 29-Feb 4.

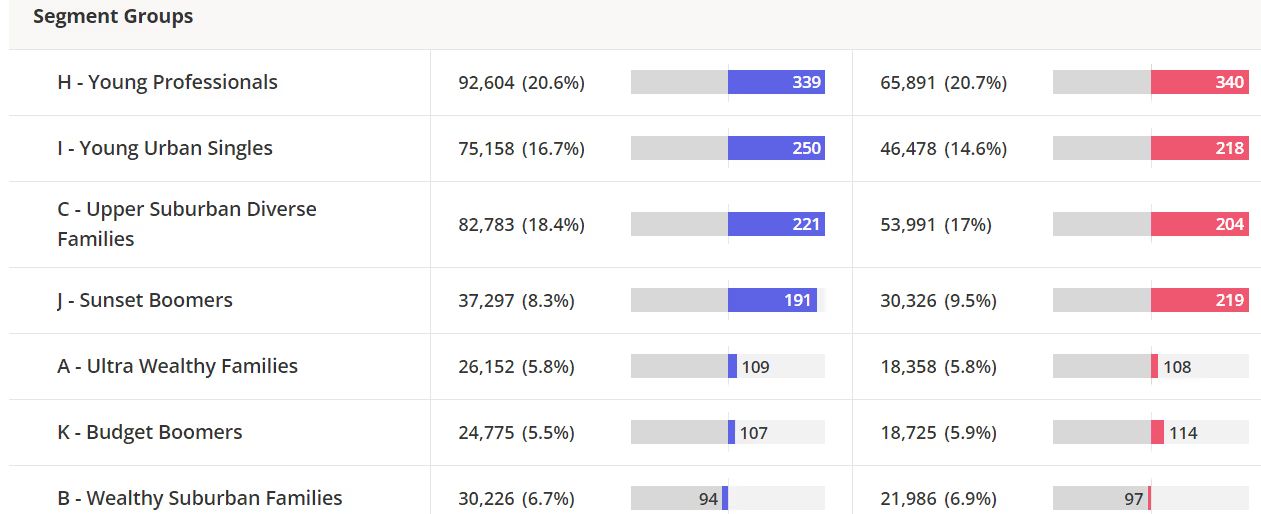

It appears the increase in visits cannot be attributed to a single segment. In fact, visits across multiple segments increased year-over-year when comparing May 2023 - April 2024 (blue) vs. May 2022-April 2023 (red) per Spatial.ai PersonaLive.

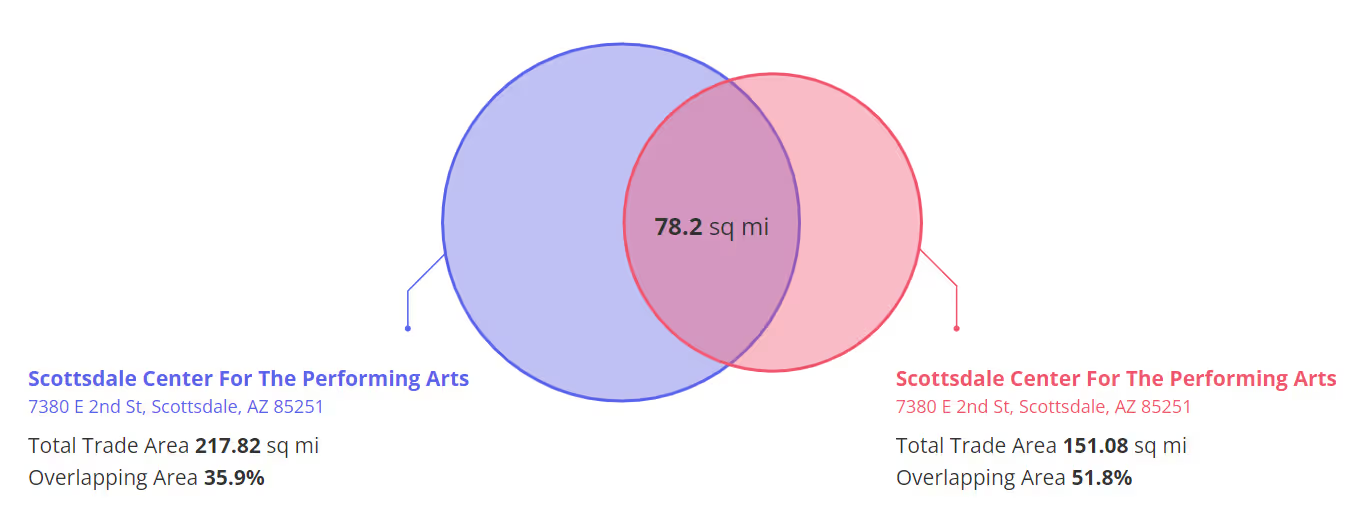

The most recent 12 months also attracted visits from a much larger trade area.

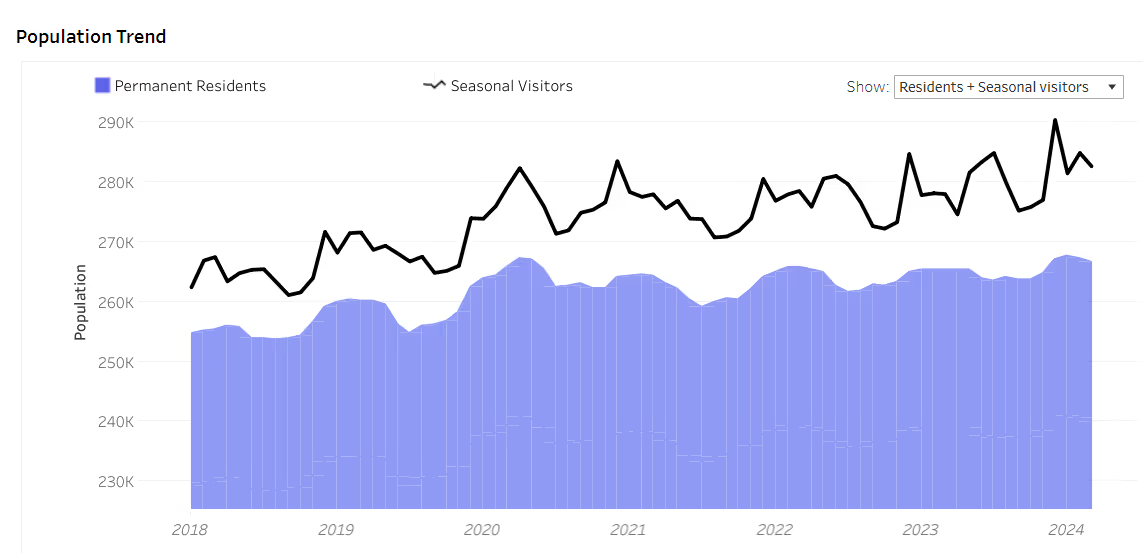

Migration may also be a factor in the increase of visits to the Scottsdale Performing Arts Center. Placer’s Migration Dashboard is noting an increase in both residents and seasonal visitors over the years.

Eatertainment chains – entertainment concepts that combine dining and play – are thriving in the current experience economy. We dove into the data for game and restaurant chains Dave & Buster’s and Main Event Entertainment (acquired by Dave & Buster’s in 2022) to better understand how eatertainment is driving success in 2024.

The past few years have been challenging ones for restaurants. But eatertainment has a special draw – and since November 2023, both Dave & Buster’s and Main Event Entertainment have seen mainly positive YoY visit growth.

In January 2024, visits slowed in the wake of extreme weather that rocked much of the country and led many would-be diners to stay home. But in February and March 2024 things picked up again, with the two chains seeing YoY visit growth ranging from 4.6% to 10.6%.

Again in April 2024, both Dave & Buster’s and Main Event Entertainment experienced minor visit gaps. But a closer look at weekly visits reveals that this was largely due to a calendar shift: April 2024 had one fewer Saturday than April 2023 – the chains' busiest day of the week by far. (In Q1 2024, Saturdays accounted for 33.8% of total visits to Main Event Entertainment and 33.3% of visits to Dave & Buster’s). And during nearly every individual week of April 2024, the brands maintained strongly positive momentum.

Dave & Buster’s and Main Event Entertainment recent visit growth has been partly fueled by the two chains’ growing store counts. And a deeper dive into how the chains’ visitation patterns have evolved since COVID shows why they are well-positioned for continued expansion – and success.

One factor likely contributing to the eatertainment brands’ strength is the increasing loyalty of their visitors. Dave & Buster’s leveled up its rewards program in 2021 – and has been upping its loyalty game ever since. Members can access special deals, like the chain’s recent 50% off food promotion, and earn points by playing games or ordering off the menu. Main Event, too, keeps customers coming back with a variety of promotions, from Monday Night Madness to Kids Eat Free Tuesdays – a particularly attractive offer for the chain’s family-oriented audience.

And since 2019, both chains have seen a steady increase in the share of visits made by customers frequenting the chain at least twice a month.

In addition, both Dave & Buster’s and Main Event appear to be finding success by leaning into the evening daypart.

Back in 2019, Main Event introduced a late-night menu and announced that all of its stores would be open until at least 12:00 AM – and even later on Fridays and Saturdays. (Even before that, some of its stores were open during the wee hours). Dave & Buster’s has also taken steps to increase its night-time business with special late-night deals and happy hours.

And location analytics indicates that this strategy is bearing fruit. Over the past several years, both brands have experienced an increase in their share of late-night visits (i.e. those taking place between 9:00 PM and 2:00 AM). And in Q1 2024, Dave & Buster’s and Main Event saw 23.9% and 27.3% of their total visits during the late-night daypart, respectively.

While it might be assumed that at-home entertainment and the "Netflix effect" pose a threat to eatertainment chains (particularly during the evening hours, as there is more content than ever to get home to), the data suggests that many consumers are staying out late for social dining and entertainment.

Demand for dining and social experiences continues to grow. As consumer behavior and demographics evolve, how will these eatertainment chains perform and which new concepts may rise to prominence as 2024 progresses?

Visit Placer.ai to find out.

In this blog, we dive into the latest location analytics and demographic data for luxury retailers and high-end department stores and take a closer look at consumer behavior in the upscale shopping space.

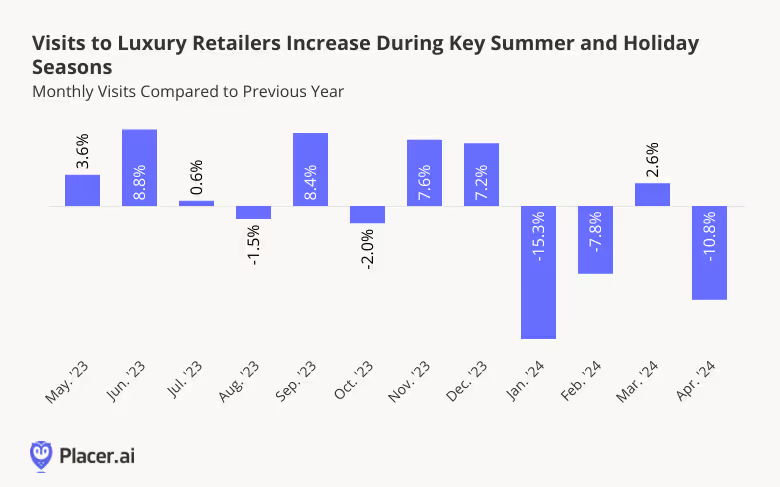

Over the past year, the Placer.ai Luxury Retail Index – including brands like Louis Vuitton, Tiffany & Co., and Chanel – saw year-over-year (YoY) foot traffic growth during crucial shopping seasons. May and June 2023 had significant increases in YoY visits, perhaps due to an influx of recreational shoppers on summer vacation, and July saw an uptick as well. YoY visits peaked again in November and December, likely reflecting the popularity of upscale retail corridors during the all-important holiday shopping season.

Some of this strength may be a result of affluent consumers refocusing their shopping on the U.S.: In 2022, many high-income shoppers chose to purchase big-ticket items abroad due to various economic benefits. But by 2023, demand for domestic luxury retail appeared to rebound, as some upscale retail clients “repatriated” their discretionary dollars.

To be sure, visit gaps re-emerged in some months of early 2024 – though these are partly attributable to factors like January’s unusually stormy weather and an April calendar shift. (April 2024 had one fewer Saturday than April 2023, providing less opportunity for visits in the highly discretionary category). But March 2024 also saw YoY visit growth. And given how well luxury retailers performed during their busiest months of year, the category may very well rally once again heading into the summer.

Recent location intelligence also offers encouraging signs from the high-end department store space.

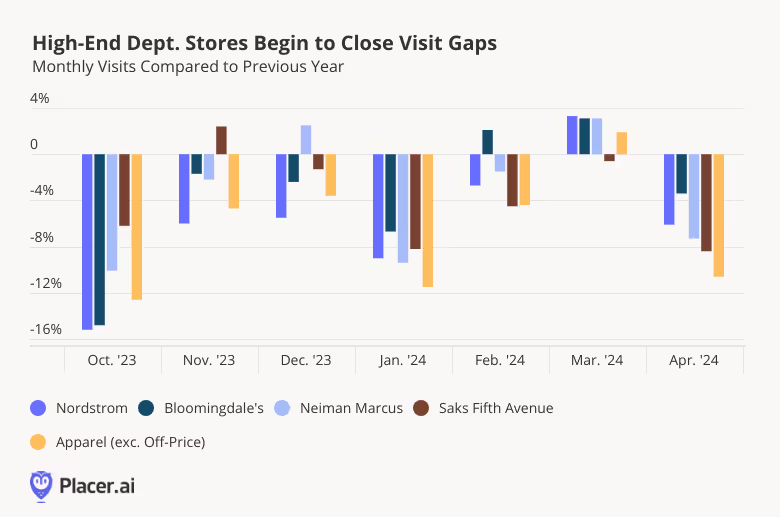

Like luxury retailers, high-end department stores saw narrowing visit gaps during the peak holiday shopping season – with Saks Fifth Avenue seeing a YoY uptick in November 2024, and Neiman Marcus seeing one in December.

In March 2024, YoY traffic turned positive for Nordstrom (3.3%), Bloomingdale’s (3.1%), and Neiman Marcus (3.1%), while Saks Fifth Avenue had just a -0.6% visit gap. And although April 2024 was a challenging month for the retailers, perhaps due in part to the calendar shift mentioned above, all four upscale department stores outperformed the traditional apparel category – another indication that high-end department stores may be poised for a comeback.

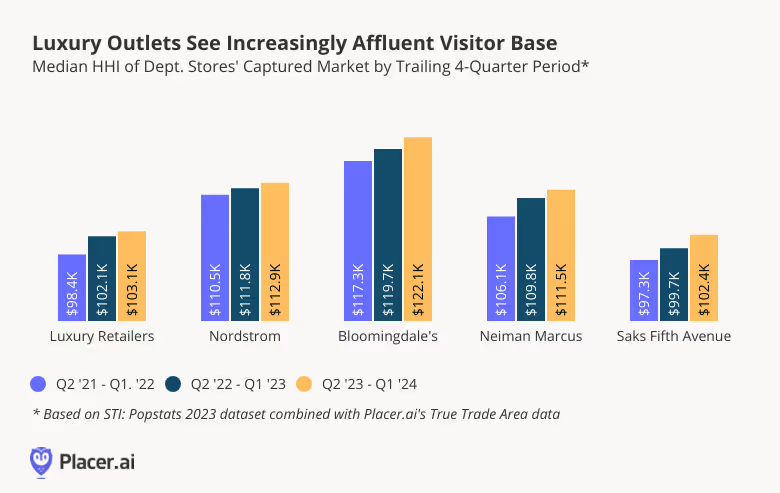

Analyzing demographic changes in the captured markets of both luxury brands and high-end department stores indicates that increasingly affluent consumers are the main drivers of visits to the segment. (A chain’s captured market is obtained by weighting each Census Block Group (CBG) in its trade area according to the CBG’s share of visits to the chain – and so reflects the population that actually visits the chain in practice).

Over the last four quarters, visitors to luxury retailers and high-end department stores came from areas with higher median household incomes (HHIs) than in previous years. For example, during the period between Q2 2023 and Q1 2024, the median HHI of Bloomingdale’s captured market was $122.1K, an increase from $119.7K between April 2022 and March 2023, and $117.3K from April 2021 to March 2022.

In the face of recent inflationary pressures, aspirational luxury shoppers (who tend to be slightly less affluent) are likely quicker to adjust their behavior and trade down to more affordable brands. Meanwhile, prestige luxury shoppers – those with the highest incomes – tend to be relatively resilient, and so are able to continue shopping at their favorite luxury brands, driving up the HHI in these retailers’ trade areas.

Luxury retailers and high-end department stores have had recent foot traffic successes, while their clientele has become increasingly affluent. Will these brands continue their upward visit trajectories – and how will they leverage affluent foot traffic going forward?

Visit Placer.ai to find out.

Discretionary retail has faced its fair share of headwinds over the past few years, from pandemic-related restrictions to inflation. And while prices have stabilized, subdued consumer confidence continues to weigh on non-essential segments. But even in this challenging environment, some companies, like Ulta Beauty, are continuing to see visit growth, while others, like Gap Inc. and its portfolio of apparel brands, are making a comeback.

With Q2 2024 well underway, we take a look at the foot traffic patterns for these companies to see how they are faring.

In 2020, Placer.ai predicted that Ulta Beauty would be an unstoppable force in beauty retail – and the chain has impressed ever since. Over the past several years, Ulta has been on a consistent upward visit trajectory, propelled by strong demand for affordable luxuries (the so-called “Lipstick Effect”), and consumer interest in self-care.

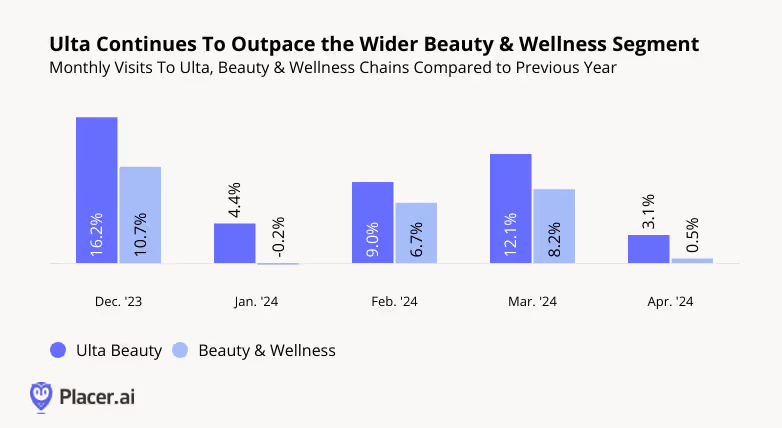

And though the pace of Ulta’s tremendous YoY visit growth has moderated somewhat in recent months, the beauty giant continues to thrive – drawing even more visitors in early 2024 than during the equivalent period of last year. Between January and April 2024, YoY visits to the beauty retailer remained consistently elevated, outperforming the wider Beauty & Wellness space.

The fashion segment has experienced rising prices and persistent inflation over the past few years, leading to a new era of discount and thrift shopping. And iconic apparel retailers like Gap Inc – operator of Gap, Old Navy, Athleta, and Banana Republic – have not been immune to the challenges facing the category.

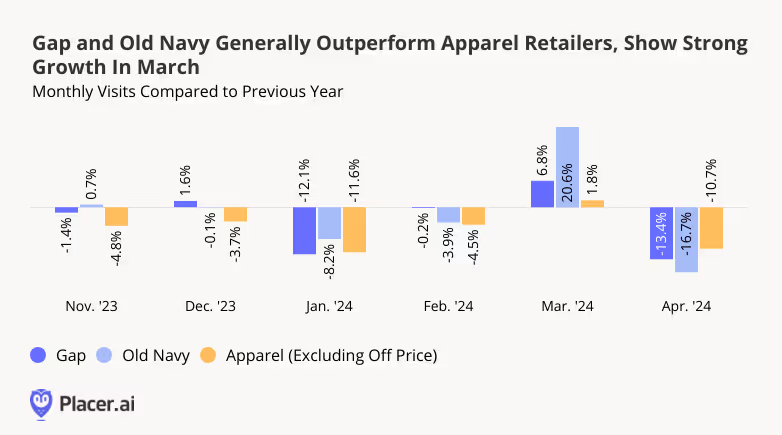

But through a combination of high-profile hirings and revitalized branding efforts, Gap Inc. has been readying itself for a comeback. In Q4 2023, the retailer announced stronger-than-expected results, driven primarily by Gap and Old Navy. And recent foot traffic to the company’s largest brands provides further evidence that its turnaround efforts may be starting to bear fruit.

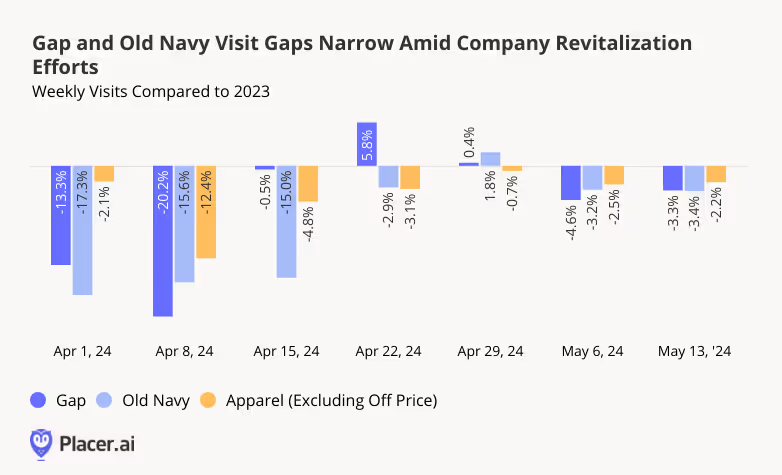

During the all-important November and December shopping season last year, Gap and Old Navy saw YoY visits hold steady or increase, outpacing the wider Apparel space. In January 2024, visits to the two chains declined in the wake of an Arctic blast that kept many shoppers at home. But in February, Gap enjoyed a 0.7% YoY visit bump, while Old Navy saw just a mild drop – less than that of the overall Apparel category. In March 2024, both Gap and Old Navy enjoyed strong YoY visit growth, far outperforming overall Apparel – likely driven by sales events held by each brand. And though April saw YoY visits decline once again, with the two chains falling behind Apparel, drilling down into weekly data offers a different perspective.

Both Gap and Old Navy started off April with lackluster YoY performance, perhaps due in part to the comparison to an early April 2023 that included Easter weekend. But towards the end of April and beginning of May, Gap and Old Navy’s’ visit gaps narrowed – with some weeks seeing positive YoY visit growth, and with the two chains once again either nearly on par with, or outperforming, overall Apparel.

Gap Inc. itself is bullish about what the next year holds in store, with big names like Zak Posen joining the Gap family in hopes of propelling the company forward. Though it may be premature to declare an end to the troubles that have plagued the clothier in recent years, early 2024 foot traffic provides further evidence that the company is heading in the right direction.

Ulta continues to experience visit growth, highlighting Beauty’s enduring appeal. Meanwhile, Gap and Old Navy are witnessing narrowed visit gaps and some weekly visit growth.

Is the Apparel segment making a comeback? Can the Beauty segment sustain its positive momentum indefinitely?

Visit Placer.ai to keep up to date with the latest retail developments.

We dove into the data to check in with specialty discount chains Ollie’s Bargain Outlet and Five Below. How did they fare in early 2024? And what can the two brands’ recent performance tell us about what lies in store for them in the months ahead?

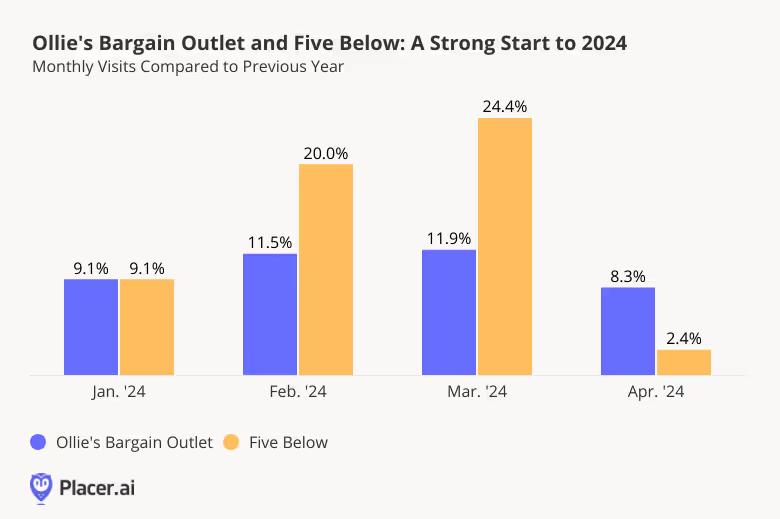

A quest for bargains and the promise of unexpected finds have kept Discount & Dollar Store shoppers coming so far in 2024. Despite lapping a strong 2023, foot traffic to Ollie’s Bargain Outlet and Five Below remained consistently above last year’s levels between January and April 2024, partly due to the chains’ continued expansions.

Though both chains draw Easter shoppers with special seasonal offerings, Five Below’s primary focus on low-ticket recreational merchandise makes it a natural destination for shoppers eager to fill their baskets with candy and other inexpensive holiday items. And Q1 2024 foot traffic to the chain appeared to be shaped by Easter shopping patterns. The brand’s YoY visits increased significantly in February with the roll-out of holiday wares, and the Saturday before Easter (March 30th, 2024) saw a sizable foot traffic boost that was 38.7% above the chainwide average for Saturdays in Q1 2024 – contributing to the month’s elevated visits overall. This pull-forward in demand, together with the comparison to an April 2023 that included Easter Sunday, at least partially explains Five Below’s more modest visit growth in April.

For both Ollie’s and Five Below, strong traffic since the beginning of the year indicates continued YoY gains may be expected in the months ahead.

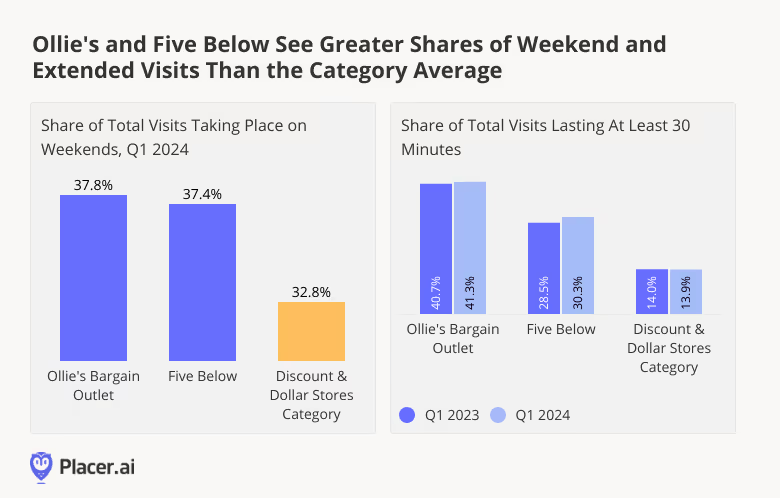

In addition to YoY visit growth in the early months of 2024, Ollie’s and Five Below are seeing elevated weekend visits and an increase in longer visits, indicative of a robust treasure-hunting culture that is driving demand.

In Q1 2024, 37.8% of visits to Ollie’s and 37.4% of Five Below’s visits occurred on weekends, while weekend visits accounted for only 32.8% of visits to the wider Discount & Dollar Store category. This is likely due to Ollie’s and Five Below’s growing notoriety as destinations for treasure hunting – a pastime perhaps preferred at the end of the work week when schedules are more flexible.

Meanwhile, the share of visits lasting over 30 minutes in Q1 2024 increased for both brands YoY, even as it slightly declined for the category as a whole. This indicates that shoppers drawn to Ollie’s and Five Below’s recreational vibes spent even more time browsing the aisles in Q1 2024 than they did last year. Ollie’s closeout buying model and shifting array of steeply discounted brand name merchandise is especially conducive to the thrill of the hunt – and the chain saw a remarkable 41.3% of visits lasting more than half an hour in Q1.

Ollie’s Bargain Outlet and Five Below continue to demonstrate their consumer appeal in 2024. As the brands expand, holidays prove to be retail highlights while a culture of treasure hunting has shown its capacity to drive consistent traffic.

For more data-driven retail insights, visit Placer.ai.

In the spirit of retail quarterly earnings season, it has been eye-opening to see the disparity in performances, especially among specialty retailers. This week, Urban Outfitters, Inc. (URBN) reported first quarter earnings, with comparable dollar sales up 4.6%, a strong growth number compared to many in the industry. Urban Outfitters, Inc. benefitted from a diversified retail portfolio, with the growth stemming from its Anthropologie, Free People and Nuuly brands, both in-store and online, while its namesake brand continues to be challenged over the past few years. As far as specialty apparel retailers go, the company has done a fantastic job of creating retail experiences that are unique and irreplaceable for their customers, and finding true competitors of its brands proves difficult.

Looking at Q1 2024 traffic performance, Free People and Anthropologie led the way, echoing the earnings release. Free People visits, excluding FP Movement, grew 8% year-over-year and Anthropologie saw an increase in traffic of 5% year-over-year. Urban Outfitters, on the other hand, actually saw traffic levels beat sales performance, with traffic flat compared to Q1 2023.

Anthropologie, despite retail and economic headwinds, has tightened up its value proposition to consumers and has a clear vision of its target shopper. Using Spatial.ai’s PersonaLive segmentation (as shown below), Anthropologie attracted the most visits from Ultra Wealthy Families in Q1 2024, followed by Young Professionals and Sunset Boomers. Compared to the other portfolio brands, Anthropologie attracts a higher median income consumer and over indexes with more mature consumers, two groups that have higher levels of spending power in today’s economy and haven’t decidedly altered their retail habits as much as middle- and lower-income shoppers. Anthropologie has clearly benefited from the strength of its visitors, and its curated multi-category retail experience that has shielded the chain from the struggles of other home furnishing and apparel retailers. It will be interesting to watch if the brand is able to continue to maintain its success through the remainder of the year if economic conditions become further challenged.

Free People appeals to a consumer somewhat in the middle of both Anthropologie and Urban Outfitters, and has been able to capitalize on Anthropologie’s success and hedge against Urban Outfitters’ struggles. Free People’s design sense makes it a crowd-favorite but also a source for many “dupes” on other retail platforms; however, the influx of similar designs haven’t seen to slow their momentum. FP Movement, the brand’s athleisure line that also has stand alone retail locations, has been another lever for growth. Using Placer.ai to look at three FP movement locations compared to the Free People chain, FP movement grew visits faster than the parent brand, and also had a higher dwell time. Urban Outfitters, Inc. disclosed that dollar sales for Free People were up almost 18% in Q1 2024, but the company doesn't break out sales between FP Movement and Free People. There are some risks with the athleisure market, as brands face softening performance and consumers shift away from more discretionary apparel categories. FP movement has created core and in-demand silhouettes that drive traffic, but with fashion trends, that may not be enough to sustain long-term visit growth.

Finally, there’s the lackluster performance from the namesake brand. Younger adults have so many retail options at their fingertips that retailers who cater to these consumers can often be lost in the shuffle, especially with so much competition coming from online and offline retail. Urban Outfitters long curated a distinct look and feel, as well as a mix of national brands and private labels that differentiated it from competitors; with retailers in similar price bands like Abercrombie & Fitch staging a comeback, Urban Outfitters has lost its footing. Looking into the consumer segments using Spatial.ai’s PersonaLive, Educated Urbanites and Young Professionals top Urban Outfitters segmentation; price-sensitivity could be making younger shoppers more discerning in their apparel purchases. Off-price may also be a factor here and provide higher levels of competition for the customer base. Urban Outfitters holds a lot of brand value, and if the brand is able to right size assortments and value in the short term, there could be upside to bring it closer to its sister brands.

Compared to most of the specialty retail narratives out in the market, Urban Outfitters, Inc. has a lot of positive momentum with a few of its brands. Nuuly, its subscription rental service, was also called out as a positive highlight of the quarter, and learnings about consumer preferences through that service could help to inform the go-forward strategies at Anthropologie, Free People and Urban Outfitters. There is a lot to celebrate as it relates to its discretionary retail fleet, despite the challenges at the namesake brand, and proves that specialty retail that still feels “special” has consumers' lasting attention.

1. Expanded grocery supply is increasing overall category engagement. New locations and deeper food assortments across formats are bringing shoppers into the category more often, rather than fragmenting demand.

2. Grocery visit growth is being driven by low- and middle-income households. Elevated food costs are leading to more frequent, budget-conscious trips, reinforcing grocery’s role as a non-discretionary category.

3. Short, frequent trips are a major driver of brick-and-mortar traffic growth. Fill-in shopping, deal-seeking, and omnichannel behaviors are pushing visit frequency higher, even as trip duration declines.

4. Scale is accelerating consolidation among large grocery chains. Larger retailers are using their size to invest in value, assortment, private label, and execution, allowing them to capture longer and more engaged shopping trips.

5. Both large and small grocers have viable paths to growth. Large chains are winning by competing for the full grocery list, while smaller banners can grow by specializing, owning specific missions, or offering compelling value that earns them a place in shoppers’ routines.

While much of the retail conversation going into 2026 focused on discretionary spending pressure, digital substitution, and higher-income consumers as the primary drivers of growth, grocery foot traffic tells a different story.

Rather than being diluted by new formats or eroded by e-commerce, brick-and-mortar grocery engagement is expanding. Visits are rising even as grocery supply spreads across wholesale clubs, discount and dollar stores, and mass merchants. At the same time, growth is being powered not by affluent trade areas, but by low- and middle-income households navigating higher food costs through more frequent, targeted trips. Shoppers are showing up more often and increasingly splitting their trips across retailers based on value, availability, and mission – pushing grocers to compete for portions of the grocery list instead of the full weekly basket.

The data also suggests that the largest grocery chains are capturing a disproportionate share of rising grocery demand – but the multi-trip nature of grocery shopping in 2026 means that smaller banners can still drive traffic growth. By strengthening their value proposition, specializing in specific products, or owning specific shopping missions, these smaller chains can complement, rather than compete with, larger one-stop destinations.

Ultimately, AI-based location analytics point to a clear set of grocery growth drivers in 2026: expanded supply that increases overall engagement, more frequent and mission-driven trips, and continued traffic concentration among large chains alongside new opportunities for smaller banners.

One driver of grocery growth in recent years is simply the expansion of grocery supply across multiple retail formats. Wholesale clubs are constantly opening new locations and discount and dollar stores are investing more heavily in their food selection, giving consumers a wider choice of where to shop for groceries. And rather than fragmenting demand, this broader availability appears to have increased overall grocery engagement – benefiting both dedicated grocery stores and grocery-adjacent channels.

Grocery stores continue to capture nearly half of all visits across grocery stores, wholesale clubs, discount and dollar stores, and mass merchants. That share has remained remarkably stable thanks to consistent year-over-year traffic growth – so even as grocery supply increases across categories, dedicated grocery stores remain the primary destination for food shopping.

Meanwhile, mass merchants have seen a decline in relative visit share as expanding grocery assortments at discount and dollar stores and the growing store fleets of wholesale clubs give consumers more alternatives for one-stop shopping.

While much of the broader retail conversation heading into 2026 centers on higher-income consumers carrying growth, the trend looks different in the grocery space. Recent visit trends show that grocery growth has increasingly shifted toward lower- and middle-income trade areas, underscoring the distinct dynamics of non-discretionary retail.

For lower- and middle-income shoppers, elevated food costs appear to be translating into more frequent grocery trips as consumers manage budgets through smaller baskets, deal-seeking, and shopping across retailers. In contrast, higher-income households – often cited as a key growth engine for discretionary retail – are contributing less to grocery visit growth, likely reflecting more stable shopping patterns or a greater ability to consolidate trips or shift spend online.

This means that, in 2026, grocery growth is not being propped up by high-income consumers. Instead, it is being fueled by necessity-driven shopping behavior in lower- and middle-income communities – reinforcing grocery’s role as an essential category and suggesting that similar dynamics may be at play across other non-discretionary retail segments.

Another factor driving grocery growth is the rise in short grocery visits in recent years. Between 2022 and 2025, the biggest year-over-year visit gains in the grocery space went to visits under 30 minutes, with sub-15 minute visits seeing particularly big boosts. As of 2025, visits under 15 minutes made up over 40% of grocery visits nationwide – up from 37.9% of visits in 2022.

This shift toward shorter visits – especially those under 15 minutes – is driven in part by the continued expansion of omnichannel grocery shopping, as many consumers complete larger stock-up orders online and rely on in-store trips for order collection or quick, fill-in needs. At the same time, the rise in short visits paired with consistent YoY growth in grocery traffic points to additional, behavior-driven forces at play – consumers' growing willingness to shop around at different grocery stores in search of the best deal or just-right product.

Value-conscious shoppers – particularly consumers from low- and middle-income households, which have driven much of recent grocery growth – seem to be increasingly shopping across multiple retailers to secure the best prices. This behavior often involves making targeted trips to different stores in search of the strongest deals, a pattern that is contributing to the rise in shorter, more frequent grocery visits. At the same time, other grocery shoppers are making quick trips to pick up a single ingredient or specialty item – perhaps reflecting the increasingly sophisticated home cooks and social media-driven ingredient crazes. In both these cases, speed is secondary to getting the best value or the right product.

So while some shorter visits reflect a growing emphasis on efficiency – as shoppers use in-store trips to complement primarily online grocery shopping – others appear driven by a preference for value or product selection over speed. Despite their differences, all of these behaviors have one thing in common – they're all contributing to continued growth in brick-and-mortar grocery visits. Grocers who invest in providing efficient in-store experiences are particularly well-positioned to benefit from these trends.

As early as 2022, the top 15 most-visited grocery chains already accounted for roughly half of all grocery visits nationwide. And by outpacing the industry average in terms of visit growth, these chains have continued to capture a growing share of grocery foot traffic.

This widening gap suggests that scale is increasingly enabling grocers to reinvest in the factors that attract and retain shoppers. Larger chains are better positioned to invest in broader and more differentiated product selection, stronger private-label programs that deliver quality at accessible price points, competitive pricing, and operational excellence across stores and omnichannel touchpoints. These capabilities allow top chains to serve a wide range of shopping missions – from quick, convenience-driven trips to more intentional visits in search of the right product or ingredient.

Consolidation at the top of the grocery category is reinforcing a virtuous cycle: scale enables better value, selection, and experience, which in turn draws more shoppers into stores and supports continued grocery traffic growth.

In 2025, the top 15 most-visited grocery chains accounted for a disproportionate share of visits lasting 15 minutes or more, while smaller grocers captured a larger share of the shortest trips. As shown above, larger grocery chains, which tend to attract longer visits, grew faster than the industry overall – but short visits, which skew more heavily toward smaller chains, accounted for a greater share of total traffic growth. Together, these patterns show that both long, destination trips and short, targeted visits are driving grocery traffic growth and creating viable paths forward for retailers of all sizes.

Larger chains are more likely to serve as destinations for fuller shopping missions, competing for the entire grocery list – or a significant share of it. But smaller banners can grow too by competing for more short visits. By specializing in a specific product category, owning a clearly defined shopping mission, or delivering a compelling value proposition, smaller grocers can earn a place in shoppers’ routines and become a deliberate stop within a broader grocery journey.

As grocery moves deeper into 2026, growth is being driven by the cumulative effect of how consumers are navigating food shopping today. Expanded supply has increased overall engagement, higher food costs are driving more frequent and targeted trips, and shoppers are increasingly willing to split their grocery list across retailers based on value, availability, and mission.

Looking ahead, this suggests that grocery growth will remain resilient, but unevenly distributed. Retailers that clearly understand which trips they are best positioned to win – and invest accordingly – will be best placed to capture that growth. Large chains are likely to continue benefiting from scale, consolidation, and their ability to serve full shopping missions, while smaller banners can grow by earning a defined role within shoppers’ broader grocery journeys. In 2026, success in grocery will be less about winning every trip and more about consistently winning the right ones.

To optimize office utilization and surrounding activity in 2026, stakeholders should:

1. Plan for continued, but slower, office recovery. Attendance continues to rise and has reached a post-pandemic high, but moderating growth suggests the return-to-office may progress at a more gradual and incremental pace than in prior years.

2. Account for growing seasonality in office staffing, local retail operations, and municipal services. As office visitation becomes increasingly concentrated in late spring and summer, offices, downtown retailers, and cities may need to plan for more predictable peaks and troughs by adjusting hours, staffing levels, and local services accordingly, rather than relying on annual averages.

3. Align leasing strategies with seasonal demand. Stronger attendance in Q2 and Q3 suggests these quarters are best suited for leasing activity, while softer Q1 and Q4 periods may be better used for renovations, repositioning, and targeted activation efforts designed to draw workers in.

4. Design hybrid policies around midweek anchor days. With Tuesdays and Wednesdays consistently driving the highest office attendance, employers can maximize collaboration and space utilization by concentrating meetings, programming, and in-office expectations midweek.

5. Reduce early-week commute friction to support attendance. Monday office attendance appears closely correlated with commute ease, suggesting that reliable and efficient transportation may be an important factor in early-week office recovery.

6. Prioritize proximity in leasing and development decisions. Visits from employees traveling less than five miles to work have increased steadily since 2019, reinforcing the value of centrally located offices and housing near employment hubs.

2025 was the year of the return-to-office (RTO) mandate. Employers across industries – from Amazon to JPMorgan Chase – instituted full-time on-site requirements and sought to rein in remote work. But the year also underscored the limits of policy. As employee pushback and enforcement challenges mounted, many organizations turned to quieter tactics such as “hybrid creep” to gradually expand in-office expectations without triggering outright resistance.

For employers seeking to boost attendance, as well as office owners, retailers, and cities looking to maximize today’s visitation patterns, understanding what actually drives employee behavior has become more critical than ever. This reports dives into the data to examine office visitation patterns in 2025 – and explore how structural factors such as weather, commute convenience, and workplace proximity have emerged as key differentiators shaping how and when, and how often workers come into the office.

National office visits rose 5.6% year over year in 2025, bringing attendance to just 31.7% below pre-pandemic levels and marking the highest point since COVID disrupted workplace routines. At the same time, the pace of growth slowed compared to 2024, signaling a possible transition into a steadier phase of recovery.

With new return-to-office mandates expected in 2026, and the balance of power quietly shifting towards employers, additional gains remain likely. But the trajectory suggested by the data points toward gradual progress rather than a return to the more rapid rebounds seen in 2023 or 2024.

Before COVID, “I couldn’t come in, it was raining” would have sounded like a flimsy excuse to most bosses. But today, weather, travel, and individual scheduling are widely accepted reasons to stay home, reflecting a broader assumption that face time should flex around convenience.

This shift is visible in the growing seasonality of office visitation, which has intensified even as overall attendance continues to rise. In 2019, office life followed a relatively steady year-round cadence, with only modest quarterly variation after adjusting for the number of working days. In recent years, however, greater seasonality has emerged. Since 2024, Q1 and Q4 have consistently underperformed while Q2 and Q3 have posted meaningfully stronger attendance – a pattern that became even more pronounced in 2025. Winter weather disruptions, extended holiday travel, and the growing normalization of “workations” appear to be pulling some visits out of the colder, holiday-heavy months and concentrating them into late spring and summer.

For employers, office owners, downtown retailers, and city planners, this emerging seasonality matters. Staffing, operating budgets, and programming decisions increasingly need to account for predictable soft quarters and peak periods, making quarterly planning a more useful lens than annual averages. Leasing activity may also convert best in Q2 and Q3, when districts feel most active. Slower quarters, meanwhile, may be better suited for renovations, construction, or employer- and city-led programming designed to give workers a reason to show up.

The growing premium placed on convenience is also evident in the persistence of the TGIF workweek – and in the factors shaping its regional variability.

Before COVID, Mondays were typically the busiest day of the week, followed by relatively steady attendance through Thursday and a modest drop-off on Fridays. Today, Tuesdays and Wednesdays have firmly established themselves as the primary anchor days, while Mondays and Fridays see consistently lower activity. And notably, this pattern has remained essentially stable over the past three years – despite minor fluctuations – as workers continue to cluster their in-office time around the days that offer the most perceived value while preserving flexibility at the edges of the week.

At the same time, while the hybrid workweek remains firmly entrenched nationwide, its contours vary significantly across regions – and the data suggests that convenience is once again a key differentiator.

Across major markets, a clear pattern emerges: Cities with higher reliance on public transportation tend to see weaker Monday office attendance, while markets where more workers drive alone show stronger early-week presence. While industry mix and local office culture still matter, the data points to commute hassle as another factor potentially shaping Monday attendance.

New York City, excluded from the chart below as a clear outlier, stands as the exception that proves the rule. Despite nearly half of local employees relying on public transportation (48.7% according to the Census 2024 (ACS)), the city’s extensive and deeply embedded transit system appears to reduce perceived friction. In 2025, Mondays accounted for 18.4% of weekly office visits in the city, even with heavy transit usage.

The contrast highlights an important nuance: Where transit is fast, frequent, and integrated into daily routines, it can support office recovery, offering a potential roadmap for other dense urban markets seeking to rebuild early-week momentum.

Another powerful signal of today’s convenience-first mindset shows up in commute distances. Since 2019, the share of office visits generated by employees traveling less than five miles has steadily increased, largely at the expense of mid-distance commuters traveling 10 to 25 miles.

To be sure, this metric reflects total visits rather than unique visitors, so the shift may be driven by increased visit frequency among workers with shorter, simpler commutes rather than a change in where employees live overall. Still, the pattern is telling: Workers with shorter commutes appear more likely to generate repeat in-person visits, while longer and more complex commutes correspond with fewer trips. Over time, this dynamic could shape office leasing decisions, residential demand near employment centers – whether in urban cores or in nearby suburbs – and the geography of the workforce.

Taken together, the data paints a clear picture of the modern return-to-office landscape. Attendance is rising, but behavior is no longer driven by mandates alone. Instead, workers are making rational, convenience-based decisions about when coming in is worth the effort.

For cities, the implication is straightforward: Ease of access matters. Investments in transit reliability, last-mile connectivity, and housing near employment centers can all play a meaningful role in shaping how consistently people show up. For employers, too, the lesson is that the path back to the office runs through convenience, not just compulsion, as attendance gains are increasingly driven by how effectively organizations reduce friction and increase the perceived value of being on-site.

1. AI is raising the bar for physical retail as shoppers arrive more informed, more intentional, and less tolerant of friction – though the impact varies by category and format.

2. As discovery shifts upstream, stores increasingly serve as confirmation rather than discovery points where shoppers validate decisions through hands-on experience and expert guidance.

3. AI-based tools can improve in-store performance by removing operational friction – shortening trips in efficiency-led formats and supporting deeper engagement in experience-led ones.

4. By embedding expertise directly into frontline workflows, AI helps retailers deliver consistent, high-quality service despite high turnover and limited training windows.

5. AI enables precise, location-specific marketing and execution, allowing retailers of any size to align assortments, staffing, and messaging with real local demand.

6. Retailers can also use AI to manage their store fleets with greater discipline and understand where to expand, where to avoid cannibalization, and where to rightsize based on observed demand rather than static assumptions.

7. AI is not a universal lever in physical retail; its value depends on the store format, and in discovery-driven models it should support operations behind the scenes rather than reshape the customer experience.

Physical retail has faced repeated claims of obsolescence, from the rise of e-commerce to the shock of COVID. Each time, analysts predicted a structural decline in brick-and-mortar. And each time, physical retail adapted.

AI has triggered a similar round of predictions. Much of the current discussion frames retail’s future as a binary outcome: either stores become heavily automated, or e-commerce becomes so optimized that physical locations lose relevance altogether.

But past disruptions point in a different direction. E-commerce changed how physical retail operated by raising expectations for omnichannel integration, speed, and clarity of purpose. Retailers that adjusted store formats, merchandising, and operations accordingly went on to drive sustained growth.

AI likely represents another inflection point for physical retail. As shoppers arrive with more information, clearer intent, and even less tolerance for friction than in the age of "old-fashioned" e-commerce, physical stores will remain – but the standards they are held to continue to rise.

This report presents four ways retailers are using AI to get – and stay – ahead as physical retail adapts to this next wave of disruption.

E-commerce moved discovery earlier in the shopping journey. Instead of beginning the process in-store, many shoppers now arrive at brick-and-mortar locations after having deeply researched products, comparing options, and narrowing choices online – entering the store to validate rather than initiate their purchasing decision.

AI-powered shopping accelerates this pattern. Conversational assistants, recommendation engines, and AI-driven discovery across search and social reduce the time and effort required to evaluate options – and this shift is changing consumers' expectations around the in-store experience.

Apple shows what it looks like when a physical store is built for well-informed shoppers. Given the prevalence of AI-powered search and assistants in high-consideration categories like consumer electronics, Apple customers likely arrive at the Apple Store with more preferences already shaped by AI-assisted research than other retail categories.

Apple Stores were designed for this kind of customer long before AI became widespread. The layout puts working products directly in customers’ hands, merchandising emphasizes live use over promotional signage, and associates are trained to answer detailed technical questions rather than walk shoppers through basic options.

That alignment is showing up in store behavior. Even as AI-powered shopping expands, Apple Stores continue to see rising foot traffic and longer visits thanks to the store's specific and curated role in the customer journey – a place where customers confirm decisions through hands-on experience and expert guidance.

Some applications of AI extend trends that e-commerce has already introduced. Others address operational challenges that previously required manual coordination or tradeoffs.

AI can reduce friction and make store visits more predictable by improving staffing allocation, reducing checkout delays, optimizing inventory placement, and managing traffic flow. These changes reduce friction without altering the visible customer experience.

Sam's Club offers a clear, recent example of AI solving a specific in-store bottleneck. For years, customers completed checkout only to face a second line at the exit, where an employee manually scanned paper receipts and spot-checked carts.

In early 2024, Sam’s Club introduced computer vision-powered exit gates, allowing customers to exit the store without stopping as AI algorithms instantly captured images of the items in their carts and matched them against digital purchase data. Employees previously tasked with receipt checks could now shift their focus to member assistance and in-store support.

The impact was measurable. Sam’s Club reported that customers now exit stores 23% faster than under manual receipt checks, a result confirmed by a sustained nationwide decline in average dwell time. During the same period, in-store traffic increased 3.3% year-over-year – demonstrating how removing friction with AI can deliver tangible gains.

AI optimizes stores for different outcomes. At Sam’s Club, it shortens visits by removing friction from task-driven trips. At Apple, upstream research leads to longer visits focused on testing, questions, and decision validation. In both cases, AI aligns store execution with shopper intent – prioritizing speed and throughput in efficiency-led formats and deeper engagement in experience-led ones.

Beyond shaping store roles and streamlining operations, AI can also address a long-standing challenge in physical retail: delivering consistent, high-quality expertise on the sales floor despite high turnover and seasonal staffing. In the past, retailers relied on heavy training investments that often failed to pay off. AI can now embed that expertise directly into frontline workflows, allowing associates to deliver confident, informed service regardless of tenure and strengthening the in-store experience at scale.

In May 2025, Lowe’s rolled out a major in-store AI enhancement called Mylow Companion, an AI-powered assistant that equips frontline staff with real-time, expert support on product details, home improvement projects, inventory, and customer questions.

Mylow Companion is embedded directly into associates’ handheld devices, delivering instant guidance through natural, conversational interactions, including voice-to-text. This enables even newly hired employees to provide confident, expert-level advice from day one, while helping experienced associates upsell and cross-sell more effectively. The tool complements Mylow, a customer-facing AI advisor launched the same year to help shoppers plan projects and discover the right products, leading to increased customer satisfaction.

While AI alone cannot solve demand challenges—especially amid macroeconomic pressure on large-ticket discretionary spending—early signals suggest it may still play a meaningful role. Location analytics indicate narrowing year-over-year visit gaps at Lowe’s post-deployment, pointing to a potentially improved in-store experience. And Home Depot’s recent announcement of agentic AI tools developed with Google Cloud suggests that these technologies are becoming table stakes in this category.

As more retailers roll out similar capabilities, those that moved earlier are better positioned to help set the bar – and benefit as the market adapts.

Beyond improving the in-store experience, AI also gives retailers a powerful way to drive foot traffic through precision marketing. By processing large volumes of behavioral, location, and timing data, AI can help retailers decide who to reach, when to engage them, where to activate, and what message or assortment will resonate – shifting marketing from broad seasonal pushes to campaigns grounded in local demand.

Target offers an early example of this approach before AI became widespread. Stores near college campuses have long tailored assortments and messaging around the academic calendar, especially during the back-to-school season. In August, these locations emphasize dorm essentials, compact storage, bedding, tech accessories, and affordable décor – supported by campaigns aimed at students and parents preparing for move-in. That localized approach has been effective in driving in-store traffic to Target stores near college campuses, with these venues seeing consistent visit spikes every August and outperforming the national average across multiple back-to-school seasons from 2023 to 2025.

AI makes local execution repeatable at scale. By analyzing visit patterns, past performance, and timing signals across thousands of locations, retailers can decide which products to promote, how to staff stores, and when to run campaigns at each location. Marketing, merchandising, and store operations then act on the same demand signals instead of separate assumptions.

Crucially, AI makes this level of localization accessible to retailers of all sizes. What once required the resources and institutional knowledge of a big-box giant can now be achieved through precision marketing and demand forecasting tools, allowing brands to adapt each store’s messaging, assortment, and execution to the unique rhythms of its community.

Beyond improving performance at individual stores, AI can also give retailers a clearer view of how their entire store fleet is working – and where it should grow, contract, or change. By analyzing foot traffic patterns, trade areas, customer overlap, and visit frequency across locations, AI helps retailers identify which sites are truly reaching their target audiences and which are underperforming relative to local demand.

AI also plays a critical role in smarter expansion. Retailers can use it to identify markets and neighborhoods where demand is growing, customer overlap is low, and incremental visits are likely – reducing the risk of cannibalization when opening new stores. By modeling how shoppers move between existing locations, AI can flag when a proposed site will attract new customers versus simply shifting traffic from nearby stores, grounding expansion decisions in observed behavior rather than demographic proxies or intuition alone.

Equally important, AI helps retailers recognize when expansion no longer makes sense. By tracking total fleet traffic, visit growth, and trade-area saturation, retailers can assess whether new stores are adding net demand or diluting performance. The same signals can identify locations where demand has structurally declined, informing rightsizing decisions and store closures. In this way, AI supports a more disciplined approach to physical retail – one that treats the store fleet as a dynamic system to be optimized over time, rather than a footprint that only grows.

The impact of AI on physical retail will vary significantly by category and format. Not every successful store experience is built around efficiency, prediction, or pre-qualification. Retailers with clearly differentiated offline value don’t necessarily benefit from forcing AI into customer-facing experiences that dilute what makes their stores work.

“Treasure hunt” formats are a clear example. Off-price retailers like TJ Maxx, Marshalls, Ross, and Burlington continue to drive strong traffic by offering unpredictability, scarcity, and discovery that cannot be replicated – or meaningfully enhanced – through AI-driven search or recommendation. The appeal lies precisely in not knowing what you’ll find. For these retailers, heavy investment in AI-led personalization or pre-shopping guidance risks undermining the core experience rather than improving it.

Similar dynamics apply in other categories. Independent boutiques, vintage stores, resale shops, and certain specialty retailers succeed by offering curation, serendipity, and human taste rather than optimization. In these cases, AI may still play a role behind the scenes – supporting inventory planning, pricing, or site selection – but it should not reshape the customer-facing experience. AI is most valuable when it reinforces a retailer’s existing value proposition. Formats built around discovery, surprise, or experiential browsing should protect those strengths, even as other parts of the retail landscape move toward greater efficiency and intent-driven shopping.

AI is forcing physical retail to evolve with intention. By creating a supportive environment for customers who arrive with made-up minds, removing friction inside the store, offering the best in-store services, and orchestrating demand with greater precision, retailers are adapting to the new world standards set by AI. All five strategies focus on aligning stores with shopper intent – what customers want, how the store supports it, and when the interaction happens.

The retailers that win in this next era won’t be the ones that use AI to simply automate what already exists. They’ll be the ones that use it to sharpen the role of physical retail – turning stores into places that help shoppers validate decisions, deliver value beyond convenience, and show up at exactly the right moment in a customer’s journey.

In the age of AI, physical retail wins by becoming more intentional – designed around informed shoppers, optimized for the right outcome in each format, and activated at moments when demand is real.