.svg)

.png)

.png)

.png)

.png)

How did the brick-and-mortar divisions of Walmart, Target, and other leading retailers perform this holiday season? Which days drove the most visits, and how did foot traffic performance this year compare to 2022? We dove into the data to find out.

Looking at daily visits to Target, Walmart, mid-tier department stores (including Macy’s, JCPenney, Kohl’s Belk, and Dillard’s), luxury department stores (including Saks Fifth Avenue, Neiman Marcus, Bloomingdale’s, and Nordstrom) and Best Buy reveals several common trends.

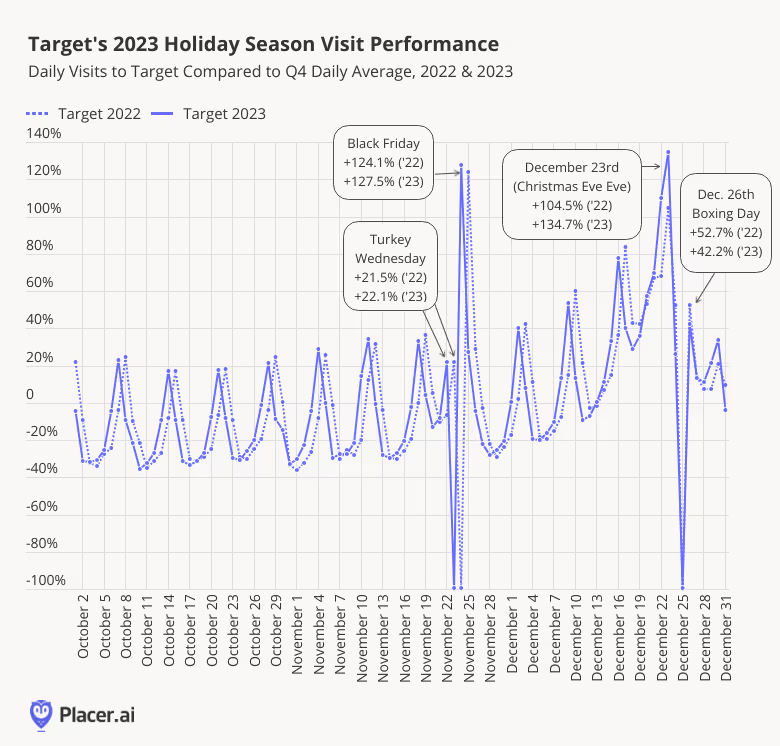

In all cases, retail visits began to creep up over the days leading up to Thanksgiving (Monday through Wednesday) as consumers took advantage of early Black Friday discounts. And the visit increase on Black Friday 2023 relative to the Q4 daily average was larger than in 2022 – perhaps thanks to budget-conscious consumers holding out for the steep discounts offered the day after Thanksgiving. The Christmas Eve Eve (December 23rd) and Super Saturday spikes were also particularly pronounced in 2023, likely thanks to the combination of both retail events falling on the same day this year.

All retailers and retail segments analyzed also saw smaller surges on Boxing Day (December 26th) 2023 when compared to 2022, likely due to calendar differences. Christmas fell on a Sunday in 2022, so December 26th was declared a federal holiday in lieu of December 25th, and many private-sector employers likely gave time off as well – giving consumers the opportunity to hit the stores and enjoy after-Christmas sales. But Boxing Day still drove visit peaks across the board in 2023 (albeit not smaller peaks than in 2022) – indicating that Boxing Day is now a U.S. phenomenon as well.

December 27th, 28th, and 29th saw a greater increase relative to the daily Q4 average in 2023 compared to 2022, culminating in a larger New Years Eve Eve (December 30th) spike. The December 30th surge may be because this year’s December 30th fell on a Saturday, which is a major shopping day in its own right. But the increase in the days prior to New Years Eve Eve, when after-Christmas sales were in full force, could indicate that consumers are still particularly attune to sales events.

Still, despite the similarities across retail categories, foot traffic data also reveals some important differences between the segments.

Visits to Target began to increase in November 2023 relative to October as the retailer offered “Four Weeks of Early Black Friday Deals,” starting October 29th. And like the other categories analyzed, Target saw its first small visit peak of the season on the Wednesday before Thanksgiving (also known as Turkey Wednesday thanks to the massive Grocery visit spikes on the day). Visits on the day before Thanksgiving were up by 21.5% and 22.1%, in 2022 and 2023, respectively, despite foot traffic on an average Wednesday tends to be lower than the Q4 daily average – indicating that “Turkey Wednesday” also holds retail significance for grocery-adjacent categories.

Visits then spiked on Black Friday and returned to seasonally normal levels on Saturday. Throughout December, foot traffic continued to swell, with every week exceeding the previous week’s visit performance. The intensity of the visit growth picked up the week before Christmas, with Christmas Eve Eve/Super Saturday seeing a significant jump. Finally, Target visits on Boxing Day and the week following Christmas also exceeded the Q4 daily average as consumers took advantage of end-of-season sales and looked for festive attire for their New Year’s Eve celebrations.

The holiday season visit pattern at Walmart differs from those at Target in several instances. The superstore’s Turkey Visit spike was significantly more pronounced than Target’s, likely thanks to Walmart’s more extensive grocery offerings. Walmart also saw smaller spikes on Black Friday – perhaps due to the retailer’s famous “everyday low prices,” which may reduce the appeal of specific sales events. The Christmas Eve Eve/Super Saturday surge were also lower than for Target, but the Super Saturday increase relative to Black Friday spike was more pronounced, with some consumers probably visiting Walmart for last-minute groceries ahead of their Christmas dinners.

.avif)

Visits to luxury department stores (Saks Fifth Avenue, Neiman Marcus, Nordstrom, and Bloomingdale’s) followed the general retail foot traffic trends, with larger peaks on Black Friday and on Christmas Eve Eve/Super Saturday in 2023 compared to 2022. Boxing Day 2023 drove a smaller visit spike relative to last year, but foot traffic was still 98.2% higher than the Q4 2023 daily average – indicating that the day is still emerging as an important retail milestone, especially for pricier segments.

.avif)

Mid-tier department stores (Macy’s, Kohl’s, JCPenney, Belk, and Dillard’s) saw more significant spikes on Black Friday and Christmas Eve Eve/Super Saturday, and smaller spikes on Boxing Day. Luxury’s department stores’ biggest post-Christmas visit peak was on Boxing Day, but mid-tier department stores experienced their largest end-of-year increase on New Year’s Eve Eve (December 30th).

.avif)

Best Buy saw the strongest Q4 visit spike on Black Friday out of all the retailers and retail segments analyzed, with foot traffic up a whopping 510.9% compared to its Q4 2023 daily average. The electronics leader also had the largest Christmas Eve Eve/Super Saturday bump – with visits up 188.1% – and Boxing Day boost, with traffic up 112.9% compared to the Q4 daily average. The visit surges over the holiday season’s retail milestones indicate that demand for electronics remains strong – even as some consumers may be putting off large purchases due to economic headwinds.

.avif)

The holiday season drove significant retail foot traffic across categories, with every segment displaying its own unique Q4 visitation pattern. How will these sectors perform in the year ahead?

Visit placer.ai/blog to find out.

2023 was a year that forced restaurant operators to stay agile. Inflation was top-of-mind for most consumers throughout the year, resulting in a trade-down to value-oriented restaurants (or trading out to value grocery chains, dollar stores, and convenience stores). That said, value wasn’t the only factor driving visits, as new menu innovations (Taco Bell was a standout) or marketing partnerships (McDonald’s Famous Orders and “adult” happy meals helping the chain to outperform from a visitation perspective). While we’ve seen visitation trends for the morning daypart improve due to a steady recovery in return to office trends, we continue to see visits during late morning and early afternoon for coffee and QSR chains due to changes in consumer routines (not to mention a resurgence in late night dining). This has also prompted several chains to refine their approach to drive-thrus and pick-up windows (Shake Shack, Chipotle, Taco Bell, among several others). On top of these trends, we’ve seen massive changes in restaurant trade areas, driving many chains to rethink their expansion plans (including an emphasis on South and Southeast, which have seen population growth due to migration).

McDonald’s new exploratory restaurant concept CosMc’s sits at the intersection of several of these trends. The smaller-format (approximately 2,800 square feet, compared to 4,000-4,500 square feet for the average McDonald’s), drive-thru only concept opened its doors last month in Bolingbrook, IL, and is part of a “limited test run”. Its menu heavily focuses on beverages, including four “Signature Galactic Boosts” (featuring Sour Cherry Energy Boost and Island Pick-Me-Up Punch drinks), iced teas and lemonades (such as a Tropical Spiceade and Blackberry Mist Green Tea), slushes and frappes (including a Chai Frappe Burst and Popping Pear Slush), and coffee-based products (highlighted by the S’Mores Cold Brew and Turmeric Spiced Latte). While beverages are the focal point, there are also a variety of breakfast and snack food options, including a Spicy Queso and Creamy Avocado Tomatillo breakfast sandwiches, McPops (filled doughnuts), Savory Hash Brown Bites, and Pretzel Bites. In addition to the experimental fare, the menu also features a host of traditional breakfast sandwiches and beverage offerings.

Given the early buzz, we decided to check out the concept for ourselves this week. It was immediately apparent how much interest CosMc’s was drawing, as the drive-thru lane spanned roughly 80 vehicles upon arrival (which required use of a separate parking lot at the Maple Park Place shopping center, which also features Burlington, Ross Dress for Less, Dollar Tree, Aldi, and Best Buy stores).

.avif)

While its unique menu has rightfully generated a significant amount of attention, it’s also clear that McDonald’s is also using CosMc’s as a test for other potential drive-thru only locations in the future. Customers order from dynamic menu boards and cashless payment devices are used to expedite the payment process. Visitors wait at the menu board until their order is ready, and then pickup windows are assigned when the order is ready.

.avif)

.avif)

Admittedly, it’s tough to make definitive conclusions about CosMc’s with the location being open for only a few weeks. Placer’s data suggests that CosMc’s saw more than double the number of visits that a typical McDonald’s saw chainwide during December 2023 (despite being open only since Dec. 7) and more than triple the number of visits per square foot (given CosMc’s smaller, roughly 2,500 square feet footprint). However, it’s also worth noting that CosMc’s visitation numbers would likely have been much higher if the location had additional capacity to satisfy the overwhelming demand.

Still, Placer offers some other ways to evaluate CosMc’s early trends. Based on 2019 Census Block Group data, CosMc’s trade area size (using a 70% of visit threshold) was just over 155 square miles during December 2023 (below). This is roughly 2.5 times the size of the trade area for the average McDonald’s location during December 2023 (62 miles) and significantly larger than the average trade area for most coffee brands (25-35 miles for more urban focused brands to 50-60 miles for more suburban/secondary market brands). In fact, the closest recent comparison we could find for CosMc’s was Raising Cane’s Post Malone and Dallas Cowboys restaurant collaboration, which had an impressive 264-mile trade area during its initial month of opening (though also helped by cross-traffic from Dallas Cowboys home game visitors from across the state of Texas). In some ways, there were also similarities between CosMc's and the Hello Kitty Cafe Trucks, which the Placer.ai Blog team wrote about last September.

Given that McDonald’s also appears to be targeting a younger demographic with CosMc’s, we thought we’d also look at the age breakdown for the potential market trade area (the population living within the trade area for the CosMc’s store). McDonald’s collective potential market trade area largely mirrors U.S. trends given its reach (the company has previously stated that 85% of the population in its top five markets–the U.S., France, the U.K., Germany and Canada–are within three miles of a McDonald’s location), it’s interesting that the potential market trade area for CosMc’s does skew to a younger audience, particularly the 22–29-year-old cohort.

By the end of 2024, McDonald’s plans to open an additional 10 CosMc’s test units, including locations in the Dallas-Fort Worth and San Antonio markets (notably some of the fastest growing markets in the U.S.). Does CosMc’s have the potential to be something more than a 10-unit test over a longer horizon? McDonald's has attempted to differentiate its coffee business in the past with its McCafe menu and standalone McCafe locations in international markets, but competition with Starbucks and others made it difficult for the company to distinguish McCafe as a standalone retail brand in the U.S. CosMc's is interesting from this perspective, as it may allow the company to build a brand more naturally and stand out with a younger audience (which appears to be working). It’s unlikely that future CosMc’s will look or operate like the pilot location in Bolingbrook. Nevertheless, the excitement around new products, an expansive trade area, and potential to connect with younger audience make it a worthwhile test (especially with 2024 shaping up to be a strong year for unit growth within the coffee category).

In December 2023, Placer.ai released two white papers: How Physical Stores Help DNBs Thrive and East Coast Migration Hubs. Below is a taste of our findings. To read more data-driven consumer research, visit our library.

DNBs – Digitally Native Brands – refer to retailers that began their retail journey exclusively online, selling their product line direct-to-consumers through their owned digital channel. But although all these businesses start out as a pure e-commerce play, many DNBs eventually move offline, choosing to leverage the various benefits of brick-and-mortar channels to grow their business even further.

Analyzing year-over-year (YoY) data for Q3 2023 shows that, while many retailers struggled, DNB leaders such as Vuori, Allbirds, Everlane, and Warby Parker all saw significant growth in quarterly visits per venue. Many of these brands also underwent significant expansions, but the increase in visits per venue reveals that many of the DNBs are seeing more crowded stores despite the increase in number of overall venues. The success of these brands in operating stores that consumers want to keep visiting – even in times of economic headwinds – suggests that DNBs are particularly well positioned to take advantage of the diverse benefits of offline stores.

How Physical Stores Help DNBs Thrive uses location intelligence to reveal the different brick-and-mortar strategies helping DNBs broaden their reach, build their brand, and acquire new audiences. Several DNBs are building massive store fleets, while others focus on a couple well-placed stores – and some focus on temporary pop-ups to reap the benefits of physical stores without the long-term commitment.

Read the full report here to discover the diverse methods that digitally native brands are enlisting to to drive growth through brick-and-mortar expansion.

Much has been written about the recent population outflows from New York, Massachusetts, and other northeastern states. But many states on the East Coast – including Maine, Vermont, Rhode Island, Delaware, North and South Carolina, and Florida – are actually seeing influxes of newcomers.

Each of these states – and each of the metropolitan areas attracting relocators within them – offers its own set of benefits. But those willing to make the move often fit a similar profile – younger individuals or families looking for a more favorable housing market, better schools, or more job opportunities.

East Coast Migration Hubs looks at several states and metro areas on the East Coast to explore the factors driving migration to these emerging hubs. Using location data to understand who is moving, and harnessing Niche’s Neighborhood Grades dataset to identify differences between origin and destination areas, the report seeks to shed light on recent domestic migration trends in the Eastern United States.

Read the full report here to discover the factors driving domestic migration to several popular relocation destinations on the East Coast.

For more data-driven consumer research, visit our library.

Last year was marked by inflation and consumer cutbacks as shoppers adjusted to price hikes across key retail and dining categories. But despite the challenges, many categories and retailers not only weathered the storm but positively thrived under the ongoing headwinds.

Now, with a new year offering fresh opportunities for growth, what are the retail and dining segments positioned for success in 2024? We dove into the data to find out.

Last year’s high grocery prices led to a surge in foot traffic to affordable supermarket chains – but food-away-from-home inflation also seems to have driven visits to high-end grocers. Visits to chains such as New York-based Uncle Giuseppe’s, Illinois-based Cermak Fresh Market, and California-based Lazy Acres saw consistent year-over-year (YoY) visit increases as consumers sought specialty ingredients to recreate restaurant-quality dishes at home. Rising interest in sustainability, natural products, and organic ingredients – especially among Gen-Z – likely helped drive traffic growth as well.

But the success of specialty grocers isn’t just coming from singles willing to splurge on the latest influencer-backed food trend – trade area demographic data reveals that families with children are overrepresented in the captured market trade area of all three specialty grocers analyzed. With restaurant prices likely increasing slightly in 2024, consumers looking to feed their families tasty dishes without breaking the bank – or shoppers feeding the growing demand for natural food products – will likely keep visits to specialty grocers high in the coming year.

.avif)

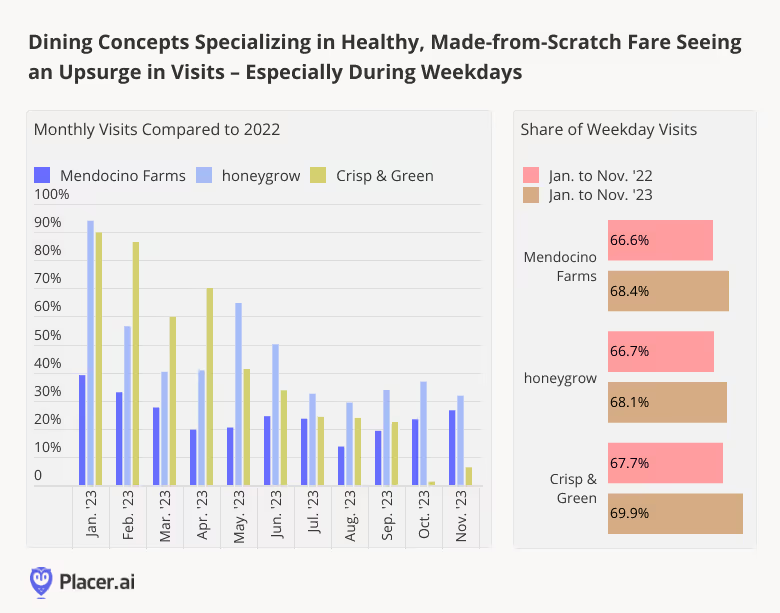

Along with the rise in specialty grocers selling natural and organic ingredients, restaurants focusing on whole, healthy foods are also seeing a boost – and the segment is positioned for further growth in 2024. Consumers are flocking to concepts such as Mendocino Farms, honeygrow, and Crisp & Green that boast fresh ingredients and made-from-scratch dishes – and these chains are all expanding to meet the growing demand.

Visits to healthy dining concepts are no longer reserved for special occasions – weekday foot traffic is also on the rise, with all three dining brands analyzed seeing a YoY rise in the share of Monday to Friday visits. With employees slowly but surely returning to the office and looking to grab a nutritious lunch mid-day or meet up with friends for a balanced dinner on their way home, demand for health-focused dining concepts is likely to continue growing in 2024.

Dave’s Hot Chicken was one of 2023’s biggest dining success stories, and the chain was not the only fried chicken franchise attracting significant foot traffic. Raising Cane’s, which has been on a roll for several years, and Huey Magoo’s Chicken Tenders – which serves grilled chicken and other fare alongside its signature fried tenders – are also taking the country by storm.

Foot traffic to the chains surged in 2023, driven in part by aggressive expansions. But zooming into November 2023 data reveals that average visits per venue are also up YoY, despite all three brands’ much larger store fleets – indicating that the fried chicken boom is meeting a ready demand. It seems, then, that while some diners will favor healthy foods in the new year, other consumers are likely to continue driving visits to fried chicken chains in 2024.

.avif)

Fried chicken isn’t the only indulgence positioned to thrive in 2024. Other affordable luxuries raked in visits last year and are likely to continue seeing growth in the year ahead.

Although inflation appears to be cooling, prices across many goods and services still remain elevated, with some shoppers still putting off large purchases. But consumers are willing to splurge on small treats that won’t break the bank, and tasty snacks and food items – from craft doughnuts to gourmet deli sandwiches to specialty coffee concoctions – could provide the perfect affordable and guilt-free pick-me-up. Parlor Doughnuts, Pickleman’s Gourmet Cafe, and Dutch Bros. Coffee are some of the chains that benefited from this trend in 2023 and will likely continue to grow in the new year.

The trade areas of the three chains analyzed all include a larger-than-average share of “non-family households” – people living with unrelated individuals. As high housing costs continue to lead more U.S. adults to live with roommates, the number of consumers looking to escape their daily grind with an affordable indulgence is likely to increase in 2024 – and drive even larger visit surges to chains offering budget-friendly treats.

.avif)

Non-comestible affordable indulgence such as tanning salons, hair-removal parlors, and eyelash salons are also seeing a rise in visits that will likely continue in the coming year. Deka Lash, Tan Republic, Glo Tanning, and LaserAway are some of the chains that saw their YoY visits increase significantly in 2023, and the growth does not appear to be slowing down.

All four chains’ trade areas included a larger share of Gen-Z visitors (aged 18-24) than the share of 18-24 year olds nationwide. And since, despite inflation, younger shoppers tend to spend more than the average American on beauty and self care – and Gen Z’s spending power is only expected to grow in the coming year – personal grooming chains are well positioned to succeed even further in 2024.

.avif)

Another personal care-adjacent segment slated for growth in 2024 is themed fitness. Gyms and studios that focus on a particular type of activity or fitness regimen – such as climbing, yoga, pilates, or HIIT are seeing their visits skyrocket, with both the number of monthly visits and the average visit frequency on the rise YoY.

The rising popularity of themed fitness concepts may be aided by the sense of community fostered by many of these chains. Touchstone Climbing organizes meetup groups geared towards specific audiences, while F45 Training prides itself on facilitating a sense of purpose and belonging among its members. And yoga and pilates classes have long been recognized for their capacity for connection-building.

With loneliness on the rise and many consumers looking to incorporate a fun, social element into their fitness routines, the demand for themed fitness concepts will likely keep on growing in 2024.

.avif)

Cost-effectiveness does not necessarily mean cheap. And while some retail segments to watch in 2024 stand out for their low price points, other segments that offer consumers a particularly strong value proposition also appear well positioned to thrive in the coming year. Chains such as Theory, Anthropologie, and Marine Layer all saw YoY increases in monthly visits every month of 2023, perhaps aided by the “quiet luxury” trend that drove demand for high-quality, non-ostentatious fashion. And while these brands may not offer the cheapest price, the focus on good craftsmanship and premium fabrics may help consumers feel better about shelling out a little more for each item.

All three brands analyzed have a significant presence in California. Diving into their captured market in the Golden State reveals that visitors to these upscale apparel retailers tend to be wealthier and are more likely to live alone when compared to the average California resident. So even as many companies look to cater to the increasing share of budget-conscious consumers, other retailers willing to invest in quality materials and offer a premium customer experience can still thrive in 2024 by meeting the needs of more affluent audiences.

.avif)

From healthy foods to fried fare, and from affordable treats to higher-priced apparel, the diversity of retail and dining segments to watch in 2024 highlights the many opportunities for success in the coming year. Where will visits skyrocket? Which brands will hit it out of the park?

Visit placer.ai/blog to find out.

Streets adorned in holiday lights, bustling Christmas stores and pop-ups, and local festivals all make the holiday season a truly magical time of year. So with Christmas in the rearview mirror, we dug into the data to explore some of the most beloved holiday spots throughout the country. Who visits Christmas stores? How do holiday events affect foot traffic to local hangouts? And what impact do annual parades have on major retail corridors like Chicago’s Mag Mile?

We dove into the data to find out.

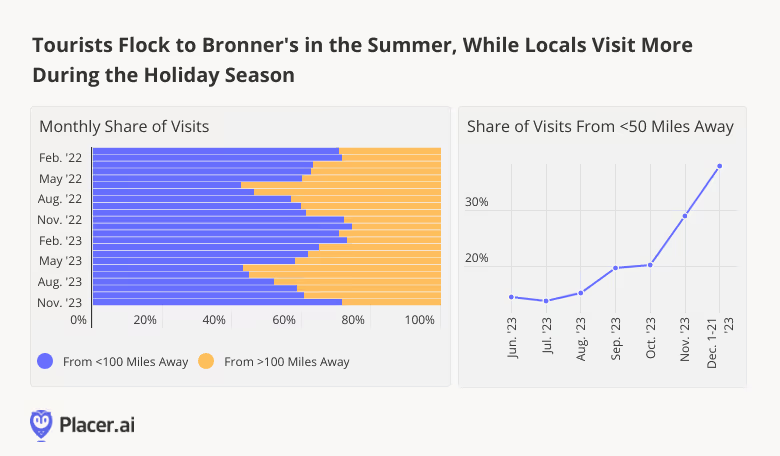

Bronner’s Christmas Wonderland in Frankenmuth, MI is the biggest Christmas store in the country – nay, the world. Spanning some 27 acres, the store carries everything from personalized holiday ornaments to Christmas trees. And the venue, which is open 361 days a year, has emerged as a true destination, where visitors can enjoy a taste of the holiday spirit and load up on all their Christmas essentials.

People visit Bronner’s all year round – but foot traffic to the store really picks up during the holiday season: Between November 1st and December 21st, 2023, the holiday wonderland drew a stunning 438.0% more daily visits, on average, than it did between January and October of this year.

Drilling down deeper into the data shows that much of this visit bump is driven by locals, who flock to Bronner’s during the Christmas season. Throughout the year, Bronner’s draws tourists from all over the country – and in the summer, most visits to the shop are by shoppers living more than 100 miles away. Individuals living within 100 miles of Bronner’s tend to visit closer to Christmas, when the time comes to stock up on supplies for the holiday. And as the holiday approaches, the share of true locals in Bronner’s visitor base – i.e. those living less than 50 miles away from the store – increases significantly.

As the Yuletide season kicks into gear, special holiday-themed pop-ups and happenings also spring up throughout the country, with bars, malls, and restaurants all hosting special events filled with holiday cheer.

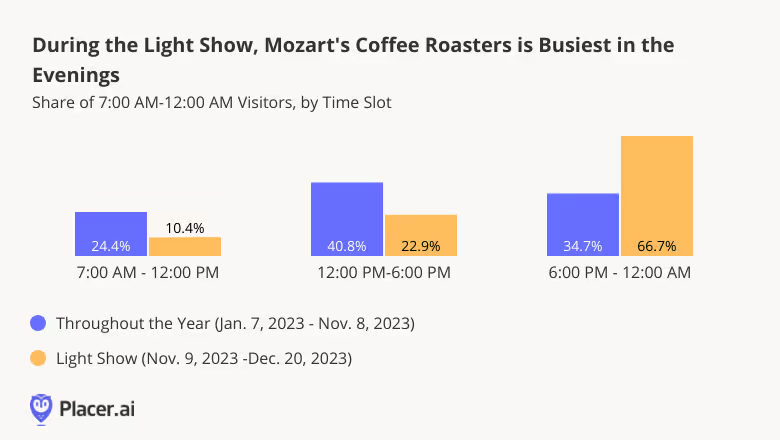

One venue that goes all out for the holidays is Mozart’s Coffee Roasters, the lakeside Austin, TX coffee shop that’s been a local landmark since 1993. With free wifi, expansive seating, and bottomless coffee, Mozart’s is the perfect place for remote employees to get some work done. And with hundreds of artists performing at the venue each year and a weekly open mic night, it’s also a great place to go out in the evenings. In the run-up to Christmas, Mozart’s hosts its famed annual holiday lights show, replete with a Bavarian Marketplace, a silent disco, and this year, an actual piece of Taylor Swift’s dance floor.

During the light show, Mozart’s is positively teeming with customers: Since the start of the event this year (November 9th), the coffee shop drew 104.3% more daily visitors, on average, than it did between January 7th (the end of last year’s show) and November 8th, 2023. And unsurprisingly, foot traffic data shows that most of this visit bump is driven by evening customers: During most of the year, the majority of visits to Mozart’s take place before 6:00 PM, with 24.4% concentrated in the morning hours. But when the festival kicks off, this pattern reverses – with 66.7% of visits taking place between 6:00 PM and midnight.

Local parades and festivals are another mainstay of the holiday season. From New York’s iconic Macy’s Thanksgiving Day Parade to the Hollywood Christmas Parade in Los Angeles, cities across America draw massive crowds to streets decked out with holiday cheer.

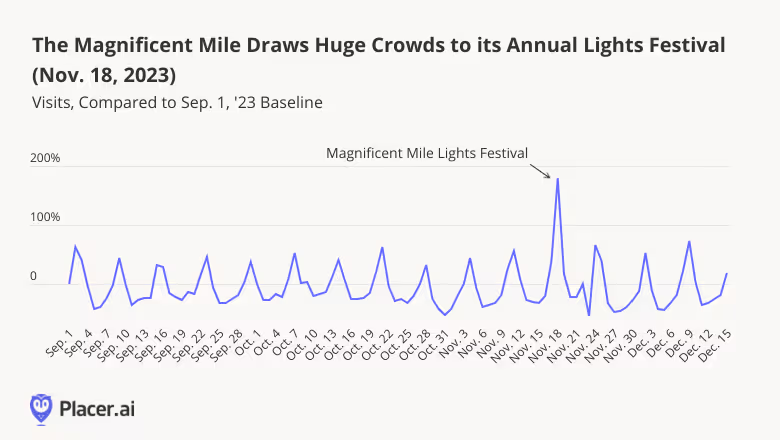

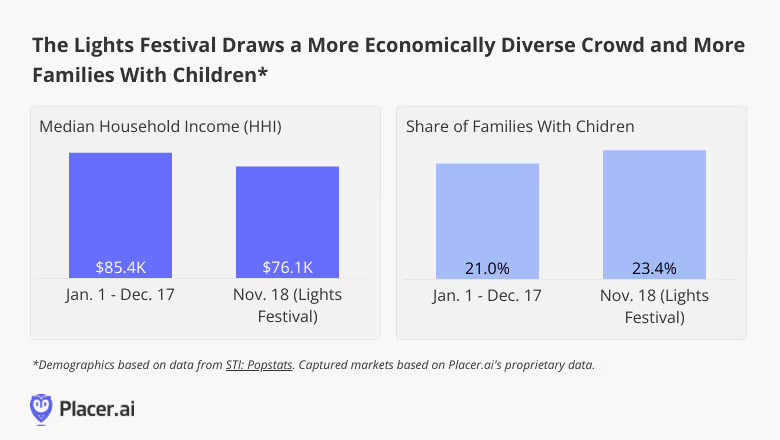

One of the nation’s most timeless Christmas celebrations is Chicago’s Wintrust Magnificent Mile Lights Festival – an all-day bonanza that features a slew of booths and activities, a televised parade, and an impressive fireworks display. The festival, which famously illuminates the city with a million lights, is one of the Mag Mile’s prime events of the year. And comparing November 18th, 2023 foot traffic to the popular Chicago retail corridor – the day of the big event – to a September 1st 2023 baseline, shows that the festivities generated a tremendous 179.5% visit spike.

And a look at the demographic characteristics of visitors to the Mag Mile during the Lights Festival reveals that the celebration draws a more economically diverse crowd, as well as a larger share of families with children. Throughout most of this year, the median household income (HHI) of the Magnificent Mile’s captured market was relatively high – $85.4K. At the same time, the share of parental households in the retail corridor’s captured market increased from 21.0% to 23.4%, highlighting the event’s special appeal for families.

Everybody needs some seasonal cheer – and the sheer variety of holiday-themed events and festivals means there’s something for everybody. How will Christmas stores fare as the retail environment continues to evolve? And how will shifting urban landscapes impact local events, parades, and festivals in the years to come?

Follow Placer.ai’s data-driven retail and civic analyses to find out.

College students make up a small percentage of the overall U.S. population. But they often have money to spend – and back-to-college shopping is a significant driver of retail sales. This year in particular, students heading back to school were expected to spend record amounts on dorm decor, clothing, and other campus essentials. And since today’s college students make up a large chunk of tomorrow’s affluent consumers, retailers across industries are eager to cement positive relationships with the segment.

So with fall semester just under way, we dove into the data to explore the spending habits of today’s undergraduate young adults. When do they shop? What do they like to buy? And what can retailers do to get their attention?

To get a sense of when collegians tend to do the most shopping, we analyzed the monthly share of college students in the captured markets of select retailers and segments, using audience segmentation data from Spatial.ai’s PersonaLive. And the analysis revealed that student consumer behavior follows a clear seasonal pattern.

In 2019, the share of college students in the captured markets of big box superstores like Target and Walmart peaked in August, and to a lesser extent in June, July, and September, as collegians enjoyed their summer vacations and did their back-to-school shopping. Additional upticks emerged in January, when many students were on winter break. But during regular school months, when midterms, finals, and homework likely kept many students hunkered down in the library, their share in the chains’ captured markets was much lower. While this pattern was disrupted in the wake of COVID, it returned in full force in 2022. Similar seasonality arose when looking at wider segments like apparel and off-price retail, as well as various dining categories.

In addition to seasonality, the above graphs also appear to indicate that despite their tight budgets, collegians don’t necessarily prioritize price over everything else. So to further explore the shopping preferences of college kids, we examined the share of the #College segment in the captured markets of popular chains across categories.

Trade area data seems to indicate that university students shop at Target, frequent non-off-price-apparel chains, eat at fast-casual restaurants – and make up smaller shares of the customer bases of less expensive alternatives. Indeed, as hard-up as they may be, undergrads know how to splurge and are willing to pay for high quality stuff. They can’t get enough Urban Outfitters and love mid to higher range brands like Madewell and lululemon athletica.

At the same time, college students are highly oriented to thrift shops – especially those like Buffalo Exchange and Plato’s Closet, where they can sell their old clothes and snag stylish, name-brand items for a steal.

Of course, the share of collegians in the captured market of any given retailer or segment can also be impacted by the behavior of other demographics. For example, if a particular chain attracts an extremely broad audience, a lower relative share of college students may indicate that their presence is being offset by other segments. Still, while a small share of collegians in a chain’s trade area may not necessarily mean that the chain does not appeal to this group, a disproportionate share of students in a chain’s captured market is a strong indication that the brand is embraced by this demographic.

And chains which see a smaller share of college students among their customer base may draw an outsize proportion of undergrads during peak season. Walmart’s captured market, for example, was just 14.0% over-indexed for the #College segment between September 2022 and August 2023, compared to a nationwide baseline. But looking just at August 2023 – peak college Back to School shopping season – the share of #College students in its captured market was 94.0% higher than the nationwide average. Walmart also enjoyed higher-than-average shares of collegians in September, June, July, January, and to a lesser extent – October. Dollar Tree, too, attracted an outsize share of collegians in the summer and in January.

Collegian shopping habits are shaped by the rhythms of campus life. And while students are budget-conscious, they place a high premium on quality and are willing to spend money on things that are important to them. Brands that can lean into college students’ seasonal groove – while providing the products they crave at price points that don’t break the bank – will be poised to win over this demographic, gaining customers that may stay with them for life.

How will college spending habits continue to evolve as the school year progresses? Which brands will stand out as collegian favorites?

Follow Placer.ai’s data-driven insights to find out.

1. Idaho and South Carolina have emerged as significant domestic migration magnets over the past four years. Between January 2021 and 2025, both states gained over 3.0% of their populations through domestic migration. Other Mountain and Sun Belt states – including Nevada, Montana, and Florida – also drew significant inflow, while California, New York, and Illinois experienced the greatest outmigration.

2. Interstate migration cooled noticeably in 2024. During the 12-month period ending January 2025, California, New York and Illinois saw their outflows slow dramatically, while domestic migration hotspots like Georgia, Texas, and Florida saw inflows flatten to zero. A similar cooling trend emerged on a CBSA level.

3. Still, some states continued to see notable relocation activity over the past year. In 2024, Idaho, South Carolina, and North Dakota drew the most relocators relative to their populations. And among the nation’s ten largest states, North Carolina led with an inflow of 0.4%.

4. Phoenix remained a rare bright spot among the nation’s ten largest metro areas. The CBSA was the only major analyzed hub to maintain positive net domestic migration through 2024.

Over the past several years, the United States has experienced significant domestic migration shifts, driven by factors like remote work, housing affordability, and regional economic opportunities. As some areas reap the benefits of population inflows, others grapple with outflows tied to higher living costs and evolving workplace dynamics.

This report dives into the location analytics to explore where Americans have moved since 2021 – and how these patterns began to change in 2024.

Since 2021, Americans have flocked toward warmer climates, expansive natural scenery, and more affordable housing options – particularly in the Mountain and Sun Belt states.

Between January 2021 and January 2025, South Carolina led the nation in positive net domestic migration – drawing an influx of newcomers equivalent to 3.6% of its January 2025 population. (This metric is referred to as a state’s “net migrated percent of population.”) Next in line was Idaho with a 3.4% net migrated percent of population, followed by Nevada, (2.8%), Montana (2.8%), Florida (2.1%), South Dakota (2.1%), Wyoming (2.0%), North Carolina (2.0%), and Tennessee (1.9%). Texas saw positive net migration of just 0.9% during the same period. However, the Lone Star State’s large overall population means a substantial number of newcomers in absolute terms.

Meanwhile, California (-2.2%), New York (-2.1%), and Illinois (-1.9%) experienced the greatest outflows relative to their populations. This exodus was driven largely by soaring housing costs and the rise of remote work, which lowered barriers to moving out of high-priced areas.

Between January 2024 and January 2025, many of the same broad patterns persisted, but at a more moderate clip – suggesting a stabilization of domestic migration nationwide. This leveling off could reflect factors such as rising mortgage interest rates, which dampened home buying and selling, as well as the increased push for employees to return to the office.

Still, South Carolina (+0.6%) and Idaho (+0.6%) remained among the top inflow states. The two hotspots were joined – and slightly surpassed – by North Dakota (+0.8%), where even modest waves of newcomers make a big impact due to the state’s lower population base. A wealth of affordable housing and a strong job market have positioned North Dakota as a particularly attractive destination for U.S. relocators in recent years. And Microsoft and Amazon’s establishment of major presences around Fargo has strengthened the region’s economy.

Meanwhile, California (-0.3%), New York (-0.2%), and Illinois (-0.1%) continued to post negative net migration, but at a markedly slower rate than in prior years. And notably, several states that had been struggling with outflow, such as Michigan, Minnesota, Virginia, Ohio, and Oregon, began showing minor positive inflow during the same 12-month window. As home affordability erodes in pandemic-era hot spots like the Mountain states and Sun Belt, these areas may emerge as new destinations for Americans seeking lower costs of living.

Zooming in on the ten most populous U.S. states offers an even clearer picture of how domestic migration patterns have stabilized over the past year. The graph below shows a side-by-side comparison of domestic migration patterns during the 36-month period ending January 2024 and the 12-month period ending January 2025.

California, New York, and Illinois saw population outflows slow dramatically during the 12 months ending January 2025 – while domestic migration magnets such as Georgia, Texas, and Florida saw inflow flatten to zero. Meanwhile, Ohio, Michigan, and Pennsylvania flipped from slightly negative to slightly positive net migration – incremental upticks that could signal a possible turnaround.

The only “Big Ten” pandemic-era migration magnet to maintain strong inflow in 2024 was North Carolina – which saw a 0.4% influx in 2024 as a result of interstate moves.

A closer look at the top four states receiving outmigration from California and New York (October 2020 to October 2024) reveals that residents leaving both states tended to settle in nearby areas or in Florida.

Among those leaving New York, 37.4% ended up in neighboring states – 21.1% moved to New Jersey, 9.2% to Pennsylvania, and 7.1% to Connecticut. But an astonishing 28.8% decamped all the way to the Sunshine State, trading the Northeast’s colder climate for Florida sunshine.

Similarly, 20.1% of California leavers chose to stay nearby, moving to Nevada (11.5%) or Arizona (8.6%). Another 19.1% moved to Texas, and 8.0% moved to Florida, making it the fourth-largest destination for Californians.

Zooming in on CBSA-level data – focusing on the nation’s ten largest metropolitan areas, all with over five million people – reveals a similar picture of slowing domestic migration over the last year.

Los Angeles, New York, Chicago, and Washington, D.C. – four cities that experienced notable population outflows between January 2021 and January 2024 – saw those outflows flatten considerably. For these metros, this leveling-off may serve as a promising sign that the waves of departures seen in recent years may have begun to subside. Conversely, Houston and Dallas, which both welcomed positive net migration between January 2021 and January 2024, registered zero-net domestic migration in 2024. Atlanta, for its part, remained flat in both of the analyzed periods.

In Miami, however, outmigration persisted at a substantial rate. Despite Florida’s overall status as a domestic migration magnet, Miami lost 2.6% of its population to domestic net migration between January 2020 and January 2024 – and another 1.0% between January 2024 and January 2025. As one of Florida’s most expensive housing markets, Miami may be losing some residents to other parts of the state or elsewhere in the region. Meanwhile, Philadelphia, which lost 0.3% of its population to net domestic migration between January 2021 and January 2024, continued losing residents at a slightly faster pace in 2024 – another 0.3% just last year.

Of the ten biggest CBSAs nationwide, only Phoenix continued to see a net domestic migration gain through 2024 (+0.2%). This highlights the CBSA’s continued draw as a (relative) relocation hotspot even in 2024’s cooling market.

Who are the domestic relocators heading to Phoenix?

From October 2020 to October 2024, the top five metro areas sending residents to the Phoenix CBSA each registered median household incomes (HHIs) of $73K to $98K – surpassing Phoenix’s own median of $72K. This suggests that many of those moving in are arriving from wealthier, often more expensive metro areas – for whom even Phoenix’s high-priced market may offer more affordable living.

Overall, domestic migration patterns appear to have cooled in 2024, reflecting economic and societal trends that have slowed the rush from pricey coastal hubs to more affordable regions. Yet states like South Carolina, Idaho, and North Dakota – as well as metro areas like Phoenix – continue to attract new arrivals, paving the way for evolving regional demographics in the years to come.

In today’s retail landscape, consumer behavior is influenced by a multitude of factors, directly impacting the success of products and brands. This report explores the latest trends in value perception, shopping behavior, and media consumption that impact which brands consumers are most likely to engage with – and how.

In the apparel space, consumers continue to prioritize value and unique merchandise.

Analysis of visits to various apparel categories reveals a steady increase in the share of visits going to off-price retailers and thrift stores at the expense of traditional apparel chains.

And the popularity of off-price chains and thrift stores appears to be widespread across multiple audience segments. Analyzing trade area data with the Experian: Mosaic psychographic dataset reveals a clear preference for second-hand retailers among both younger (ages 25-30) and older (51+) consumer segments. Meanwhile, middle-class parents aged 36-45 with teenagers – the “Family Union” segment – are significantly more likely to shop at off-price apparel stores, highlighting their emphasis on buying new, while saving both time and money.

This suggests that the powerful blend of treasure-hunting and deep value, central to both the off-price and thrift experiences, is driving traffic from a variety of audiences, and that other industries could benefit from combining affordability with the allure of unique products.

Diving deeper into the location intelligence for the apparel space further highlights thrift and off-price’s broad appeal – and that a combination of quality and price motivates consumers to visit different retailers.

Between 2019 and 2024, the share of Bloomingdale’s, Saks Fifth Avenue, Neiman Marcus, and Nordstrom visitors that also visited a Goodwill or Ross Dress for Less increased significantly.

And while this could mean that the current economic climate is causing some higher-income consumers to trade down to lower-priced retailers, it could also be that consumers are prioritizing sustainability and seeking value in terms of “bang for their buck” – shopping a combination of retailers depending on the cost versus quality considerations for each purchase.

Consumers increasingly expect to shop on their own terms, opting for a more flexible shopping experience that blurs the lines between traditional retail channels and categories.

Superstores and warehouse stores, for example, often evoke the image of navigating aisle after aisle of nearly every product imaginable – a time-consuming endeavor given the sheer size of their stores. But the latest location intelligence shows that more consumers are turning to these retailers for super-quick shopping trips.

Between 2019 and 2024, the share of visits lasting less than ten minutes at Target, Walmart, BJ’s Wholesale Club, Sam’s Club, and to a lesser extent Costco, rose steadily – perhaps due to increased use of flexible BOPIS (buy online, pick-up in-store) and curbside pick-up options. These stores may also be seeing a rise in consumers popping in to grab just a few items as-needed or to cherry-pick particular deals to complement their larger online shopping orders.

This trend highlights the demand for frictionless store experiences that allow visitors to conveniently shop or pick up orders even at large physical retailers.

And the breaking down of traditional retail silos isn’t limited to big-box chains. Diving into the data for quick service restaurants (QSR), fast casual chains, and grocery stores indicates that more consumers are also looking for new ways to grab a convenient bite.

Since 2019, grocery stores have been claiming an increasingly large share of the midday short visit pie – i.e. visits between 11:00 AM 3:00 PM lasting less than ten minutes – at the expense of QSR chains. This suggests that consumers seeking quick and affordable lunches are increasingly turning to grocery stores to pick up a few items or take advantage of self-service food bars. Notably, the rise in supermarket lunching hasn’t come at the expense of fast-casual restaurants, which have also upped their quick-service games – and have seen a small increase in their share of the quick lunchtime crowd over the past five years.

While some of QSR’s relative decline in short lunchtime visits could be due to discontent with rising fast-food prices, it’s clear that an increasing share of consumers see grocery and fast-casual chains as viable options during the lunch rush.

In 2025, tapping into hot trends and creating viral moments are among the most powerful tools for amplifying promotions and driving foot traffic to physical stores.

Retailers across categories have successfully harnessed the power of pop culture collaborations to generate excitement – and visits – by leaning into trending themes. On October 8th, 2024, for example, Wendy’s launched its epic Krabby Patty Collab, inspired by the beloved SpongeBob franchise. And during the week of the offering, the chain experienced a remarkable 21.5% increase in foot traffic compared to an average week that year.

Similarly, Crumbl – adept at creating buzz through manufactured scarcity – sparked a frenzy with the debut of its exclusive Olivia Rodrigo GUTS cookie. Initially available only at select locations near the artist’s concert venues, the cookie was launched nationwide for a limited time from August 19th to 24th, 2024. This buzz-driven release resulted in a 27.7% traffic surge during the week of the launch, as fans rushed to get a taste of the star-studded treat.

And it’s not just dining chains benefiting from these pop-culture moments. On February 16th, 2025, Bath & Body Works launched a Disney Princess-inspired fragrance line, perfect for fans of Cinderella, Ariel, Belle, Jasmine, Moana, and Tiana. The collaboration resonated, fueling a 23.2% visit spike for the chain.

While tapping into existing pop-culture trends has the ability to drive traffic, so does creating a new one. Analysis of movie theater visits on National Popcorn Day (Sunday, January 19th, 2025) shows how initiating a trend can spur social media engagement and impact in-person traffic to physical retail spaces.

National Popcorn Day was a successful promotional holiday across the movie theater industry in 2025. Both Regal Cinemas and AMC Theatres offered popcorn-based promotions on the day, but Cinemark’s “Bring Your Own Bucket” campaign, in particular, appears to have spurred a significant foot traffic boost during the event.

Visits to Cinemark on National Popcorn Day in 2025 increased 57.5% relative to the Sunday visit average for January and February 2025, as movie-goers showed off their out-of-the-bucket popcorn receptacles on social media. Clearly, by starting a trend that invited creativity and expression, Cinemark was able to amplify the impact of its National Popcorn Day promotion.

Location intelligence illuminates some of the key trends shaping consumer behavior in 2025. The data reveals that value-driven shopping, demand for flexibility across touchpoints, and the power of unique retail moments have the power to drive consumer engagement and the success of retail categories, brands, and products.

Placer.ai observes a panel of mobile devices in order to extrapolate and generate visitation insights for a variety of locations across the U.S. This panel covers only visitors from within the United States and does not represent or take into account international visitors.

Downtown districts in the nation’s major cities attract domestic travelers all year long with their iconic sights, lively entertainment, and diverse dining offerings. But each hub follows its own rhythm, shaped by distinct seasonal peaks and dips in visitor flow.

This white paper examines downtown hotel visitation patterns in four of the nation’s most popular destinations for domestic tourists: Miami, Chicago, New York, and Los Angeles. Focusing on 20 downtown hotels in each city, the analysis explores seasonal variations in domestic travel, city-specific dynamics, and differentiating factors.

Domestic tourism has rebounded strongly in recent years, and hotels in Miami and Chicago have been the biggest beneficiaries. In 2024, visits to analyzed hotels in each of these cities’ downtown areas grew by 8.9% and 7.4%, respectively, compared to 2023. Meanwhile, hotels in downtown and midtown Manhattan saw a more modest 2.0% increase, while Los Angeles experienced a slight year-over-year (YoY) decline in downtown hotel visits.

One factor that may be driving Miami and Chicago’s stronger performance is their higher proportion of long-distance visitors, defined as those visiting from over 250 miles away. Miami remains a top destination for snowbirds and spring breakers, while Chicago serves as a cultural and entertainment hub for the sprawling Midwest. These long-distance leisure travelers may be more likely to splurge on downtown hotel stays during their trips, helping drive hotel visit growth in the two cities.

By contrast, hotels in the Los Angeles and Manhattan city centers drew lower shares of domestic travelers coming from less than 250 miles away. These shorter-haul domestic tourists may be less likely to splurge on downtown hotels than those taking longer vacations. Both cities are also surrounded by numerous regional getaway options that can draw long-haul leisure travelers away from their downtown cores.

Each of the four analyzed cities has its own unique ebbs and flows – and city center hotel visits reflect these patterns. Miami, with its warm, sunny climate, experiences influxes of tourists during the winter and spring, with March seeing the biggest jump in downtown hotel visits last year (13.0% above the monthly visit average). Chicago, which thrives in the summer with its many festivals and events, saw its biggest downtown hotel visit bump in August. Meanwhile, Manhattan experienced a major uptick in December, likely fueled by holiday tourism and New Year celebrations, and Los Angeles visits were highest in the summertime.

What drives these seasonal visit peaks? Miami has long been a top tourism destination, especially in early spring, when snowbirds and spring breakers flock to the city for sun and relaxation. In recent years, the city has seen a rise in short-term domestic tourism, suggesting that the city is becoming increasingly popular for weekend getaways. According to the Placer.ai Tourism Dashboard, the share of domestic tourists staying just one or two nights grew from 71.7% in March 2022 to 78.3% in March 2024.

This shift aligns with an impressive increase in the magnitude of downtown Miami’s springtime hotel visit peak: In March 2022, visits to downtown hotels were 5.0% above the monthly average for the year, a share that more than doubled by 2024 to 12.9%.

These numbers may mean that more people are choosing to head to Miami for a quick break from the cold – and staying in downtown hotels to make the most of their short getaway.

Chicago’s major August visit spike was likely driven by the Windy City’s impressive lineup of major summer festivals, from Lollapalooza to the Chicago Air and Water Show, which draw thousands of attendees from across the country.

Lollapalooza fueled the largest visit spike to the city – between Thursday, August 1st and Sunday, August 4th, visits to downtown Chicago hotels surged between 51.1% and 63.8% above 2024 daily averages for those days of the week. The Air and Water Show and the Chicago Jazz Festival also generated significant hotel visit increases – highlighting the boost these events bring to the city’s tourism and hospitality sector.

The Big Apple draws a diverse mix of visitors throughout the year. But in December – the city’s peak tourist season – visitors pour in from all over the country to skate in Rockefeller Center, browse Fifth Avenue’s festive window displays and experience the city’s unique holiday magic.

And analyzing data from hotels in midtown and downtown Manhattan reveals a striking shift in the types of visitors who stay in the heart of NYC during the holiday season. While visitors from other urban centers dominated downtown hotel stays throughout most of the year – accounting for 47.9% of visits from January to November 2024 – their share dropped to 42.0% in December 2024. Meanwhile, the share of guests from suburban areas and small towns rose from 37.3% to 41.0%, and the share of guests from rural and semi-rural areas nearly doubled, from 3.5% to 6.1%.

These patterns suggest that, though Manhattan typically attracts a wide range of visitors, the holiday season is uniquely appealing to tourists from smaller towns and suburban areas. Understanding these trends can provide crucial context for hotels and civic stakeholders alike as they work to maximize the opportunities presented by the city’s December visit surge.

Los Angeles hotels also experience significant demographic shifts during peak season. In July, visits to downtown LA hotels surged by 15.3% relative to the 2024 monthly visit average. And a closer look at audience segmentation data suggests a corresponding surge in the share of "Flourishing Families" – an Experian: Mosaic segment consisting of affluent, middle-aged households with children. Throughout the year, "Flourishing Families" comprised between 7.7% and 8.7% of the census block groups (CBGs) driving visits to downtown LA hotels. But in July, this share jumped to 9.9%.

These families may be taking advantage of summer vacations to enjoy Los Angeles’ cultural attractions and entertainment. Hotels and city stakeholders who understand the appeal the city holds for this demographic can better cater to them through family-friendly promotions and strategic marketing efforts to target these households.

Downtowns are making a comeback – and hotels in the heart of the nation’s major tourist hubs are reaping the benefits. By understanding who frequents these downtown hotels and when, local businesses and civic leaders can optimize their resource management and strategic planning to make the most of these opportunities.