.svg)

.png)

.png)

.png)

.png)

Shoppers continue to prioritize value in 2024, offering opportunities for discount and dollar stores to thrive during the upcoming holiday season.

With that in mind, we took a look at visitation metrics – both from 2024 and from previous years – to see how the segment is performing and what the crucial holiday season might hold for discount retailers Dollar Tree and Dollar General.

Discount and dollar stores continue to benefit from an inflation-impacted economy, with category leaders like Dollar Tree and Dollar General continuing to expand their footprints to serve the increasing number of budget-conscious shoppers.

And in large part thanks to the increased store count, visits to Dollar Tree and Dollar General have continued to increase – Q3 2024 visits to the chains were up by 5.3% and 4.8% YoY, respectively. Monthly visits also showed impressive growth, with October 2024 visits up by 7.6% at Dollar Tree and 7.8% at Dollar General. These growth numbers may be slightly lower than the visit increases posted by the category in the past – but the ongoing positive performance by discount & dollar store leaders indicates that the category remains one of the most consistently strong players in the wider retail space.

November and December are typically the most important months for retailers as multiple shopping events – Turkey Wednesday, Black Friday, Christmas Eve Eve, and Boxing Day – drive consumers to the tills. And while many retailers open the holiday season with visit spikes driven by big Black Friday discounts, the visitation patterns look slightly different at discount chains, where prices are already low and discounts are – as their name implies – already applied. So when do these retailers get their holiday visit boosts?

Comparing weekly visit numbers in 2021, 2022, and 2023 to each year’s weekly average reveals differences between the two discount & dollar store leaders. Visits to Dollar Tree gradually increase from early November onward and peak on the last full week before Christmas, likely driven by shoppers flocking to its stores to pick up snacks, gift wrap, and stocking stuffers. Meanwhile, Dollar General’s visits exhibited more stability – although visits were higher than average between Black Friday and Christmas Eve Eve, the increase was much more muted relative to Dollar Tree’s holiday spike. Dollar General’s softer holiday traffic may be due to the expansion of its Dollar General Market concept, which turned many of its stores into destinations for fresh foods – so consumers may be treating Dollar General more like a grocery store and less like a holiday shopping spot.

Previous years’ visitation patterns indicate that the busiest time of the year is still ahead for Dollar General and Dollar Tree. How will these retailers perform during the critical pre-Christmas rush? Visit Placer.ai to find out.

Heading into the Q3 2024 retailer reporting period, most expected Walmart to continue gaining market share from essentials-focused retailers. In our coverage of Walmart’s Q2 2024 update, we highlighted the chain’s significant disruption in the grocery category, driven by everyday low pricing, Walmart+ store delivery orders, store remodeling efforts, an improved selection of premium merchandise, and a broadened marketplace offering. These strategies notably boosted visits among higher-income households earning $100,000 or more annually.

While Walmart did indeed disrupt essentials retailers this quarter, what stood out even more was its impact across discretionary categories. Management reported low-single-digit comparable sales growth in general merchandise, with mid-single-digit unit growth offsetting low-to-mid single-digit price deflation. Categories like home, toys, and hardlines led this growth, complemented by strength in beauty, fashion, and apparel. Walmart’s marketplace played a key role in this success, offering consumers a broader selection of brands and items than in-store. Marketplace sales in beauty, toys, hardlines, and home each grew by 20% year-over-year.

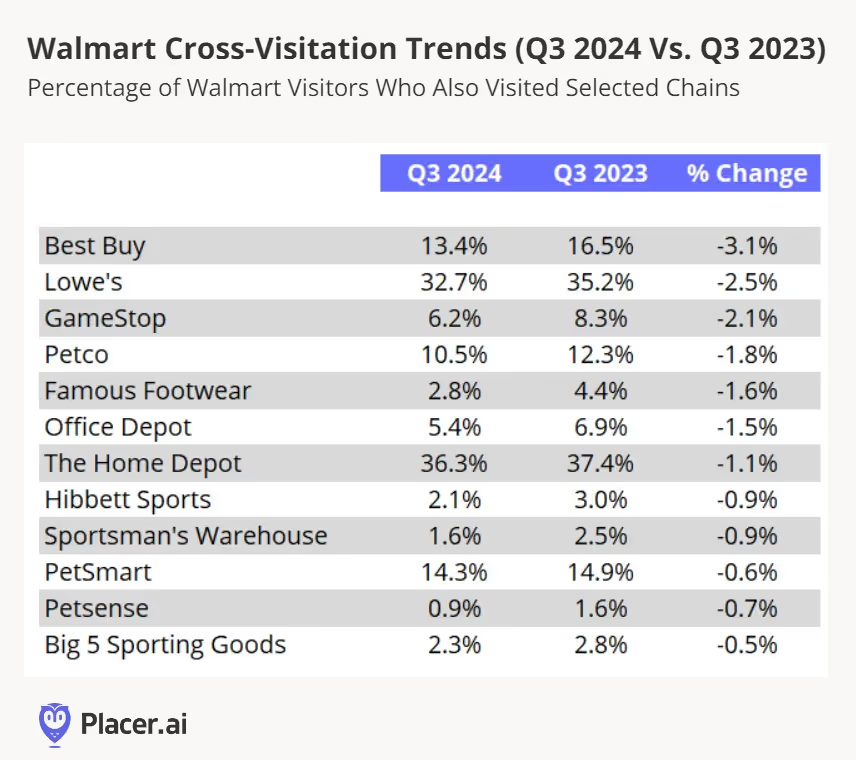

To assess Walmart’s impact on other general merchandise retailers, we analyzed cross-visitation trends. Our data indicates that year-over-year cross-visitation between Walmart and other hardgoods retailers like Best Buy, GameStop, Lowe’s, Home Depot, Hibbett Sports, Sportsman Warehouse, and Big 5—as well as pet retailers like Petco and PetSmart—declined. This suggests a potential shift in consumer behavior, with shoppers consolidating more of their general merchandise purchases at Walmart.

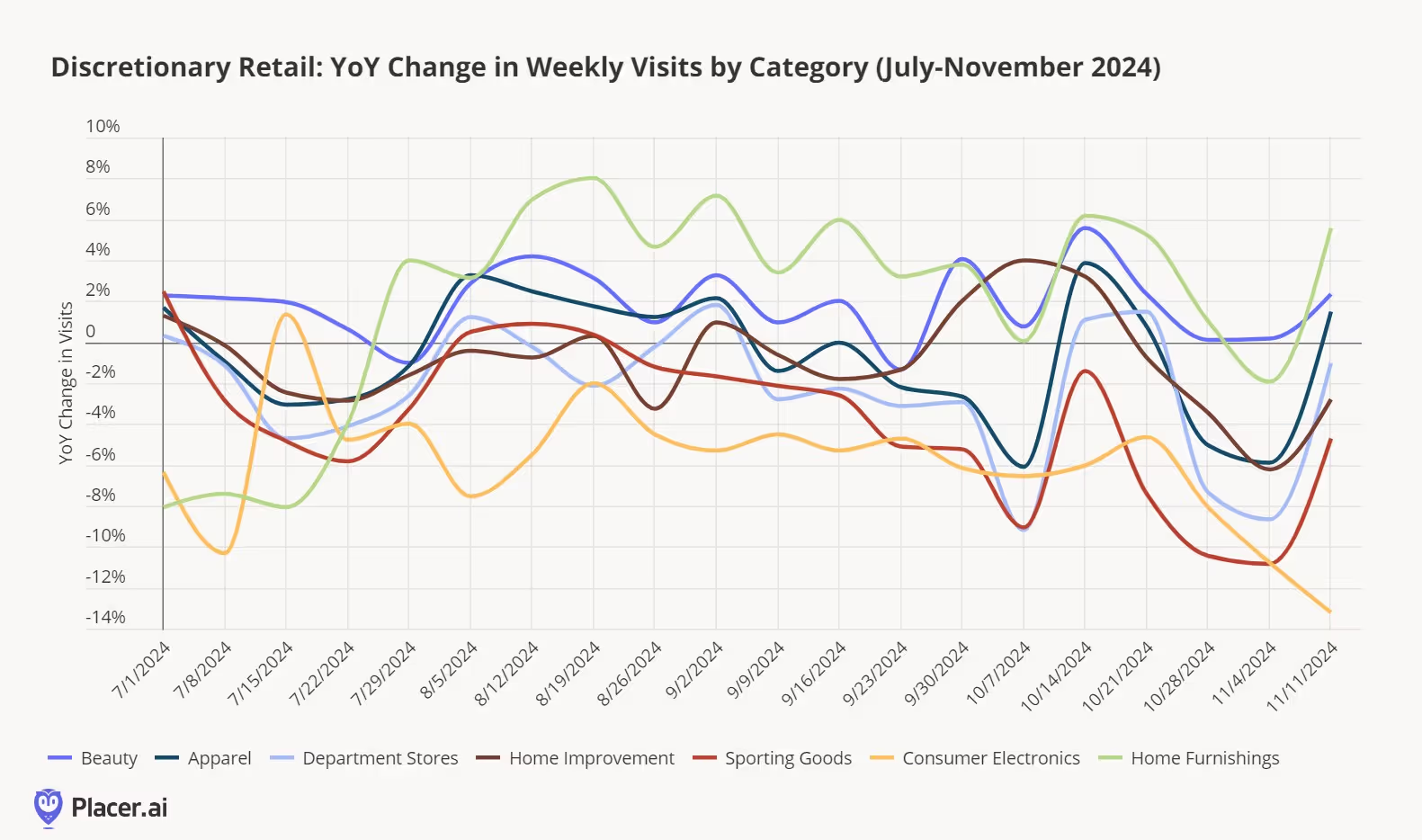

To confirm Walmart's impact on general merchandise, we analyzed visitation trends across several discretionary categories from July to November 2024 (below). With the exceptions of beauty and home furnishings—more on that category in a minute—most categories experienced year-over-year declines throughout much of the August to October quarter. Notably, mid-October brought a temporary improvement in visit trends, coinciding with major promotional events such as Amazon’s Big Deal Days, Walmart’s Holiday Deals Event, and Target’s Circle Week, underscoring how deal-driven consumers are in today’s environment. Following these promotions, shopping activity largely paused until last week, when Black Friday deal announcements began to drive renewed interest.

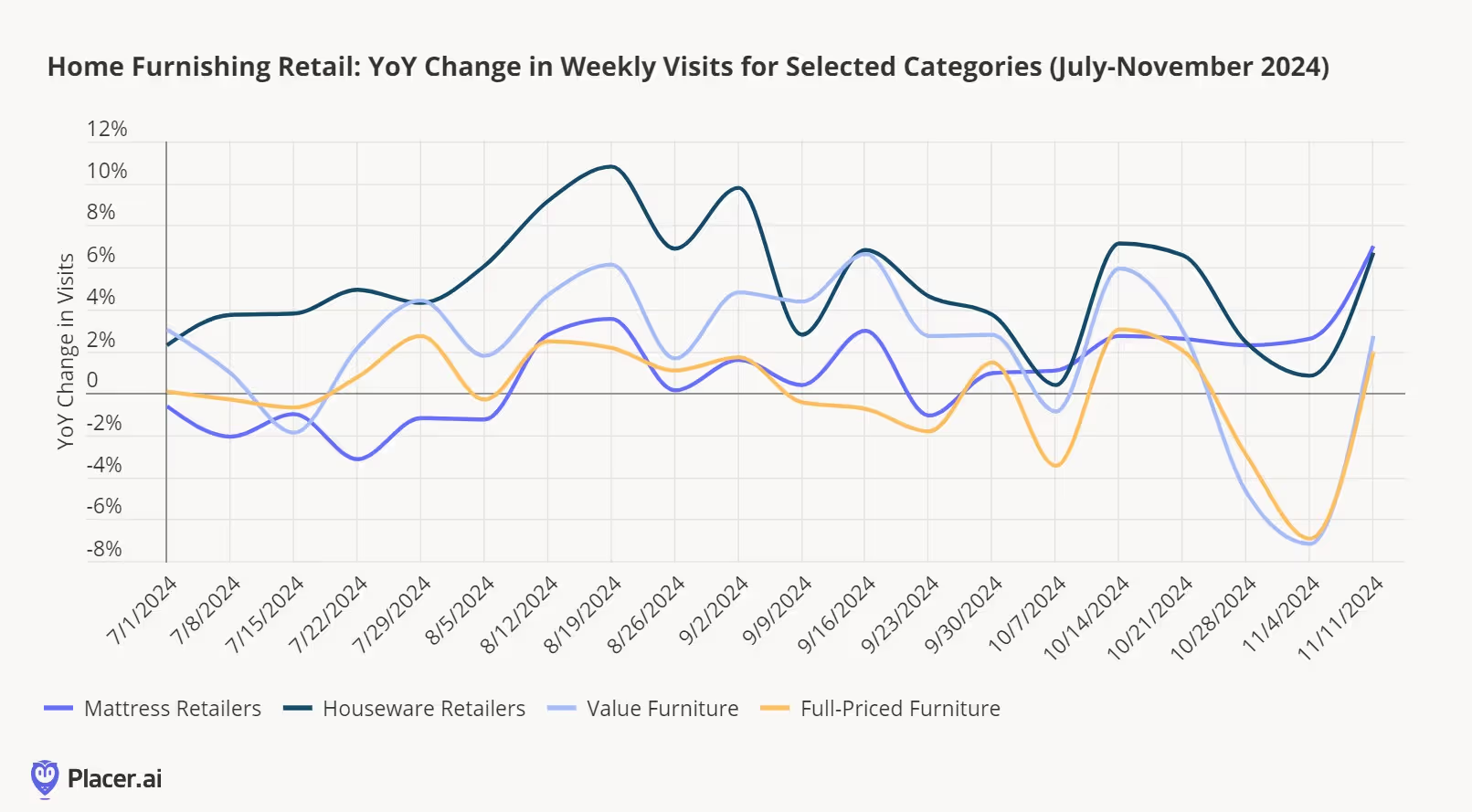

Home furnishings deserve a closer look. Earlier this year, we noted strong visit trends in housewares retail, and that momentum has largely continued. Mattress retailers, which began the year on a high note, have also maintained positive year-over-year visitation growth in the second half of 2024. Notably, furniture retailers—both value-focused and full-priced—saw year-over-year visitation gains during the quarter, though there was a slight pause in November as consumers waited for Black Friday deals.

These trends align with the third-quarter 2024 update from Williams-Sonoma, where management highlighted improvements in furniture sales at its West Elm and Pottery Barn brands. Additionally, the company cited strength in seasonal items and housewares, suggesting that Walmart’s strong performance in the home category reflects both broader industry trends and its own merchandising improvements. These patterns may also mark the early stages of a new home furnishings cycle as we near the five-year anniversary of the COVID-19 pandemic.

Walmart’s strong performance in discretionary categories serves as a warning to other discretionary retailers to elevate their strategies ahead of the holiday shopping season. With in-store merchandise enhancements and a robust third-party marketplace offering access to over 700 million stock-keeping units (SKUs), Walmart is positioned to be even more competitive this holiday season.

With the rise of hybrid and remote work, we’ve observed a notable shift in everyday consumer behaviors, particularly around fitness, shopping, running errands, and grabbing takeout. Without the need to commute on certain days, it’s easier for consumers to squeeze in a workout or make a quick trip to a store. Local outdoor shopping centers have become prime beneficiaries of this new “pop-in, pop-out” behavior. Here, we explore some of the brands poised to thrive in this evolving landscape.

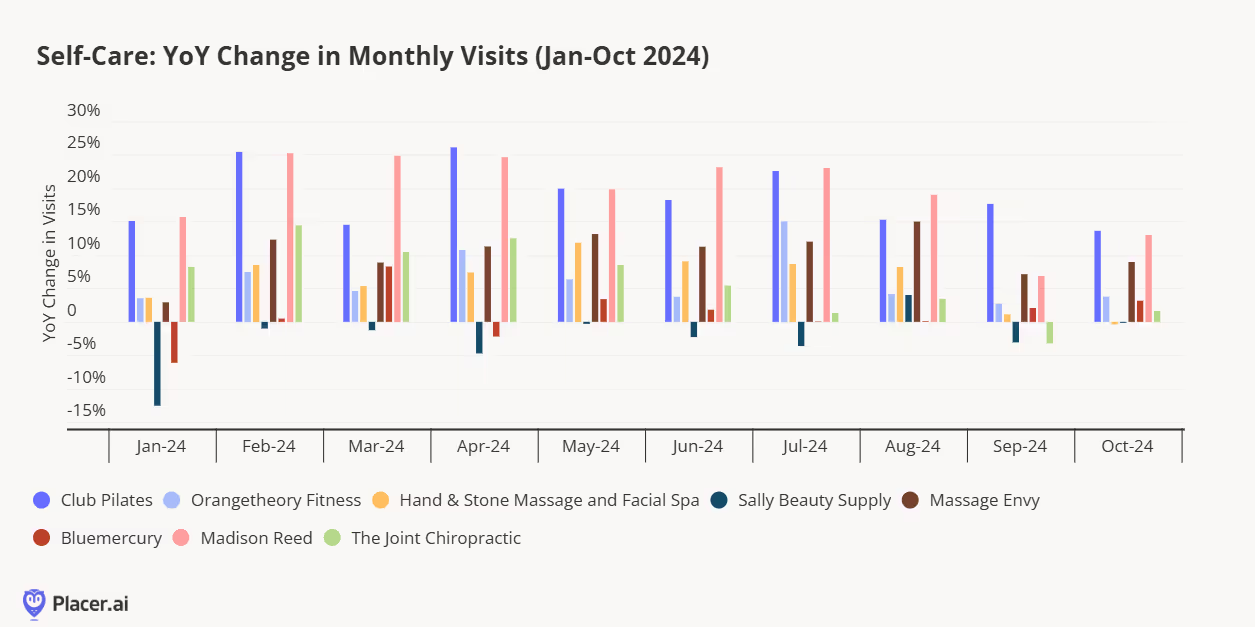

At the start of this year, we predicted that the beauty category boom we witnessed last year would persist, with wellness and self-care becoming integral parts of that definition. For many, self-care includes a good workout, whether low-impact or high-intensity. We've previously highlighted fitness trends, with brands like Club Pilates and Orangetheory Fitness continuing to demonstrate year-over-year growth. A perfect post-workout activity might include a massage or chiropractic session to ease sore muscles or restore alignment—services that have driven increased traffic for brands like Massage Envy and Joint Chiropractic. Another standout is Madison Reed, which offers "salon results without salon cost or time" and continues to expand its footprint.

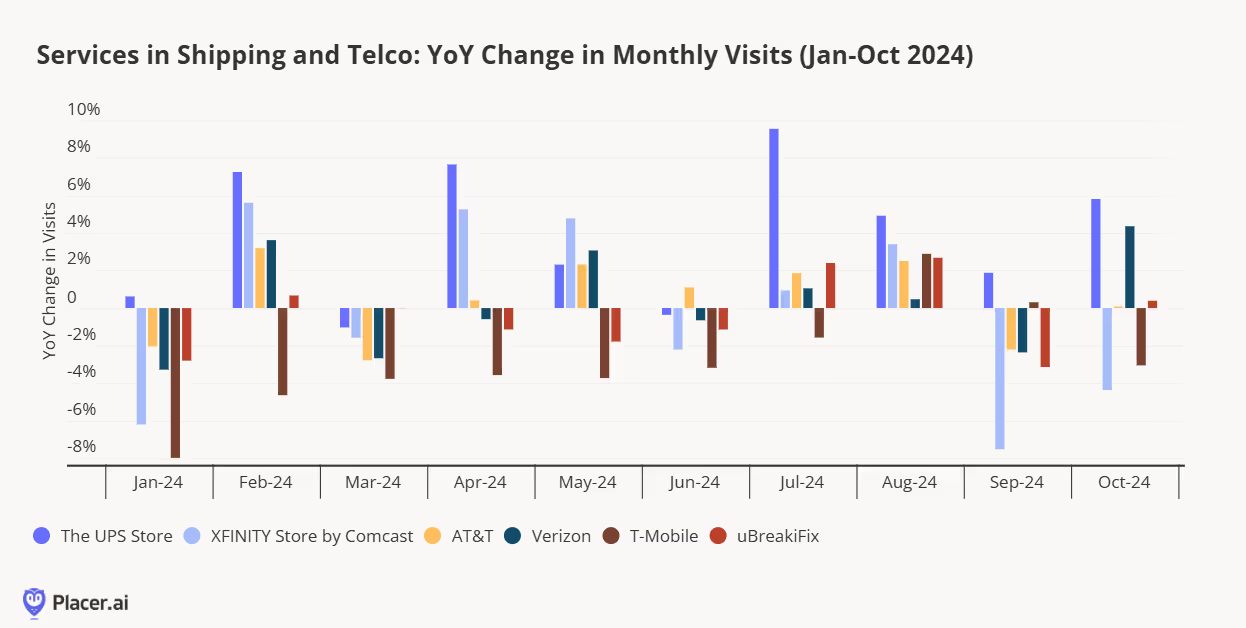

The next group of brands stands out for their ubiquity—you’re likely to find one or more of these stores in any local outdoor shopping center. UPS is indispensable for shipping and returning items, serving as a go-to for everyday logistics. Meanwhile, telecommunications and internet service providers like AT&T, Verizon, T-Mobile, and Xfinity maintain a steady customer base, driven by the regular upgrade cycle for cell phones and service plans.

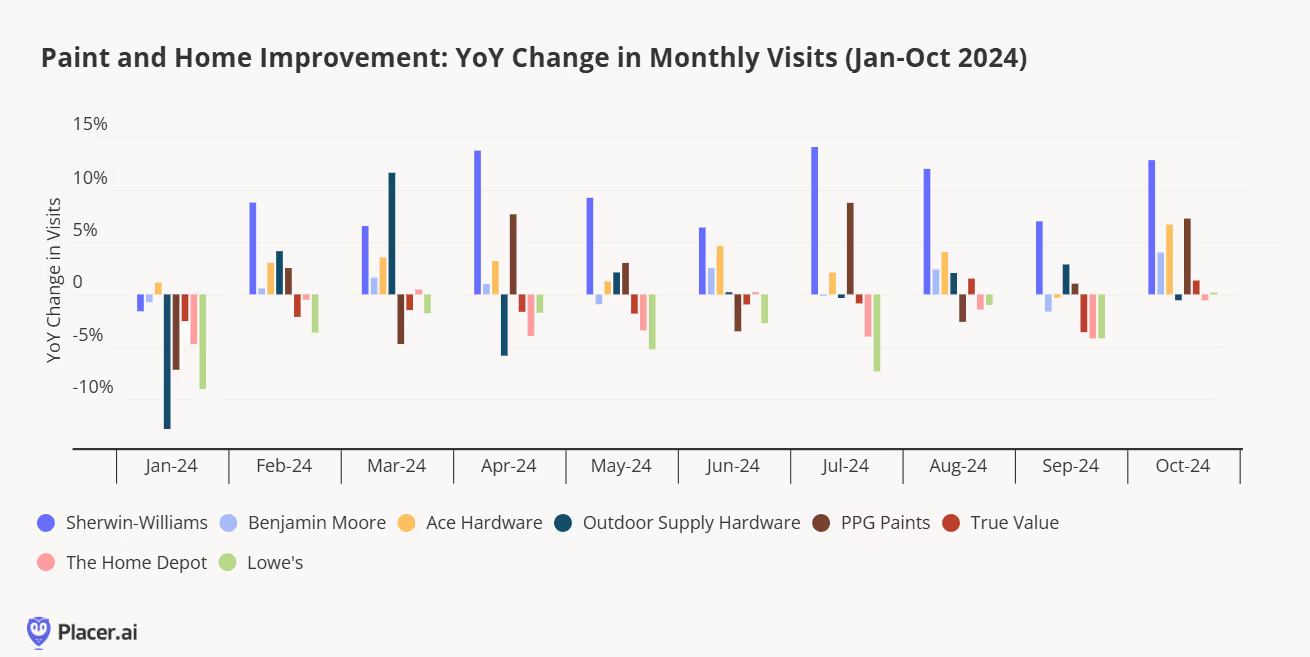

Another home improvement and furnishings replacement cycle may be upon us. Pandemic-driven nesting behaviors accelerated demand in previous years, but now, many consumers are cautiously approaching this phase. Instead of investing in big-ticket items like dining or living room furniture, there’s growing enthusiasm for budget-friendly updates, such as applying a fresh coat of paint. Sherwin-Williams stands out as a key player, experiencing increased foot traffic. This rise in paint store visits could signal a positive trend for future investments in home improvement, redecorating, and refurnishing.

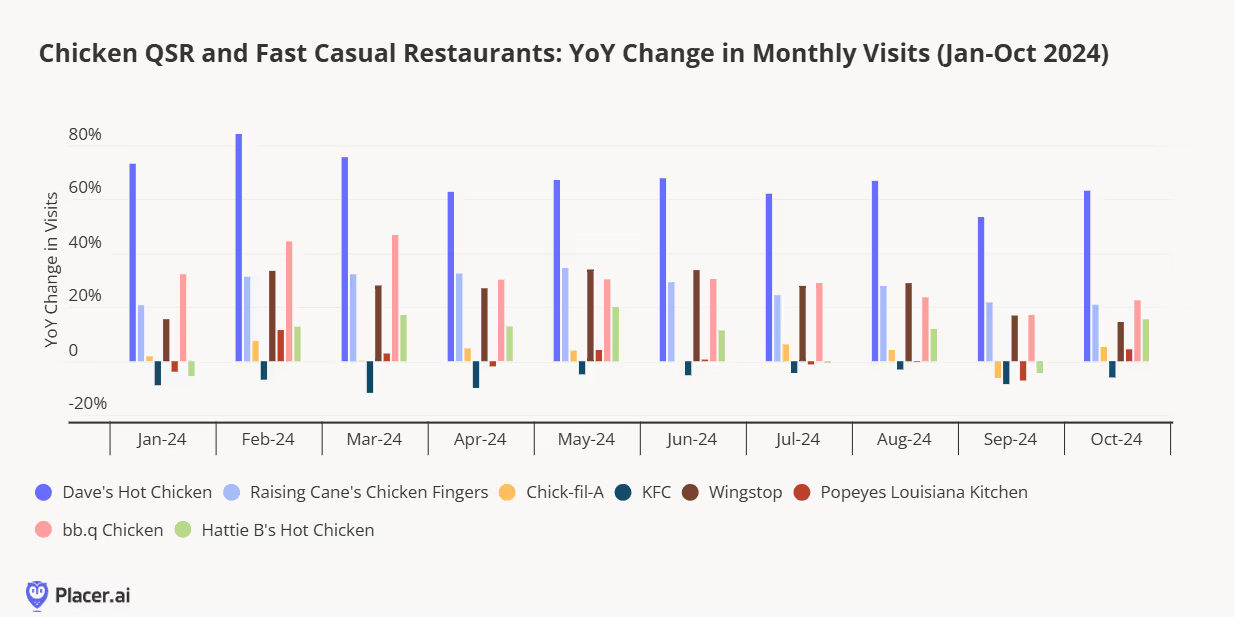

Next, we have some tasty additions perfect for local outdoor shopping centers. Americans’ love affair with chicken shows no signs of slowing down. Dave’s Hot Chicken has developed a cult following for its juicy, flavorful chicken, while Raising Cane’s draws loyal fans for its irresistible tenders and signature sauce. Bb.q Chicken offers a unique twist, boasting over a dozen wing flavors, including Caribbean Spice, Hot Mala, and Cheesling cheese dust.

With Black Friday just a week away, it's the perfect time to reflect on the state of retail and what lies ahead over the next 28 days as consumers prepare for holiday gatherings, celebrations, and gift-giving. The retail industry in 2024 has been anything but consistent—some categories continue to thrive, others have struggled, and a few are clawing their way back to prominence.

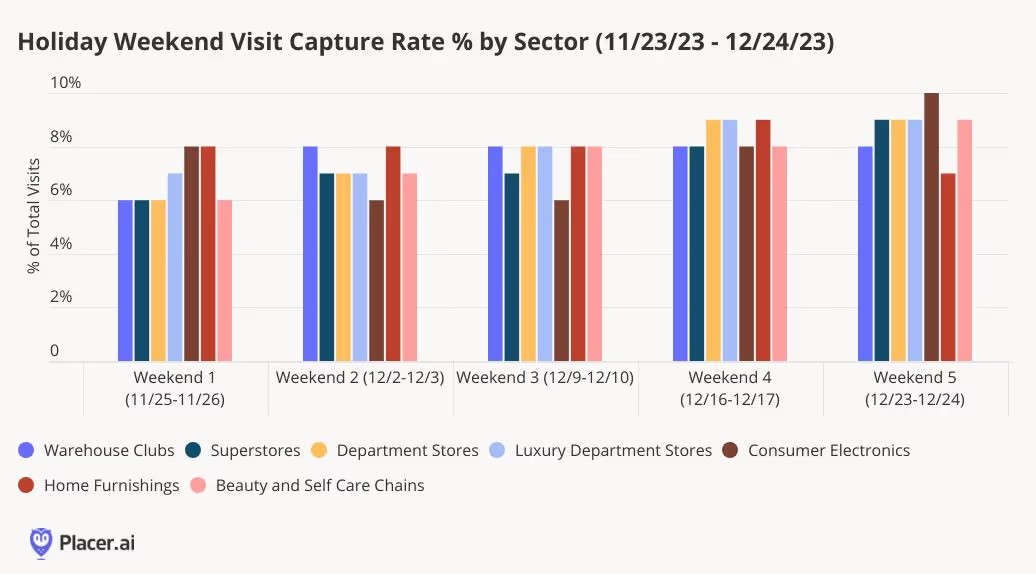

This year’s holiday season is likely to follow a similar pattern, but the key differentiator is time. As we highlighted in our TL;DR newsletter on LinkedIn this week, the 2024 holiday shopping period has five fewer days compared to last year, reminiscent of the 2019 vs. 2018 holiday timeline. Holiday shopping kicked off earlier this year, with department stores seeing increased activity in October. With a condensed holiday window, it’s now up to retailers to drive more frequent visits and encourage consumers to linger longer in their stores.

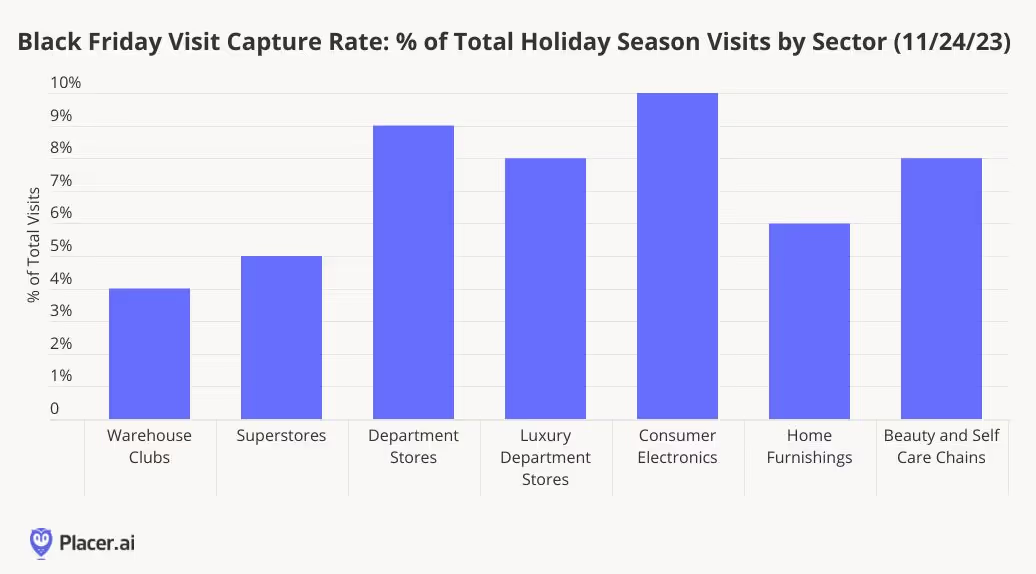

Analyzing daily visits during last year’s holiday season, there were five weekends compared to four this year. Across key holiday gifting retail categories in 2023, those five weekends (Saturday and Sunday combined) accounted for 39% of total holiday season visits, defined as Thanksgiving Day through Christmas Eve. Individually, each weekend contributed between 7% and 9% of total sector visitation, with the last two weekends each capturing 9%. In 2024, each weekend would need to account for approximately 10% of total holiday season visits to match last year’s pace.

One advantage of having fewer weekends between Thanksgiving and Christmas is the reduction in lull periods, which are traditionally challenging for retailers trying to attract visitors. This year, two of the four weekends include Black Friday weekend and Super Saturday. In 2023, Black Friday alone accounted for 7% of total holiday visitation across the analyzed sectors, meaning a strong Black Friday could help offset the impact of having fewer weekends. By sector, Black Friday holds particular importance for department stores and consumer electronics retailers, as they typically see a higher share of visits on that day compared to other categories.

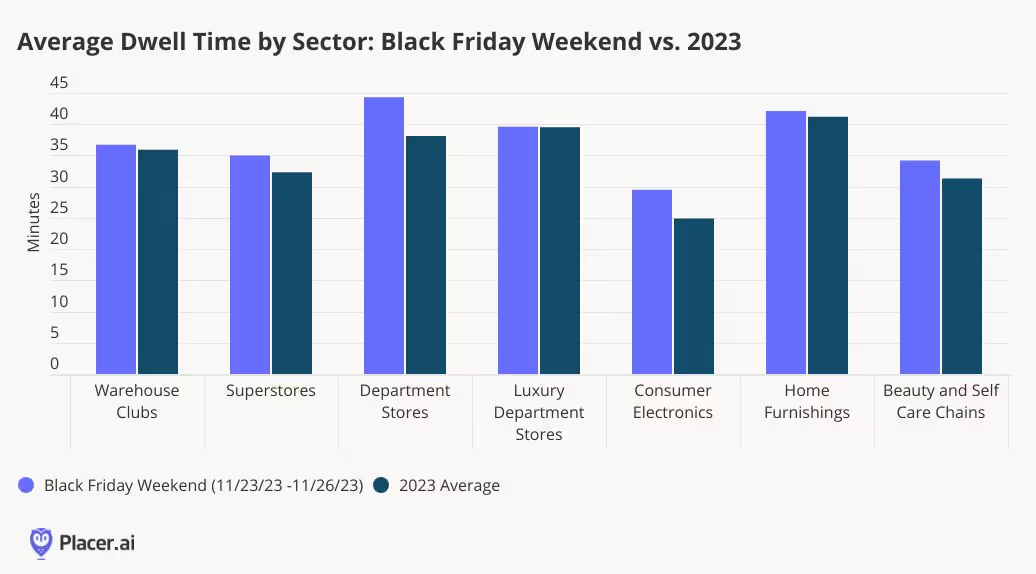

Another way to offset the five fewer shopping days? Increasing the time consumers spend in stores. In 2023, dwell times during Black Friday weekend (Thursday–Sunday) were, on average, three minutes longer than the full-year average across the analyzed sectors. Department stores had the largest gap, with visitors staying six minutes longer than average on Black Friday, followed by consumer electronics, superstores, and beauty retailers. These sectors are among the most popular for holiday shoppers during Black Friday weekend, making it encouraging that visitors stayed longer while seeking holiday deals.

A final advantage for physical retail is that fewer shopping days mean a shorter delivery window for e-commerce. With less time to shop, the holidays could sneak up on consumers, potentially driving more visitors into stores this year. While this is purely speculative, our enthusiasm for physical retail at Placer compels us to make at least one bold prediction!

The past several years have been a boom period for affordable indulgences – with consumers tightening their purse strings and finding inexpensive ways to treat themselves. Against this backdrop, discount specialty retailers Five Below and Ollie’s Bargain Outlet have been growing their footprints – and their audiences. But have the two chains reached their growth ceilings? How did they fare in Q3 2024 – and what can they expect this holiday season?

We dove into the data to find out.

Five Below opened a record 205 new stores last year, leaning into growing consumer demand for low-cost toys, decor, and other indulgences. And though the chain announced plans to moderate fleet growth following a below-target Q2 2024, visit data shows that overall, the chain remains well-positioned for continued success. In Q3 2024, Five Below’s growing footprint fueled a 13.8% chain-wide year-over-year (YoY) visit boost. Though the average number of visits to each individual Five Below location remained slightly below 2023 levels, the chain’s visit-per-location gap narrowed to 1.6% from 4.3% in Q2. And in some key growth markets, Five Below saw significant increases in both YoY visits and visits per location: California, one of Five Below’s biggest regional markets and the focus of a major expansion push this year, saw visits per location grow 4.4% amidst a 21.6% overall visit increase.

Ollie’s Bargain Outlet is another value-focused specialty retailer that has benefited from consumer trading down in recent years. And foot traffic data highlights the success of Ollie’s ongoing expansion: In Q3 2024, foot traffic to Ollie’s increased 7.5% YoY, while the average number of visits to each Ollie’s location also increased slightly by 0.9%. Though this represents a smaller visit-per-location increase than that seen in Q2, Ollie’s ability to maintain strong per-location visit levels while increasing its store count shows that the chain’s offerings are still meeting robust demand. And Ollie’s shows no sign of slowing down – snapping up former Big Lots store leases and plotting westward expansion.

Five Below and Ollie’s are both popular holiday shopping destinations. But what can the two retailers expect this year?

Visit data shows that Five Below and Ollies experience holiday milestones somewhat differently. Ollie’s, with its broad selection of deeply discounted high-ticket items, sees a slightly bigger Black Friday spike than Five Below: On November 24th, 2023, visits to Ollie’s surged by 222.9% compared to a 2023 daily average, higher than Five Below’s none-too-shabby 204.1%.

Meanwhile, the run-up to Christmas is is Five Below’s time to shine – with visits slowly increasing throughout December before reaching a crescendo on Super Saturday. In 2023, Five Below’s busiest day of the year was December 23rd, as customers flocked to the chain to pick up stocking stuffers, festive decor, and other inexpensive holiday items. Ollie’s, on the other hand, saw a more moderate 171.7% Super Saturday visit increase. As Five Below continues to expand its pricier “Five Beyond” offerings, Black Friday may take on greater importance for the retailer in coming years.

But while Ollie’s visit peaks were more subdued than those of Five Below throughout most of the holiday season, the chain’s treasure hunt vibe consistently drew longer visitor dwell times. On Black Friday last year, 26.5% of visitors to Ollie’s remained in-store for more than 45 minutes, compared to just 18.3% at Five Below. And despite Ollie’s significantly smaller Super Saturday crowds, customers spent substantially more time browsing its aisles to snag the perfect bargain find.

Five Below and Ollie’s both appear poised to enjoy a busy holiday season. Will the retailers deliver?

Follow Placer.ai’s data-driven retail analyses to find out.

The Kroger Co. has come a long way from its humble beginnings as a single grocery store in downtown Cincinnati, Ohio, in 1883. Today, the brand operates over 2,700 stores under its numerous grocery store banners.

We analyzed the visitation patterns at some of Kroger’s largest chains to see how these brands have fared over the past few months, and looked at what last year’s visit data can tell us about the upcoming Thanksgiving holiday.

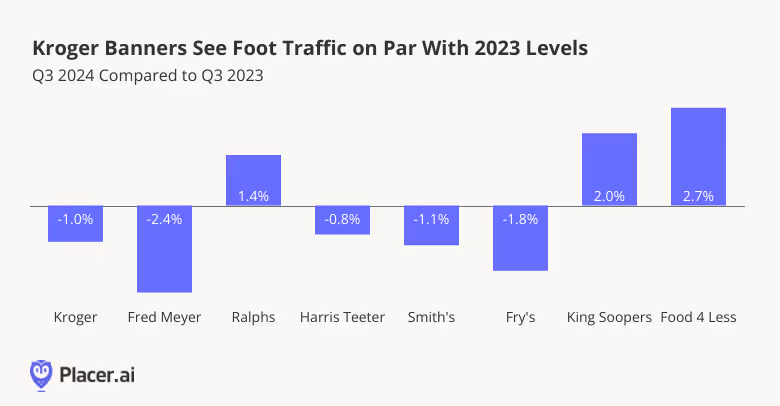

The Kroger Co.’s various grocery banners vary in size and scale, with its eponymous banner Kroger – more than 1200 stores across much of the midwest and south – attracting the largest visit share relative to the company’s full grocery portfolio. Kroger’s other major regional chains, including Harris Teeter (mid and south atlantic states); Ralphs (California), King Soopers (primarily Colorado), Food 4 Less (California, Illinois, and Indiana), Smith’s (Mountain states), Fry’s (Arizona), and Fred Meyer (Pacific northwest), lend the company considerable presence nationwide.

On the whole, visits to the analyzed Kroger chains remained fairly close to 2023’s levels, with visits to Kroger, Fred Meyer, Harris Teeter, Smith’s, and Fry’s sustaining minor YoY visit gaps. No-frills value chain Food 4 Less enjoyed 2.7% YoY visit growth in Q3, likely buoyed by the same trading down behaviors that have propelled growth at other low-cost supermarkets this year. Ralphs and King Soopers also saw YoY visit growth, perhaps aided by California and Colorado’s relatively high median household incomes (HHIs) – $94.1K and $89.1K, respectively, according to data from STI: PopStats, compared to the nationwide baseline of $76.1K.

Kroger’s extensive reach allows it to appeal to a wide range of grocery shoppers. The company operates both discount grocery chains, such as Food 4 Less, more upscale ones like Harris Teeter, and everything in between.

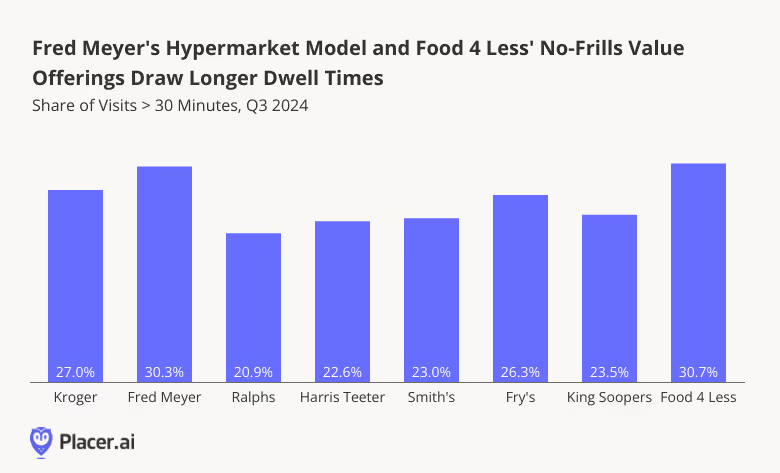

Diving into the share of visits lasting 30 minutes or longer at individual Kroger banners reveals substantial variation, with Fred Meyer and Food 4 Less receiving the highest shares of long visits among the analyzed chains. In Q3 2024, 30.3% of Fred Meyer visits and 30.7% of Food 4 Less visits lasted over 30 minutes – a stark contrast to Ralphs (20.9%), Harris Teeter (22.6%) and King Soopers (23.5%).

This variance in dwell times may reflect the differing offerings of each chain. Hypermarket Fred Meyer provides a wide range of services beyond groceries – including pharmacies, department stores, and jewelry offerings – which could encourage shoppers to spend more time exploring. And Food 4 Less falls squarely into the discount grocery segment, one that often sees customers spending more time in-store searching for the best deals.

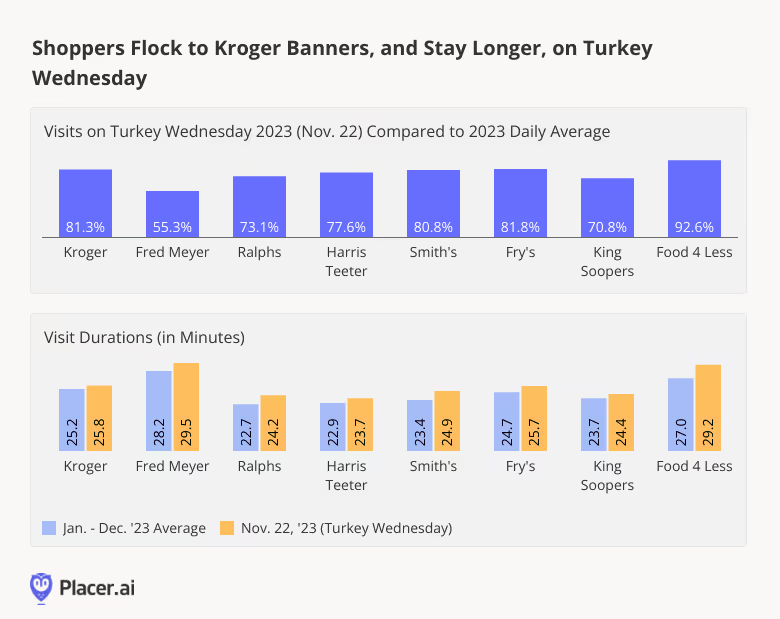

While not (yet!) an official holiday, Turkey Wednesday – the day before Thanksgiving – is one of the most important days of the year for grocers as shoppers flock to stores to pick up last-minute items for their upcoming feasts.

And while Thanksgiving is still over a week away, analyzing trends from previous years can help grocers prepare for the coming frenzy. On November 22nd, 2023 – the day before Thanksgiving – visits across all analyzed Kroger chains shot up between 55.3% and 92.6% compared to the daily visit average for 2023. And visitors at each of the chains stayed longer in-store than they typically did during the rest of the year.

With visits to Kroger’s major banners either nearly on par with or ahead of last year’s levels, the company appears well-positioned to enjoy another year of strong Turkey Wednesday visits.

If previous years are any indication, Kroger’s grocery banners should be preparing for a surge in Thanksgiving shopping. Will visits outpace those of last year?

Visit Placer.ai to keep up with the latest data-driven grocery insights.

This report leverages location intelligence data to analyze the auto dealership market in the United States. By looking at visit trends to branded showrooms, used car lots, and mixed inventory dealerships – and analyzing the types of visitors that visit each category – this white paper sheds light on the state of car dealership space in 2023.

Prior to the pandemic and throughout most of 2020, visits to both car brand and used-only dealerships followed relatively similar trends. But the two categories began to diverge in early 2021.

Visits to car brand dealerships briefly returned to pre-pandemic levels in mid-2021, but traffic fell consistently in the second half of the year as supply-chain issues drove consistent price increases. So despite the brief mid-year bump, 2021 ended with overall new car sales – as well as overall foot traffic to car brand dealerships – below 2019 levels. Visits continued falling in 2022 as low inventory and high prices hampered growth.

Meanwhile, although the price for used cars rose even more (the average price for a new and used car was up 12.1% and 27.1% YoY, respectively, in September 2021), used cars still remained, on average, more affordable than new ones. So with rising demand for alternatives to public transportation – and with new cars now beyond the reach of many consumers – the used car market took off and visits to used car dealerships skyrocketed for much of 2021 and into 2022. But in the second half of last year, as gas prices remained elevated – tacking an additional cost onto operating a vehicle – visits to used car dealerships began falling dramatically.

Now, the price of both used and new cars has finally begun falling slightly. Foot traffic data indicates that the price drops appear to be impacting the two markets differently. So far this year, sales and visits to dealerships of pre-owned vehicles have slowed, while new car sales grew – perhaps due to the more significant pent-up demand in the new car market. The ongoing inflation, which has had a stronger impact on lower-income households, may also be somewhat inhibiting used-car dealership visit growth. At the same time, foot traffic to used car dealerships did remain close to or slightly above 2019 levels for most of 2023, while visits to branded dealerships were significantly lower year-over-four-years.

The situation remains dynamic – with some reports of prices creeping back up – so the auto dealership landscape may well continue to shift going into 2024.

With car prices soaring, the demand for pre-owned vehicles has grown substantially. Analyzing the trade area composition of leading dealerships that sell used cars reveals the wide spectrum of consumers in this market.

Dealerships carrying a mixed inventory of both new and used vehicles seem to attract relatively high-income consumers. Using the STI: Popstats 2022 data set to analyze the trade areas of Penske Automotive, AutoNation, and Lithia Auto Stores – which all sell used and new cars – reveals that the HHI in the three dealerships’ trade areas is higher than the nationwide median. Differences did emerge within the trade areas of the mixed inventory car dealerships, but the range was relatively narrow – between $77.5K to $84.5K trade area median HHI.

Meanwhile, the dealerships selling exclusively used cars – DriveTime, Carvana, and CarMax – exhibited a much wider range of trade area median HHIs. CarMax, the largest used-only car dealership in the United States, had a yearly median HHI of $75.9K in its trade area – just slightly below the median HHI for mixed inventory dealerships Lithia Auto Stores and AutoNation and above the nationwide median of $69.5K. Carvana, a used car dealership that operates according to a Buy Online, Pick Up in Store (BOPIS) model, served an audience with a median HHI of $69.1K – more or less in-line with the nationwide median. And DriveTime’s trade areas have a median HHI of $57.6K – significantly below the nationwide median.

The variance in HHI among the audiences of the different used-only car dealerships may reflect the wide variety of offerings within the used-car market – from virtually new luxury vehicles to basic sedans with 150k+ miles on the odometer.

Visits to car brands nationwide between January and September 2023 dipped 0.9% YoY, although several outliers reveal the potential for success in the space even during times of economic headwinds.

Visits to Tesla’s dealerships have skyrocketed recently, perhaps thanks to the company’s frequent price cuts over the past year – between September 2022 and 2023, the average price for a new Tesla fell by 24.7%. And with the company’s network of Superchargers gearing up to serve non-Tesla Electric Vehicles (EVs), Tesla is finding room for growth beyond its already successful core EV manufacturing business and positioning itself for a strong 2024.

Japan-based Mazda used the pandemic as an opportunity to strengthen its standing among U.S. consumers, and the company is now reaping the fruits of its labor as visits rise YoY. Porsche, the winner of U.S New & World Report Best Luxury Car Brand for 2023, also outperformed the wider car dealership sector. Kia – owned in part by Hyundai – and Hyundai both saw their foot traffic increase YoY as well, thanks in part to the popularity of their SUV models.

Analyzing dealerships on a national level can help car manufacturers make macro-level decisions on marketing, product design, and brick-and-mortar fleet configurations. But diving deeper into the unique characteristics of each dealership’s trade area on a state level reveals differences that can serve brands looking to optimize their offerings for their local audience.

For example, analyzing the share of households with children in the trade areas of four car brand dealership chains in four different states reveals significant variation across the regional markets.

Nationwide, Tesla served a larger share of households with children than Kia, Ford, or Land Rover. But focusing on California shows that in the Golden State, Kia’s trade area population included the largest share of this segment than the other three brands, while Land Rover led this segment in Illinois. Meanwhile, Ford served the smallest share of households with children on a nationwide basis – but although the trend held in Illinois and Pennsylvania, California Ford dealerships served more households with children than either Tesla or Land Rover.

Leveraging location intelligence to analyze car dealerships adds a layer of consumer insights to industry provided sales numbers. Visit patterns and audience demographics reveal how foot traffic to used-car lots, mixed inventory dealerships, and manufacturers’ showrooms change over time and who visits these businesses on a national or regional level. These insights allow auto industry stakeholders to assess current demand, predict future trends, and keep a finger on the pulse of car-purchasing habits in the United States.