.svg)

.png)

.png)

.png)

.png)

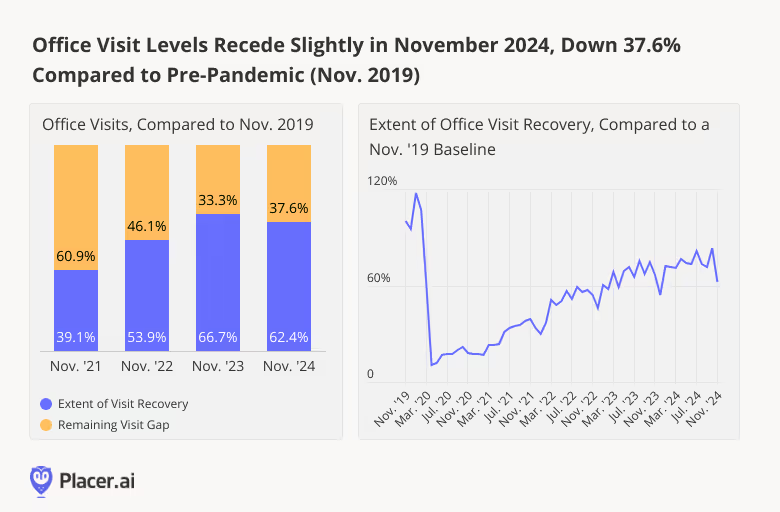

After reaching new heights in October 2024, how did the office recovery fare in November? We dove into the data to find out.

In November 2024, visits to office buildings nationwide were 62.4% of what they were in November 2019, down from 66.7% in November 2023. This marks the most substantial drop in office foot traffic since January 2024 – and a sharp decline from October 2024.

But though significant, November’s downturn is likely a reflection of this year’s record-breaking Thanksgiving travel rather than of any real office recovery slowdown. Millions of Americans took to the skies and roads to spend the holiday with loved ones. And with remote work making it easier than ever before for professionals to plug in from virtually anywhere, many likely extended their trips without taking extra days off – leading to fewer office visits in the days leading up to the holiday.

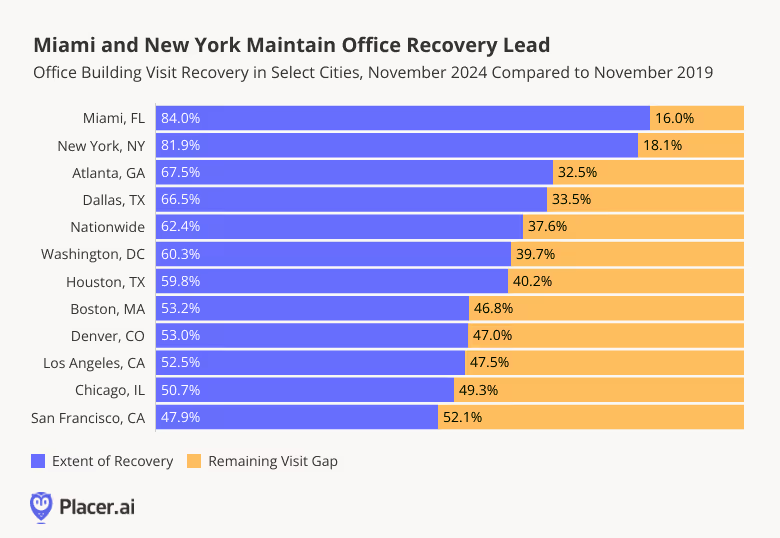

Taking a look at regional trends, Miami continued to outshine other cities in November 2024, with visits at 84.0% of pre-pandemic levels – perhaps due in part to strict return-to-office (RTO) policies implemented by major players within the city’s growing tech and finance sector. New York came in second with recovery at 81.9%, while San Francisco continued to lag behind other major cities. But with major projects like the September 2024 grand opening of the revamped Transamerica Pyramid set to revitalize the city’s Financial District, more accelerated recovery may be ahead for this West Coast hub.

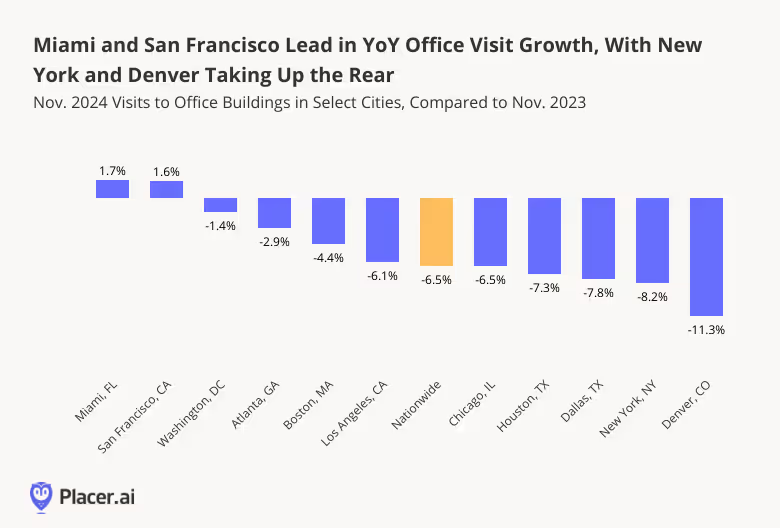

Indeed, San Francisco was among November 2024’s regional leaders for year over year (YoY) office visit growth. Nationwide, office building foot traffic was down 6.5% YoY. But in San Francisco, visits increased 1.6% – likely bolstered by recent RTO mandates from major local employers like Salesforce. The city’s temperate climate may also have played a role in encouraging residents to stay local for the holidays. Miami, too – a popular holiday destination in its own right – saw visits increase 1.7% YoY.

Denver, meanwhile, experienced its fourth snowiest November on record, which may have contributed to a larger portion of its workforce embracing remote work during the month – and an 11.3% YoY visit decline. And in New York, extended “workcations” by remote-capable finance employees, as well as potential disruptions in public transit and increased congestion during the holiday season, may have fueled a larger-than-average drop. Given the Big Apple’s strong overall recovery trajectory, we will likely see a rebound to more robust YoY growth by January, when the holiday season winds down.

While Thanksgiving travel created a temporary headwind for office recovery, cities like Miami and San Francisco demonstrate that the story is far from uniform. And looking ahead to the coming months, the office recovery still appears poised to continue apace.

For more data-driven office recovery analyses, follow Placer.ai.

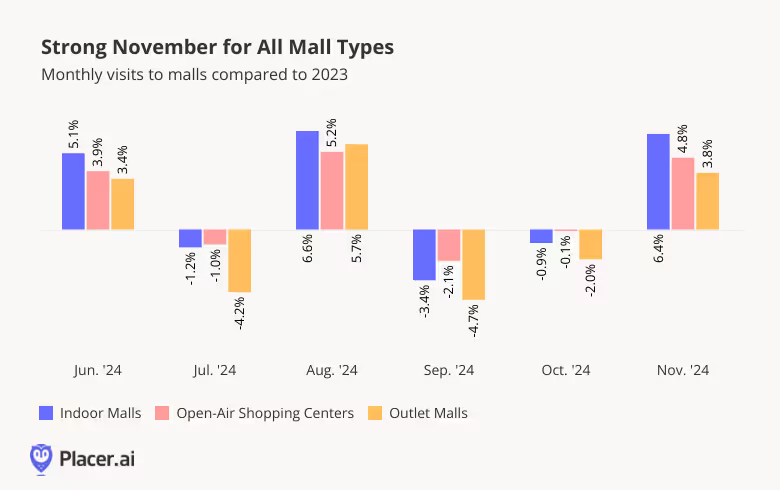

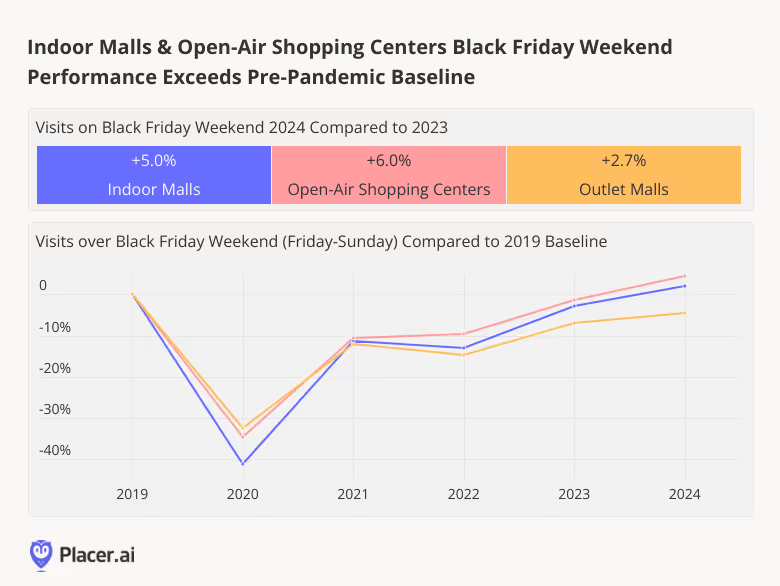

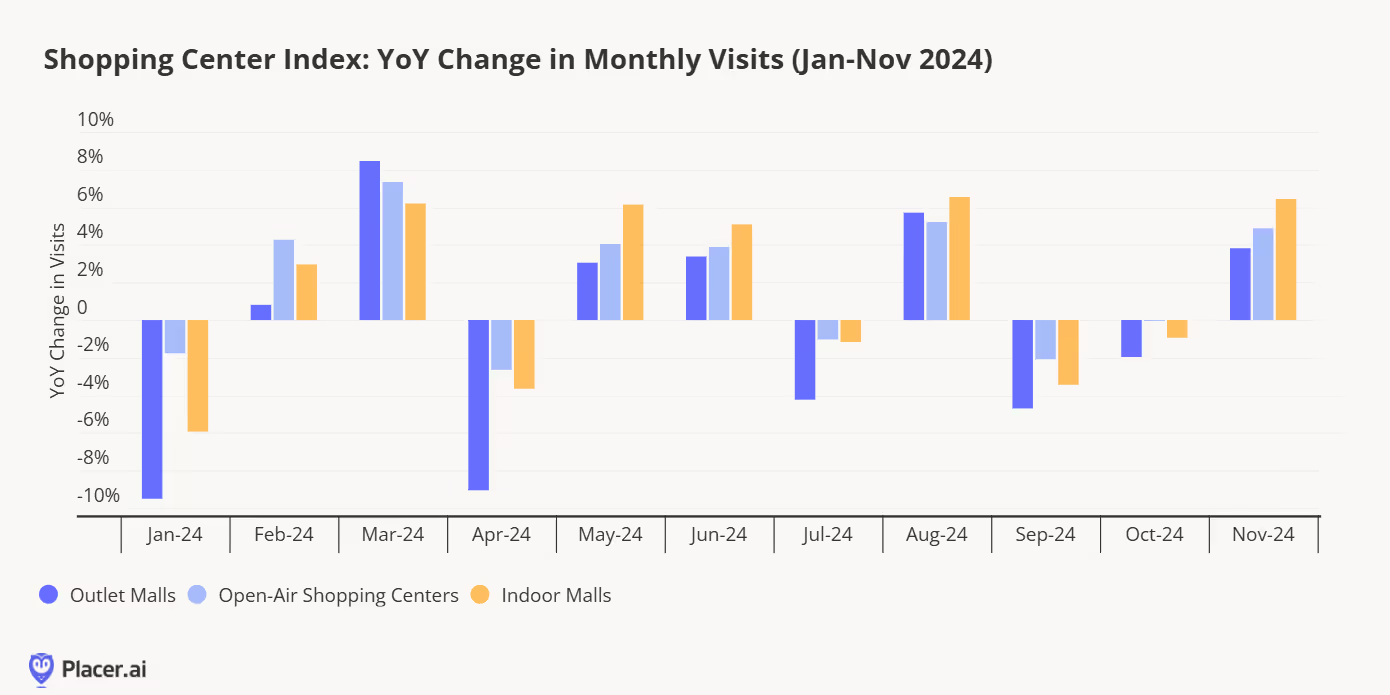

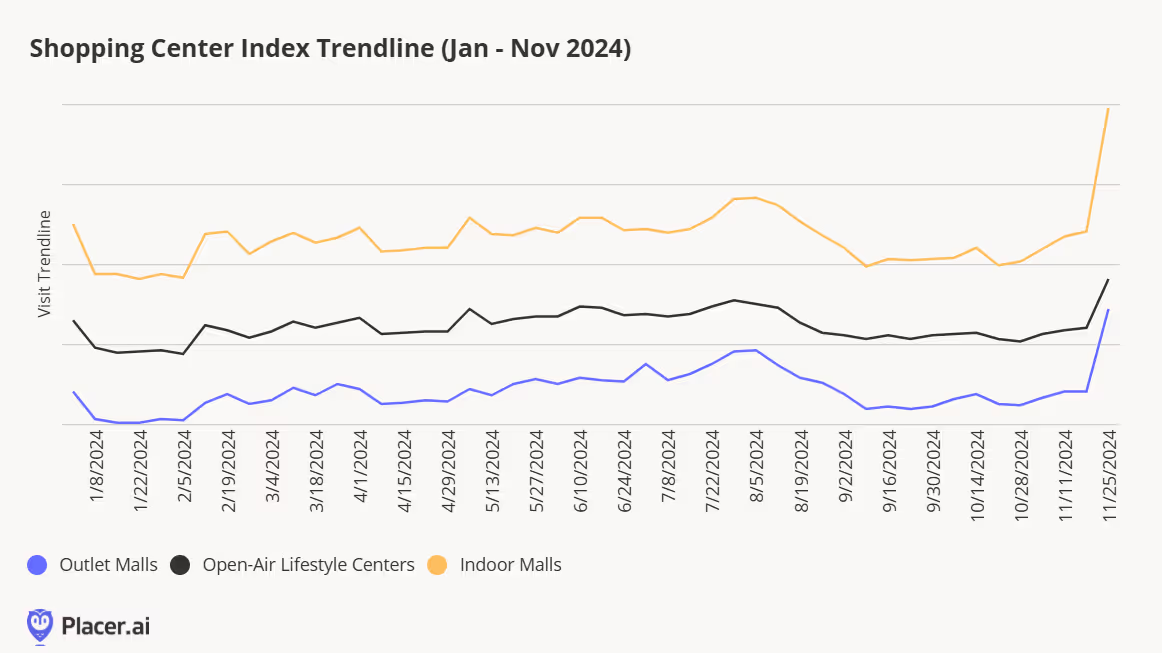

Following weaker foot traffic performances in September and October, mall visits swung positive in November: Indoor malls, open-air shopping centers, and outlet malls received year-over-year (YoY) visit boosts of 6.4%, 4.8%, and 3.8%, respectively. The strong YoY growth across all mall types underscores the continued attraction of brick-and-mortar retail – particularly during the holiday season.

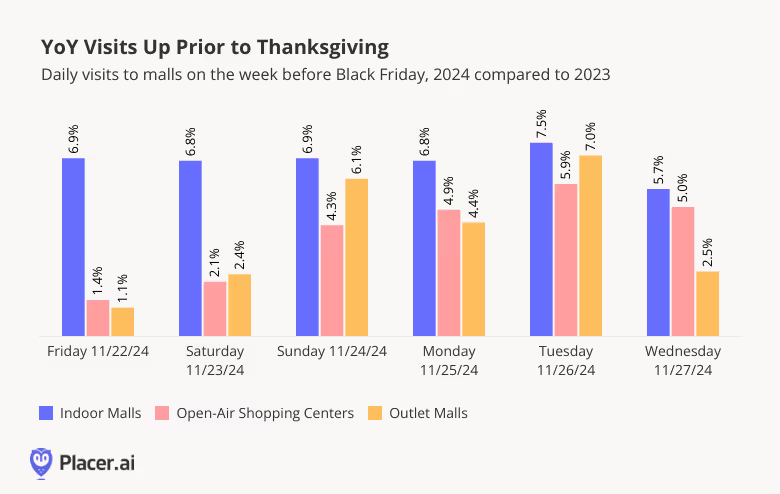

While much of the November boost is likely due to the malls’ strong Black Friday performance, foot traffic data indicates that early deals also drove visits before the big day: Comparing daily visits during the week before Black Friday (from Friday November 22nd to Wednesday November 27th) to visits during the equivalent days in 2023 (November 17th to 22nd 2023) reveals that malls received more pre-Black Friday mall visits this year than in 2023.

This willingness to shop ahead of Black Friday instead of waiting for the best deals on the day itself may highlight the effectiveness of retailers’ early promotions– or it could signal the readiness of some consumers to spend more freely this holiday season.

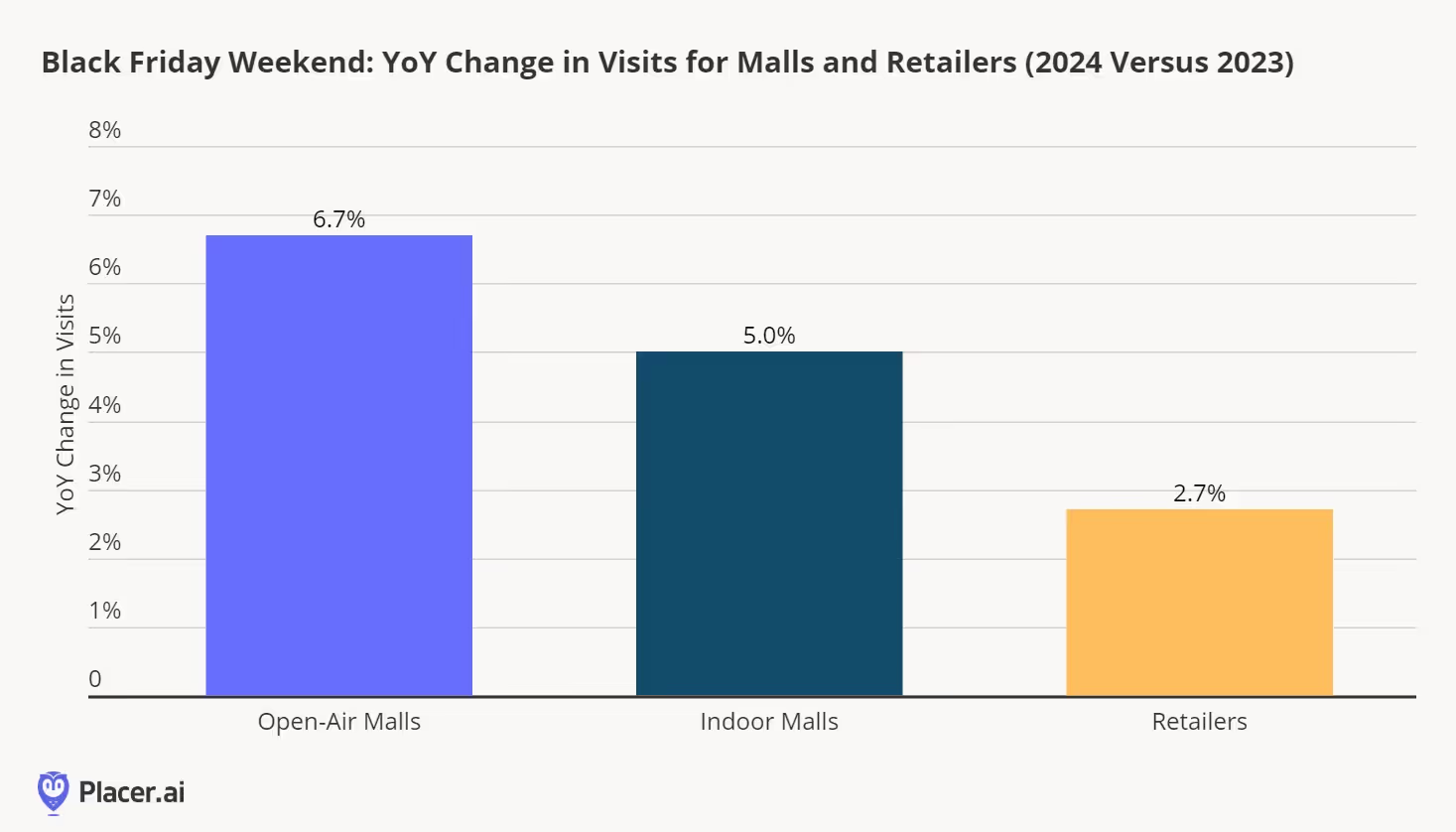

Still, despite the positive pre-Black Friday showing, the majority of the November visit boost can likely be attributed to malls’ impressive Black Friday Performance. All three formats saw YoY visit growth over Black Friday weekend, with open-air shopping centers seeing the largest visit increases – foot traffic for this sub-category was up 6.0% compared to Black Friday weekend 2023. In fact, this year’s Black Friday numbers were so strong that visits to indoor malls and open-air shopping centers even exceeded pre-pandemic Black Friday weekend.

These numbers reveal that, despite the rise in early Black Friday deals and online shopping, many consumers still want to experience the excitement of Black Friday bargain hunting in person. And this powerful kickoff to the 2024 holiday season indicates that the unique experiential offering of malls – combining shopping, dining, and entertainment all under one roof – continue to play a central role in the wider retail landscape.

For more data-driven retail insights, visit placer.ai.

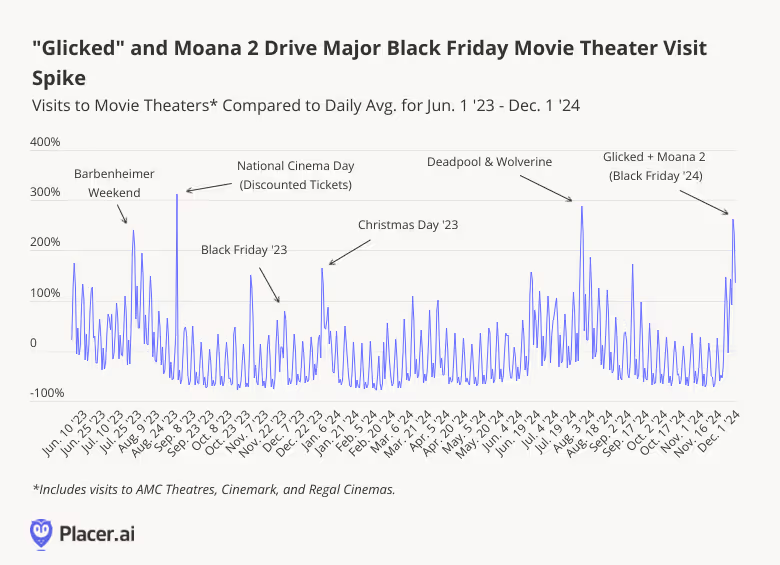

Hot on the heels of last year’s Barbenheimer phenomenon, 2024 brought us “Glicked”— the powerhouse pairing of Gladiator II and Wicked that lit up movie theaters across the country. How did these box office juggernauts – followed just a few days later by Disney’s much-anticipated release of Moana 2 – impact movie theater foot traffic during the Thanksgiving holiday weekend?

We dove into the data to find out.

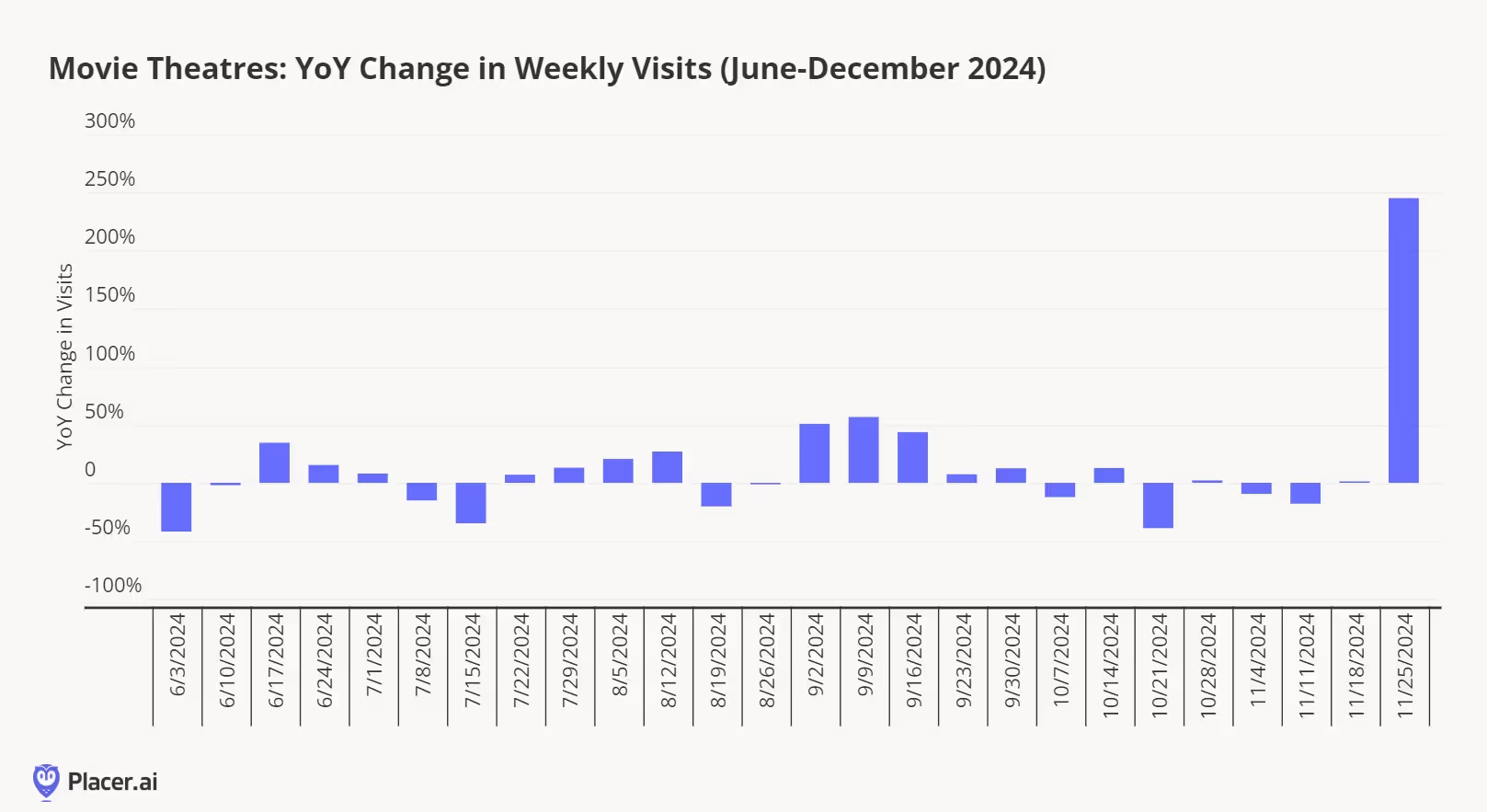

On its premiere day (Friday, November 22nd, 2024) “Glicked” drew a 69.2% increase in movie theater visits compared to the daily average between June 1, 2023 and December 1, 2024. By Saturday, November 23rd, foot traffic surged by a dramatic 147.3%, solidifying the weekend as one of the most memorable of the year. And on Wednesday, November 27th, the release of Moana 2 drove an impressive 142.6% foot traffic increase.

But the real box office magic came on Black Friday (November 29th), when the combined power of Glicked, Moana 2, and the holiday shopping frenzy fueled an epic 263.2% surge in theater visits – making November 29th the third busiest for theaters since June 1st 2023. Foot traffic to movie theaters on this year’s Black Friday even outpaced the unforgettable levels seen on Barbenheimer Saturday (July 22nd, 2023), when visits soared to 241.0% above the daily average.

Black Friday is always a busy time for movie theaters. In 2019, movie theater visits on Black Friday (November 29th, 2019) were up 80.2% compared to an average 2019 Friday – while in 2022 and 2023 (November 25th, 2022 and November 24th, 2023), they were up 40.8% and 39.4% compared to an average Friday for each of those years.

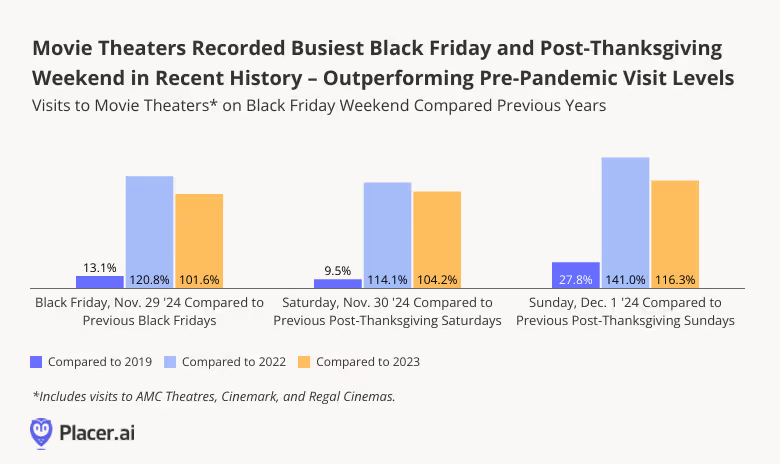

And in 2024, Black Friday cinematic foot traffic surged past previous years’ benchmarks – surpassing even pre-pandemic levels. On November 29th, 2024, visits to movie theaters were 13.1% higher than on Black Friday in 2019 – and the effect lasted through the weekend, pushing visits up 9.5% and 27.8% on the Saturday and Sunday after Thanksgiving compared to the equivalent period of 2019.

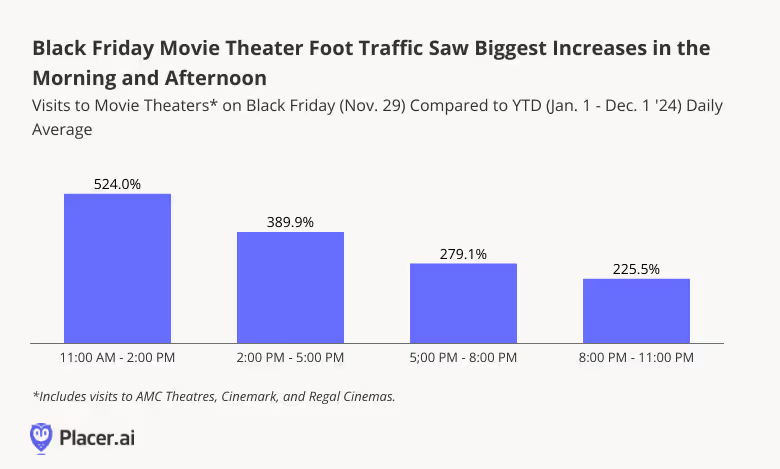

But the Black Friday foot traffic surge wasn’t distributed equally throughout the day. Unsurprisingly given the holiday weekend, morning and early afternoon screenings saw the most impressive visit increases – with foot traffic up an incredible 524.0% between 11:00 AM and 2:00 PM compared to an average year-to-date (YTD) Friday. Afternoons (2:00 PM–5:00 PM) weren’t far behind, with visits climbing 389.9%. But impressively, even though Friday evenings are typically busy times for movie theaters year round, visits on the evening of Black Friday surged by more than 200% between 5:00 PM and 11:00 PM.

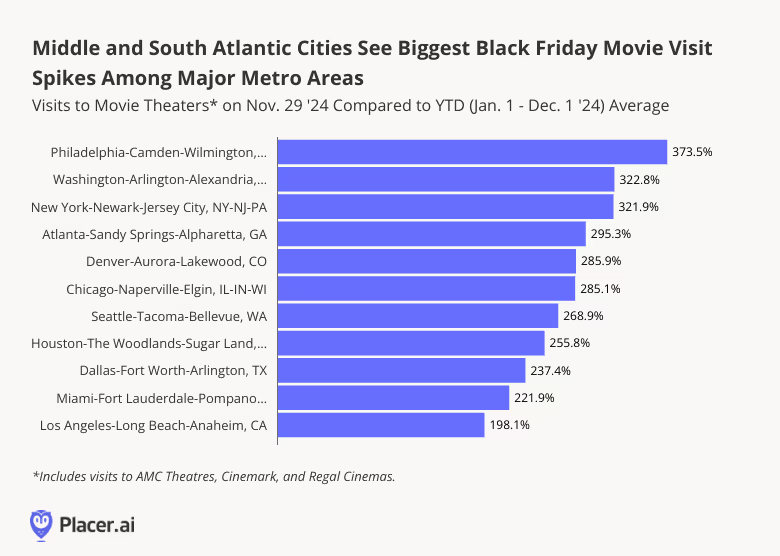

Black Friday’s box office boost also wasn’t evenly spread across the map. Leading the charge was the Philadelphia-Camden-Wilmington area, where theater visits soared by an astonishing 373.5% compared to its 2024 year-to-date average. Close on its heels were Washington, D.C. (322.8%) and New York (321.9%), proving that East Coast audiences were all in for some big-screen magic.

Interestingly, Black Friday was less resonant on the West Coast, particularly in California, where the cultural pull of the big shopping day seems to be less strong. Los Angeles, for example, saw a more modest boost in visits, reflecting the region’s typically lighter Black Friday enthusiasm.

Black Friday, it turns out, isn’t just about shopping – it also has the power to supercharge movie theater foot traffic. And while Gladiator II, Wicked, and Moana 2 all drew crowds on their opening days, the strategic timing of their pre-holiday releases drove a Black Friday visit surge for the ages. Whether driven by the thrill of a new hit or the magic of the holiday season, people are returning to theaters – and in record numbers.

For more data-driven consumer behavior insights, visit placer.ai.

Holiday shoppers in November 2024 turned out in greater numbers than last year, particularly at malls. Following a strong spring and summer year-over-year performance (despite April having one fewer weekend and Easter falling in March, as well as July having one less weekend than 2023), and a weaker early fall, it seems many consumers held off on their mall visits until November.

Indoor malls saw the highest total visits, followed by open-air lifestyle centers and outlet malls.

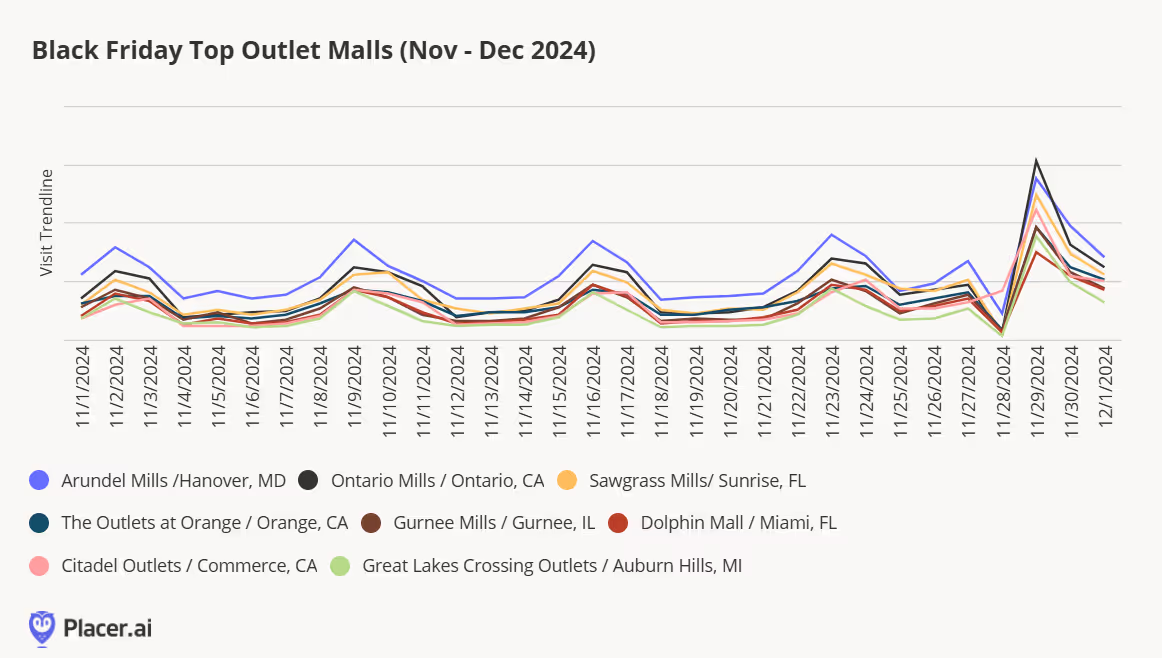

Deal-hunting was a major theme this year, drawing shoppers in large numbers to outlet malls. For most of November, Arundel Mills in Hanover, MD, led in total visits. However, when it came to post-Thanksgiving steps and walking off turkey-induced calories, Ontario Mills in Southern California claimed the top spot. Sawgrass Mills in Florida secured third place, while the Assyrian fortress-themed Citadel Outlets in Los Angeles landed fourth—complete with a massive Black Friday traffic jam on the 5 Freeway. Gurnee Mills in Illinois rounded out the top five for national outlet mall traffic.

We watched Moana 2 on Black Friday at the Outlets of Orange, the sixth most-visited outlet mall in America. Judging by the unbelievably crowded parking lot, it might be worth checking the Placer app for historical traffic comparisons. The silver lining to the 25-minute parking hunt? With half an hour of previews now the norm, no one missed a moment of the movie! The mall was bustling, with lines stretching around the corners of some stores. Crowds filled the main thoroughfare, and eager shoppers formed long queues at popular spots like Victoria’s Secret and Pink.

Shoppers at juniors' retailers like American Eagle needed a bit of patience, as did those heading to Skechers.

Great Lakes Crossing Outlets in Michigan secured seventh place, while Dolphin Mall in Miami, FL rounded out the top eight.

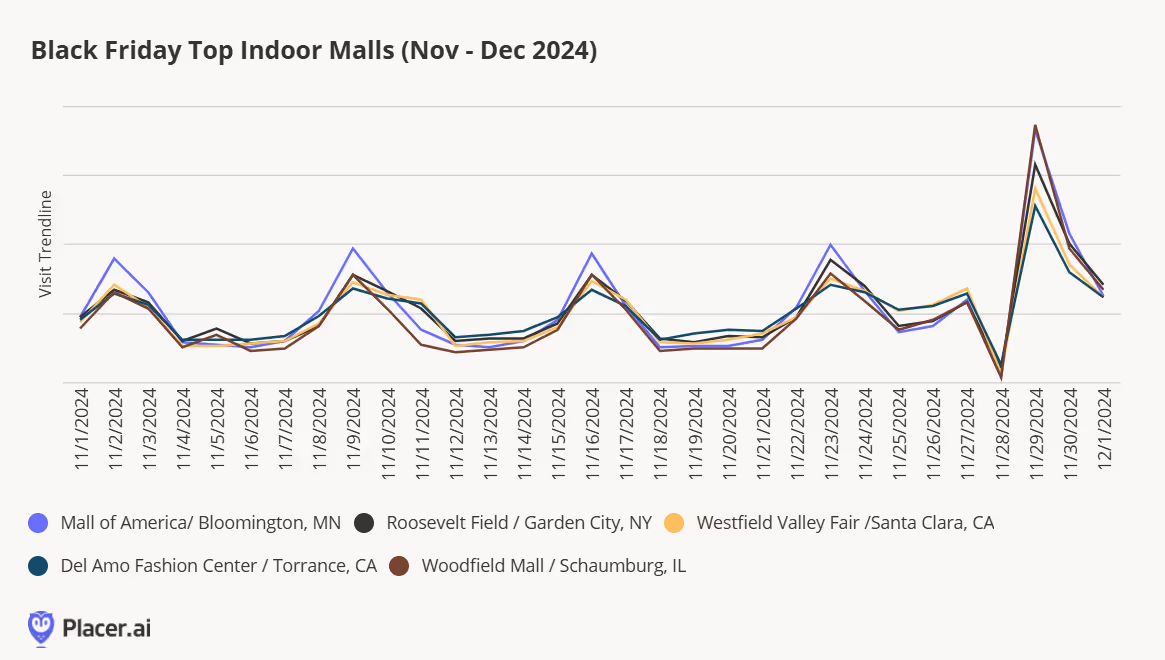

From November 1 to December 1, the top five most-visited indoor malls were Mall of America in Minnesota, Roosevelt Field in New York, Westfield Valley Fair in California, Del Amo Fashion Center in California, and Woodfield Mall in Illinois. However, Black Friday brought a shift in rankings. Woodfield Mall claimed the top spot for Black Friday visits, with the other malls each moving down one position compared to their overall November visitation rankings.

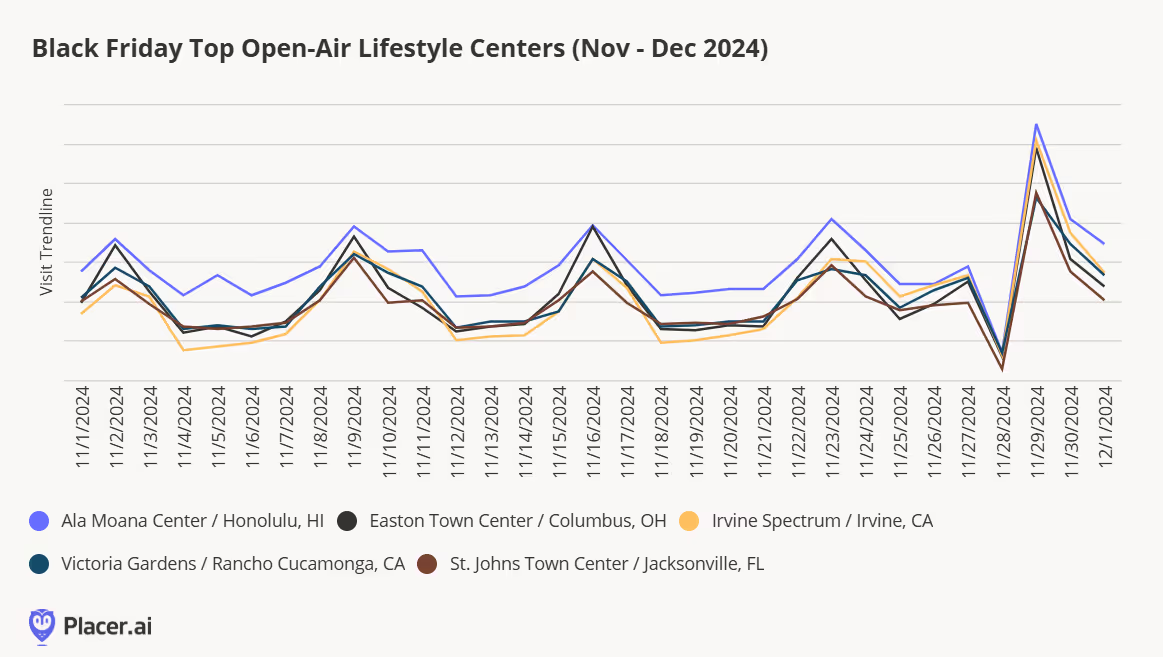

From November 1 to December 1, Ala Moana Center in Hawaii consistently held its #1 spot among open-air shopping centers, including on Black Friday. If you're enjoying the aloha spirit this holiday season, don’t miss unique Hawaiian stores like Honolulu Cookie Co., Island Slipper, and Malie Organics. The rankings saw some shifts on Black Friday, with Irvine Spectrum climbing from third place throughout November to the #2 spot. Easton Town Center secured third place, while St. Johns Town Center and Victoria Gardens rounded out the fourth and fifth spots, respectively, on the busiest shopping day of the year.

Black Friday 2024 provided valuable insights into consumer behavior as we look ahead to 2025. Placer’s blog highlighted a +2.7% increase in Black Friday weekend visits compared to last year, with shoppers focusing on value while also seeking unique and differentiated products, evidenced by strong year-over-year trends at off-price retailers like HomeGoods, Marshalls, and T.J. Maxx. Pandemic-era categories like home furnishings and sporting goods may also be seeing signs of a resurgence.

The standout takeaway, however, was the evolving role of malls. Mixed-use developments and placemaking, a key trend for malls heading into 2024, proved pivotal this Black Friday weekend. Open-air and indoor malls saw larger year-over-year visit increases (6.7% and 5.0%, respectively) than retailers across all property types (up 2.7%). This was a trend echoed by operators like Simon, further underscoring the mall’s continued relevance in modern retail.

Retailers remain integral to malls, but seasonal attractions, entertainment options, and a more diverse tenant mix have transformed malls into community hubs and prime destinations for both residents and tourists. These attractions have a symbiotic effect, driving greater foot traffic to mall tenants compared to standalone stores of the same brands.

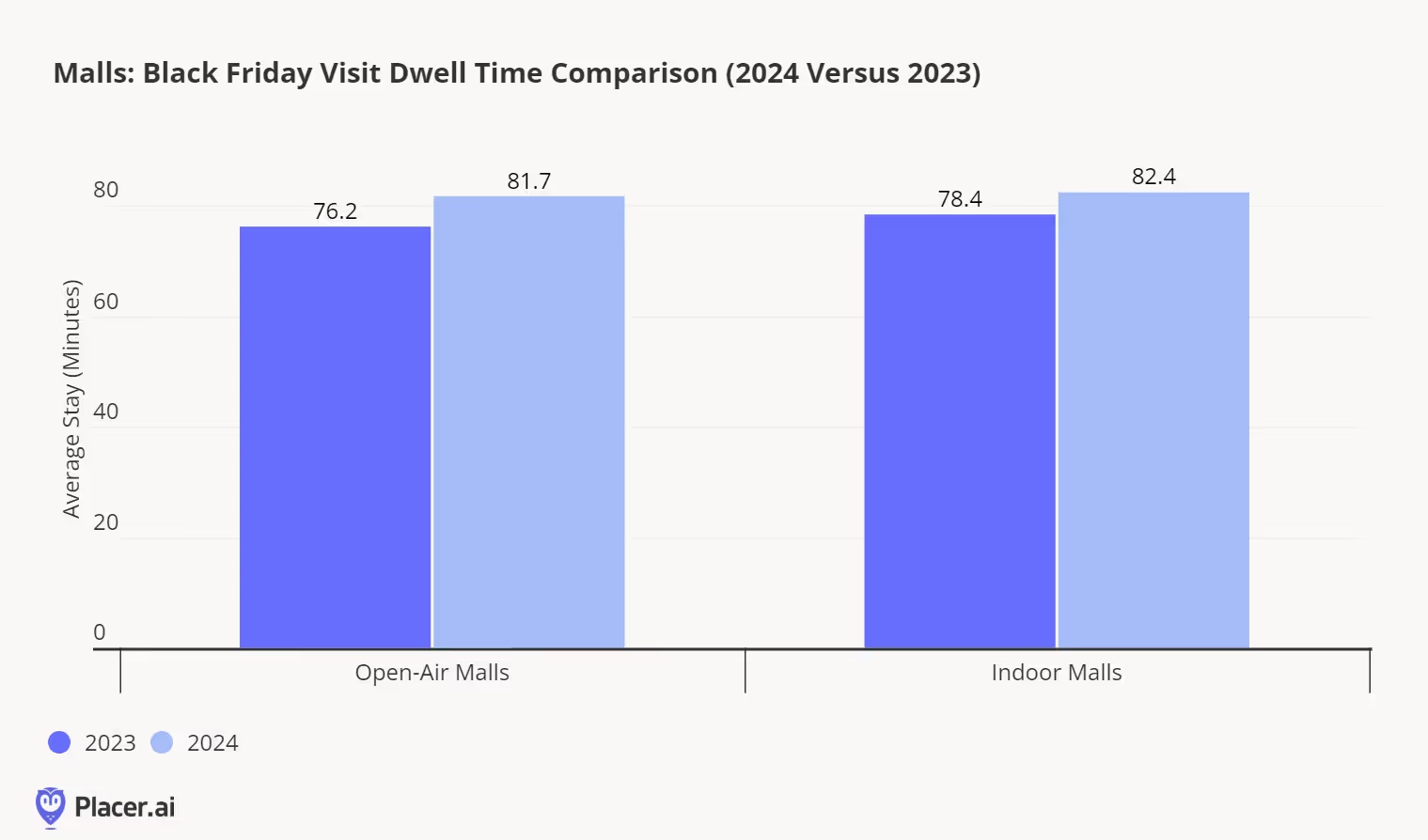

Need evidence that this strategy works? Consumers are staying longer. Our data shows that open-air malls experienced a 7.2% increase in dwell time over Black Friday weekend, while indoor malls saw a 5.1% rise. As we've highlighted before, the longer consumers spend at a mall, the more likely they are to make a purchase.

A strong box office undeniably played a role in Black Friday visit trends and dwell time. Our data shows a nearly 250% increase in visits to movie theaters this Black Friday compared to last year (below). However, the data also reveals that many malls with unique holiday attractions and effective marketing strategies experienced increased visits, indicating that mall traffic was driven by more than just blockbuster movies.

Taken together, our data reinforces that malls have become more vital than ever to modern retail, evolving from traditional shopping hubs into multifaceted destinations that blend commerce, entertainment, and community experiences. Changes in tenant mix have introduced a diverse array of retailers, including digitally native brands, experiential stores, and unique local offerings, catering to broader consumer tastes. Increased visitor attractions, such as dine-in theaters, fitness studios, and immersive art installations, create compelling reasons that drive repeat visits for more than just shopping. Mall-focused events, from seasonal pop-ups to live performances, further enhance the draw by fostering engagement and creating a sense of occasion. This strategic evolution has positioned malls as essential anchors in the retail ecosystem, blending convenience and experience to meet the demands of today’s shoppers.

The holiday shopping season is in full swing, and with Black Friday weekend behind us, it's time to assess how this season is shaping up for retailers. As we noted before Thanksgiving, the shortened window between Thanksgiving and Christmas this year places added pressure on retailers to drive store traffic during key holiday events and weekends.

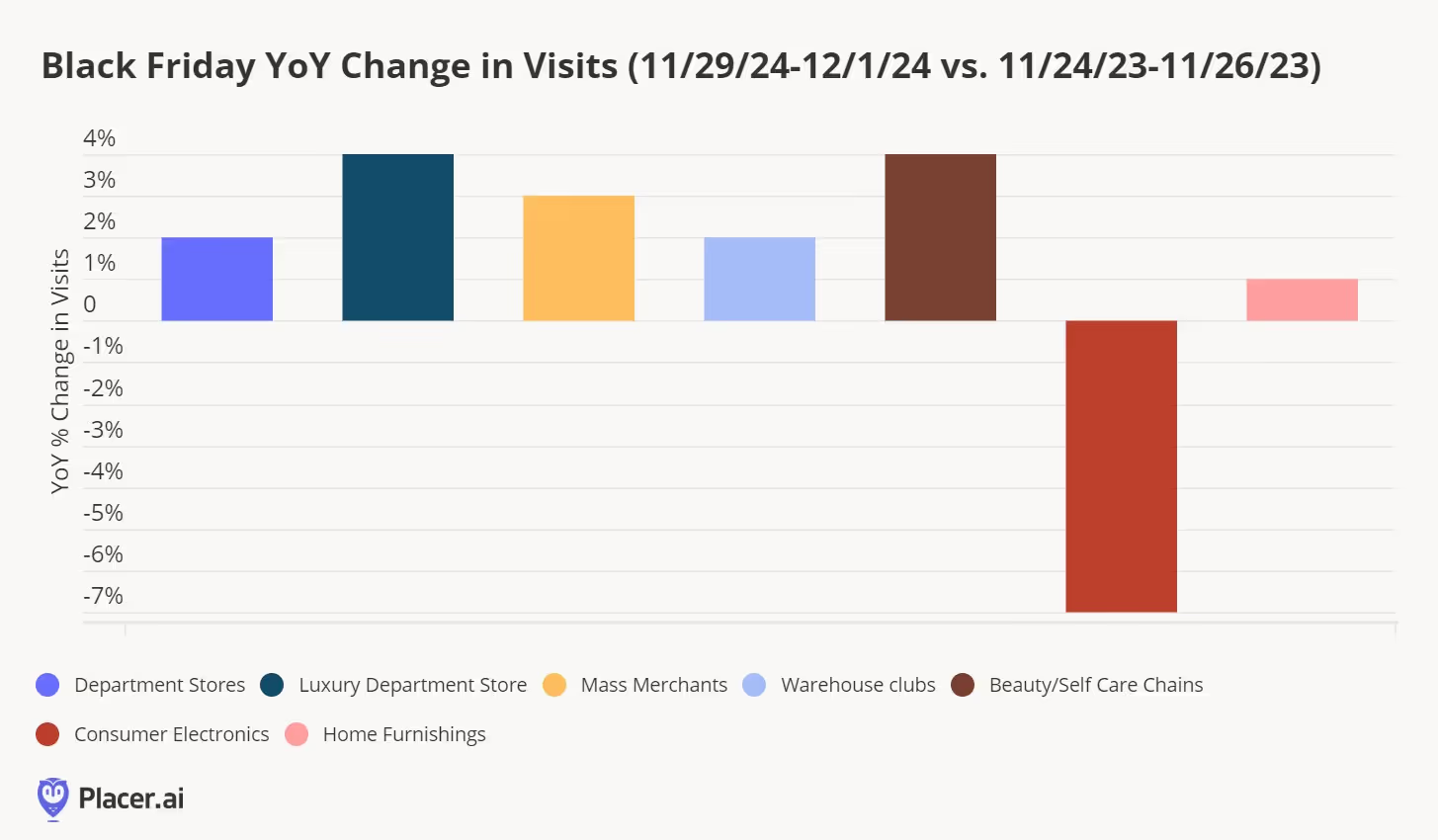

In 2023, Black Friday accounted for approximately 7% of holiday season retail visits, making it crucial for retailers this year to attract consumers early to mitigate potential slowdowns later in the season. Without burying the lede, Black Friday weekend (Friday through Sunday) delivered on this goal, with six of the seven analyzed retail sectors experiencing visitation growth. While the fervor around Black Friday may not match the excitement of the 1990s and 2000s, this year reaffirmed its enduring importance as a cornerstone of holiday shopping.

From a category perspective, luxury department stores had a strong performance this year, with traffic up 4% compared to Black Friday weekend last year. Nordstrom, in particular, stood out with a successful event. Throughout 2024, luxury department stores have worked hard to align more closely with consumer expectations in terms of assortment, in-store experience, and value, which clearly paid off during this key retail event. According to PersonaLive segmentation, Ultra Wealthy Families made up a quarter of visitors to luxury department stores during Black Friday weekend, bolstering traffic as these consumers tend to be less price-sensitive.

Full-line department stores, mass merchants, beauty, and home furnishing retailers also saw a 2-3% increase in traffic year-over-year. Overall, while discretionary retail still faces challenges, the weekend showed more positive momentum than we've seen in recent years.

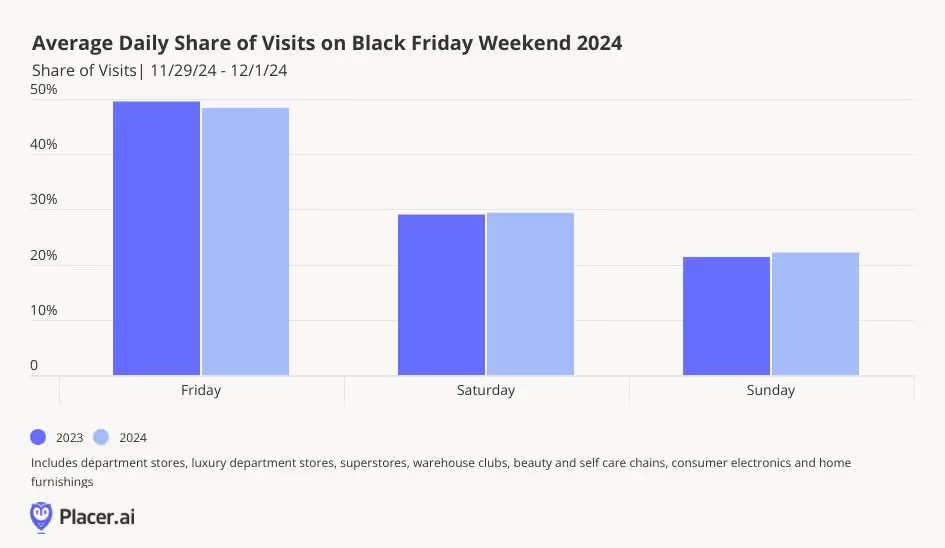

Placer’s traffic estimates revealed that while most categories experienced an increase in weekend traffic, there was a noticeable shift in the distribution of visits across the days compared to last year. This year, Friday accounted for a smaller share of event visits than in 2023, while Sunday saw a higher percentage of traffic. Despite this shift, Friday still represented nearly 50% of event visits on average across retail sectors. It’s possible that consumers delayed their shopping trips until later in the weekend, potentially after conducting online research on Friday and Saturday.

What about the iconic lines outside retailers—did they make a comeback? Our data indicates that a few specific items drove consumers to camp out and arrive early for store openings on Black Friday. Notably, Target's exclusive release of the Taylor Swift Eras Tour book and a vinyl edition of her latest album, The Tortured Poets Department, attracted early crowds. Hourly visit data shows a higher share of visits between 4 AM and 6 AM compared to 2023. While last year saw a greater share of visits during regular store hours, this year shoppers arrived earlier, likely drawn by these exclusive products.

What does Black Friday weekend reveal about the rest of the holiday season? The industry successfully overcame its first hurdle—boosting overall holiday visitation despite fewer shopping days—thanks to the growth seen last weekend. However, challenges remain with more lull weeks ahead and an earlier Super Saturday this year. As we noted previously, a shorter season also means tighter shipping windows, which could drive increased in-store visits in the final days before Christmas. On the positive side, discretionary retail saw strong visitation, with key items and promotions effectively capturing the holiday spirit and engaging consumers during this critical period.

This report leverages location intelligence data to analyze the auto dealership market in the United States. By looking at visit trends to branded showrooms, used car lots, and mixed inventory dealerships – and analyzing the types of visitors that visit each category – this white paper sheds light on the state of car dealership space in 2023.

Prior to the pandemic and throughout most of 2020, visits to both car brand and used-only dealerships followed relatively similar trends. But the two categories began to diverge in early 2021.

Visits to car brand dealerships briefly returned to pre-pandemic levels in mid-2021, but traffic fell consistently in the second half of the year as supply-chain issues drove consistent price increases. So despite the brief mid-year bump, 2021 ended with overall new car sales – as well as overall foot traffic to car brand dealerships – below 2019 levels. Visits continued falling in 2022 as low inventory and high prices hampered growth.

Meanwhile, although the price for used cars rose even more (the average price for a new and used car was up 12.1% and 27.1% YoY, respectively, in September 2021), used cars still remained, on average, more affordable than new ones. So with rising demand for alternatives to public transportation – and with new cars now beyond the reach of many consumers – the used car market took off and visits to used car dealerships skyrocketed for much of 2021 and into 2022. But in the second half of last year, as gas prices remained elevated – tacking an additional cost onto operating a vehicle – visits to used car dealerships began falling dramatically.

Now, the price of both used and new cars has finally begun falling slightly. Foot traffic data indicates that the price drops appear to be impacting the two markets differently. So far this year, sales and visits to dealerships of pre-owned vehicles have slowed, while new car sales grew – perhaps due to the more significant pent-up demand in the new car market. The ongoing inflation, which has had a stronger impact on lower-income households, may also be somewhat inhibiting used-car dealership visit growth. At the same time, foot traffic to used car dealerships did remain close to or slightly above 2019 levels for most of 2023, while visits to branded dealerships were significantly lower year-over-four-years.

The situation remains dynamic – with some reports of prices creeping back up – so the auto dealership landscape may well continue to shift going into 2024.

With car prices soaring, the demand for pre-owned vehicles has grown substantially. Analyzing the trade area composition of leading dealerships that sell used cars reveals the wide spectrum of consumers in this market.

Dealerships carrying a mixed inventory of both new and used vehicles seem to attract relatively high-income consumers. Using the STI: Popstats 2022 data set to analyze the trade areas of Penske Automotive, AutoNation, and Lithia Auto Stores – which all sell used and new cars – reveals that the HHI in the three dealerships’ trade areas is higher than the nationwide median. Differences did emerge within the trade areas of the mixed inventory car dealerships, but the range was relatively narrow – between $77.5K to $84.5K trade area median HHI.

Meanwhile, the dealerships selling exclusively used cars – DriveTime, Carvana, and CarMax – exhibited a much wider range of trade area median HHIs. CarMax, the largest used-only car dealership in the United States, had a yearly median HHI of $75.9K in its trade area – just slightly below the median HHI for mixed inventory dealerships Lithia Auto Stores and AutoNation and above the nationwide median of $69.5K. Carvana, a used car dealership that operates according to a Buy Online, Pick Up in Store (BOPIS) model, served an audience with a median HHI of $69.1K – more or less in-line with the nationwide median. And DriveTime’s trade areas have a median HHI of $57.6K – significantly below the nationwide median.

The variance in HHI among the audiences of the different used-only car dealerships may reflect the wide variety of offerings within the used-car market – from virtually new luxury vehicles to basic sedans with 150k+ miles on the odometer.

Visits to car brands nationwide between January and September 2023 dipped 0.9% YoY, although several outliers reveal the potential for success in the space even during times of economic headwinds.

Visits to Tesla’s dealerships have skyrocketed recently, perhaps thanks to the company’s frequent price cuts over the past year – between September 2022 and 2023, the average price for a new Tesla fell by 24.7%. And with the company’s network of Superchargers gearing up to serve non-Tesla Electric Vehicles (EVs), Tesla is finding room for growth beyond its already successful core EV manufacturing business and positioning itself for a strong 2024.

Japan-based Mazda used the pandemic as an opportunity to strengthen its standing among U.S. consumers, and the company is now reaping the fruits of its labor as visits rise YoY. Porsche, the winner of U.S New & World Report Best Luxury Car Brand for 2023, also outperformed the wider car dealership sector. Kia – owned in part by Hyundai – and Hyundai both saw their foot traffic increase YoY as well, thanks in part to the popularity of their SUV models.

Analyzing dealerships on a national level can help car manufacturers make macro-level decisions on marketing, product design, and brick-and-mortar fleet configurations. But diving deeper into the unique characteristics of each dealership’s trade area on a state level reveals differences that can serve brands looking to optimize their offerings for their local audience.

For example, analyzing the share of households with children in the trade areas of four car brand dealership chains in four different states reveals significant variation across the regional markets.

Nationwide, Tesla served a larger share of households with children than Kia, Ford, or Land Rover. But focusing on California shows that in the Golden State, Kia’s trade area population included the largest share of this segment than the other three brands, while Land Rover led this segment in Illinois. Meanwhile, Ford served the smallest share of households with children on a nationwide basis – but although the trend held in Illinois and Pennsylvania, California Ford dealerships served more households with children than either Tesla or Land Rover.

Leveraging location intelligence to analyze car dealerships adds a layer of consumer insights to industry provided sales numbers. Visit patterns and audience demographics reveal how foot traffic to used-car lots, mixed inventory dealerships, and manufacturers’ showrooms change over time and who visits these businesses on a national or regional level. These insights allow auto industry stakeholders to assess current demand, predict future trends, and keep a finger on the pulse of car-purchasing habits in the United States.