.svg)

.png)

.png)

.png)

.png)

Sourcing food at home has become a lot more attractive for consumers against the backdrop of economic concerns in 2024. In Kroger’s earnings call, CEO Rodney McMullen called out that out of home food costs are outpacing in home food costs, leading shoppers to focus more on in-home meal solutions. Cooking can be seen as a cost saving lever for visitors, but the pandemic period also fostered a love of cooking and spending time in the kitchen, even for higher income households not necessarily looking to save money. And it appears through Placer’s location insights that retailers that focus on outfitting the kitchen have been benefiting from this change in consumer behavior.

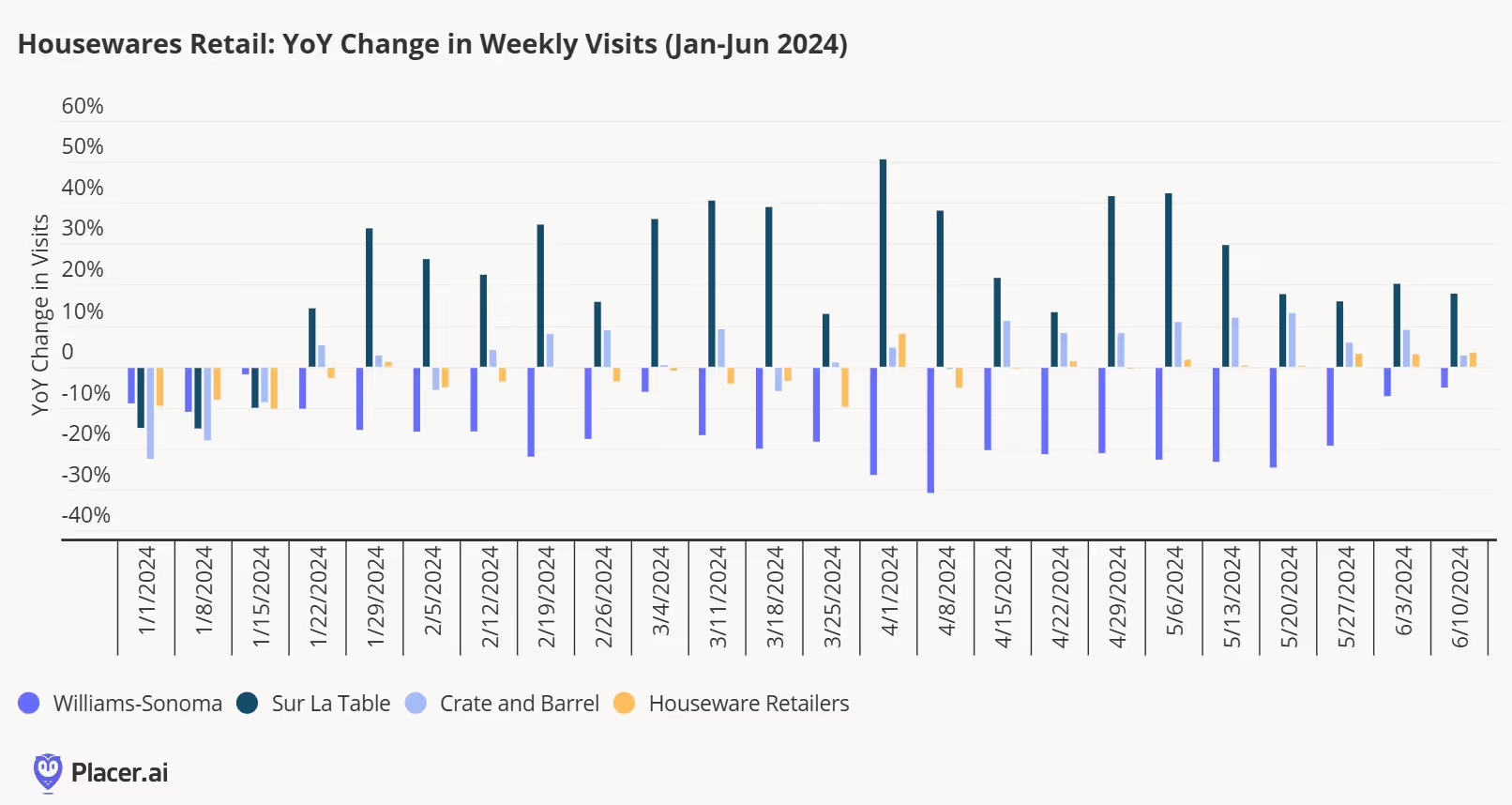

Despite the home industry having its challenges in foot traffic after the pandemic, housewares retailers have had some positive momentum over the past few months. Beyond that, houseware retailers that specialize in kitchen wares, such as Crate & Barrel and Sur La Table, have seen traffic growth throughout 2024. Williams-Sonoma, despite challenging year-over-year declines in traffic, reported comparable sales growth in the first quarter of 2024, which signals a higher level of conversion in-store.

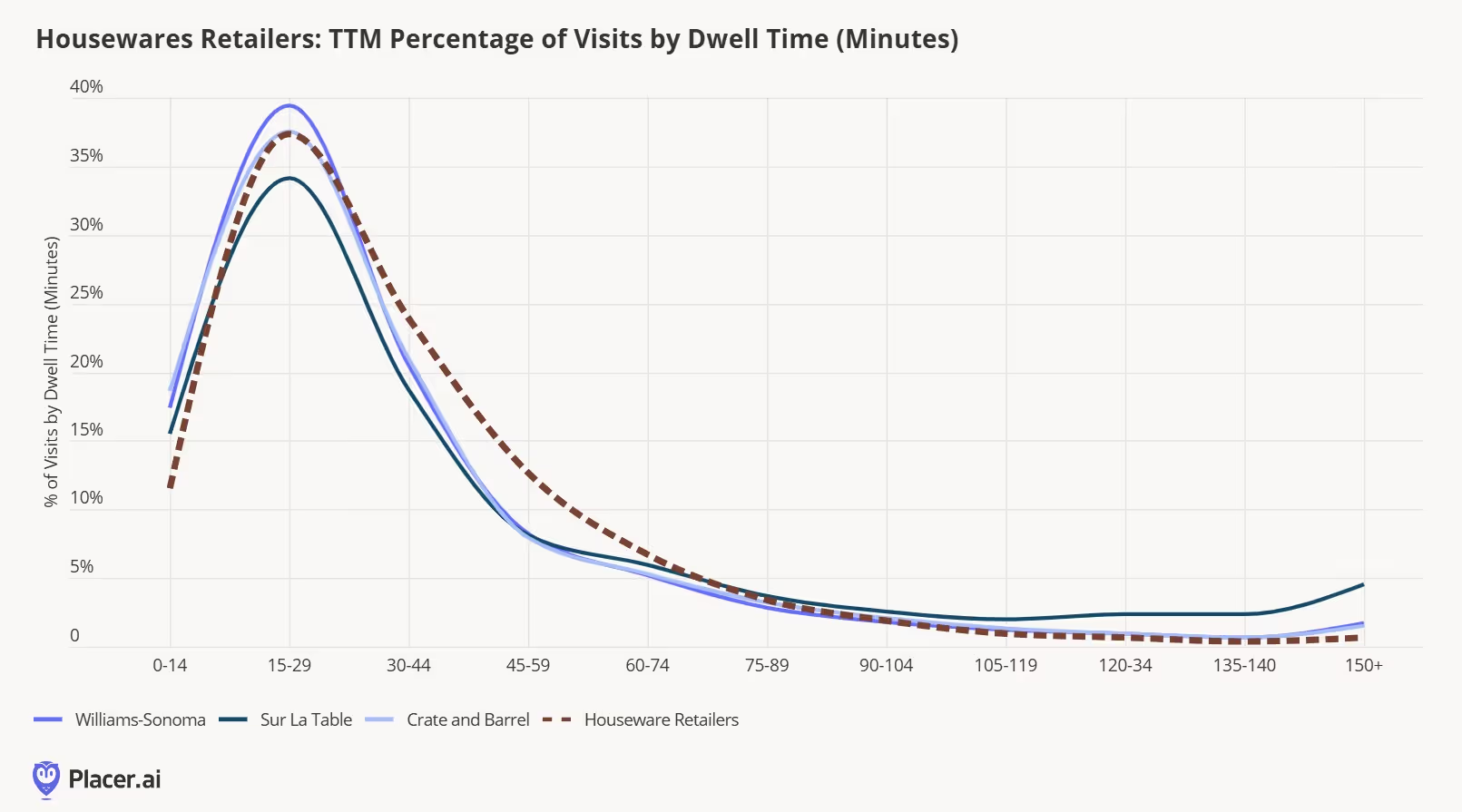

Sur La Table, a retailer that’s been challenged in the past, has found new life in changing consumer needs. One of Sur La Table’s core competencies is in-store cooking classes, and experiential retail continues to be one way the industry can provide inherent value to visitors. Dwell times are almost 10 minutes longer than Williams-Sonoma, its closest competitor (below). It also has the highest median household income of visitors and has the highest share of visits from households over $150k. Certainly at-home cooking has increased across income brackets, but high-end consumers also appear to be interested in adjacent home categories to take their skills to the next level. Blending product knowledge, experiences and assortment has greatly benefitted Sur La Table, and even against a challenging specialty retail landscape, the retailer has once again found its niche.

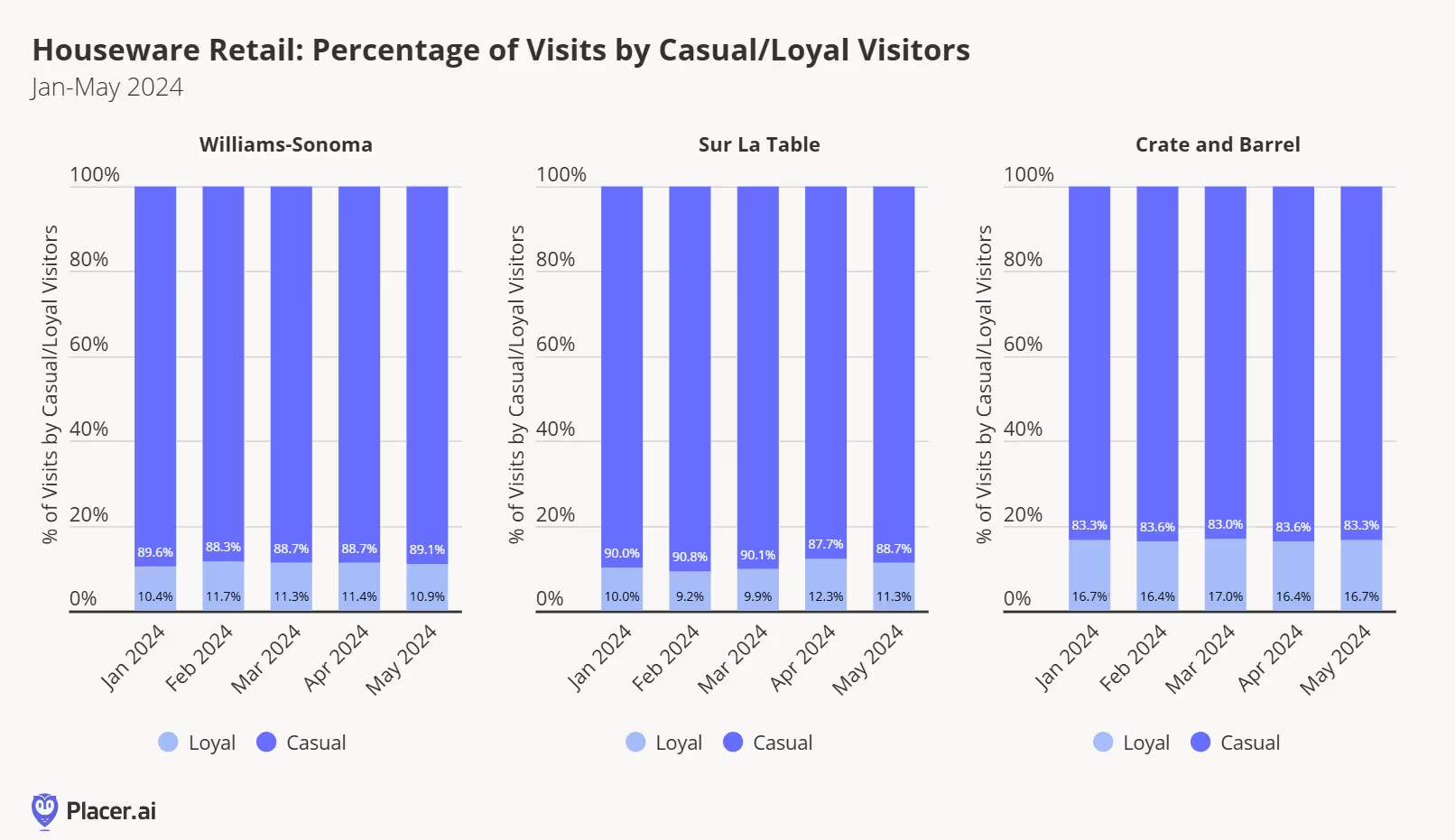

These retailers are often at the top of wedding registry lists, which could benefit traffic as we head into the summer months and the height of wedding season. Crate & Barrel, while not solely a kitchen focused retailer, has long been known as a registry destination that helps registrants outfit a kitchen with all of the cookware and gadgets one could need. Year to date through June, Crate & Barrel traffic is up 3% year-over-year, which is even more impressive considering that its assortment features an array of home furnishings categories, including furniture. Looking at demographic segments using Spatial.ai, Crate & Barrel over indexes in visits from Educated Urbanites and Young Professionals and Sunset Boomers compared the the average of other housewares chains, a signal that the wedding registry business, typically fueled by kitchen goods, could be attracting these particular subsets. Crate & Barrel also has a high level of loyalty in visits compared to other competitors in the space.

As we reported about Wayfair a few weeks ago, home retailers that have created exciting experiences and reasons to visit are still resonating with consumers, despite the tempered interest in the home category. An increased interest in cooking by consumers certainly plays a part in these retailers' success, but they have also had to provide even more incentive to drive traffic growth as consumers shift their attention away from purchasing for their homes. Having an experiential component or registry business have kept kitchen focused retailers more aligned with their consumer’s needs, which drive inherent value in today’s retail landscape, something not easy to come by.

Thrifting is on the rise. Whether fueled by a desire to shop more sustainably, find unique pieces, or save money, consumers have been increasingly turning to secondhand clothing stores for their new threads. And interest in thrift shopping is only expected to grow over the next few years – with some estimates putting the U.S. secondhand market at $73 billion by 2028.

With 2024 nearly at the midway point, we dove into the data to take a closer look at the segment.

The past few years have seen a growing interest among consumers in all things value, and thrift shops have been reaping the benefits. Between January and May 2024, the segment experienced strong monthly year-over-year (YoY) foot traffic growth. And compared to pre-COVID, too, thrift stores drew 29.6% more foot traffic in Q1 2024 than in Q1 2019.

Diving into the visit performance of individual thrift store chains reveals strength across a variety of brands. YoY visits to Goodwill, Crossroads Trading Co., and Savers were consistently elevated between January and May 2024.

Who are the shoppers driving thrift shop visit growth? Analyzing the demographics of thrift store visitors’ trade areas reveals that in 2024, thrift stores serve an economically diverse customer base. Data from the STI: PopStats dataset combined with Placer.ai captured market data shows that Goodwill draws customers from areas with a median household income (HHI) below the nationwide median $76.1K. Savers, for its part, draws shoppers from average-income areas, while Crossroad Trading Co. attracts a high-HHI customer base – likely due to the chain’s strong presence in affluent California and focus on high-end items.

Still, a look at the wider apparel shopping habits of thrift store visitors shows that these shoppers tend to be bargain hunters: Between January and May 2024, visitors to Crossroads Trading Co. and Savers were more likely to visit Goodwill than any other clothing chain. But they – together with Goodwill visitors – also did plenty of shopping at off-price chains like Ross Dress For Less, Marshall’s, and T.J. Maxx. (Crossroad Trading Co., which places a strong emphasis on selling on-trend, high-end items, also saw many of its customers shopping at Macy’s, while Savers visitors were more likely to frequent Kohl’s).

This consistent interest in budget-friendly venues underscores the strong preference for value among the growing ranks of thrift store shoppers

Thrifting is proving its staying power, with visits to major thrift stores outpacing those of other apparel categories. Will the secondhand market continue on its upward trajectory?

Follow Placer.ai to keep up with the latest data-driven retail trends.

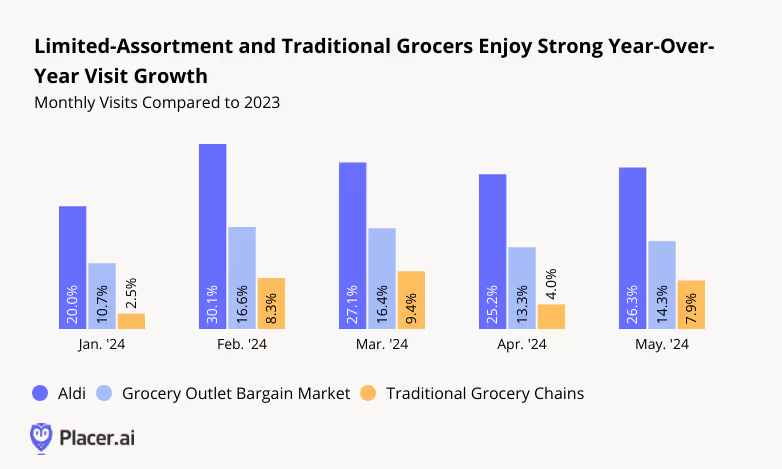

Limited-assortment value grocery stores like Aldi and Grocery Outlet Bargain Market have thrived in recent years, as inflation-wary consumers sought out ways to save money at the till.

But how are these chains faring in 2024? Have cooling inflation and increased consumer confidence put a dent in their performance? We dove into the data to find out.

As the name suggests, limited-assortment grocery stores are known for carrying fewer products than traditional grocery stores in a bid to cut down on overhead costs and pass savings on to consumers. These chains also utilize other methods, such as private label brands, opportunistic merchandising, and fewer in-store amenities, to keep prices low.

And foot traffic data shows that in the first part of 2024, consumers continued flocking to these brands to grab groceries at a discount – driving year-over-year (YoY) foot traffic growth that far outperformed that of traditional grocery stores. In May 2024, for example, visits to the overall grocery segment grew by 7.9% YoY, while Aldi and Grocery Outlet Bargain Market experienced YoY growth of 26.3%, 14.3%, and respectively.

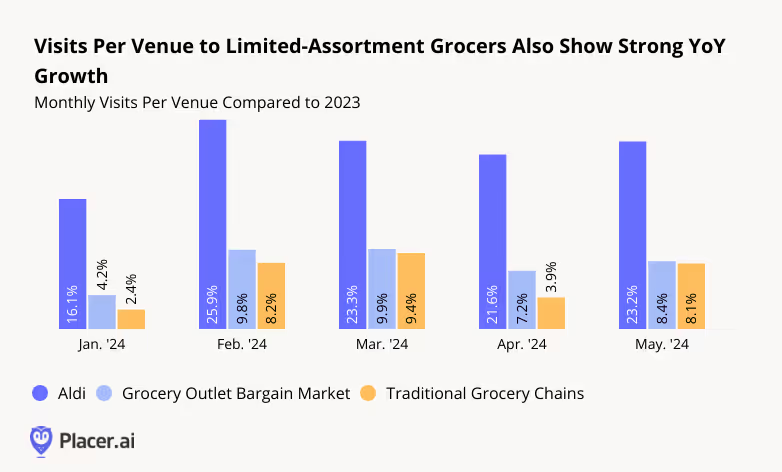

Some of this foot traffic growth can be attributed to the two chains’ continued expansion: Aldi added dozens of new stores in 2023 – with hundreds more in the pipeline – and Grocery Outlet Bargain Market also significantly grew its footprint. But the average number of visits to both brands’ individual locations also increased, again outpacing traditional grocery, showing that their expansion is meeting robust demand.

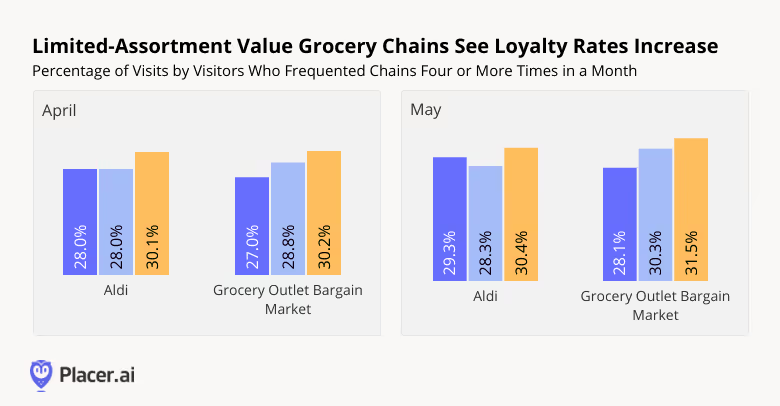

Looking into the loyalty rates of visitors to these limited-assortment value chains provides more reason for optimism for the sector: Over the past three years, Aldi and Grocery Outlet Bargain Market both saw an increase in loyal visits – defined as those made by people who frequented the chains at least four times in a month.

In April 2022, for example, 28.0% of visits to Aldi and 27.0% of visits to Grocery Outlet Bargain Market were made by people who visited the chains at least four times during the month – but by 2024, these shares grew to 30.1% and 30.2%, respectively. A similar trend was observed in May 2024.

Increasingly, it seems, people are doing at least part of their routine weekly grocery shopping at these limited-assortment chains. And with consumers continuing to seek ways to save money, these grocers are well-positioned to continue growing their visit shares.

The limited-assortment, value grocery model continues to prove its staying power, with impressive foot traffic, visits per location, and loyalty rates.

Will the segment continue on its upward trajectory?

Visit Placer.ai to find out.

About the Placer 100 Index for Retail & Dining: The Placer 100 Index for Retail & Dining is a curated, dynamic list of leading chains that often serve as prime tenants for shopping centers and malls. The index includes chains from various industries, such as superstores, grocery, dollar stores, dining, apparel, and more. Among the notable chains featured are Walmart, Target, Costco, Kroger, Ulta Beauty, The Home Depot, McDonald’s, Chipotle, Crunch Fitness, and Trader Joe's. The goal of the list is to provide insight into the wider trends impacting the retail, dining, and shopping center segments.

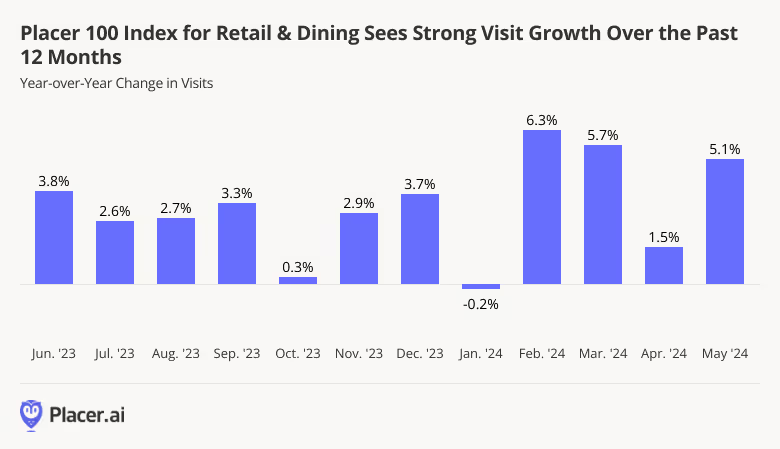

Foot traffic patterns at leading chains can serve as an interesting proxy for consumer sentiment – offering a glimpse into the overall health of the retail and dining spaces. And analyzing the YoY foot traffic performance of the Placer 100 Index for Retail & Dining over the past twelve months reveals that, for the most part, major retail and dining players have enjoyed consistently strong visit growth. In November and December 2023 – during the height of last year’s holiday shopping season – foot traffic to the chains included in the Index increased 2.9% and 3.7% respectively, compared to the equivalent period of 2022.

And although 2024 opened with a slight, weather-driven YoY decline in visits, retail and dining foot traffic quickly bounced back, finishing out May with a 5.1% increase. This springtime jump was partly due to two special calendar days – Mother’s Day weekend, and Memorial Day weekend – both of which drove bigger visit spikes this year than in 2023.

These robust visitation patterns highlight consumer resilience in the face of headwinds – and may be an encouraging indicator of a thriving summer ahead.

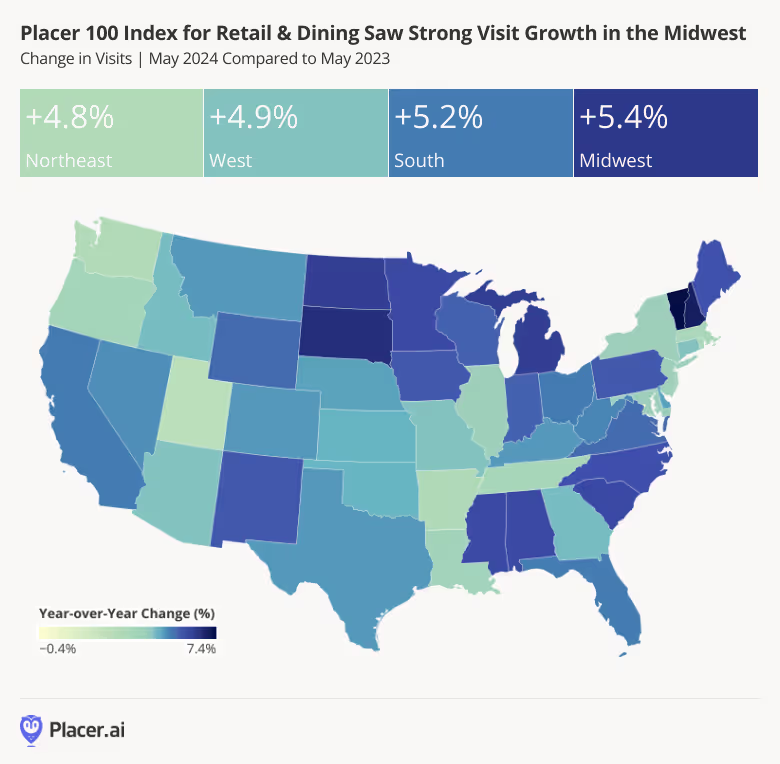

Zooming into the Index’s regional performance during May 2024 uncovers impressive positive YoY visit growth across the nation.

The Midwest led the way, buoyed by strong YoY foot traffic growth in South Dakota (6.7%), Michigan (6.4%), and North Dakota (6.4%). But the two states with the biggest YoY visit boosts – Vermont (7.4%) and New Hampshire (7.0%) – were in the Northeast, and the South and West performed well too. This impressive increase in retail and dining visits was observed across the vast majority of the continental U.S., regardless of population size and local weather conditions. Such widespread growth indicates a robust and uniform recovery in consumer activity nationwide, suggesting that factors beyond regional characteristics, such as slowing inflation and increased consumer confidence, played a significant role in driving this trend.

Drilling down into the rankings of individual chains in the index can highlight some of the key trends shaping retail and dining this year.

Value-oriented retailers – including Aldi, Ollie’s Bargain Outlet, and Dollar General, – featured prominently among May’s top performers, both for YoY chain-wide visits and for YoY average visits per location. This robust showing demonstrates the continued draw of budget fare, which has been observed across a wide range of segments – from grocery to apparel.

The quest for savings spilled over into other segments as well. Value gym Crunch Fitness, which grew its footprint significantly over the past year, ranked among the top performers both for overall visits and for visits per location – showcasing the success of its expansion strategy. And casual dining chains Chili’s Grill & Bar and Buffalo Wild Wings also made the list, with YoY visit growth likely driven by successful value promotions.

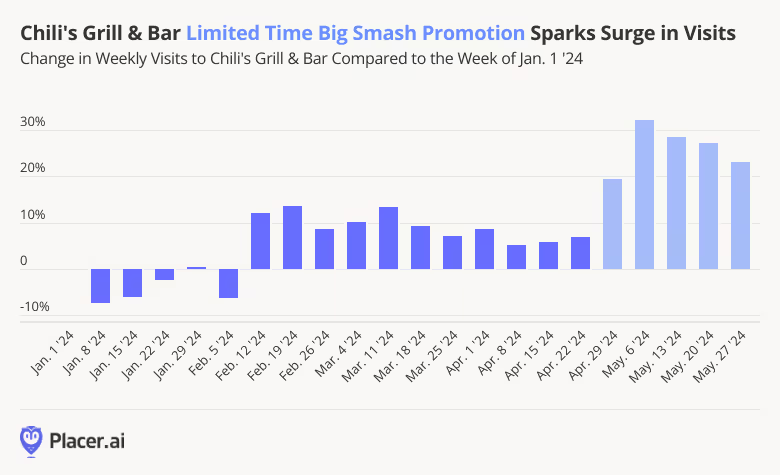

Indeed, Chili's Grill & Bar – propelled by its hit Big Smasher Burger promotion – has emerged as this month's leading chain, topping the charts both for overall visits (26.3%) and for average visits per location (26.1%).

Hungry, budget-conscious diners can get Chili’s Big Smasher as part of the chain’s signature 3 for Me deal, which lets diners choose a beverage, starter, and main course starting at $10.99. And the offering, which was launched on April 29th, 2024, has become a sensation – going viral on TikTok and garnering significant media attention.

The promotion is competitively priced against QSR offerings, at a time when fast-food chains have seen slowing sales due to cutbacks by inflation-wary consumers. Chili's has been praised for delivering exceptional value – and taking a closer look at weekly visitation trends shows that this strategy is paying off. Chili’s saw a surge of weekly visit growth beginning the week of the promotion (April 29th), and has continued thriving since. This highlights the importance of understanding consumer needs and finding ways to deliver value.

Will June continue to see a rise in retail and dining visits as summer approaches? Will the success of retail and dining foot traffic remain evenly spread across regions, even as some areas are more affected by summer heat? And will value-oriented retailers continue to dominate the ten top performers in retail and dining?

Visit Placer.ai to find out.

It’s no secret that the restaurant category is starting to get more promotional. As consumers–especially lower income consumers–have shifted toward substitute food retail channels like value grocers, warehouse clubs, and convenience stores due to the compounded effect of food-away-from home inflation, restaurant chains across all tiers are resorting to increased promotional activity to drive visit trends.

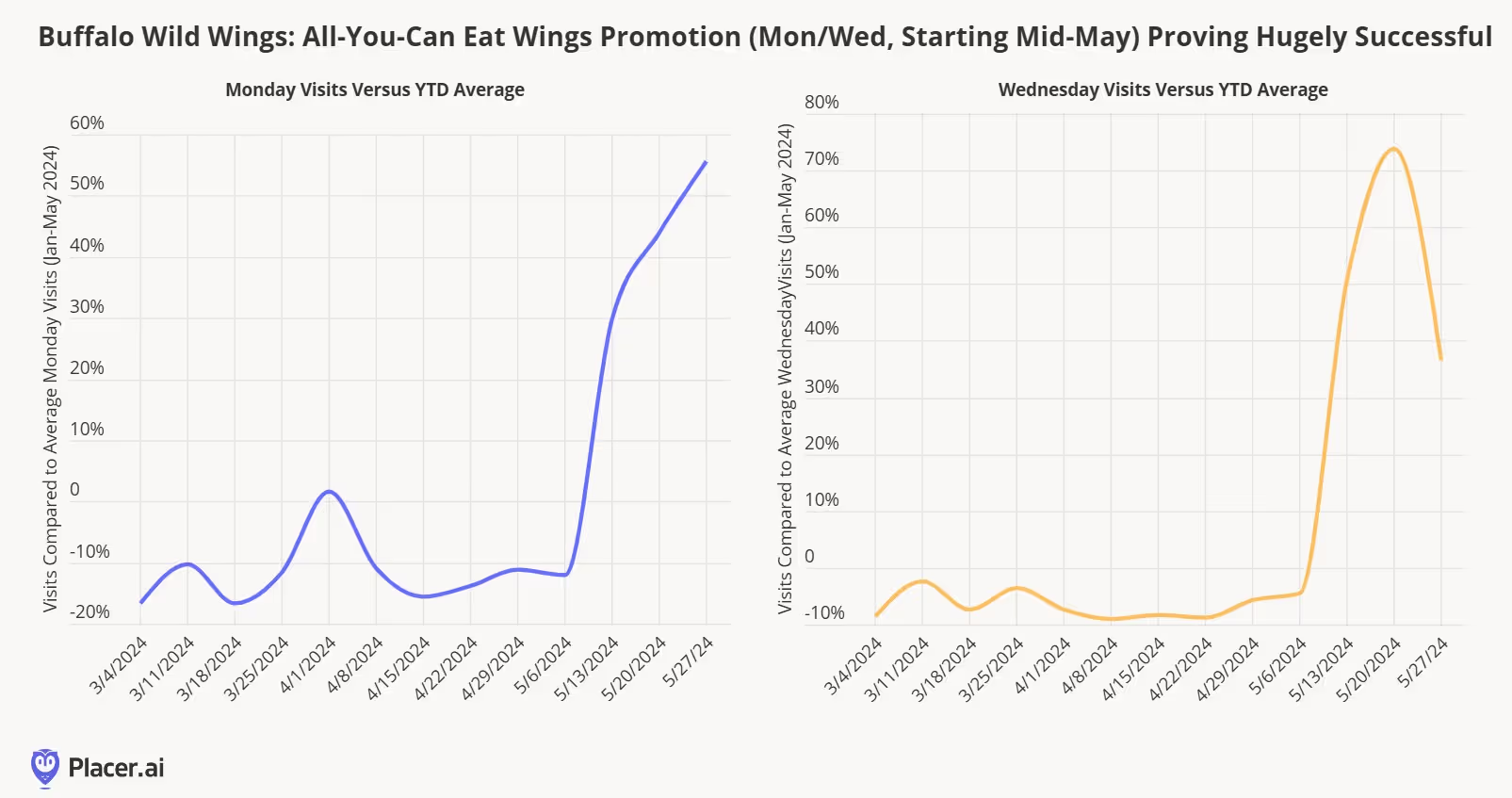

Over the past few weeks, we’ve discussed that several casual dining chains had seen success through all-you-can eat and other deep discount promotions. Last week, we noted that Chili’s had been outperforming broader casual-dining category averages through its value messaging. We also noted the success of Buffalo Wild Wings All-You-Can Eat wings promotions on Monday and Wednesdays starting in mid-May. Below, we show visit trends to Buffalo Wild Wings on Mondays and Wednesdays compared to their year-to-date averages since the beginning of March. The promotion has helped to drive incremental visits on two traditionally slower days. During May, the chain was seeing visits greater than 30% its normal daily visit count for Mondays and Wednesdays during the earlier part of the promotion and exceeding 50% during the latter part of the month. While it's unlikely that this promotion will be permanent–restaurants have to work with their suppliers ahead of time to make sure they have sufficient food for promotions like this–but given the success, the chain may consider running during other months (and potentially other days of the week) later this year.

However, as we noted in our recap of this year’s National Restaurant Association show, QSR chains have started to get more promotional ahead as they look to recapture visit share lost to value grocers, dollar stores, and c-stores (especially within lower-income trade areas). McDonald’s will launch a national $5 value menu promotion on June 25, but it’s clear that other QSR chains are already seeing success with their competing $5 promotions. Below, we show year-over-year weekly visit trends from March through early June for the major QSR burger chains. Burger King launched its own $5 Your Way Meal value menu this past week, and has seen visit trends accelerate since then. Starbucks–which has historically stayed away from discounts as a way to protect its premium brand position–also surprised the industry by announcing a $5-$7 “pairings menu” this week.

Easing commodity costs have allowed restaurants to get more promotional, although when paired with rising labor costs (especially in California, which we covered last week), it does set up an environment where restaurant profits will likely be squeezed over the next several months. Also, substitute food retail channels are likely to introduce their own price reductions in the months to come (as we’ve already seen from Walmart).

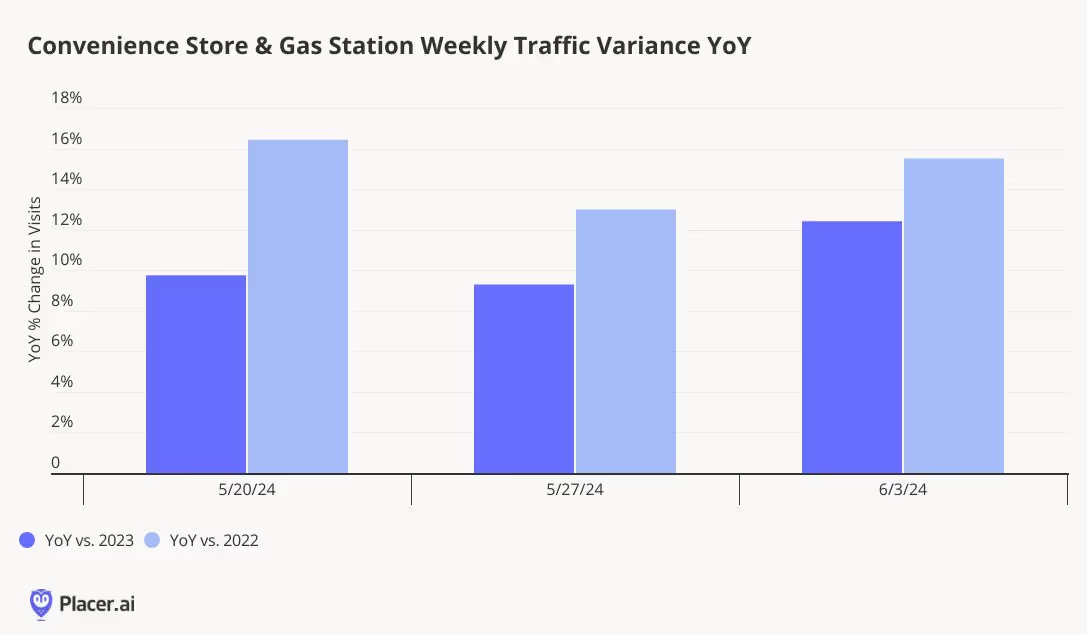

Summer has unofficially arrived, and with that comes the desire to relax, unwind and travel. And despite some of the economic uncertainty still facing consumers, 2024 is off to a surprising start for traffic in certain parts of retail. According to AAA, auto traffic growth for Memorial Day weekend was projected to grow by 4% compared to last year and by almost 2% versus 2019. Car travel has long been seen as the value-based travel method across the U.S., and who can forget the allure of the “summer road trip”. But inflationary pressures may have made it less appealing over the past few years. In the most recent consumer price index for May 2024, a drop in gasoline prices was a large positive contributor to the overall rate of 3.3%, which could provide a stronger consumer push for summer car travel.

With the positive momentum in auto traffic and gas prices, gas station and convenience store traffic has greatly benefited since Memorial Day weekend. In fact, visits to chains from May 20 to June 10 this year increased by 11% compared to the same weeks in 2023 and 15% versus 2022. Traffic to convenience stores and gas chains is up almost 30% compared to the same weeks in 2019. Traffic growth steadily climbed over the course of the three weekends measured, and the weeks had some of the highest growth rates so far in 2024 with the exception of a week in March. Even with the projected increase in auto traffic across the country, convenience and gas is the summer blockbuster, building on the consumer trends of the past year and the successful strategies of various retailers.

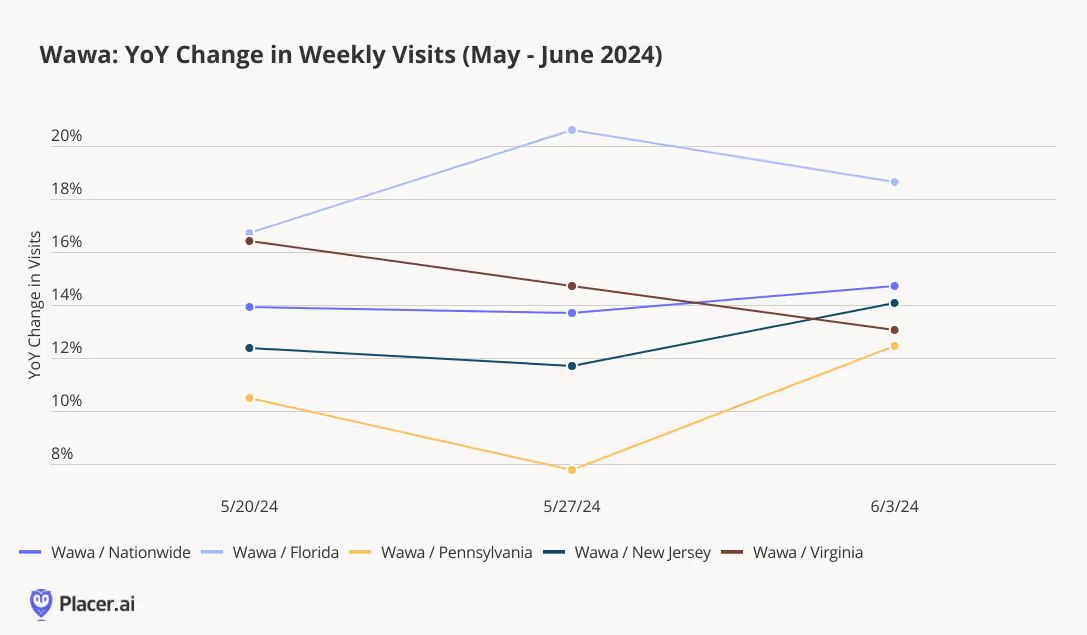

Wawa, in particular, saw strong visit patterns in the first unofficial few weeks of summer travel. The chain at a total level is up an impressive 14% year-over-year for the measured weeks. Looking at Wawa’s performance across various states, Florida drove much of the growth in traffic as the weather heats up, and outperformed some of the brand’s stronghold states like Pennsylvania & New Jersey. Average dwell times at Wawa locations in Florida are almost a minute higher than the chain average, highlighting that stores are not only pulling in more visits, but keeping visitors in-store for longer. The strong performance of the Florida locations, even during the off season, corroborates the brand’s investment in expansion across the state. One might suspect that Wawa is well positioned heading into the remainder of the summer with its coastal strategy.

Will C-stores continue to grow traffic as we officially enter the summer season? All signs point to yes, even if gas prices rise due to increased demand. Chains have done a fantastic job of enticing consumers with unique food offerings and might become the must-visit destination before heading to the beach this summer.

The first quarter of 2024 was generally a good one for retailers. Though unusually cold and stormy weather left its mark on the sector’s January performance, February and March saw steady year-over-year (YoY) weekly visit growth that grew more robust as the quarter wore on.

March ended on a high note, with the week of March 25th – including Easter Sunday – seeing a 6.1% YoY visit boost, driven in part by increased retail activity in the run-up to the holiday. (Last year, Easter fell on April 9th, 2023, so the week of March 25th is being compared to a regular week.)

Though prices remain high and consumer confidence has yet to fully regain its footing, retail’s healthy Q1 showing may be a sign of good things to come in 2024.

Drilling down into the data for leading retail segments demonstrates the continued success of value-priced, essential, and wellness-related categories.

Discount & Dollar Stores led the pack with 11.2% YoY quarterly visit growth, followed by Grocery Stores, Fitness, and Superstores – all of which outperformed Overall Retail. Dining also enjoyed a YoY quarterly visit bump, despite the segment’s largely discretionary nature. And despite the high interest rates continuing to weigh on the housing and home renovation markets, Home Improvement & Furnishings maintained just a minor YoY visit gap.

Discount & Dollar Stores experienced strong YoY visit growth throughout most of Q1 – and as go-to destinations for groceries and other other essential goods, they held their own even during mid-January’s Arctic blast. In the last week of March, shoppers flocked to leading discount chains for everything from chocolate Easter bunnies to basket-making supplies – driving a remarkable 21.5% YoY visit spike.

Dollar General continued to dominate the Discount & Dollar Store space in Q1, with visits to its locations accounting for nearly half of the segment’s quarterly foot traffic (44.7%). Next in line was Dollar Tree, followed by Family Dollar and Five Below. Together, the four chains – all of which experienced positive YoY quarterly visit growth – drew a whopping 91.6% of quarterly visits to the category.

Rain or shine, people have to eat. And like Discount & Dollar Stores, traditional Grocery Stores were relatively busy through January as shoppers braved the storms to stock up on needed items. Momentum continued to build throughout the quarter, culminating in a 10.5% foot traffic increase in the week ending with Easter Sunday.

Like in other categories, it was budget-friendly Grocery banners that took the lead. No-frills Aldi drove a chain-wide 24.4% foot traffic increase in Q1, by expanding its fleet – while also growing the average number of visits per location. Other value-oriented chains, including Trader Joe’s and Food Lion, experienced significant foot traffic increases of their own. And though conventional grocery leaders like H-E-B, Kroger, and Albertsons saw smaller visit bumps, they too outperformed Q1 2023 by meaningful margins.

January is New Year’s resolution season – when people famously pick themselves up off the couch, dust off their trainers, and vow to go to the gym more often. And with wellness still top of mind for many consumers, the Fitness category enjoyed robust YoY visit growth throughout most of Q1 – despite lapping a strong Q1 2023.

Predictably, Fitness’s visit growth slowed during the last week of March, when many Americans likely indulged in Easter treats rather than work out. But given the category’s strength over the past several years, there is every reason to believe it will continue to flourish.

For Fitness chains, too, cost was key to success in Q1 – with value gyms experiencing the biggest visit jumps. EōS Fitness and Crunch Fitness, both of which offer low-cost membership options, saw their Q1 visits skyrocket 28.9% and 22.0% YoY, respectively – helped in part by aggressive expansions. At the same time, premium and mid-range gyms like Life Time and LA Fitness are also finding success – showing that when it comes to Fitness, there’s plenty of room for a variety of models to thrive.

Superstores – including wholesale clubs – are prime destinations for big, planned shopping expeditions – during which customers can load up on a month’s supply of food items or stock up on home goods. And perhaps for this reason, the category felt the impact of January’s inclement weather more than either dollar chains or supermarkets – which are more likely to see shoppers pop in as needed for daily essentials.

But like Grocery Stores and Discount & Dollar Stores, Superstores ended the quarter with an impressive YoY visit spike, likely fueled by Easter holiday shoppers.

As in Q4 2023, membership warehouse chains – Costco Wholesale, BJ’s Wholesale Club, and Sam’s Club – drove much of the Superstore category’s positive visit growth, as shoppers likely engaged in mission-driven shopping in an effort to stretch their budgets. Still, segment mainstays Walmart and Target also enjoyed positive foot traffic growth, with YoY visits up 3.9% and 3.5%, respectively.

Moving into more discretionary territory, Dining experienced a marked January slump, as hunkered-down consumers likely opted for delivery. But the segment rallied in February and March, even though foot traffic dipped slightly during the last week of March, when many families gathered to enjoy home-cooked holiday meals.

Coffee Chains and Fast-Casual Restaurants saw the largest YoY visit increases, followed by QSR – highlighting the enduring power of lower-cost, quick-serve dining options. But Full-Service Restaurants (FSR) also saw a slight segment-wide YoY visit uptick in Q1 – good news for a sector that has yet to bounce back from the one-two punch of COVID and inflation. Within each Dining category, however, some chains experienced outsize visit growth – including favorites like Dutch Bros. Coffee, Slim Chickens, In-N-Out Burger, and Texas Roadhouse.

Since the shelter-in-place days of COVID – when everybody had their sourdough starter and DIY was all the rage – Home Improvement & Furnishings chains have faced a tough environment. Many deferred or abandoned home improvement projects in the wake of inflation, and elevated interest rates coupled with a sluggish housing market put a further damper on the category.

Against this backdrop, Home Improvement & Furnishings’ relatively lackluster Q1 visit performance should come as no surprise. But the narrowing of the visit gap in March – which also saw one week of positive visit growth – may serve as a promising sign for the segment. (The abrupt foot traffic drop during the week of March 25th, 2024 is likely a just reflection of Easter holiday shopping pattern.)

Within the Home Improvement & Furnishings space, some bright spots stood out in Q1 – including Harbor Freight Tools, which saw visits increase by 10.0%, partly due to the brand’s growing store count. Tractor Supply Co., Menards, and Ace Hardware also registered visit increases.

January 2024’s stormy weather left its mark on the Q1 retail environment, especially for discretionary categories. But as the quarter progressed, retailers rallied, with healthy YoY foot traffic growth that peaked during the last week of March – the week of Easter Sunday. All in all, retail’s positive Q1 performance leaves plenty of room for optimism about what’s in store for the rest of 2024.

This report includes data from Placer.ai Data Version 2.0, which implements improvements to our extrapolation capabilities, adds short visit monitoring, and enhances visit detection.

Over the past year, Fast-Casual & Quick-Service Restaurant (QSR) chains have thrived, consistently outperforming the Full-Service Dining segment with positive year-over-year (YoY) visit growth every quarter since 2023. In this white paper, we dive into the data for leading dining chains to take a closer look at what’s driving visitors to the QSR segment and what other dining categories can learn from fast-food’s success.

One of the key factors separating QSR chains – aptly known as “fast food” – from the rest of the dining industry is the speed at which diners can get a ready-to-eat meal in their hands. And within the QSR space, speed of service is one of the ways chains differentiate themselves from their competition.

Leading fast-food chains are investing heavily in technologies and systems designed to help them serve customers ever more quickly:

Taco Bell’s “Touch Display Kitchen System” is designed to optimize cooking operations and improve wait times, while the chain’s Go Mobile restaurant format seeks to alleviate bottlenecks in the drive-thru lane. Chick-fil-A also has dedicated channels for quick mobile order pick-up and is planning four-lane drive-thrus with second-floor kitchens to get meals out even faster. And to save time at the drive-thru, Wendy’s is experimenting with generative AI and developing an underground, robotic system to deliver digital orders to designated parking spots within seconds.

And location intelligence shows that all three chains are succeeding in reducing customer wait times. Over the past four years, Taco Bell, Chick-fil-A, and Wendy’s have seen steady increases in the share of visits to their venues lasting less than 10 minutes.

The data also suggests that investment in speed of service can increase overall visitation to QSR venues.

In late 2022, McDonald’s opened a to-go-only location outside of Dallas, TX with a lane dedicated to mobile order fulfillment via a conveyor belt. And in Q1 2024, this venue not only had a larger share of short visits compared to the other McDonald’s locations in the region, but also more visits compared to the McDonald’s average visits per venue in the Dallas-Fort Worth CBSA.

This provides further support for the power of fast order fulfillment to drive QSR visits, with customers motivated by the prospect of getting in and out quickly.

The success of the fast-food segment is even driving other restaurants to borrow typical QSR formats – especially during time slots when people are most likely to grab a bite to eat on the go.

In September 2023, full-service leader Applebee’s opened a new format: a fast casual location focusing on To Go orders in Deer Park, NY, featuring pick-up lockers for digital orders and limited dine-in options without table service.

And the new format is already attracting outsized weekday and lunchtime crowds. In Q1 2024, 20.5% of visits to the chain’s To Go venue took place during the 12:00 PM - 2:00 PM time slot, while the average Applebee’s in the New York-Newark-Jersey City CBSA received less than 10% of its daily visits during that daypart. The new restaurant also drew a significantly higher share of weekday visits than other nearby venues.

This suggests that takeaway-focused venues could help full-service chains grow their visit share during weekdays and the coveted lunch rush, when consumers may be less inclined to have a sit-down meal.

An additional factor contributing to QSR and Fast Casual success in 2024 may be the rise of chicken-based chains. Chicken is a versatile ingredient that has remained relatively affordable, which could be contributing to its growing popularity and the rapid expansion of several chicken chains.

Comparing the relative visit share (not including delivery) of various sub-segments within the wider Fast Casual & QSR space showed that the share of visits to chains with chicken-based menus has increased steadily between 2019 and 2023: In Q1 2024, 15.3% of Fast Casual & QSR visits were to a chicken restaurant concept, compared to just 13.4% in Q1 2019.

The strength of chicken-based concepts is also evident when comparing average visits per venue at leading chicken chains with the wider Fast Casual & QSR average.

Both Chick-fil-A, the nation’s predominant chicken chain, and Raising Cane’s, a rapidly expanding player in the fast-food chicken space, are receiving significantly more visits per venue than their Fast Casual & QSR peers: In Q1 2024, Raising Cane’s and Chick-fil-A restaurants saw an average of 153.0% and 237.7% more visits per venue, respectively, compared to the combined Fast Casual & QSR industries average.

The elevated traffic at chicken chains likely plays a part in their profitability per restaurant relative to other Fast Casual & QSR concepts with more sizable fleets.

QSR and Fast-Casual chains are also particularly adept at generating seasonal visit spikes through unique Limited Time Offers and holiday promotions adapted to the calendar.

Arby’s recently launched a 2 for $6 sandwich promotion on February 1st, with two of the three sandwich options on promotion being fish-based in an apparent attempt to entice diners eschewing meat in observance of Lent. The company also brought back a specialty fish sandwich, likely with the goal of further appealing to the Lent-observing demographic.

The offers seem to have driven significant traffic spikes, with foot traffic during the promotion period significantly higher than the January daily visit average. And traffic was particularly elevated during Lent – which this year fell on Wednesday, February 14th through Thursday, March 28th, with visits spiking on Fridays when those observing are most likely to seek out fish-based meals.

Some of the elevated visits in the second half of Q1 may be attributed to the comparison to a weaker January across the dining segment. But the success of the fish-forward promotion specifically during Lent suggests that the company’s calendar-appropriate LTO played a major role in driving visits to the chain.

Shorter-term promotions – even those lasting just a single day – can also drive major visit spikes.

Since 1991, White Castle has transformed its fast-food restaurants into a reservation-only, “fine-dining” experience for dinner on Valentine's Day. In 2024, Valentine’s Day fell on a Wednesday, and White Castle’s sit-down event drove a 11.8% visit increase relative to the average Wednesday in Q1 2024 and a 3.9% visit increase compared to the overall Q1 2024 daily average.

The elevated visit numbers over Valentine’s Day are even more impressive when considering that a full-service dining room can accommodate fewer visitors than the drive-thrus and counter service of White Castle’s typical QSR configuration. The spike in February 14th visits may also be attributed to an increased number of diners showing up throughout the day to take in the Valentine’s Day buzz.

QSR and Fast-Casual dining are having a moment. And the data shows that a combination of factors – including fast and efficient service, the rising popularity of chicken-based dining concepts, and effective LTOs – are all playing a part in the categories’ recent success.

This report includes data from Placer.ai Data Version 2.0, which implements improvements to our extrapolation capabilities, adds short visit monitoring, and enhances visit detection.

The first American mall opened in 1956 and reinvented retail – within a decade there were over 4,500 malls across the country. But a rise in e-commerce coupled with the oversaturation of mall options across the country paved the way for mall visits to slow, and many predicted that malls would go the way of the dinosaur.

But although malls were hit hard over the past few years as lockdowns and rising costs contributed to a significant drop in foot traffic, shopping centers have proven resilient. Leading players in the space have consistently reinvented themselves and explored alternate ways to draw in crowds – and as inflation cools, malls are bouncing back as well.

This white paper analyzes the Placer.ai Shopping Center Industry – a collection of over 3000 shopping centers across the United States – as well as the Placer.ai’s Mall Indexes, which focus on top-tier Indoor Malls, Open-Air Shopping Centers, Outlet Malls. The report examines how visits are shifting and where behaviors are changing – and where they’re staying the same – and takes a closer look at the strategies malls are using to attract shoppers in 2024.

Malls experienced a rocky few years as pandemic-related restrictions and economic headwinds kept many shoppers at home, and visits to all mall types in 2021 were between 10.7% to 15.3% lower than in 2019. But foot traffic trends improved significantly in 2022 – likely due to the fading out of COVID restrictions.

By 2023, visits to the wider Shopping Center Industry were just 2.3% lower than they had been in 2019, and the visit gaps for Indoor Malls and Open-Air Shopping Centers had narrowed to 5.8% and 1.0% lower, respectively. Outlet Malls also saw visits ticking up once again, with the visit gap compared to 2019 narrowing to 8.5% in 2023 after having dropped to 11.3% in 2022. This more sustained foot traffic dip may stem from consumers’ desire to save on gas costs or the impacts of inclement weather. However, the narrowing visit gaps suggest that shoppers are increasingly returning to the segment, and foot traffic may yet pick up again in 2024.

COVID-19 impacted more than just visit numbers – it also changed in-store consumer behavior. And now, with the Coronavirus a distant memory for many, some of these pandemic-acquired habits are fading away, while other shifts appear to be holding steady.

One visit metric that appears to have reverted to pre-COVID norms is the share of weekday vs. weekend visits. Weekday visits had increased in 2021 – at the height of COVID – as consumers found themselves with more free time midweek, but the balance of weekday vs. weekend visits has now returned to 2019 levels.

In 2023, the Shopping Center Industry, which includes a number of grocery-anchored centers along with open-air shopping centers and their relatively large variety of dining options, saw the largest share of weekday visits, followed by Indoor Malls. Outlet Malls received the lowest share of weekday visits – around 55% – likely due to the longer distances usually required to drive to these malls, making them ideal destinations for weekend day trips.

While the day of the week that people frequent malls hasn't changed significantly since 2019, there is one notable difference in mall foot traffic pre- and post-pandemic. Almost all mall categories are seeing fewer during the late morning-midday and late evening dayparts, while the amount of people heading to a mall in the afternoon and early evening has increased.

In 2019, Indoor Malls saw 20.1% of visits occurring between 10:00am and 1:00pm, but that share decreased to 18.6% in 2023. Meanwhile, the share of visits between 4:00-7:00 pm rose from 29.1% in 2019 to 32.4% in 2023. Similar patterns repeated across all shopping center categories, with the 1:00-4:00pm daypart seeing a slight increase, the 4:00-7:00 pm daypart receiving the largest boost and the 7:00-10:00 pm daypart seeing the largest drop. So although changes in work habits have not altered the weekly visit distribution, it seems like hybrid workers are taking advantage of their new, and likely more flexible schedules to frequent malls in the afternoon instead of reserving their mall trips for after work. The significant numbers of Americans moving to the suburbs in recent years may also be contributing to the decline of late night visits, with these suburban newcomers perhaps less likely to spend time outside the house during the evening hours.

Although malls have enjoyed consistent growth in foot traffic over the past two years, visits still remain below 2019 levels. How can shopping centers attract more shoppers and recover their pre-COVID foot traffic?

Some malls are attracting visitors by looking beyond traditional retail with offerings such as gyms, amusement parks, and even entertainment complexes. And with more traditional mall anchors shutting their doors than ever, even smaller shopping centers are adding lifestyle experiences options in newly vacant spaces – and incorporating unique elements into traditional retail spaces.

In September 2023, the Chandler Fashion Center in Arizona opened a giant SCHEELS store in its mall. The 250,000-square-foot sporting goods store boasts more than just sneakers – visitors can ride on a 45-foot Ferris Wheel or marvel at a 16,000-gallon saltwater aquarium. And monthly visitation data to the mall reveals the power of this new retail destination, with foot traffic to the mall experiencing a major jump from October 2023 onward. The excitement of the new SCHEELS seems to be sustaining itself, with February 2024 visits 23.3% higher than the same period of 2023.

Restaurants, too, can help bring people into malls. The Southgate Mall in Missoula, Montana, experienced a jump in monthly visits following the opening of a Texas Roadhouse steakhouse in November 2023. Customers seem to be receptive to this new addition – the mall saw a sustained increase in foot traffic from November 2023 onward, with year-over-year (YoY) visit growth of 17.0% in February 2024.

The addition of Texas Roadhouse provides Missoula residents with a family-friendly dining experience while tapping into the evergreen popularity of steakhouses.

Malls that don’t want to choose between adding a dining option and incorporating a novel entertainment venue can blend the two and go the “eatertainment” route. One shopping center – North Carolina’s Cross Creek Mall – is proving just how effective these concepts can be for a mall looking to grow its foot traffic.

Eatertainment destination Main Event opened at the mall in August 2023, bringing laser tag, video games, virtual reality, and 18 bowling lanes with it. Main Event’s opening also provided a boost in foot traffic to the mall – monthly visits to Cross Creek Mall surged following the opening. And this foot traffic boost sustained itself, particularly into the colder winter months – January and February 2024 saw YoY growth of 12.3% and 25.1%, respectively.

Integrating entertainment options at malls is one strategy for driving visits, but there are plenty of other ways to bring people through the doors. Pop-ups have been a particularly popular option of late, especially as more online brands venture into the world of physical retail. And malls, which typically tend to leave a small portion of their storefronts vacant, can be the perfect place to host a retailer for a limited time.

One brand – Shein – has been a leader in the pop-up space, bringing its affordable fashion to malls in Las Vegas, Seattle, and Indianapolis. These short-term residencies – typically no longer than three to four days – allow shoppers to try the popular online retailer’s products before they buy.

Shein has enjoyed success with its mall residencies, evidenced by the foot traffic at the Woodfield Mall in Illinois, which hosted a three-day pop-up from December 15-17, 2023. The retail event was hugely popular, with visits reaching Super Saturday (the last weekend before Christmas) proportions – even though this year’s Super Saturday coincided with Christmas Eve Eve (December 23rd) and drove unusually high traffic spikes.

Shein pop-ups are typically very short – no more than three to four days. This format, known for creating a sense of urgency among shoppers, has proven powerful in driving store visits. But can longer-lasting pop-ups find success as well?

Foot traffic data from pop-ups hosted by Swedish home furnisher IKEA suggests that yes – longer-term residencies can be successful. The chain is working on growing its presence across the country, particularly in malls. To that end, IKEA has been experimenting with mall pop-ups, beginning with a six-month residency at the Rosedale Center in Roseville, Minnesota.

IKEA opened its store on February 16, 2024, and visits to the mall increased significantly immediately after. The first week of the pop-up saw a 12.9% growth in visits compared to a January 1-7, 2024 baseline. And by the third week of the pop-up, there were still noticeably more people frequenting the mall than before the launch.

The luxury retail segment has had a great few years, and malls are tapping into this popularity. Nearly 40% of new high-end store openings in 2023 were in mall settings, many in Sunbelt states like Texas, Florida, and Arizona, perhaps driven in part by demand from an influx of wealthy newcomers to those states.

A comparison of upscale shopping malls to standard shopping centers across Sunbelt States reveals just how popular high-end retail is in the region. Malls with a high percentage of luxury and designer stores like the Lenox Square Mall in Georgia or the NorthPark Center in Texas saw considerably more YoY visit growth than the average visit growth for shopping centers in their respective states.

Lenox Square Mall saw foot traffic increase 31.2% YoY in 2023, while shopping centers in Georgia saw their visits grow by just 2.7% YoY in the same period. Similar trends repeated in Louisiana, Arizona, California, and Florida. And while some of this growth may be due to the resilience of these wealthier shoppers in the face of inflation, one thing is clear – luxury is here to stay.

Malls are thriving, carving out spaces for themselves in a competitive retail environment. By prioritizing experiential retail, entertainment, pop-up shops, and luxury offerings, shopping centers across the country are remaining relevant in a rapidly changing retail world. And mall operators that recognize the power of innovation and evolve along with their customers can hope to meet with continued success.