.svg)

.png)

.png)

.png)

.png)

.avif)

Off-price apparel chains continue to drive traffic in 2024. We dove into the latest location analytics for four of the largest brands – T.J. Maxx, Marshalls, Ross Dress for Less, and Burlington – to take a closer look at these retailers’ foot traffic growth and evolving visitor bases.

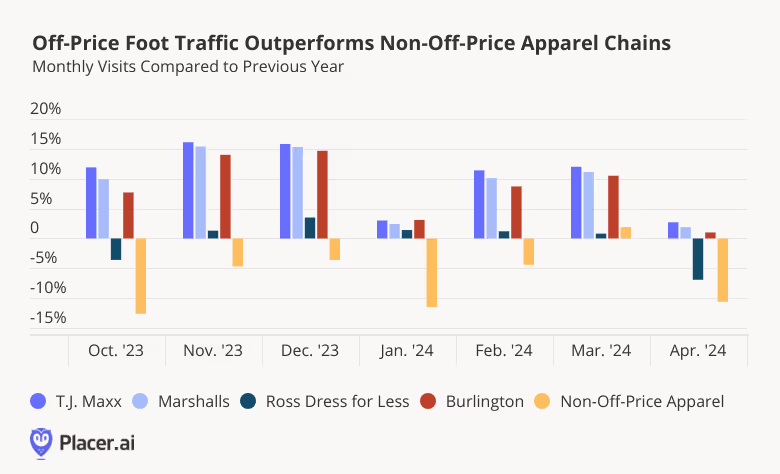

The off-price sector started off 2024 strong, with the four off-price leaders – T.J. Maxx, Marshalls (both owned by TJX Companies), Ross Dress for Less, and Burlington – consistently outperforming the wider non-off-price apparel segment. YoY visits to the four brands were also mostly positive for the period analyzed, in part thanks to the companies’ ongoing expansions.

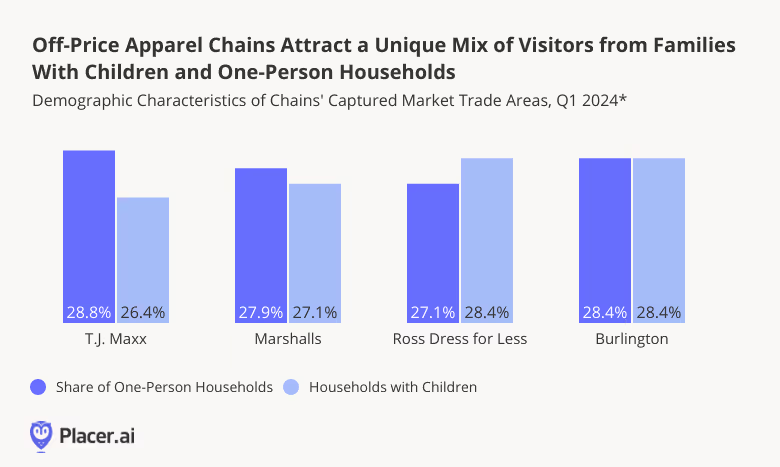

Diving into the demographic composition of the four chains’ trade areas reveals that there are many formulas for success in the off-price space. And while some companies have found success by attracting families looking to stretch their budgets, others are growing their visits by drawing singles looking to stock up on the latest styles without breaking the bank.

T.J. Maxx and Marshalls – where YoY Q1 2024 visits grew 8.9% and 7.9%, respectively – both have relatively large shares of one-person households in their trade areas. Members of these one-person households are typically younger – often belonging to the coveted Gen-Z demographic – and TJX C.E.O. Ernie Herrman has emphasized the company’s success among this audience segment as an important growth driver.

Meanwhile, the 1.1% YoY increase in overall visits for Ross Dress for Less in Q1 2024 seems driven by the chain’s popularity among families – 28.4% of the chain’s captured market consists of households with children. And Burlington achieved its Q1 7.6% YoY visit growth by appealing to both demographics.

It seems, then, that each off-price leader has found a different formula for success by catering to a unique demographic mix.

Over the last several months, off-price apparel chains have outperformed traditional apparel retailers in YoY visits as they expand their real estate footprints. Taking on new territory, off-price retailers drive visits from a unique mix of households with children and singles.

For more data-driven retail insights, visit Placer.ai.

As visits to Superstores continue to rise, we analyzed recent foot traffic data for Walmart, Target, Costco Wholesale, Sam’s Club, and BJ’s Wholesale Club and dove into Walmart’s Q1 2024 regional performance.

Wholesale chains – which receive about 20% of all visits to Walmart, Target, Costco Wholesale, Sam’s Club (owned by Walmart), and BJ’s Wholesale Club – generally outperformed classic superstore banners Target and Walmart during the first four months of the year. Visits to all three wholesale clubs analyzed were up every month on a year-over-year (YoY) basis, with Costco maintaining its lead in the space. Some of the success of wholesale clubs may be due to the makeup of their visitor base – Costco, Sam’s Club, and BJ’s tend to serve a large share of consumers from family households, and these may be opting for more buying in bulk in an effort to stretch budgets.

But visits to more classic superstores are also heating up – following a muted performance in January, when an arctic blast kept many at home, foot traffic to Target grew YoY in February, March, and April.

Walmart also experienced visit growth for most of the period, despite the slight dip in April due to calendar shifts: Visits for the superstore giant dropped 8.5% in YoY for the week of April 1st - 8th 2024 compared to the traffic surges of Easter week 2023 (April 3rd - 9th 2023), impacting the overall monthly numbers, but visits returned to growth during the last two weeks of April (4.3% and 4.0% YoY, respectively, for the weeks of April 15th - 21st and 22nd -28th).

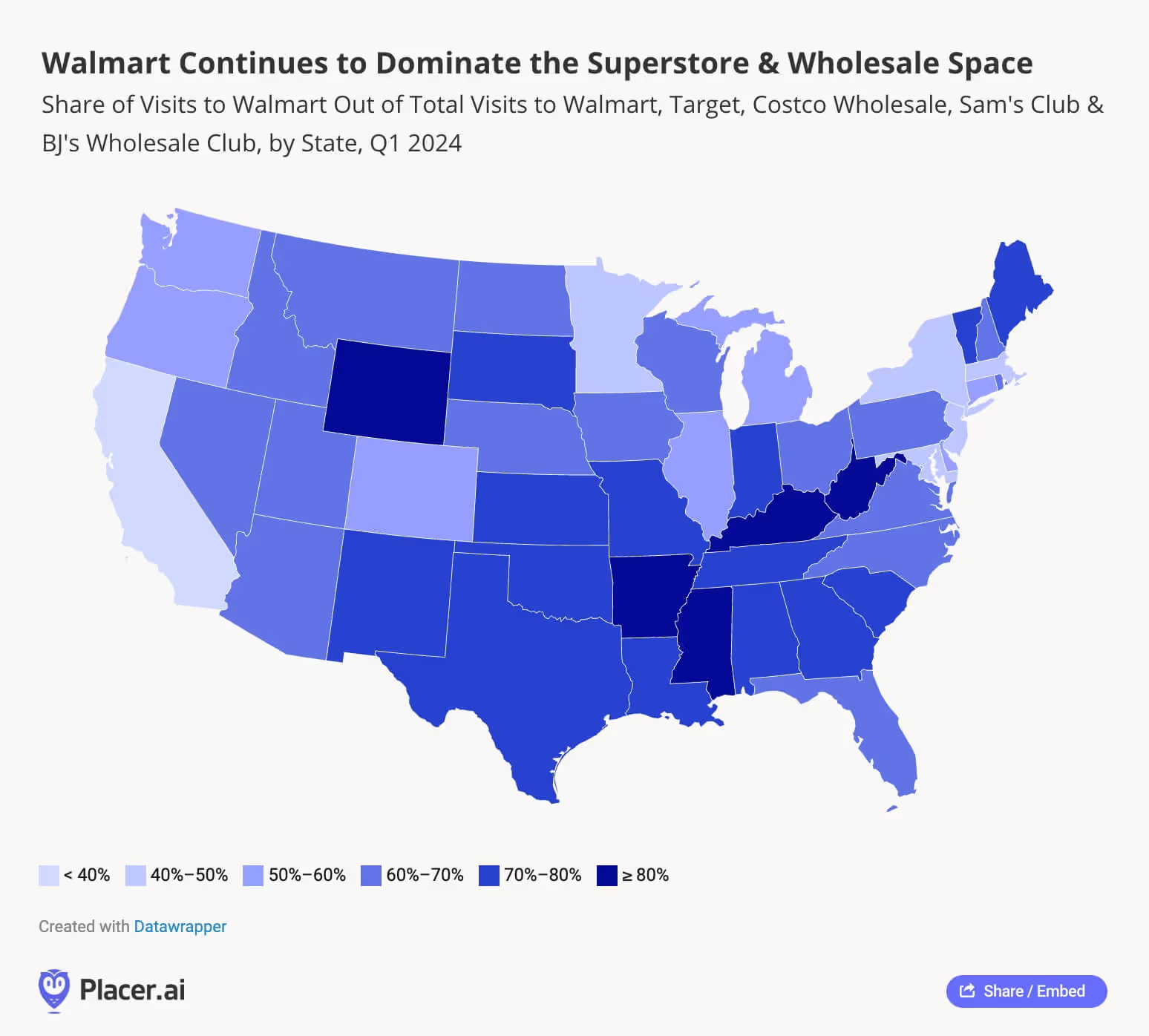

And while Walmart’s growth may not be quite as impressive as that of smaller superstores, the company has retained its position as the largest retailer in the U.S. Nationwide, the Walmart banner receives over 60% of all visits to Target, Walmart, Costco, Sam’s Club, and BJ’s, and in most of the south, the superstore’s relative visit share exceeds 70%. In a handful of states – including the retailer’s home state of Arkansas along with Mississippi, Kentucky, West Virginia, and Wyoming – 4 out of every 5 visits to the five superstore chains analyzed go to Walmart.

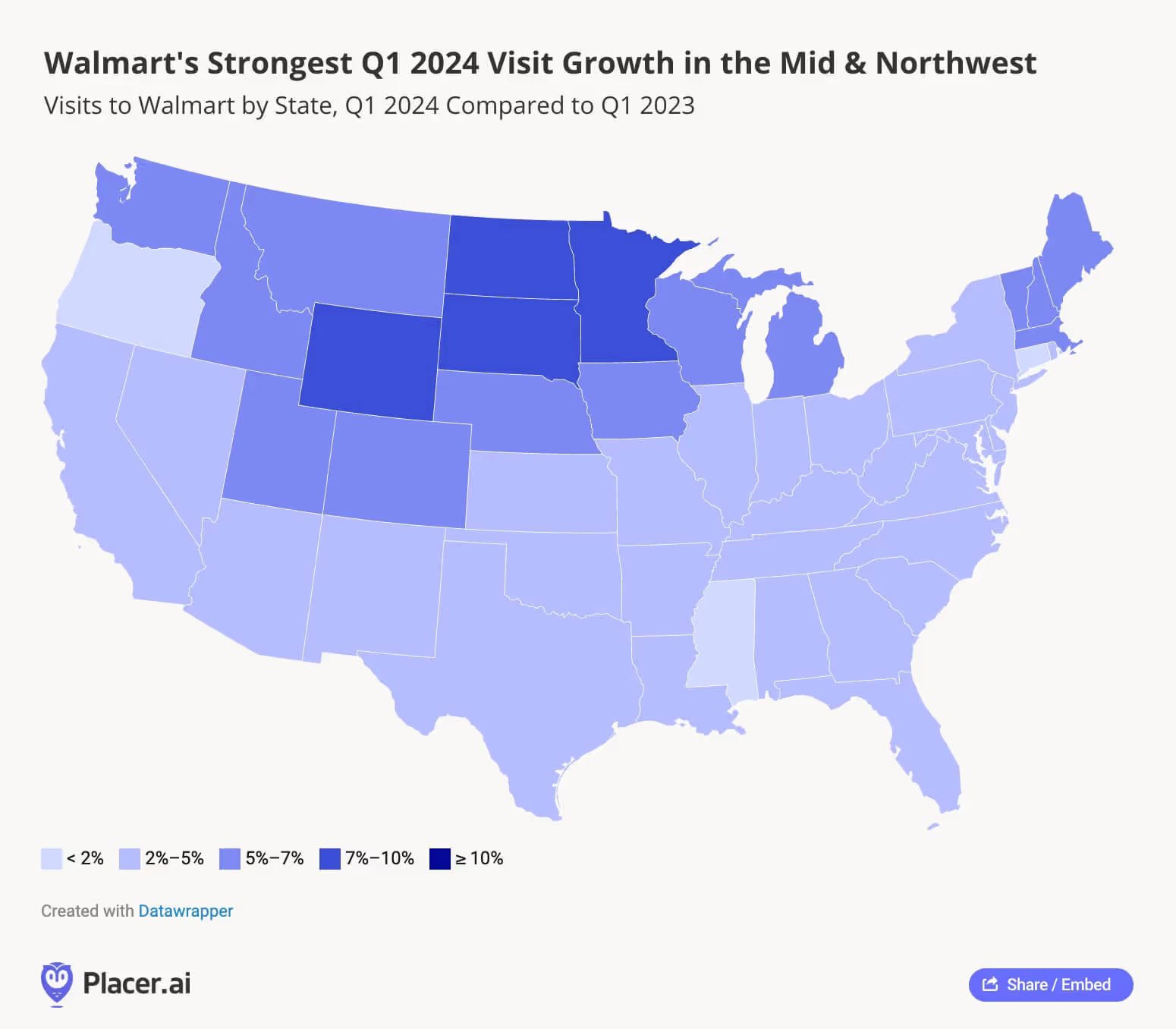

And even as Walmart optimizes its fleet, analyzing the retailer’s Q1 2024 YoY visit increases by region reveals pockets of major growth throughout the country. In addition to the 2-5% traffic increases across most of the South – where the retailer already dominates the superstore space – Walmart is also posting impressive visit increases in the Northeast, Midwest, and Northwest, with the strongest growth in Minnesota, Wyoming, and the Dakotas.

As budget-strapped consumers continue looking for bargains, the legacy retail giant may still have room to grow even larger in 2024.

Superstore and wholesale club visits are on the rise as U.S. shoppers continue to defy predictions of a consumer spending slowdown while still looking for ways to stretch their budgets.

Will these trends continue as the year progresses?

Visit placer.ai to find out.

.avif)

Discount & Dollar Stores have become an important part of the wider retail landscape over the past couple of years, and location intelligence indicates that the category is continuing to gain momentum in 2024. We dove into the data for Dollar General, Dollar Tree, and Family Dollar to understand how these banners are performing and analyze the regional reach of each chain.

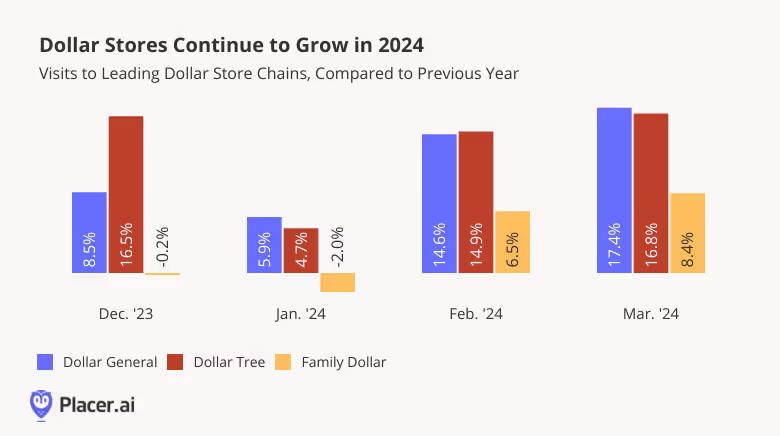

Recent visitation data for the major Discount & Dollar Store banners indicates that the category is still on the rise: Monthly visits to both Dollar General and Dollar Tree grew year-over-year (YoY) between December 2023 and March 2024. Dollar Tree-owned Family Dollar – which recently announced the closure of 1000 stores over the next couple of years – also saw its YoY traffic grow in February and March.

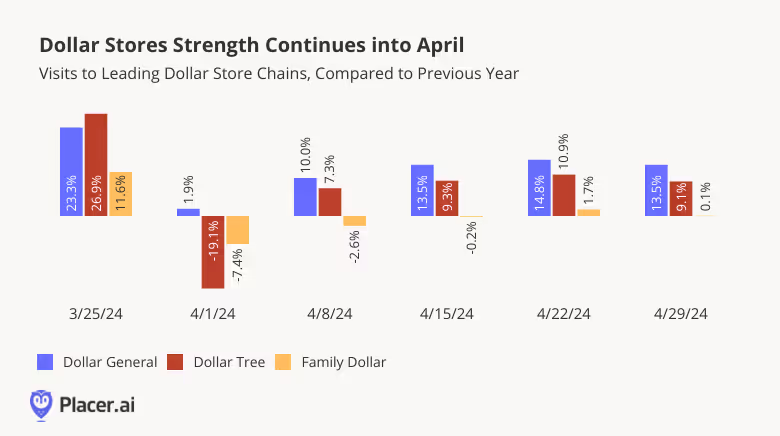

With the exception of the week of April 1st 2024 – when the Easter calendar shift caused a regular week in 2024 to be compared to the week of Easter in 2023 – visitation trends remained positive in April, highlighting the ongoing strength of the Discount & Dollar Store category. Even Family Dollar – which has already begun to close stores – saw its numbers remain on par with last year’s visit levels, indicating the ongoing demand for value-priced goods in 2024.

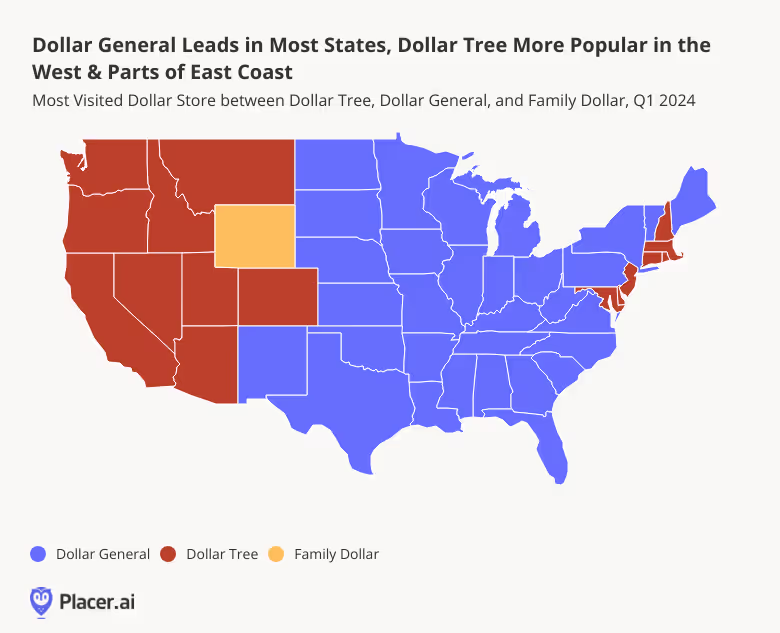

Looking at the Q1 2024 state-by-state relative visit share of the three chains – Dollar General, Dollar Tree, or Family Dollar – reveals some clear regional differences in consumer preferences across states.

Dollar Tree was more popular in the West, with the Dollar Tree brand leading in most western states and the company’s Family Dollar banner receiving the plurality of visits in Wyoming. Dollar Tree was also the most-visited chain in several states on the East Coast, including Maryland, New Jersey, Connecticut, and Massachusetts.

Dollar General, meanwhile, received the majority or plurality of the visit share in the rest of the country.

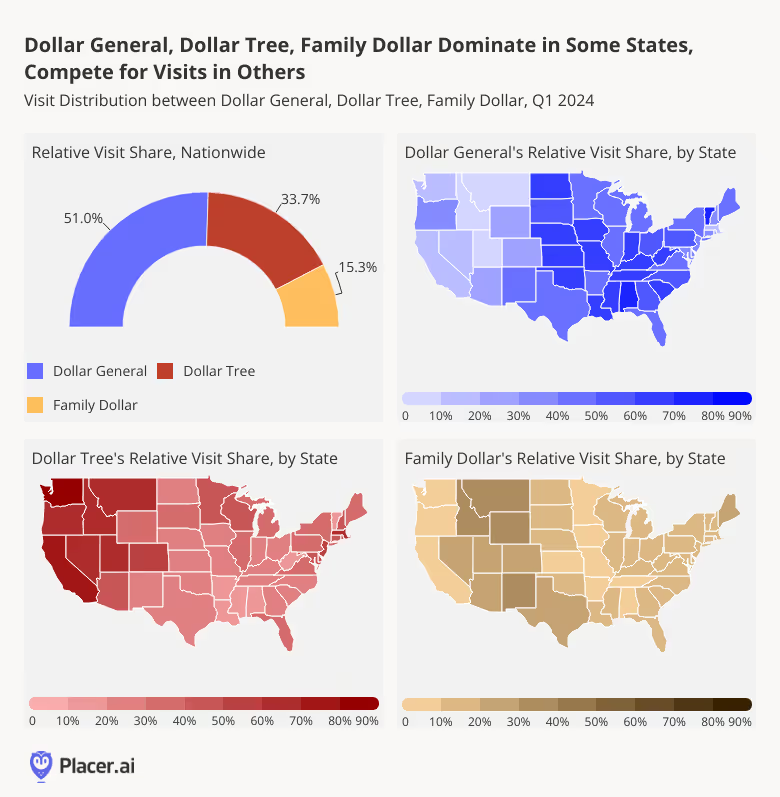

But although Dollar General does receive a majority of the combined Dollar General, Dollar Tree, and Family Dollar visit share nationwide, the Discount & Dollar Store category does not conform to a “winner-take-all” model. In many states, Dollar Tree’s visit share is just slightly lower than that of Dollar General.

In New York, for example, where Dollar General received 44.6% of the combined visit share in Q1 2024, 38.1% of visits in the same period went to Dollar Tree. And in Florida, where 44.2% of the combined visits to the three banners went to Dollar General, 38.2% of visits went to Dollar Tree. It seems, then, that even in states where Dollar General takes the lead, there is plenty of Discount & Dollar Store demand to sustain multiple players in the space.

Early 2024 data suggests that the Discount & Dollar Store sector is not slowing down any time soon. What will the rest of the year have in store for the space?

Visit placer.ai to find out.

Equinox hit the news this week as they rolled out a new $40,000 per year longevity membership called “Optimize by Equinox.” This program promises to provide a personalized health plan of action that includes personal training, nutrition, sleep coaching, and massage therapy. There will also be biomarker testing in partnership with Function Health and fitness testing. New York City and Highland Park, Texas are the pioneering locations for this program, with more to come. Placer took a look at the Highland Park location as well as one on Greenwich Ave in New York City. The Highland Park location has shown extraordinary year-over-year growth, with each month of the year showing increases compared to the prior year. The New York City location is a bit more mixed but had a strong showing year-over-year last fall and at the beginning of 2024.

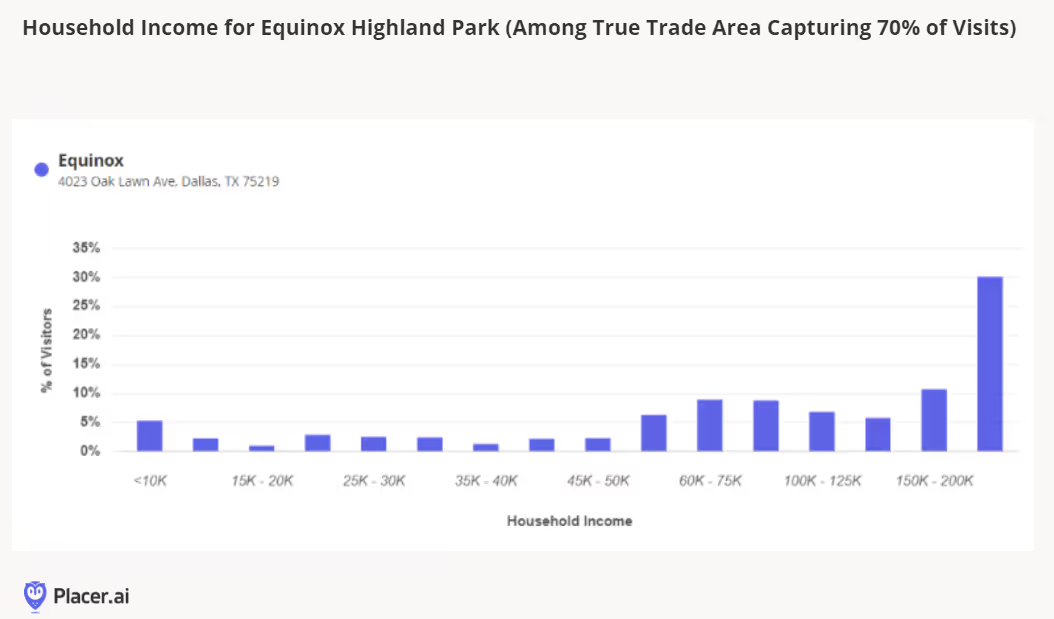

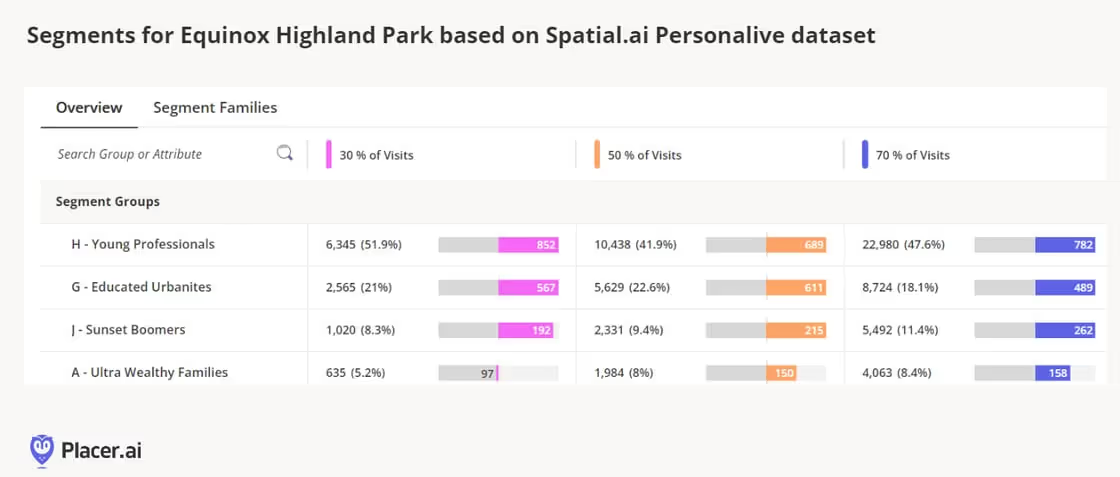

A 2023 survey by A/B Consulting and Maveron VC suggested that almost half (46%) of people earning over $250,000 would spend the majority of their discretionary income on trying to improve health and longevity, compared to only 34% of people earning under $50,000. Bryan Johnson is a tech millionaire who is often in the press with his latest experiments at reversing aging. From routine MRIs to frequent sampling of bodily fluids, he is a rare example of what one might do to try to live forever if one had nearly unlimited means to do so. While not all of us have millions to spend on unlocking the secrets to the fountain of youth, there’s no doubt that wellness and longevity are top of mind for many people, be it endeavoring to walk 10,000 steps a day or aiming for a rainbow diet. Looking at Equinox in Highland Park in Dallas, TX we see that indeed, this wealthy enclave is an apt location to pioneer this longevity offering. In the true trade area capturing 70% of visits, more than 3 in 10 have a household income exceeding $200K.

The Spatial.ai PersonaLive dataset further cements the fact that the top visitor segments are a group with higher-than-average discretionary incomes, such as Young Professionals, Educated Urbanites, Sunset Boomers, and Ultra Wealthy Families.

Additional data from the AGS Behavior & Attitudes dataset indicates that among those living in trade areas comprising 70% of visits to the Highland Park Equinox, many are indeed health-oriented, over-indexing on behaviors such as exercising (index 122), being yoga enthusiasts (index 168), and utilizing mobile app fitness trackers (index 160). However, they tend to under-index on getting regular medical checkups (index 86) - which is exactly where Optimize could fit in with its frequent testing and personalized approach. In addition, this particular location might want to take advantage of the clamor for pedicures (index 137) and manicures (index 147) and consider increased retail media network exposure due to enthusiasm for health info from TV (index 159).

Of all the specialty retail sectors, baby has been one of the most interesting to watch over the past few years for a few reasons. The industry is closely tied to a specific consumer life stage, and the CDC recently reported that the birth rate in the United States declined 2% in 2023, reaching the lowest rate recorded. If fewer consumers enter the family formation life stage, or have fewer children, the pool of potential visitors for retailers to draw from slowly dries up. The industry also faced massive disruption over the past year with the bankruptcy of Bed Bath & Beyond and the shuttering of its buybuy Baby chain last summer. The buybuy Baby closure marked the end of the large specialty baby chain sector in the retail industry, with the category facing the bifurcation of sales and traffic between big box retailers + Amazon and small independent specialty retailers.

Still, there have been some signs of life for baby-based retail despite the headwinds. Babylist, a popular online registry tool, launched its first brick-and-mortar outpost in Los Angeles last year. Buybuy Baby’s new owners reopened 11 locations in late 2023, concentrated in New England and the Mid-Atlantic. Then, in March, Kohl’s announced its partnership with WHP Global to bring Babies“R”Us to its stores. The Babies“R”Us shop-in-shop format receives a lot of positive momentum from both the Sephora at Kohl's partnership as well as the Toys“R”Us & Macy’s partnership; both predecessor collaborations have been rolled out to a majority, if not all, doors.

This week, we learned of the 200 initial locations receiving the Babies“R”Us (BRU) concept this summer, which will receive a wide assortment of hardgoods and softgoods, and be positioned next to the children’s apparel department. This new partnership is no doubt a continuation of Kohl’s strategy to attract and retain younger visitors, and the Babies“R”Us model can hopefully help the retailer hold onto Sephora shoppers as they enter the family formation period. Another likely goal is to steal some market share away from the mass merchants dominating in baby and lure some former buybuy Baby shoppers.

According to Placer.ai data, The Babies“R”Us + Kohl’s locations performed similarly to the total Kohl’s chain in 2024, with both chains showing visits down 23% year-over-year. The Babies“R”Us + Kohl’s locations do have a slightly higher visitor median household income of $84k compared to the total chain at $81K, which supports the notion that the Sephora & Babies“R”Us partnerships are meant to bring premium offerings to the typical store.

The partnership launch, as mentioned above, is a clear offensive move to capture some of the former buybuy Baby business in the areas where the locations did not reopen. Using Placer’s location analytics, we compared a national subset of 16 former buybuy Baby locations to the newly announced Babies”R”Us + Kohl’s locations. Looking at the visit demographics between the Kohl’s locations in the first four months of 2024 and the former buybuy Baby locations in 2023, it’s clear that Kohl’s attracts a suburban family and more mature consumer base, as where buybuy Baby locations were a stronghold with young urban singles and young professionals. Kohl’s may have an opportunity to attract new or existing grandparents to the partner stores, but will need to use the Sephora angle to attract younger consumers who may also be looking to start a family in the next few years.

Kohl’s is also betting big on the East Coast, with a number of partnership stores located in New York, New Jersey, Pennsylvania and Massachusetts. A few of these locations are in direct competition with the newly reopened buybuy Baby locations and will create some fascinating local competition. In the Boston metro area, there are both a Kohl’s and buybuy Baby location within 9 miles of each other but have local differences that may benefit Kohl’s entry into the market. Kohl’s has a median household income of about $30k more than visits to buybuy Baby and also captures more loyalty, with more loyal visits than buybuy Baby throughout the first four months of 2024.

This particular Kohl’s location has a smaller disparity to buybuy Baby in attracting young professionals, but it also attracts wealthier and more mature visitors that once again may translate into attracting parents and grandparents. 22% of buybuy Baby’s trade area overlaps with Kohl’s and the two share 11 square miles of overlapping trade area, so it will be interesting to see how Kohl’s can pull visits away from the competition.

As 2024 progresses, Kohl’s opens its partnership locations, baby retail will hopefully find its footing and provide retail solutions for potential and new parents. E-commerce has filled the void for baby registry services, but brick-and-mortar retail still holds a lot of importance for parents. Baby specialty retail is essential to the success of baby products and brands, and there is a lot of white space opportunity in the category for retailers to emerge to take share. Consumers, even if there are fewer of them, need experiences and solutions provided by retailers, and baby retail is a cautionary, but optimistic tale for other specialty sectors for the remainder of the year.

How did the home improvement and decor segments fare in the first months of 2024? We checked in with some of the categories’ biggest names – including Home Depot, Lowe’s, Tractor Supply Co., Harbor Freight Tools, Homesense, HomeGoods, and At Home – to see what Q1 portends for their performance the rest of the year.

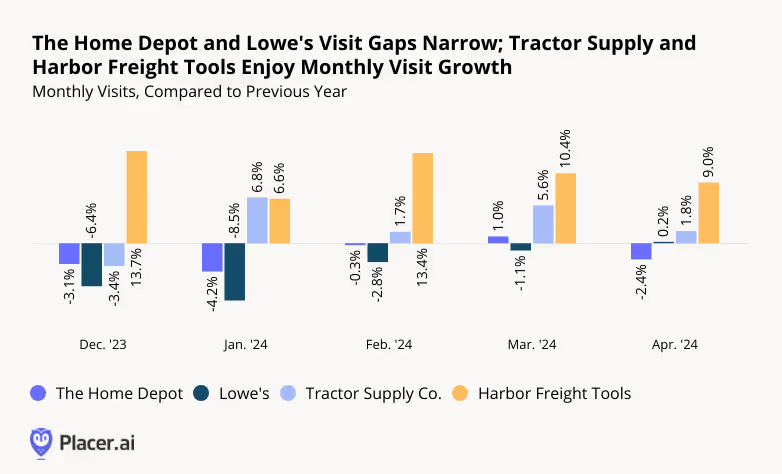

Last year was a challenging one for the home improvement space – as consumers cut back on discretionary spending and put pricey renovations on hold. But Q1 2024 visit data suggests that the category may be ready for a comeback. Throughout Q1 2024, Lowe’s saw its monthly visit gap narrow steadily – and in April 2024 saw the first YoY visit uptick the chain has experienced since 2021. And YoY visits to Home Depot were down just 0.3% in February 2024 and up 1.0% in March. Though Home Depot saw a minor visit gap emerge once again in April, the home improvement powerhouse appears to be on solid footing heading into the spring season.

While Home Depot and Lowe’s are rebounding, other home improvement chains are thriving. Discount chain Harbor Freight Tools continued to grow its footprint – and its visits – by expanding into new markets and cementing its role as a go-to destination for inexpensive home maintenance supplies. And farming essentials retailer Tractor Supply Co. also increased its store count together with its traffic. By occupying somewhat less discretionary niches, these two retailers have managed to avoid some of the headwinds plaguing the category.

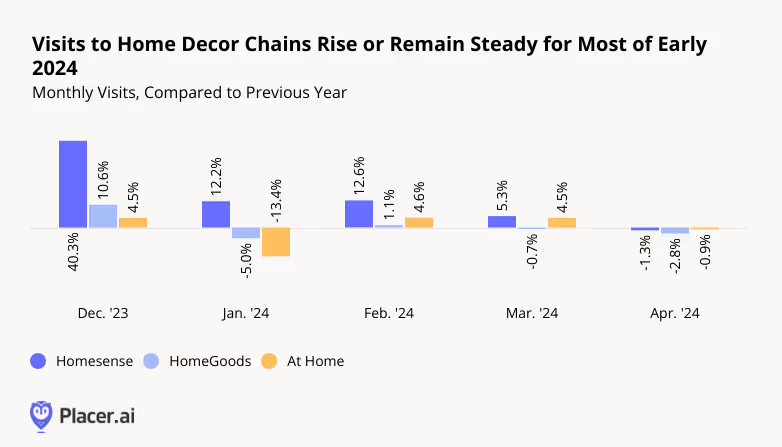

The home decor segment, including brands like Homesense, HomeGoods (both owned by parent company TJX Companies), and At Home, offers consumers a way to enhance their living spaces while avoiding the high costs associated with renovations or moving. And in Q1 2024, shoppers leaned into the category’s offerings.

Despite lapping a strong 2023, Homesense – which recently decided to close its ecommerce channel and focus on offline expansion – saw YoY visit growth throughout Q1. And though inclement weather weighed on HomeGoods’ and At Home’s January performance, YoY visits to the two brands increased or remained stable in February and March. In April 2024, all three chains held steady with slight YoY visit gaps – no small feat given the category’s largely discretionary nature.

Indeed, diving into the demographics of visitors to Homesense, HomeGoods, and At Home reveals that it is more affluent consumers that are driving visits to the three chains. Each chain's potential market* boasts a median household income (HHI) close to or above the nationwide median of $76.1K/year. But the median HHI of each chain’s captured market is notably higher – suggesting it is the wealthiest consumer segments in each chain’s trade area that are visiting the brands.

*A chain’s potential market refers to the population residing in a given trade area, where the Census Block Groups (CBGs) making up the trade area are weighted to reflect the number of households in each CBG. A chain’s captured market weighs each CBG according to the actual number of visits originating to the chain from that CBG.

.avif)

Home improvement and decor chains have seen their shares of ups and downs over the past few years, from pandemic highs to inflationary lows. And while some players thrived in Q1 2024, others weathered headwinds while maintaining their equilibrium. How will the space continue to fare as 2024 progresses?

Follow Placer.ai to find out.

The positive retail momentum observed in Q1 2024 continued into Q2 – as stabilizing prices and a strong job market fostered cautious optimism among consumers. Year-over-year (YoY) retail foot traffic remained elevated throughout the quarter, with June in particular seeing significant weekly visit boosts ranging from 4.7% to 8.5%.

The robustness of the retail sector in Q2 was also highlighted by positive visit growth during the quarter’s special calendar occasions, including Mother’s Day (the week of May 6th) and Memorial Day (the week of May 27th). And though consumer spending may moderate as the year wears on, retail’s strong Q2 showing offers plenty of room for optimism ahead of back-to-school sales and other summer milestones.

On a quarterly basis, overall retail visits rose 4.2% in Q2. And diving into specific categories shows that value continued to reign supreme, with discount and dollar stores seeing the most robust YoY visit growth (11.2%) of any analyzed category.

Other essential goods purveyors, such as grocery store chains (7.6%) and superstores (4.6%), also outperformed the overall retail baseline. And fitness – a category deemed essential by many health-conscious consumers – outpaced overall retail with a substantial 6.0% YoY foot traffic increase.

The decidedly more discretionary home improvement industry performed less well than overall retail in Q2 – but in another sign of consumer resilience, it too experienced a YoY visit uptick. And overall restaurant foot traffic increased 2.6% YoY.

Discount and dollar stores enjoyed a strong Q2 2024, maintaining YoY visit growth above 10.0% for six out of the quarter’s 13 weeks. Only during the week of April 1st did the category see a temporary decline, likely the result of an Easter calendar shift. (The week of April 1st 2024 is being compared to the week of April 3rd, 2023, which included the run-up to Easter)

Some of this growth can be attributed to the continued expansion of segment leaders like Dollar General. But the category has also been bolstered by the emphasis consumers continue to place on value in the face of still-high prices and economic uncertainty.

Dollar General, which has been expanding both its store count and its grocery offerings, saw YoY visits increase between 9.1% and 15.9% throughout the quarter. Affordable-indulgence-oriented Five Below, which has also been adding locations at a brisk clip, saw YoY visits increase between 4.9% and 18.8%.

And though Dollar Tree has taken steps to rightsize its Family Dollar brand, the company’s eponymous banner – which caters to middle-income consumers in suburban areas – continued to grow both its store count and its visits in Q2.

Grocery store chains also performed well in Q2 2024 – experiencing strongly positive foot traffic growth throughout the quarter. Though the sector continues to face its share of challenges, stabilizing food-at-home prices and improvements in employee retention and supply chain management have helped propel the industry forward.

Diving into the performance of specific chains shows that within the grocery segment, too, price was paramount in Q2 2024 – with limited-assortment value grocery stores like Aldi and Trader Joe’s leading the way.

Traditional chains H-E-B and Food Lion (owned by Ahold Delhaize) – both of which are known for relatively low prices – outperformed the wider grocery sector with respective YoY foot traffic boosts of 11.4% and 8.7%. But ShopRite, Safeway (owned by Albertsons), Kroger, and Albertsons also drew more visits in Q2 2024 than in the equivalent period of last year.

Fitness has proven to be relatively inflation-proof in recent years – thriving even in the face of reduced discretionary spending and consumer cutbacks. Indeed, rising prices may have actually helped boost gym attendance, as people sought to squeeze the most value out of their monthly fees and replace pricy outings with already-paid-for gym excursions.

And despite lapping a remarkably strong 2023, visits to gyms nationwide remained elevated YoY in Q2 2024.

Diving into the data for some of the nation’s leading gyms shows that today’s fitness market has plenty of room at the top. Planet Fitness, 24 Hour Fitness, Life Time Fitness, Orangetheory Fitness, and LA Fitness all experienced YoY visit growth in Q2 2024 – reflecting consumers’ enduring interest in all things wellness-related.

But it was EōS Fitness and Crunch Fitness – two value gyms that have been pursuing aggressive expansion strategies – that really hit it out of the park, with respective YoY foot traffic increases of 23.4% and 21.4%.

The week of April 1st saw a decline in YoY visits to superstores – likely attributable to the Easter calendar shift noted above. But the category quickly rallied, and with back-to-school shopping and major superstore sales events coming up this July, the category appears poised to enjoy continued success throughout the summer.

Within the superstore category, wholesale clubs continued to stand out – with Costco Wholesale, Sam’s Club and BJ’s Wholesale Club enjoying YoY foot traffic growth ranging from 12.0% to 7.4%. But Target and Walmart also impressed with 4.6% and 4.0% YoY visit increases.

Inflation, elevated interest rates, and a sluggish real estate market have created a perfect storm for the home improvement industry, with spending on renovations in decline. The accelerated return to office has likely also taken its toll on the category, as people spend more time outside the home and have less availability to immerse themselves in DIY projects.

But despite these challenges, weekly YoY foot traffic to home improvement and furnishing chains remained elevated throughout much of the Q2 – with June and April seeing mostly positive YoY visit growth, and May hovering just below 2023 levels. This (modest) visit growth may be driven by consumers loading up on supplies for necessary home repairs, or by shoppers seeking materials for smaller projects. And given the importance of Q2 for the home improvement sector, this largely positive snapshot may offer some promise of good things to come.

Some chains within the home improvement category continued to perform especially well in Q2 2024 – with rapidly expanding, budget-oriented Harbor Freight Tools leading the pack. But Ace Hardware, Menards, The Home Depot, and Lowe’s also saw foot traffic increases in Q2, showcasing the category’s resilience in the face of headwinds.

Restaurants – including full-service restaurants (FSR), quick-service restaurants (QSR), fast-casual chains, and coffee chains – lagged behind grocery stores and other essential goods retailers in Q2 2024, as price-sensitive consumers prioritized needs over wants and ate at home more often.

Still, YoY restaurant foot traffic remained up throughout most of the quarter. And impressively, the sector saw a YoY visit uptick during the week of Mother’s Day (the week of May 6th, 2024, compared to the week of May 8th, 2023) – an important milestone for FSR.

The restaurant industry’s YoY visit growth was felt across segments – though fast-casual and coffee chains experienced the biggest visit boosts. Like in Q1 2024, fast-casual restaurants hit the sweet spot between indulgence and affordability, outpacing QSR in the wake of fast food price hikes. And building on the positive YoY trendline that began to emerge last quarter, full-service restaurants finished Q2 2024 with a 1.4% YoY visit uptick.

Chain expansion was the name of the restaurant game in Q2 2024, with several chains that have been growing their footprints outperforming segment averages – including CAVA, Chipotle Mexican Grill, Ziggi’s Coffee, California-based Philz Coffee, Raising Cane’s, Whataburger, and First Watch. Chili’s Grill and Bar also outpaced the full-service category average, aided by the revamping of its “3 for Me” menu.

Retailers and restaurants in Q2 2024 continued to face plenty of challenges, from inflation to rising labor costs and volatile consumer confidence. But foot traffic trends across industries – including both essential goods purveyors like grocery stores and more discretionary categories like home improvement and restaurants – suggest plenty of room for cautious optimism as 2024 wears on.

Return-to-office (RTO) trends have been closely watched over the past few years, with relevant stakeholders trying to puzzle out the impact remote and hybrid work have had on business operations and worker performance. And while visits to office buildings, overall, remain below pre-pandemic levels, office recovery varies from city to city – reflecting the complex and nuanced nature of regional economic trends, workforce preferences, and industry-specific needs.

This white paper harnesses location analytics to explore office recovery in the country’s second-largest economy – Los Angeles. The first part of the report is based on an analysis of foot traffic data from Placer.ai’s Los Angeles Office Index – an index comprising 100 office buildings in LA (including several in the greater metro area). The second part of the report broadens the lens to analyze visits by local employees to points of interest (POIs) corresponding to four major LA-area office districts: Century City, Downtown LA, Santa Monica, and Culver City. The white paper examines the impact that return-to-work mandates have had on visits to office buildings, discovers which demographic groups are driving the RTO, and explores the connection between commute time and return-to-office rates.

The return to office in Los Angeles has consistently lagged behind other major cities, underperforming nationwide recovery levels since the pandemic ground in-office work to a virtual halt. Still, the city’s office buildings are seeing a steady increase in visits, with foot traffic tending to spike at the beginning of each year. This indicates that even though office visits in LA are still below national averages, they are on a steady growth trajectory – a promising sign for stakeholders in the city.

A closer examination of Los Angeles office buildings also shows that despite the overall lag, some top-performing buildings in the LA metro area are defying the odds. Visits to the 20 local office buildings with the narrowest Q2 2024 post-COVID visit gaps were down just 8.7% in June 2024 compared to January 2019 – significantly outperforming the nationwide average.

So while overall office recovery in the city is still behind nationwide trends, these top-performing buildings indicate an optimistic outlook for the city’s office spaces.

Diving into the demographics of visitors to LA’s top-performing office buildings reveals an important insight: these buildings are attracting younger workers. This cohort has shown a stronger preference for in-person work compared to their older colleagues.

Analyzing the buildings’ captured markets with psychographics from AGS: Panorama reveals that these buildings are attracting visitors from areas with larger shares of "Emerging Leaders" and "Young Coastal Technocrats" than the broader metro area.

"Emerging Leaders'' – upper-middle-class professionals in early stages of their careers – make up 20.3% of households in the trade areas feeding visits to these top-performing buildings, compared to 14.9% in the broader LA CBSA. Similarly, "Young Coastal Technocrats," young and highly educated professionals in tech and professional services, account for 14.7% of households driving visits to the top-performing buildings, compared to only 12.1% in the broader area.

The trend suggests that companies in these high-performing office buildings employ many early-career professionals eager to accelerate their careers and work in-person with colleagues and mentors. This is a positive sign for the future of the office market in the LA metro area, indicating that it is attractive to key demographic groups that are likely to drive future growth and innovation.

Over the past few years, the debate regarding return-to-office mandates has been a heated one. Will employees follow return-to-office requirements? Can companies enforce the return to office after offering remote and hybrid work options? Recent location analytics data suggests that, at least in the Los Angeles metro area, some return-to-office mandates have been effective.

Three major tech companies – Activision Blizzard, TikTok, and SNAP Inc. – recently made their return-to-office policies stricter. Activision mandated a full return to the office in January 2024. TikTok has also intensified its return-to-office policy while seeking to expand its office presence in the greater Los Angeles area. And SNAP Inc. required employees to return to the office earlier this year as a condition of continued employment.

Visitation patterns at each of these companies' respective headquarters suggest that their policies have directly impacted visit frequency. Since the beginning of the year, the share of repeat office visits (defined as two or more visits per week) has increased for all three locations. Activision saw its share of repeat office visits grow from 52.1% in H1 2023 to 61.4% in the same period of 2024. TikTok’s repeat visits grew from 49.5% to 61.0%, and SNAP’s repeat visits increased from 36.6% to 42.8%.

These numbers highlight how return-to-office policies can lead to noticeable changes in office visit patterns and offer a blueprint to other businesses looking to foster a stronger in-office workforce.

Los Angeles is the second-largest metro area in the country, with several distinct business districts across its sprawling landscape. And a closer look at four major office hubs in the greater LA area – Century City, Downtown LA, Santa Monica, and Culver City – highlights how the office recovery can vary, not just by city or demographic, but on a neighborhood level.

Weekday visits by local employees to all four analyzed business districts have rebounded significantly since 2020 – though each area has followed its own particular trajectory.

Culver City, home to major businesses including Sony Pictures and Disney Digital Network, saw the least pronounced drop in employee visits during the early days of the pandemic. And in Q2 2024, weekday visits by local workers were down just 18.4% compared to Q1 2019.

Century City, on the other hand, saw the most marked drop in local employee foot traffic as the pandemic set in. But the district’s recovery trajectory has also been the most dramatic – with a Q2 2024 visit gap of just 28.5%, smaller than Downtown LA’s 29.7% visit gap. Perhaps capitalizing on this momentum, Century City is expanding its business district with the addition of a major new office building, set to be completed in 2026 and serve as the headquarters for Creative Artists Agency. Santa Monica, for its part, finished off Q2 2024 with a 23.3% visit gap.

Century City stands out within the Los Angeles metropolitan area for its dramatic decline and subsequent resurgence in local employee foot traffic. And looking at another metric of office recovery – employee commute distance – further underscores the district’s remarkable comeback.

The share of employees commuting to Century City from three to seven miles away has nearly returned to pre-COVID levels – suggesting a normalization of commuting patterns by local workers living in the area. In H1 2019, 33.5% of workers in Century City commuted between 3 and 7 miles to work; in 2022, that number had dropped to 29.8%. But by 2024, the share of visitors making that commute had grown to 32.5% – much closer to pre-COVID numbers.

Similarly, the region’s trade area size, which had contracted significantly in the wake of the pandemic, bounced back significantly in 2024. This serves as another indication of Century City’s rebound, cementing Century City’s status as a key business hub within the Los Angeles metropolitan area.

Five years after the upheaval caused by the pandemic, office spaces are still changing. Although the Los Angeles area has taken longer to recover than other major cities, analyzing local visitation data shows significant potential for the city’s business areas. With young employees leading the return-to-office charge, the city is poised to keep driving its strong economy and adjust to an evolving office environment.

Retail media networks (RMNs) have cemented their roles as the future – and present – of advertising. These networks enable advertisers to promote products and services through a retailer’s online properties and physical stores, when consumers are close to the point-of-purchase and primed to buy.

Today, we take a closer look at two newcomers to the retail media space: Costco Wholesale and Wawa. Both chains have an online presence – but both also excel at in-store experiences, offering unique opportunities for consumer engagement and exposure to new products.

This white paper dives into the data to explore some of the key advantages Costco and Wawa bring to the retail media table – and examine how the retailers’ physical reach can best be leveraged to help advertising partners find new audiences.

Wawa and Costco, the latest additions to the growing number of companies with retail media networks, exhibit significant advertising potential. Both brands boast a wide reach and diverse customer base, and both have access to troves of customer data through membership and loyalty programs.

Foot traffic data confirms the robust offline positioning of the two retailers. In Q1 2024, year-over-year (YoY) visits to Costco and Wawa increased 9.5% and 7.5% respectively – showing that their in-store engagement is on a growth trajectory.

And since consumers tend to spend a lot more time in-store than they do on retailers’ websites, Costco’s and Wawa’s strong brick-and-mortar growth positions them especially well to help advertisers reach new customers. In Q1 2024, the average visits to Costco’s and Wawa’s physical stores lasted 37.4 and 11.4 minutes respectively – compared to just 6.7 and 4.6 minutes for the chains’ websites. These longer in-store dwell times can be harnessed to maximize ad exposure and offer partners more extended opportunities for meaningful interactions with customers. Partners can also analyze the behavior and preferences of the two chains’ growing visitor bases to craft targeted online campaigns.

Costco’s retail media network will tap into the on- and offline shopping habits of its staggering 74.5 million members to inform targeted advertising by partners. And the retailer’s tremendous reach offers a significant opportunity to engage customers in-store.

But while Costco is dominant in some areas of the country, other markets are led by competitors like Sam’s Club and BJ’s Wholesale Club. And advertisers looking to choose between competing RMNs or hone in on the areas where Costco is strongest can analyze Costco's performance and visit share – on a local or national level – to determine where to focus their efforts.

An analysis of the share of visits to wholesalers across the country reveals that Costco is the dominant wholesale membership club in much of the Western United States. But Costco also captures the largest share of wholesale club visits in many other major population centers, including important markets like New York, Chicago, Phoenix, and San Antonio. Costco’s widespread brick-and-mortar dominance offers prospective advertising partners a significant opportunity to connect with regional audiences in a wide array of key markets.

Another one of Costco’s key advantages as a retail media provider lies in its highly loyal and engaged audience. In May 2024, a whopping 41.4% of Costco’s visitors frequented the club at least twice during the month – compared to 36.6% for Sam’s Club and 36.0% for BJ’s Wholesale.

Moreover, Costco led in average visit duration compared to its competitors. In May 2024, customers spent an average of 37.1 minutes at Costco – surpassing even the impressive dwell times at Sam’s Club and BJ’s Wholesale Club.

YoY visits per location to Costco, too, were the highest of the analyzed wholesalers, all three of which saw YoY increases. These metrics further establish the wholesaler’s position as an effective retail media provider.

Even when foot traffic doesn't show a brand’s clear regional dominance, location analytics can reveal other metrics that signal its unique potential. Take the Richmond-Petersburg, VA, designated market area (DMA), for example. In May 2024, BJ’s Wholesale Club led the DMA with 41.2% of wholesale club visits, while Costco was a close second with 37.3% of visits.

But despite BJ’s lead in visit share, Costco's Richmond audience was more affluent. Costco's visitors came from trade areas with a median household income (HHI) of $93.2K/year, compared to $73.1K/year for Sam’s Club and $89.5K/year for BJ’s. Additionally, Costco drew a higher share of weekday visits than its counterparts.

Analyzing shopper habits and preferences across chains on a local level can provide crucial context for strategists working on media campaigns. Advertisers can partner with the brands most likely to attract consumers interested in their offerings, and identify where – and when – to focus their advertising efforts.

Convenience stores, or c-stores, are emerging as destinations in and of themselves – and their rising popularity among a wider-than-ever swath of consumers opens up significant opportunities in the retail advertising space.

Wawa is a relative newcomer to the world of retail media, after other c-stores like 7-Eleven and Casey’s launched their networks in 2022 and 2023. But despite coming a bit late to the party, the potential for Wawa’s Goose Media Network is significant – thanks to a cadre of highly loyal visitors who enjoy the physical shopping experience the c-store chain offers.

In May 2024, Wawa’s share of loyal visitors (defined as those who visited the chain at least twice in a month) was 60.1%. In contrast, other leading c-store chains operating in Wawa’s market area – QuickTrip and 7-Eleven, for example – saw loyalty rates of 56.0% and 47.9%, respectively, for the same period.

Additionally, Wawa visitors browsed the aisles longer than those at other convenience retailers. In May 2024, 39.9% of Wawa visitors stayed in-store for 10 minutes or longer, compared to 29.6% at QuickTrip and 25.7% at 7-Eleven.

Wawa's loyal customer base and longer visit durations make it a strong contender in the retail media space. By harnessing this high level of customer engagement, Wawa can draw in advertisers and develop targeted marketing strategies that resonate with its dedicated shoppers.

Wawa has been on an expansion roll over the past few years, with plans to open at least 280 stores over the next decade in North Carolina, Tennessee, Georgia, Alabama, Ohio, Indiana, and Kentucky. The chain has also been steadily increasing its footprint in Florida – between January 2019 and April 2024, Wawa grew from 167 Sunshine State locations to 280, with more to come.

And analyzing changes in Wawa’s visit share in one of Florida’s biggest markets – the Miami-Ft. Lauderdale DMA – shows how successful the chain’s local expansion has been. Between January 2019 and April 2024, Wawa more than doubled its category-wide visit share in the Miami area (i.e. the portion of total c-store visits in the DMA going to Wawa) – from 19.0% to nearly 40.0%.

A look at changes in Wawa’s Miami-Ft. Lauderdale trade area shows that the chain’s growing visit share has been driven by an expanding market and an increasingly diverse audience.

In April 2019, there were some 55 zip code tabulation areas (ZCTAs) in the Miami-Ft. Lauderdale DMA from which Wawa drew at least 3,000 visits per month. By April 2021, this figure grew to 96 – and by April 2024, it reached 129.

Over the same period, the share of “Family Union” households in Wawa’s local captured market – defined by the Experian: Mosaic dataset as families comprised of middle-income, blue collar workers – nearly doubled, growing from 7.4% in April 2019 to 14.4% in April 2024.

Retail media networks that make it easier to introduce shoppers to products and brands that are closely aligned with their preferences and habits offer a win-win-win for retailers, advertisers, and consumers alike. And Costco and Wawa are extremely well-positioned to make the most of this opportunity.