.svg)

.png)

.png)

.png)

.png)

Department stores across the country have been evolving to meet changing consumer wants and needs, and Macy’s & Bloomingdale’s are no exception. Owned by the same company – Macy’s, Inc – these two brands have been recalibrating their store fleets and experimenting with new formats.

We took a closer look at visitation trends to both brands to understand how they diverge, analyze their respective strengths, and explore what might be ahead for both.

In recent years, Macy’s, Inc. has focused on optimizing its store fleet, a long-running project that gained momentum with the 2023 appointment of former Bloomingdale’s executive Tony Spring as CEO. This change coincided with a turnaround strategy involving the closing of some 30% of the brand’s traditional department stores; the expansion of Macy’s small-format model; and the addition of more Bloomingdale’s locations.

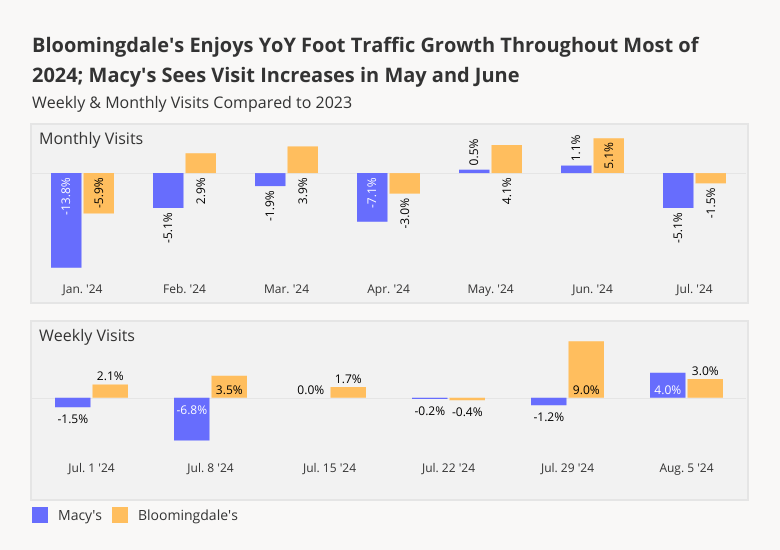

And a look at foot traffic trends at Bloomingdale’s shows that the high-end brand is indeed experiencing an uptick in demand, making it ripe for expansion. For much of the period between January and July 2024, Bloomingdale’s saw YoY monthly visit increases, with only January, April, and July seeing YoY declines. January’s drop was likely due to the inclement weather that weighed on retailers nationwide, while the April 2024 YoY downturn may have been due in part to the comparison to an April 2023 that had five weekends. And though July 2024 as a whole saw visits down 1.5% YoY, a look at weekly foot traffic to Bloomingdale’s shows that throughout most of that month and into August, the chain continued to draw more visits than in 2023.

Macy’s, for its part, had a slower start to 2024 – with YoY monthly visits down through April 2024. But in May and June, Macy’s visit gap closed, with foot traffic just above 2023 levels. And though Macy’s also saw monthly YoY visits decline in July, the chain’s weekly foot traffic has remained at or above 2023 levels since the middle of the month – likely spurred by back-to-school shopping and sales.

With the upcoming holiday season expected to bring a surge in foot traffic, both Macy’s and Bloomingdale’s are well-positioned to capitalize on these opportunities and potentially drive further growth.

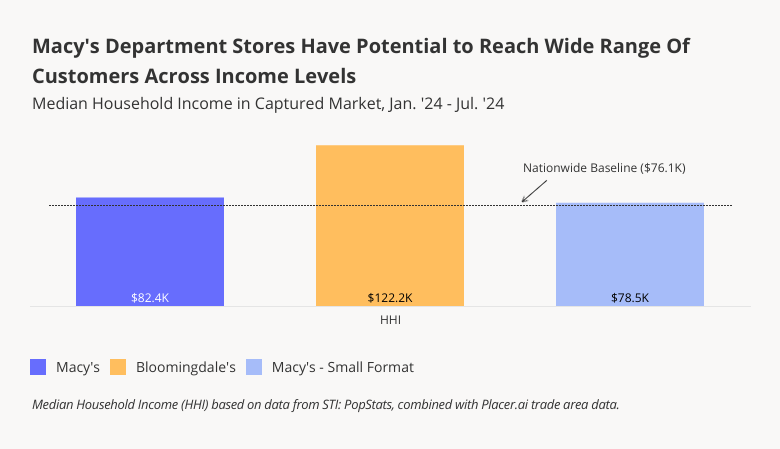

Analyzing the median household incomes (HHI) of Macy’s and Bloomingdale’s captured markets shows how Macy’s, Inc.’s revitalization strategy is helping the company further diversify the range of options available for shoppers of all kinds underneath its umbrella.

Between January and July 2024, for example, luxury-focused Bloomingdale’s attracted visitors from areas with the highest median HHI of the three brands – $122.2K, well above the nationwide average of $76.1K. Bloomingdale’s affluent audience may be less prone to inflation-driven cutbacks than the average American, contributing to the chain’s stronger positioning this year.

By contrast, Macy’s shoppers came from areas with a median HHI of $82.4K, while visitors to Macy’s small-format stores (some 13 locations nationwide) came from areas with a median HHI of $78.5K – just above the nationwide baseline. By expanding its small-format footprint, Macy’s may succeed at increasing its draw among more average-income shoppers.

This income variation underscores the broad retail potential of each chain, ensuring that consumers can find options that cater to their specific needs across Macy’s diverse offerings.

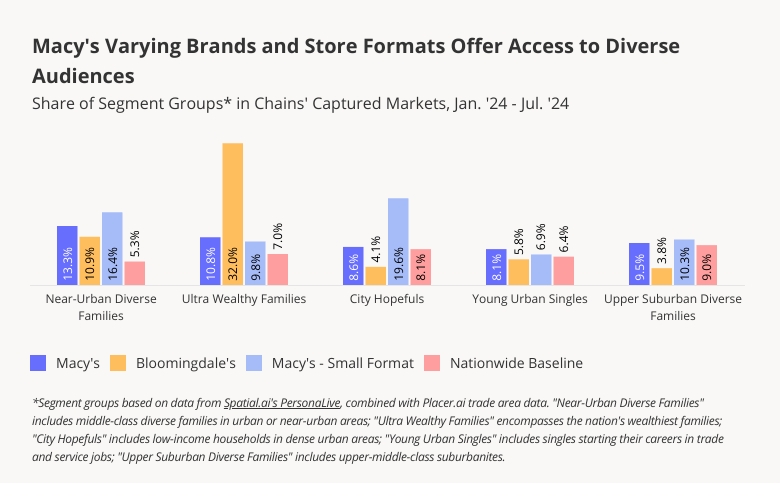

Analyzing the psychographic characteristics of Macy’s and Bloomingdale’s captured markets can shed additional light on how the chain’s turnaround strategy may help it reach new audiences. Macy’s traditional department stores already draw a diverse mix of consumers. But the addition of new Bloomingdale’s locations will help the company make further inroads into affluent segment groups like “Ultra Wealthy Families” – which makes up a whopping 32.0% of Bloomingdale’s captured market. At the same time, Macy’s smaller-format stores will offer the company greater access to the more modest-income “City Hopefuls” and “Near-Urban Diverse Families”, as well as the upper-middle-class “Upper Suburban Diverse Families”.

Macy’s and Bloomingdale’s continue to adapt to shifting consumer preferences by focusing on their strengths in specific markets and among their demographic segments, and by expanding its small-format stores. With the holiday season approaching, can both chains continue to drive visits?

Visit Placer.ai to keep on top of the latest data-driven retail news.

Summer 2024 has seen fierce competition among fast food and dining chains, with many embracing limited-time offers (LTOs) to attract customers and drive visits. As restaurant price wars continue unabated, these promotions are proving crucial in keeping consumer interest alive.

We dove into the visit performance of four brands – McDonald’s, Burger King, Taco Bell, and Smoothie King – to see how their LTOs are driving visits.

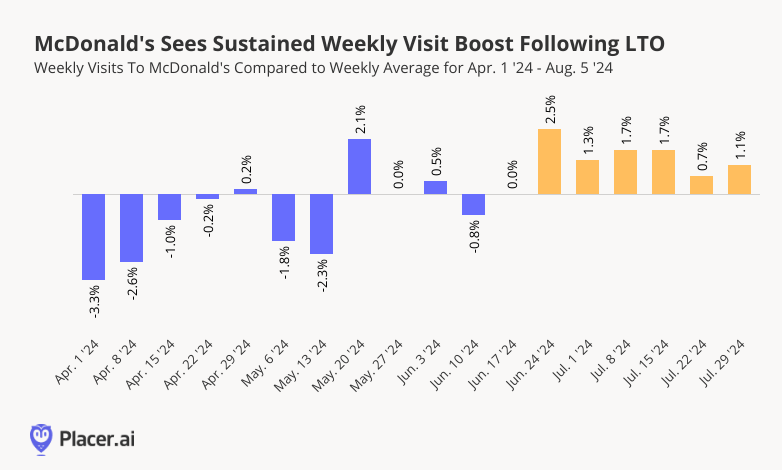

On June 25th, 2024, McDonald’s launched a limited-time offer, allowing customers to purchase a McDouble or McChicken, a 4-piece Chicken McNuggets, small fries, and a small soft drink for just $5. Originally intended to run for about a month, the promotion was so successful that it was extended through August. Foot traffic began to trend upwards following the promotion’s launch, with visits during the week of June 24th up 2.5% compared to the chain’s weekly average between April 1st and August 5th. And foot traffic to McDonald’s has remained consistently elevated in the weeks since.

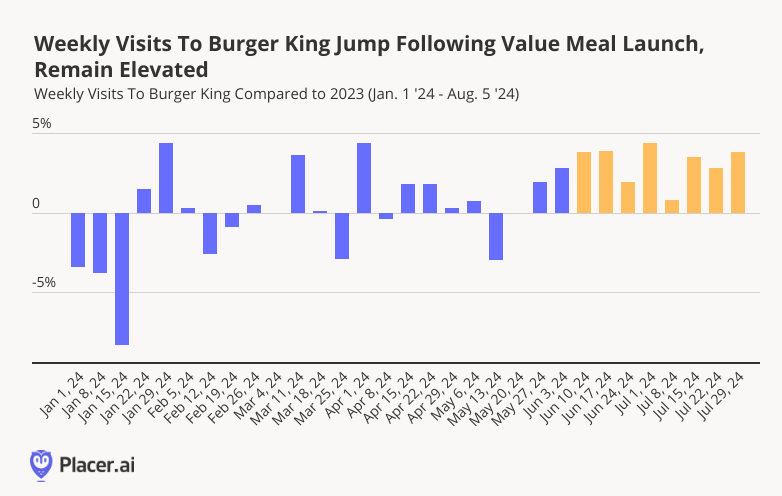

Like McDonald’s, Burger King has also been leaning into value-driven promotions, launching the "$5 Your Way" value meal on June 10th, 2024. And the promotion seems to be driving visits in a significant way. While weekly YoY visits to the chain have fluctuated throughout 2024, they jumped 3.8% YoY during the week of June 10th, and have remained consistently elevated since. Burger King, recognizing the power of the value meal, has chosen to keep the special running until October.

And following its recent rightsizing efforts, Burger King isn’t resting on its laurels. Building on the success of its $5 value meal, the chain also launched a limited-time, extra-spicy menu update on July 18th. This new offering appears to have helped keep visits elevated: After waning slightly during the week of July 8th, foot traffic to Burger King picked up once again during the week of the launch.

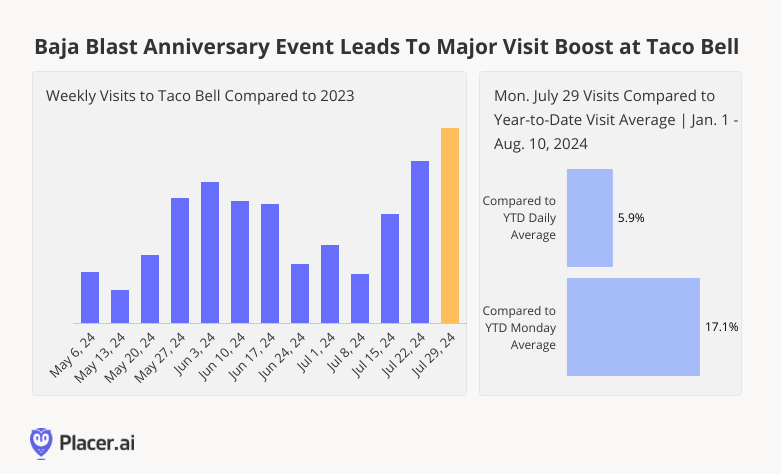

Tex-Mex favorite Taco Bell kicked off the 20th anniversary of its popular lime-flavored drink, Baja Blast, with a special "Bajaversary" promotion on July 29th, 2024, offering free drinks and freezes both in-store and on the app. The deal seems to have resonated strongly with customers, with visits growing by 12.3% year-over-year (YoY) for the week of July 29th. Daily visits also experienced a major increase – on the day of the special, visits surged by 17.1% compared to the YTD Monday visit average and were 5.9% higher than the overall YTD visit average.

The Summer Olympics were a major event, with millions of viewers tuning in to watch athletes at their best. And many fast food chains jumped on the Olympics bandwagon, offering discounts, deals, and limited-time menu items inspired by the event.

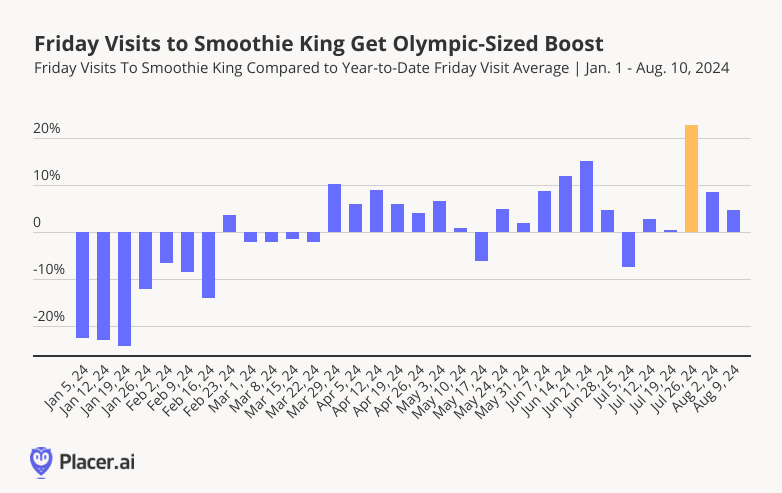

Smoothie King, known for its health-focused beverages, was one such brand with an Olympics special. The chain offered 32-oz smoothies for just $5 on Friday, July 26th, 2024, to coincide with the Olympic kickoff. The deal ran for one day only and fueled a significant foot traffic boost. Visits to Smoothie King on July 26th were 22.9% higher than the YTD Friday visit average – highlighting the effectiveness of well-timed, event-based offers.

For now at least, it seems that LTOs – particularly those focused on offering diners more bang for their buck – are reigning supreme in the fast-food space.

Will these promotions continue to drive foot traffic and maintain customer engagement?

Visit Placer.ai for the latest data-driven dining news.

With Q3 2024 underway, we checked in with beauty chains Ulta Beauty and Sally Beauty Supply, owned by Sally Beauty Holdings, Inc. How did they fare in the first half of the year? And what are some of the factors driving their success?

We dove into the data to find out.

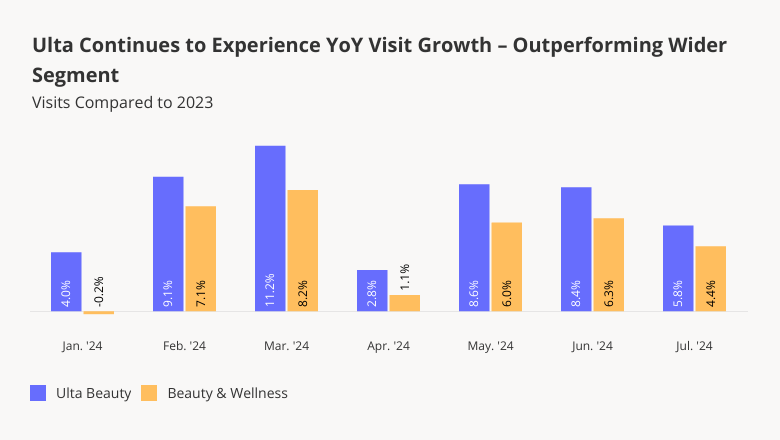

Ulta Beauty thrived in 2022 and 2023, propelled by the lipstick effect – which sees consumers splurging on low-cost indulgences when times are tight – and by the post-pandemic consumer obsession with wellness. And though the beauty giant’s visit growth has moderated somewhat in recent months, it continues to see year-over-year (YoY) foot traffic growth.

Between January and July 2024, Ulta consistently outperformed the wider beauty segment, with monthly YoY visit increases ranging between 2.8% and 11.2%. On a quarterly basis, visits to the chain jumped 6.6% YoY in Q2 2024. Though some of Ulta’s visit growth can be attributed to the chain’s growing store count, the average number of visits to each Ulta location also increased 4.6% YoY in Q2 2024.

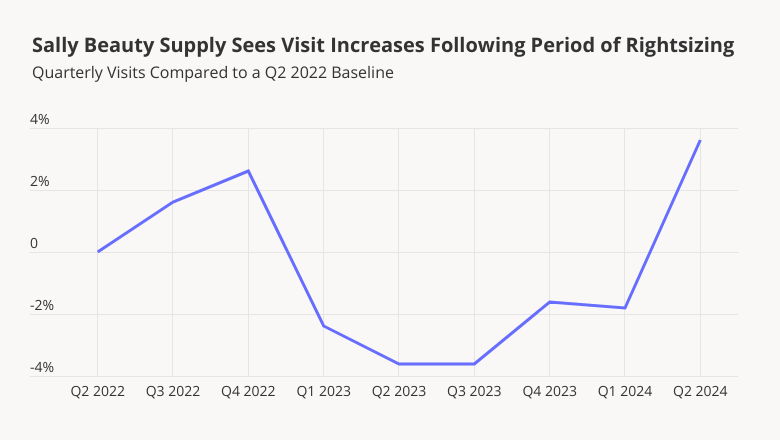

Sally Beauty Supply – the hair care-oriented beauty chain with more than 3,100 stores nationwide – is another beauty brand to watch this year. In 2022, Sally Beauty announced a store optimization plan that included the shuttering of more than 300 stores. And foot traffic data shows that the chain’s rightsizing efforts are paying off.

Comparing quarterly visits to Sally Beauty to a Q2 2022 baseline shows that after declining throughout 2023, overall visits to the chain have begun to pick up once again – with Q2 2024 foot traffic up 3.6%.

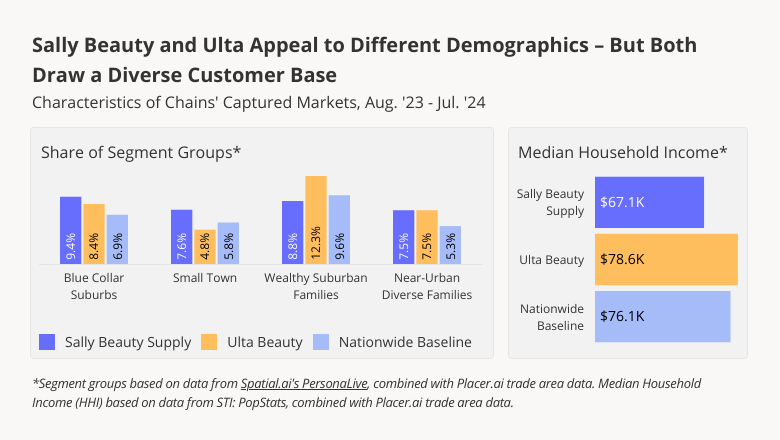

One factor that appears to be driving success for both Ulta and Sally Beauty is their unusually broad appeal. Analyzing the two chains’ captured markets with data from Spatial.ai’s PersonaLive and STI: PopStats shows that though there are differences between Ulta and Sally Beauty’s captured markets, both brands draw large shares of customers from across demographic groups.

Overall, the median household income of Ulta’s captured market is higher than that of Sally Beauty – $78.6K, compared to $67.1K. Ulta’s distinct mix of prestige and budget products is especially likely to draw Wealthy Suburban Families, while Sally Beauty’s offerings hold special appeal for Small Towns.

But both brands’ captured markets include higher-than-average shares of the Blue Collar Suburbs and Near-Urban Diverse Families segment groups – showing that despite their differences, Ulta and Sally Beauty both boast diverse customer bases.

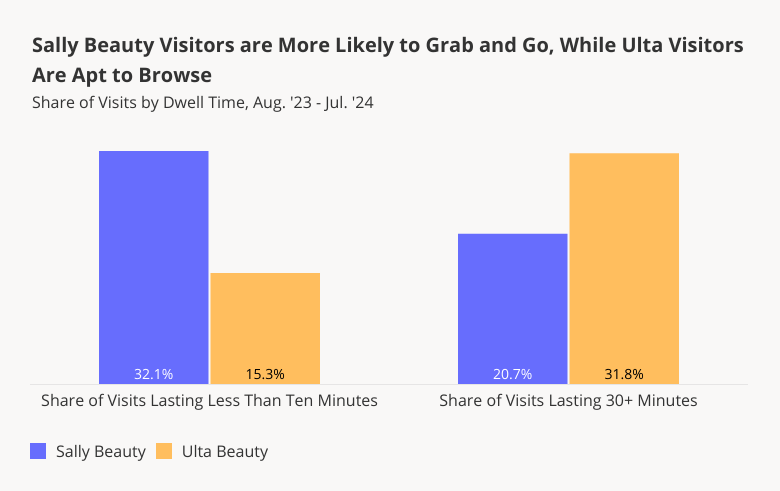

Still, visitors interact with the two beauty chains differently. During the 12-month period ending in July 2024, some 32.1% of visits to Sally Beauty lasted less than 10 minutes – compared to just 15.3% of visits to Ulta.

Sally Beauty’s far greater share of visits under ten minutes may be partly a result of its hair-focused product mix. In Q2 2024, some 64.8% of Sally Beauty’s net sales were in the hair color and care segments, while just 8.1% were in skincare and cosmetics. Ulta’s offerings, by contrast, are very much centered on cosmetics. And while shoppers buying hair care products may be more likely to take advantage of options like BOPIS (buy online, pick up in-store), those on the hunt for makeup may be more intent on trying out products and browsing in-store. Beauty professionals, who make up a larger share of Sally Beauty’s customer base than that of Ulta’s, may also be more inclined to use this service.

On the flip side, Ulta drew a much higher share of extended visits (30+ minutes) during the analyzed period – 31.8%, compared to 20.7% for Sally Beauty. In addition to browsing the aisles and trying new products, many Ulta customers likely remain longer in-store to avail themselves of the chain’s varied in-store salon services.

Ulta and Sally Beauty have different offerings – and serve different customer bases. But the success and broad appeal of both brands shows that in the beauty space of 2024, there’s plenty of room at the top.

For more data-driven insights, visit Placer.ai.

Discount & dollar stores had a strong Q2 2024, as consumers continued to prioritize value amid persistent high prices. We dove into the data for category leaders Dollar General and Dollar Tree to take a closer look at the drivers of these chains’ most recent success.

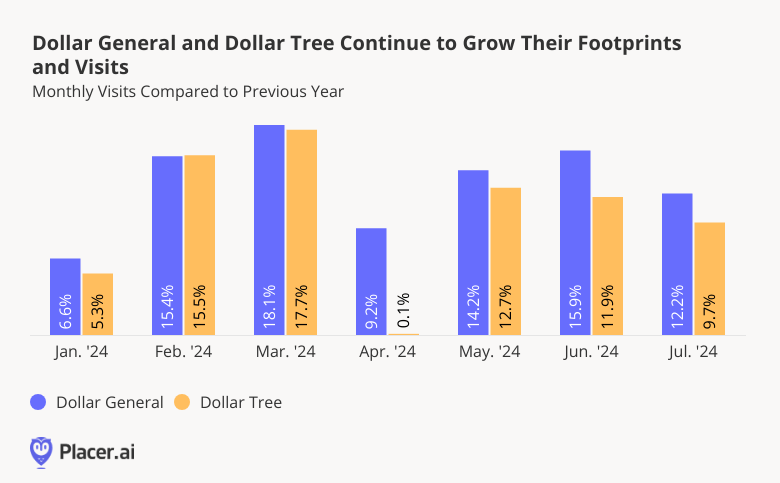

Dollar General – the nation’s largest dollar store player – opened nearly 200 stores last quarter, surpassing 20,000 U.S. locations. And Dollar Tree, the second-biggest dollar store chain by real estate footprint, stands at over 8,300 locations, including more than 100 new additions in the first months of 2024.

These chains’ significant fleet expansions continue to fuel foot traffic growth. Both Dollar General and Dollar Tree saw consistently positive YoY visit growth during the first seven months of 2024. Only in April 2024 did Dollar Tree’s YoY foot traffic appear to falter, likely as a result of decreased YoY demand for its traditional holiday merch due to an Easter calendar shift.

On a quarterly basis, YoY visits to Dollar General and Dollar Tree in Q2 2024 rose 13.1% and 8.4%, respectively. Over the same period, the two chains also experienced YoY increases in the average number of visits to each of their locations (10.3% for Dollar General and 3.7% for Dollar Tree), indicating that visits to individual stores remained robust as the brands grew.

And both brands plan on continuing to expand in the near future. Dollar General expects to open a total of 730 new stores in 2024, while Dollar Tree announced the takeover of 170 99 Cents Only Stores to complement the banner’s other openings. These strategic initiatives should continue to drive foot traffic gains for both brands in the coming months.

What’s behind Dollar General and Dollar Tree’s visit success? A look at changes in visitor interaction with the two chains suggests that for both dollar leaders, rising customer loyalty has played an important role.

Since July 2022, the share of visitors frequenting the two brands on a regular basis has been on an upward trajectory. In July 2024, 35.5% of Dollar General visitors frequented the chain at least three times during the month – up from 34.1% in July 2022. This increase in visitor frequency may be due in part to Dollar General’s inroads into the grocery space – giving consumers even more of a reason to visit the chain for daily essentials on a regular basis.

And though Dollar Tree’s somewhat more modest fleet drives a slightly smaller share of repeat visitors, it too has seen an increase in frequent visitors while investing in diversified offerings at various price-points – including consumables. In July 2024, 16.6% of Dollar Tree’s visitors also visited the chain at least three times, up from 13.9% in July 2022.

For both chains, visitor frequency is driven in part by seasonality, with loyalty upticks in December and May, likely driven by holiday season and Mother’s Day shoppers. Still, Dollar Tree, which remains a more traditional dollar store than Dollar General, experiences more dramatic seasonal visit peaks than its prime competitor – and its loyalty also follows a more pronounced seasonal pattern.

With the biggest players in the discount & dollar category seemingly going strong, will the second half of 2024 bring even more success to this retail space?

Visit Placer.ai to find out.

Midway through 2024, foot traffic to Lowe’s and Home Depot – the leaders in the home improvement space – is climbing. What’s driving these retailers’ recent visit growth? We dove into the data to find out.

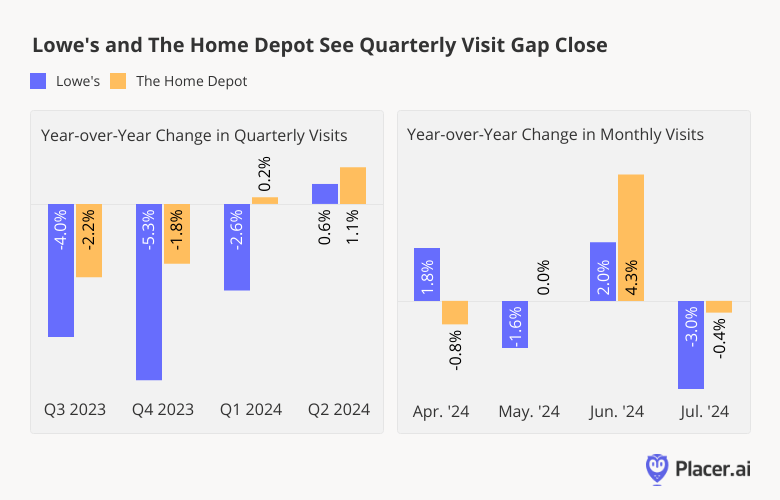

After a meteoric rise in foot traffic during the pandemic, the home improvement segment has experienced a turbulent few years – one of the primary reasons being a cool housing market that has curbed demand for projects. But after a significant period of consistent YoY visit gaps, visits to Lowe’s and Home Depot in 2024 appear to be matching and even slightly surpassing 2023 levels.

Between Q3 2023 and Q2 2024, Lowe’s and Home Depot both saw their YoY visit gaps gradually narrow and then close – finishing out Q2 with modest YoY gains. This turnaround may have been partly due to modest lifts in new home sales at the start of 2024 compared to 2023 – spurring an uptick in home improvement projects in the following months.

And though YoY visits to both retailers experienced a decline in July 2024 – perhaps due to May and June’s YoY declines in new and existing home sales – recent indications that the housing market may be heating up may bode well for the home improvement category in the second half of 2024 and beyond.

In addition to an increase in YoY visits, the resurgence of cross-shopping behavior between Home Depot and Lowe’s further suggests that a turnaround may be unfolding in the home improvement space. Location analytics shows that during recent home improvement booms, cross shopping between the two retailers was common, perhaps as judicious consumers taking on large projects looked to explore their options.

In Q2 of 2020 and 2021 – periods of strong foot traffic for both retailers – a large share of Lowe’s visitors also visited Home Depot. And although Lowe’s maintains a smaller retail footprint than Home Depot, many of Home Depot’s visitors visited a Lowe’s store as well.

But in the years that followed, economic headwinds led many consumers to defer their projects, and cross-shopping behavior began to moderate. In Q2 2023, only 48.8% of visitors to Lowe’s also visited Home Depot, and just 44.8% of Home Depot’s visitors visited Lowe’s.

However, in Q2 2024, consumers’ home improvement cross-shopping showed signs of a potential change of course. During the period, cross shopping between the brands climbed to 51.5% for Lowe’s and 45.7% for Home Depot. A return to in-store comparison shopping could mean that consumers are again taking on higher-stakes home improvement projects, which justify a visit to both retailers.

After an extended period of YoY visit gaps, foot traffic to the home improvement leaders is on the rise. Will Lowe’s and Home Depot continue to build on these positive visitation trends?

Visit Placer.ai to find out.

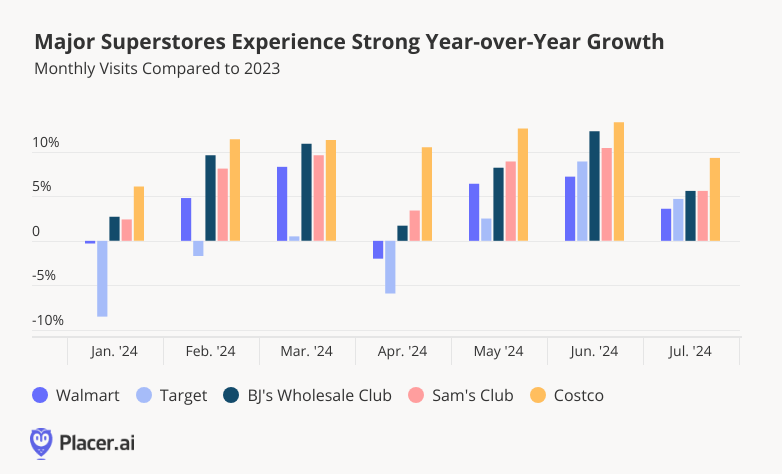

With H2 2024 underway, we took a look at the foot traffic performance of superstores Walmart and Target, and membership warehouse clubs BJ’s Wholesale Club, Sam’s Club, and Costco. How did foot traffic compare to 2023’s visitation patterns? And what special events helped propel visits?

Superstores have been thriving – with YoY visits to retail giants Walmart and Target elevated consistently since May 2024. And though Target had a slower start to the year, YoY foot traffic to the chain picked up in Q2, and the retailer has been flourishing since. (Target and Walmart's April 2024 YoY foot traffic drops are likely attributable in part to calendar shifts: April 2023 had one more weekend than April 2024 – and one of them was Easter.)

Membership warehouse clubs have been faring even better, with Costco leading the pack in Q2. BJ’s and Sam’s Club also experienced strong visit growth, with July visits elevated by 5.6% YoY for both brands.

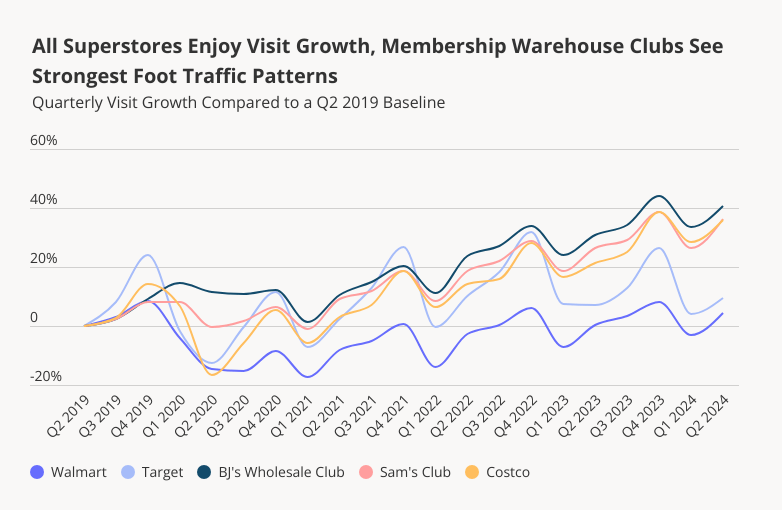

A closer look at the baseline change in quarterly visits since Q2 2019 further highlights the strong positioning of superstores and wholesale clubs in 2024. All five retailers drew more visits in Q2 2024 than they did pre-pandemic (Q2 2019).

But these visit increases have not been equally distributed across the retailers: While all of them experienced growth relative to a Q2 2019 baseline, membership warehouse visits have been outpacing those of superstores on a consistent basis since Q1 2023. As prime destinations for inexpensive, bulk buying, the segment has likely been buoyed by families and younger consumers seeking ways to save money on groceries and other basics amid high prices.

But superstores have also been having a moment. And one factor which may have contributed to Target’s Q2 2024 turnaround is its doubling down on loyalty: In April 2024, the chain revamped its Target Circle Rewards, adding, among other things, a new paid tier called Target Circle 360.

A key benefit of Target’s loyalty program, which is free to join for the regular tiers, is access to deep discounts during Target Circle Week. This year, the big sales event took place between July 7th and 13th – and examining foot traffic trends to the chain reveals that the promotion fueled a major visit boost: During the week of July 8th, weekly visits to Target were the highest they’ve been since the start of the year, and 6.8% higher than 2024’s weekly visit average. This year’s Circle Week visits also outperformed last year’s by 8.7%.

This demonstrates how the revamped loyalty program and exclusive sales events are successfully driving more customers to Target stores. And other retailers are taking note, with Walmart debuting its own major summer sales events and Costco and Sam’s Club battling it out for the most affordable prices – a major win for shoppers nationwide.

Superstores enjoyed elevated visitation patterns in Q2 2024. Will the superstore and wholesale club price wars continue? And with back-to-school shopping well underway, and the holiday shopping season quickly approaching, how will these retailers continue to perform?

Visit Placer.ai to keep up with the latest data-driven retail news.

Malls have come a long way since their introduction to the world in the 1950s. These gleaming retail hubs promised shoppers a taste of the American dream, offering a third place for teens, families, and everyone in between to shop, socialize, and hang out.

And though malls have faced challenges in recent years, as e-commerce and pandemic-induced store closures led to shifts in consumer habits, the outlook is brightening. Malls have embraced innovation, incorporating enhanced entertainment, dining, and experiential offerings that attract a diverse range of visitors and redefine their purpose.

This white paper takes a look at the recent location intelligence metrics to gain an understanding of the changes taking place at malls across the country – including both indoor malls and open-air shopping centers. The report explores questions like: Why do malls experience foot traffic bumps during the summer months? How much of an impact do movie theaters have on mall visits, and what can mall operators learn from the Mall of America and American Dream malls’ focus on experiential entertainment?

Mall visitation is highly seasonal, with strikingly consistent monthly visitation patterns. Each year, visits decline somewhat in February, pick up in March, and begin to trend upward again in May – before peaking again in August. Then, after a slower September and October, foot traffic skyrockets during the holiday season, spiking dramatically in December.

And while these trends follow similar patterns every year, comparing monthly visits throughout 2019, 2023, and 2024 (YTD) to each year’s own January baseline shows that this seasonality is growing more pronounced - especially for indoor malls.

Following a lackluster 2023, visits to both indoor malls and open-air shopping centers peaked higher in March 2024 than in 2019. And this summer, indoor malls in particular saw a much larger visit boost than in previous years. In August 2024, for example, visits to indoor malls were 27.3% higher than in January 2024 – a substantially higher baseline jump than that seen either in August 2019 (17.0%) or in August 2023 (12.0%). And though open-air shopping centers experienced a smaller summer visit boost, they too saw a bigger bump this year than in 2019 or in 2023.

But malls aren’t just seeing larger visit spikes this year relative to their January baselines – they are also drawing bigger crowds than they did in 2023.

Between June and August 2024, indoor malls and open-air shopping centers both experienced year-over-year (YoY) visit growth. Indoor malls saw the largest YoY foot traffic boost (3.7%) – perhaps owing in part to 2024’s record-breaking heat, which led many patrons to seek refuge in air conditioned spaces. Still, open-air shopping centers, which feature plenty of air conditioned stores and restaurants, also enjoyed a YoY visit boost of 2.8% during the analyzed period.

Malls’ strong summer baseline and YoY foot traffic growth built upon the strong performance seen during most of 2024 so far, leading to the question: What is driving malls’ positive momentum? We delve into some of the factors propelling these changes below.

One offering that continues to play a significant role in driving foot traffic to malls is on-site movie theaters. Summer blockbuster releases, in particular, help attract crowds to theaters, in turn boosting overall visits to malls.

Much like malls, movie theaters have also proven their resilience over the past few years. While pundits fretted about the theater’s impending death, production houses were busy releasing blockbuster after blockbuster and shattering box-office records at an impressive clip. And while 2023 was certainly a banner year for blockbuster summer releases, 2024 has had its fair share of stunning box-office successes, leading to major visit boosts at theaters across the country.

Analyzing visits to malls with and without movie theaters highlights the impact of these summer Hollywood hits. Between June and August 2024, malls with theaters saw bigger visit boosts compared to a monthly year-to-date (YTD) average than malls without – an effect observed both for indoor malls and for open-air shopping centers.

For both mall types, the gap between centers with and without movie theaters was most pronounced in July 2024, likely owing to the release of Inside Out 2 in mid-June as well as the July releases of Deadpool & Wolverine and Twister. But in June and August 2024, too, centers with movie theaters sustained particularly impressive visit boosts – a solid sign that movie theaters and malls remain a winning combination.

Malls with movie theaters also drew higher shares of evening visits (7:00 PM - 10:00 PM) this summer than those without. Between June and August 2024, for example, evening outings accounted for 22.9% of visits to open-air shopping centers with movie theaters – compared to 18.2% of visits to centers without theaters. Indoor malls with theaters also saw a larger share of evening visits than those without – 18.1% compared to 15.0%.

This increase in evening traffic is likely driven by major summer movie releases and the flexibility of summer schedules, with many visitors – including families – taking advantage of late-night outings without the concern of early wakeup calls. These summer visitation trends benefit both theaters and malls, opening up opportunities for increased sales through concessions, promotions, and evening deals that attract a more relaxed and engaged crowd.

Analyzing the demographics of malls’ captured markets also reveals that centers with movie theaters are more likely to attract certain family-oriented segments than those without. (A mall’s captured market consists of the mall’s trade areas – the census block groups (CBGs) feeding visitors to the mall – weighted according to each CBG’s actual share of visits to the mall.)

Between June and August 2024, for example, 14.2% of the captured markets of open-air shopping centers with movie theaters were made up of “Wealthy Suburban Families” – compared to 9.7% for open-air shopping centers without theaters.

Indoor malls saw a similar pattern with regard to “Near-Urban Diverse Families”: Middle class families living in and around cities made up 9.0% of the captured markets of indoor malls with movie theaters, compared to 7.1% of the captured markets of those without.

This increase in foot traffic from middle-class and wealthy family segments can be a boon for malls and retail tenants – driving up food court profits and bolstering sales at stores with kid-friendly offerings.

Malls have long positioned themselves as destinations for summer entertainment as well as retail therapy, holding – in addition to back to school sales – events like Fourth of July celebrations and even indoor basketball and arena football games. And during the summer months, malls attract visitors from further away.

Between June and August 2024, indoor malls drew 18.2% of visitors from 30+ miles away – compared to just 16.7% during the first five months of the year. Similarly, open-air shopping centers drew 19.6% of visits from 30+ miles away during the summer, compared to 17.1% between January and May.

Extended daylight hours, summer trips away from home, and more free time are likely among the contributors to the summer draw for long-distance mall visitors. But in addition to their classic offerings – from movie theaters to stores and food courts – malls have also invested in other kinds of unique experiences to attract visitors. This next section takes a look at two mega-malls winning at the visitation game, to see what sets them apart.

The Minneapolis-based Mall of America opened in 1992, redefining the limits of what a mall could offer. The mall boasts hundreds of stores, games, rides, and more – and is constantly expanding its attractions, cementing its status as a top destination for retail and entertainment.

Between June and August 2024, Mall of America experienced a 13.8% YoY visit increase, far outperforming the 3.7% visit boost seen by the wider indoor mall space. And as a major tourist attraction – the mall hosted a series of Olympic-themed events throughout the summer – it also drew 41.6% of visits from 30+ miles away. This share of distant visitors was significantly higher than that seen at the mall during the first five months of 2024, and more than double the segment-wide summer average of 18.2%.

The Mall of America also seems to be attracting more upper-middle-class families during the summer than other indoor malls: Between June and August 2024, some 18.0% of Mall of America’s captured market consisted of “Upper Suburban Diverse Family Households” – a segment including upper-middle-class suburbanites – compared to just 11.1% for the wider indoor mall segment. The increased presence of these families at the Mall of America may be driven by the variety of events offered during the summer.

In 2019, the American Dream Mall in New Jersey opened and became the second-largest mall in the country. Since the mall opened its doors, it has also focused on blending retail and entertainment to draw in as wide a range of visitors as possible – and summer 2024 was no exception.

The mall hosted the Arena Football League Championship, ArenaBowl XXXIII, on Friday, July 19th. The event successfully attracted a higher share of visitors traveling from 30+ miles away compared to the average summer Friday – 35.4% compared to 25.7%.

Visits to the mall on the day of the championship were also 13.6% higher than the Friday visit average for the period between June and August 2024, showcasing the mall’s ability to draw in crowds by hosting major events.

Malls – both indoor and open-air – continue to evolve while playing a central role in the American retail landscape. Increasingly, malls are emerging as destinations for more than just shopping – especially during the summer – driving up foot traffic and attracting visitors from near and far. And while much is often said about the impact of holiday seasons on mall foot traffic, summer months offer another opportunity to boost mall visits. Malls that can curate experiences that resonate with their clientele can hope to see foot traffic growth – in the summer months and beyond.

New York City is one of the world’s leading commercial centers – and Manhattan, home to some of the nation's most prominent corporations, is at its epicenter. Manhattan’s substantial in-office workforce has helped make New York a post-pandemic office recovery leader, outpacing most other major U.S. hubs. And the plethora of healthcare, service, and other on-site workers that keep the island humming along also contribute to its thriving employment landscape.

Using the latest location analytics, this report examines the shifting dynamics of the many on-site workers employed in Manhattan and the up-and-coming Hudson Yards neighborhood. Where does today’s Manhattan workforce come from? How often do on-site employees visit Hudson Yards? And how has the share of young professionals across Manhattan’s different districts shifted since the pandemic?

Read on to find out.

The rise in work-from-home (WFH) trends during the pandemic and the persistence of hybrid work have changed the face of commuting in Manhattan.

In Q2 2019, nearly 60% of employee visits to Manhattan originated off the island. But in Q2 2021, that share fell to just 43.9% – likely due to many commuters avoiding public transportation and practicing social distancing during COVID.

Since Q2 2022, however, the share of employee visits to Manhattan from outside the borough has rebounded – steadily approaching, but not yet reaching, pre-pandemic levels. By Q2 2024, 54.7% of employee visits to Manhattan originated from elsewhere – likely a reflection of the Big Apple’s accelerated RTO that is drawing in-office workers back into the city.

Unsurprisingly, some nearby boroughs – including Queens and the Bronx – have seen their share of Manhattan worker visits bounce back to what they were in 2019, while further-away areas of New York and New Jersey continue to lag behind. But Q2 2024 also saw an increase in the share of Manhattan workers commuting from other states – both compared to 2023 and compared to 2019 – perhaps reflecting the rise of super commuting.

Commuting into Manhattan is on the rise – but how often are employees making the trip? Diving into the data for employees based in Hudson Yards – Manhattan’s newest retail, office, and residential hub, which was officially opened to the public in March 2019 – reveals that the local workforce favors fewer in-person work days than in the past.

In August 2019, before the pandemic, 60.2% of Hudson Yards-based employees visited the neighborhood at least fifteen times. But by August 2021, the neighborhood’s share of near-full-time on-site workers had begun to drop – and it has declined ever since. In August 2024, only 22.6% of local workers visited the neighborhood 15+ times throughout the month. Meanwhile, the share of Hudson Yards-based employees making an appearance between five and nine times during the month emerged as the most common visit frequency by August 2022 – and has continued to increase since. In August 2024, 25.0% of employees visited the neighborhood less than five times a month, 32.5% visited between five and nine times, and 19.2% visited between 10 and 14 times.

Like other workers throughout Manhattan, Hudson Yards employees seem to have fully embraced the new hybrid normal – coming into the office between one and four times a week.

But not all employment centers in the Hudson Yards neighborhood see the same patterns of on-site work. Some of the newest office buildings in the area appear to attract employees more frequently and from further away than other properties.

Of the Hudson Yards properties analyzed, Two Manhattan West, which was completed this year, attracted the largest share of frequent, long-distance commuters in August 2024 (15.3%) – defined as employees visiting 10+ times per month from at least 30 miles away. And The Spiral, which opened last year, drew the second-largest share of such on-site workers (12.3%).

Employees in these skyscrapers may prioritize in-person work – or have been encouraged by their employers to return to the office – more than their counterparts in other Hudson Yards buildings. Employees may also choose to come in more frequently to enjoy these properties’ newer and more advanced amenities. And service and shift workers at these properties may also be coming in more frequently to support the buildings’ elevated occupancy.

Diving deeper into the segmentation of on-site employees in the Hudson Yards district provides further insight into this unique on-site workforce.

Analysis of POIs corresponding to several commercial and office hubs in the borough reveals that between August 2019 and August 2024, Hudson Yards’ captured market had the fastest-growing share of employees belonging to STI: Landscape's “Apprentices” segment, which encompasses young, highly-paid professionals in urban settings.

Companies looking to attract young talent have already noticed that these young professionals are receptive to Hudson Yards’ vibrant atmosphere and collaborative spaces, and describe this as a key factor in their choice to lease local offices.

Manhattan is a bastion of commerce, and its strong on-site workforce has helped lead the nation’s post-pandemic office recovery. But the dynamics of the many Manhattan-based workers continues to shift. And as new commercial and residential hubs emerge on the island, workplace trends and the characteristics of employees are almost certain to evolve with them.

The restaurant space has experienced its fair share of challenges in recent years – from pandemic-related closures to rising labor and ingredient costs. Despite these hurdles, the category is holding its own, with total 2024 spending projected to reach $1.1 trillion by the end of the year.

And an analysis of year-over-year (YoY) visitation trends to restaurants nationwide shows that consumers are frequenting dining establishments in growing numbers – despite food-away-from-home prices that remain stubbornly high.

Overall, monthly visits to restaurants were up nearly every month this year compared to the equivalent periods of 2023. Only in January, when inclement weather kept many consumers at home, did restaurants see a significant YoY drop. Throughout the rest of the analyzed period, YoY visits either held steady or grew – showing that Americans are finding room in their budgets to treat themselves to tasty, hassle-free meals.

Still, costs remain elevated and dining preferences have shifted, with consumers prioritizing value and convenience – and restaurants across segments are looking for ways to meet these changing needs. This white paper dives into the data to explore the trends impacting quick-service restaurants (QSR), full-service restaurants (FSR), and fast-casual dining venues – and strategies all three categories are using to stay ahead of the pack.

Overall, the dining sector has performed well in 2024, but a closer look at specific segments within the industry shows that fast-casual restaurants are outperforming both QSR and FSR chains.

Between January and August 2024, visits to fast-casual establishments were up 3.3% YoY, while QSR visits grew by just 0.7%, and FSR visits fell by 0.3% YoY. As eating out becomes more expensive, consumers are gravitating toward dining options that offer better perceived value without compromising on quality. Fast-casual chains, which balance affordability with higher-quality ingredients and experiences, have increasingly become the go-to choice for value-conscious diners.

Fast-casual restaurants also tend to attract a higher-income demographic. Between January and August 2024, fast-casual restaurants drew visitors from Census Block Groups (CBGs) with a weighted median household income of $78.2K – higher than the nationwide median of $76.1K. (The CBGs feeding visits to these restaurants, weighted to reflect the share of visits from each CBG, are collectively referred to as their captured market).

Perhaps unsurprisingly, quick-service restaurants drew visitors from much less affluent areas. But interestingly, despite their pricier offerings, full-service restaurants also drew visitors from CBGs with a median HHI below the nationwide baseline. While fast-casual restaurants likely attract office-goers and other routine diners that can afford to eat out on a more regular basis, FSR chains may serve as special occasion destinations for those with more moderate means.

Though QSR, FSR, and fast-casual spots all seek to provide strong value propositions, dining chains across segments have been forced to raise prices over the past year to offset rising food and labor costs. This next section takes a look at several chains that have succeeded in raising prices without sacrificing visit growth – to explore some of the strategies that have enabled them to thrive.

The fast-casual restaurant space attracts diners that are on the wealthier side – but some establishments cater to even higher earners. One chain of note is NYC-based burger chain Shake Shack, which features a captured market median HHI of $94.3K. In comparison, the typical fast-casual diner comes from areas with a median HHI of $78.2K.

Shake Shack emphasizes high-quality ingredients and prices its offerings accordingly. The chain, which has been expanding its footprint, strategically places its locations in affluent, upscale, and high-traffic neighborhoods – driving foot traffic that consistently surpasses other fast-casual chains. And this elevated foot traffic has continued to impress, even as Shake Shack has raised its prices by 2.5% over the past year.

Steakhouse chain Texas Roadhouse has enjoyed a positive few years, weathering the pandemic with aplomb before moving into an expansion phase. And this year, the chain ranked in the top five for service, food quality, and overall experience by the 2024 Datassential Top 500 Restaurant Chain.

Like Shake Shack, Texas Roadhouse has raised its prices over the past year – three times – while maintaining impressive visit metrics. Between January and August 2024, foot traffic to the steakhouse grew by 9.7% YoY, outpacing visits to the overall FSR segment by wide margins.

This foot traffic growth is fueled not only by expansion but also by the chain's ability to draw traffic during quieter dayparts like weekday afternoons, while at the same time capitalizing on high-traffic times like weekends. Some 27.7% of weekday visits to Texas Roadhouse take place between 3:00 PM and 6:00 PM – compared to just 18.9% for the broader FSR segment – thanks to the chain’s happy hour offerings early dining specials. And 43.3% of visits to the popular steakhouse take place on Saturdays and Sundays, when many diners are increasingly choosing to splurge on restaurant meals, compared to 38.4% for the wider category.

Though rising costs have been on everybody’s minds, summer 2024 may be best remembered as the summer of value – with many quick-service restaurants seeking to counter higher prices by embracing Limited-Time Offers (LTOs). These LTOs offered diners the opportunity to save at the register and get more bang for their buck – while boosting visits at QSR chains across the country.

Limited time offers such as discounted meals and combo offers can encourage frequent visits, and Hardee’s $5.99 "Original Bag" combo, launched in August 2024, did just that. The combo allowed diners to mix and match popular items like the Double Cheeseburger and Hand-Breaded Chicken Tender Wraps, offering both variety and affordability. And visits to the chain during the month of August 2024 were 4.9% higher than Hardee’s year-to-date (YTD) monthly visit average.

August’s LTO also drove up Hardee’s already-impressive loyalty rates. Between May and July 2024, 40.1% to 43.4% of visits came from customers who visited Hardee’s at least three times during the month, likely encouraged by Hardee’s top-ranking loyalty program. But in August, Hardee’s share of loyal visits jumped to 51.5%, highlighting just how receptive many diners are to eating out – as long as they feel they are getting their money’s worth.

McDonald’s launched its own limited-time offer in late June 2024, aimed at providing value to budget-conscious consumers. And the LTO – McDonald’s foray into this summer’s QSR value wars – was such a resounding success that the fast-food leader decided to extend the deal into December.

McDonald’s LTO drove foot traffic to restaurants nationwide. But a closer look at the chain’s regional captured markets shows that the offer resonated particularly well with “Young Urban Singles” – a segment group defined by Spatial.ai's PersonaLive dataset as young singles beginning their careers in trade jobs. McDonald's locations in states where the captured market shares of this demographic surpassed statewide averages by wider margins saw bigger visit boosts in July 2024 – and the correlation was a strong one.

For example, the share of “Young Urban Singles” in McDonald’s Massachusetts captured market was 56.0% higher than the Massachusetts statewide baseline – and the chain saw a 10.6% visit boost in July 2024, compared to the chain's statewide H1 2024 monthly average. But in Florida, where McDonald’s captured markets were over-indexed for “Young Urban Singles” by just 13% compared to the statewide average, foot traffic jumped in July 2024 by a relatively modest 7.3%.

These young, price-conscious consumers, who are receptive to spending their discretionary income on dining out, are not the sole driver of McDonald’s LTO foot traffic success. Still, the promotion’s outsize performance in areas where McDonald’s attracts higher-than-average shares of Young Urban Singles shows that the offering was well-tailored to meet the particular needs and preferences of this key demographic.

While QSR, fast-casual, and FSR chains have largely boosted foot traffic through deals and specials, reputation is another powerful way to attract diners. Restaurants that earn a coveted Michelin Star often see a surge in visits, as was the case for Causa – a Peruvian dining destination in Washington, D.C. The restaurant received its first Michelin Star in November 2023, a major milestone for Chef Carlos Delgado.

The Michelin Star elevated the restaurant's profile, drawing in affluent diners who prioritize exclusivity and are less sensitive to price increases. Since the award, Causa saw its share of the "Power Elite" segment group in its captured market increase from 24.7% to 26.6%. Diners were also more willing to travel for the opportunity to partake in the Causa experience: In the six months following the award, some 40.3% of visitors to the restaurant came from more than ten miles away, compared to just 30.3% in the six months prior.

These data points highlight the power of a Michelin Star to increase a restaurant’s draw and attract more affluent audiences – allowing it to raise prices without losing its core clientele. Wealthier diners often seek unique culinary experiences, where price is less of a concern, making these establishments more resilient to inflation than more venues that serve more price-sensitive customers.

Dining preferences continue to evolve as restaurants adapt to a rapidly changing culinary landscape. From the rise in fast-casual dining to the benefits of limited-time offers, the analyzed restaurant categories are determining how to best reach their target audiences. By staying up-to-date with what people are eating, these restaurant categories can hope to continue bringing customers through the door.