.svg)

.png)

.png)

.png)

.png)

With the year almost over, we dove into the visitation data for off-price leaders to see how the TJX chains, Burlington, and Ross Dress for Less are positioned ahead of the holidays.

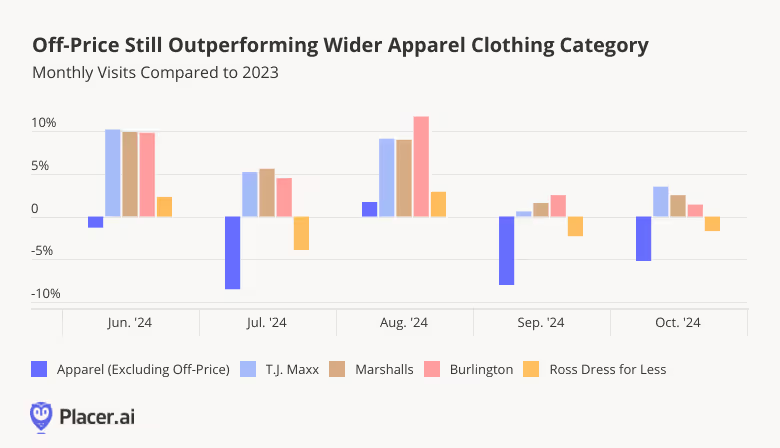

The off-price segment continued to outperform the wider apparel category in recent months as consumers continued favoring budget-friendly retail outlets. Visits to TJX-owned T.J. Maxx and Marshalls as well as to Burlington remained elevated, with the three chains seeing YoY growth of 5.1%, 5.5%, and 6.4% in Q3 2024. And while Ross foot traffic declined slightly relative to 2023 in July, September, and October, the chain’s YoY visit gap remained significantly smaller than that of the wider apparel category.

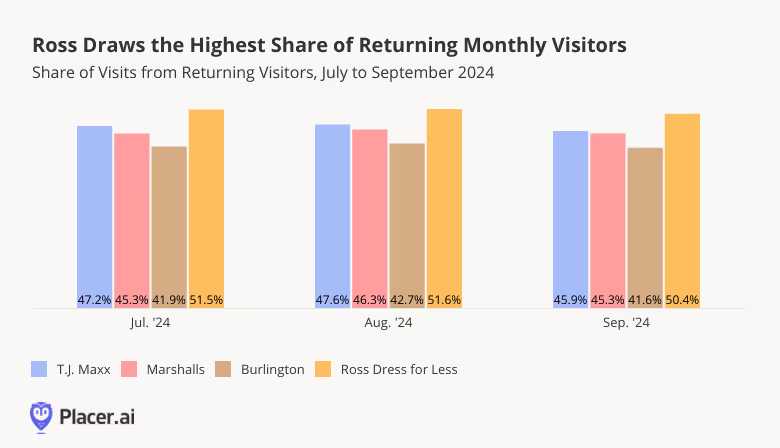

And even as Ross lags slightly behind the rest of the off-price space, the chain leads the segment in one metric – the share of returning visitors every month. In Q3 2024, over half of Ross’ monthly visits came from visitors who visited the chain at least twice in the month, compared with 41.9% - 47.6% of visits from returning visitors for the other three off-price leaders.

This data indicates that Ross is already extremely successful at cultivating a loyal clientele that regularly visits the company’s stores – and adding new shoppers to its circle of dedicated customers could drive further YoY visit growth going forward.

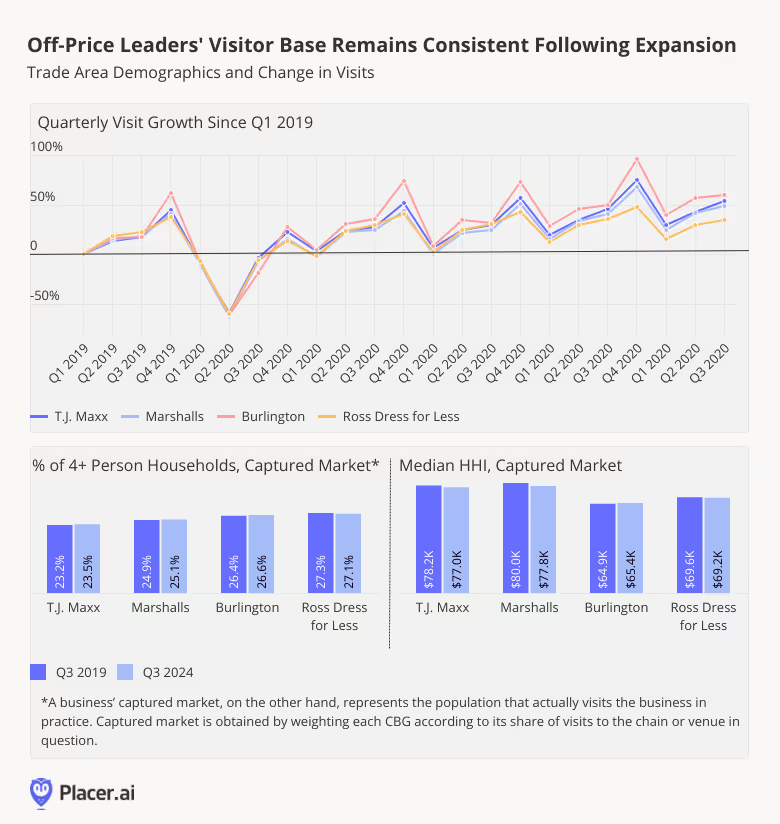

Expansion has been a major driver of off-price growth in recent years. Since 2019, the four off-price chains analyzed have all greatly increased their brick-and-mortar footprints, leading to visit surges nationwide.

And impressively, T.J.Maxx, Marshalls, Burlington, and Ross have all managed to expand their physical reach dramatically without straying from their core audience. Diving into the four chains’ trade area demographics in Q3 2019 and Q3 2024 reveals that, even as the retailers’ store fleet configurations evolved, their trade area demographics remained strikingly consistent.

Since 2019, the share of large households in the retailers’ trade areas has remained remarkably steady – though all four brands have seen a slight increase in the share of 4+ person households. The trade areas’ median household incomes (HHIs) did shift slightly as the chains expanded – falling for T.J. Maxx and Marshalls, and, to a lesser extent, Ross, while increasing somewhat for Burlington – but the change from 2019 has been minimal.

It seems, then, that these four off-price leaders have successfully grown their reach over the past five years while maintaining a strong connection with their core customer base, positioning them for continued sustained success in the competitive retail landscape.

As the holiday season approaches, the off-price retail sector remains resilient. The year-over-year growth and high loyalty rates seen by category leaders along with their success at expanding without alienating their core audiences positions these chains to remain a formidable force within the wider retail landscape.

For more data-driven retail insights, visit placer.ai/blog.

The all-important fourth quarter of the year is underway, and leading beauty chains like Ulta Beauty and Sally Beauty Supply are gearing up for an exciting holiday shopping season. We dove into the data to see how the two chains have performed in recent months – and what they can expect in this year’s Q4 retail milestones.

In Q3 2024 (July - September), quarterly visits to Ulta and Sally Beauty were essentially on par with last year’s levels. Ulta saw a minor year-over-year (YoY) uptick of 1.2%, while Sally Beauty maintained a slight visit gap.

Diving into monthly visit trends, ever-expanding Ulta experienced positive YoY foot traffic growth throughout the summer – especially in August, when an additional Saturday provided vacationers and back-to-school shoppers with extra weekend browsing time. And though visits to the chain dipped in September, they quickly bounced back again, with October seeing a 4.5% YoY visit boost likely bolstered by Halloween offerings and seasonal sales.

Sally Beauty, for its part, has been closing locations as part of a store optimization plan implemented largely in 2023. Viewed against this backdrop, the chain’s modest monthly visit gaps – which narrowed to just 0.2% in October 2024 – are particularly impressive. And Sally Beauty Holdings, Inc. has remained nimble on its feet, testing new concepts like Happy Beauty Co., a new store format with cosmetics and other self-care products priced under $10.

For both chains, their October showing signals that eager customers are gearing up for a busy Q4.

But how do Ulta and Sally Beauty experience the holiday season? Which retail milestones resonate most strongly with their customers – and where do they see the most impressive holiday visit boosts?

Ulta Beauty leans heavily into Black Friday each year with early deals that culminate in a shopping bonanza on the day after Thanksgiving – and in 2023, the milestone was the chain’s busiest day of the year. On November 24th, 2023, visits to Ulta were up 270.6% compared to a 2023 daily average. The second-busiest day of the year for Ulta was Super Saturday (December 23rd, 2023), which saw a 219.0% visit bump.

Still, looking at major Ulta markets throughout the country reveals significant regional variation in holiday milestone visitation patterns. Like many other retailers, Ulta experiences bigger Black Friday visit bumps in midwestern metro areas like Chicago, and much smaller ones in California hubs like Los Angeles. And though Black Friday is more important for the chain than Super Saturday on a national level, several CBSAs – including Dallas, New York, and Los Angeles – saw bigger boosts on Super Saturday than on Black Friday.

Sally Beauty – with its more specialized focus on hair care products – sees smaller holiday visit bumps than Ulta. But the chain’s holiday deals do draw crowds. December 23rd was Sally Beauty’s busiest day last year, with visits up 86.2% nationwide and significantly elevated throughout the chain’s major markets. And though Black Friday is much less significant for the retailer – in 2023, it was only Sally Beauty’s 11th busiest day of the year – the chain’s Black Friday deals drove a 55.4% visit bump.

And visits aren’t the only thing that increase at Ulta and Sally Beauty during the holidays. Looking at driving distances to the two chains shows that on Q4 milestones – and especially Black Friday – people travel farther to shop the sales. On Black Friday 2023, and to a lesser extent Super Saturday, both retailers saw significant jumps in the share of visitors traveling more than 10 or 30 miles to visit their brick-and-mortar locations.

.avif)

Affordable luxuries like cosmetics and hair care products make the perfect stocking stuffers for consumers still concerned about high prices. And if last year’s holiday trends are any indication, Ulta and Sally Beauty appear poised to enjoy a very festive holiday season indeed.

Visit Placer.ai for more data-driven retail insights.

While Boston trails both the New York City and Nationwide Office Building Index in return-to-office rates, one standout related to office activity is the Newbury Street location of the Dutch brand Suitsupply. Visitation to this location saw steady growth from February to August this year.

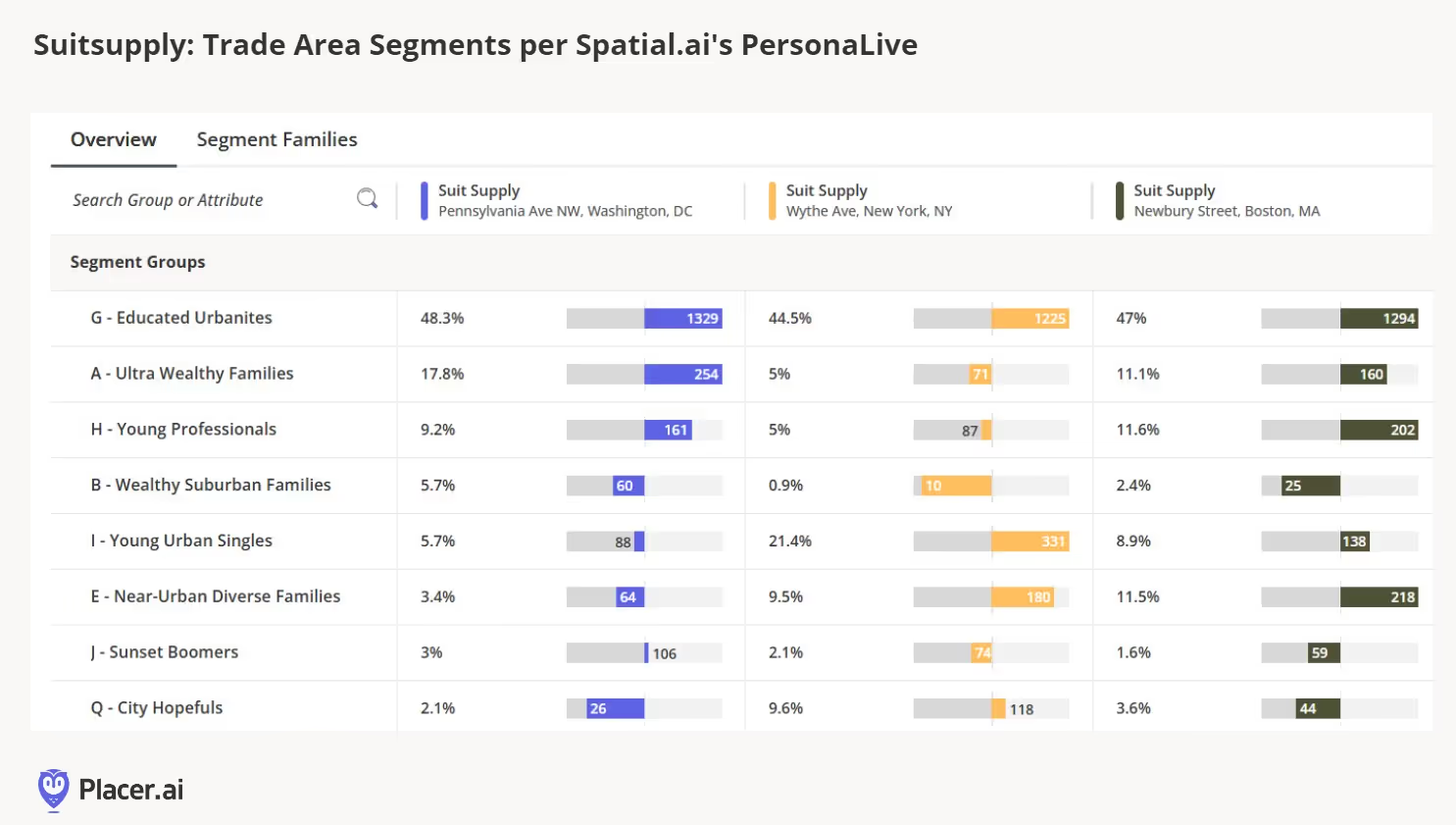

When examining the three East Coast cities in the chart—Washington, D.C., New York, and Boston—Educated Urbanites make up nearly half of Suitsupply's trade area, according to Spatial.ai’s PersonaLive data. In Boston specifically, there are also high indices for Near Urban Diverse Families and Young Professionals.

Both the Newbury St and Washington, DC Suitsupply locations saw the greatest gains compared to the prior year.

What might explain the gains in Boston? We have a few theories. First, Boston is a city where nearly a quarter of the population consists of students. The steady growth at the Newbury Street location from February to August could reflect students preparing for spring interviews, purchasing suits for summer internships, and later for weddings in late summer and early fall. Notably, a previous Anchor article highlighted that fall has become the most popular time of year for weddings. Additionally, the strong cohort of students and young professionals in their 20s and 30s may find the office environment particularly beneficial for camaraderie and mentorship. This group is also more likely to seek out—or at least be less resistant to—returning to the office compared to millennials and Gen X.

On a lighter note, there could be something lucky about this store, as it was the 100th location opened by the Amsterdam-based brand. From a quantitative perspective, year-over-year traffic to Newbury Street has increased over the past six months, with notable growth in June and August.

The importance of visual merchandising and the customer experience cannot be overlooked. A unique feature of Suitsupply is its in-store tailoring, often showcased prominently in the front window. This not only provides engaging "retail theater" but also reassures customers of the craftsmanship behind their suits. Some shoppers have even been drawn into the store out of curiosity sparked by seeing an artisan at work. Online reviews for the Boston location highlight customers' appreciation for attentive service, reasonable prices, meticulous attention to detail, and outstanding tailoring.

This week, we attended the Restaurant Finance & Development Conference (RFDC) in Las Vegas, a gathering of industry leaders including senior executives, real estate professionals, franchise groups, investors, and analysts. Similar to insights from last month’s Fast Casual Executive Summit, many operators acknowledged that 2024 has been a challenging year but expressed cautious optimism as they look ahead to 2025.

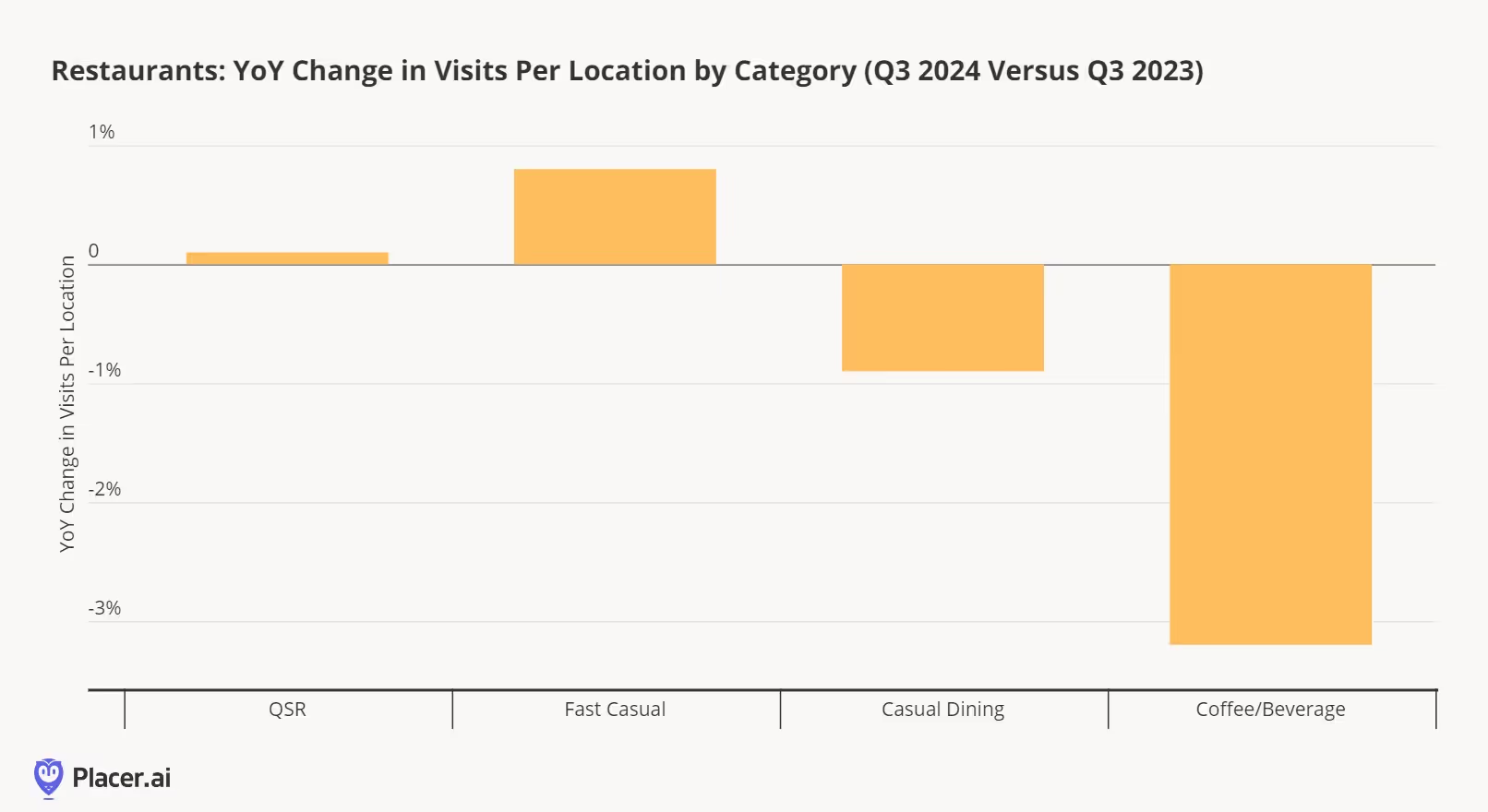

Restaurant operators have faced numerous headwinds this year, including inconsistent weather, heightened promotional activity across all tiers, increased competition from other food retail channels, elevated labor costs and shortages, and unfavorable lease terms contributing to a rise in bankruptcies. In Q3 2024, most restaurant chains experienced flat or declining visit-per-location trends, as shown below.

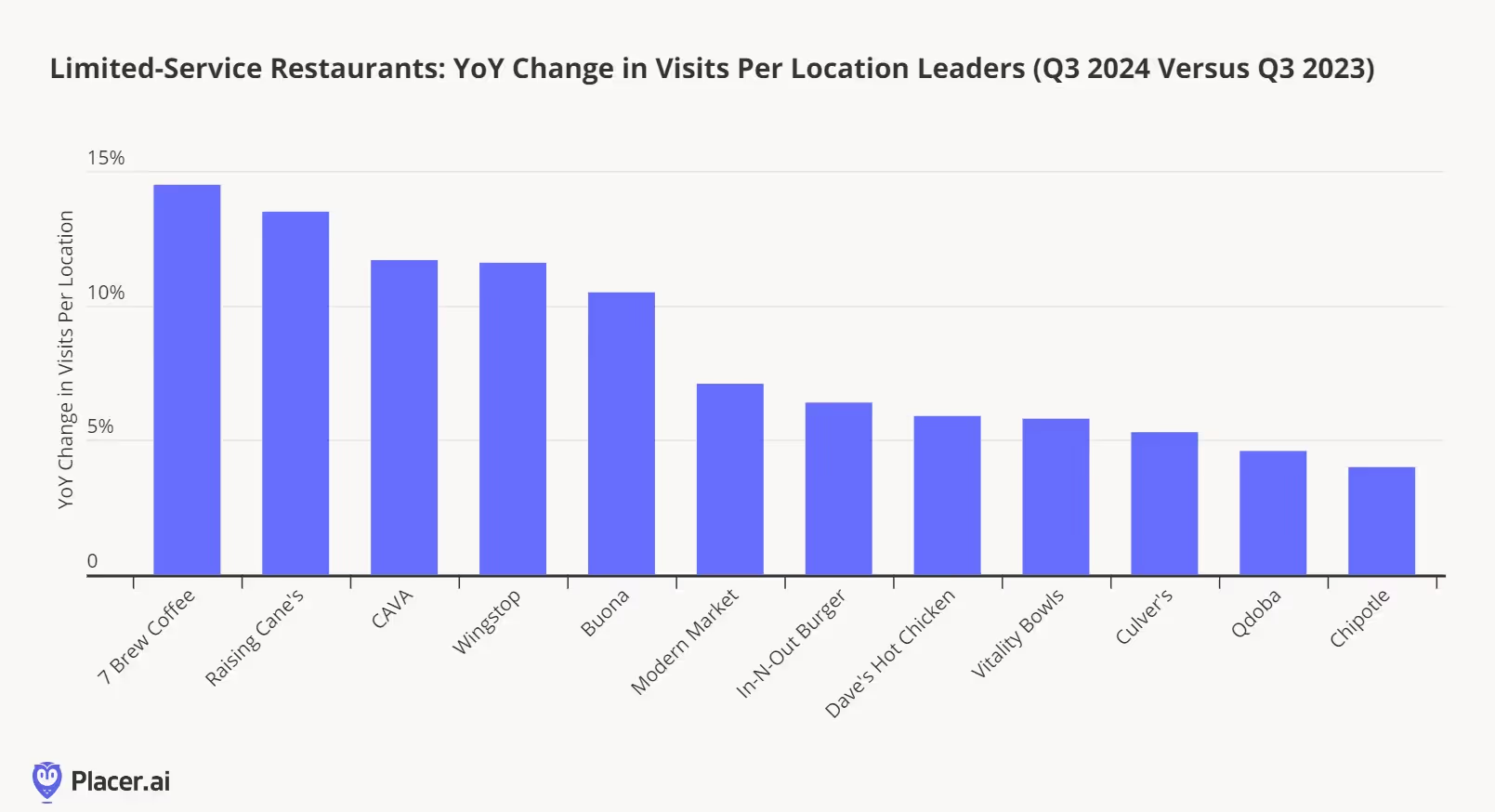

Still, some chains managed to achieve impressive growth in visitation per location this past quarter. Below, we highlight the top-performing limited-service restaurant chains (including QSR, fast casual, and coffee/beverage categories with more than 20 units) based on year-over-year visitation per location during Q3 2024.

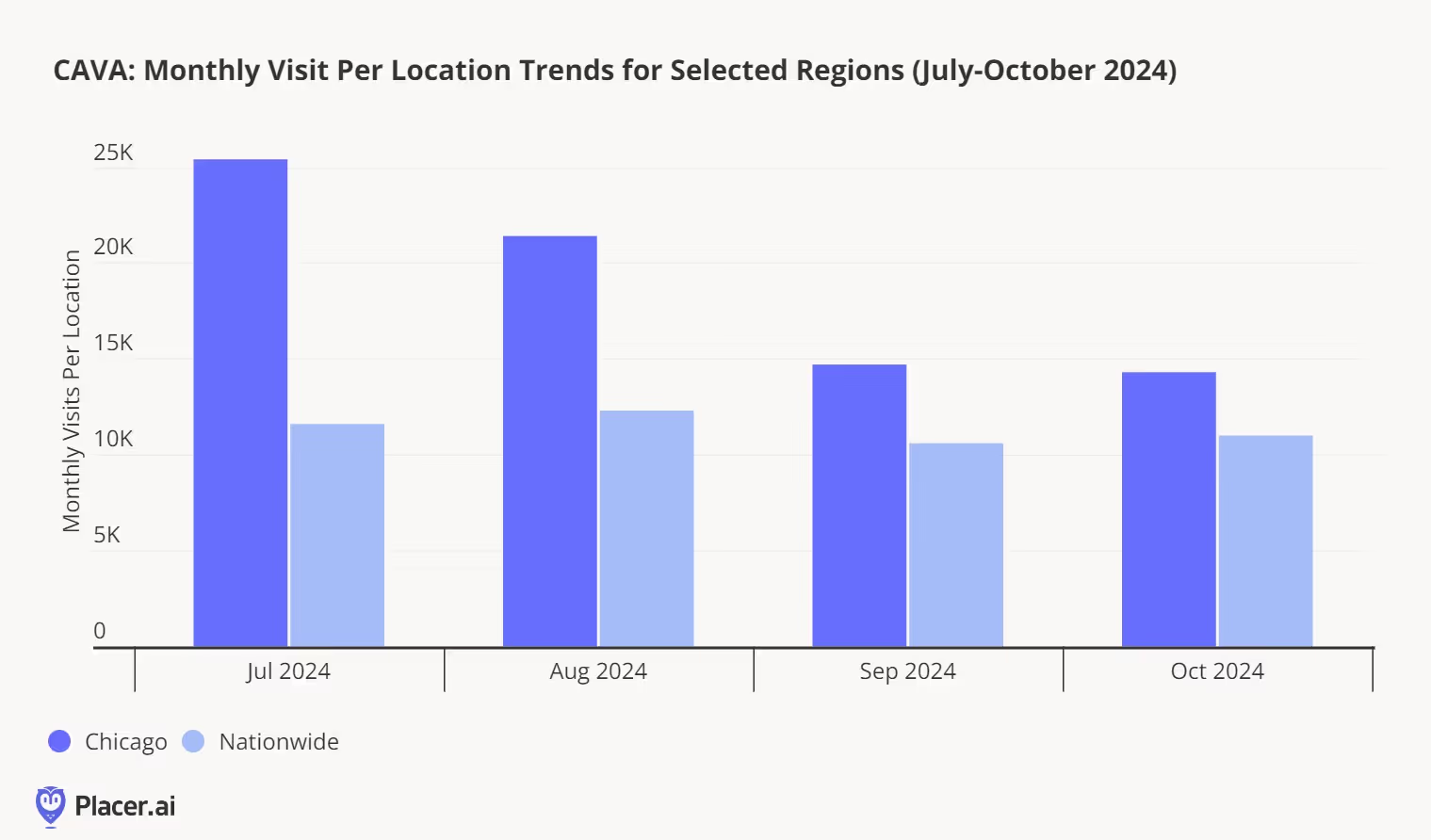

The most striking takeaway from this chart is that these standout restaurant chains largely avoided the "value wars" seen across the industry this year. Instead, they leaned on menu innovation—chains like CAVA, Chipotle, and Wingstop introduced new offerings that didn’t overly complicate preparation—and operational excellence, particularly in drive-thru efficiency, with leaders such as 7 Brew, Raising Cane’s, In-N-Out, and Culver’s driving visit growth.

Reflecting on the success of these chains, it’s unsurprising that a major theme among restaurant operators at the RFDC event was maximizing returns from existing locations rather than prioritizing unit expansion in 2025. Many chains emphasized improving operations, including simplifying menus to boost throughput while still allowing limited-time offers to drive demand. Others highlighted technology-driven solutions, such as automated make lines and AI-powered voice ordering for drive-thrus. Additionally, executives explored alternative strategies to enhance unit-level returns, including expanded catering services and leveraging retail media opportunities.

What else is on restaurant operators’ minds as we look ahead to 2025?

The festive season is upon us, making it the perfect time to focus on a retail category that truly shines in Q4 2024: gifting, books, and paper. Despite the digital age, consumers continue to show a strong preference for shopping for these items in-store and still value tangible versions of these products. However, as discretionary retail faces challenges in meeting consumer expectations, has this category managed to capture consumer excitement and deliver delight amidst competing distractions and purchase priorities?

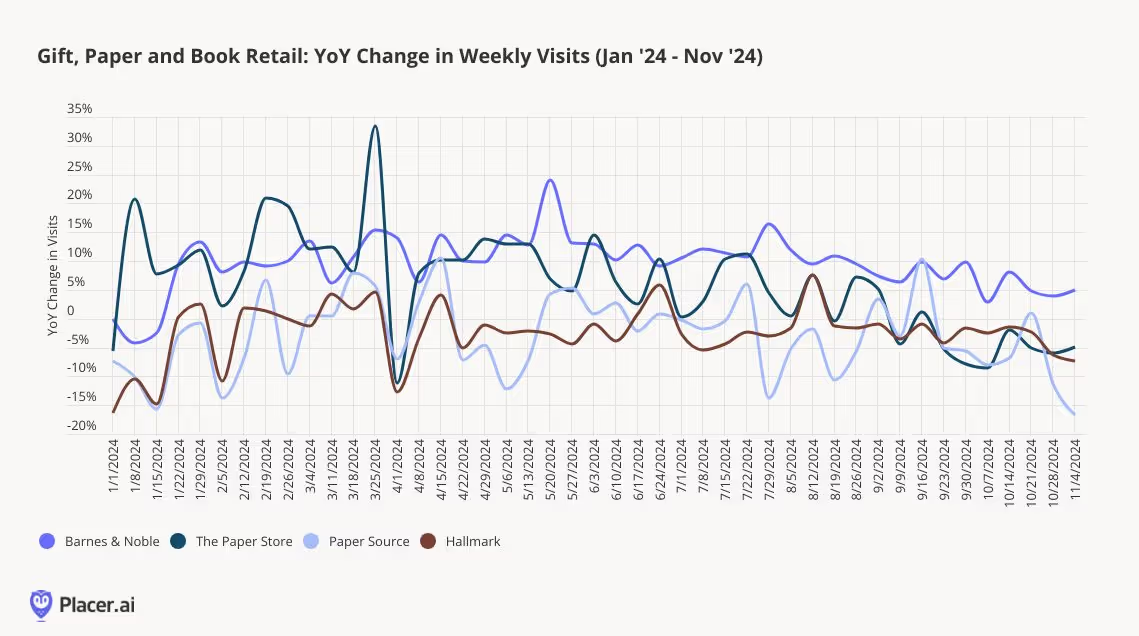

The book, paper, and gift market has experienced mixed performance among retailers this year, but even those facing year-over-year traffic declines have opportunities to improve. Barnes & Noble continues to set the standard, particularly in a category that was among the first to face e-commerce disruption; compared to 2019, visits are up 7% in 2024 despite a smaller store footprint. Paper Source is down 2% year-over-year in visits but is maintaining trends consistent with 2023. Similarly, Hallmark stores have seen a 2% decline in traffic year-to-date, though this aligns with a 5% reduction in store count. Notably, The Paper Store, a Northeastern chain of Hallmark Gold Crown stores, has outperformed the broader Hallmark brand by positioning itself more as a gift-first retailer, with cards and stationery playing a secondary role.

The book, paper, and gift market has experienced mixed performance among retailers this year, but even those facing year-over-year traffic declines have opportunities to improve. Barnes & Noble continues to set the standard, particularly in a category that was among the first to face e-commerce disruption; compared to 2019, visits are up 7% in 2024 despite a smaller store footprint. Paper Source is down 2% year-over-year in visits but is maintaining trends consistent with 2023. Similarly, Hallmark stores have seen a 2% decline in traffic year-to-date, though this aligns with a 5% reduction in store count. Notably, The Paper Store, a Northeastern chain of Hallmark Gold Crown stores, has outperformed the broader Hallmark brand by positioning itself more as a gift-first retailer, with cards and stationery playing a secondary role.

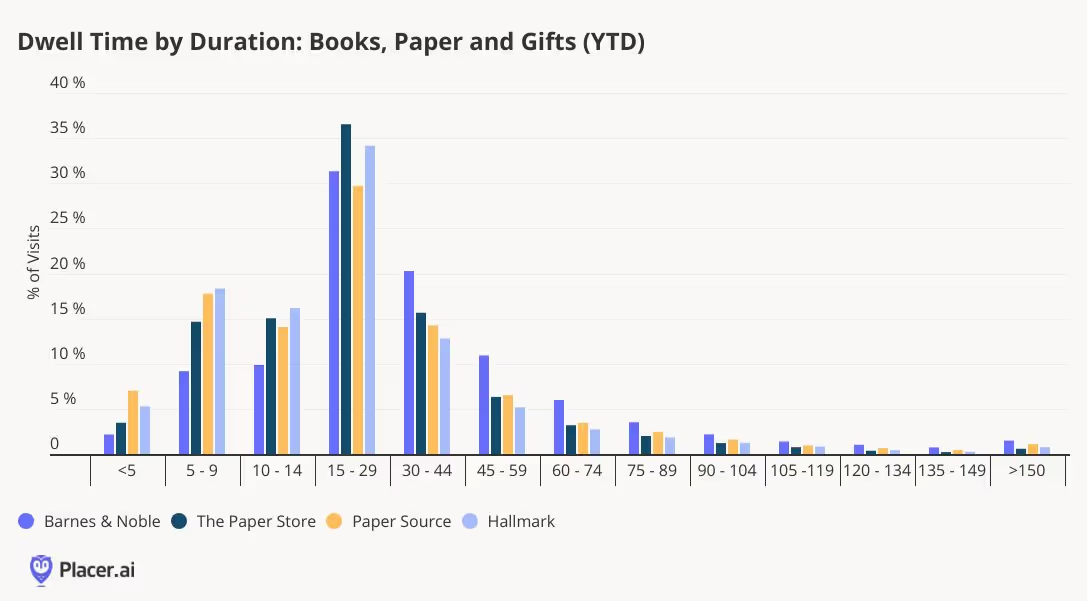

Barnes & Noble's consistent and sustainable traffic growth can be attributed to several successful initiatives. The retailer has expanded its product categories, doubled down on gifting, strengthened its position as a third space, and tapped into consumers' enduring love for books—all of which have set it apart in a challenging discretionary retail landscape. The effectiveness of these efforts is reflected in the chain's dwell time, which averages 37 minutes—nearly 10 minutes longer than any of the other chains reviewed—and excels at keeping visitors in-store for over 30 minutes.

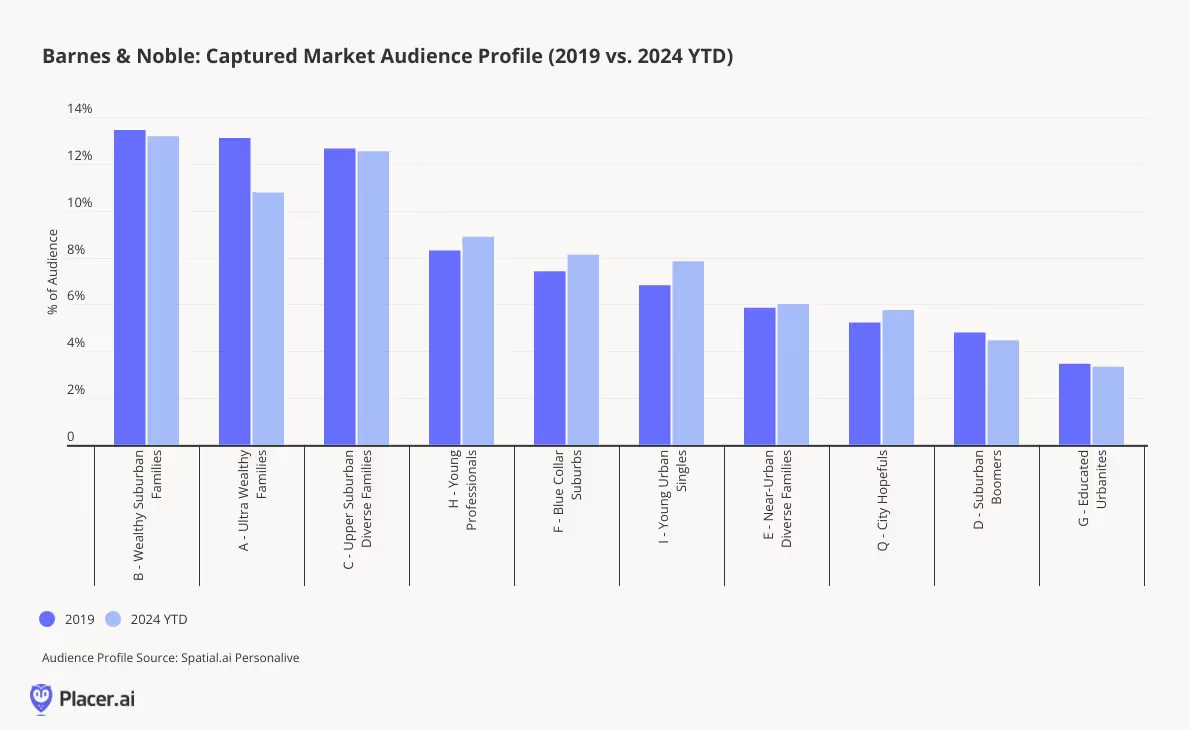

Barnes & Noble has done an impressive job of evolving its visitor demographics over time, particularly in the face of the digital revolution and the disruption of the book category. The success of specialty retailers often reflects broader cultural movements and shifts in consumer preferences, and Barnes & Noble is no exception. According to PersonaLive customer segments, the chain has significantly increased its penetration of younger consumer segments, such as Young Professionals and Young Urban Singles, when comparing 2024 year-to-date with 2019. Factors contributing to this trend could include the rise of book club culture among younger cohorts, the appeal of working from the in-store café, and an expanded assortment of gifts and paper products for special occasions.

This focus on younger consumers seems to be paying off. In 2024, 6% of Barnes & Noble visitors also shopped at a Hallmark location, although only 1% visited Paper Source, its sister brand. The integration of Paper Source shop-in-shops within Barnes & Noble locations may be cannibalizing cross-visitation between the two standalone chains.

As for Paper Source, it shares many of the elements driving Barnes & Noble's success but faces challenges in fully unlocking its potential. One key differentiator is its invitation business, but as consumers increasingly turn to digital platforms like Facebook or Paperless Post for invitations, even the booming wedding market hasn’t been enough to significantly drive growth.

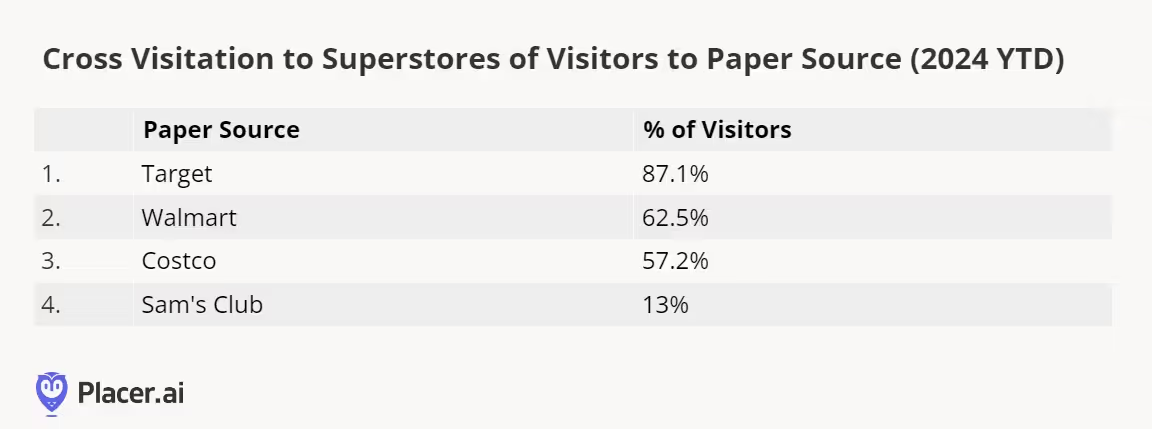

A significant challenge for Paper Source comes from competition within the superstore category. This year, 87% of Paper Source visitors also shopped at Target, and 63% visited Walmart. Both retailers have invested heavily in expanding their party supplies, cards, and gifting assortments, making it more convenient for shoppers to purchase these items during a single trip, rather than visiting a separate specialty store.

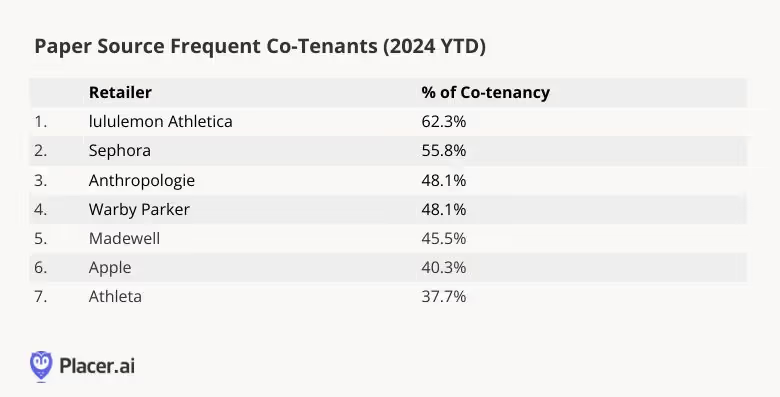

Paper Source has a strong demographic foundation to build upon as it works toward stabilization. According to PersonaLive, the chain significantly outperforms Barnes & Noble in visitation percentages among Ultra Wealthy Families, Young Professionals, and Educated Urbanites, with Ultra Wealthy Families accounting for nearly a quarter of its visitors. Its frequent co-tenants reflect similar socio-economic patterns, aligning with successful specialty chains that appeal to wealthier shoppers, such as lululemon, Sephora, Anthropologie, Warby Parker, Madewell, and Apple. With these favorable dynamics in place, Paper Source has an opportunity to thrive—success may depend on effective messaging and marketing to this affluent customer base.

The differences between Hallmark stores and The Paper Store highlight contrasting strategies: one chain has successfully expanded its product offerings to capture a more engaged audience, while the other remains closely tied to the traditional paper category and has struggled to do the same. There is little overlap in visitation between the two chains, suggesting that consumers may perceive The Paper Store as entirely separate from Hallmark, despite its status as a Gold Crown retailer.

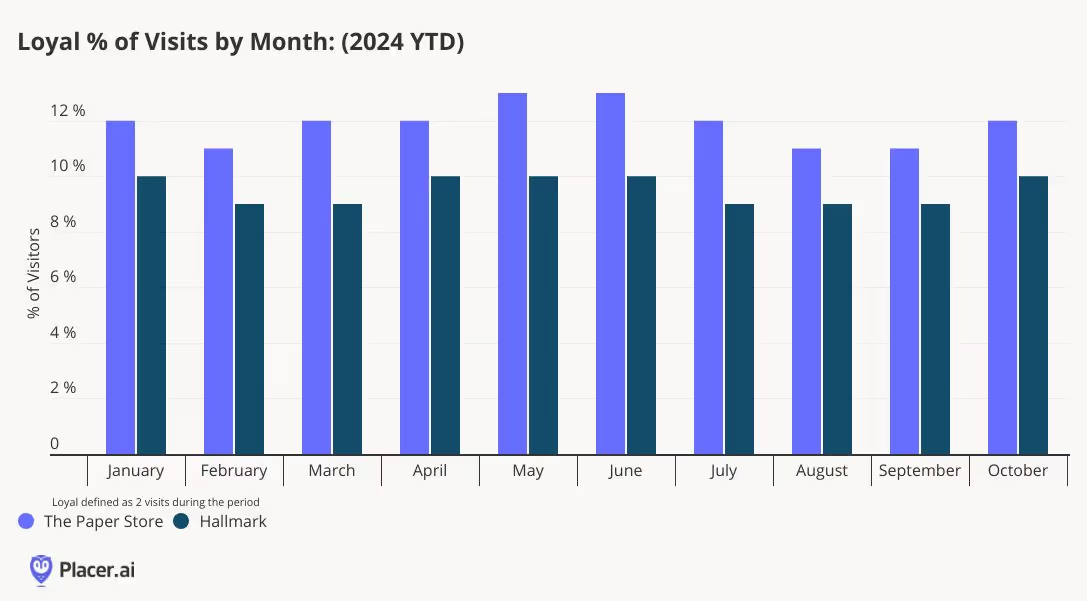

The Paper Store’s elevated and expanded assortment has fostered stronger loyalty among its visitors compared to the Hallmark chain. In 2024, loyal visitors—defined as those visiting twice per month—accounted for 12% of The Paper Store’s visitors, 2 percentage points higher than Hallmark. Additionally, The Paper Store serves more as a destination, with 37% of visitors heading home afterward, also 2 points higher than Hallmark. By expanding its product categories and curating localized selections, The Paper Store has successfully differentiated itself from the traditional Hallmark model, a strategy that could benefit the national chain as well.

The gifting, book, and paper retail category demonstrates varied consumer behavior across chains. The success of Barnes & Noble and The Paper Store underscores the importance of expanding product assortments to attract visits, as consumers increasingly seek convenience by consolidating their purchases in fewer trips. While consumers may tolerate more frequent visits for essential retail, in specialty retail, convenience and variety are critical. The category’s overall resilience suggests that consumers still have discretionary spending power for the right products at the right time, offering hope for retailers still refining their approach.

The sporting goods and sportswear category has had a rough couple of months. Two mainstays in the space – Bob’s Stores and Eastern Mountain Sports – filed for bankruptcy in June, and several sportswear and athleisure leaders posted disappointing results. So is the consumer demand for leggings and sneakers waning? Or is the category merely facing a temporary slowdown? We dove into the data to find out.

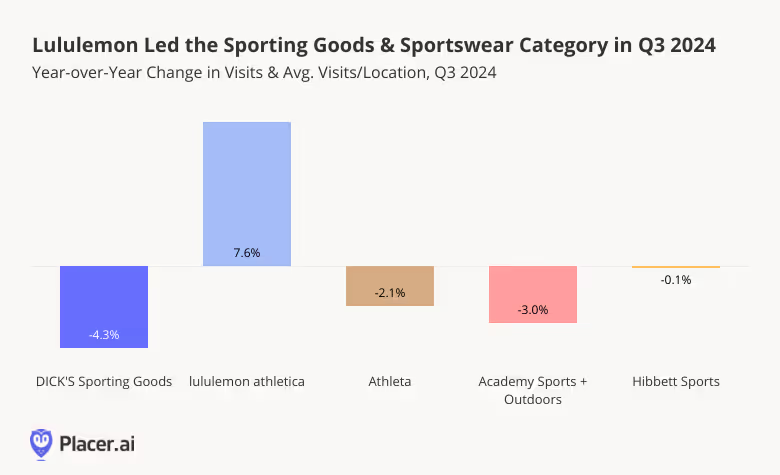

With budgets still tight, many shoppers are turning to value apparel and value athletic wear – and this trading down may be impacting the sporting goods and sportswear space: Q3 2024 visits to most sporting goods and athletic wear chains analyzed, including DICK’s Sporting Goods, Athleta, Academy Sports + Outdoor, and Hibbett Sports, remained at or moderately below 2023 levels. Still, the relatively minimal visit gaps indicate that demand for the category remains stable and may rise again with increased consumer confidence.

Meanwhile, lululemon athletica saw a 7.6% increase in YoY visits in Q3 2024 thanks to the company’s ongoing expansion.

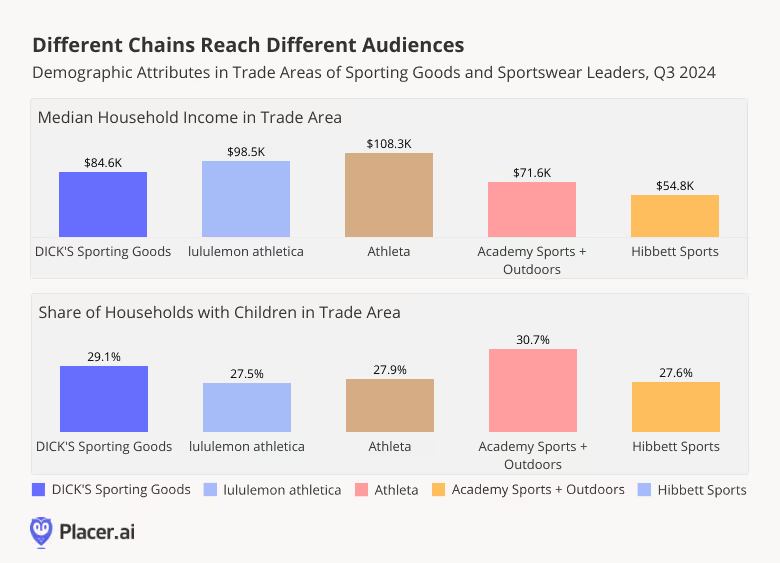

But even as the sporting goods and sportswear category may be facing a temporary lull, diving into the demographics of the trade areas for the various retailers reveals the variety of sporting goods and sportswear consumers – showing the varied demand for the category.

The median household income within the trade areas of the five chains analyzed ranged from $54.8K for Hibbett Sports to $108.3K for Athleta. The share of households with children within the trade areas also varied among the chains: DICK’s Sporting Goods, and Academy Sports + Outdoors included significantly more households with children in their captured markets when compared with Athleta, lululemon, or Hibbett Sports.

It seems, then, that each chain appeals to a specific consumer segment – DICK’s and Academy Sports both serve families, although DICK’s attracts the higher-income households and Academy Sports draws more middle-income shoppers. Lululemon and Athleta both operate at the higher-end of the athletic wear spectrum, but Athleta shoppers tend to come from slightly more affluent areas with larger household sizes. And Hibbett has carved out a niche among lower-income consumers.

Demand for sportswear and gym gear may not be as strong as it was at the height of the pandemic when gyms were closed and consumers were doubling down on comfort. But the variety of audiences within the category leaders’ trade areas indicates that appetite for athletic wear and sporting goods is still widespread. And with Black Friday around the corner, these chains – and especially the higher-priced retailers among them – may well get a boost from price-conscious consumers looking to snag discounts at their favorite premium chains.

For more data-driven retail insights, visit placer.ai.

1. Market Divergence: While San Francisco's return-to-office trends have stabilized, Los Angeles is increasingly lagging behind national averages with office visits down 46.6% compared to pre-pandemic levels as of June 2025.

2. Commuter Pattern Shifts: Los Angeles faces a persistent decline in out-of-market commuters while San Francisco's share of out-of-market commuters has recovered slightly, indicating deeper structural challenges in LA's office market recovery.

3. Visit vs. Visitor Gap: Unlike other markets where increased visits per worker offset declining visitor numbers, Los Angeles saw both metrics decline year-over-year, suggesting fundamental workforce retention issues.

4. Century City Exception: Century City emerges as LA's strongest office submarket with visits only 28.1% below pre-pandemic levels, driven by its premium amenities and strategic location adjacent to Westfield Century City shopping center.

5. Demographic Advantage: Century City's success may stem from its success in attracting affluent, educated young professionals who value lifestyle integration and are more likely to maintain consistent office attendance in hybrid work arrangements.

While return-to-office trends have stabilized in many markets nationwide, Los Angeles and San Francisco face unique challenges that set them apart from national patterns. This report examines the divergent trajectories of these two major West Coast markets, with particular focus on Los Angeles' ongoing struggles and the emergence of one specific submarket that bucks broader trends.

Through analysis of commuter patterns, demographic shifts, and localized performance data, we explore how factors ranging from out-of-market workforce changes to amenity-driven location advantages are reshaping the competitive landscape for office real estate in Southern California.

Both Los Angeles and San Francisco continue to significantly underperform the national office occupancy average. In June 2025, average nationwide visits to office buildings were 30.5% below January 2019 levels, compared to a 46.6% and 46.4% decline in visits to Los Angeles and San Francisco offices, respectively.

While both cities now show similar RTO rates, they arrived there through different trajectories. San Francisco has consistently lagged behind national return-to-office levels since pandemic restrictions first lifted.

Los Angeles, however, initially mirrored nationwide trends before its office market began diverging and falling behind around mid-2022.

The decline in office visits in Los Angeles and San Francisco can be partly attributed to fewer out-of-market commuters. Both cities saw significant drops in the percentage of employees who live outside the city but commute to work between H1 2019 and H1 2023.

However, here too, the two cities diverged in recent years: San Francisco's share of out-of-market commuters relative to local employees rebounded between 2023 and 2024, while Los Angeles' continued to decline – another indication that LA's RTO is decelerating as San Francisco stabilizes.

Like in other markets, Los Angeles saw a larger drop in office visits than in office visitors when comparing current trends to pre-pandemic levels. This is consistent with the shift to hybrid work arrangements, where many of the workers who returned to the office are coming in less frequently than before the pandemic, leading to a larger drop in visits compared to the drop in visitors.

But looking at the trajectory of RTO more recently shows that in most markets – including San Francisco – office visits are up year-over-year (YoY) while visitor numbers are down. This suggests that the workers slated to return to the office have already done so, and increasing the numbers of visits per visitor is now the path towards increased office occupancy.

In Los Angeles, visits also outperformed visitors – but both figures were down YoY (the gap in visits was smaller than the gap in visitors). So while the visitors who did head to the office in LA in Q2 2025 clocked in more visits per person compared to Q2 2024, the increase in visits per visitor was not enough to offset the decline in office visitors.

While Los Angeles may be lagging in terms of its overall office recovery, the city does have pockets of strength – most notably Century City. In Q2 2025, the number of inbound commuters visiting the neighborhood was just 24.7% lower than it was in Q2 2019 and higher (+1.0%) than last year's levels.

According to Colliers' Q2 2025 report, Century City accounts for 27% of year-to-date leasing activity in West Los Angeles – more than double any other submarket – and commands the highest asking rental rates. The area benefits from Trophy and Class A office towers that may create a flight-to-quality dynamic where tenants migrate from urban core locations to this Westside submarket.

The submarket's success is likely bolstered by its strategic location adjacent to Westfield Century City shopping center – visit data reveals that 45% of weekday commuters to Century City also visited Westfield Century City during Q2 2025. The convenience of accessing the mall's extensive retail, dining, and entertainment options during lunch breaks or after work may encourage employees to come into the office more frequently.

Perhaps thanks to its strategic locations and amenities-rich office buildings, Century City succeeds in attracting relatively affluent office workers.

Century City's office submarket has a higher median trade area household income (HHI) than either mid-Wilshire or Downtown LA. The neighborhood also attracts significant shares of the "Educated Urbanite" Spatial.ai: PersonaLive segment – defined as "well educated young singles living in dense urban areas working relatively high paying jobs".

This demographic typically has fewer family obligations and greater flexibility in their work arrangements, making them more likely to embrace hybrid schedules that include regular office attendance. Affluent singles also tend to value the lifestyle amenities and networking opportunities that come with working in a premium office environment like Century City: This demographic is often in career-building phases where in-person collaboration and visibility matter more, driving consistent office utilization that helps sustain the submarket's performance even as other LA office areas struggle with lower occupancy rates.

The higher disposable income of this audience also aligns well with the submarket's upscale retail and dining options at nearby Westfield Century City, creating a mutually reinforcing ecosystem where the office environment and surrounding amenities cater to their preferences.

As the broader Los Angeles market grapples with a shrinking commuter base and declining office utilization, the performance gap between premium, amenity-rich locations and traditional office districts is likely to widen. For investors and tenants alike, these trends underscore the growing importance of location quality, demographic targeting, and lifestyle integration in determining long-term office market viability across Southern California.

Century City's success – anchored by its affluent, career-focused workforce and integrated lifestyle amenities – can offer a blueprint for office market resilience in the hybrid work era.

1. Appetite for offline retail & dining is stronger than ever. Both retail and dining visits were higher in H1 2025 than they were pre-pandemic.

2. Consumers are willing to go the extra mile for the perfect product or brand. The era of one-stop-shops may be waning, as many consumers now prefer to visit multiple chains or stores to score the perfect product match for every item on their shopping list.

3. Value – and value perception – gives chains a clear advantage. Value-oriented retail and dining segments have seen their visits skyrocket since the pandemic.

4. Consumer behavior has bifurcated toward budget and premium options. This trend is driving strength at the ends of the spectrum while putting pressure on many middle-market players.

5. The out-of-home entertainment landscape has been fundamentally altered. Eatertainment and museums have stabilized at a different set point than pre-COVID, while movie theater traffic trends are now characterized by box-office-driven volatility.

6. Hybrid work permanently reshaped office utilization. Visits to office buildings nationwide are still 33.3% below 2019 levels, despite RTO efforts.

The first half of 2025 marked five years since the onset of the pandemic – an event that continues to impact retail, dining, entertainment, and office visitation trends today.

This report analyzes visitation patterns in the first half of 2025 compared to H1 2019 and H1 2024 to identify some of the lasting shifts in consumer behavior over the past five years. What is driving consumers to stores and dining venues? Which categories are stabilizing at a higher visit point? Where have the traffic declines stalled? And which segments are still in flux? Read the report to find out.

In the first half of 2025, visits to both the retail and dining segments were consistently higher than they were in 2019. In both the dining and the retail space, the increases compared to pre-COVID were probably driven by significant expansions from major players, including Costco, Chick-fil-A, Raising Cane's, and Dutch Bros, which offset the numerous retail and dining closures of recent years.

The overall increase in visits indicates that, despite the ubiquity of online marketplaces and delivery services, consumer appetite for offline retail and dining remains strong – whether to browse in store, eat on-premises, collect a BOPIS order, or pick up takeaway.

A closer look at the chart above also reveals that, while both retail and dining visits have exceeded pre-pandemic levels, retail visit growth has slightly outpaced the dining traffic increase.

The larger volume of retail visits could be due to a shift in consumer behavior – from favoring convenience to prioritizing the perfect product match and exhibiting a willingness to visit multiple chains to benefit from each store's signature offering. Indeed, zooming into the superstore and grocery sector shows an increase in cross-shopping since COVID, with a larger share of visitors to major grocery chains regularly visiting superstores and wholesale clubs. It seems, then, that many consumers are no longer looking for a one-stop-shop where they can buy everything at once. Instead, shoppers may be heading to the grocery stores for some things, the dollar store for other items, and the wholesale club for a third set of products.

This trend also explains the success of limited assortment grocers in recent years – shoppers are willing to visit these stores to pick up their favorite snack or a particularly cheap store-branded basic, knowing that this will be just one of several stops on their grocery run.

Diving into the traffic data by retail category reveals that much of the growth in retail visits since COVID can be attributed to the surge in visits to value-oriented categories, such as discount & dollar stores, value grocery stores, and off-price apparel. This period has been defined by an endless array of economic obstacles like inflation, recession concerns, gas price spikes, and tariffs that all trigger an orientation to value. The shift also speaks to an ability of these categories to capitalize on swings – consumers who visited value-oriented retailers to cut costs in the short term likely continued visiting those chains even after their economic situation stabilized.

Some of the visit increases are due to the aggressive expansion strategies of leaders in those categories – including Dollar General and Dollar Tree, Aldi, and all the off-price leaders. But the dramatic increase in traffic – around 30% for all three categories since H1 2019 – also highlights the strong appetite for value-oriented offerings among today's consumers. And zooming into YoY trends shows that the visit growth is still ongoing, indicating that the demand for value has not yet reached a ceiling.

While affordable pricing has clearly driven success for value retailers, offering low prices isn't a guaranteed path to growth. Although traffic to beauty and wellness chains remains significantly higher than in 2019, this growth has now plateaued – even top performers like Ulta saw slight YoY declines following their post-pandemic surge – despite the relatively affordable price points found at these chains.

Some of the beauty visit declines likely stems from consumers cutting discretionary spending – but off-price apparel's ongoing success in the same non-essential category suggests budget constraints aren't the full story. Instead, the plateauing of beauty and drugstore visits while off-price apparel visits boom may be due to the difference in value perception: Off-price retailers are inherently associated with savings, while drugstores and beauty retailers, despite carrying affordable items, lack that same value-driven brand positioning. This may suggest that in today's market, perceived value matters as much as actual affordability.

Another indicator of the importance of value perception is the decline in visits to chains selling bigger-ticket items – both home furnishing chains and electronic stores saw double-digit drops in traffic since H1 2019.

And looking at YoY trends shows that visits here have stabilized – like in the beauty and drugstore categories – suggesting that these sectors have reached a new baseline that reflects permanently shifted consumer priorities around discretionary spending.

A major post-pandemic consumer trend has been the bifurcation of consumer spending – with high-end chains and discount retailers thriving while the middle falls behind. This trend is particularly evident in the apparel space – although off-price visits have taken off since 2019 (as illustrated in the earlier graph) overall apparel traffic declined dramatically – while luxury apparel traffic is 7.6% higher than in 2019.

Dining traffic trends also illustrate this shift: Categories that typically offer lower price points such as QSR, fast casual, and coffee have expanded significantly since 2019, as has the upscale & fine dining segment. But casual dining – which includes classic full-service chains such as Red Lobster, Applebee's, and TGI Fridays – has seen its footprint shrink in recent years as consumers trade down to lower-priced options or visit higher-end venues for special occasions.

Chili's has been a major exception to the casual dining downturn, largely driven by the chain's success in cementing its value-perception among consumers – suggesting that casual dining chains can still shine in the current climate by positioning themselves as leaders in value.

Consumers' current value orientation seems to be having an impact beyond the retail and dining space: When budgets are tight, spending money in one place means having less money to spend in another – and recent data suggests that the consumer resilience in retail and dining may be coming at the expense of travel – or perhaps experiences more generally.

While airport visits from domestic travelers were up compared to pre-COVID, diving into the data reveals that the growth is mostly driven by frequent travelers visiting airports two or more times in a month. Meanwhile, the number of more casual travelers – those visiting airports no more than once a month – is lower than it was in 2019.

This may suggest that – despite consumers' self-reported preferences for "memorable, shareable moments" – at least some Americans are actually de-prioritizing experiences in the first half of 2025, and choosing instead to spend their budgets in retail and dining venues.

The out of home entertainment landscape has also undergone a significant change since COVID – and the sector seems to have settled into a new equilibrium, though for part of the sector, the equilibrium is marked by consistent volatility.

Eatertainment chains – led by significant expansions from venues like Top Golf – saw a 5.5% visit increase compared to pre-pandemic levels, though YoY growth remained modest at 1.1%. On the other hand, H1 2025 museum traffic fell 10.9% below 2019 levels with flat YoY performance (+0.2%). The minimal year-over-year changes in both categories suggest that these entertainment segments have found their new post-COVID equilibrium.

The rise of eatertainment alongside the drop in museum visits may also reflect the intense focus on value for today's consumers. Museums in 2025 offer essentially the same value proposition that they offered in 2019 – and for some, that value proposition may no longer justify the entrance fee. But eatertainment has gained popularity in recent years as a format that offers consumers more bang for their buck relative to stand-alone dining or entertainment venues – which makes it the perfect candidate for success in today's value-driven consumer landscape.

But movie theaters traffic trends are still evolving – even accounting for venue closures, visits in H1 2025 were well below H1 2019 levels. But compared to 2024, movie traffic was also up – buoyed by the release of several blockbusters that drove audiences back to cinemas in the first half of 2025. So while the segment is still far from its pre-COVID baseline, movie theaters retain the potential for significant traffic spikes when compelling content drives consumer demand.

The blockbuster-driven YoY increase can perhaps also be linked to consumers' spending caution. With budgets tight, movie-goers may want to make sure that they're spending time and money on films they are sure to enjoy – taking fewer risks than they did in 2019, when movie tickets and concession prices were lower and consumers were less budget-conscious.

H1 2025 also brought some moderate good news on the return to office (RTO) front, with YoY visits nationwide up 2.1% and most offices seeing YoY office visit increases – perhaps due to the plethora of RTO mandates from major companies. But comparing office visitation levels to pre pandemic levels highlights the way left to go – nationwide visits were 33.3% below H1 2019 levels in H1 2025, with even RTO leaders New York and Miami still seeing 11.9% and 16.1% visit gaps, respectively.

So while the data suggests that the office recovery story is still being written – with visits inching up slowly – the substantial gap from pre-pandemic levels suggests that remote and hybrid work models have fundamentally reshaped office utilization patterns.

Five years post-pandemic, consumer behavior across the retail, dining, entertainment, and office spaces has crystallized into distinct new patterns.

Traffic to retail and dining venues now surpasses pre-pandemic levels, driven primarily by value-focused segments. But retail and dining segments that cater to higher income consumers –such as luxury apparel and fine dining – have also stabilized at a higher level, highlighting the bifurcation of consumer behavior that has emerged in recent years. Entertainment formats show more variability – while eatertainment traffic has settled above and museums below 2019 levels, and movie theaters still seeking stability. Office spaces remain the laggard, with visits well below pre-pandemic levels despite corporate return-to-office initiatives showing modest impact.

It seems, then, that the new consumer landscape rewards businesses that can clearly articulate their value proposition to attract consumers' increasingly selective spending and time allocation – or offer a premium product or experience catering to higher-income audiences.

.avif)

1. Overall dining traffic is mostly flat, but growth is concentrated in specific areas.

While nationwide dining visits were nearly unchanged in early 2025, western states like Utah, Idaho, and Nevada showed moderate growth, while states in the Midwest and South, along with Washington D.C., saw declines.

2. Fine dining and coffee chains are growing through expansion, not just busier locations.

These two segments were the only ones to see an increase in total visits, but their visits-per-location actually decreased, indicating that opening new stores is the primary driver of their growth.

3. Higher-income diners are driving the growth in resilient categories.

The segments that saw visit growth—fine dining and coffee—also attracted customers with the highest median household incomes, suggesting that affluent consumers are still spending on dining despite economic headwinds.

4. Remote work continues to reshape dining habits.

The share of suburban customers at fine dining establishments has increased since 2019, while it has decreased for coffee chains. This reflects a shift towards "destination" dining closer to home and away from commute-based coffee runs.

5. Limited-service restaurants own the weekdays; full-service restaurants win the weekend.

QSR, fast casual, and coffee chains see the majority of their traffic from Monday to Friday, whereas casual and fine dining see a significant spike in visits on weekends.

6. Each dining segment dominates a specific time of day.

Consumer visits are highly predictable by the hour: coffee leads in the early morning, fast casual peaks at lunch, casual dining takes the afternoon, fine dining owns the dinner slot, and QSR captures the late-night crowd.

Overall dining visits held relatively steady in the first five months of 2025, with year-over-year (YoY) visits to the category down 0.5% for January to May 2025 compared to the same period in 2024. Most of the country saw slight declines (less than 2.0%), though some states and districts experienced larger drops: Washington, D.C, saw the largest visit gap (-3.6% YoY), followed by Kansas and North Dakota (-2.9%), Arkansas (-2.8%), Missouri and Kentucky (-2.6%), Oklahoma (-2.1%), and Louisiana (-2.0%).

Still, there were several pockets of moderate dining strength, specifically in the west of the United States. January to May 2025 dining visits in Utah, Idaho, and Nevada increased 1.8% to 2.4% YoY, while the coastal states saw traffic rise 0.6% (California) to 1.2% (Washington). Vermont also saw a slight increase in dining visits (+1.9%).

Diving into visit trends by dining segment shows that fine dining and coffee saw the strongest overall visit trends, with visits to the segments up 1.3% and 2.6% YoY, respectively, between January and May 2025. But visits per location trends were negative for both segments – a decline of 0.8% YoY for fine dining and 1.8% for coffee during the period – suggesting that much of the visit strength is due to expansions rather than more crowded restaurants and coffee shops.

In contrast, full-service casual dining saw overall visits decrease by 1.5%, while visits per location remained stable (+0.2%) YoY between January and May 2025. Several casual dining chains have rightsized in the past twelve months – including Red Lobster, TGI Fridays, and Outback Steakhouse – which impacted overall visit numbers. But the data seems to show that their rightsizing was effective, as the remaining locations successfully absorbed the traffic and maintained performance levels from the previous year. And the monthly data also provides much reason for optimism, with May traffic up both overall and on a visit per location basis – suggesting that the casual dining segment is well positioned for growth in the second half of 2025.

Meanwhile, QSR and fast casual chains saw similar minor visits per venue dips (-1.5% and -1.2%, respectively). At the same time, QSR also saw an overall visit dip (-0.8%) while traffic to fast casual chains increased slightly (+0.3%) – suggesting that the fast casual segment is expanding more aggressively than QSR. But the two segments decoupled somewhat in May, with overall traffic and visits per venue to fast casual chains up YoY while traffic remained flat and visits per venue fell slightly for QSR – perhaps due to the relatively greater affluence of fast casual's consumer base.

Analyzing the income levels of visitors to the various dining segments over time shows that each segment followed a slightly different trend – and the differences in visitor income may help explain some of the current traffic patterns.

The only three segments with YoY visit growth – casual dining, fine dining, and coffee – also had the highest captured market median household income (HHI). Although the median HHI in the captured market of upscale and fine dining chains fell after COVID, it has risen back steadily over time and now stands at $98.0K – slightly higher than the $97.1K median HHI between January to May 2019. This may explain the segment's resilience in the face of wider consumer headwinds. Meanwhile, the median HHI at fast casual and coffee chains has fallen slightly, perhaps due to aggressive expansions in the space – including Dave's Hot Chicken and Dutch Bros – which likely broadened the reach of the segments, driving visits up and trade area median HHI down.

Like fine dining, casual dining also saw its trade area median HHI increase slightly over time – but the segment has still been facing visit dips. This could mean that, even though consumers trading down to casual dining may have boosted the trade area median HHI for the segment, it still might not have been enough to make up for the customers lost to tighter budgets.

The QSR segment saw its trade area median HHI remain remarkably steady – and visits to the segment have also been quite consistent – staying between $70.6K and $70.9K between 2019 and 2025 – which may explain why the segment's visits remained relatively stable YoY.

Diving into the psychographic segmentation shows that, although the fine dining segment attracted visitors from the highest-income areas between January and May 2025, fast casual chains drew the highest share of visitors from suburban areas, followed by casual dining and coffee. QSR attracted the smallest share of suburban visitors, with just 30.5% of the category's captured market between January and May 2025 belonging to Spatial.ai: PersonaLive suburban segments.

But looking at the data since 2019 reveals small but significant changes in the shares of suburban audiences in some categories' captured markets. And although the percentage changes are slight, these represent hundreds of thousands of diners every year.

The data shows that shares of suburban segments in the captured markets of fine dining chains have increased, while their share in the captured market of coffee chains has decreased. The shares of suburban visitors to QSR, fast casual, and casual chains have remained relatively steady.

This may suggest that the COVID-19 pandemic and the subsequent rise of remote and hybrid work models are still impacting consumer dining habits, benefiting destination-worthy experiences in suburban locales such as fine dining chains while reducing the necessity of daily coffee runs that were often tied to commuting and office work. Meanwhile, the stability in QSR, fast casual, and casual dining segments could indicate that these categories continue to meet consistent suburban demand for convenience and everyday dining, largely unaffected by the redistribution seen in the fine dining and coffee sectors.

Although QSR, fast casual, casual dining, fine dining, and coffee all fall under the wider dining umbrella, the data shows distinct consumer behavior patterns regarding visits to these five categories.

Limited service segments, including QSR, fast casual, and coffee tend to see higher shares of visits on weekdays, while full service segments – casual dining and fine dining – receive higher shares of weekend visits. Diving deeper shows that QSR has the largest share of weekday visits, with 72.3% of traffic coming in between Monday and Friday, followed by fast casual (69.8% of visits on weekdays) and coffee (69.4% of visits on weekdays.) Looking at trends within the work week shows that QSR receives a slightly larger visit share between Monday and Thursday compared to the other limited service segments. Meanwhile, coffee seems to receive the smallest share of Friday visits – 16.3% compared to 17.0% for fast casual and 17.2% for QSR.

On the full-service side, casual dining and fine dining chains have relatively similar shares of weekend visits (39.0% and 38.8%, respectively), but fine dining also sees an uptick of visits on Fridays (with 19.1% of weekly visits) as consumers choose to start the weekend on a festive note.

Hourly visit patterns also show variability between the segments. Coffee is the unsurprising leader of early visits, with 14.6% of visits taking place before 8 AM and, almost two-thirds (64.9%) of visits taking place before 2 PM. Fast casual leads the lunch rush (29.4% of visits between 11 AM and 2 PM), casual dining chains receive the largest share of afternoon (2 PM to 5 PM) visits, and fine dining chains receive the largest share of dinner visits, with almost 70% of visits taking place between 5 PM and 11 PM. QSR leads the late night visit share – 4.1% of visits take place between 11 PM and 5 AM – followed by casual dining chains (3.2% late night and overnight visit share), likely due to the popularity of 24-hour diners.

This suggests that each dining segment effectively "owns" a different part of the day, from the morning coffee ritual and the quick lunch break to the leisurely evening meal and late-night cravings.

An analysis of average visit duration also reveals a small but lasting shift in post-pandemic dining behavior. Between January and May 2025, the average dwell time for nearly every dining segment was shorter than during the same period in 2019. This efficiency trend is evident across limited-service categories like QSR, fast casual, and coffee shops, suggesting a continued emphasis on speed and convenience.

The one notable exception to this trend is upscale and fine dining, where the average visit duration has actually increased compared to pre-COVID levels. This may suggest that, while visits to most segments have become more transactional, consumers are treating fine dining more as an extended, deliberate experience, reinforcing its position as a destination-worthy occasion.