.svg)

.png)

.png)

.png)

.png)

.avif)

Last year’s holiday shopping season was an impactful one, with many categories seeing record-breaking sales and visits. And perhaps no category benefits from Q4 peaks quite like department stores, which see major foot traffic spikes on Black Friday and in the run-up to Christmas.

So with Q4 2024 seemingly primed to be another strong season, we took a look at department store visitation patterns this year and during previous holiday seasons to see what might lie ahead for the category in the coming weeks.

The holiday shopping calendar often begins as early as October, as consumers start preparing for Halloween before shifting their focus to Thanksgiving, Black Friday, and Christmas. This time of year tends to be one of the busiest for many retailers, as it encompasses a variety of shopping needs, including gifts and seasonal celebrations.

And one retail category that sees major visit increases every holiday season is department stores. Chains like Nordstrom, Macy’s, and Bloomingdale’s experience substantial spikes in visits throughout Q4 as shoppers flock to their locations to take advantage of sales and find gifts for their loved ones.

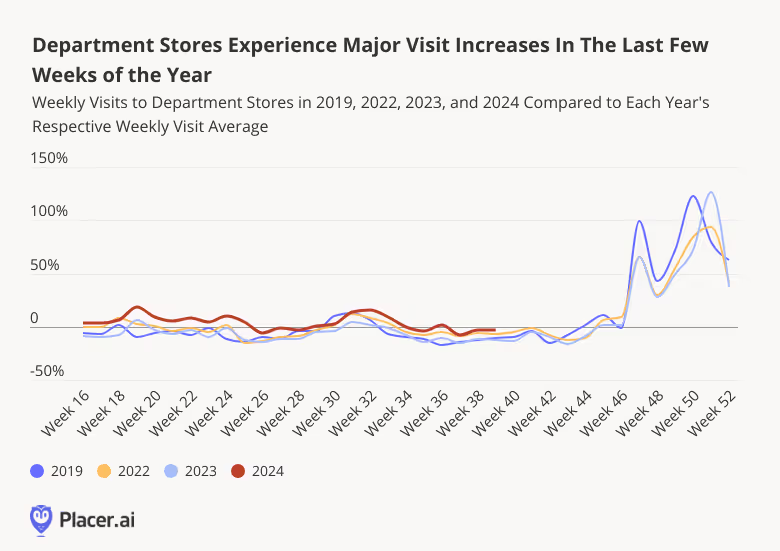

And though consumers’ holiday shopping behavior varies somewhat each year, analyzing weekly fluctuations in visits to department stores reveals some predictable patterns. Every year, visits to department stores see modest increases during major retail events like Valentine’s Day, Mother’s Day, and back-to-school shopping season – before surging during the week of Black Friday (week 47) and then again in the run-up to Christmas. During the week of last year’s Black Friday, for example, department store visits soared 65.2% above the 2023 weekly average – only to go even higher (122.8%) during the week before Christmas (week 51).

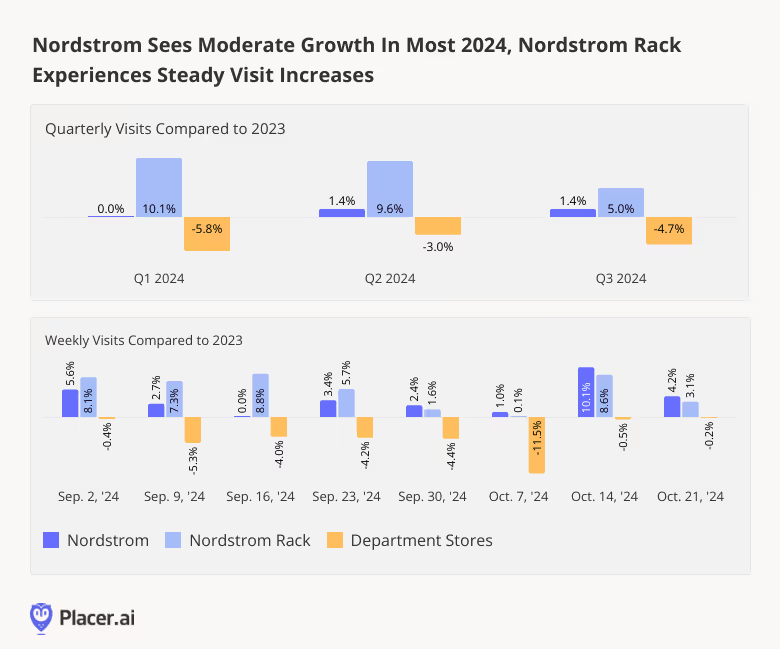

Nordstrom is one department store that seems poised to enjoy a particularly robust holiday shopping season this year. The chain, which operates more than 90 of its namesake stores, also has an off-price banner – Nordstrom Rack – with over 250 locations. And both brands have enjoyed stable visit growth since April 2024 – with quarterly YoY visits to Nordstrom and Nordstrom Rack elevated by 1.4% and 9.6%, respectively, in Q2 2024, and by 1.4% and 5.0%, respectively, in Q3 2024. By contrast, the wider department store category sustained consistent YoY visit gaps.

Drilling down deeper into weekly visit data shows that this positive trend continued into October. And while Nordstrom Rack – which is firmly in expansion mode – outperformed Nordstrom’s traditional stores through September, this trend reversed slightly in October, as the holiday season grew closer. With Black Friday just around the corner, both chains seem well positioned to continue driving visits to their respective stores.

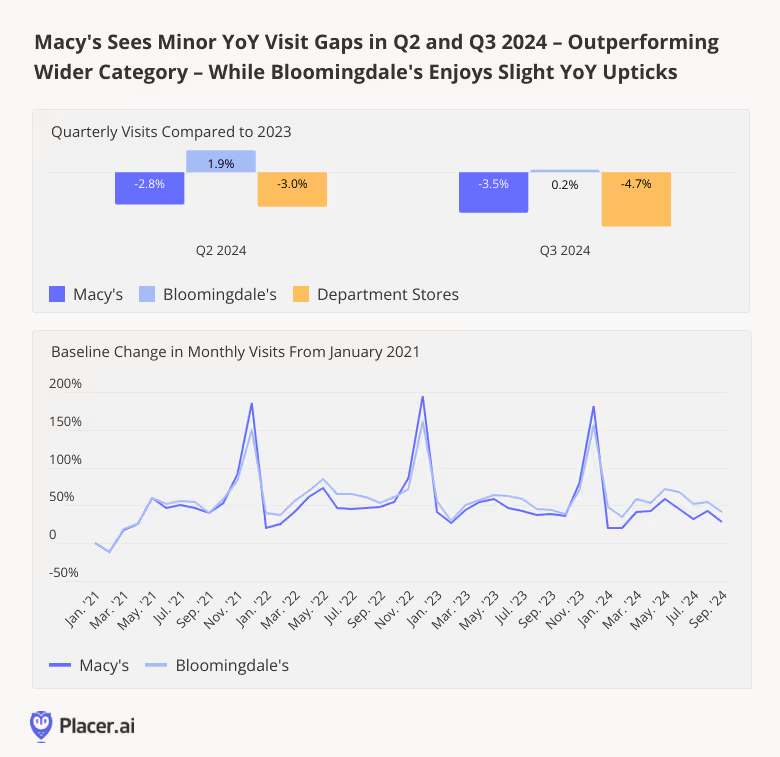

Macy’s Inc., for its part, is doubling down on its “Bold New Chapter” – a turnaround strategy involving a significant trimming of the company’s traditional Macy’s portfolio and the addition of several Bloomingdale’s and small-format stores. In August, Macy’s announced its intention to increase to 55 the number of Macy’s locations slated for closure by the end of 2024. And though the plan’s implementation is still in early stages, foot traffic data suggests that both Macy’s and Bloomingdale’s are holding their own.

In Q2 and Q3 2024, Macy’s sustained minor YoY visit gaps – 2.8% and 3.5%, respectively – slightly outperforming the broader category. Meanwhile, Macy’s high-end Bloomingdale’s brand saw a YoY visit uptick of 1.9% in Q2, while Q3 visits remained flat compared to 2023. And given the huge monthly visit spikes both chains experience each year in November and December, Macy’s and Bloomingdale’s appear well positioned to once again experience a surge in foot traffic as the holiday season begins.

If previous years are any indication, department stores should be getting ready for significant foot traffic increases as the holidays quickly approach. Will improving consumer sentiment and cooling inflation lead to visit increases at department stores, or will consumers decide to take it easy this year?

Visit Placer.ai to keep up with the latest data-driven retail insights.

The holiday season is right around the corner, bringing with it some of the most impactful shopping periods of the year. We took a closer look at visit performance across major wholesale clubs and superstores – Target, Walmart, Sam’s Club, BJ’s Wholesale, and Costco – to see what their 2024 performance and past holiday season visit patterns can tell us about what to expect this Q4.

Warehouse clubs have been thriving in 2024, buoyed by price-conscious consumers eager to load up on inexpensive essentials. In Q3, quarterly visits to retail giants Sam’s Club and BJ’s Wholesale rose 5.2% and 5.9%, respectively. And Costco, holding its place ahead of the pack, saw a foot traffic increase of 7.2%. For all three chains, the robust visit growth continued into October, with visits up 3.6% to 5.9% YoY.

Meanwhile, Target and Walmart saw respective quarterly YoY foot traffic upticks of 1.0% and 0.9% in Q3 2024. In August – the height of the back-to-school shopping season – visits to both chains increased just over 3.0% YoY. And though foot traffic to the superstore behemoths slowed in September as the summer rush abated, Target saw its visit gap narrow once again in October, while Walmart experienced a slight 0.2% increase.

Warehouse retailers have been the clear foot traffic winners this year – but digging deeper into historical data suggests that it is Target that is primed to experience the busiest holiday season of the analyzed chains.

During the week of November 20th, 2023 – the week of Turkey Wednesday and Black Friday – visits to Target soared 18.9% compared to the chain’s 2023 weekly visit average, marking the biggest pre-Thanksgiving visit spike of any of the analyzed chains.

But Target’s real visit surge came during the week of December 18th – the week before Christmas, including the all-important Super Saturday – when visits to Target surged 87.3% above the chain’s 2023 weekly visit average. This was more than double the relative increase experienced by Walmart (39.6%), Sam’s Club (32.8%), BJ’s Wholesale (32.3%), or Costco (34.1%). And with recent visits to Target on par with – or slightly above – last year’s levels, the retail giant is likely poised to win the holidays once again.

Overall, Super Saturday was a bigger milestone for Target last year than Black Friday. (On the former, visits surged 166.1% compared to a 2023 daily average, while on the latter they rose 135.3%.) But digging deeper into the data reveals significant regional differences in Target’s performance on the two major shopping days.

In some parts of the country – including several midwestern, south central, and nearby states where Black Friday has special resonance – the day after Thanksgiving drew bigger visit spikes than Super Saturday. Some markets in particular saw outsized Black Friday visit surges, including West Virginia (348.6%), Kentucky (232.3%), and Indiana (227.4%). Other markets, such as California (74.6%) and Colorado (89.5%), experienced more moderate – though still substantial – Black Friday jumps.

In contrast, visits to Target on Super Saturday were more evenly distributed across the country, with several western and sunbelt states recording substantial visit increases – including New Mexico, which saw a 200.6% jump in visits to Target on December 23, 2023 compared to the 2023 daily visit average.

With solid Q3s under their belts, Target, Walmart, Costco, Sam’s Club, and BJ’s Wholesale Club are all well-positioned to enjoy a robust holiday season this year. Will the retail giants deliver?

Follow Placer.ai’s data-driven retail analyses to find out.

A cool housing market, still-high interest rates, and other economic headwinds have weighed on the home improvement industry this year. But how did category leaders The Home Depot and Lowe’s fare in Q3 2024 – and what lies ahead for them this holiday season?

We dove into the data to find out.

Looking first at the relative positioning of Home Depot and Lowe’s within the wider home improvement sector shows that the two leaders have maintained their dominance, despite the growing popularity of smaller chains like Harbor Freight Tools and Tractor Supply Co.

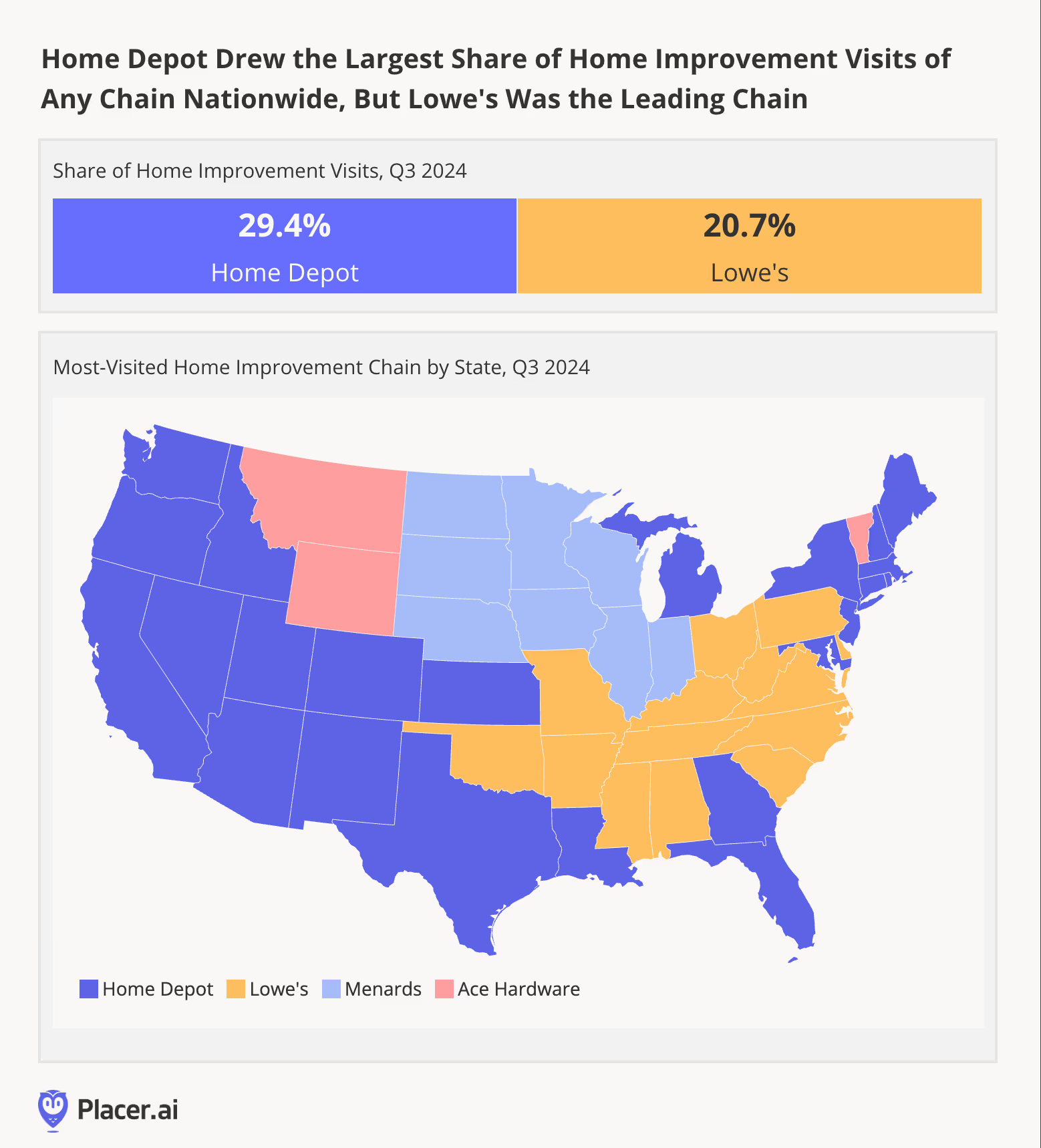

In Q3 2024, Home Depot accounted for 29.4% of visits to home improvement and furnishing chains nationwide – while Lowe’s accounted for 20.7%. And diving into the data on a statewide level shows that each of the giants holds sway in a different area of the country. Home Depot drew the most visits in much of the Western United States as well as in most of New England. Lowe’s, on the other hand, led parts of the South and Midwest. And in some states, smaller chains like Menards and Ace Hardware dominated the landscape.

Given the challenges faced by the home improvement industry this year, it may come as no surprise that both Home Depot and Lowe’s sustained year-over-year (YoY) visit gaps in Q3 2024 – 3.1% and 4.1%, respectively. But digging deeper into the data suggests that the two chains may still be poised to enjoy a robust holiday season.

Unlike many other categories, visits to home improvement chains tend to peak in spring rather than during the holiday season. Still, Home Depot and Lowe’s do see visit spikes on Q4 retail milestones like Black Friday and Super Saturday. Last year, for example, Home Depot and Lowe’s drew 77.8% and 78.6% more visits, respectively, on Black Friday (Nov. 24th) than on an average day in 2023. Indeed, the big day was Home Depot’s busiest day of 2023 and Lowe’s second-busiest.

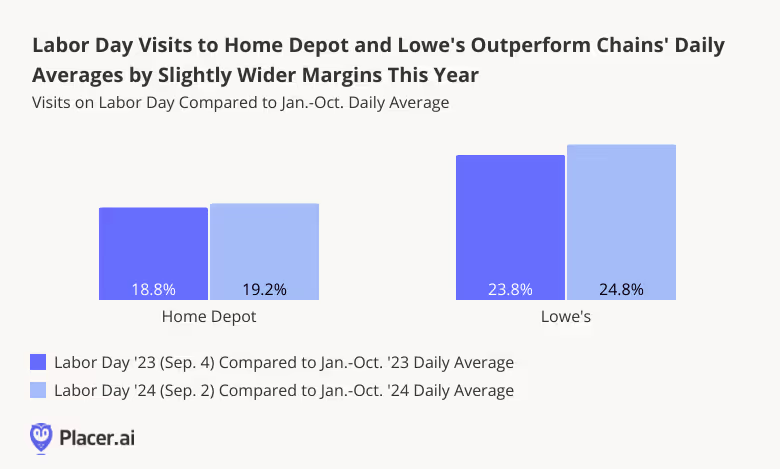

And a look at Home Depot and Lowe’s visit performance during Labor Day – another, more recent retail milestone – shows that the two chains continue to excel at attracting visits on key calendar days. On September 4th, 2023 (Labor Day last year), visits to Lowe’s were 23.8% higher than the January to October 2023 daily visit average. And this year, Lowe’s relative Labor Day spike was even more significant – 24.8%. Home Depot, too, saw a slightly more pronounced Labor Day boost this year than last. So even if overall foot traffic to the home improvement leaders remained somewhat below last year’s levels, they may be in for a busy Q4.

The home improvement industry has yet to regain its pandemic-era glory. But analyzing visit trends to category leaders shows that holiday visit spikes may help fuel a successful holiday season this year. How will Lowe’s and Home Depot perform on Black Friday?

Follow Placer.ai’s data-driven retail analyses to find out.

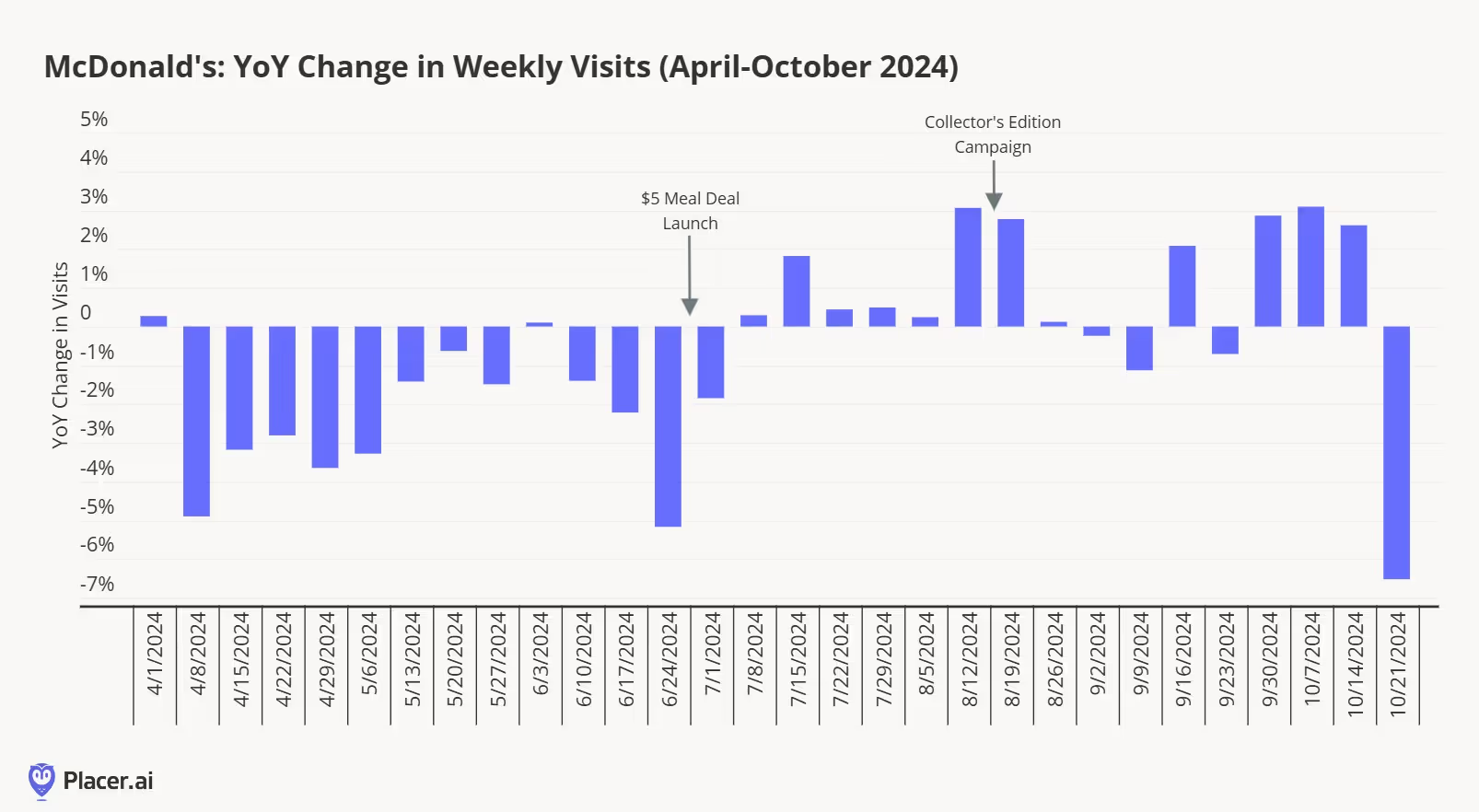

It’s been an eventful week for the QSR Burger category, with much of the focus on this week’s quarterly updates focusing on events that took place after Q3 2024 ended. Let’s start with McDonald’s, where an E.Coli outbreak overshadowed what was largely a positive quarter of visitation gains, where the chain had reversed the visitation declines that it saw during the driven year-over-year visitation increases through its $5 Meal Deal and Collector’s Edition promotion (below).

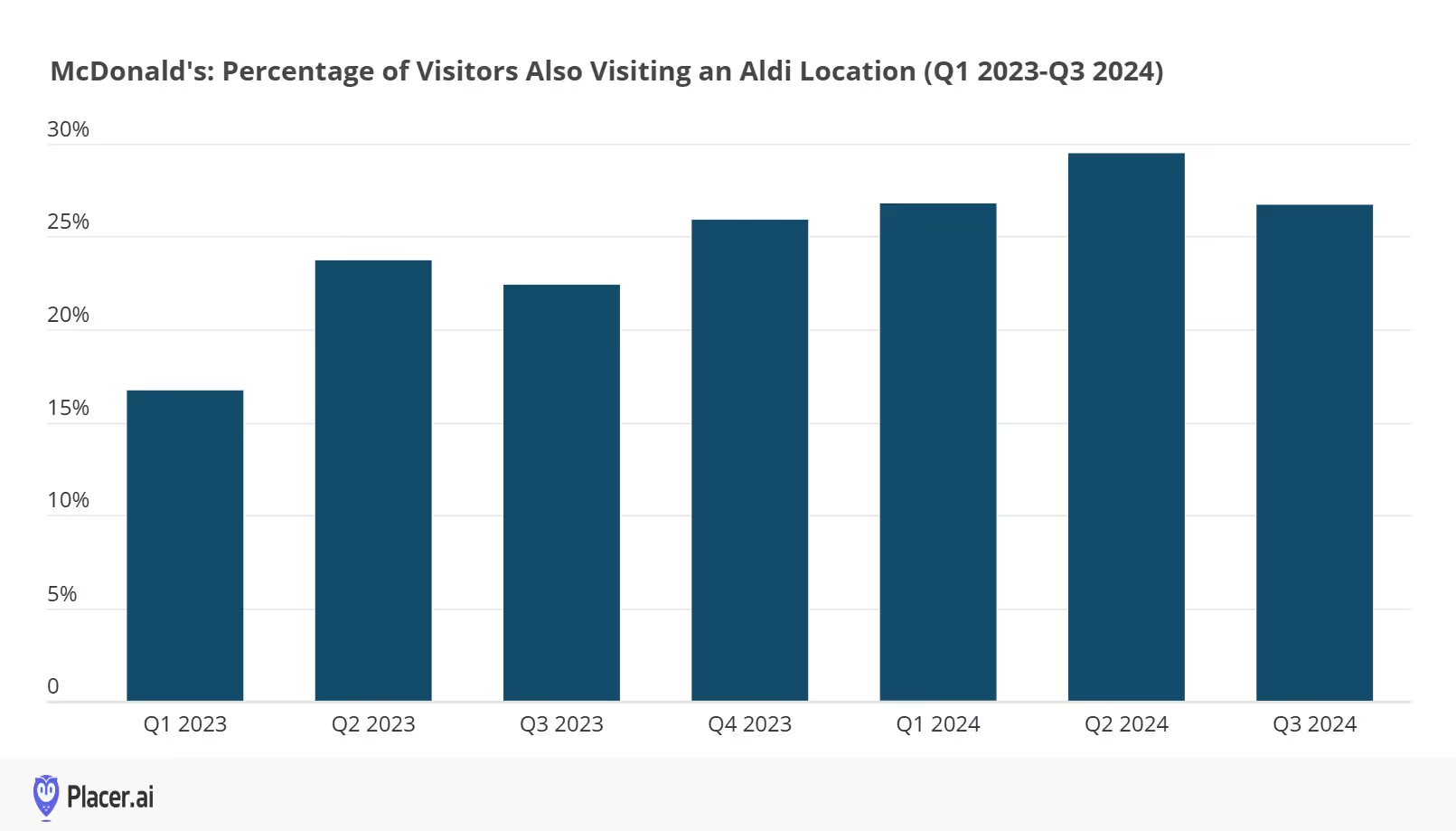

According to the company, the $5 Meal Deal “continued drawing customers back into our restaurants throughout the quarter, maintaining an average check north of $10 and being profitable for our franchisees.” Importantly, McDonald’s management also called out that the $5 Meal Deal is gaining traction among low-income consumers and that it “successfully [grew] traffic share with this group for the first time in over a year.” Our data indicates this as well. Over the past several months, we’ve looked at McDonald’s cross visitation trends with Aldi as a barometer of its traction with lower-income consumers. The percentage of McDonald’s visitors that also visited an Aldi had been steadily increasing through Q2 2024, but we did see a reversal of this trend in Q3 2024, suggesting that more consumers are finding value at the chain. The company remains committed to having the $5 Meal Deal on its menus until December as it works towards “sustainable guest count-led growth.”

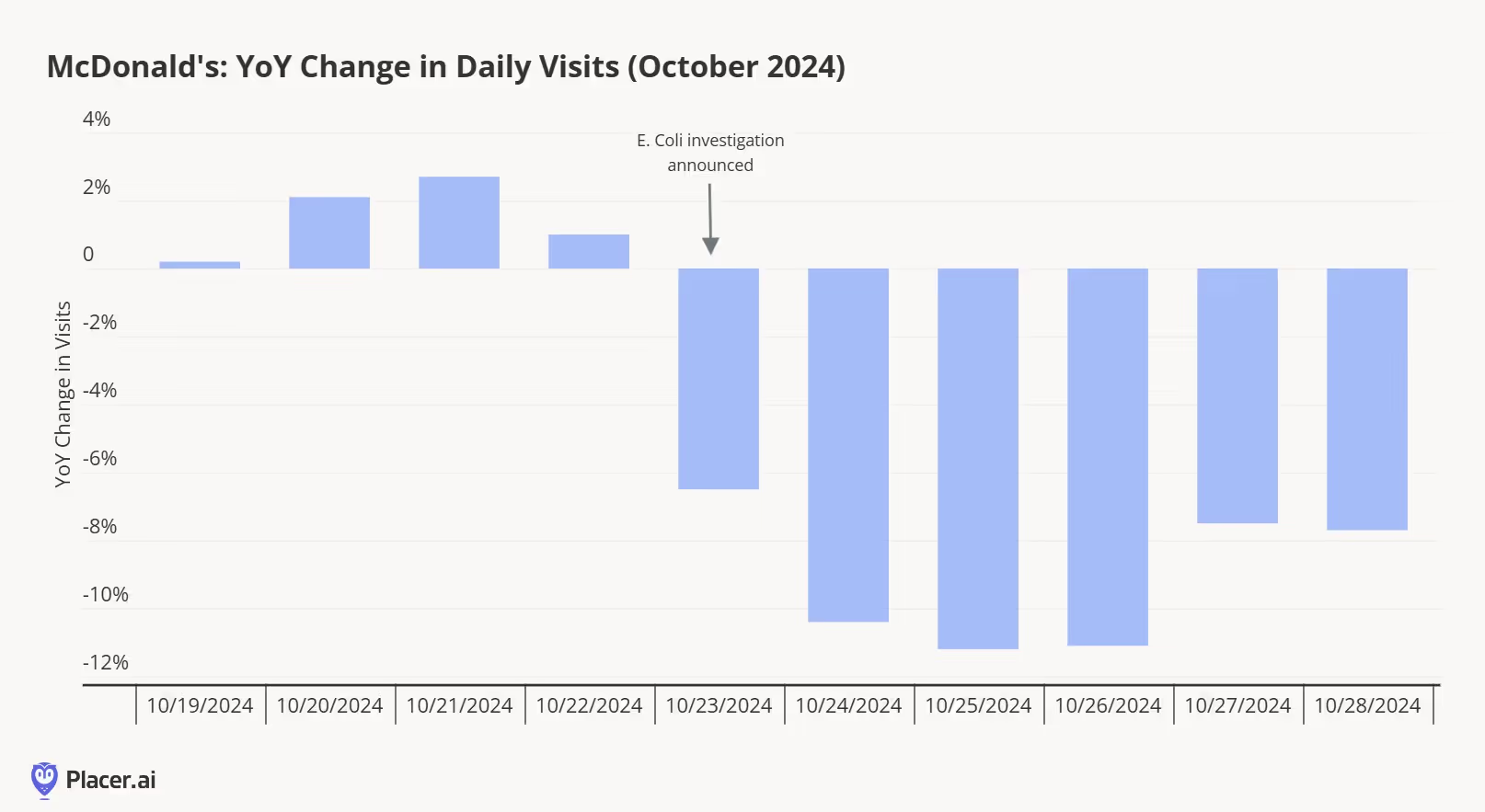

McDonald’s E. Coli outbreak did have a negative impact on visitation trends, but these trends may be short-lived. Our data indicated a 6.5% decline in year-over-year visits nationwide on Wednesday, Oct. 25 (the day after the E. Coli outbreak investigation was announced), 10%-11% declines from Oct. 26-Oct. 28, and 7%-8% declines from Oct 29-30. It’s natural to compare this situation to Chipotle’s E. Coli outbreak in 2015, where visitation trends were severely impacted for many months. However, there are meaningful differences between McDonald’s and Chipotle’s cases. First, McDonald’s was quickly able to identify and communicate the source of the outbreak–slivered onions from a Colorado Springs facility at supplier Taylor Farms, which were immediately removed from the company’s supply chain–while also ruling out its beef patties as a source, which has helped to keep the outbreak relatively contained. Second, in addition to an E. Coli outbreak, Chipotle also faced a norovirus outbreak, calling into question the safety of the chain’s entire supply chain. These differences help to explain why we may already be seeing visitation declines inflect at McDonald’s.

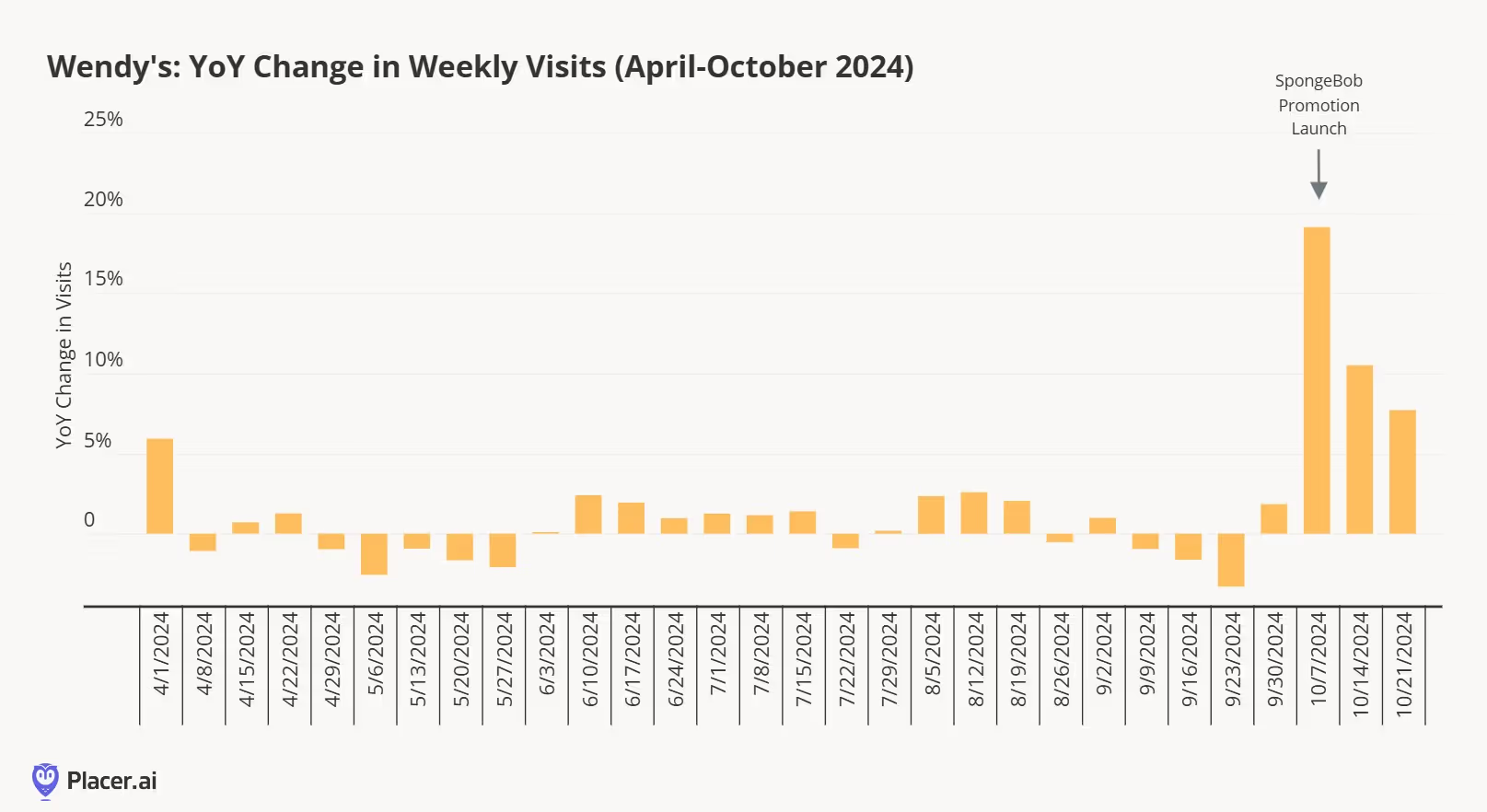

McDonald’s Collector’s Edition was not the only nostalgia-driven promotion driving visits in recent weeks, as Wendy’s Krabby Patty Burger and Pineapple Under the Sea Frosty celebrating SpongeBob's 25th anniversary drove a meaningful lift in visits (below). In fact, this might be the most successful limited-time-offer promotion that we’ve seen across the QSR sector since McDonald’s Adult Happy Meal in October 2022. Importantly, this promotion innovated on existing core menu items without adding complexity. Given the strong visitation lift, we expect more nostalgia-themed promotions in the year ahead.

Affecting everything from merchandise sales to local bars to entire neighborhoods, the economic effect of the Los Angeles Dodgers’ road to the World Series cannot be disputed.

After a comeback from 5-0 to win 7-6 against the New York Yankees, the Dodgers kept everyone on the edge of their seats. With history made by Freddie Freeman’s walk-off grand slam to win Game 1, fans will have moments seared in their memories for decades to come. Dodgers fans are willing to shell out big to celebrate their champions. Fanatics reported that after winning Wednesday night, “the Dodgers set a Fanatics sales record for first-hour sales of a team's merchandise, across any sport, after claiming a championship.” The top five players for merchandise sales were Ohtani, Freeman, Betts, Yamamoto, and Kershaw.

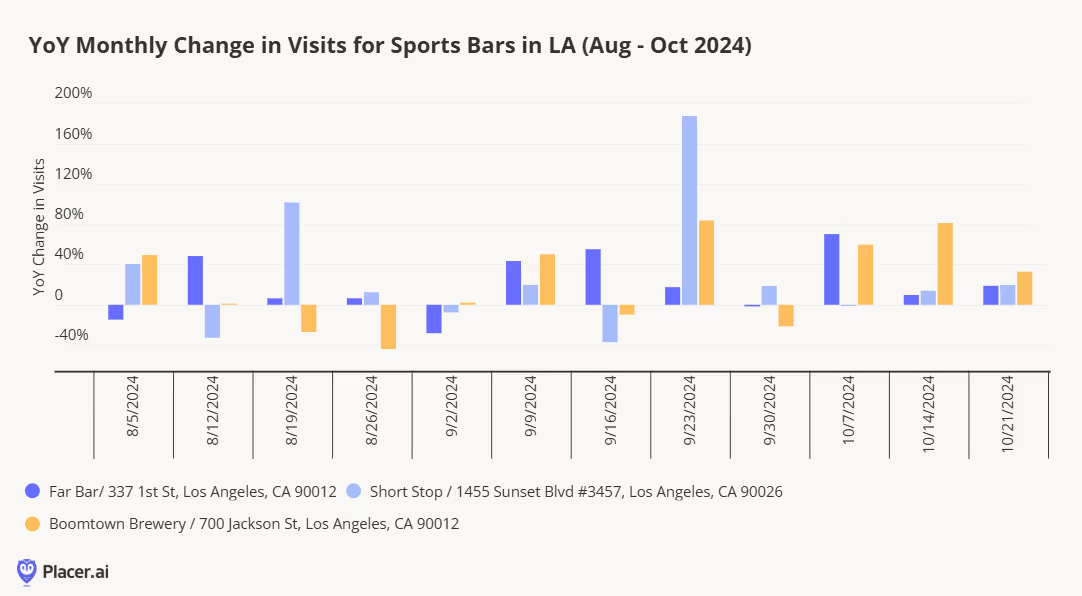

Local bars in various parts of L.A. that featured Dodgers games saw an uptick in year-over-year traffic most weeks, particularly in recent weeks leading up to the National League Championship and the World Series. Spontaneous parades erupted in locations such as Whittier Blvd in East L.A., in Downtown L.A., and near Dodger Stadium in Elysian Park.

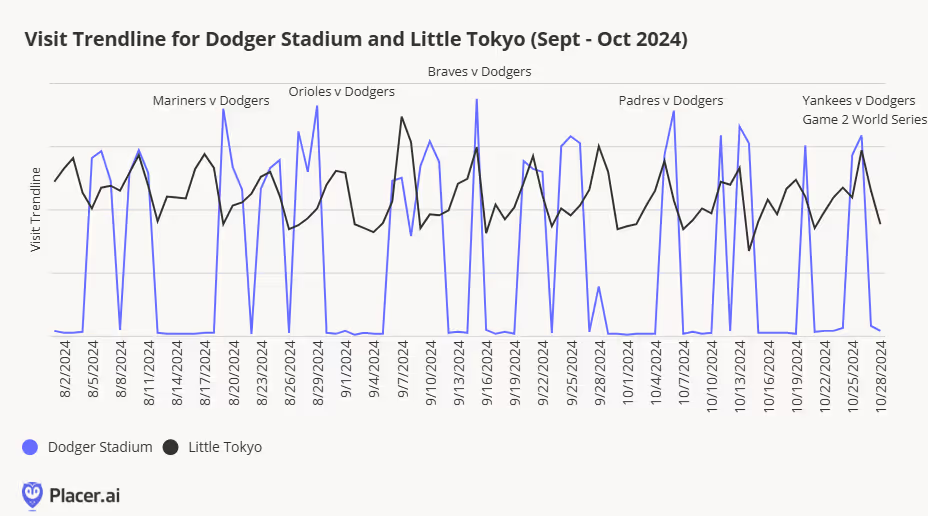

We’ve previously written about the Shohei Effect on hotels like the Miyako that features the mural “LA Rising” by Robert Vargas, but now after a World Series championship, the Boys in Blue are set to go even higher into the stratosphere of fandom. We looked at the foot traffic to Dodger Stadium and to Little Tokyo, and no surprise there’s definitely an uptick to the latter on game days, especially on Saturdays. Vargas is currently working on a mural of the late Fernando Valenzuela in Boyle Heights, and Angelenos will likely be flocking in droves to come see “Fernandomania Forever” when it is unveiled.

One interesting finding is that visitation was actually higher during some of the regular season games than for the World Series Games 1 and 2 that took place in LA. One reason may be the sky high prices. Per reseller Ticket IQ, “the average price for a World Series ticket on the secondary market was $3,887, the second most expensive average since it started tracking data in 2010.” For some fans, it was a dream of a lifetime, one that some were willing to “sell a kidney” to attend.

As we enter November, the holiday season is already in full swing across the country. We’re likely to see the consumer’s embrace of seasonal decorations soon, just as we saw in the fall season. The retail industry has already lived through one major promotional event in October, and it’s time to take the temperature on physical retail foot traffic as we head into the busiest part of the season.

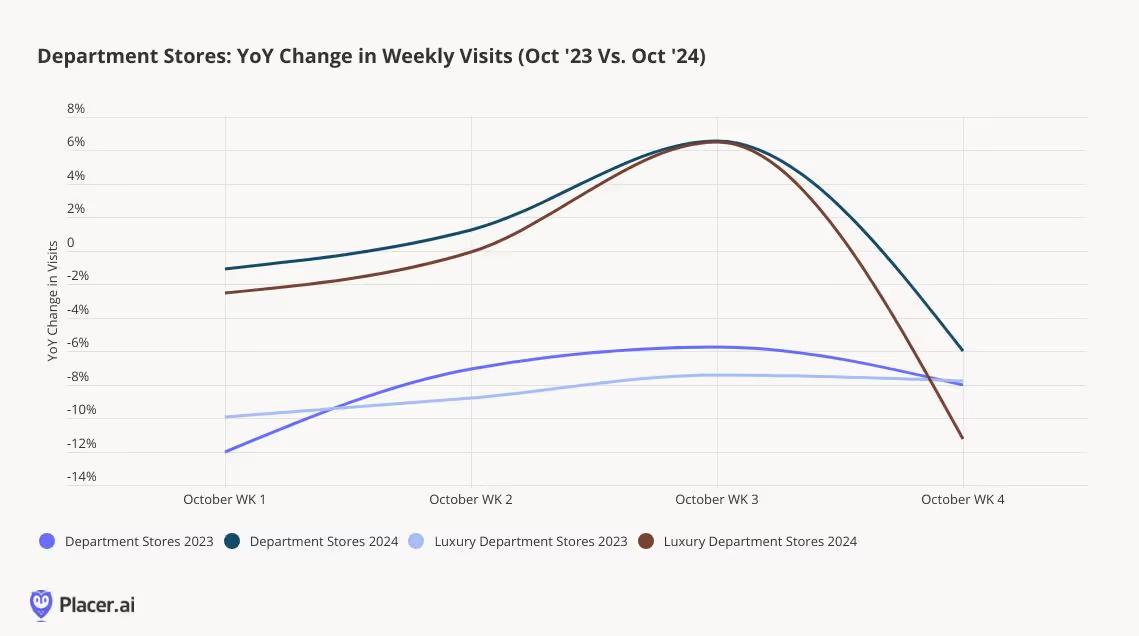

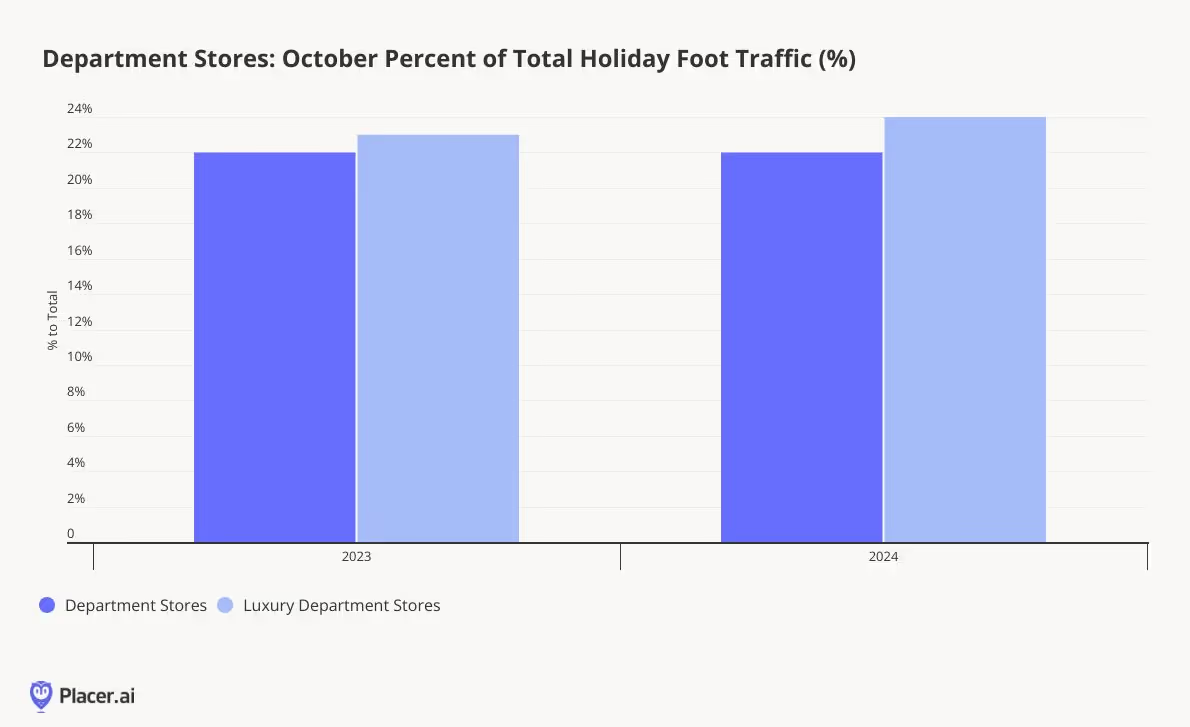

One thing that jumped out upon initial review was the foot traffic from department stores, excluding off-price retail. Looking at the four full weeks of October 2024, traffic to full line department stores was flat to last year, compared to the same period last year when traffic was down 8% to 2022 in October (store counts are about even to last year). Visits to luxury department stores show a similar story; traffic in 2023 was down 9% in October and trended down 2% this year. Coming from a sector of retail that has been challenged for years, this slight improvement is worthy of celebration.

Just how important is October’s contribution to holiday shopping visits? For full line department stores, October accounted for 22% of total holiday season visits in both 2022 and 2023; October traffic for luxury department stores was 24% of total holiday traffic in 2022 and 23% in 2023. That means that there’s still almost ¾ of total visitation still left for retailers to capture over the next two months. However, with traffic trending better in 2024 than in 2023 for department stores overall, this year might actually be a proof point for pull forward holiday demand.

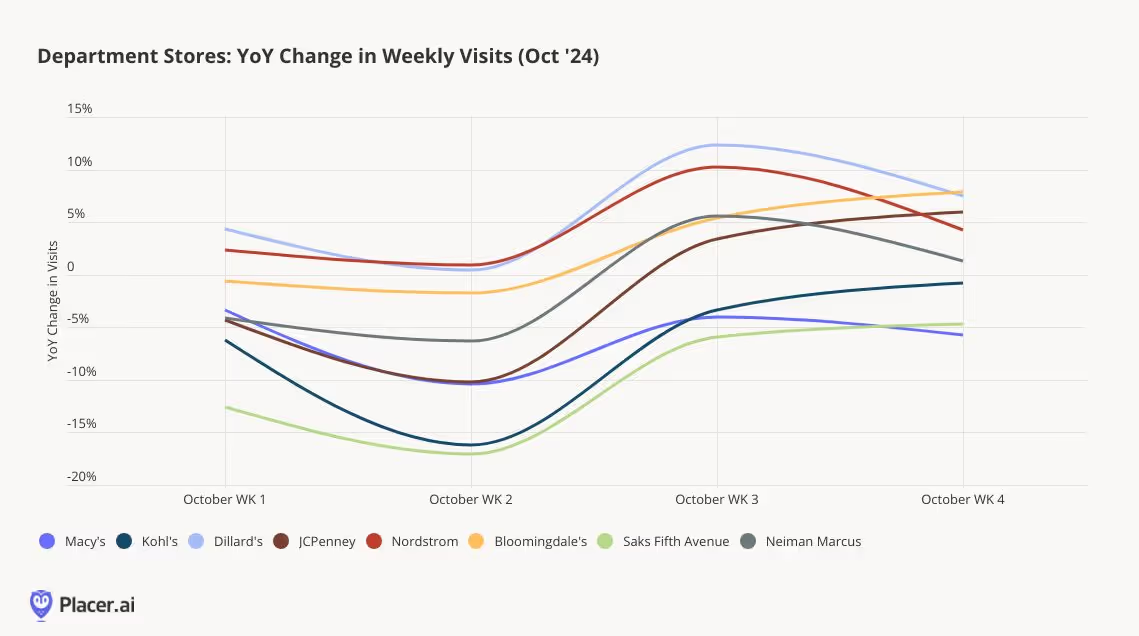

Looking at visitation by retailers within the two sectors, Dillard’s, unsurprisingly led the charge for full line department stores in visitation growth. JCPenney also saw a lot of trend improvement compared to last year, as did Macy’s in the back half of the month. The only major retailer that has underperformed 2023 in October was Kohl’s. Through the lens of luxury department stores, Bloomingdale’s and Nordstrom grew traffic in the low to mid-single digits in October, with Neiman Marcus only down slightly to 2023 levels.

Another interesting insight Placer’s data uncovered; department stores are more of a destination for consumers this year. Looking at Macy’s cross-visitation specifically in October, the percent of visitors to Macy’s that traveled home after visiting was almost 50 basis points higher than in 2023. Our data also showed a lower percentage of cross visitation between Macy’s and other department stores this year compared to last October. Department stores may be doing a better job of capturing consumers' attention and better aligning themselves with the needs of their shoppers. This is in contrast of what we're seeing in essential retail categories such as grocery stores and superstores, where consumers are willing to cross shop multiple retailers; this underscores just how different consumer behavior is by category.

What does this signal about the remainder of the “true” holiday season? It’s hard to tell as we stand today, but the trend improvement across department stores this year gives us some optimism about consumers flocking to physical stores this year. But, it’s important to give consumers a reason to visit as many times as possible, especially as retail fatigue sets in from shopping earlier in the season. Value is still going to be the top driver of visitation this year, but unique products, services and experiences are still important to capturing the joy of the season.

This report includes data from Placer.ai Data Version 2.0, which implements improvements to our extrapolation capabilities, adds short visit monitoring, and enhances visit detection.

Grabbing a coffee or snack at a convenience store is a time-honored road trip tradition – but increasingly, Convenience Stores (C-Stores) have also emerged as places people go out of their way to visit.

Convenience stores have thrived in recent years, making inroads into the discretionary dining space and growing both their audiences and their sales. Between April 2023 and March 2024, C-Stores experienced consistent year-over-year (YoY) visit growth, generally outperforming Overall Retail. Unsurprisingly, C-Stores fell behind Overall Retail in November and December 2023, when holiday shoppers flocked to malls and superstores to buy gifts for loved ones. But in January 2024, the segment regained its lead, growing YoY visits even as Overall Retail languished in the face of an Arctic blast that had many consumers hunkering down at home.

C-Stores’ current strength is partially due to the significant innovation by leading players in the space: Chains like Casey’s, Maverik, Buc-ee’s, and Rutter’s are investing in both in their product offerings and in their physical venues to transform the humble C-Store from a stop along the way into a bona fide destination. Dive into the data to explore some of the key strategies helping C-Stores drive consumer engagement and stay ahead of the pack.

While chain expansion may explain some of the C-Store segment growth, a look at visit-per-location trends shows that demand is growing at the store level as well. Over the past year (April 2023 to March 2024), average visits per location on an industry-wide basis grew by 1.8%, compared to the year prior (April 2022 to 2023).

And within this growing segment, some brands are distinguishing themselves and outperforming category averages. Casey’s, for example, saw the average number of visits to each of its locations increase by 2.3% over the same time frame – while Maverik, Buc-ee’s and Rutter’s saw visits per location increase by 3.2%, 3.4% and 3.9%, respectively.

Each in its own way, Casey’s, Maverik, Buc-ee’s, and Rutter’s, are helping to transform C-Stores from pit stops where people can stretch their legs and grab a cup of coffee to destinations in and of themselves.

Midwestern gas and c-store chain Casey’s – famous for its breakfast pizza and other grab-and-go breakfast items – has emerged as a prime spot for fast food pizza lovers to grab a slice first thing in the morning. And Salt Lake City, Utah-based Maverik – which recently acquired Kum & Go and its 400-plus stores – is also establishing itself as a breakfast destination thanks to its specialty burritos and other chef-inspired creations.

Casey’s and Maverik’s popular breakfast options are likely helping the chains receive its larger-than-average share of morning visits: In Q1 2024, 16.3% of visits to Maverik and 17.5% of visits to Casey’s took place during the 7:00 AM - 10:00 AM daypart, compared to just 14.9% of visits to the wider C-Store category.

Psychographic data from the Spatial.ai’s FollowGraph dataset – which looks at the social media activity of a given audience – also suggests that Casey’s and Maverik’s have opened stores in locations that allow them to reach their target audience. Compared to the average consumer, residents of Casey’s potential market are 7% more likely to be “Fast Food Pizza Lovers” than both the average consumer and the average C-Store trade area resident. Residents of Maverik’s potential market are 16% more likely than the average consumer to be “Mexican Food Enthusiasts,” compared to residents of the average C-Store’s trade area who are only 1% more likely to fall into that category.

With both chains expanding, Casey’s and Maverik can hope to introduce new audiences to their unique breakfast options and solidify their hold over the morning daypart within the C-Store space over the next few years.

Everything is said to be bigger in the Lone Star State, and Texas-based convenience store chain Buc-ee’s – holder of the record for the worlds’ largest C-Store – is no exception. With a unique array of specialty food items and award-winning bathrooms, Buc-ee’s has emerged as a well-known tourist attraction. And the popular chain’s status as a visitor hotspot is reflected in two key metrics.

First, Buc-ee’s attracts a much greater share of weekend visits than other convenience store chains. In Q1 2024, 39.6% of visits to Buc-ee’s took place on the weekends, compared to just 28.3% for the wider C-Store industry. And second, Buc-ee’s captured markets feature higher-than-average shares of family-centric households – including those belonging to Experian: Mosaic’s Suburban Style, Flourishing Families, and Promising Families segments.

Rather than merely a place to stop on the way to work, Buc-ee’s has emerged as a favored destination for families and for people looking for something fun to do on their days off.

Buc-ee’s isn’t the only C-Store chain that believes bigger is better. Pennsylvania-based Rutter’s is increasing visits and customer dwell time by expanding its footprint – both in terms of store count and venue size. New stores will be 10,000 to 12,000 square feet – significantly larger than the industry average of around 3,100 square feet. And in more urban areas, where space is at a premium, the company is building upwards.

Rutter’s added a second floor to one of its existing locations in York, PA in December 2023. The remodel, which was met with enthusiasm by customers, provided additional seating for up to 30 diners, a beer cave, and an expanded wine selection. And in Q1 2024, the location experienced 15.6% YoY visit growth – compared to a chainwide average of 7.6%. Visitors to the newly remodeled Rutter’s also stayed significantly longer than they did pre-renovation. The share of extended visits to the store (longer than ten minutes) grew from 20.8% in Q1 2023 to 27.0% in Q1 2024 – likely from people browsing the chain’s selection of beers or grabbing a bite to eat.

Convenience stores are flourishing, transforming into some of the most exciting dining and tourist destinations in the country. Today, C-Store customers can expect to find brisket sandwiches, gourmet coffees, or craft beers, rather than the stale cups of coffee of old. And the data shows that customers are receptive to these innovations, helping drive the segment’s success.

The first quarter of 2024 was generally a good one for retailers. Though unusually cold and stormy weather left its mark on the sector’s January performance, February and March saw steady year-over-year (YoY) weekly visit growth that grew more robust as the quarter wore on.

March ended on a high note, with the week of March 25th – including Easter Sunday – seeing a 6.1% YoY visit boost, driven in part by increased retail activity in the run-up to the holiday. (Last year, Easter fell on April 9th, 2023, so the week of March 25th is being compared to a regular week.)

Though prices remain high and consumer confidence has yet to fully regain its footing, retail’s healthy Q1 showing may be a sign of good things to come in 2024.

Drilling down into the data for leading retail segments demonstrates the continued success of value-priced, essential, and wellness-related categories.

Discount & Dollar Stores led the pack with 11.2% YoY quarterly visit growth, followed by Grocery Stores, Fitness, and Superstores – all of which outperformed Overall Retail. Dining also enjoyed a YoY quarterly visit bump, despite the segment’s largely discretionary nature. And despite the high interest rates continuing to weigh on the housing and home renovation markets, Home Improvement & Furnishings maintained just a minor YoY visit gap.

Discount & Dollar Stores experienced strong YoY visit growth throughout most of Q1 – and as go-to destinations for groceries and other other essential goods, they held their own even during mid-January’s Arctic blast. In the last week of March, shoppers flocked to leading discount chains for everything from chocolate Easter bunnies to basket-making supplies – driving a remarkable 21.5% YoY visit spike.

Dollar General continued to dominate the Discount & Dollar Store space in Q1, with visits to its locations accounting for nearly half of the segment’s quarterly foot traffic (44.7%). Next in line was Dollar Tree, followed by Family Dollar and Five Below. Together, the four chains – all of which experienced positive YoY quarterly visit growth – drew a whopping 91.6% of quarterly visits to the category.

Rain or shine, people have to eat. And like Discount & Dollar Stores, traditional Grocery Stores were relatively busy through January as shoppers braved the storms to stock up on needed items. Momentum continued to build throughout the quarter, culminating in a 10.5% foot traffic increase in the week ending with Easter Sunday.

Like in other categories, it was budget-friendly Grocery banners that took the lead. No-frills Aldi drove a chain-wide 24.4% foot traffic increase in Q1, by expanding its fleet – while also growing the average number of visits per location. Other value-oriented chains, including Trader Joe’s and Food Lion, experienced significant foot traffic increases of their own. And though conventional grocery leaders like H-E-B, Kroger, and Albertsons saw smaller visit bumps, they too outperformed Q1 2023 by meaningful margins.

January is New Year’s resolution season – when people famously pick themselves up off the couch, dust off their trainers, and vow to go to the gym more often. And with wellness still top of mind for many consumers, the Fitness category enjoyed robust YoY visit growth throughout most of Q1 – despite lapping a strong Q1 2023.

Predictably, Fitness’s visit growth slowed during the last week of March, when many Americans likely indulged in Easter treats rather than work out. But given the category’s strength over the past several years, there is every reason to believe it will continue to flourish.

For Fitness chains, too, cost was key to success in Q1 – with value gyms experiencing the biggest visit jumps. EōS Fitness and Crunch Fitness, both of which offer low-cost membership options, saw their Q1 visits skyrocket 28.9% and 22.0% YoY, respectively – helped in part by aggressive expansions. At the same time, premium and mid-range gyms like Life Time and LA Fitness are also finding success – showing that when it comes to Fitness, there’s plenty of room for a variety of models to thrive.

Superstores – including wholesale clubs – are prime destinations for big, planned shopping expeditions – during which customers can load up on a month’s supply of food items or stock up on home goods. And perhaps for this reason, the category felt the impact of January’s inclement weather more than either dollar chains or supermarkets – which are more likely to see shoppers pop in as needed for daily essentials.

But like Grocery Stores and Discount & Dollar Stores, Superstores ended the quarter with an impressive YoY visit spike, likely fueled by Easter holiday shoppers.

As in Q4 2023, membership warehouse chains – Costco Wholesale, BJ’s Wholesale Club, and Sam’s Club – drove much of the Superstore category’s positive visit growth, as shoppers likely engaged in mission-driven shopping in an effort to stretch their budgets. Still, segment mainstays Walmart and Target also enjoyed positive foot traffic growth, with YoY visits up 3.9% and 3.5%, respectively.

Moving into more discretionary territory, Dining experienced a marked January slump, as hunkered-down consumers likely opted for delivery. But the segment rallied in February and March, even though foot traffic dipped slightly during the last week of March, when many families gathered to enjoy home-cooked holiday meals.

Coffee Chains and Fast-Casual Restaurants saw the largest YoY visit increases, followed by QSR – highlighting the enduring power of lower-cost, quick-serve dining options. But Full-Service Restaurants (FSR) also saw a slight segment-wide YoY visit uptick in Q1 – good news for a sector that has yet to bounce back from the one-two punch of COVID and inflation. Within each Dining category, however, some chains experienced outsize visit growth – including favorites like Dutch Bros. Coffee, Slim Chickens, In-N-Out Burger, and Texas Roadhouse.

Since the shelter-in-place days of COVID – when everybody had their sourdough starter and DIY was all the rage – Home Improvement & Furnishings chains have faced a tough environment. Many deferred or abandoned home improvement projects in the wake of inflation, and elevated interest rates coupled with a sluggish housing market put a further damper on the category.

Against this backdrop, Home Improvement & Furnishings’ relatively lackluster Q1 visit performance should come as no surprise. But the narrowing of the visit gap in March – which also saw one week of positive visit growth – may serve as a promising sign for the segment. (The abrupt foot traffic drop during the week of March 25th, 2024 is likely a just reflection of Easter holiday shopping pattern.)

Within the Home Improvement & Furnishings space, some bright spots stood out in Q1 – including Harbor Freight Tools, which saw visits increase by 10.0%, partly due to the brand’s growing store count. Tractor Supply Co., Menards, and Ace Hardware also registered visit increases.

January 2024’s stormy weather left its mark on the Q1 retail environment, especially for discretionary categories. But as the quarter progressed, retailers rallied, with healthy YoY foot traffic growth that peaked during the last week of March – the week of Easter Sunday. All in all, retail’s positive Q1 performance leaves plenty of room for optimism about what’s in store for the rest of 2024.

This report includes data from Placer.ai Data Version 2.0, which implements improvements to our extrapolation capabilities, adds short visit monitoring, and enhances visit detection.

Over the past year, Fast-Casual & Quick-Service Restaurant (QSR) chains have thrived, consistently outperforming the Full-Service Dining segment with positive year-over-year (YoY) visit growth every quarter since 2023. In this white paper, we dive into the data for leading dining chains to take a closer look at what’s driving visitors to the QSR segment and what other dining categories can learn from fast-food’s success.

One of the key factors separating QSR chains – aptly known as “fast food” – from the rest of the dining industry is the speed at which diners can get a ready-to-eat meal in their hands. And within the QSR space, speed of service is one of the ways chains differentiate themselves from their competition.

Leading fast-food chains are investing heavily in technologies and systems designed to help them serve customers ever more quickly:

Taco Bell’s “Touch Display Kitchen System” is designed to optimize cooking operations and improve wait times, while the chain’s Go Mobile restaurant format seeks to alleviate bottlenecks in the drive-thru lane. Chick-fil-A also has dedicated channels for quick mobile order pick-up and is planning four-lane drive-thrus with second-floor kitchens to get meals out even faster. And to save time at the drive-thru, Wendy’s is experimenting with generative AI and developing an underground, robotic system to deliver digital orders to designated parking spots within seconds.

And location intelligence shows that all three chains are succeeding in reducing customer wait times. Over the past four years, Taco Bell, Chick-fil-A, and Wendy’s have seen steady increases in the share of visits to their venues lasting less than 10 minutes.

The data also suggests that investment in speed of service can increase overall visitation to QSR venues.

In late 2022, McDonald’s opened a to-go-only location outside of Dallas, TX with a lane dedicated to mobile order fulfillment via a conveyor belt. And in Q1 2024, this venue not only had a larger share of short visits compared to the other McDonald’s locations in the region, but also more visits compared to the McDonald’s average visits per venue in the Dallas-Fort Worth CBSA.

This provides further support for the power of fast order fulfillment to drive QSR visits, with customers motivated by the prospect of getting in and out quickly.

The success of the fast-food segment is even driving other restaurants to borrow typical QSR formats – especially during time slots when people are most likely to grab a bite to eat on the go.

In September 2023, full-service leader Applebee’s opened a new format: a fast casual location focusing on To Go orders in Deer Park, NY, featuring pick-up lockers for digital orders and limited dine-in options without table service.

And the new format is already attracting outsized weekday and lunchtime crowds. In Q1 2024, 20.5% of visits to the chain’s To Go venue took place during the 12:00 PM - 2:00 PM time slot, while the average Applebee’s in the New York-Newark-Jersey City CBSA received less than 10% of its daily visits during that daypart. The new restaurant also drew a significantly higher share of weekday visits than other nearby venues.

This suggests that takeaway-focused venues could help full-service chains grow their visit share during weekdays and the coveted lunch rush, when consumers may be less inclined to have a sit-down meal.

An additional factor contributing to QSR and Fast Casual success in 2024 may be the rise of chicken-based chains. Chicken is a versatile ingredient that has remained relatively affordable, which could be contributing to its growing popularity and the rapid expansion of several chicken chains.

Comparing the relative visit share (not including delivery) of various sub-segments within the wider Fast Casual & QSR space showed that the share of visits to chains with chicken-based menus has increased steadily between 2019 and 2023: In Q1 2024, 15.3% of Fast Casual & QSR visits were to a chicken restaurant concept, compared to just 13.4% in Q1 2019.

The strength of chicken-based concepts is also evident when comparing average visits per venue at leading chicken chains with the wider Fast Casual & QSR average.

Both Chick-fil-A, the nation’s predominant chicken chain, and Raising Cane’s, a rapidly expanding player in the fast-food chicken space, are receiving significantly more visits per venue than their Fast Casual & QSR peers: In Q1 2024, Raising Cane’s and Chick-fil-A restaurants saw an average of 153.0% and 237.7% more visits per venue, respectively, compared to the combined Fast Casual & QSR industries average.

The elevated traffic at chicken chains likely plays a part in their profitability per restaurant relative to other Fast Casual & QSR concepts with more sizable fleets.

QSR and Fast-Casual chains are also particularly adept at generating seasonal visit spikes through unique Limited Time Offers and holiday promotions adapted to the calendar.

Arby’s recently launched a 2 for $6 sandwich promotion on February 1st, with two of the three sandwich options on promotion being fish-based in an apparent attempt to entice diners eschewing meat in observance of Lent. The company also brought back a specialty fish sandwich, likely with the goal of further appealing to the Lent-observing demographic.

The offers seem to have driven significant traffic spikes, with foot traffic during the promotion period significantly higher than the January daily visit average. And traffic was particularly elevated during Lent – which this year fell on Wednesday, February 14th through Thursday, March 28th, with visits spiking on Fridays when those observing are most likely to seek out fish-based meals.

Some of the elevated visits in the second half of Q1 may be attributed to the comparison to a weaker January across the dining segment. But the success of the fish-forward promotion specifically during Lent suggests that the company’s calendar-appropriate LTO played a major role in driving visits to the chain.

Shorter-term promotions – even those lasting just a single day – can also drive major visit spikes.

Since 1991, White Castle has transformed its fast-food restaurants into a reservation-only, “fine-dining” experience for dinner on Valentine's Day. In 2024, Valentine’s Day fell on a Wednesday, and White Castle’s sit-down event drove a 11.8% visit increase relative to the average Wednesday in Q1 2024 and a 3.9% visit increase compared to the overall Q1 2024 daily average.

The elevated visit numbers over Valentine’s Day are even more impressive when considering that a full-service dining room can accommodate fewer visitors than the drive-thrus and counter service of White Castle’s typical QSR configuration. The spike in February 14th visits may also be attributed to an increased number of diners showing up throughout the day to take in the Valentine’s Day buzz.

QSR and Fast-Casual dining are having a moment. And the data shows that a combination of factors – including fast and efficient service, the rising popularity of chicken-based dining concepts, and effective LTOs – are all playing a part in the categories’ recent success.