.svg)

.png)

.png)

.png)

.png)

About the Mall Index: The Index analyzes data from 100 top-tier indoor malls, 100 open-air shopping centers (not including outlet malls) and 100 outlet malls across the country, in both urban and suburban areas. Placer.ai leverages a panel of tens of millions of devices and utilizes machine learning to make estimations for visits to locations across the country.

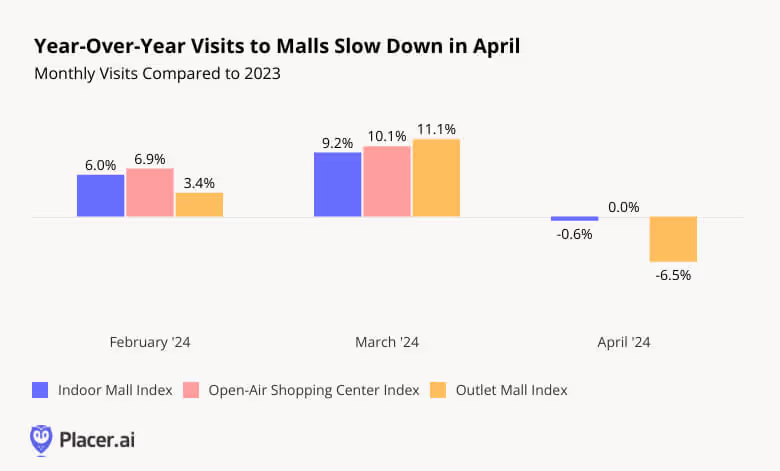

In April 2024, YoY mall visits slowed following two months of positive visit growth. For Indoor Malls, the decline was marginal – and Open-Air Shopping Centers saw visits remain on par with last year’s levels. But Outlet Malls saw a significant drop of 6.5% in visits.

Although at first glance this slowdown may suggest a resurgence of the retail challenges that plagued much of 2022 and 2023, a deeper dive into weekly visit trends paints a much rosier picture.

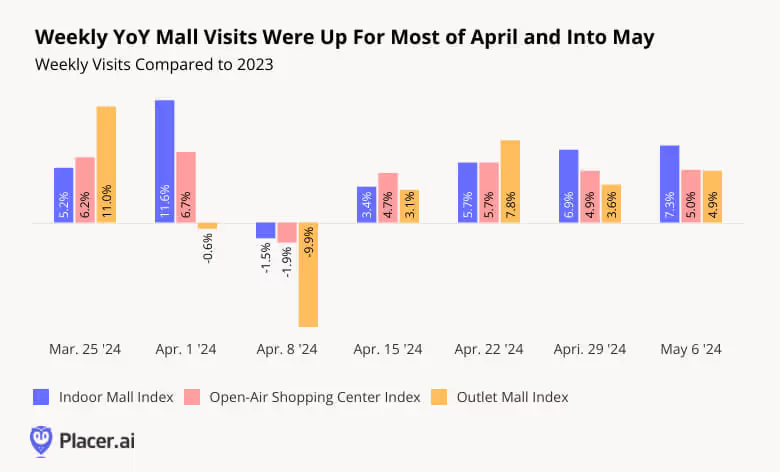

Indoor Malls and Open-Air Shopping Centers experienced robust YoY visit increases every week of April 2024 and into May, with the sole exception of the week of April 8th. This isolated drop appears to be due to a calendar discrepancy: In 2023, Easter fell on April 9th, while in 2024, the holiday fell on March 31st. So the week of April 8th, 2024 is being compared to the week immediately after the holiday (including Easter Monday) when malls likely experienced heightened activity due to gift returns and pent-up demand following holiday store closures. Though Easter Monday isn’t an official holiday in the U.S., many people likely take the day off – giving them more time to hit the stores.

Outlet Malls, which saw a steeper decline during the week of April 8th, appear to have been particularly impacted by the Easter calendar difference – shoppers may be especially likely to make the trek to an outlet mall on a holiday weekend, or on Easter Monday. But Outlet Malls also saw their positive momentum quickly recover.

The continued rise in weekly YoY mall visits signals continued retail strength into the spring of 2024.

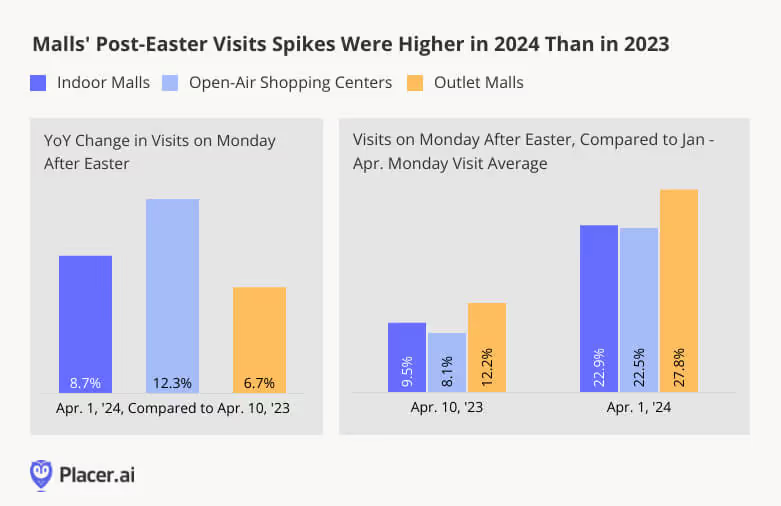

Holiday retail foot traffic is typically characterized by two main spikes: a pre-holiday visit spike evident in the days preceding the holiday, and a post-holiday uptick driven largely by gift returns and pent-up demand after stores reopen. The Monday after Easter follows this pattern – and comparing this year’s post-Easter visit spike to the one observed in 2023 provides further evidence of the category’s resilience.

On Monday, April 1st, 2024 – the day after Easter – Indoor Malls, Open-Air Shopping Centers, and Outlet Malls all drew significantly more visits than on an average Monday. And this year’s post-Easter visit spikes – ranging from 22.5% to 27.8% – were even more impressive than last year’s. Outlet Malls, which may be more likely to draw visitors on the day after Easter, saw the biggest post-Easter visit spikes.

All three mall types also saw more absolute visits this year on the day after Easter than they did in 2023 – with April 1st, 2024 foot traffic to Indoor Malls, Open-Air Shopping Centers, and Outlet Malls up 8.7%, 12.3%, and 6.7%, respectively, compared to April 10th, 2023.

Weekly YoY visit data and post-Easter foot traffic trends show that malls remain on an upward trajectory. As inflation continues to ease, malls may regain some leverage and can potentially attract crowds more readily than they did in 2023.

For more data-driven retail insights, visit our blog at placer.ai.

.avif)

Off-price apparel chains continue to drive traffic in 2024. We dove into the latest location analytics for four of the largest brands – T.J. Maxx, Marshalls, Ross Dress for Less, and Burlington – to take a closer look at these retailers’ foot traffic growth and evolving visitor bases.

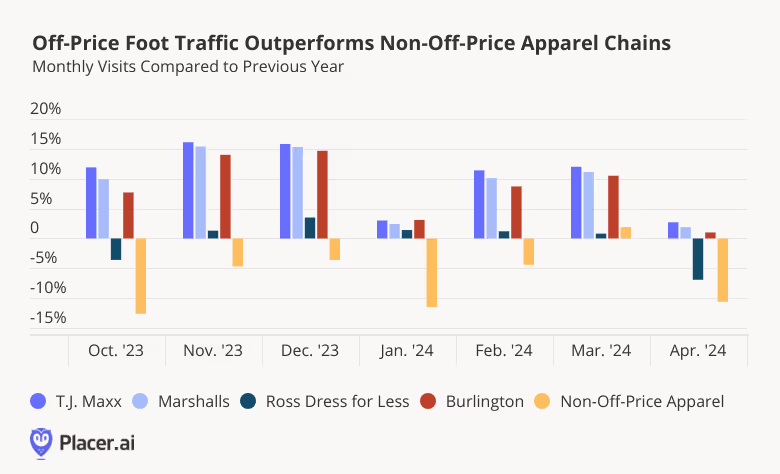

The off-price sector started off 2024 strong, with the four off-price leaders – T.J. Maxx, Marshalls (both owned by TJX Companies), Ross Dress for Less, and Burlington – consistently outperforming the wider non-off-price apparel segment. YoY visits to the four brands were also mostly positive for the period analyzed, in part thanks to the companies’ ongoing expansions.

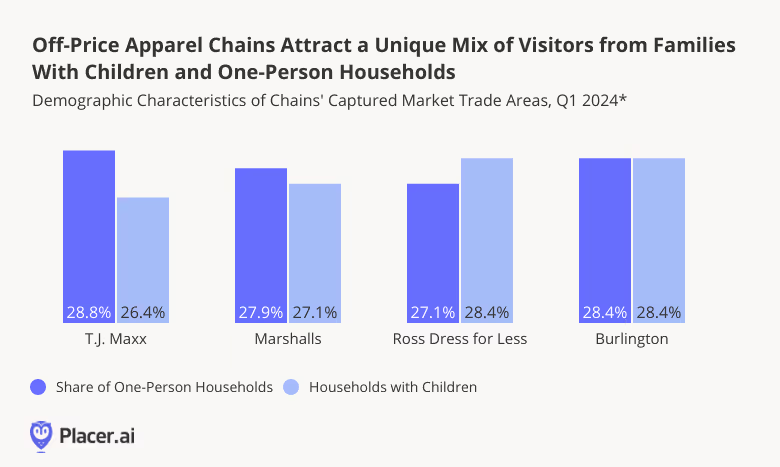

Diving into the demographic composition of the four chains’ trade areas reveals that there are many formulas for success in the off-price space. And while some companies have found success by attracting families looking to stretch their budgets, others are growing their visits by drawing singles looking to stock up on the latest styles without breaking the bank.

T.J. Maxx and Marshalls – where YoY Q1 2024 visits grew 8.9% and 7.9%, respectively – both have relatively large shares of one-person households in their trade areas. Members of these one-person households are typically younger – often belonging to the coveted Gen-Z demographic – and TJX C.E.O. Ernie Herrman has emphasized the company’s success among this audience segment as an important growth driver.

Meanwhile, the 1.1% YoY increase in overall visits for Ross Dress for Less in Q1 2024 seems driven by the chain’s popularity among families – 28.4% of the chain’s captured market consists of households with children. And Burlington achieved its Q1 7.6% YoY visit growth by appealing to both demographics.

It seems, then, that each off-price leader has found a different formula for success by catering to a unique demographic mix.

Over the last several months, off-price apparel chains have outperformed traditional apparel retailers in YoY visits as they expand their real estate footprints. Taking on new territory, off-price retailers drive visits from a unique mix of households with children and singles.

For more data-driven retail insights, visit Placer.ai.

As visits to Superstores continue to rise, we analyzed recent foot traffic data for Walmart, Target, Costco Wholesale, Sam’s Club, and BJ’s Wholesale Club and dove into Walmart’s Q1 2024 regional performance.

Wholesale chains – which receive about 20% of all visits to Walmart, Target, Costco Wholesale, Sam’s Club (owned by Walmart), and BJ’s Wholesale Club – generally outperformed classic superstore banners Target and Walmart during the first four months of the year. Visits to all three wholesale clubs analyzed were up every month on a year-over-year (YoY) basis, with Costco maintaining its lead in the space. Some of the success of wholesale clubs may be due to the makeup of their visitor base – Costco, Sam’s Club, and BJ’s tend to serve a large share of consumers from family households, and these may be opting for more buying in bulk in an effort to stretch budgets.

But visits to more classic superstores are also heating up – following a muted performance in January, when an arctic blast kept many at home, foot traffic to Target grew YoY in February, March, and April.

Walmart also experienced visit growth for most of the period, despite the slight dip in April due to calendar shifts: Visits for the superstore giant dropped 8.5% in YoY for the week of April 1st - 8th 2024 compared to the traffic surges of Easter week 2023 (April 3rd - 9th 2023), impacting the overall monthly numbers, but visits returned to growth during the last two weeks of April (4.3% and 4.0% YoY, respectively, for the weeks of April 15th - 21st and 22nd -28th).

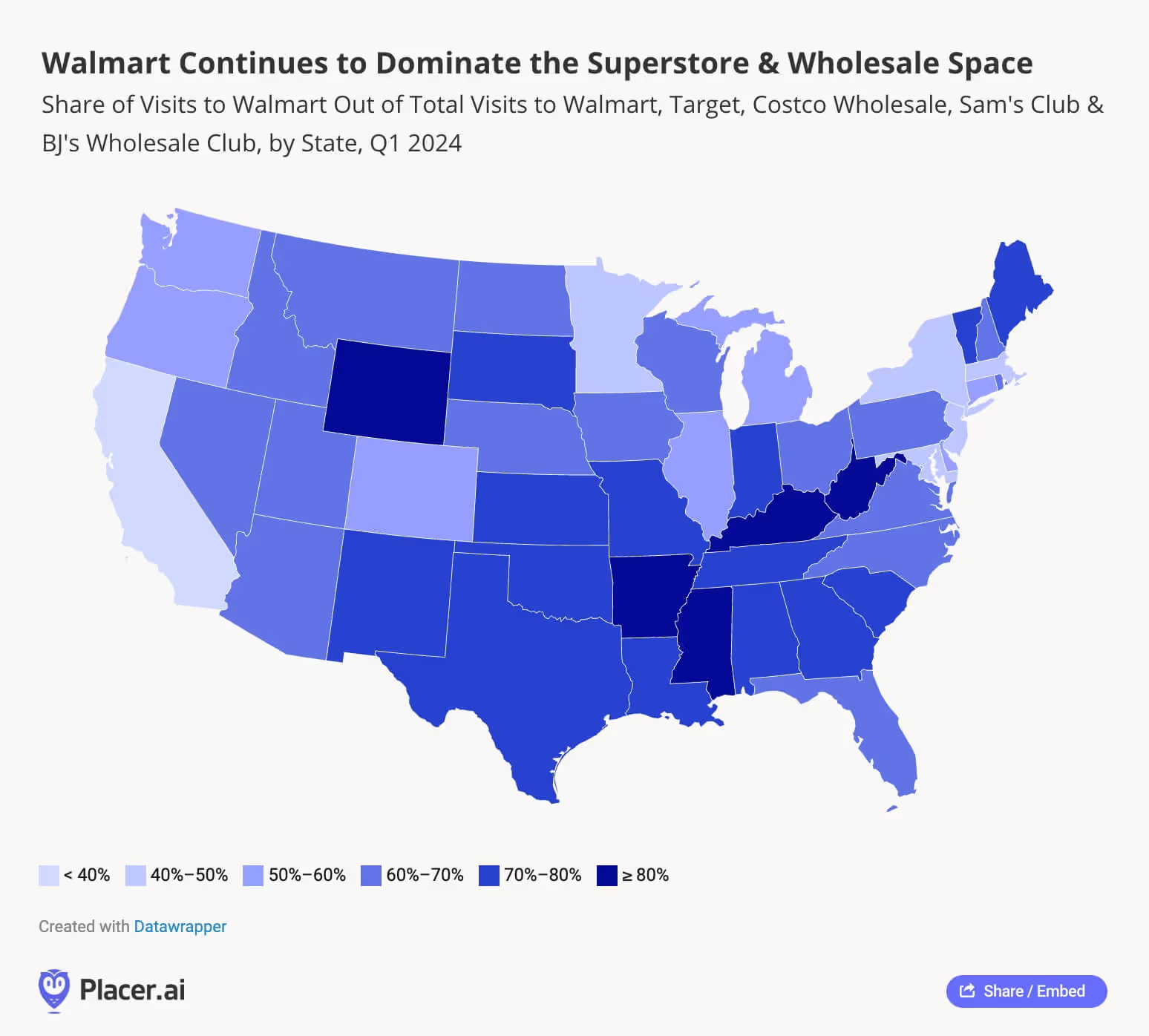

And while Walmart’s growth may not be quite as impressive as that of smaller superstores, the company has retained its position as the largest retailer in the U.S. Nationwide, the Walmart banner receives over 60% of all visits to Target, Walmart, Costco, Sam’s Club, and BJ’s, and in most of the south, the superstore’s relative visit share exceeds 70%. In a handful of states – including the retailer’s home state of Arkansas along with Mississippi, Kentucky, West Virginia, and Wyoming – 4 out of every 5 visits to the five superstore chains analyzed go to Walmart.

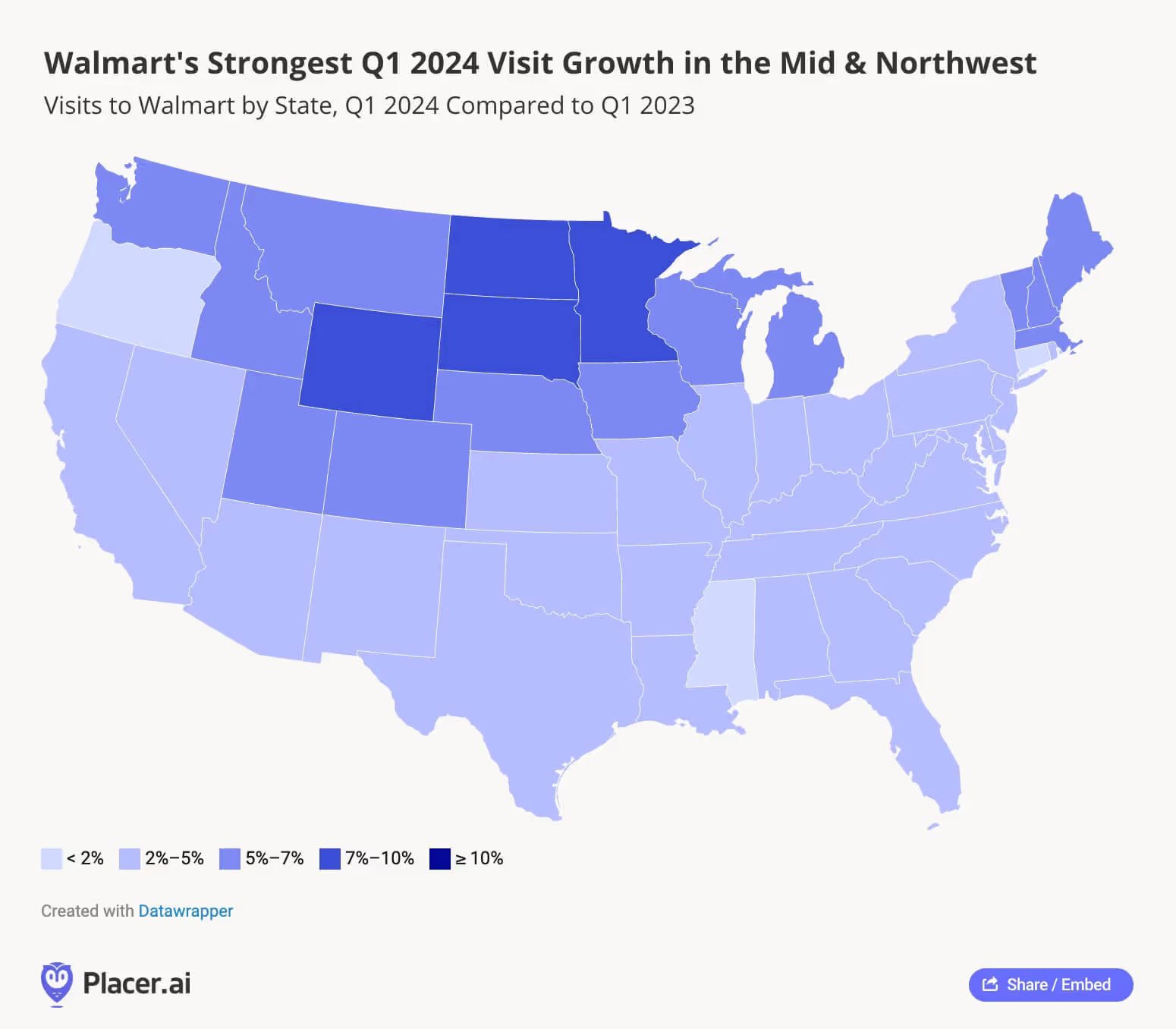

And even as Walmart optimizes its fleet, analyzing the retailer’s Q1 2024 YoY visit increases by region reveals pockets of major growth throughout the country. In addition to the 2-5% traffic increases across most of the South – where the retailer already dominates the superstore space – Walmart is also posting impressive visit increases in the Northeast, Midwest, and Northwest, with the strongest growth in Minnesota, Wyoming, and the Dakotas.

As budget-strapped consumers continue looking for bargains, the legacy retail giant may still have room to grow even larger in 2024.

Superstore and wholesale club visits are on the rise as U.S. shoppers continue to defy predictions of a consumer spending slowdown while still looking for ways to stretch their budgets.

Will these trends continue as the year progresses?

Visit placer.ai to find out.

.avif)

Discount & Dollar Stores have become an important part of the wider retail landscape over the past couple of years, and location intelligence indicates that the category is continuing to gain momentum in 2024. We dove into the data for Dollar General, Dollar Tree, and Family Dollar to understand how these banners are performing and analyze the regional reach of each chain.

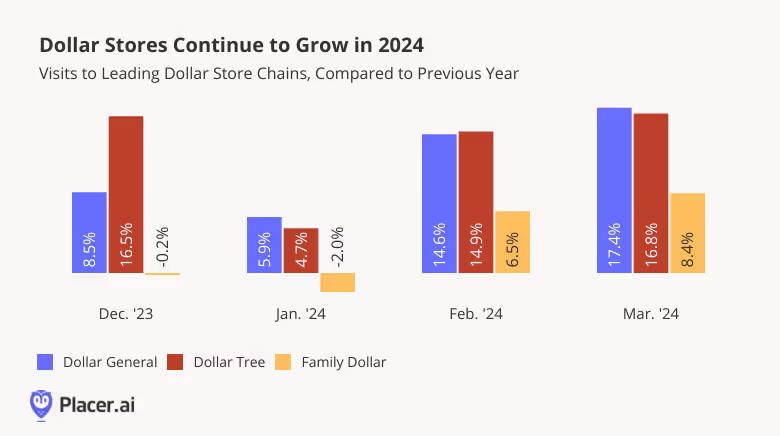

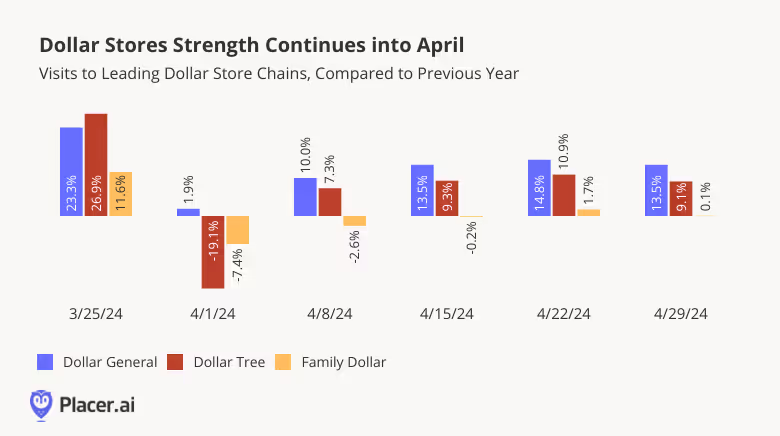

Recent visitation data for the major Discount & Dollar Store banners indicates that the category is still on the rise: Monthly visits to both Dollar General and Dollar Tree grew year-over-year (YoY) between December 2023 and March 2024. Dollar Tree-owned Family Dollar – which recently announced the closure of 1000 stores over the next couple of years – also saw its YoY traffic grow in February and March.

With the exception of the week of April 1st 2024 – when the Easter calendar shift caused a regular week in 2024 to be compared to the week of Easter in 2023 – visitation trends remained positive in April, highlighting the ongoing strength of the Discount & Dollar Store category. Even Family Dollar – which has already begun to close stores – saw its numbers remain on par with last year’s visit levels, indicating the ongoing demand for value-priced goods in 2024.

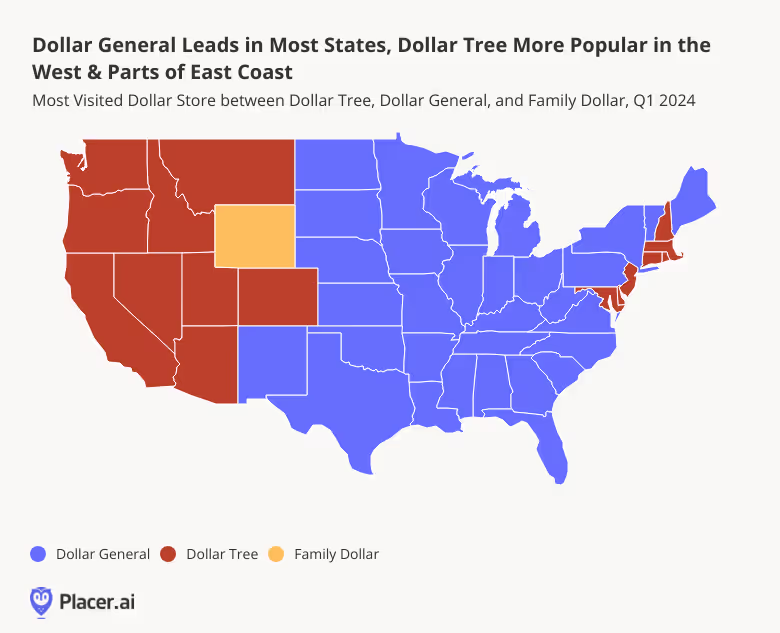

Looking at the Q1 2024 state-by-state relative visit share of the three chains – Dollar General, Dollar Tree, or Family Dollar – reveals some clear regional differences in consumer preferences across states.

Dollar Tree was more popular in the West, with the Dollar Tree brand leading in most western states and the company’s Family Dollar banner receiving the plurality of visits in Wyoming. Dollar Tree was also the most-visited chain in several states on the East Coast, including Maryland, New Jersey, Connecticut, and Massachusetts.

Dollar General, meanwhile, received the majority or plurality of the visit share in the rest of the country.

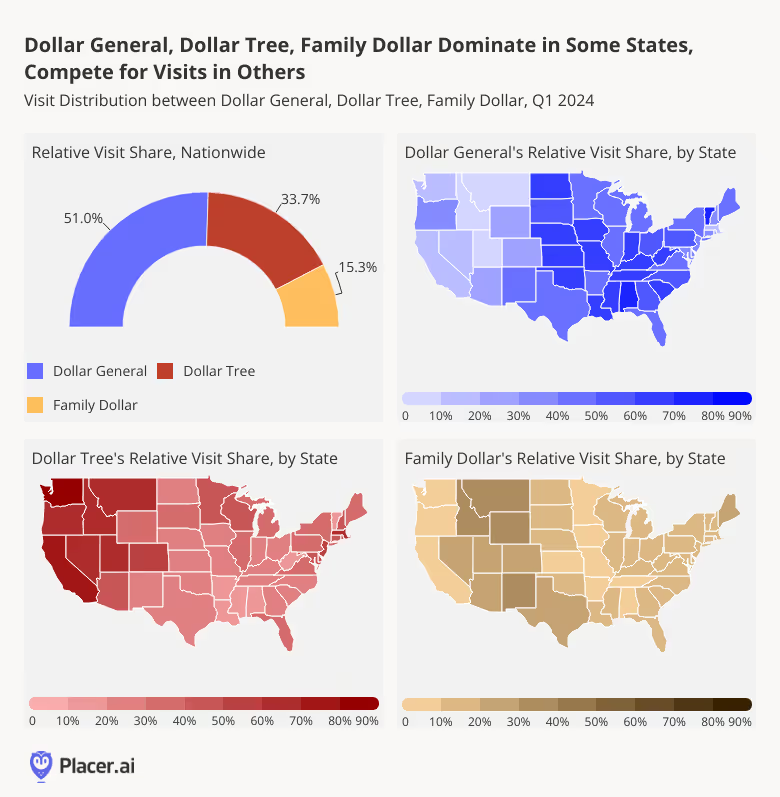

But although Dollar General does receive a majority of the combined Dollar General, Dollar Tree, and Family Dollar visit share nationwide, the Discount & Dollar Store category does not conform to a “winner-take-all” model. In many states, Dollar Tree’s visit share is just slightly lower than that of Dollar General.

In New York, for example, where Dollar General received 44.6% of the combined visit share in Q1 2024, 38.1% of visits in the same period went to Dollar Tree. And in Florida, where 44.2% of the combined visits to the three banners went to Dollar General, 38.2% of visits went to Dollar Tree. It seems, then, that even in states where Dollar General takes the lead, there is plenty of Discount & Dollar Store demand to sustain multiple players in the space.

Early 2024 data suggests that the Discount & Dollar Store sector is not slowing down any time soon. What will the rest of the year have in store for the space?

Visit placer.ai to find out.

Equinox hit the news this week as they rolled out a new $40,000 per year longevity membership called “Optimize by Equinox.” This program promises to provide a personalized health plan of action that includes personal training, nutrition, sleep coaching, and massage therapy. There will also be biomarker testing in partnership with Function Health and fitness testing. New York City and Highland Park, Texas are the pioneering locations for this program, with more to come. Placer took a look at the Highland Park location as well as one on Greenwich Ave in New York City. The Highland Park location has shown extraordinary year-over-year growth, with each month of the year showing increases compared to the prior year. The New York City location is a bit more mixed but had a strong showing year-over-year last fall and at the beginning of 2024.

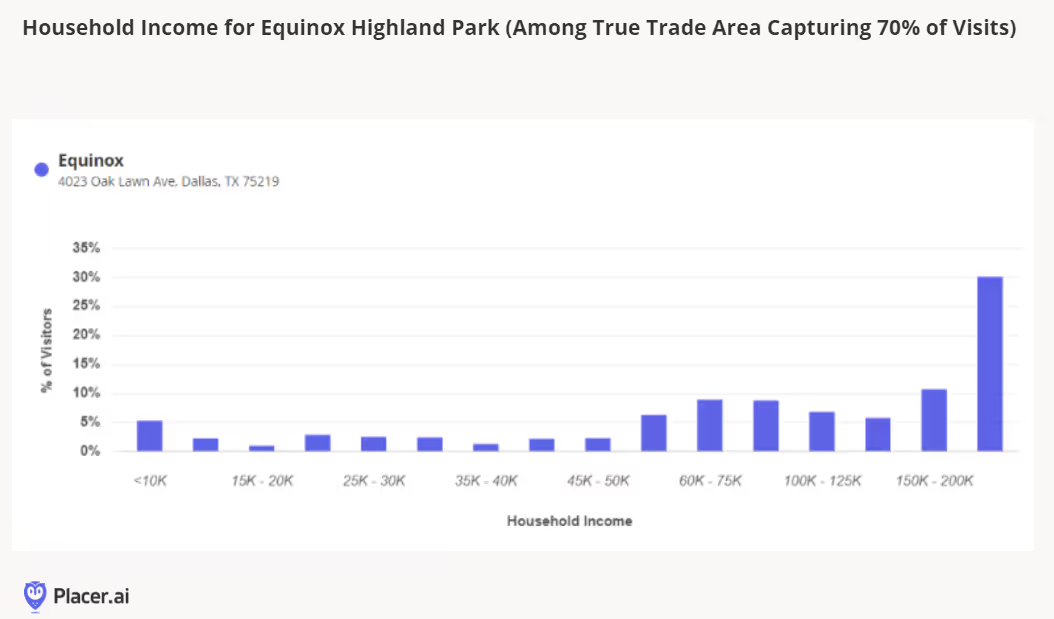

A 2023 survey by A/B Consulting and Maveron VC suggested that almost half (46%) of people earning over $250,000 would spend the majority of their discretionary income on trying to improve health and longevity, compared to only 34% of people earning under $50,000. Bryan Johnson is a tech millionaire who is often in the press with his latest experiments at reversing aging. From routine MRIs to frequent sampling of bodily fluids, he is a rare example of what one might do to try to live forever if one had nearly unlimited means to do so. While not all of us have millions to spend on unlocking the secrets to the fountain of youth, there’s no doubt that wellness and longevity are top of mind for many people, be it endeavoring to walk 10,000 steps a day or aiming for a rainbow diet. Looking at Equinox in Highland Park in Dallas, TX we see that indeed, this wealthy enclave is an apt location to pioneer this longevity offering. In the true trade area capturing 70% of visits, more than 3 in 10 have a household income exceeding $200K.

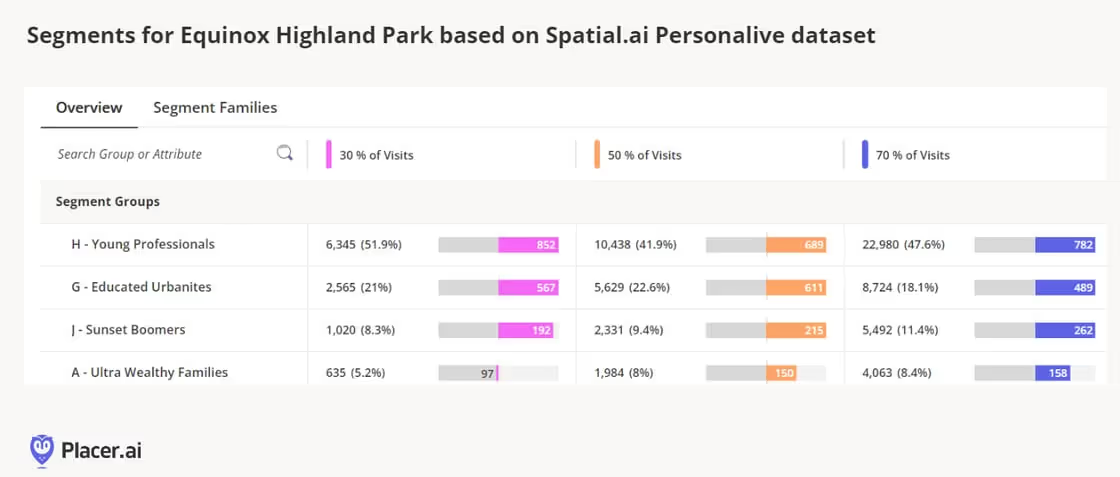

The Spatial.ai PersonaLive dataset further cements the fact that the top visitor segments are a group with higher-than-average discretionary incomes, such as Young Professionals, Educated Urbanites, Sunset Boomers, and Ultra Wealthy Families.

Additional data from the AGS Behavior & Attitudes dataset indicates that among those living in trade areas comprising 70% of visits to the Highland Park Equinox, many are indeed health-oriented, over-indexing on behaviors such as exercising (index 122), being yoga enthusiasts (index 168), and utilizing mobile app fitness trackers (index 160). However, they tend to under-index on getting regular medical checkups (index 86) - which is exactly where Optimize could fit in with its frequent testing and personalized approach. In addition, this particular location might want to take advantage of the clamor for pedicures (index 137) and manicures (index 147) and consider increased retail media network exposure due to enthusiasm for health info from TV (index 159).

Of all the specialty retail sectors, baby has been one of the most interesting to watch over the past few years for a few reasons. The industry is closely tied to a specific consumer life stage, and the CDC recently reported that the birth rate in the United States declined 2% in 2023, reaching the lowest rate recorded. If fewer consumers enter the family formation life stage, or have fewer children, the pool of potential visitors for retailers to draw from slowly dries up. The industry also faced massive disruption over the past year with the bankruptcy of Bed Bath & Beyond and the shuttering of its buybuy Baby chain last summer. The buybuy Baby closure marked the end of the large specialty baby chain sector in the retail industry, with the category facing the bifurcation of sales and traffic between big box retailers + Amazon and small independent specialty retailers.

Still, there have been some signs of life for baby-based retail despite the headwinds. Babylist, a popular online registry tool, launched its first brick-and-mortar outpost in Los Angeles last year. Buybuy Baby’s new owners reopened 11 locations in late 2023, concentrated in New England and the Mid-Atlantic. Then, in March, Kohl’s announced its partnership with WHP Global to bring Babies“R”Us to its stores. The Babies“R”Us shop-in-shop format receives a lot of positive momentum from both the Sephora at Kohl's partnership as well as the Toys“R”Us & Macy’s partnership; both predecessor collaborations have been rolled out to a majority, if not all, doors.

This week, we learned of the 200 initial locations receiving the Babies“R”Us (BRU) concept this summer, which will receive a wide assortment of hardgoods and softgoods, and be positioned next to the children’s apparel department. This new partnership is no doubt a continuation of Kohl’s strategy to attract and retain younger visitors, and the Babies“R”Us model can hopefully help the retailer hold onto Sephora shoppers as they enter the family formation period. Another likely goal is to steal some market share away from the mass merchants dominating in baby and lure some former buybuy Baby shoppers.

According to Placer.ai data, The Babies“R”Us + Kohl’s locations performed similarly to the total Kohl’s chain in 2024, with both chains showing visits down 23% year-over-year. The Babies“R”Us + Kohl’s locations do have a slightly higher visitor median household income of $84k compared to the total chain at $81K, which supports the notion that the Sephora & Babies“R”Us partnerships are meant to bring premium offerings to the typical store.

The partnership launch, as mentioned above, is a clear offensive move to capture some of the former buybuy Baby business in the areas where the locations did not reopen. Using Placer’s location analytics, we compared a national subset of 16 former buybuy Baby locations to the newly announced Babies”R”Us + Kohl’s locations. Looking at the visit demographics between the Kohl’s locations in the first four months of 2024 and the former buybuy Baby locations in 2023, it’s clear that Kohl’s attracts a suburban family and more mature consumer base, as where buybuy Baby locations were a stronghold with young urban singles and young professionals. Kohl’s may have an opportunity to attract new or existing grandparents to the partner stores, but will need to use the Sephora angle to attract younger consumers who may also be looking to start a family in the next few years.

Kohl’s is also betting big on the East Coast, with a number of partnership stores located in New York, New Jersey, Pennsylvania and Massachusetts. A few of these locations are in direct competition with the newly reopened buybuy Baby locations and will create some fascinating local competition. In the Boston metro area, there are both a Kohl’s and buybuy Baby location within 9 miles of each other but have local differences that may benefit Kohl’s entry into the market. Kohl’s has a median household income of about $30k more than visits to buybuy Baby and also captures more loyalty, with more loyal visits than buybuy Baby throughout the first four months of 2024.

This particular Kohl’s location has a smaller disparity to buybuy Baby in attracting young professionals, but it also attracts wealthier and more mature visitors that once again may translate into attracting parents and grandparents. 22% of buybuy Baby’s trade area overlaps with Kohl’s and the two share 11 square miles of overlapping trade area, so it will be interesting to see how Kohl’s can pull visits away from the competition.

As 2024 progresses, Kohl’s opens its partnership locations, baby retail will hopefully find its footing and provide retail solutions for potential and new parents. E-commerce has filled the void for baby registry services, but brick-and-mortar retail still holds a lot of importance for parents. Baby specialty retail is essential to the success of baby products and brands, and there is a lot of white space opportunity in the category for retailers to emerge to take share. Consumers, even if there are fewer of them, need experiences and solutions provided by retailers, and baby retail is a cautionary, but optimistic tale for other specialty sectors for the remainder of the year.

The COVID-19 pandemic – and the subsequent shift to remote work – has fundamentally redefined where and how people live and work, creating new opportunities for smaller cities to thrive.

But where are relocators going in 2024 – and what are they looking for? This post dives into the data for several CBSAs with populations ranging from 500K to 2.5 million that have seen positive net domestic migration over the past several years – where population inflow outpaces outflow. Who is moving to these hubs, and what is drawing them?

The past few years have seen a shift in where people are moving. While major metropolitan areas like New York still attract newcomers, smaller cities, which offer a balance of affordability, livability, and career opportunities, are becoming attractive alternatives for those looking to relocate.

Between July 2020 and July 2024, for example, the Austin-Round Rock-Georgetown, TX CBSA, saw net domestic migration of 3.6% – not surprising, given the city of Austin’s ranking among U.S. News and World Report’s top places to live in 2024-5. Raleigh-Cary, NC, which also made the list, experienced net population inflow of 2.6%. And other metro areas, including Fayetteville-Springdale-Rogers, AR (3.3%), Des Moines-West Des Moines, IA (1.4%), Oklahoma City, OK (1.1%), and Madison, WI (0.6%) have seen more domestic relocators moving in than out over the past four years.

All of these CBSAs have also continued to see positive net migration over the past 12 months – highlighting their continued appeal into 2024.

What is driving domestic migration to these hubs? While these metropolitan areas span various regions of the country, they share a common characteristic: They all attract residents coming, on average, from CBSAs with younger and less affluent populations.

Between July 2020 and July 2024, for example, relocators to high-income Raleigh, NC – where the median household income (HHI) stands at $84K – tended to hail from CBSAs with a significantly lower weighted median HHI ($66.9K). Similarly, those moving to Austin, TX – where the median HHI is $85.4K – tended to come from regions with a median HHI of $69.9K. This pattern suggests that these cities offer newcomers an aspirational leap in both career and financial prospects.

Moreover, most of these CBSAs are drawing residents with a younger weighted median age than that of their existing residents, reinforcing their appeal as destinations for those still establishing and growing their careers. Des Moines and Oklahoma City, in particular, saw the largest gaps between the median age of newcomers and that of the existing population.

Career opportunities and affordable housing are major drivers of migration, and data from Niche’s Neighborhood Grades suggests that these CBSAs attract newcomers due to their strong performance in both areas. All of the analyzed CBSAs had better "Jobs" and "Housing" grades compared to the regions from which people migrated. For example, Austin, Texas received the highest "Jobs" rating with an A-, while most new arrivals came from areas where the "Jobs" grade was a B.

While the other analyzed CBSAs showed smaller improvements in job ratings, the combination of improvements in both “Jobs” and “Housing” make them appealing destinations for those seeking better economic opportunities and affordability.

Young professionals may be more open than ever to living in smaller metro areas, offering opportunities for cities like Austin and Raleigh to thrive. And the demographic analysis of newcomers to these CBSAs underscores their appeal to individuals seeking job opportunities and upward mobility.

Will these CBSAs continue to attract newcomers and cement their status as vibrant, opportunity-rich hubs for young professionals? And how will this new mix of population impact these growing markets?

Visit Placer.ai to keep up with the latest data-driven civic news.

Convenience stores, or c-stores, have been one of the more exciting retail categories to watch over the past few years. The segment has undergone significant shifts, embracing more diverse offerings like fresh food and expanded dining options, while also exploring new markets and adapting to changing consumer needs. We looked at the recent foot traffic data to see what this category's successes reveal about the current state of brick-and-mortar retail.

Convenience stores are increasingly viewed not only as places to fuel up, but as affordable destinations for quick meals, snacks, and other necessities. And analyzing monthly visits to the category shows that it is continuing to benefit from its positioning as a stop for food, fuel, and in some cases, tourism.

Despite lapping a strong H1 2023, visits to the category either exceeded last year’s levels or held steady during all but one of the first eight months of 2024 – highlighting the segment’s ongoing strength. Only in January 2024 did C-stores see a slight YoY dip, likely reflecting a weather-induced exaggeration of the segment’s normal seasonality.

Indeed, examining monthly fluctuations in visits to c-stores (compared to a January 2021 baseline) shows that foot traffic to the category tends to peak in summer months – perhaps driven by summer road trips and vacations – and slow down significantly in winter. Given summer’s importance for convenience stores, the category’s August YoY visit bump is a particularly promising indication of c-stores’ robust positioning this year.

While some C-store chains, like 7-Eleven, have a nationwide presence, others are concentrated in specific areas of the country. But as the popularity of C-stores continues to grow, regional chains like Wawa, Buc-ee’s, and Sheetz are expanding into new territories, broadening their reach.

Wawa, a beloved brand with roots in Pennsylvania, has become synonymous with its fresh sandwiches, coffee, and a highly loyal customer base. Wawa has been a major player in the c-store space in recent years, with a revamped menu driving ever-stronger foot traffic to its Mid-Atlantic region stores. Between January and August 2024, YoY visits to the chain were mostly elevated. And the chain is now venturing into states like Florida – where its store count has grown significantly over the past few years – as well as Georgia and Alabama.

Meanwhile, Texas favorite Buc-ee’s, though known for its enormous stores and mind boggling array of dining options, has a relatively small footprint – but that might be changing. The chain, which also outpaced its already-strong 2023 performance this year, is opening locations in Arkansas and North Carolina, further building on its reputation as a destination for travelers. And Sheetz, another regional chain with a strong presence in Pennsylvania, is also expanding, with plans to open locations in Southern states like North Carolina and Tennessee.

This trend toward regional expansion offers significant opportunities for growth, not only by increasing store count, but also by reaching new consumer bases and target audiences. Customer behavior differs between markets – and by expanding into new areas, c-stores can tap into unique local visitation patterns.

One metric that highlights local differences in consumer behavior is dwell time, or the amount of time a customer spends inside a convenience store per visit. In some regions, visitors tend to move in and out quickly, while in others, customers linger for longer periods of time.

Analyzing convenience store dwell times by state highlights substantial differences in visitor behavior. During the first eight months of 2024, coastal states (with the exception of Oregon) tended to see shorter average dwell times (between 7.5 and 11.8 minutes). On the other hand, in states like Wyoming, Montana, and North Dakota, average dwell times ranged between 21.2 and 28.2 minutes.

Interestingly, the states with the longest dwell times also have some of the highest percentages of truck traffic on interstate highways – suggesting that these longer stops are perhaps made by long-haul truckers looking for a place to shower, relax, and grab a bite to eat.

Even as regional favorites expand their reach, nationwide classic 7-Eleven is taking steps to further cement its growing role as a prime grab-and-go food and beverage destination. And like other dining destinations, the chain relies on limited-time offers (LTOs) to fuel excitement – and visits.

One of the most iconic, and beloved c-store LTOs is 7-Eleven’s Slurpee Day, which falls each year on July 11th. The event, during which all 7-Eleven locations hand out free slurpees, tends to drive significant upticks in foot traffic – and this year was no exception. Visits to the convenience store jumped by a whopping 127.3% on July 11th, 2024 relative to the YTD daily visit average – proving that good deals will bring customers in the door.

The convenience store sector continues building on the impressive growth seen in 2023. As many chains double down on expanding both their regional presence and their offerings, will they continue to drive growth in the coming years?

Visit Placer.ai to keep up with the latest data-driven convenience store updates.

Grocery chains in the United States are increasingly investing in on-site healthcare clinics, transforming their stores into hubs for both food and wellness. While grocery stores have long featured pharmacies and some basic healthcare services like vaccinations, recent years have seen a shift towards more extensive healthcare offerings.

Today, many grocery stores offer a range of services – from primary and urgent care to dental and mental health care. In addition to providing an important community service, grocery-anchored healthcare clinics can boost foot traffic at chains, help health providers reach more patients, and allow shoppers to manage their health and home needs in one convenient trip.

This white paper examines the impact these in-store clinics have on grocery chain visitation patterns and trade area characteristics. Are shoppers more or less likely to make repeat visits to grocery stores with healthcare services? And how does the addition of a clinic affect the demographic profile of a grocery store’s captured market? The report examines these questions and more, offering insights for stakeholders across the grocery and healthcare industries.

Analyzing foot traffic to grocery stores with and without in-store clinics shows the positive impact of these services: Across chains, locations with on-site healthcare offerings drew more visits in H1 2024 than their chain-wide averages.

The Kroger Co., which operates numerous regional banners as well as its own eponymous chain, has been a leader in in-store healthcare services since the early aughts. The company introduced its in-store medical center, The Little Clinic in 2003 – and today operates over 225 Little Clinic locations across its Kroger banner, as well as regional chains Dillons, Jay C Food Stores, Fry’s, and King Soopers.

And in H1 2024, the eight Dillons locations with clinics saw, on average, 93.0% more visits per location than the chain’s banner-wide average. Jay C, which offers two in-store clinics, also saw visits to these venues outpace the H1 2024 banner-wide average by 92.9%. For both chains, relatively small overall footprints may contribute to their outsize visit differences: Indiana-focused Jay C operates just 22 locations, all in the Hoosier State, while Kansas-based Dillons has some 64 locations.

But similar patterns, if somewhat less pronounced, could be observed at Kroger (43.0%), Fry’s (19.2%), and King Soopers (16.5%) – as well as at H-E-B (14.5%), which boasts its own expanding network of in-store clinics.

Analyzing the trade areas of grocery stores with healthcare clinics shows that these services tend to draw more affluent visitors from within the stores’ trade areas.

For some chains, including King Soopers, H-E-B, and Jay C, the clinics are positioned to begin with in areas serving higher-income communities. The median household income (HHI) of King Soopers’ in-store clinic’s potential markets, for example, came in at $92.3K in H1 2024 – significantly above the chain’s overall potential market median HHI of $88.1K. Similarly, the potential markets of H-E-B and Jay C Food Stores with clinics had higher median HHIs than the chains’ overall averages.

And for all three chains, stores with clinics tended to attract visitors from captured markets with even higher median HHIs – showing that within these affluent communities, it is the more well-to-do customers that tend to frequent these venues. (A chain or store’s potential market is obtained by weighting each CBG in its trade area according to the size of the population – thus reflecting the general composition of the community it serves. A chain or store’s captured market, on the other hand, is obtained by weighting each CBG according to its share of visits to the business in question – and thus represents the population that actually visits it in practice.)

Other brands, including Fry’s, Kroger, and Dillons, have positioned clinics in stores with potential market median HHIs slightly below chain-wide averages. But within these markets, too, it is the more affluent consumers that are visiting these stores, pushing up the median HHI of their captured markets.

These patterns highlight that, for now, grocery store clinics tend to attract consumers on the upper ends of local income spectrums. This information can be utilized by healthcare professionals and grocery store owners to pinpoint neighborhoods that may be open to grocery-anchored clinics, or to take steps to increase penetration in other areas.

Supermarket giant Kroger is a major player in the world of grocery-anchored healthcare, offering visitors access to pharmacies, clinics, and telehealth options via its grocery stores. What impact has the company’s embrace of healthcare had on visits and loyalty?

An analysis of household compositions across the potential and captured markets of Kroger-owned stores with and without Little Clinic offerings suggests that families with children are extremely receptive to these services.

In H1 2024, Kroger, King Soopers, Fry’s, Jay C, and Dillons all featured captured markets with higher shares of STI: PopStats’ “Households With Children” segment than their potential ones – highlighting the chains’ appeal for families. But the share of parental households in those stores with Little Clinics jumped significantly higher for all five banners.

The share of families with children in King Soopers’ overall captured market stood at 28.3% in H1 2024, higher than the 27.2% in its potential one. But the households with children in the captured markets of King Soopers locations with Little Clinics was significantly higher – 30.6% – and similar patterns emerged at Jay C, Dillons, Kroger, and Fry’s.

This special draw is likely linked to the clinics' focus on family health services like physicals, nutrition plans, and vaccines. The convenience of being able to take care of healthcare, grocery shopping, and pharmacy needs all in one go makes these stores particularly attractive to parents. And this jump in foot traffic shows the strategic advantage of incorporating healthcare services into the retail environment.

Providing essential healthcare services at the supermarket can establish a grocery chain as a crucial part of a shopper's daily life, enhancing visitor loyalty, and helping nurture long-term customer relationships. Indeed, in-store clinics offer a unique opportunity for grocery providers to connect with customers on a level that extends beyond the transactional.

An analysis of several Kroger-branded locations in the Cincinnati metro area showcases the profound impact in-store clinics can have on customer loyalty. In H1 2024, stores with Little Clinics had significantly higher shares of repeat visitors – defined as those making six or more stops at the store during the analyzed period – than those without.

For instance, 36.4% of visitors to a Kroger Marketplace store with an in-store clinic in Harrison, Ohio, frequented the location at least six times during the first half of 2024. But over the same period, only 29.0% of visitors stopped by at least six times to a nearby Kroger location in Cleves, Ohio – just ten miles away. Similarly, 30.7% of visitors to the Beechmont Ave. Kroger Food & Drug location with a clinic visited at least six times in H1 2024, compared to 23.0% for the nearby Ohio Pike Kroger store.

This trend was consistent across the analyzed locations, with those offering in-store clinics attracting significantly higher shares of loyal visitors. These metrics support the value of offering additional services as a draw for frequent visitors, while also providing the clinics themselves with the visitor volume needed to operate profitably.

Texan grocery chain H-E-B is beloved across the state – and though the chain isn’t new to the healthcare scene, it has been doubling down on wellness. In 2022, H-E-B launched H-E-B Wellness, a healthcare platform that offers patrons a variety of medical services, including – as of today – some 12 primary care clinics, many of them inside stores.

H-E-B stores with primary care clinics are helping to cement the grocer’s role as a convenient one-stop for local residents – allowing them to drop in to a nearby location for both daily grocery needs and wellness care.

H-E-B has always placed a premium on community, stepping up to help local residents in times of need. And though the chain as a whole draws an overwhelming majority of its visitors from nearby areas, those with clinics do so even more effectively. In H1 2024, some 83.6% of visitors to H-E-B came from less than 10 miles away. But for locations with primary care clinics, this share increased to 88.0%.

This suggests that wellness services are particularly appealing to nearby residents, strengthening H-E-B’s connection with local consumers even further. And for a grocery store centered on community engagement, the integration of health services into its offerings is proving to be a winning strategy.

H-E-B has been steadily expanding its primary care offerings since it launched the Wellness concept, adding two primary clinics at locations in Cypress, TX and Katy, TX in June 2023. Following the opening of these clinics – which operate Mondays through Fridays – both locations saw marked increases in the share of “Urban Cliff Dwellers” in their weekday captured markets. This STI: Landscape segment group encompasses families both with and without children, earning modest incomes and enjoying middle-class pleasantries.

Between June 2022 - May 2023, the share of “Urban Cliff Dwellers” in the weekday captured markets of the Cypress and Katy locations stood at 9.5% and 7.2%, respectively. But once the stores had clinics in place, those numbers jumped to 12.4% and 11.0%, respectively.

This increase in the stores’ reach among “Urban Cliff Dwellers” immediately following the clinics’ openings suggests that in addition to more affluent consumers, middle-class families also harbor considerable interest in these services. As more retailers continue making inroads into the healthcare sector, they may find similar success in attracting diverse groups of convenience-seeking shoppers.

As grocery stores lean into healthcare, they are transforming into multifaceted hubs that offer both essential health services and everyday shopping needs. Retailers like Kroger and H-E-B are reaping the benefits of boosted foot traffic, higher-income visitors, and strengthened community ties – while offering their shoppers convenience that helps streamline their daily routines.