.svg)

.png)

.png)

.png)

.png)

We dove into the latest data for java leaders Starbucks, Dutch Bros., and Dunkin’ – to discover how each brand drove visits in Q2 2024 and explore coffee consumer visit patterns heading into the summer.

Starbucks has been finding foot traffic success this summer with promotions that seem to be resonating with consumers. In May 2024, the chain launched 50% Off Fridays (beginning May 10th), special Monday Deal Drops (beginning May 13th), and limited-time only summer drinks. And in June, Starbucks’ promotions continued with a new Pairings Menu and a round of handcrafted iced beverages.

Since the week of May 6th, 2024, weekly traffic to Starbucks has been consistently elevated YoY – with visits up 2.3% YoY for Q2 2024 as a whole – indicating that Starbucks’ array of summer promotions are shoring up traffic to the chain.

Like Starbucks, Dutch Bros. ushered in the warm season with a special line-up of summer drinks in May 2024. But even before the launch of these seasonal promotions, the coffee powerhouse has been driving visits.

In Q2 2024, Dutch Bros.’ visits increased 15.0% YoY amidst ongoing fleet expansion. And throughout H1 2024, monthly visits-per-location increased YoY nearly across the board – surpassing the wider category average – indicating that Dutch Bros.’ growth is meeting robust demand.

In June 2024, Dutch Bros. saw 5.7% YoY visit-per-location growth, the chain’s largest increase of the year so far. With more planned expansions, an additional promotional drink release in July, and continued steps to advance mobile ordering and its rewards program, Dutch Bros. appears poised to drive growth in the back half of 2024 as well.

Though indisputably a coffee chain, Dunkin’ is still donut-obsessed and celebrates the doughy treat every year on National Donut Day (this year, June 7th). Among its many promotional events this summer, Dunkin’ treated customers to a free donut with the purchase of a beverage on the big day. And the milestone turned out to be Dunkin’s busiest day of the year so far – driving a 28.4% foot traffic increase compared to the daily year-to-date average (January 1st to July 20th, 2024).

Indeed, National Donut Day seems to have kickstarted Dunkin’s busy summer. Following several weeks of flagging YoY visit performance in May – likely attributable in part to the chain’s strong May 2023 performance – Dunkin’ saw a YoY visit boost of 4.5% during the week of June 3rd, 2024. And subsequent weeks have seen a continuation of this positive momentum, as the chain continues to promote its summer fare.

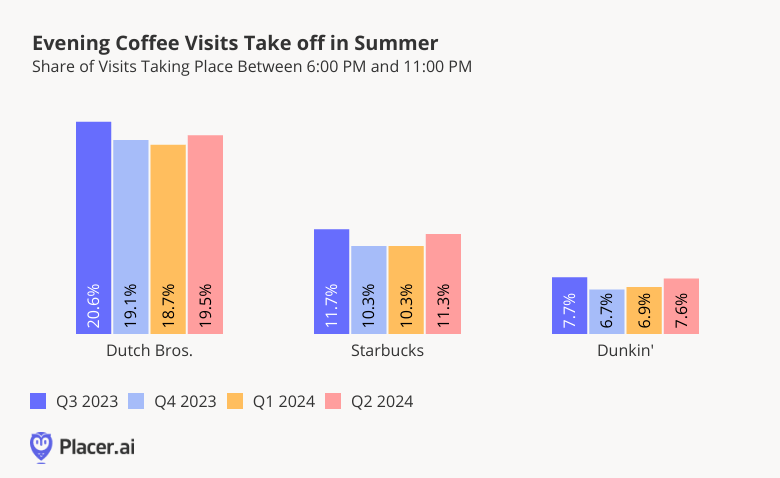

Starbucks, Dutch Bros., and Dunkin’ each do summer in their own way. But one thing all three chains have in common is an increase in evening visits during the summer months.

In Q3 2023, including the peak summer months of July and August, all three chains experienced significant upticks in evening visits (between 6:00 and 11:00 PM). During the winter months – Q4 2023 and Q1 2024 – the share of visits taking place in the evenings dropped for all three chains, before picking up again in Q2 2024.

A variety of factors may be behind this summer shift in coffee consumption. Consumers may be more likely to be out socializing during lazy summer evenings – when students are off and many Americans take vacation. Extended daylight hours in summer may also entice more consumers into an extra caffeine boost later in the day.

If last year’s Q3 evening coffee visit boost is any indication, Starbucks, Dunkin’, and Dutch Bros. may all be in for evening foot traffic increases as the summer wears on.

How will these coffee giants stay hot during the final stretch of summer and will they maintain their momentum going forward?

Visit Placer.ai to find out.

Summer is a time when many consumers are on the go – and vacationers moving between activities look to quick-service restaurants (QSR) and fast-casual chains to fill up and beat the heat.

We checked in with McDonald’s, Wendy’s, Wingstop, and Shake Shack to see how they are performing heading into the summer, and examined location analytics for McDonald’s latest concept – CosMc’s – to uncover emerging visitation trends for the new chain.

Popular wing and burger destinations Wingstop and Shake Shack are thriving this summer, as both chains double down on expansion plans. Shake Shack is on track to add dozens of new locations to its 300+ domestic shacks in 2024, and Wingstop’s hundreds of newly added locations bring its U.S. restaurant count to nearly 2000 venues.

These aggressive expansion strategies are playing a significant role in the chains’ respective visit growth. In June 2024, Wingstop’s visits were up 34.2% YoY, while Shake Shack’s were up 28.1%.

As the chains expand their footprints, both are taking steps to increase store efficiency and improve service. Wingstop recently adopted a new in-house transaction software, while Shack Shack continues to streamline the kiosk ordering experience.

.png)

The experience at many eateries continues to change – as do the prices diners see on their menus. During the first months of 2024, inflation drove price increases across the QSR space. And as consumers took note of the higher prices, “the summer of value wars” got underway – with a long list of chains, including fast-food giants McDonald’s and Wendy’s, introducing low-cost meals and menus to reel in inflation-wary diners.

Despite price hikes felt by consumers, in Q2 2024, McDonald’s visits grew by 0.4% YoY and Wendy’s grew by 1.4%. And the late-June launch of McDonald’s and Wendy’s new limited-time $5 bundles – which are already making their impact felt on the ground – may drive further foot traffic growth for the two chains throughout the summer.

.png)

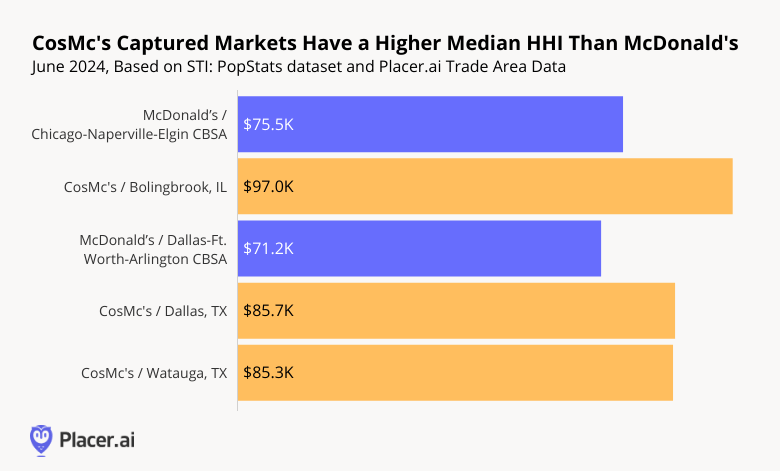

While many fast-food diners are looking for value this summer, they’re also proving eager to try new culinary experiences. McDonald’s spin-off restaurant CosMc’s landed in late 2023, with throngs of eager diners lining up for a taste of the unique concept. Since the first location opened in Bolingbrook, IL, several new CosMc’s have emerged to heavy fanfare, including one in Watauga, TX and another in Dallas.

And although CosMc’s is still in its infancy, location analytics shows that the concept already drives traffic from more affluent consumers than the traditional McDonald’s chain.

In June 2024, for example, the median household income (HHI) in the captured market of the Bolingbrook, IL CosMc’s was $97.0K – significantly higher than that of McDonald’s in the Chicago metro area ($75.5K) or of McDonald’s nationwide ($65K).

A similar trend could be observed in the Dallas-Ft. Worth-Arlington CBSA – where the captured markets of local CosMc’s featured significantly higher median HHIs than those of McDonald’s.

As a beverage-led concept, CosMc’s may drive more traffic from higher-income consumers than a traditional McDonald’s – where simple soft drinks typically come as an inexpensive meal add-on. And as a result, the chain may help McDonald’s bring a new consumer cohort into the fold.

Summer 2024 is undoubtedly shaping up to be the “Summer of Value” and perhaps the “Summer of Fast Food” as well. Will favorable trends continue in the months ahead?

Visit Placer.ai to find out.

The fast-casual space has been having a moment – with rising QSR prices leading many diners to embrace an upgraded experience. So with Q2 2024 in the rearview mirror, we dove into the data to check in with two fast-casual restaurant chains that have been doing particularly well: Chipotle and sweetgreen. How did their Q2 performance compare to that of the wider fast-casual segment? And what is it, exactly, that they are doing right?

We dove into the data to find out.

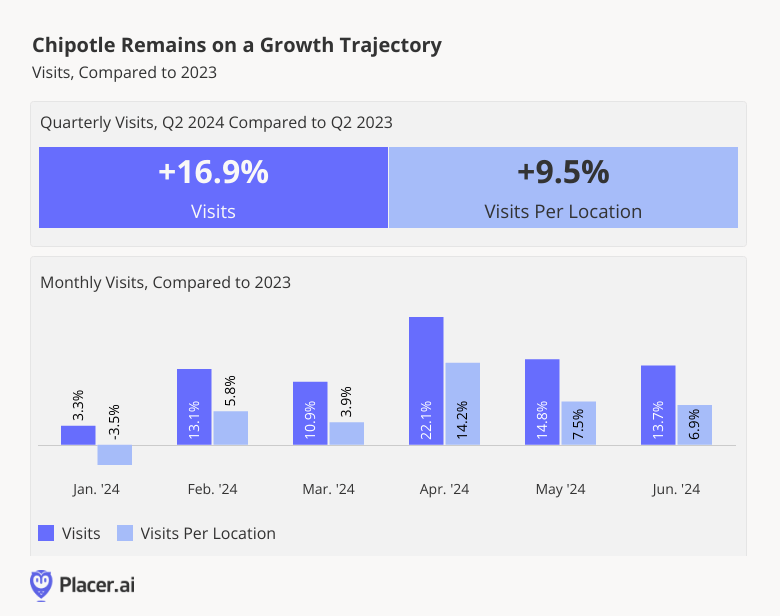

In the first quarter of 2024, Chipotle reported a 14.1% YoY increase in total revenue, and a 7.0% increase in comparable restaurant sales. And the chain isn’t showing any signs of slowing down. In Q2 2024, Chipotle saw YoY chain-wide foot traffic growth of 16.9%. And while some of this increase was undoubtedly due to the chain’s continued expansion – Chipotle added some 247 U.S. restaurants over the past year – the average number of visits to each of Chipotle’s restaurants also increased by an impressive 9.5%. By way of comparison, fast-casual restaurants experienced average quarterly YoY visit growth of just 4.2%, and visit-per-location growth of 2.9%.

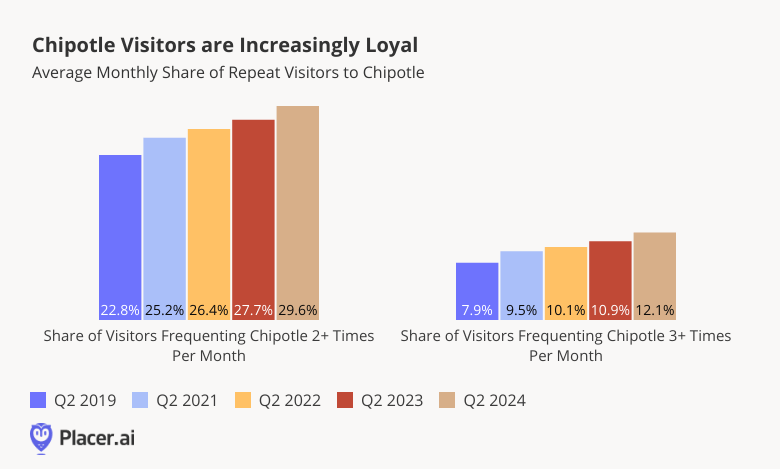

One factor that appears to be contributing to Chipotle’s remarkable visit growth is its repeat customer base – which is growing more loyal with every passing year. Between Q2 2019 and Q2 2024, the share of visitors frequenting a Chipotle at least twice a month increased from 22.8% to 29.6%, while the share of visitors frequenting a Chipotle at least three times a month grew from 7.9% to 12.1%.

This rise in loyalty has taken place against the backdrop of Chipotle’s growing loyalty program – Chipotle Rewards – which launched in Q1 2019 and today boasts more than 40 million members. The program, which lets members earn points for every dollar spent, offers diners access to personalized deals and a range of special promotions – like free delivery on National Burrito Day. (Before you ask, foot traffic data shows that National Burrito Day, which fell on Thursday, April 4th, 2024 wasn’t just a day for ordering online: It was Chipotle’s busiest Thursday of the year so far, with visits up 19.7% compared to a regular Thursday). This April, Chipotle also partnered with Tekken 8 to offer diners in-game currency in exchange for orders – with special perks for Rewards members.

Another eatery that has been performing remarkably well in 2024 is sweetgreen – the fast-casual restaurant known for its healthy, fresh food. During Q2 2024, visits to sweetgreen were up a remarkable 19.9% YoY, a reflection of the chain’s growing footprint. But foot traffic data shows that there is more than enough demand to sustain sweetgreen’s accelerated expansion – over the analyzed period, the average number of visits to each sweetgreen location also increased by 5.9%.

A look at the hourly distribution of visits to sweetgreen shows that though the chain has made inroads into the dinner daypart, lunchtime remains its prime time to shine – especially on weekdays.

During the first half of 2024, 24.9% of weekday visits to sweetgreen took place between noon and 2:00 PM – compared to just 21.7% for the wider fast-casual category. But while sweetgreen, popular among the in-office crowd, drew a greater share of lunchtime visitors on weekdays, the fast-casual segment as a whole drew a greater share of lunchtime visitors on the weekends. Indeed, on Saturdays and Sundays, the share of lunchtime sweetgreen visitors dropped to 22.7%, while the share of fast-casual lunchtime visitors increased to 22.2%.

Still, suppertime is also a popular daypart for the salad chain on weekdays – with 20.0% of Monday - Friday visits taking place between 6:00 and 8:00 PM. As sweetgreen continues to lean into steaks and other dinner fare, it will be interesting to see if the restaurant begins to capture even more evening traffic.

Chipotle’s and sweetgreen’s strong quarter positions them well for further growth as the year wears on. Will Chipotle’s loyalty continue to increase? And will sweetgreen double down on dinner?

Follow Placer.ai’s data-driven restaurant analyses to find out.

Millennials everywhere, rejoice, because a beloved brand is back, for the next generation. Limited Too, an apparel staple for girls growing up in the 1990’s and 2000’s, has found its way back to the retail stage after years of dormancy. The brand began teasing its return a month ago, but last week brought the announcement that Limited Too’s relaunch will take place via a new apparel line at Kohl’s. With the Fourth of July over and Amazon Prime Day complete, the back-to-school season is officially upon us, even if it still feels like summer. In Kohl’s press release on Friday, the Limited Too introduction is a part of its larger back-to-school efforts, and it appears to be aimed at expanding apparel offerings for girls. And, with Kohl’s recent and upcoming additions like Sephora, Babies”R”Us, and now Limited Too, the target is clearly to woo and excite the Millennial shopper.

The relaunch of Limited Too includes fashion for girls size 7-16, the same Tween demographic that the brand originally captured. Mall-based Limited Too shut its doors in 2008, and the majority of stores were converted into rival retailer, Justice, who shuttered all of its stores in 2020. The brand revival is likely positioned by Kohl’s to appeal to parents who grew up with an affinity for the brand who can now purchase for their children.

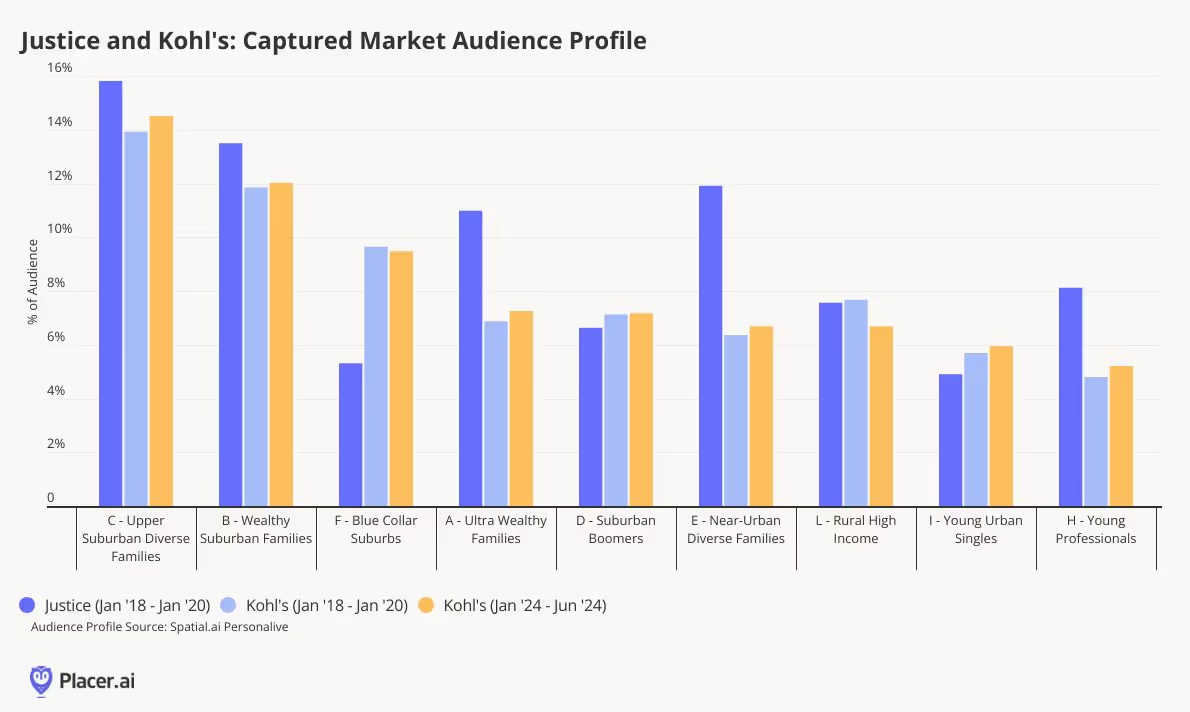

With the relaunch, how well situated is Kohl’s to attract this ideal “Limited Too Loyalist”? We took a look at a sampling of former Justice stores prior to closing, from 2018 to January 2020, and compared the audience profile of Justice visitors to Kohl’s visitors using Spatial.ai PersonaLive, both during the same time period as well as in 2024.

Our data highlights that both retailers actually have a similar audience profile of visitors, and that Kohl’s has continued to grow its percentage of Upper Suburban Diverse Families and Wealthy Suburban Families to more closely align with the former Justice demographics. Since the pandemic and through its new partnerships and planned additions, Kohl’s has been able to capture wealthier suburban families, and as Millennials continue to migrate out of urban centers, the retailer may have set itself up well to welcome these shoppers.

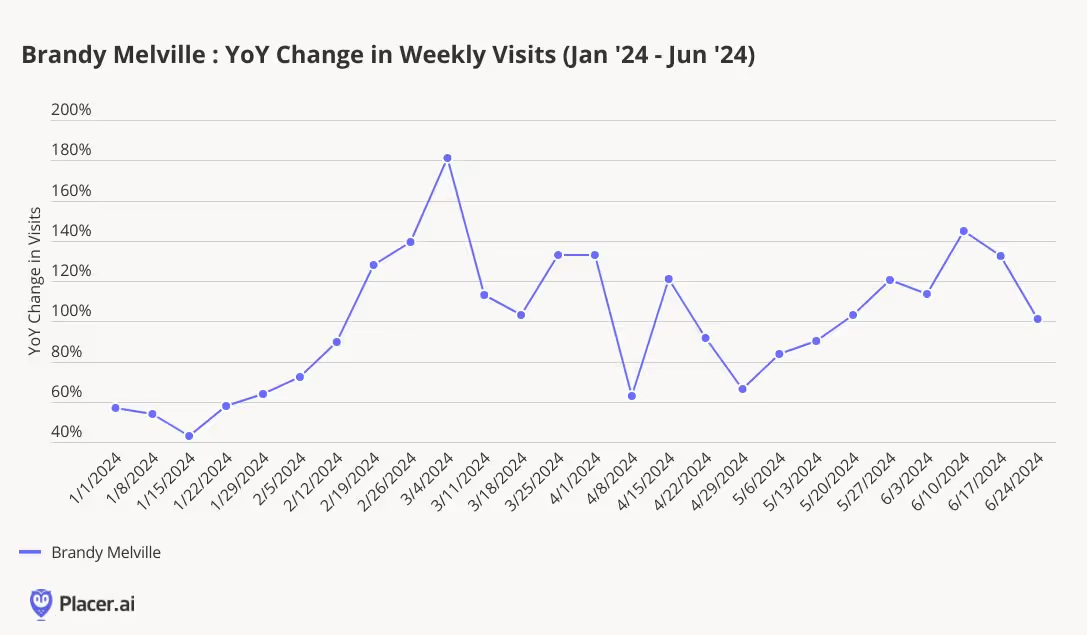

The tween apparel market today is highly fragmented, as is true with most areas of discretionary retail, with shoppers having access to countless brands and channels to choose from. Mass merchants, fast fashion, and athleisure brands are all vying for the attention of tweens, who are in turn influencing the retail decisions of their parents. A few months ago, we wrote about Brandy Melville, a somewhat controversial retailer that is still hugely popular with tweens. The retailer has the cool and elusive styling that young shoppers crave, and continues to be a strong traffic performer so far in 2024 (below). We’ve also written about the renaissance of Abercrombie & Fitch, another 2000’s brand with a strong connection to Millennials that has been able to recapture visitors’ attention, and still operates the Abercrombie Kids brand aimed at the same size range as the newly launched Limited Too.

Kohl’s new bet for the back-to-school season hangs on appealing to nostalgic Millennial parents, a group that quickly is becoming a target for many retailer strategies. We wrote last week about the rise of younger visitors to warehouse clubs, and the importance of younger shoppers to growing the member base. In a competitive and value-oriented retail environment, appealing to this group and gaining their loyalty in visits is critical to long-term success. It will be interesting to see if the Millennial love for Limited Too still remains, even after all these years.

Another year, another acquisition for casual-dining restaurant leader Darden Restaurants. Following up last year’s acquisition of Ruth’s Chris Steakhouse, Darden plans to acquire Chuy's for $605M (representing 10.3x Chuy’s trailing-twelve-month adjusted EBITDA of $59, or 8.2x adjusting for run-rate G&A costs that can be eliminated by adding Chuy’s to the Darden portfolio). Chuy’s is among the leading players in the Mexican casual-dining space in terms of revenue ($451M in revenue during 2023, adjusting for the extra week in the reporting calendar), average revenue per unit ($4.5M), and restaurant-level EBITDA (20%).

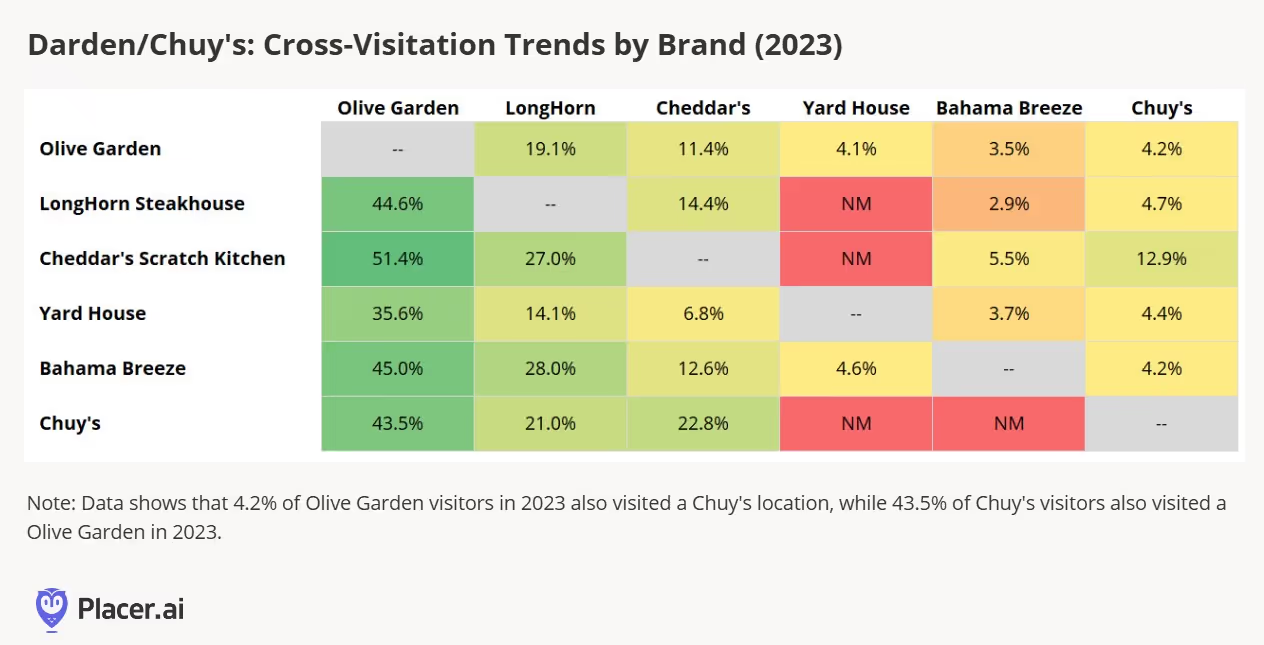

The acquisition of Chuy’s makes sense to us on a number of levels. First, and most obviously, Chuy’s fills a gap in the Darden portfolio. The company already owns the top player among casual-dining Italian chains (Olive Garden) and the number-two player in casual-dining steakhouses in addition to its other casual-dining (Cheddar’s, Yard House, Bahama Breeze) and fine-dining (Ruth’s Chris, The Capital Grille, Eddie V's, Seasons 52) concepts. By adding a casual-dining Mexican concept to its portfolio, we believe there will be an opportunity to attract incremental visitors. Below, we’ve presented cross visitation for Darden’s casual-dining brands and Chuy’s in 2023, and we see minimal overlap (although the cross-visit data is admittedly impacted by chain size and geography). According to our data, only 4%-5% of visitors to Darden’s existing restaurants also visited a Chuy’s location in 2023 (with the exception of Cheddar’s, which saw a 12.9% cross-visitation percentage).

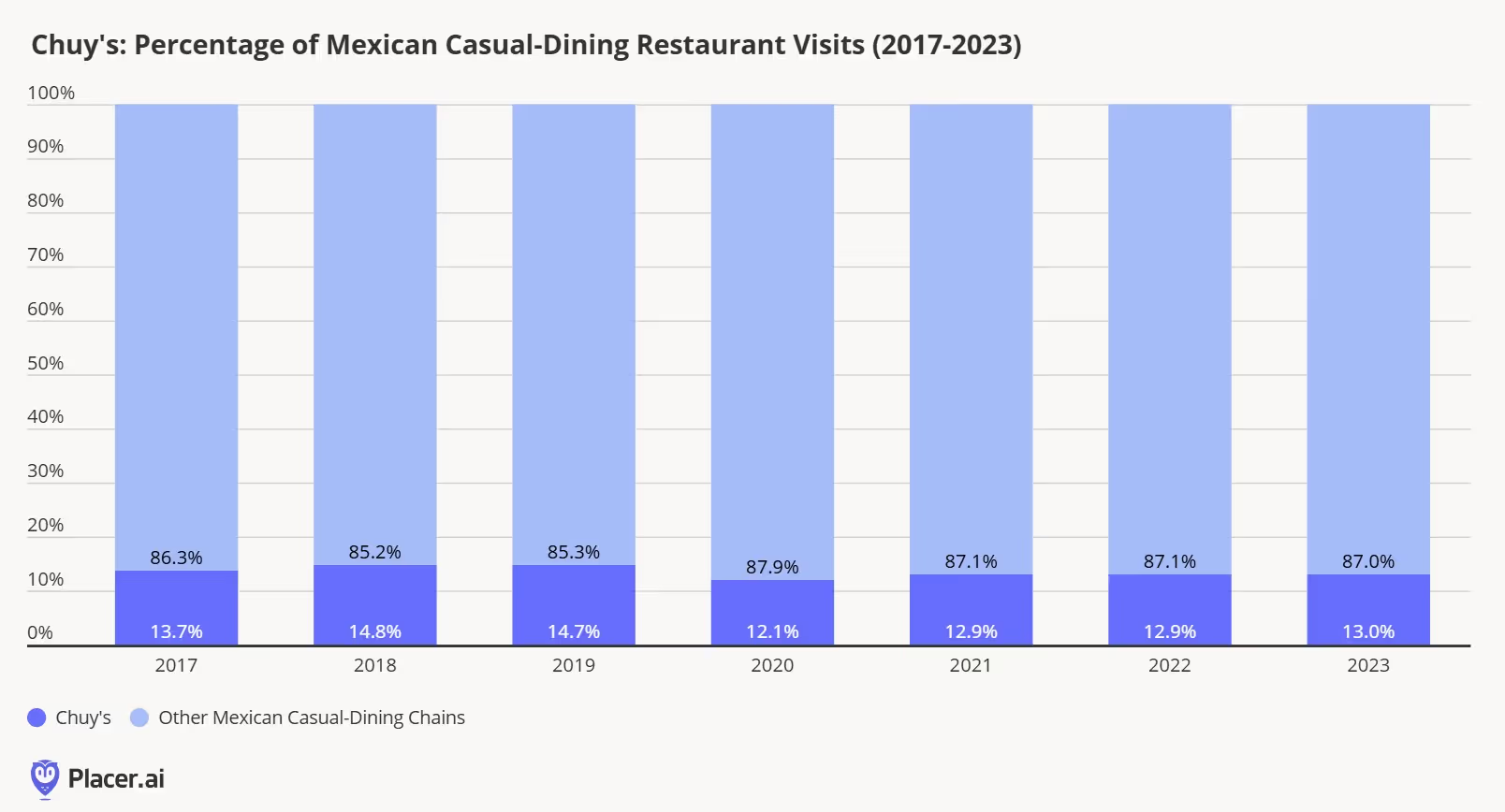

Second, despite Chuy’s being the leading player in the Mexican casual dining space, it’s still a relatively fragmented category that is ripe for consolidation. Below, we show the share of visitation data for Chuy’s compared to almost 20 other full-service Mexican restaurant chains from 2017-2023. Despite Chuy’s growth, its share of visits relative to the rest of the category has remained relatively healthy in the 12%-15% range. Backed by Darden’s purchasing, advertising, and real estate scale advantages, we see a meaningful opportunity to consolidate share of visits going forward, including visit per location improvement.

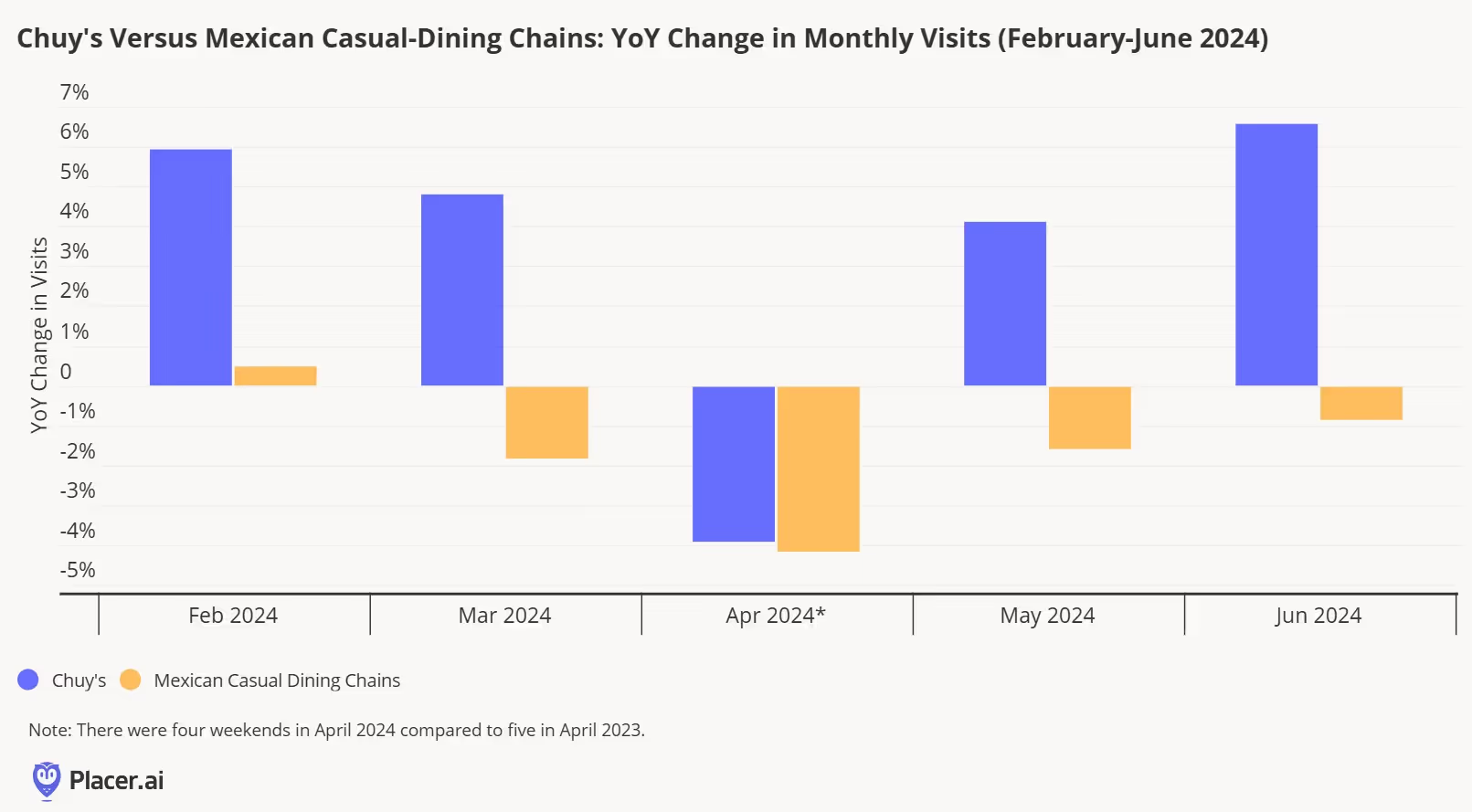

Chuy’s has been one of the leaders in the Mexican casual-dining chains in terms of visitation growth this year, outpacing monthly visits for the category by 5% on average (below). While integration will take time, applying guest experience, menu innovation, pricing, and marketing best practices from Darden should help to maintain this leadership.

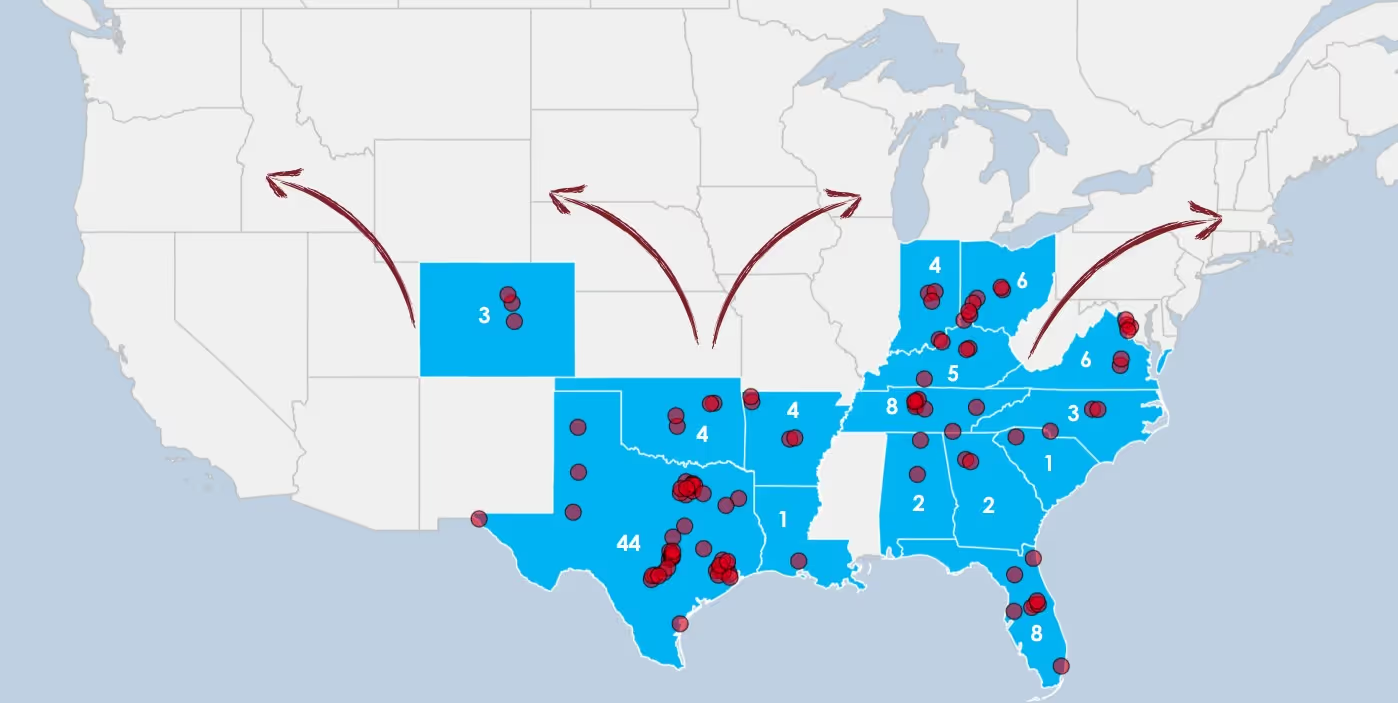

At 101 company-owned restaurants today, Chuy’s is comparable to several other brands in the Darden portfolio (including Yard House at 88 units and Ruth’s Chris at 79). The chain is well established in Texas (44 company-owned units) but has a relatively small presence in other states across the Southeast and Midwest (below).

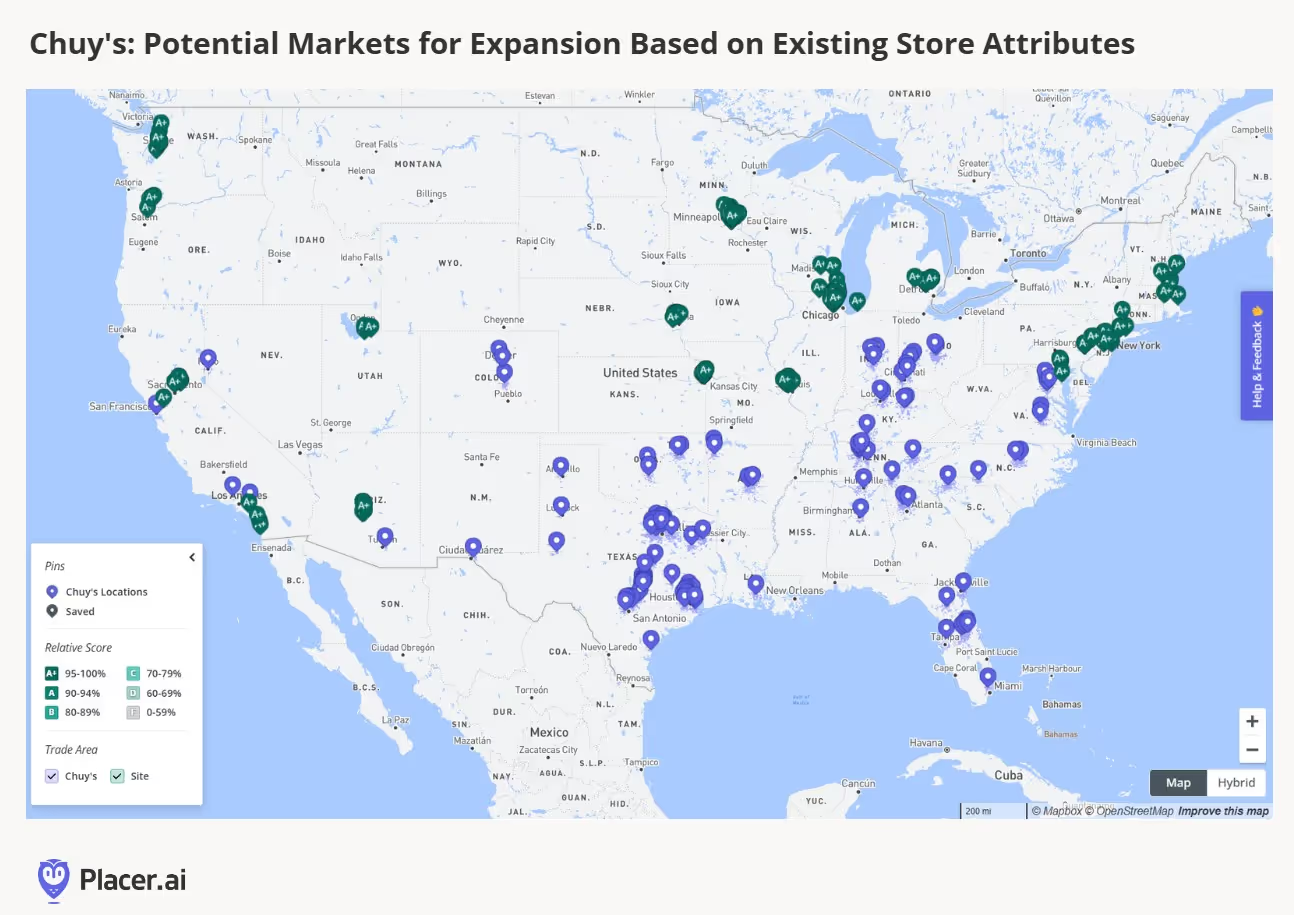

As Darden and Chuy’s management pointed out in a conference call to discuss the transaction, there are significant opportunities in both existing and new markets. Placer’s Site Selection tool (which identifies the characteristics of Chuy’s top locations–including trade area populations, demographic fit, cannibalization risk, and competition density–and finds markets/sites with similar characteristics) sees the best fits for expansion in several West, Midwest, and Northeast markets.

The first half of 2024 is proving to be more heavily visited for all types of shopping centers. June in particular is stronger than it was last year. After some January doldrums, where all shopping traffic was lower than the prior year due to weather, February began to pick up and March was particularly strong comparatively for outlet malls compared to last year. April saw a general downtick for more discretionary shopping, but May and June are looking strong so far.

The top 5 outlet malls by traffic during the last week of June were Arundel Mills, Ontario Mills, Sawgrass Mills, Legends Outlets Kansas City, and The Outlets at Orange. Among indoor malls, shoppers flocked to Mall of America, Roosevelt Field, Westfield Valley Fair, Del Amo Fashion Center, and Westfield Southcenter. Weather is always a consideration in the summer months, but as shopping centers have become increasingly sophisticated about strategically placed shade or places to take a break, it can be quite refreshing to visit an open-air lifestyle center. Tops in the nation for traffic include Ala Moana Center, Pier Park, Easton Town Center, Irvine Spectrum Center, and Victoria Gardens. As for high street retail corridors, no one can match the Big Apple. Three of the top five high streets were here, including Times Square and 42nd St at #1, SoHo at #3, and 5th Ave at #4. In second place was Michigan Ave in Chicago and in fifth place was Beverly Hills.

The first Lollapalooza – a four-day music festival – took place in 1991. Chicago’s Grant Park became the event’s permanent home (at least in the United States) in 2005, drawing thousands of revelers and music fans to the park each year.

This year, the festival once again demonstrated its powerful impact on the city. On August 1st, 2024, visits to Grant Park surged by 1,313.2% relative to the YTD daily average, as crowds converged on the park to see Chappell Roan’s much-anticipated performance. And during the first three days of the event, the event drew significantly more foot traffic than in 2023 – with visits up 18.9% to 35.9% compared to the first three days of last year’s festival (August 3rd to 5th, 2023).

Lollapalooza led to a dramatic spike in visits to Grant Park – and it also attracted a different type of visitor compared to the rest of the year.

Analyzing Grant Park’s captured market with Spatial.ai’s PersonaLive dataset reveals that Lollapalooza attendees are more likely to belong to the “Young Professionals” and “Ultra Wealthy Families” segment groups than the typical Grant Park visitor.

By contrast, the “Near-Urban Diverse Families” segment group, comprising middle-class diverse families living in or near cities, made up only 6.5% of visitors during the festival, compared to 12.0% during the rest of the year.

Additionally, visitors during Lollapalooza came from areas with higher HHIs than both the nationwide baseline of $76.1K and the average for park visitors throughout the year. Understanding the demographic profile of visitors to the park during Lollapalooza can help planners and city officials tailor future events to these segment groups – or look for ways to make the festival accessible to a wider range of music lovers.

Lollapalooza’s impact on Chicago extended beyond the boundaries of Grant Park, with nearby hotels seeing remarkable surges in foot traffic. The Congress Plaza Hotel on South Michigan Avenue witnessed a staggering 249.1% rise in visits during the week of July 29, 2024, compared to the YTD visit average. And Travelodge on East Harrison Street saw an impressive 181.8% increase. These spikes reflect the festival’s draw not just for locals but for out-of-town visitors who fill hotels across the city.

The North Michigan Avenue retail corridor also enjoyed a significant increase in foot traffic during the festival, with visits on Thursday, August 1st 56.0% higher than the YTD Thursday visit average. On Friday, August 2nd, visits to the corridor were 55.7% higher than the Friday visit average. These numbers highlight Lollapalooza’s role in driving economic activity across Chicago, as festival-goers venture beyond the park to explore the city’s vibrant retail and hospitality offerings.

City parks often serve as community hubs, and Flushing Meadows Corona Park in Queens, NY, has been a major gathering point for New Yorkers. The park hosted one of New York’s most beloved summer concerts – Governors Ball – which moved from Governors Island to Flushing Meadows in 2023.

During the festival (June 9th -11th, 2024), musicians like Post Malone and The Killers drew massive crowds to the park, with visits soaring to the highest levels seen all year. On June 9th, the opening day of the festival, foot traffic in the park was up 214.8% compared to the YTD daily average, and at its height, on June 8th, the festival drew 392.7% more visits than the YTD average.

The park also hosted other big events this summer – a July 21st set by DMC helped boost visits to 185.1% above the YTD average. And the Hong Kong Dragon Boat Festival on August 3rd and 4th led to major visit boosts of 221.4% and 51.6%, respectively.

These events not only draw large crowds, but also highlight the park’s role as a space where cultural and civic life can find expression, flourish, and contribute to the health of local communities.

Analyzing changes in Flushing Meadows Corona Park’s trade area size offers insight into how far people are willing to travel for these events. During Governors Ball, for example, the park’s trade area ballooned to 254.5 square miles, showing the festival's wide appeal. On July 20th, by contrast, when the park hosted several local bands and DJs, the trade area was a much more modest 57.0 square miles.

Summer events drive community engagement, economic activity, and civic pride. Cities that invest in their parks and event hubs, fostering lively and inclusive spaces, can create lasting value for both residents and visitors, enriching the cultural and social life of urban areas.

For more data-driven civic stories, visit Placer.ai.

The pandemic and economic headwinds that marked the past few years presented the multi-billion dollar hotel industry with significant challenges. But five years later, the industry is rallying – and some hotel segments are showing significant growth.

This white paper delves into location analytics across six major hotel categories – Luxury Hotels, Upper Upscale Hotels, Upscale Hotels, Upper Midscale Hotels, Midscale Hotels, and Economy Hotels – to explore the current state of the American hospitality market. The report examines changes in guest behavior, personas, and characteristics and looks at factors driving current visitation trends.

Overall, visits to hotels were 4.3% lower in Q2 2024 than in Q2 2019 (pre-pandemic). But this metric only tells part of the story. A deeper dive into the data shows that each hotel tier has been on a more nuanced recovery trajectory.

Economy chains – those offering the most basic accommodations at the lowest prices – saw visits down 24.6% in Q2 2024 compared to pre-pandemic – likely due in part to hotel closures that have plagued the tier in recent years. Though these chains were initially less impacted by the pandemic, they were dealt a significant blow by inflation – and have seen visits decline over the past three years. As hotels that cater to the most price-sensitive guests, these chains are particularly vulnerable to rising costs, and the first to suffer when consumer confidence takes a hit.

Luxury Hotels, on the other hand, have seen accelerated visit growth over the past year – and have succeeded in closing their pre-pandemic visit gap. Upscale chains, too, saw Q2 2024 visits on par with Q2 2019 levels. As tiers that serve wealthier guests with more disposable income, Luxury and Upscale Hotels are continuing to thrive in the face of headwinds.

But it is the Upper Midscale level – a tier that includes brands like Trademark Collection by Wyndham, Fairfield by Marriott, Holiday Inn Express by IHG Hotels & Resorts, and Hampton by Hilton – that has experienced the most robust visit growth compared to pre-pandemic. In Q2 2024, Upper Midscale Hotels drew 3.5% more visits than in Q2 2019. And during last year’s peak season (Q3 2023), Upper Midscale hotels saw the biggest visit boost of any analyzed tier.

As mid-range hotels that still offer a broad range of amenities, Upper Midscale chains strike a balance between indulgence and affordability. And perhaps unsurprisingly, hotel operators have been investing in this tier: In Q4 2023, Upper Midscale Hotels had the highest project count of any tier in the U.S. hotel construction and renovation pipeline.

The shift in favor of Upper Midscale Hotels and away from Economy chains is also evident when analyzing changes in relative visit share among the six hotel categories.

Upper Midscale hotels have always been major players: In H1 2019 they drew 28.7% of overall hotel visits – the most of any tier. But by H1 2024, their share of visits increased to 31.2%. Upscale Hotels – the second-largest tier – also saw their visit share increase, from 24.8% to 26.1%.

Meanwhile, Economy, Midscale, and Upper Upscale Hotels saw drops in visit share – with Economy chains, unsurprisingly, seeing the biggest decline. Luxury Hotels, for their parts, held firmly onto their piece of the pie, drawing 2.8% of visits in H1 2024.

Who are the visitors fueling the Upper Midscale visit revival? This next section explores shifts in visitor demographics to four Upper Midscale chains that are outperforming pre-pandemic visit levels: Trademark Collection by Wyndham, Holiday Inn Express by IHG Hotels & Resorts, Fairfield by Marriott, and Hampton by Hilton.

Analyzing the captured markets* of the four chains with demographics from STI: Popstats (2023) shows variance in the relative affluence of their visitor bases.

Fairfield by Marriott drew visitors from areas with a median household income (HHI) of $84.0K in H1 2024, well above the nationwide average of $76.1K. Hampton by Hilton and Trademark Collection by Wyndham, for their parts, drew guests from areas with respective HHIs of $79.6K and $78.5K – just above the nationwide average. Meanwhile, Holiday Inn Express by IHG Hotels & Resorts drew visitors from areas below the nationwide average.

But all four brands saw increases in the median HHIs of their captured markets over the past five years. This provides a further indication that it is wealthier consumers – those who have had to cut back less in the face of inflation – who are driving hotel recovery in 2024.

(*A chain’s captured market is obtained by weighting each Census Block Group (CBG) in its trade area according to the CBG’s share of visits to the chain – and so reflects the population that actually visits the chain in practice.)

Much of the Upper Midscale visit growth is being driven by chain expansion. But in some areas of the country, the average number of visits to individual hotel locations is also on the rise – highlighting especially robust growth potential.

Analyzing visits to existing Upper Midscale chains in four metropolitan areas with booming tourism industries – Salt Lake City, UT, Palm Bay, FL, San Diego, CA, and Richmond, VA – shows that these markets feature robust untapped demand.

Utah, for example, has emerged as a tourist hotspot in recent years – with millions of visitors flocking each year to local destinations like Salt Lake City to see the sights and take in the great outdoors. And Upper Midscale hotels in the region are reaping the benefits. In H1 2024, the overall number of visits to Upper Midscale chains in Salt Lake City was 69.4% higher than in H1 2019. Though some of this increase can be attributed to local chain expansion, the average number of visits to each individual Upper Midscale location in the area also rose by 12.5% over the same period.

Palm Bay, FL (the Space Coast) – another tourist favorite – is experiencing a similar trend. Between H1 2019 and H1 2024, overall visits to local Upper Midscale hotel chains grew by 36.4% – while the average number of visits per location increased a substantial 16.9%. Given this strong demand, it may come as no surprise that the area is undergoing a hotel construction boom. Upper Midscale hotels in other areas with flourishing tourism sectors, like San Diego, CA and Richmond, VA, are seeing similar trends, with increases in both overall visits and and in the average number of visits per location.

Though Economy chains have underperformed versus other categories in recent years, the tier does feature some bright spots. Some extended-stay brands in the Economy tier – hotels with perks and amenities that cater to the needs of longer-stay travelers – are succeeding despite category headwinds.

Choice Hotels’ portfolio, for example, includes WoodSpring Suites, an Economy chain offering affordable extended-stay accommodations in 35 states. In H1 2024, the chain drew 7.7% more visits than in the first half of 2019 – even as the wider Economy sector continued to languish. InTown Suites, another Economy extended stay chain, saw visits increase by 8.9% over the same period.

And location intelligence shows that the success of these two chains is likely being driven, in part, by their growing appeal to young, well-educated professionals. In H1 2019, households belonging to Spatial.ai: PersonaLive’s “Young Professionals” segment made up 9.6% of WoodSpring Suites’ captured market. But by H1 2024, the share of this group jumped dramatically to 13.3%. At the same time, InTown Suites saw its share of Young Professionals increase from 12.0% to 13.4%.

Whether due to an affinity for prolonged “workcations” (so-called “bleisure” excursions) or an embrace of super-commuting, younger guests have emerged as key drivers of growth for the extended stay segment. And by offering low–cost accommodations that meet the needs of these travelers, Economy chains can continue to grow their share of the pie.

The hospitality industry recovery continues – led by Upper Midscale Hotels, which offer elevated experiences that don’t break the bank. But today’s market has room for other tiers as well. By keeping abreast of local visitation patterns and changing consumer profiles, hotels across chain scales can personalize the visitor experience and drive customer satisfaction.

The past few years have provided the tourism sector with a multitude of headwinds, from pandemic-induced lockdowns to persistent inflation and a rise in extreme weather events. But despite these challenges, people are more excited than ever to travel – more than half of respondents to a recent survey are planning on increasing their travel budgets in the coming months.

And while revenge travel to overseas destinations is still very much alive and well, the often high costs associated with traveling abroad are shaping the way people choose to travel. Domestic travel and tourism are seeing significant growth as more affordable alternatives.

This white paper takes a closer look at two of the most popular domestic tourism destinations in the country – New York City and Los Angeles. Over the past year, both cities have continued to be leading tourism hotspots, offering a wealth of attractions for visitors. What does tourism to these two cities look like in 2024, and what has changed since before the pandemic? How have inflation and rising airfare prices affected the demographics and psychographics of visitors to these major hubs?

Analyzing the distribution of domestic tourists across CBSAs nationwide from May 2023 to April 2024 reveals New York and Los Angeles to be two of the nation’s most popular destinations. (Tourists include overnight visitors staying in a given CBSA for up to 31 days).

The New York-Newark-Jersey City, NY-NJ-PA metro area drew the largest share of domestic tourists of any CBSA during the analyzed period (2.7%), followed closely by the Los Angeles-Long Beach-Anaheim, CA CBSA (2.5%). Other domestic tourism hotspots included Orlando-Kissimmee-Sanford, FL (tied for second place with 2.5% of visitors), Dallas-Fort Worth-Arlington, TX (1.9%), Las Vegas-Henderson-Paradise, NV (1.8%), Miami-Fort Lauderdale-Pompano Beach, FL (1.8%), and Chicago-Naperville, Elgin, IL-IN-WI (1.6%).

The Big Apple. The City That Never Sleeps. Empire City. Whatever it’s called, New York City remains one of the most well-known tourist destinations in the world. And for many Americans, New York is the perfect place for an extended weekend getaway – or for a multi-day excursion to see the sights.

But where do these NYC-bound vacationers come from? Diving into the data on the origin of visitors making medium-length trips to New York City (three to seven nights) reveals that increasingly, these domestic tourists are coming from nearby metro areas.

Between 2018-2019 and 2023-2024, for example, the number of tourists visiting New York City from the Philadelphia metro area increased by 19.2%.

The number of tourists coming from the Boston and Washington, D.C metro areas, and from the New York CBSA itself (New York-Newark-Jersey City, NY-NJ-PA) also increased over the same period.

Meanwhile, further-away CBSAs like San Francisco-Oakland-Berkeley, CA, Atlanta-Sandy Springs-Alpharetta, GA, and Miami-Fort Lauderdale-Pompano Beach, FL fed fewer tourists to NYC in 2023-2024 than they did pre-pandemic. It seems that residents of these more distant metro areas are opting for vacation destinations closer to home to avoid the high costs of air travel.

Diving even deeper into the characteristics of visitors taking medium-length trips to New York City reveals another demographic shift: Tourists staying between three and seven nights in the Big Apple are skewing younger.

Between 2018-2019 and 2023-2024, the share of visitors to New York City from areas with median ages under 30 grew from 2.1% to 4.5%. Meanwhile, the share of visitors from areas with median ages between 31 and 40 increased from 34.3% to 37.7%.

The impact of this trend is already being felt in the Big Apple, with The Broadway League reporting that the average age of audiences to its shows during the 2022- 2023 season was the youngest it had been in 20 seasons.

The shift towards younger tourists can also be seen when examining the psychographic makeup of visitors to popular attractions in New York City. Analyzing the captured markets of major NYC landmarks with data from Spatial.ai’s PersonaLive dataset reveals an increase in households belonging to the “Educated Urbanites” segment between 2018-2019 and 2023-2024.

These well-educated, young singles are increasingly visiting iconic NYC venues such as the Whitney Museum of American Art, The Metropolitan Museum of Art, The American Museum of Natural History, and the Statue of Liberty. This shift highlights the growing popularity of these attractions among young, educated singles, reflecting a broader trend of increased domestic tourism among this demographic.

New York City’s tourism sector is adapting to meet the changing needs of travelers, fueled increasingly by younger visitors who may be unable to take a costly international vacation. How have travel patterns to Los Angeles changed in response to increasing travel costs?

While New York City is the East Coast’s tourism hotspot, Los Angeles takes center stage on the West Coast. And as overseas travel has become increasingly out of reach for Americans with less discretionary income, the share of domestic tourists originating from areas with lower HHIs has risen.

Before the pandemic, 57.6% of visitors to LA came from affluent areas with median household incomes (HHIs) of over $90K/year. But by 2023-2024, this share decreased to 50.7%. Over the same period, the share of visitors from areas with median HHIs between $41K and $60K increased from 9.7% to 12.5%, while the share of visitors from areas with HHIs between $61K and $90K rose from 32.1% to 35.8%.

Diving into the psychographic makeup of visitors to popular Los Angeles attractions – Universal Studios Hollywood, Disneyland California, the Santa Monica Pier, and Griffith Observatory – also reflects the above-mentioned shift in HHI. The captured markets of these attractions had higher shares of middle-income households belonging to the “Family Union” psychographic segment in 2023-2024 than in 2018-2019.

Experian: Mosaic defines this segment as “middle income, middle-aged families living in homes supported by solid blue-collar occupations.” Pre-pandemic, 16.0% of visitors to Universal Studios Hollywood came from trade areas with high shares of “Family Union” households. This number jumped to 18.8% over the past year. A similar trend occurred at Disneyland, Santa Monica Pier, and Griffith Observatory.

And like in New York City, growing numbers of visitors to Los Angeles appear to be coming from nearby areas. Between 2018-2019 and 2023-2024, the share of in-state visitors to major Los Angeles attractions increased substantially – as people likely sought to cut costs by keeping things local.

Pre-pandemic, for example, 68.9% of visitors to Universal Studios Hollywood came from within California – a share that increased to 72.0% over the past year. Similarly, 59.7% of Griffith Observatory visitors in 2018-2019 came from within the state – and by 2023-2024, that number grew to 64.7%.

Even when times are tight, people love to travel – and New York and Los Angeles are two of their favorite destinations. With prices for airfare, hotels, and dining out increasing across the board, younger and more price-conscious households are adapting, choosing to visit nearby cities and enjoy attractions closer to home. And as the tourism industry continues its recovery, understanding emerging visitation trends can help stakeholders meet travelers where they are.