.svg)

.png)

.png)

.png)

.png)

July has become a heavy hitter in the retail calendar as retailers battle for consumers' attention and spending. Promotional activity during this month is incredibly high as the industry enters the back-to-school season and debut of pre-fall collections. However, one promotional event has long held the top spot in July, with its history pre-dating Prime Day and other retailer deal day events: The Nordstrom Anniversary Sale.

The Anniversary Sale’s premise is unique compared to other promotional events across the retail calendar; most items included in the event are exclusive to Nordstrom and typically the discounts are on new releases instead of previously released mark downs. The sale has become a signal of the changing of seasons as consumers prepare their fall wardrobes. Over the years, it has provided incredible insight into the psyche of the consumer and the impact of social media influencers on the retail industry.

The annual event has undergone some major changes over the last decade. Nordstrom was quick to embrace the power of social media influencers, and the Anniversary Sale gave influencers incredible opportunities to drive conversion from themselves and the retailer, and in return, receive high commissions. It wasn’t uncommon for user generated content to skyrocket with influencers posting hauls of their Anniversary Sale finds and deals. However, the commission structure has evolved over time, and the retailer has seemingly shifted its focus away from content creators as the primary driver of consumer engagement.

This year marked the longest public Anniversary Sale, which ran from July 12th through August 3rd. (Any consumer can shop at Nordstrom during the public Anniversary sale, but Nordstrom cardmembers usually have early access to the sale, and pre-sale lengths have fluctuated over the years). This year had 23 sale days, compared to 21 in 2023 & 2024, 17 in 2019 and 2022, and 12 in 2021, which may have been impacted by pandemic induced supply chain issues.

Looking at overall visitation for the event, traffic was up 17% compared to 2024 and 15% compared to 2023, but that does account for the two extra days of the sale. On a more comparable basis, the average visits per day of the 2025 Anniversary Sale were up 7% vs. 2024 and up 5% vs. 2023, respectively, highlighting that 2025 did bring a higher volume of average visitors per day, despite the longer sale period. But average visits per day during the sale were below 2019, 2021 and 2022 levels, when influencer marketing around the event was much higher than it is today.

Still, Nordstrom has regained its footing with many consumers over the past year, and that combined with consumers' desire for value across retail may have contributed to this year’s higher volume of visits compared to the past few years.

Another interesting outcome from this year? The percentage of visits during the weekend was higher in 2025 than all previous years reviewed. The public sale did start on a Saturday this year, which could have had an impact, but it also indicates that consumers might have been looking to the sale as an event to plan their shopping around, instead of a quick stop off during the week. Beginning the sale on Saturday may have moved the needle to drum up shopper excitement and incentivize visitors to shop on the first day of the event.

Consumers of all segments are increasing their appetite for value across the retail industry, and it appears that the Anniversary Sale was primed to welcome wealthy shoppers who wanted to score this year’s trends and designers at a lower price point. According to PersonaLive consumer segmentation, 2025 saw a higher distribution of visits from Ultra Wealthy Families & Wealth Suburban Families than the previous two sale events. There may have been fewer aspirational shoppers this year as well, concentrating visits with consumers who have higher levels of disposable income.

There was also an increase in the share of visits by older consumer segments at the expense of younger shoppers, which is interesting considering potential differences in consumer sentiment between generations and less emphasis on marketing the sale through social media.

Overall, the success of this year’s Anniversary Sale from a visitation perspective is encouraging, as many retailers contend with rising prices and waning consumer demand for discretionary goods. The strong visitation trends during the early back-to-school period highlight the brand value and positive consumer perception that the retailer has successfully cultivated in recent years. Nordstrom has found the formula to engage and retain shoppers, and it’s no wonder that we selected it as a Ten Top Brand to Watch for 2025.

Retailers have to be more creative to drive consumer activity in-store for the remainder of the year, but exclusivity might just be the key to success as evidenced by the Anniversary Sale performance.

To see up-to-date retail traffic trends, visit our free tools.

In June and July 2025, visits to Placer’s Industrial Manufacturing Composite Index grew 3.0% and 2.3% year over year (YoY), respectively, as supply chains raced against the clock to build inventory in advance of the new tariffs set to come into effect on August 7th. But as the deadline approached, YoY visits to these sites by employees and logistics partners began to decline, dropping to 4.2% YoY during the week of August 11th, 2025.

The timing of this decline, occurring just days after tariff implementation, points to manufacturers potentially working through stockpiled inventory and reassessing supply chain strategies under the new cost structure. While it's still early to determine whether this represents a temporary recalibration or the beginning of a more sustained slowdown, the data suggests that the manufacturing sector is entering a period of adjustment as businesses adapt to the new tariff environment.

Bath & Body Works emerged as a surprise retail winner in February 2025’s Placer 100 roundup, when overall visits to the chain jumped by 13.7% YoY in conjunction with its Disney-themed fragrance release. And the chain is maintaining its relevance in the face of declining discretionary spending and tighter consumer budgets through a multi-pronged approach, including store expansions, a TikTok presence, and partnerships with influencers.

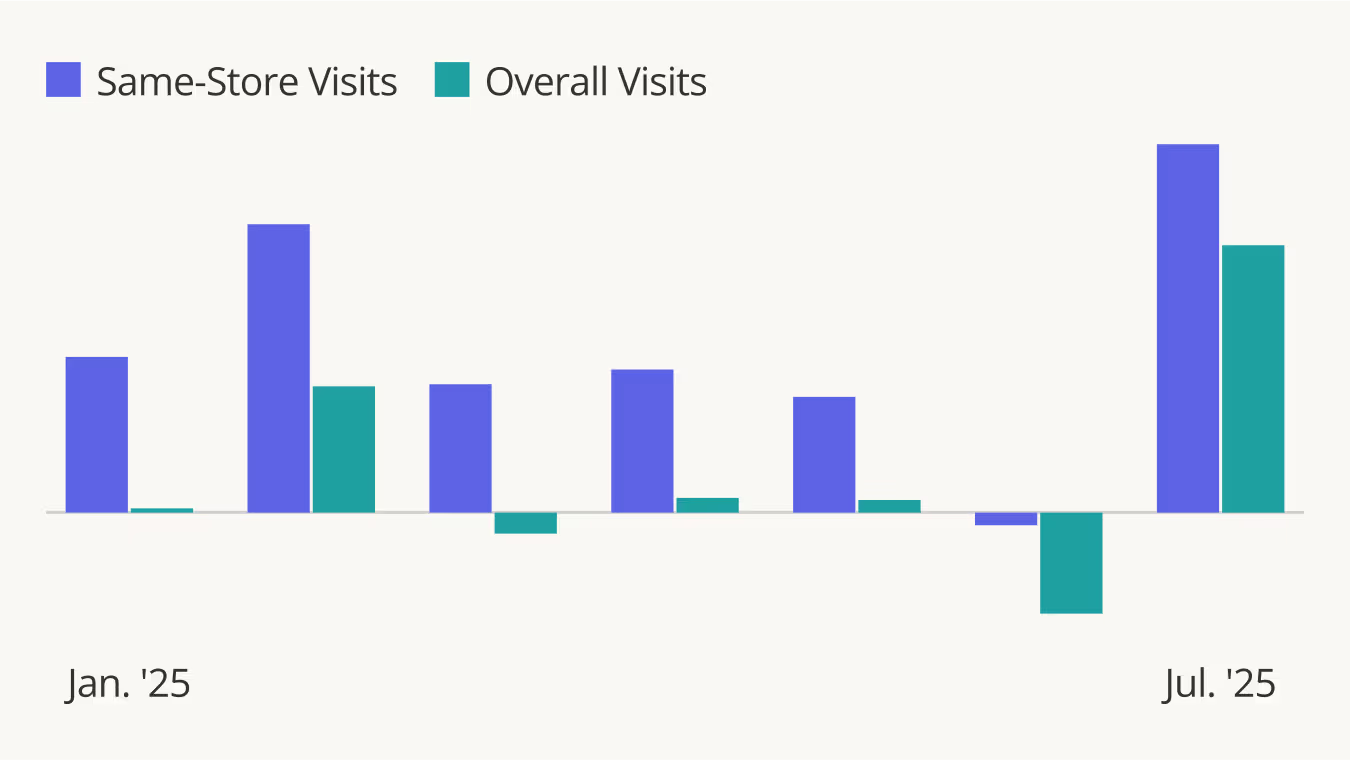

Still, traffic to the chain reflects the impact of softened discretionary spending. Although overall traffic increased 3.5% in Q2 2025 compared to Q2 2024, thanks in part to the chain's strategic expansion, same-store visits for the quarter fell slightly, as seen in the chart below. But foot traffic rebounded dramatically in July, when its semi-annual sale sent same-store visits up by 12.7% and overall visits up by 17.5%, highlighting how compelling promotions – especially when consumer budgets are tight – can lead to foot traffic spikes.

Visit Placer.ai/anchor for the latest data-driven retail insights.

The beauty industry continues to flourish, with external factors like the rise of #BeautyTok, the influence of online creators, and a steady stream of new products driving interest. Within this landscape, Ulta (ULTA) has been driving strong sales, capitalizing on continued interest in beauty to fuel this growth.

Following major gains through the pandemic years and beyond, Ulta's visits have flattened slightly. In Q2 2025, overall visits to the chain grew by 1.4% year over year (YoY), likely thanks to store openings (Ulta opened 62 new stores between Q1 2024 and Q1 2025), as same-store visits declined by 1.1% in the same period.

Despite softer same-store foot traffic as seen in the chart below, Ulta delivered strong comp sales growth of 2.9% last quarter, driven by a 2.3% rise in average ticket size and a 10.0% increase in e-commerce sales. Now, the chain seems to be entering a new phase of its story, choosing to wind down its Target partnership in favor of its Ulta Beauty Unleashed growth plan.

As Ulta’s growth momentum slows, its decision not to renew its six-year partnership with Target may be a strategic move to direct traffic to its growing store fleet.

The partnership launched in 2021 with the goals of making prestige beauty more accessible to Target shoppers while helping Ulta "deepen loyalty with existing guests and introduce Ulta Beauty to new guests." And, at least for Ulta, the strategy seems to have worked – the share of Target shoppers also visiting Ulta stores has increased significantly since the launch, as seen in the chart below. This suggests that the Ulta shop-in-shops helped the chain acquire new customers through the brand exposure generated by the partnership.

But the data also suggests that the benefits to Ulta may be diminishing. Since 2023, the share of Target shoppers also visiting Ulta appears to have plateaued around 30%, indicating that the shop-in-shops are no longer driving meaningful traffic to stand-alone Ulta stores. Meanwhile, Ulta now has a larger store fleet than it did in 2021 (the company opened approximately 150 new stores between Q2 2021 and Q1 2025). This expansion likely also contributed to increased cross-visitation while reducing the partnership's value proposition, as beauty consumers now have more opportunities to visit standalone Ulta stores. With the partnership's customer acquisition benefits plateauing and Ulta's expanded footprint reducing reliance on Target's locations, ending the collaboration appears to be a logical step toward maximizing traffic to Ulta's own stores.

Now, both brands have new opportunities to focus on their relative strengths. For Ulta, that means building out its Ulta Beauty Unleashed program, which will see the brand focus on improving store operations, enhancing the digital experience, and moving into new markets. Meanwhile, incoming Target CEO Michael Fiddelke plans to take the company back to its roots, focusing on its own merchandise and using technology to improve efficiency.

As Ulta transitions away from its Target partnership and focuses on its Ulta Beauty Unleashed growth plan, the company is well-positioned to capitalize on expanding store operations, enhanced digital experiences, and entry into new markets.

For the latest data-driven retail insights, visit Placer.ai/anchor.

Dollar General and Dollar Tree have grown significantly in recent years, upending the competitive dynamics in the wider retail landscape. Can these chains continue to grow? Or are they beginning to reach their saturation point? We dove into the data to find out.

Dollar Tree recently completed the sale of the Family Dollar brand, allowing management to dedicate its efforts to "Dollar Tree's long-term growth, profitability and returns on capital."

The strategic refocus appears to be already paying off. As the chart below shows, year-over-year (YoY) overall and same-store visits to the chain have surged in recent months, indicating strong organic performance amplified by fleet expansion.

Meanwhile, Dollar General is also experiencing traffic growth – though momentum has cooled slightly. After posting a robust 12.2% visit increase between July 2023 and July 2024, growth has decelerated to 2.9% year-over-year in July 2025.

Still, although Dollar General's growth has slowed while Dollar Tree's growth has picked up, Dollar General remains the significantly larger chain. In H1 2025, 58.7% of combined visits to the two retailers went to Dollar General, compared to 41.3% of visits to Dollar Tree. And just because Dollar General's growth has slowed somewhat does not mean that the company has reached its saturation point.

Even though both chains have been growing for several years, geographic data reveals that domestic expansion opportunities for both retailers still exist.

The map below shows the share of combined visits to Dollar General and Dollar Tree going to each chain by DMA. Dollar Tree receives a majority of visits in the yellow DMAs, which are heavily concentrated in the Western United States. In contrast, Dollar General receives the majority of visits in the purple DMAs which cover most of the Midwest and South.

This distinct geographic segmentation indicates that rather than competing head-to-head, each chain has built regional strongholds – creating significant white space opportunities for cross-regional expansion. Dollar Tree's renewed focus and accelerating traffic position it well to build up its position in the South and Midwest – Dollar General's traditional markets. Conversely, Dollar General's established operational scale and proven rural market penetration strategy could drive significant growth for the chain in Dollar Tree's Western strongholds.

Dollar Tree’s sharpened focus and accelerating traffic growth signal strong long-term potential, while Dollar General’s scale ensures it remains a formidable player despite cooling momentum. With distinct geographic strongholds, both retailers still have significant white space for expansion – setting the stage for continued growth rather than saturation.

For the most up-to-date superstore visit data, check out Placer.ai's free tools.

Value-oriented retailers Ollie's Bargain Market (OLLI) and Five Below (FIVE) continue their impressive growth trajectory, with Q2 2025 visits surging 18.3% and 14.3% year-over-year, respectively.

Both chains are aggressively expanding their footprints – Ollie's acquired around 40 Big Lots leases and opened 25 of its projected 75 new stores by May 2025, while Five Below plans to add 150 locations this year after opening hundreds in 2024. Critically, the expansions are not coming at the expense of existing stores. Same-store visits grew 9.4% at Ollie's and 5.9% at Five Below, meaning individual locations are actually busier now than last year – despite the larger fleet size.

These positive traffic trends underscore the strong consumer appetite for value-oriented discretionary retail in today's economic environment and highlight the growth potential of the two chains.

Five Below and Ollie's positive visit trends demonstrate that growth doesn't have to be zero-sum. Rather than cannibalizing each other's traffic, both chains are successfully growing in parallel, as their increased store presence and busier locations expand the overall value-oriented discretionary retail market.

This growth can also be seen from the cross-visitation data in the chart below. H1 2025 saw the largest share of Ollie's shoppers visiting Five Below and the largest share of Five Below shoppers visiting Ollie's in recent years. (The cross-visitation from Ollie's to Five Below was likely significantly higher than the reverse due to Five Below's much larger physical footprint.)

This rising cross-visitation between the two chains validates the expanding market opportunity for value-oriented discretionary retail, as consumers increasingly embrace multiple value-oriented shopping destinations to meet their needs.

The strong performance of Five Below and Ollie's in Q2 2025 demonstrates the resilience and growth potential of the discount retail sector during challenging economic times.

Visit Placer.ai/anchor for the latest data-driven retail insights.

The pandemic and economic headwinds that marked the past few years presented the multi-billion dollar hotel industry with significant challenges. But five years later, the industry is rallying – and some hotel segments are showing significant growth.

This white paper delves into location analytics across six major hotel categories – Luxury Hotels, Upper Upscale Hotels, Upscale Hotels, Upper Midscale Hotels, Midscale Hotels, and Economy Hotels – to explore the current state of the American hospitality market. The report examines changes in guest behavior, personas, and characteristics and looks at factors driving current visitation trends.

Overall, visits to hotels were 4.3% lower in Q2 2024 than in Q2 2019 (pre-pandemic). But this metric only tells part of the story. A deeper dive into the data shows that each hotel tier has been on a more nuanced recovery trajectory.

Economy chains – those offering the most basic accommodations at the lowest prices – saw visits down 24.6% in Q2 2024 compared to pre-pandemic – likely due in part to hotel closures that have plagued the tier in recent years. Though these chains were initially less impacted by the pandemic, they were dealt a significant blow by inflation – and have seen visits decline over the past three years. As hotels that cater to the most price-sensitive guests, these chains are particularly vulnerable to rising costs, and the first to suffer when consumer confidence takes a hit.

Luxury Hotels, on the other hand, have seen accelerated visit growth over the past year – and have succeeded in closing their pre-pandemic visit gap. Upscale chains, too, saw Q2 2024 visits on par with Q2 2019 levels. As tiers that serve wealthier guests with more disposable income, Luxury and Upscale Hotels are continuing to thrive in the face of headwinds.

But it is the Upper Midscale level – a tier that includes brands like Trademark Collection by Wyndham, Fairfield by Marriott, Holiday Inn Express by IHG Hotels & Resorts, and Hampton by Hilton – that has experienced the most robust visit growth compared to pre-pandemic. In Q2 2024, Upper Midscale Hotels drew 3.5% more visits than in Q2 2019. And during last year’s peak season (Q3 2023), Upper Midscale hotels saw the biggest visit boost of any analyzed tier.

As mid-range hotels that still offer a broad range of amenities, Upper Midscale chains strike a balance between indulgence and affordability. And perhaps unsurprisingly, hotel operators have been investing in this tier: In Q4 2023, Upper Midscale Hotels had the highest project count of any tier in the U.S. hotel construction and renovation pipeline.

The shift in favor of Upper Midscale Hotels and away from Economy chains is also evident when analyzing changes in relative visit share among the six hotel categories.

Upper Midscale hotels have always been major players: In H1 2019 they drew 28.7% of overall hotel visits – the most of any tier. But by H1 2024, their share of visits increased to 31.2%. Upscale Hotels – the second-largest tier – also saw their visit share increase, from 24.8% to 26.1%.

Meanwhile, Economy, Midscale, and Upper Upscale Hotels saw drops in visit share – with Economy chains, unsurprisingly, seeing the biggest decline. Luxury Hotels, for their parts, held firmly onto their piece of the pie, drawing 2.8% of visits in H1 2024.

Who are the visitors fueling the Upper Midscale visit revival? This next section explores shifts in visitor demographics to four Upper Midscale chains that are outperforming pre-pandemic visit levels: Trademark Collection by Wyndham, Holiday Inn Express by IHG Hotels & Resorts, Fairfield by Marriott, and Hampton by Hilton.

Analyzing the captured markets* of the four chains with demographics from STI: Popstats (2023) shows variance in the relative affluence of their visitor bases.

Fairfield by Marriott drew visitors from areas with a median household income (HHI) of $84.0K in H1 2024, well above the nationwide average of $76.1K. Hampton by Hilton and Trademark Collection by Wyndham, for their parts, drew guests from areas with respective HHIs of $79.6K and $78.5K – just above the nationwide average. Meanwhile, Holiday Inn Express by IHG Hotels & Resorts drew visitors from areas below the nationwide average.

But all four brands saw increases in the median HHIs of their captured markets over the past five years. This provides a further indication that it is wealthier consumers – those who have had to cut back less in the face of inflation – who are driving hotel recovery in 2024.

(*A chain’s captured market is obtained by weighting each Census Block Group (CBG) in its trade area according to the CBG’s share of visits to the chain – and so reflects the population that actually visits the chain in practice.)

Much of the Upper Midscale visit growth is being driven by chain expansion. But in some areas of the country, the average number of visits to individual hotel locations is also on the rise – highlighting especially robust growth potential.

Analyzing visits to existing Upper Midscale chains in four metropolitan areas with booming tourism industries – Salt Lake City, UT, Palm Bay, FL, San Diego, CA, and Richmond, VA – shows that these markets feature robust untapped demand.

Utah, for example, has emerged as a tourist hotspot in recent years – with millions of visitors flocking each year to local destinations like Salt Lake City to see the sights and take in the great outdoors. And Upper Midscale hotels in the region are reaping the benefits. In H1 2024, the overall number of visits to Upper Midscale chains in Salt Lake City was 69.4% higher than in H1 2019. Though some of this increase can be attributed to local chain expansion, the average number of visits to each individual Upper Midscale location in the area also rose by 12.5% over the same period.

Palm Bay, FL (the Space Coast) – another tourist favorite – is experiencing a similar trend. Between H1 2019 and H1 2024, overall visits to local Upper Midscale hotel chains grew by 36.4% – while the average number of visits per location increased a substantial 16.9%. Given this strong demand, it may come as no surprise that the area is undergoing a hotel construction boom. Upper Midscale hotels in other areas with flourishing tourism sectors, like San Diego, CA and Richmond, VA, are seeing similar trends, with increases in both overall visits and and in the average number of visits per location.

Though Economy chains have underperformed versus other categories in recent years, the tier does feature some bright spots. Some extended-stay brands in the Economy tier – hotels with perks and amenities that cater to the needs of longer-stay travelers – are succeeding despite category headwinds.

Choice Hotels’ portfolio, for example, includes WoodSpring Suites, an Economy chain offering affordable extended-stay accommodations in 35 states. In H1 2024, the chain drew 7.7% more visits than in the first half of 2019 – even as the wider Economy sector continued to languish. InTown Suites, another Economy extended stay chain, saw visits increase by 8.9% over the same period.

And location intelligence shows that the success of these two chains is likely being driven, in part, by their growing appeal to young, well-educated professionals. In H1 2019, households belonging to Spatial.ai: PersonaLive’s “Young Professionals” segment made up 9.6% of WoodSpring Suites’ captured market. But by H1 2024, the share of this group jumped dramatically to 13.3%. At the same time, InTown Suites saw its share of Young Professionals increase from 12.0% to 13.4%.

Whether due to an affinity for prolonged “workcations” (so-called “bleisure” excursions) or an embrace of super-commuting, younger guests have emerged as key drivers of growth for the extended stay segment. And by offering low–cost accommodations that meet the needs of these travelers, Economy chains can continue to grow their share of the pie.

The hospitality industry recovery continues – led by Upper Midscale Hotels, which offer elevated experiences that don’t break the bank. But today’s market has room for other tiers as well. By keeping abreast of local visitation patterns and changing consumer profiles, hotels across chain scales can personalize the visitor experience and drive customer satisfaction.

The past few years have provided the tourism sector with a multitude of headwinds, from pandemic-induced lockdowns to persistent inflation and a rise in extreme weather events. But despite these challenges, people are more excited than ever to travel – more than half of respondents to a recent survey are planning on increasing their travel budgets in the coming months.

And while revenge travel to overseas destinations is still very much alive and well, the often high costs associated with traveling abroad are shaping the way people choose to travel. Domestic travel and tourism are seeing significant growth as more affordable alternatives.

This white paper takes a closer look at two of the most popular domestic tourism destinations in the country – New York City and Los Angeles. Over the past year, both cities have continued to be leading tourism hotspots, offering a wealth of attractions for visitors. What does tourism to these two cities look like in 2024, and what has changed since before the pandemic? How have inflation and rising airfare prices affected the demographics and psychographics of visitors to these major hubs?

Analyzing the distribution of domestic tourists across CBSAs nationwide from May 2023 to April 2024 reveals New York and Los Angeles to be two of the nation’s most popular destinations. (Tourists include overnight visitors staying in a given CBSA for up to 31 days).

The New York-Newark-Jersey City, NY-NJ-PA metro area drew the largest share of domestic tourists of any CBSA during the analyzed period (2.7%), followed closely by the Los Angeles-Long Beach-Anaheim, CA CBSA (2.5%). Other domestic tourism hotspots included Orlando-Kissimmee-Sanford, FL (tied for second place with 2.5% of visitors), Dallas-Fort Worth-Arlington, TX (1.9%), Las Vegas-Henderson-Paradise, NV (1.8%), Miami-Fort Lauderdale-Pompano Beach, FL (1.8%), and Chicago-Naperville, Elgin, IL-IN-WI (1.6%).

The Big Apple. The City That Never Sleeps. Empire City. Whatever it’s called, New York City remains one of the most well-known tourist destinations in the world. And for many Americans, New York is the perfect place for an extended weekend getaway – or for a multi-day excursion to see the sights.

But where do these NYC-bound vacationers come from? Diving into the data on the origin of visitors making medium-length trips to New York City (three to seven nights) reveals that increasingly, these domestic tourists are coming from nearby metro areas.

Between 2018-2019 and 2023-2024, for example, the number of tourists visiting New York City from the Philadelphia metro area increased by 19.2%.

The number of tourists coming from the Boston and Washington, D.C metro areas, and from the New York CBSA itself (New York-Newark-Jersey City, NY-NJ-PA) also increased over the same period.

Meanwhile, further-away CBSAs like San Francisco-Oakland-Berkeley, CA, Atlanta-Sandy Springs-Alpharetta, GA, and Miami-Fort Lauderdale-Pompano Beach, FL fed fewer tourists to NYC in 2023-2024 than they did pre-pandemic. It seems that residents of these more distant metro areas are opting for vacation destinations closer to home to avoid the high costs of air travel.

Diving even deeper into the characteristics of visitors taking medium-length trips to New York City reveals another demographic shift: Tourists staying between three and seven nights in the Big Apple are skewing younger.

Between 2018-2019 and 2023-2024, the share of visitors to New York City from areas with median ages under 30 grew from 2.1% to 4.5%. Meanwhile, the share of visitors from areas with median ages between 31 and 40 increased from 34.3% to 37.7%.

The impact of this trend is already being felt in the Big Apple, with The Broadway League reporting that the average age of audiences to its shows during the 2022- 2023 season was the youngest it had been in 20 seasons.

The shift towards younger tourists can also be seen when examining the psychographic makeup of visitors to popular attractions in New York City. Analyzing the captured markets of major NYC landmarks with data from Spatial.ai’s PersonaLive dataset reveals an increase in households belonging to the “Educated Urbanites” segment between 2018-2019 and 2023-2024.

These well-educated, young singles are increasingly visiting iconic NYC venues such as the Whitney Museum of American Art, The Metropolitan Museum of Art, The American Museum of Natural History, and the Statue of Liberty. This shift highlights the growing popularity of these attractions among young, educated singles, reflecting a broader trend of increased domestic tourism among this demographic.

New York City’s tourism sector is adapting to meet the changing needs of travelers, fueled increasingly by younger visitors who may be unable to take a costly international vacation. How have travel patterns to Los Angeles changed in response to increasing travel costs?

While New York City is the East Coast’s tourism hotspot, Los Angeles takes center stage on the West Coast. And as overseas travel has become increasingly out of reach for Americans with less discretionary income, the share of domestic tourists originating from areas with lower HHIs has risen.

Before the pandemic, 57.6% of visitors to LA came from affluent areas with median household incomes (HHIs) of over $90K/year. But by 2023-2024, this share decreased to 50.7%. Over the same period, the share of visitors from areas with median HHIs between $41K and $60K increased from 9.7% to 12.5%, while the share of visitors from areas with HHIs between $61K and $90K rose from 32.1% to 35.8%.

Diving into the psychographic makeup of visitors to popular Los Angeles attractions – Universal Studios Hollywood, Disneyland California, the Santa Monica Pier, and Griffith Observatory – also reflects the above-mentioned shift in HHI. The captured markets of these attractions had higher shares of middle-income households belonging to the “Family Union” psychographic segment in 2023-2024 than in 2018-2019.

Experian: Mosaic defines this segment as “middle income, middle-aged families living in homes supported by solid blue-collar occupations.” Pre-pandemic, 16.0% of visitors to Universal Studios Hollywood came from trade areas with high shares of “Family Union” households. This number jumped to 18.8% over the past year. A similar trend occurred at Disneyland, Santa Monica Pier, and Griffith Observatory.

And like in New York City, growing numbers of visitors to Los Angeles appear to be coming from nearby areas. Between 2018-2019 and 2023-2024, the share of in-state visitors to major Los Angeles attractions increased substantially – as people likely sought to cut costs by keeping things local.

Pre-pandemic, for example, 68.9% of visitors to Universal Studios Hollywood came from within California – a share that increased to 72.0% over the past year. Similarly, 59.7% of Griffith Observatory visitors in 2018-2019 came from within the state – and by 2023-2024, that number grew to 64.7%.

Even when times are tight, people love to travel – and New York and Los Angeles are two of their favorite destinations. With prices for airfare, hotels, and dining out increasing across the board, younger and more price-conscious households are adapting, choosing to visit nearby cities and enjoy attractions closer to home. And as the tourism industry continues its recovery, understanding emerging visitation trends can help stakeholders meet travelers where they are.

The positive retail momentum observed in Q1 2024 continued into Q2 – as stabilizing prices and a strong job market fostered cautious optimism among consumers. Year-over-year (YoY) retail foot traffic remained elevated throughout the quarter, with June in particular seeing significant weekly visit boosts ranging from 4.7% to 8.5%.

The robustness of the retail sector in Q2 was also highlighted by positive visit growth during the quarter’s special calendar occasions, including Mother’s Day (the week of May 6th) and Memorial Day (the week of May 27th). And though consumer spending may moderate as the year wears on, retail’s strong Q2 showing offers plenty of room for optimism ahead of back-to-school sales and other summer milestones.

On a quarterly basis, overall retail visits rose 4.2% in Q2. And diving into specific categories shows that value continued to reign supreme, with discount and dollar stores seeing the most robust YoY visit growth (11.2%) of any analyzed category.

Other essential goods purveyors, such as grocery store chains (7.6%) and superstores (4.6%), also outperformed the overall retail baseline. And fitness – a category deemed essential by many health-conscious consumers – outpaced overall retail with a substantial 6.0% YoY foot traffic increase.

The decidedly more discretionary home improvement industry performed less well than overall retail in Q2 – but in another sign of consumer resilience, it too experienced a YoY visit uptick. And overall restaurant foot traffic increased 2.6% YoY.

Discount and dollar stores enjoyed a strong Q2 2024, maintaining YoY visit growth above 10.0% for six out of the quarter’s 13 weeks. Only during the week of April 1st did the category see a temporary decline, likely the result of an Easter calendar shift. (The week of April 1st 2024 is being compared to the week of April 3rd, 2023, which included the run-up to Easter)

Some of this growth can be attributed to the continued expansion of segment leaders like Dollar General. But the category has also been bolstered by the emphasis consumers continue to place on value in the face of still-high prices and economic uncertainty.

Dollar General, which has been expanding both its store count and its grocery offerings, saw YoY visits increase between 9.1% and 15.9% throughout the quarter. Affordable-indulgence-oriented Five Below, which has also been adding locations at a brisk clip, saw YoY visits increase between 4.9% and 18.8%.

And though Dollar Tree has taken steps to rightsize its Family Dollar brand, the company’s eponymous banner – which caters to middle-income consumers in suburban areas – continued to grow both its store count and its visits in Q2.

Grocery store chains also performed well in Q2 2024 – experiencing strongly positive foot traffic growth throughout the quarter. Though the sector continues to face its share of challenges, stabilizing food-at-home prices and improvements in employee retention and supply chain management have helped propel the industry forward.

Diving into the performance of specific chains shows that within the grocery segment, too, price was paramount in Q2 2024 – with limited-assortment value grocery stores like Aldi and Trader Joe’s leading the way.

Traditional chains H-E-B and Food Lion (owned by Ahold Delhaize) – both of which are known for relatively low prices – outperformed the wider grocery sector with respective YoY foot traffic boosts of 11.4% and 8.7%. But ShopRite, Safeway (owned by Albertsons), Kroger, and Albertsons also drew more visits in Q2 2024 than in the equivalent period of last year.

Fitness has proven to be relatively inflation-proof in recent years – thriving even in the face of reduced discretionary spending and consumer cutbacks. Indeed, rising prices may have actually helped boost gym attendance, as people sought to squeeze the most value out of their monthly fees and replace pricy outings with already-paid-for gym excursions.

And despite lapping a remarkably strong 2023, visits to gyms nationwide remained elevated YoY in Q2 2024.

Diving into the data for some of the nation’s leading gyms shows that today’s fitness market has plenty of room at the top. Planet Fitness, 24 Hour Fitness, Life Time Fitness, Orangetheory Fitness, and LA Fitness all experienced YoY visit growth in Q2 2024 – reflecting consumers’ enduring interest in all things wellness-related.

But it was EōS Fitness and Crunch Fitness – two value gyms that have been pursuing aggressive expansion strategies – that really hit it out of the park, with respective YoY foot traffic increases of 23.4% and 21.4%.

The week of April 1st saw a decline in YoY visits to superstores – likely attributable to the Easter calendar shift noted above. But the category quickly rallied, and with back-to-school shopping and major superstore sales events coming up this July, the category appears poised to enjoy continued success throughout the summer.

Within the superstore category, wholesale clubs continued to stand out – with Costco Wholesale, Sam’s Club and BJ’s Wholesale Club enjoying YoY foot traffic growth ranging from 12.0% to 7.4%. But Target and Walmart also impressed with 4.6% and 4.0% YoY visit increases.

Inflation, elevated interest rates, and a sluggish real estate market have created a perfect storm for the home improvement industry, with spending on renovations in decline. The accelerated return to office has likely also taken its toll on the category, as people spend more time outside the home and have less availability to immerse themselves in DIY projects.

But despite these challenges, weekly YoY foot traffic to home improvement and furnishing chains remained elevated throughout much of the Q2 – with June and April seeing mostly positive YoY visit growth, and May hovering just below 2023 levels. This (modest) visit growth may be driven by consumers loading up on supplies for necessary home repairs, or by shoppers seeking materials for smaller projects. And given the importance of Q2 for the home improvement sector, this largely positive snapshot may offer some promise of good things to come.

Some chains within the home improvement category continued to perform especially well in Q2 2024 – with rapidly expanding, budget-oriented Harbor Freight Tools leading the pack. But Ace Hardware, Menards, The Home Depot, and Lowe’s also saw foot traffic increases in Q2, showcasing the category’s resilience in the face of headwinds.

Restaurants – including full-service restaurants (FSR), quick-service restaurants (QSR), fast-casual chains, and coffee chains – lagged behind grocery stores and other essential goods retailers in Q2 2024, as price-sensitive consumers prioritized needs over wants and ate at home more often.

Still, YoY restaurant foot traffic remained up throughout most of the quarter. And impressively, the sector saw a YoY visit uptick during the week of Mother’s Day (the week of May 6th, 2024, compared to the week of May 8th, 2023) – an important milestone for FSR.

The restaurant industry’s YoY visit growth was felt across segments – though fast-casual and coffee chains experienced the biggest visit boosts. Like in Q1 2024, fast-casual restaurants hit the sweet spot between indulgence and affordability, outpacing QSR in the wake of fast food price hikes. And building on the positive YoY trendline that began to emerge last quarter, full-service restaurants finished Q2 2024 with a 1.4% YoY visit uptick.

Chain expansion was the name of the restaurant game in Q2 2024, with several chains that have been growing their footprints outperforming segment averages – including CAVA, Chipotle Mexican Grill, Ziggi’s Coffee, California-based Philz Coffee, Raising Cane’s, Whataburger, and First Watch. Chili’s Grill and Bar also outpaced the full-service category average, aided by the revamping of its “3 for Me” menu.

Retailers and restaurants in Q2 2024 continued to face plenty of challenges, from inflation to rising labor costs and volatile consumer confidence. But foot traffic trends across industries – including both essential goods purveyors like grocery stores and more discretionary categories like home improvement and restaurants – suggest plenty of room for cautious optimism as 2024 wears on.