What is Real Estate Data Analytics?

Real estate data analytics empowers industry professionals to make informed decisions about buying, selling, renting, or managing property. The process involves collecting relevant information from multiple sources and transforming it into actionable insights. Brokers, investors, developers, and owners use these insights to evaluate potential returns, time transactions, identify qualified tenants, strengthen negotiations, and direct marketing efforts more efficiently.

AI-based platforms for real estate data analytics support this work by offering curated datasets and tools that help uncover real-world patterns, enabling faster and more confident decision-making.

Making Data-Driven Real Estate Decisions

Historically, real estate analysis relied on conventional indicators – occupancy rates, rental income, and broad market trends. In recent years, however, the field has expanded to include non-traditional variables that reveal more nuanced signals of market health. The presence of neighborhood amenities, sentiment expressed in online reviews, or even patterns in elevator usage can all contribute to a property’s performance profile.

Advances in location analytics have pushed this evolution further. Today’s datasets offer highly accurate visibility into how people interact with their physical environment – how many individuals visit a shopping center on a given day, where else they shop, and how those behaviors shift over time. For commercial assets, these inputs can be mission-critical, giving owners and operators a clearer view of value and operational potential.

To stay competitive, commercial real estate (CRE) professionals increasingly depend on AI tools to gather and analyze large volumes of data across categories such as:

- Local property values and rental rates

- Area development plans, traffic flows, and crime statistics

- Foot traffic patterns, consumer behavior, and the competitive landscape

- Migration flows and population trends

- Commuter behavior and visitation frequency to nearby office spaces

- Demographic and psychographic profiles

Together, these datasets create a more complete picture of market dynamics and help real estate stakeholders respond to emerging opportunities with greater precision.

Key Uses for Real Estate Data Analytics

Real estate data analytics supports more confident decision-making and can materially improve outcomes for owners, operators, and brokers. The examples below highlight how data-driven insights shape strategy in commercial real estate.

Identifying the Right Tenants for a Shopping Center

A broker tasked with securing new tenants for a shopping center once relied primarily on historical rents, long-term occupancy trends, and intuition. Today, the process has expanded to include a wider and far more accurate set of indicators. These inputs help assess demand, refine merchandising strategy, and strengthen positioning during negotiations.

Core Data Inputs for Tenant Selection

1. Center-wide visitation trends

- Daily, weekly, and monthly visit volumes

- Dwell times and seasonality patterns

- Comparisons against prior years and against competing centers

- Peak visit days and periods of underperformance

2. Foot traffic performance by individual tenants

- Visit counts for each store

- Trajectory of visits over time – rising, stable, or declining

- Identification of strong anchors or underperforming venues

3. Demographic and trade-area insights

- The center’s True Trade Area and its catchment boundaries

- Median household income, age distribution, and other CBG-level traits

- Shopping preferences and lifestyle attributes of core visitors

4. Cross-shopping behavior

- Other retailers frequently visited by the center’s most engaged shoppers

- Unexpected or out-of-path venues that resonate with the same audience

5. Co-tenancy patterns

- Retailers that commonly cluster with existing tenants

- Chains with proven success as co-tenants in similar centers

6. Competitive landscape and market saturation

- Strength and positioning of nearby retail options

- Categories with robust unmet demand

- Areas where new entrants may face cannibalization risk

How These Insights Drive Outcomes

A comprehensive view of visitation, demographics, co-tenancy, and competitive context helps teams identify retailers with the highest likelihood of success in a given location. It also supports more precise rent setting and gives brokers data-based leverage when negotiating lease terms or responding to rent reduction requests.

Finding and Assessing Real Estate Acquisition Opportunities

Real estate data analytics plays a central role in identifying and evaluating commercial real estate (CRE) acquisition targets. It also supports marketing existing assets and informing development strategies. When an investment team – for example, a REIT evaluating multiple properties – needs to make quick, confident decisions, analytics provides a structured framework for comparing options.

Core Data Inputs for Acquisition Evaluation

1. Venue health

- Foot traffic levels and visit trends over time

- Performance relative to comparable properties

- Indicators of stability or upside potential based on visitation patterns

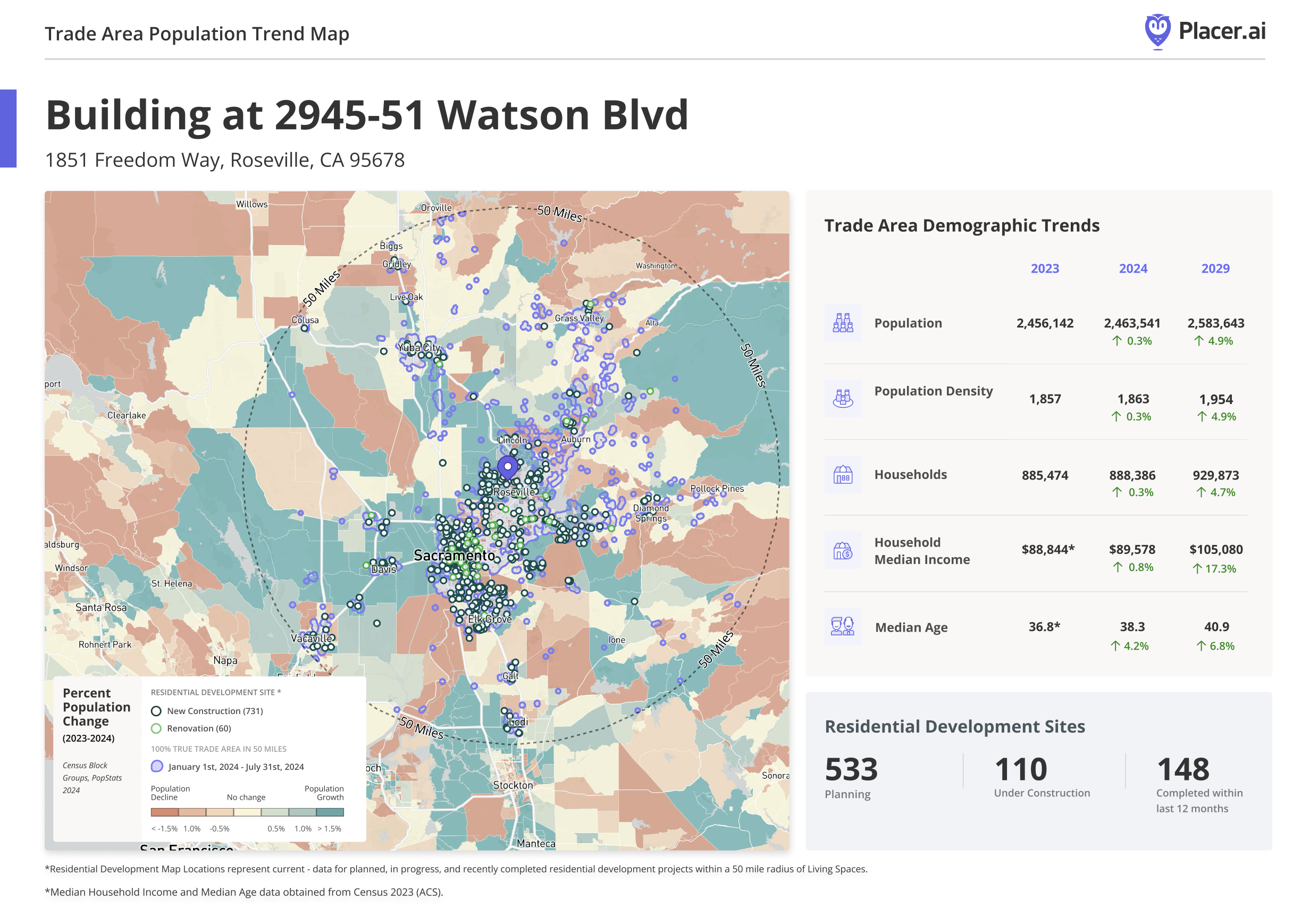

2. Trade area size and characteristics

- The geographic catchment from which the property draws its visitors

- Demographic traits of relevant CBGs, including median household income and age distribution

- Consumer preferences and shopping behavior within the trade area

3. Local market dynamics

- Strength of nearby retail corridors and key generators of demand

- Recurring events that drive seasonal spikes in visitation

- Adjacent dining, entertainment, and cultural anchors that increase foot traffic

- Local risk factors such as crime rates or regulatory constraints

4. Migration and demographic trends

- Population growth or decline in the surrounding city or region

- Movement of young adults, families, and other key demographic groups

- Shifts in household composition that may influence long-term demand

How These Inputs Support Better Decisions

When aggregated, these datasets offer a multi-dimensional view of each prospective acquisition. They help surface not only current performance but also future potential, identify operational risks, and highlight markets with durable demand drivers. For investment managers, this accelerates underwriting, sharpens valuation assumptions, and supports more disciplined portfolio construction.

What Makes a Good Real Estate Analytics Tool?

Not all real estate analytics platforms are created equal. To support meaningful analysis and confident decision-making, a high-quality solution should incorporate several foundational attributes.

Key Attributes of Effective Real Estate Analytics Platforms

1. Accurate

- Data must reliably reflect real-world conditions and continually validated against 1st-party and authoritative data sources.

- Points of interest (POIs) must be precisely defined to avoid distorted results.

- Location insights should reach the property level, describing how people interact with specific places rather than relying on broad regional summaries.

2. Up-to-date

- Visitation metrics should refresh frequently – ideally within days.

- Demographic layers should reflect the latest census releases and recent supplemental datasets.

3. Comprehensive

- The platform should integrate multiple relevant datasets so users can evaluate all factors that influence performance, market position, and long-term potential.

4. Actionable

- The interface should be intuitive, enabling users to translate complex data into clear insights.

- Tools and visualizations should help users focus on the metrics that matter, avoiding information overload.

5. Privacy-first

- Data providers must comply with all laws, regulations, and industry standards.

- Data must be stripped of personal identifiers, including MAIDs, names, device IDs, and contact details before it is received by any analytics platform.

- Visualizations should never reveal the location of an individual device, or show any data for locations with fewer than 50 unique devices.

Real Estate Data Analytics Software - The Placer.ai Solution

Using a location intelligence platform like Placer.ai enables CRE professionals to analyze market, property, and consumer trends with greater precision. Placer.ai leverages a panel of tens of millions of devices and utilizes machine learning to make accurate estimations for foot traffic across the country, from specific POIs, to chains, markets, and regions. Visitation data is enhanced with Placer Marketplace 3rd party datasets that further describe businesses, audiences, and markets.

Insights into how audiences and places interact are presented via an intuitive UI, data feeds, or the Placer API. Placer.ai’s dedicated support professionals and best-in-class research team are also available to deliver expert analysis and strategic guidance.

Whether you need real estate data analytics to understand market conditions, benchmark properties, or assess ROI, Placer.ai provides the data and insights to strengthen your strategy.

Key Takeaways

1. Real estate data analytics turns diverse datasets into actionable insights for CRE that help professionals evaluate returns, optimize operations, and make faster, more informed decisions.

2. Accurate location analytics reveals how consumers interact with the physical world – enabling more accurate assessments of markets, asset value, and consumer demand.

3. Data-driven tools strengthen tenanting and acquisition decisions by clarifying performance and fit, identifying risk, and highlighting long-term market potential.

.svg)