Affecting everything from merchandise sales to local bars to entire neighborhoods, the economic effect of the Los Angeles Dodgers’ road to the World Series cannot be disputed.

After a comeback from 5-0 to win 7-6 against the New York Yankees, the Dodgers kept everyone on the edge of their seats. With history made by Freddie Freeman’s walk-off grand slam to win Game 1, fans will have moments seared in their memories for decades to come. Dodgers fans are willing to shell out big to celebrate their champions. Fanatics reported that after winning Wednesday night, “the Dodgers set a Fanatics sales record for first-hour sales of a team's merchandise, across any sport, after claiming a championship.” The top five players for merchandise sales were Ohtani, Freeman, Betts, Yamamoto, and Kershaw.

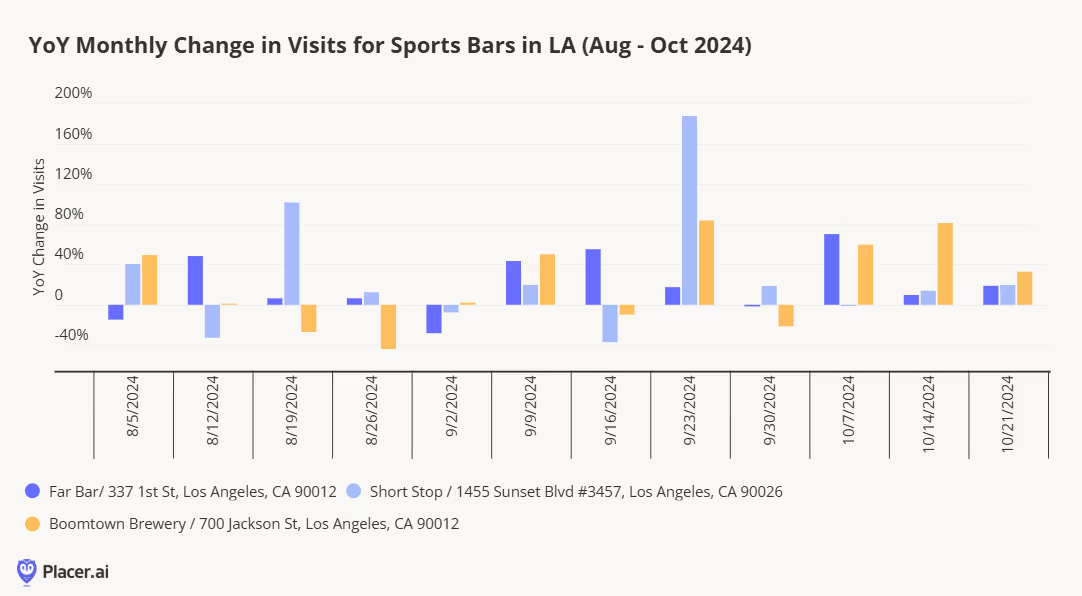

Local bars in various parts of L.A. that featured Dodgers games saw an uptick in year-over-year traffic most weeks, particularly in recent weeks leading up to the National League Championship and the World Series. Spontaneous parades erupted in locations such as Whittier Blvd in East L.A., in Downtown L.A., and near Dodger Stadium in Elysian Park.

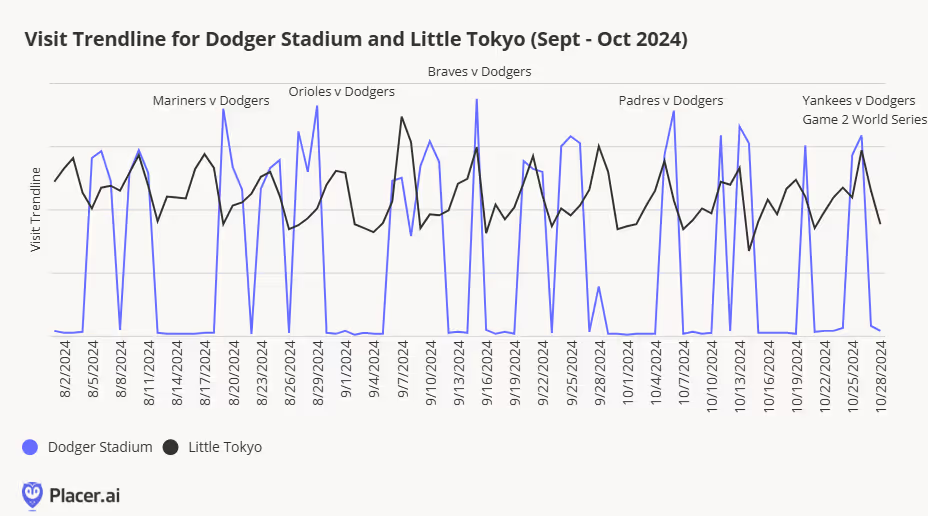

We’ve previously written about the Shohei Effect on hotels like the Miyako that features the mural “LA Rising” by Robert Vargas, but now after a World Series championship, the Boys in Blue are set to go even higher into the stratosphere of fandom. We looked at the foot traffic to Dodger Stadium and to Little Tokyo, and no surprise there’s definitely an uptick to the latter on game days, especially on Saturdays. Vargas is currently working on a mural of the late Fernando Valenzuela in Boyle Heights, and Angelenos will likely be flocking in droves to come see “Fernandomania Forever” when it is unveiled.

One interesting finding is that visitation was actually higher during some of the regular season games than for the World Series Games 1 and 2 that took place in LA. One reason may be the sky high prices. Per reseller Ticket IQ, “the average price for a World Series ticket on the secondary market was $3,887, the second most expensive average since it started tracking data in 2010.” For some fans, it was a dream of a lifetime, one that some were willing to “sell a kidney” to attend.

Photo Image Credit: Los Angeles Times

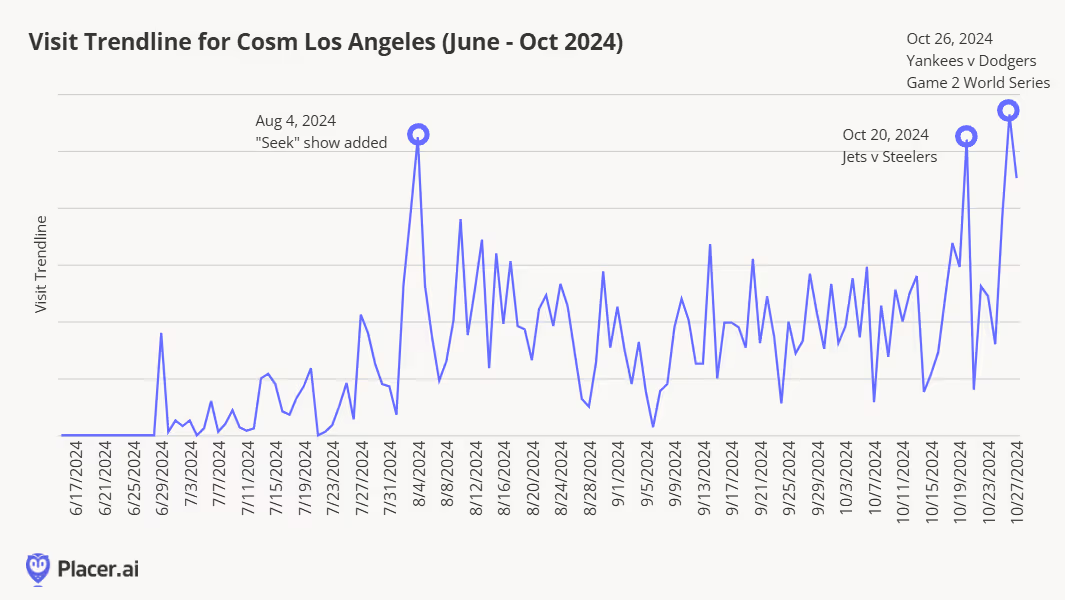

If you’ve ever wished you could root for your alma mater from afar, attend a World Series, or blast into space, Cosm may have the solution. This immersive technology company combines state-of-the art stadium experiences with dining and bar service. Think a smaller version of the Sphere, a larger version of an IMAX theater, with the simulation of being at an actual stadium all while enjoying the comforts of a booth with food brought to you.

For fans of large screen immersive experiences, this venue allows you to be enveloped by the aquatic performers of Cirque du Soleil's “O”, feel like you’re on the 50-yard line for the Ohio State versus Penn State football game, or be a pioneering astronaut seeing the earth from space in “Orbital.”

Since it opened at the end of June this year, popular showings have included “Seek,” which takes you on a journey through the cosmos, as well as sports favorites like the New York Jets versus Pittsburgh Steelers game. Game 2 of the World Series had a sell-out crowd as those who chose not to buy tickets for thousands of dollars still had the joy of celebrating in an arena venue with hundreds of other fans, with the feeling of being behind the dugout.

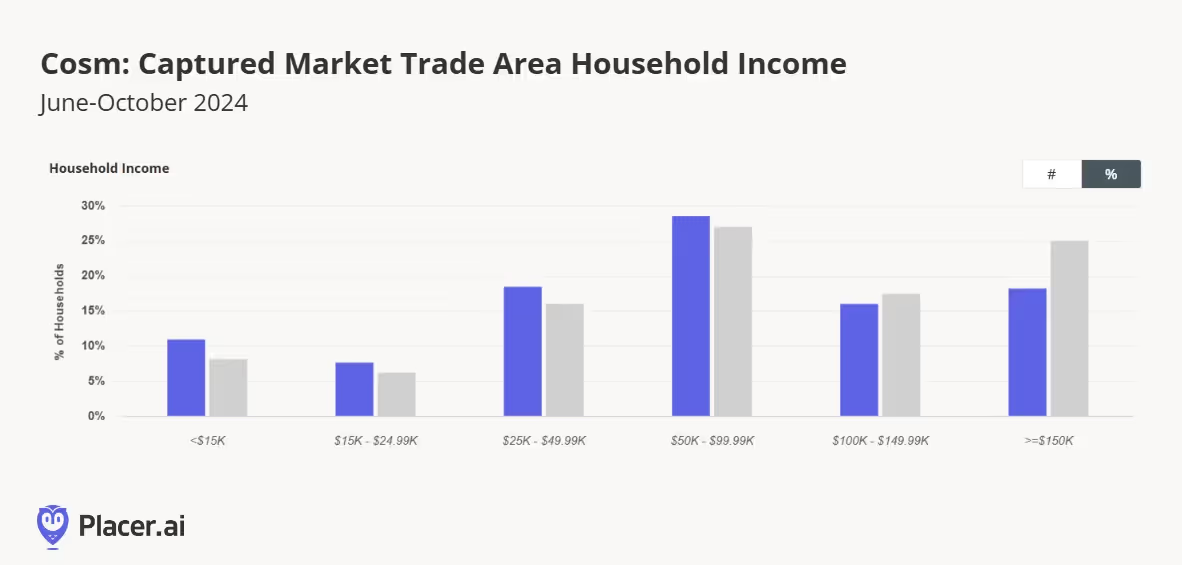

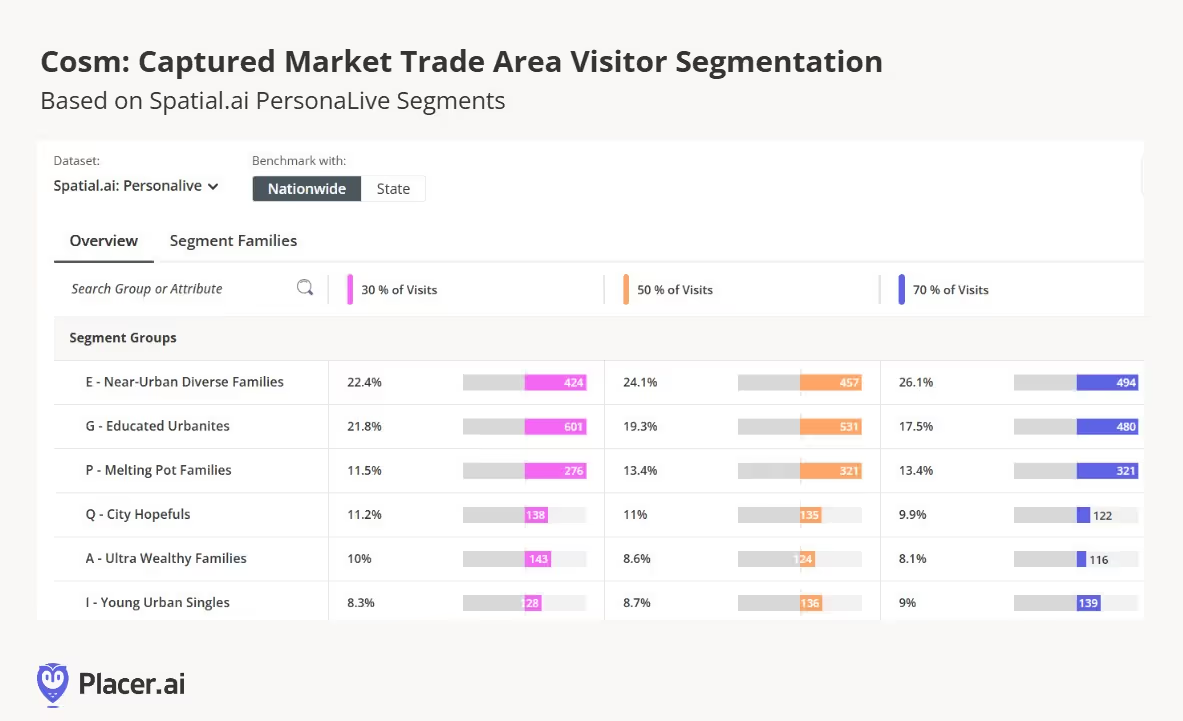

The Los Angeles Times describes Cosm as “part planetarium, part mini-Sphere,” so instead of needing to travel to Griffith Observatory or Las Vegas, one can just jet down the 405 to Inglewood to have a similar experience. So, who’s visiting Cosm? Roughly 3 in 10 (29%) have a hold income (HHI) of $50K-$99.9K. Nearly 1 in 5 (19%) have a HHI of $25K-$49.9K. These two household income segments over index compared to the CA household incomes (shown in gray).

In terms of demographics, per Spatial.ai PersonaLive, Near-Urban Diverse Families, Educated Urbanites, and Melting Pot Families make up the top 3 segments.

Photo Image Credit: Orange County Register

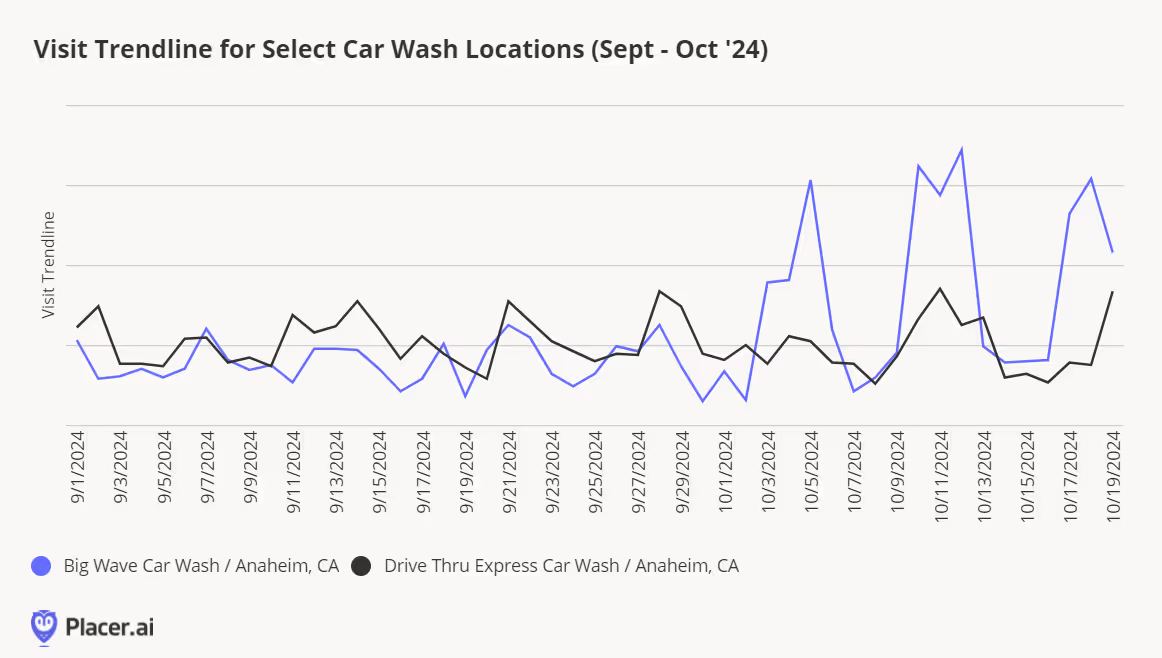

We know there’s appetite for Six Flags Fright Fest, Universal Studios Halloween Horror Nights, Knotts’ Scary Farm, and Halloween Screams at Walt Disney World, but one innovative car wash takes you to another level, inviting you to go on a “nightmarish journey that turns an ordinary car wash into a realm of terror.” Big Wave Car Wash in Anaheim is one of the locations, and it’s immediately clear that this spooky spectacular is a hit. Compared to another local car wash competitor, we see that the addition of the scary performers nearly triples Big Wave’s traffic, especially Thursday-Sunday with the October kickoff.

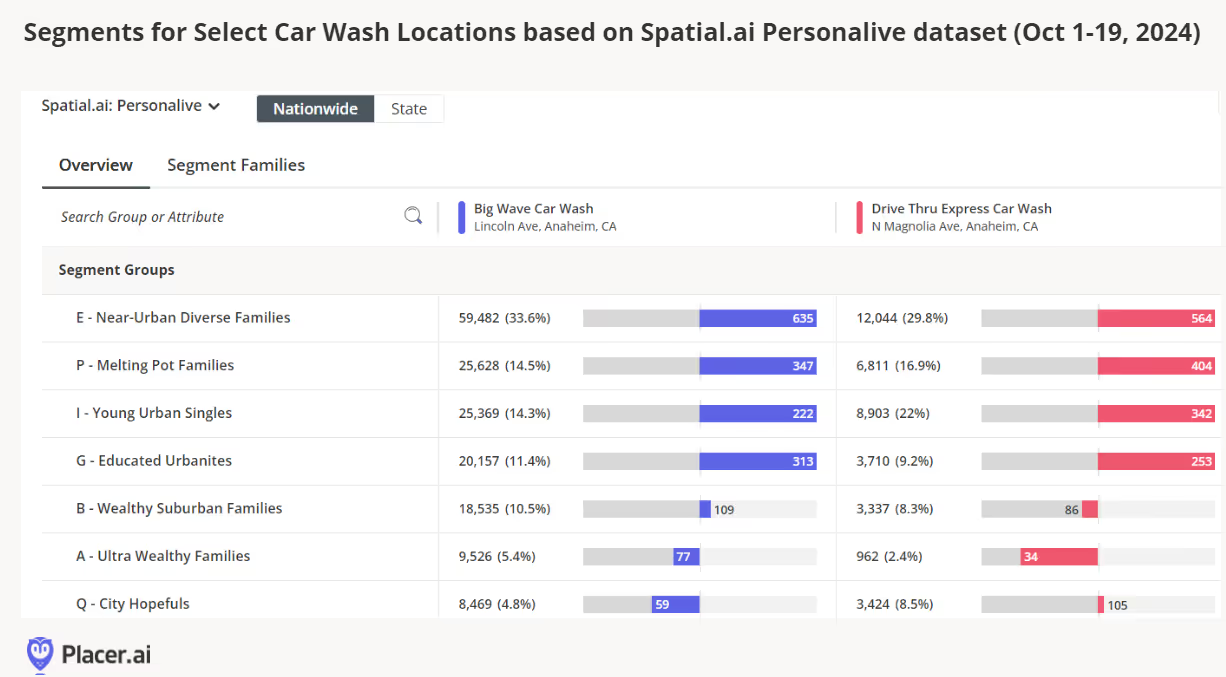

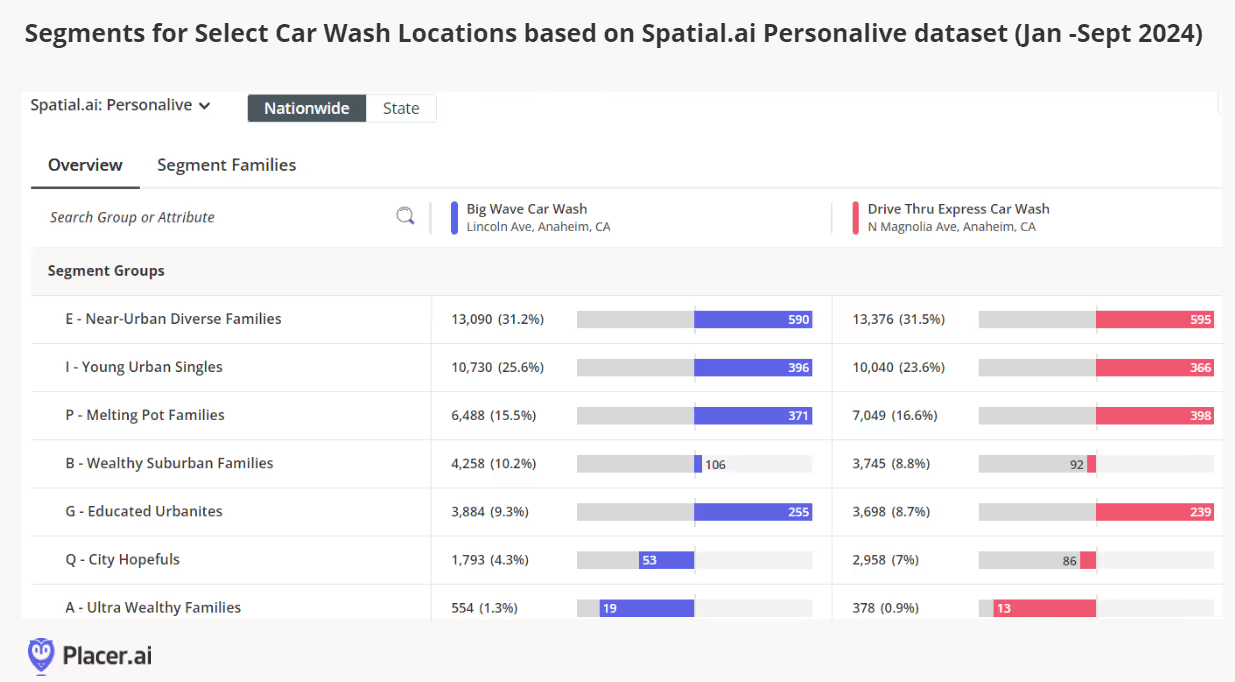

We compared the Spatial.ai PersonaLive segments for Big Wave and Drive Thru Express Car Wash from January-September 2024 vs from October 1-19, 2024. In the month of October alone, we saw over 4x more visits from Near-Urban Diverse families and from Melting Pot Families to the haunted carwash compared to the entire rest of the year. Among Young Urban Singles, there was a 2.5x multiplier for just the three weeks in October compared to January-September. And while Ultra Wealthy Families normally only make up 1% of the visits, during this spooky spectacular, they accounted for 5%. Now you know where to go when junior is bored–head for the haunted car wash!

No surprise, the trade area drawn during the month of October is significantly larger as people come from a total trade area of 53 sq miles during this event (October 1-19, 2024 in red), compared to 12 sq miles the rest of the year (January-September 2024 in blue).

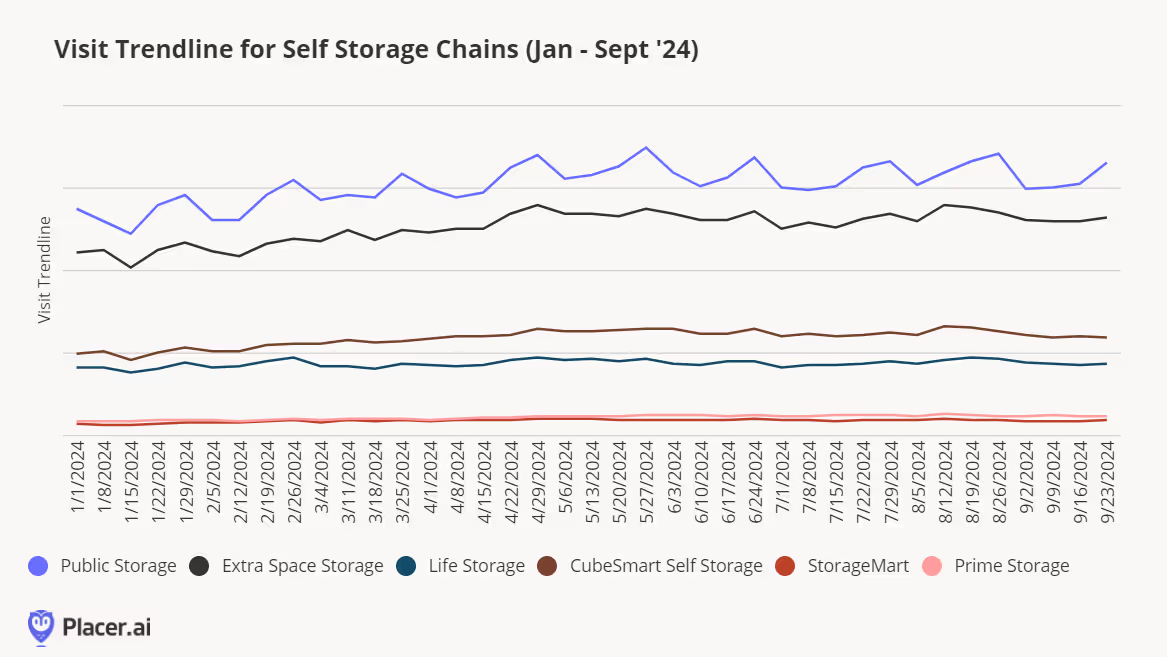

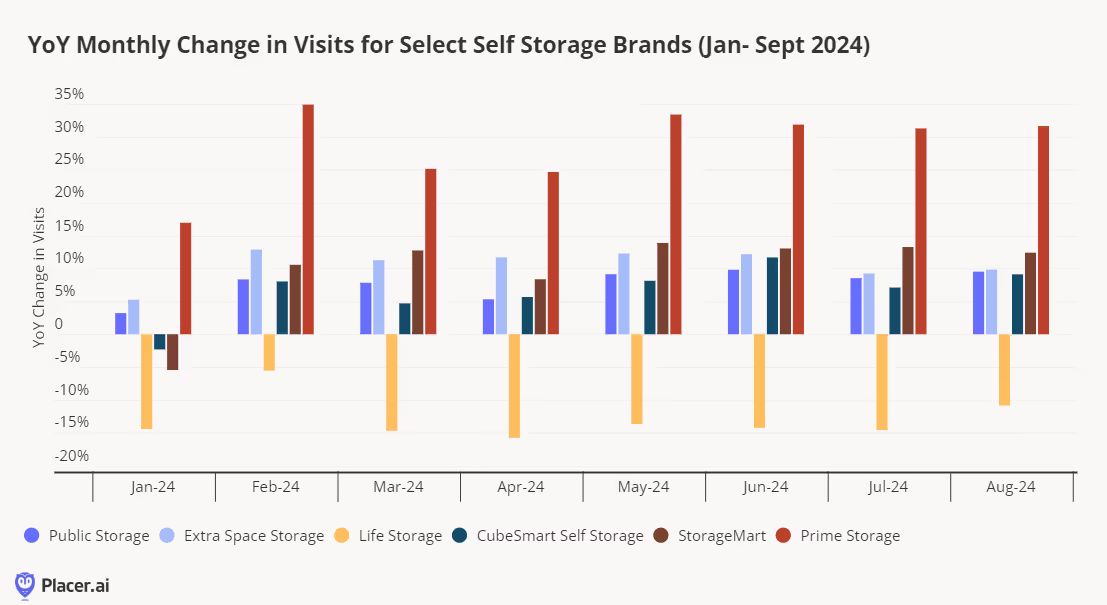

Americans have a love affair with stuff, and one of the hallmarks of this is the enduring strength of self-storage units. Public Storage takes the lead in overall visits, with Extra Space Storage not far behind. Looking at the Public Storage visits data, we see a clear spike in visits near the end of the month. This is due be due to housing transitions that also tend to occur with this pattern, as people prepare to move out at month’s end or conversely to pick up items for move-in at the beginning of a month.

Compared to last year, visits are generally up across most of these chains (which is partly the result of the industry consolidation trend we examined last year). The highest variance is seen with Prime Storage, a company largely based on the East Coast, but with a presence in the Midwest as well. StorageMart bought Manhattan Mini Storage in 2021 and has over 250 locations now.

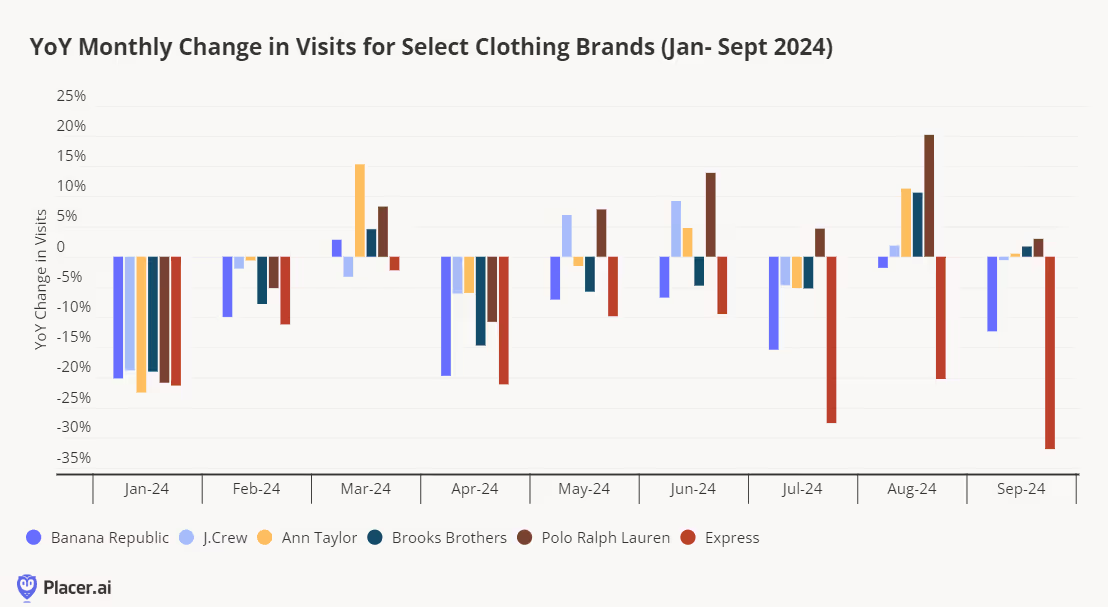

In just a few months, we will be coming on the 5-year anniversary of COVID-19. During that time, we hunkered down, bought tons of athleisure, and stared at our forlorn office clothing sitting unworn in our closets. Fast forward a few years to present day and much like bootcut jeans are back in style, the pendulum is starting to veer back towards a more tailored style. This time around, the suits may not be as constricting, but there is certainly more structure to fall’s fashion than the cozy comfy sweatpants and leggings that the whole world came to embrace upon working from home. Among locations that are not multi-story or in enclosed malls, we see that Ann Taylor increased traffic to its locations in March, June, and August compared to last year, and that Polo Ralph Lauren has also seen increases in the past few months. This particular grouping of brands all has at least 30 or more locations each tracked by Placer and tend to be ubiquitous at many malls or as standalone boutiques. A recent visit to Banana Republic indicated a merchandising assortment that appeared to be more than 50% office wear in the women’s section, with blazers and tailored pants, silky shirts, and dresses ready to be accessorized with heels and some statement jewelry.

However, we are seeing even larger increases in year-over-year traffic at some of the more specialized/high-end brands, particularly in women’s contemporary that offer sharp-looking items that look just as polished at the boardroom or the PTA meeting, like the blazers at Veronica Beard or the “Effortless Pant” from Aritzia that is a smash hit on social media. The majority of this next grouping of brands got their start at department stores or specialty retailers, but with increased success, many are launching their own brick-and-mortar boutiques. Clearly, having a holy grail item that is on the fashion editors’ favorites list gives a boost to store traffic. One of the trends we are seeing is the continuation of the love for comfort everyone adopted during Covid mixed with a slightly more structured but still understated minimalist but luxe aesthetic, like COS. Theory, a wardrobe staple with its neutral color palette and streamlined silhouettes, has been generating positive year-over-year traffic during the back-to-school and fall season. Vince, also featuring rather understated and neutral basics, also saw its traffic lift for the fall season. Eileen Fisher is another interesting brand. Once regarded as clothing adapted to your mom’s generation, Gen Z is also starting to embrace it for its softness and sustainability, and it is one of the more popular brands to buy secondhand. In April of this year, Guess and WHP Global completed the acquisition of rag & bone, which has long been hailed for their on-trend jeans and boots. Time will tell what direction they will take the brand, or if they will stick with its tried-and-true New York roots.

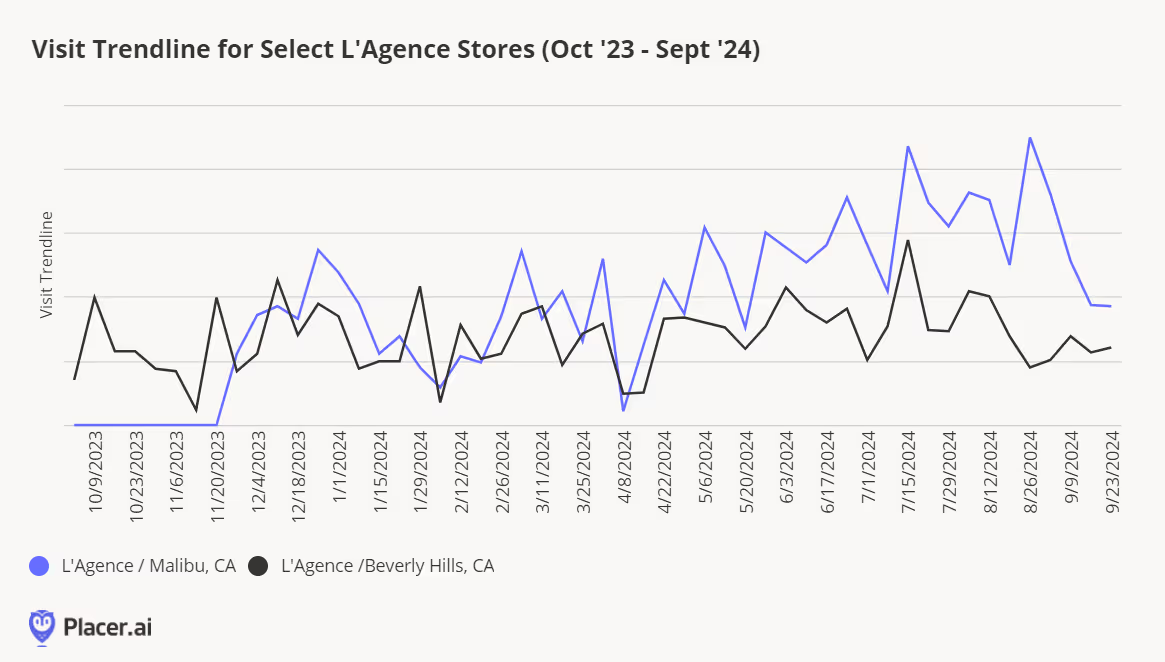

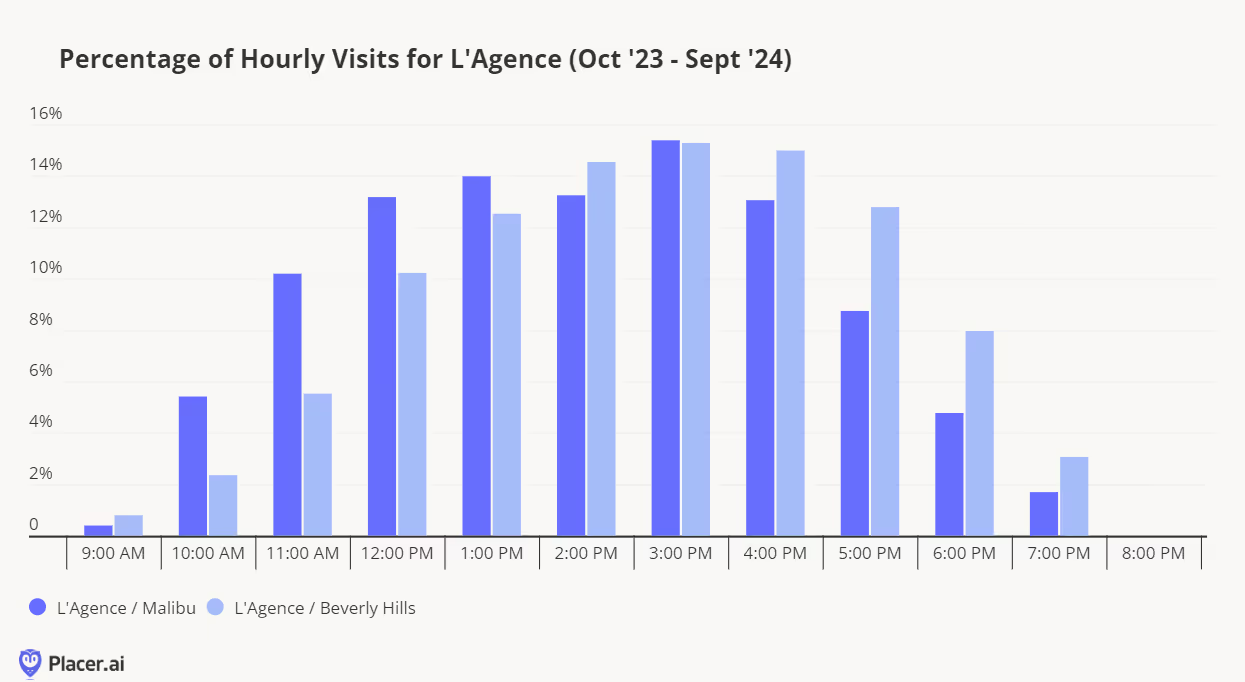

Another brand to keep an eye on that we’re already familiar with from prestige department stores like Nordstrom, Bloomingdale’s, and Saks Fifth Avenue is L’Agence. This brand goes seamlessly from day to night with classics like tweed blazers, satiny tank tops, and perfectly-fitting jeans. They’ve now expanded to more stand-alone stores, including Southern California shopping meccas like Malibu and Beverly Hills. While the Malibu one just opened in late fall 2023, its traffic has been growing steadily upwards, even overtaking that of the Beverly Hills outpost of late.

One interesting thing to note is that the Malibu location attracts a higher proportion of its audience during the morning hours, whereas the Beverly Hills location gets the evening crowd. This information would be useful for staffing purposes or for knowing when to hold events.

If you’ve been to your local recreation center or even shopping center lately, pickleball is definitely still going on strong. Invented in 1965 on Bainbridge Island, for many decades it was considered more of a seniors’ recreational activity. But with the recent explosion of interest and proliferation of courts, we may be about to see the same snowboarding vs skiing battle that occurred in the 1980s and 1990s, except instead of the young punks carving down the slopes, it’s people of all ages carving out Pickleball courts with tape to the dismay of their tennis-loving brethren and sound-sensitive neighbors.

According to the Sports and Fitness Industry Association (SFIA), “pickleball continues to be the fastest growing sport in America, having grown 51.8% from 2022 to 2023 and an incredible 223.5% in 4 years since 2020.” The sport has some similarities to tennis, table tennis, and badminton, but one reason it has become so popular is the social nature of it - often played as doubles - and the fact that since the court is smaller, there’s less running to engage in, but there is still the excitement of rapid volleying. The ability to serve underhand also makes it more accessible to new players.

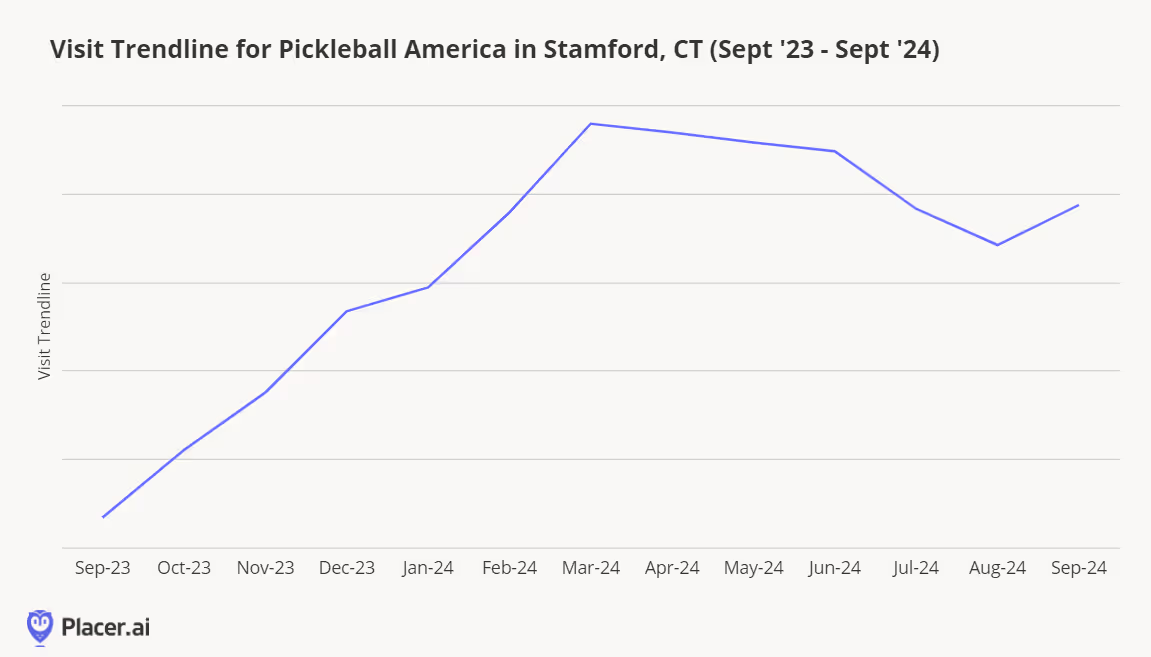

Pickleball America bills itself as “one of the largest indoor pickleball venues in America” and with 80,000 sq ft at the Stamford Town Center, it clearly can live up to that claim. With clever events like “Dinko de Mayo” or resident events to bring a nearby living community together, pickleball could just be the glue that starts to bring people together for socialization and cure the loneliness epidemic. Indoor pickleball venues can also be a source of family fun, with lounges and fresh popcorn available, as well as foosball, table tennis, and essential board games.

Another sport that may be giving tennis and pickleball a run for its money is padel. This sport has the unique benefit of one being able to hit shots off the fence or wall, often made of glass or mesh, that is at the perimeter. So now we’re talking 3D thinking as one figures out what angles to hit.

One can fit about 2 padel courts on a tennis court, and up to 4 pickleball courts on a tennis court. So from an economics perspective, you can definitely charge for more people when playing padel or pickleball. Padel is described more as a mix of tennis, squash, and badminton and is the fastest-growing sport globally with over 25 million players in 90+ countries, per PadAthletes. At P1 Padel in Las Vegas, NV, the most popular times to frequent are in the evening from 6-8 PM. There is also a morning contingent between 9-11 AM.

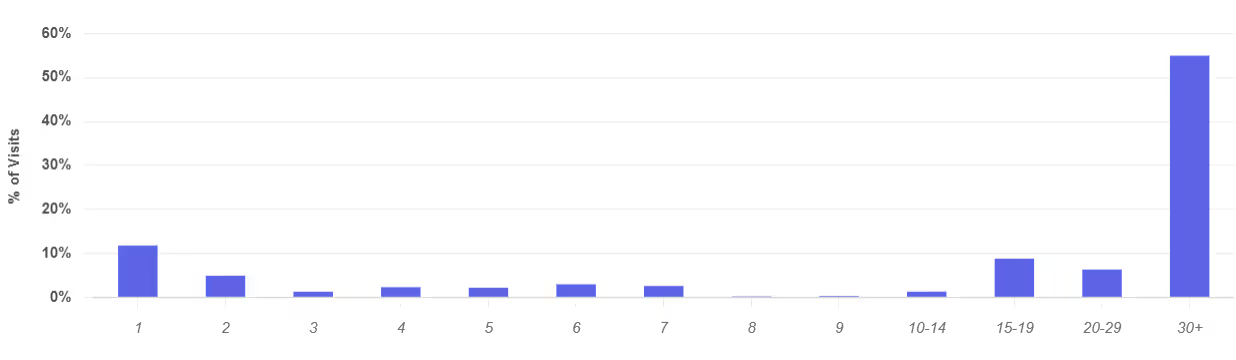

Padel players at this location are quite loyal, with a majority coming 30+ times in the past 12 months.

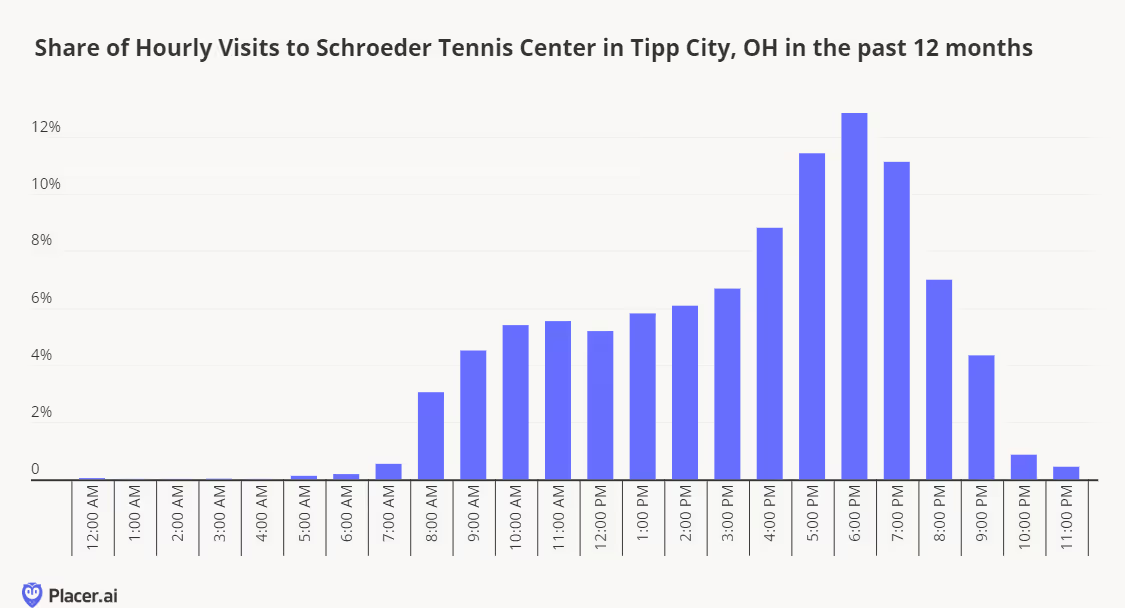

With pickleball and padel nipping at its heels, the USTA (US Tennis Association) is fighting back with its own version of more accessible tennis, namely “red ball.” With a smaller court, a smaller racket, and balls that are up to 75% slower, this version helps newbies obtain control over the ball more quickly and has less ground to cover for those lateral runs and quick pivots. Schroeder Tennis Center in Tipp City, OH is one such location that is participating in this USTA pilot program. The bulk of visits are between 4-8 pm, which are prime post-school or post-work hours. According to the Tennis Industry Association, 23.8 million Americans ages 6 and older played tennis at least once in 2023 and 25.1 million Americans who didn’t play tennis in 2023 are “very interested” in doing so now.

Tennis has a long and storied history and iconic locations like Wimbledon and Roland Garros. What young tennis player doesn’t dream of their moment on Center Court? Tennis also has associations with country clubs and networking. It will likely remain the king of racquet sports. But these two new princes of pickleball and padel prove that tennis cannot just rest on its laurels but will need to evolve in order to stay competitive.

Introduction

2024 has been another challenging year for retailers. Still-high prices and an uncertain economic climate led many shoppers to trade down and cut back on unnecessary indulgences. Value took center stage, as cautious consumers sought to stretch their dollars as far as possible.

But price wasn’t the only factor driving consumer behavior in 2024. This past year saw the rise of a variety of retail and dining trends, some seemingly at odds with one another. Shoppers curbed discretionary spending, but made room in their budgets for “essential non-essentials” like gym memberships and other wellness offerings. Consumers placed a high premium on speed and convenience, while at the same time demonstrating a willingness to go out of their way for quality or value finds. And even amidst concern about the economy, shoppers were ready to pony up for specialty items, legacy brands, and fun experiences – as long as they didn’t break the bank.

How did these currents – likely to continue shaping the retail landscape into 2025 – impact leading brands and categories? We dove into the data to find out.

Conventional Value Reaching Its Ceiling

Bifurcation has emerged as a foundational principle in retail over the past few years: Consumers are increasingly gravitating toward either luxury or value offerings and away from the ‘middle.’ Add extended economic uncertainty along with rapid expansions and product diversification from top value-oriented retailers, and you have an explosion of visits in the value lane.

But we are seeing a ceiling to that growth – especially in the discount & dollar store space. Throughout 2023 and the first part of 2024, visits to discount & dollar stores increased steadily. But no category can sustain uninterrupted visit growth forever. Since April 2024, year–over-year (YoY) foot traffic to the segment has begun to slow, with September 2024 showing just a modest 0.8% YoY visit increase.

Discount & dollar stores, which attract lower-income shoppers compared to both grocery stores and superstores, have also begun lagging behind these segments in visit-per-location growth. In Q3, the average number of visits to each discount and dollar store location remained essentially flat compared to 2023 (+0.2%), while visits per location to superstores and grocery stores grew by 2.8% and 1.0%, respectively. As 2024 draws to a close, it is the latter segments, which appeal to shoppers with incomes closer to the nationwide median of $76.1K, which are seeing better YoY performance.

The deceleration doesn’t mean that discount retailers are facing existential risk – discount & dollar stores are still extremely strong and well-positioned with focused offerings that resonate with consumers. The visitation data does suggest, however, that future growth may need to focus on initiatives other large-scale fleet expansions. Some of these efforts will involve moving upmarket (see pOpShelf), some will focus on fleet optimization, and others may include new offerings and channels.

Return of the middle anyone?

Innovative and Disruptive Value Shake Up Retail and Dining

Still, in an environment where consumers have been facing the compounded effects of rising prices, value remains paramount for many shoppers. And brands that have found ways to let customers have their cake and eat it too – enjoy specialty offerings and elevated experiences without breaking the bank – have emerged as major visit winners this year.

Trader Joe’s Drives Visits With Private Label Innovation

Trader Joe’s, in particular, has stood out as one of the leading retail brands for innovative value in 2024, a trend that is expected to continue into 2025.

Trader Joe’s dedicated fan base is positively addicted to the chain’s broad range of high-quality specialty items. But by maintaining a much higher private label mix than most grocers – approximately 80%, compared to an industry average of 25% to 30% – the retailer is also able to keep its pricing competitive. Trader Joe’s cultivates consumer excitement by constantly innovating its product line – there are even websites dedicated to showcasing the chain’s new offerings each season. In turn, Trader Joe’s enjoys much higher visits per square foot than the rest of the grocery category: Over the past twelve months, Trader Joe’s drew a median 56 visits per square foot – compared to 23 for H-E-B, the second-strongest performer.

Chili’s Beats QSR at its Own Game

Casual dining chain Chili’s has also been a standout on the disruptive value front this past year – offering consumers a full-service dining experience at a quick-service price point.

Chili’s launched its Big Smasher Burger on April 29th, 2024, adding the item to its popular ‘3 for Me’ offering, which includes an appetizer, entrée, and drink for just $10.99 – lower than than the average ticket at many quick-service restaurant chains. The innovative promotion, which has been further expanded since, continues to drive impressive visitation trends. With food-away-from-home inflation continuing to decelerate, this strategy of offering deep discounts is likely to continue to be a key story in 2025.

The Convenience Myth

Convenience is king, right?

Well, probably not. If convenience truly were king, visitors would orient themselves to making fewer, longer visits to retailers – to minimize the inconvenience of frequent grocery trips and spend less time on the road. But analyzing the data suggests that, while consumers may want to save time, it is not always their chief concern.

Looking at the superstore and grocery segments (among others) reveals that the proportion of visitors spending under 30 minutes at the grocery store is actually increasing – from 73.3% in Q3 2019 to 76.6% in Q3 2024. This indicates that shoppers are increasingly willing to make shorter trips to the store to pick up just a few items.

At the same time, more consumers than ever are willing to travel farther to visit specialty grocery chains in the search of specific products that make the visit worthwhile.

Cross visitation between chains is also increasing – suggesting that shoppers are willing to make multiple trips to find the products they want – at the right price point. Between Q3 2023 and Q3 2024, the share of traditional grocery store visitors who also visited a Costco at least three times during the quarter grew across chains.

Does this mean convenience doesn’t matter? Of course not. Does it indicate that value, quality and a love of specific products are becoming just as, if not more, important to shoppers? Yes.

The implications here are very significant. If consumers are willing to go out of their way for the right products at the right price points – even at the expense of convenience – then the retailers able to leverage these ‘visit drivers’ will be best positioned to grow their reach considerably. The willingness of consumers to forego convenience considerations when the incentives are right also reinforces the ever-growing importance of the in-store experience.

So while convenience may still be within the royal family, the role of king is up for grabs.

Serving Diners Quicker With Automatization

Chipotle Draws Crowds With Autocado

Convenience may not be everything, but the drive for quicker service has emerged as more important than ever in the restaurant space. Diners want their fast food… well, as fast as possible. And to meet this demand, quick-service restaurants (QSRs) and fast-casual chains have been integrating more technology into their operations. Chipotle has been a leader in this regard, unveiling the “Autocado” robot at a Huntington Beach, California location last month. The robot can peel, pit, and chop avocados in record time, a major benefit for the Tex-Mex chain.

And the Autocado seems to be paying off. The Huntington Beach location drew 10.0% more visits compared to the average Chipotle location in the Los Angeles-Long Beach-Anaheim metro area in Q3 2024. Visitors are visiting more frequently and getting their food more quickly – 43.9% of visits at this location lasted 10 minutes or less, compared to 37.5% at other stores in the CBSA.

Are diners flocking to this Chipotle location to watch the future of avocado chopping in action, or are they enticed by shorter wait times? Time will tell. But with workers able to focus on other aspects of food preparation and customer service, the innovation appears to be resonating with diners.

McDonald’s Leans into Automation in Texas

McDonald’s, too, has leaned into new technologies to streamline its service. The chain debuted its first (almost) fully automated, takeaway-only restaurant in White Settlement, TX in 2022 – where orders are placed at kiosks or on app, and then delivered to customers by robots. (The food is still prepared by humans.) Unsurprisingly, the restaurant drives faster visits than other local McDonald’s locations – in Q3 2023, 79.7% of visits to the chain lasted less than 10 minutes, compared to 68.5% for other McDonald’s in the Dallas-Fort Worth-Arlington, TX CBSA. But crucially, the automated location is also busier than other area McDonald’s, garnering 16.8% more visits in Q3 than the chain’s CBSA-wide average. And the location draws a higher share of late-night visits than other area McDonald’s – customers on the hunt for a late-night snack might be drawn to a restaurant that offers quick, interaction-free service.

Evolving Retail Formats - Finding the Right Fit

Changing store formats is another key trend shaping retail in 2024. Whether by reducing box sizes to cut costs, make stores more accessible, or serve smaller growth markets – or by going big with one-stop shops, retailers are reimagining store design. And the moves are resonating with consumers, driving visits while at the same improving efficiency.

Macy’s Draws Local Weekday Visitors With Small-Format Stores

Macy’s, Inc. is one retailer that is leading the small-format charge this year. In February 2024, Macy’s announced its “Bold New Chapter” – a turnaround plan including the downsizing of its traditional eponymous department store fleet and a pivot towards smaller-format Macy’s locations. Macy’s has also continued to expand its highly-curated, small-format Bloomie’s concept, which features a mix of established and trendy pop-up brands tailored to local preferences.

And the data shows that this shift towards small format may be helping Macy’s drive visits with more accessible and targeted offerings that consumers can enjoy as they go about their daily routines: In Q3 2024, Macy’s small-format stores drew a higher share of weekday visitors and of local customers (i.e. those coming from less than seven miles away) than Macy’s traditional stores.

Harbor Freight Tools and Ace Hardware Serve Smaller Growth Markets With Less Square Footage

Small-format stores are also making inroads in the home improvement category. The past few years have seen consumers across the U.S. migrating to smaller suburban and rural markets – and retailers like Harbor Freight Tools and Ace Hardware are harnessing their small-format advantage to accommodate these customers while keeping costs low.

Harbor Freight tools and Ace Hardware’s trade areas have a high degree of overlap with some of the highest growth markets in the U.S., many of which have populations under 200K. And while it can be difficult to justify opening a Home Depot or Lowe’s in these hubs – both chains average more than 100,000 square feet per store – Harbor Freight Tools and Ace Hardware’s smaller boxes, generally under 20,000 square feet, are a perfect fit.

This has allowed both chains to tap into the smaller markets which are attracting growing shares of the population. And so while Home Depot and Lowe’s have seen moderate visits declines on a YoY basis, Harbor Freight and Ace Hardware have seen consistent YoY visit boosts since Q1 2024 – outperforming the wider category since early 2023.

Hy-Vee Bucks the Trend by Going Big

Are smaller stores a better bet across the board? At the end of the day, the success of smaller-format stores depends largely on the category. For retail segments that have seen visit trends slow since the pandemic – home furnishings and consumer electronics, for example – smaller-format stores offer brands a more economical way to serve their customers. Retailers have also used smaller-format stores to better curate their merchandise assortments for their most loyal customers, helping to drive improved visit frequency.

That said, a handful of retailers, such as Hy-Vee, have recently bucked the trend of smaller-format stores. These large-format stores are often designed as destination locations – Hy-Vee’s larger-format locations usually offer a full suite of amenities beyond groceries, such as a food hall, eyewear kiosk, beauty department, and candy shop. Rather than focusing on smaller markets, these stores aim to attract visitors from surrounding areas.

Visit data for Hy-Vee’s large-format store in Gretna, Nebraska indicates that this location sees a higher percentage of weekend visits than other area locations – 37.7% compared to 33.1% for the chain’s Omaha CBSA average – as well as more visits lasting over 30 minutes (32.9% compared to 21.9% for the metro area as a whole). For these shoppers, large-format, one-stop shops offer a convenient – and perhaps more exciting – alternative to traditionally sized grocery stores. The success of the large-format stores is another sign that though convenience isn’t everything in 2024, it certainly resonates – especially when paired with added-value offerings.

A Resurgence of Legacy Brands

Many retail brands have entrenched themselves in American culture and become an extension of consumers' identities. And while some of these previously ubiquitous brands have disappeared over the years as the retail industry evolved, others have transformed to keep pace with changing consumer needs – and some have even come back from the brink of extinction. And the quest for value notwithstanding, 2024 has also seen the resurgence of many of these (decidedly non-off-price) legacy brands.

In apparel specifically, Gap and Abercrombie & Fitch – two brands that dominated the cultural zeitgeist of the 1990s and early 2000s before seeing their popularity decline somewhat in the late aughts and 2010s – may be staging a comeback. Bed Bath & Beyond, a leader in the home goods category, is also making a play at returning to physical retail through partnerships.

Anthropologie, another legacy player in women’s fashion and home goods, is also on the rise. Anthropologie’s distinctive aesthetic resonates deeply with consumers – especially women millennials aged 30 to 45. And by capturing the hearts of its customers, the retailer stands as a beacon for retailers that can hedge against promotional activity and still drive foot traffic growth.

And visits to the chain have been rising steadily. In Q4 2023, the chain experienced a bigger holiday season foot traffic spike than pre-pandemic, drawing more overall visits than in Q4 2019. And in Q3 2024, visits were higher than in Q3 2023.

Meeting the Evolving Needs of Millennials

And speaking of the 35 to 40 set – the generation that all retailers are courting? Millennials. Does that sound familiar? Yes, because this is the same generational cohort that retailers tried to target a decade ago. As millennials have aged into the family-formation stage of life, their retail needs have evolved, and the industry is now primed to meet them.

Sam’s Club Draws Value-Conscious Singles and Starters

From the revival of nostalgic brands like the Limited Too launch at Kohl’s to warehouse clubs expanding memberships to younger consumers as they move to suburban and rural communities, there are myriad examples of retailers reaching out to this cohort. And Sam’s Club offers a prime example of this trend.

Over the past few years, millennials and Gen-Zers have emerged as major drivers of membership growth at Sam’s Club, drawn to the retailer’s value offerings and digital upgrades – like the club’s Scan & Go technology. Over the same period, Sam’s Club has grown the share of “Singles and Starters” households in its captured market from 6% above the national benchmark in Q3 2019 to 15% in Q3 2024. And with plans to involve customers in co-creating products for its private-label brand, Sam’s Club may continue to grow its market share among this value-conscious – but also discerning and optimistic – demographic.

Taco Bell Brings in Crowds With Value Nostalgia Menu

Millennials are also now old enough to wax nostalgic about their youth – and brands are paying attention. This summer, Taco Bell leaned into nostalgia with a promotion bringing back iconic menu items from the 60s, 70s, 80s, and 90s – all priced under $3. The promotion, which soft-launched at three Southern California locations in August, was so successful that the company is now offering the specials nationwide. The three locations that trialed the “Decades Menu” saw significant boosts in visits during the promotional period compared to their daily averages for August. And people came from far and wide to sample the offerings – with a higher proportion of visitors traveling over seven miles to reach the stores while the items were available.

What Lies Ahead?

Hot on the heels of a tumultuous 2023, 2024’s retail environment has certainly kept retailers on their toes. While embracing innovative value has helped some chains thrive, other previously ascendant value segments, including discount & dollar stores, may have reached their growth ceilings. Consumers clearly care about convenience – but are willing to make multiple grocery stops to find what they need. At the same time, legacy brands are plotting their comeback, while others are harnessing the power of nostalgia to drive millennials – and other consumers – through their doors.

.svg)

.png)

.png)

.png)

.png)