.svg)

.png)

.png)

.png)

.png)

There are so many ways to say Happy New Year in Asian languages, such as “Gong Xi Fa Cai” in Mandarin, which means wishing you prosperity in the coming year, “Saehae Bok Mani Badeuseyo” in Korean, wishing you lots of luck, and “Chuc mung nam moi” in Vietnamese, with a similar meaning of wishing you a joyful year. Along with these auspicious greetings are traditional foods such as dumpling soup, mung bean pancake, BBQ beef, sticky rice cakes, and candied fruits. Within the melting pot that is the USA, one can often find an Asian-themed shopping center in which to partake of the festivities. In Westminster, CA, Asian Garden Mall is one of the largest Vietnamese shopping centers in the U.S. At The Source OC, Korean shops and eateries abound. In the Midwest, one can visit Asia Mall Minnesota, with a pan-Asian panoply of offerings.

Last year, Lunar New Year kicked off on Jan. 22, and we can see that Asian Garden Mall visits skyrocketed on that day (below)

During the summer, there is also a vibrant night market there, open from 7-11pm on the weekends. Finds include pork skewers and buns, grilled scallops, mini shrimp crepes, and sugar cane juice.

The night market takes place in the parking lot of Asian Garden Mall and draws accretive business. What would normally be empty during the Feb-May period without a night market becomes a thriving evening adventure during the summer months.

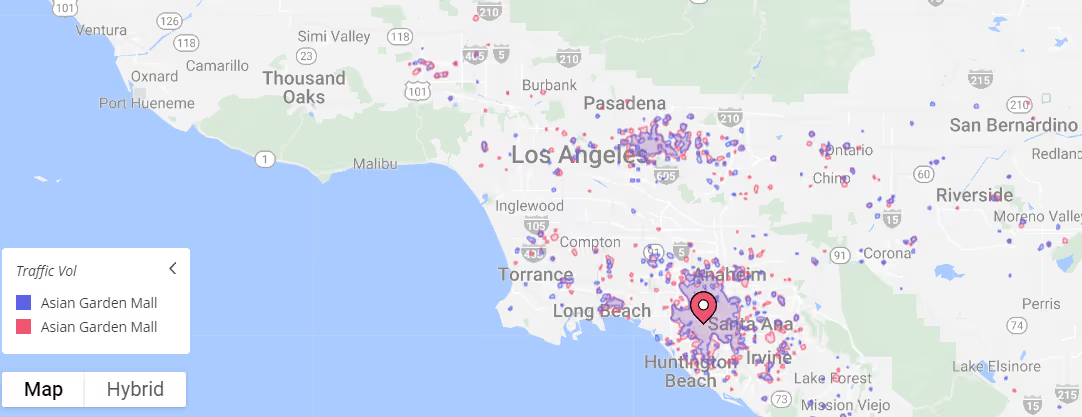

In comparing Feb-May visits (blue) versus Jun-Sept visits (red) below, the mall also draws from a much larger trade area when the night market is occurring.

In terms of festivities, parades and food stalls abound at celebrations like the Tet festival in New Orleans, which takes place this year on Feb. 16-18 in the Village de l’Est neighborhood. There will be fireworks and a dragon dance and of course vats of simmering pho, crispy spring rolls, and puffy fried bananas. In San Jose, CA, home to one of the US’s largest Vietnamese populations, a Tet celebration will be held in the former Sears parking lot at Eastridge Center from Feb 16-18. There will be a talent contest, a visit from Miss Vietnam California, carnival rides, and of course plenty of food booths and desserts.

One of the newer Korean-themed malls is the Source OC, which opened in 2019. While the majority of the food options transport you to being in Korea, there is also Italian at Il Fiora, Japanese at Izakaya Ichie, and Mexican at La Huasteca. One can indulge in Gangnam House Korean BBQ, Monday to Sunday shaved ice, and Cheesetella Japanese Cheesecake. We saw the Source OC dip during Covid like practically all retail, but it has bounced back and is now exceeding pre-Covid visitation levels. Besides the draw of the food, there is also an indoor golf-simulator, a VR experience, and a children’s playground.

Both Koreatown Plaza and Koreatown Galleria are long-standing stalwarts in the heart of LA, but as Americans of all ethnicities increasingly migrate to suburbs, we will no doubt see more shopping center options catering to ethnic tastes outside of downtowns.

The nation’s first enclosed shopping mall was Southdale Center in Edina, MN, a project that opened in 1956, by Victor Gruen, an Austrian-American who would henceforth be known as the “father of the shopping mall.” His original vision was a community hub with access to many shops as well as medical centers, schools, and even residences. This did not occur in the 50s, but three-quarters of a century later, many mall developers are re-envisioning malls to be places to live, eat, play, and shop as well as have access to essential services and to be that third space for community gatherings and celebrations. How fitting that another recent mall in Minnesota, the Asia Mall has been conceived as a reflection of the local community. It opened in November 2022, inspired by the desire for a one-stop pan-Asian mall to get all groceries as opposed to dashing around Minneapolis, St. Paul, Brooklyn Park, and Brooklyn Center to obtain the desired goods. Food and drinks are procured from various Asian countries, such as Vietnam, China, and Korea and anchored by grocery store Asian Mart 88. Dining includes Pho Mai, Hot Pot City with all-you-can-eat hot pot, Cruncheez Korean hot dogs, and Mochi Dough doughnuts. As part of the trend for including essential services, this mall also has a hair salon, insurance company, and travel agency.

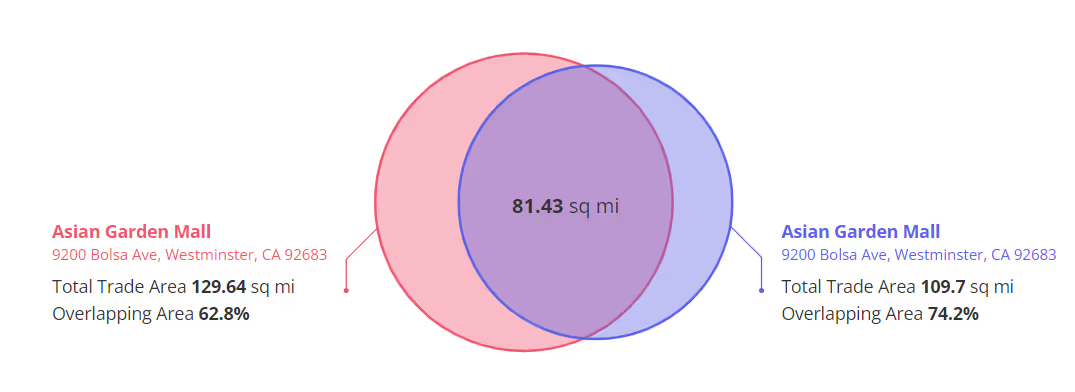

It also appears the concept of one-stop-shop, be it for Asian groceries or for warehouse-sized purchases, is prized by the inhabitants of Eden Prairie who really value efficiency. Asia Mall does half the visits of the nearby Costco, which is impressive. Besides home and work, visitors of Asia Mall are most likely to visit Costco before or after a shopping trip (below).

How did off-price leaders T.J. Maxx, Marshalls (both owned by TJX Companies), Burlington, and Ross perform in last year? And how is 2024 shaping up for the category? We dove into the foot traffic data to find out.

Off-price apparel retailers typically employ a straightforward method: sell excess or off-season merchandise that would otherwise remain unsold at a discount, benefiting both shoppers and manufacturers.

This retail model has consistently performed well, as evidenced by the consistent growth in visits to T.J. Maxx, Marshalls, Ross, and Burlington over the past few years. And despite the overall sluggishness experienced by much of the apparel retail category in 2023, visits to these stores continued to increase year-over-year (YoY) in every quarter analyzed.

.png)

January 2024 YoY visit growth slowed slightly – perhaps due to Q1 2023’s exceptionally strong performance. But despite the difficult comparison, foot traffic for most chains remained close to 2023 levels while YoY January visits to Ross increased 5.5%, highlighting the resilience of the off-price sector.

.avif)

The demographic and psychographic makeup of a chain’s trade area – which shows the types of visitors who frequent the chain – can be determined by looking at the chain’s potential or captured market. A chain’s potential market is calculated by weighing the Census Block Groups (CBGs) feeding visits to the chain according to the size of the CBG, while the captured market weighs each CBG according to the relative number of visits to the chain originating from that CBG.

Using these tools to analyze the median household income (HHI) in the trade areas of the four chains reveals a divergence between the two TJX-owned chains T.J. Maxx and Marshalls, on one side, and Ross Dress for Less and Burlington, on the other. The median HHI in T.J. Maxx and Marshalls’ potential market is higher than the potential median HHI for Ross and Burlington – and the two TJX brands’ captured market median HHI is even higher. Meanwhile, the median HHI in Ross and Burlington’s captured market is lower than the median HHI in their own potential markets.

The variance in median HHI between the chains may have to do with differences in branding and product selection. Marshalls and T.J. Maxx tend to have the higher price points, with T.J. Maxx in particular expanding its designer offerings over the past few years through its Runway stores. Ross and Burlington, known for their no-frills approach to clothing shopping, have relatively lower price points – and may see more customers seeking bargains over high fashion.

.png)

While an analysis of trade area median HHI highlights differences between the chains’ visitor bases, a deeper exploration of Marshalls, Ross, and Burlington’s trade areas suggests that the retailers also share common ground – specifically, their popularity with middle-income families. For almost all brands, the captured market share of households categorized by the Spatial.ai: PersonaLive dataset as “Family Union” and “Cultural Connections” was larger than the potential market share. T.J. Maxx, which had a slightly lower share of “Cultural Connection” households in its captured market relative to its potential market, was the sole exception.

All four chains continue to add stores to their fleets – Ross opened 97 stores in fiscal 2023, and Burlington is looking to expand in over 60 former Bed Bath and Beyond locations. Focusing on trade areas with diverse families, then, may serve Marshalls, Ross, and Burlington. And T.J. Maxx, which has been enjoying a resurgence of interest from younger shoppers, might consider expanding into areas that attract young professionals.

%20(1).avif)

Off-price apparel retailers continue to succeed despite – or perhaps because of – a challenging economic climate. Will their success continue into 2024?

Visit placer.ai to keep up-to-date on the latest data-driven retail trends.

With shopping center vacancy rates now lower than they were pre-COVID, we dove into the demographic and psychographic trade area data for leading Indoor Malls, Open-Air Shopping Centers, and Outlet Malls to understand who visited malls in 2023.

Diving into the demographics of the trade areas of the various mall types in 2023 reveal both similarities and differences between the typical visitor to Indoor Malls, Open-Air Shopping Centers, and Outlet Malls.

In all three mall types, the median trade area household income (HHI) in the three mall types was higher than the nationwide median HHI of $69.5K (according to the STI: Popstats 2022 dataset). But Open-Air Shopping Centers drew the highest income visitors, with a trade area median HHI of $87.8K in 2023. The trade area of Open-Air Shopping Centers also had the lowest share of Households with Children and the highest share of singles (One-Person and Non-Family Households).

Outlet Malls lay at the other end of the spectrum, with a trade area median trade HHI of $73.9K, the highest share of Households with Children, and the lowest share of single households. And the median HHI and household composition for the trade area of Indoor Malls stood between those of the other two types.

.avif)

Even though Outlet Malls tend to draw the highest, and Open-Air Shopping Centers draw the lowest share of family visitors (Households with Children), diving deeper into various family segments reveals a more nuanced picture.

For example, the trade areas of Outlet Malls do indeed contain the highest shares of the “Family Union” and “Promising Families” segments – defined by Experian: Mosaic as blue-collar families and young families in starter homes, respectively. But Open-Air Shopping Centers tend to draw the highest share of the more affluent “Flourishing Families” segment – perhaps thanks to the Open-Air Shopping Centers’ higher trade area median HHI.

So while the demographic analysis can provide an overall snapshot of the various mall types’ audience, diving into the psychographics can yield a higher-resolution picture of the types of shoppers frequenting each shopping center category.

.png)

For the most part, malls – especially Indoor Malls and Open-Air Shopping Centers – succeeded in exceeding or staying close to 2022 visit levels last year, despite the economic headwinds. And while January data indicates that the space may be entering a challenging period, there are plenty of reasons to think that the dip in early 2024 foot traffic is just a temporary setback driven by a unique set of circumstances. As the year continues to unfold, tracking visits in this sector will offer more insights into the state of the 2024 consumer.

For more data-driven retail insights, visit placer.ai/blog.

When we last checked in with the home improvement category, high interest rates and a cooling housing market had impacted visits to retailers The Home Depot, Lowe’s, and Tractor Supply. As 2024 gets underway, what might lie ahead for these chains? We take a look at the data to find out.

Home Depot and Lowe’s, two of the largest home improvement retailers in the country, command a significant share of the industry. The two chains experienced ups and downs over the past few years, from a pandemic-era spike in visits to a more recent slowdown as rising prices and slowing home sales led many would-be shoppers to rethink a renovation.

The turbulence in the Home Improvement space continued in 2023. In the first half of the year, foot traffic to The Home Depot and Lowe’s showed modest increases on a year-over-year (YoY) basis – but that momentum slowed into the years’ second half as home sales dropped to a six-month low.

Visit performance to these retailers may well improve in 2024. Should home sales pick up as mortgage rates continue on their expected downward trajectory, home improvement chains would likely see an increase in visits as new homeowners grab equipment for renovations.

.avif)

Analyzing median household income (HHI) of visitors to The Home Depot and Lowe’s, segmented by potential and captured markets, may provide insights into The Home Depot's stronger year-over-year foot traffic performance. (A chain's potential market looks at the Census Block Groups (CBGs) where visitors to a chain originate, weighted according to the CBG’s population. In contrast, captured market visit data reflects figures weighted by the actual number of visits from each CBG.)

The trade area median HHI tends to be higher for Home Depot than for Lowe’s in the chains’ potential markets – and the differences grow even more pronounced when analyzing the captured market. The Home Depot’s potential market median HHI stood at $71.5K/year – just slightly higher than Lowe’s $69.6K/year. But The Home Depot’s captured market median HHI was $74.3K/year in 2023 – around 4% higher than the chain’s potential market median HHI. Meanwhile, Lowe’s captured market median HHI of $69.0K/year was around 1% lower than its potential market median HHI.

The income disparity between the visitor bases of the two chains may provide context for The Home Depot’s foot traffic strength compared to Lowe’s – The Home Depot’s wealthier customers may be more insulated from the effects of inflation. And as inflation eases and demand for home renovations creeps up, Lowe’s may yet see visits tick up as its customers return to the chain.

.png)

Tractor Supply Co. – another major home improvement chain – also offers a variety of products geared toward farm and ranch living, including animal feed and farm equipment. The company was a surprising pandemic winner, seeing its sales and foot traffic grow significantly as people moved to the countryside.

The chain's popularity has remained strong even as the pandemic-induced migration trends subside and the influx of city-dwellers to rural areas slows down. Visits to Tractor Supply remained consistently high throughout 2023, with only two months experiencing YoY foot traffic lags. Tractor Supply visits also outpaced visits to the home improvement category as a whole, indicating sustained demand for farm products.

.avif)

A deeper exploration of the three home improvement chains’ psychographic compositions indicates that Tractor Supply’s popularity with rural segments (as defined by the Spatial.ai: PersonaLive dataset) may be fueling some of its sustained visit success.

All three chains saw a higher share of rural visitors in their captured market compared to their potential market – indicating that rural consumers are particularly interested in home improvement tools and products. And of the three chains, Tractor Supply served the largest share of rural visitors by far. The share of rural audience segments in Tractor Supply’s potential markets significantly exceeded the share of these segments in the trade areas of Lowe’s and The Home Depot’s, and the relative share of rural segments in Tractor Supply’s captured market was even more impressive.

Lowe’s, which has bolstered its rural presence over the past year, had the second-highest percentage of rural segments in both its potential and captured markets – although its share of rural visitors was still considerably lower than Tractor Supply’s.

Meanwhile, The Home Depot saw the smallest share of rural visitors across all rural segments analyzed. The company’s captured market had just slightly more Rural High Income and Rural Low Income visitors relative to its potential market, and there was no difference between its captured and potential market shares of Rural Average Income consumers.

The impressive over-representation of rural customers to Lowe’s and Tractor Supply suggest that the rural potential for home improvement chains is significant – and chains that tap into the segment may see further foot traffic to their stores.

.avif)

The home improvement space has seen plenty of variance over the past few years, from the pandemic-fueled DIY highs of 2020 and 2021 to the overall slowdown brought on by inflation in 2023. Will visits begin to pick up again into 2024?

Visit placer.ai/blog for the latest data-driven retail insights.

How did Target, Walmart, Costco, Sam’s Club, and BJ’s Wholesale Club perform offline last year? Who visited the chains in 2023? And what does 2024 have in store for the space? We dove into the foot traffic and trade area composition data to find out.

The superstore and wholesale space performed well across the board in 2023, with leading retailers seeing consistent year-over-year (YoY) quarterly visit growth throughout the year. Costco led the pack in terms of overall YoY visit performance, followed by Sam’s Club and BJ’s Wholesale Club. The wholesale clubs’ strength may be due in part to the chains’ attractive gas prices, which were likely particularly tempting to 2023 consumers looking to stretch their budget.

Visits to Target also remained above the chain’s 2022 baseline during all four quarters, and Walmart – which closed several stores last year – mostly beat its 2022 visit performance, with the exception of Q4 where traffic remained essentially on par with last year’s levels.

%20(1).png)

Visits to four out of five of the analyzed superstores and wholesale clubs dipped slightly in January 2024 relative to January 2023, perhaps due to comparisons to a strong Q1 2023 performance or to post-holidays consumer cutbacks. But despite the challenging circumstances, the YoY drops remained minimal – so the softer start to the year is not necessarily an indication of things to come.

And in contrast to the subdued visit performance in the rest of the category, Costco foot traffic exceeded its January 2023 visit baseline – revealing the potential for the superstore space to grow in a positive direction in 2024.

.png)

Analyzing monthly visits to leading superstore and wholesale clubs in 2023 compared to each chain’s monthly visit average reveals different consumer patterns for each brand.

While all chains saw their monthly visits peak in December, Target experienced the most significant holiday peak, with a 33.9% increase in monthly visits compared to its 2023 monthly average – more than double the increases of the other four chains analyzed. Target also saw the strongest August visit growth relative to its 2023 monthly average as parents and students likely flocked to the chain in search of Back-to-School apparel and supplies.

In June and July, Walmart’s relative visit growth exceeded that of the other four chains – possible thanks to consumers stocking up on summer supplies. And the wholesale clubs saw larger relative increases in November, as those chains’ bulk grocery offerings may have helped consumers shop for a crowd ahead of Thanksgiving dinner.

.avif)

The trade areas of all five chains analyzed included a higher share of Households with Children when compared to the nationwide average. But the two superstore brands – Walmart and Target – also had larger percentages of 1-Person and Non-Family (roommate) Households when compared to the nationwide average, while the three wholesale clubs had smaller shares.

So while average wholesale clubs and their large selection of bulk packaged items cater primarily to families, superstores seem to attract a wider range of shoppers, including consumers shopping for one and living alone or with roommates.

.png)

Diving into the psychographic composition of the trade areas highlights additional differences between the various chains’ audiences.

The trade areas of Walmart and of its subsidiary Sam’s Club had the highest share of Spatial.ai: PersonaLive’s small town and rural audience segments, including “Small Town Low Income,” “Rural Low Income,” “Rural Average Income,” and “Rural High Income.”

Suburban segments were more distributed. Walmart and Sam’s Club served a higher share of “Blue Collar Suburbs” while Target and Costco drew more “Wealthy Suburban Families” – and BJ’s Wholesale Club received the largest percentage of “Upper Suburban Diverse Families.”

BJ’s trade area also included the largest shares of almost all the urban segments with the exception of “Educated Urbanites” – defined by Spatial.ai as “well educated young singles living in dense urban areas working relatively high paying jobs” – for which Target came out on top.

.avif)

The leading superstore and wholesale clubs performed well in 2023 as consumers relied on their bulk-packaging and value-pricing to stretch their increasingly strained budgets.

What does 2024 have in store? Visit the placer.ai blog to find out.

It only comes around once every 12 years, and for those born in the Year of the Dragon, they are considered to be the luckiest of the Zodiac signs. This year’s element is wood, and thus a Wood Dragon year can portend good fortune, action, and expansion. Let’s take a look at some Asian concepts, brands, and shopping centers and see if our Placer trends indicate whether they might be in for a lucky, powerful year.

Tea drinks, especially those including tapioca pearls otherwise known as boba have created billionaires in China, and global expansion means that you can get your fill of the chewy goodies all over the world nowadays. Some of the largest chains in the US include Kung Fu Tea, with over 350 locations; Gong Cha; Sharetea with more than 500 stores in 15 locations; Boba Guys known for their famous strawberry puree matcha tea latte; and It’s Boba Time, Happy Lemon, YiFang Taiwan Fruit Tea, and Boba Loca.

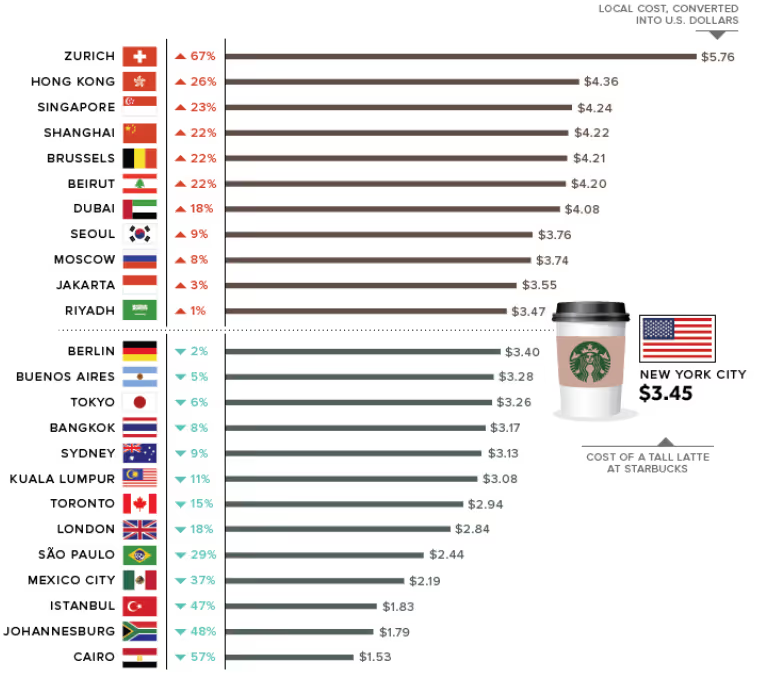

Tea has been an integral part of our global history. As a precious commodity, it was traded along the Silk Road, leading to increased transcontinental commerce. In American history, the Boston Tea Party was perhaps not so much about tea itself but about taxation and representation, but in any words, it was definitely a catalyst towards American independence. And now, thousands of years later, tea continues to be a tour de force for antioxidants, anti-aging, and an overall delicious base for a bevy of creative drinks. Economists often talk about the “latte index” - used to estimate purchasing power parity in 16 countries around the world compared to the cost of a tall Starbucks latte in NYC.

With the way things are going with teas, could a boba index not be far behind? We examined year-over-year traffic for some of the leading tea/boba chains compared to specialty coffee chains. Boba has seen gains compared to last year, usually at a higher percentage than coffee. Both beverage type chains have trended upwards in 2023, although coffee had a bit of a dip in the latter part of the year.

To be fair, one can often order a coffee at a tea store and vice versa, but there are certainly toppings and color sensations at tea stores that are uniquely suited to social media, such as butterfly pea, which is an intense shade of violet, or various vibrant toppings such as popping boba in pink and orange. In some creations, the tea is even dispensed with entirely, such as Tiger Sugar’s brown sugar boba milk with a deep caramel flavor, or their highly-coveted ice cream bar version of the drink.

For those wishing for an authentic taste of an Asian shopping mall experience during Lunar New Year, there are many options around the US including Chinese shopping malls in the west like Focus Plaza/San Gabriel Square in San Gabriel Valley, Diamond Jamboree in Irvine, Shanghai Plaza in Chinatown Las Vegas, and Great Wall Mall in Kent, WA as well as in the east like Tangram and New World Mall in Flushing, NY.

Of these malls, Diamond Jamboree is the most visited. It has local favorites like The Kickin' Crab, Hai Di Lao, and Pepper Lunch. For dessert, head on over to Meet Fresh, with its refreshing grass jelly or chewy taro balls or SomiSomi for the cutest fish-shaped pancakes and a delectable choice of soft-serve flavors like ube and sesame.

Next is Shanghai Plaza, which is located in Las Vegas Chinatown. At Shanghai Taste, one can slurp xiao long bao soup dumplings, and another favorite - sheng jian bao - which is basically the love child of the more well known bao zi (meat bun) and the aforementioned xiao long bao. Somehow, it manages to have the fluffiness of the outer dough with a burst of soup and filling inside. Add the slight crunchiness of a pan-fried base and your mouth will be amazed by the variety of flavors and textures.

San Gabriel Square, also known as Focus Plaza, is the granddaddy of San Gabriel Valley larger-than-life malls. Also lovingly named “Chinese Disneyland” it offers a famous restaurant Five Star Seafood, a 99 Ranch, as well as other restaurants and jewelry stores. It opened in 1990 and became the place where one could go to buy laserdiscs for karaoke machines, as well as buy delicacies like honey-dried mangoes or salted plums. Nearly 25 years later, it is poised for renovation as it competes with other Chinese malls in the Greater Los Angeles and Orange County area for hot new restaurants and bakeries.

Moving across the country, we have Tangram in Queens, NY. Who doesn’t love an Asian food hall, with its dizzying array of hawkers, smells, and bustle? Tangram opened its Food Hall in January 2023, with a mix of international cuisine such as Joju for Vietnamese sandwiches, Zaab Zaab for Thai food, and Na Tart for egg tarts. One unique offering at Xi’an Famous Food is their piece de resistance lamb noodles. Topped with melt-in-your-mouth lamb, the broth is composed of both cumin and chili, and the hand-pulled noodles offer you that perfect texture referred to as “qq” in Chinese, whose closest renditions for noodles in another language might be “al dente.” This food hall spans 24,000 square feet and is lit with neon to mimic the non-stop night market energy in cosmopolitan Asian cities.

Great Wall Mall in Kent, Seattle is another Pan-Asian shopping center, despite its Chinese-centric name. Anchored by a 99 Ranch market, it also includes Chinese and Vietnamese restaurants, a Korean clothing store, hair and nail salons, and home decor. Architecturally, the outside is flanked by a fortress-style wall that mimics the Great Wall of China.

Last, but not least, we have New World Mall. Another sprawling food hall awaits, with over two dozen eateries to choose from. The exciting part of visiting food halls is the ability to get to the level of regional cuisine. Whether its Chongqing xiao mian featuring spicy Sichuan noodles or knife-cut noodles from Lanzhou, one has the opportunity to try a variety of cooking styles, nuances in similar-sounding dishes, and basically explore an entire country through its diversity of tastes.

The holiday shopping season traditionally stretches from Black Friday to New Years Eve: Shoppers looking to snag deals, purchase gifts, or enhance their celebrations drive visit spikes at retailers across the country. And although many consumers expressed concern over high prices impacting their holiday budget, spending in 2024 actually increased compared to 2023, with brick-and-mortar stores playing a key role in last year’s holiday season.

So where were the largest holiday spikes? How did last year’s calendar configuration impact retail traffic? Which segment came out ahead – and how did dining fit into the mix? Most importantly – what can we learn from the 2024 holiday season to prepare for 2025?

The holiday shopping season is the busiest time of the year for many retail categories. Between Black Friday and December 31st 2024, daily visits to brick-and-mortar stores increased 12.7%, on average, compared to the rest of the year.

Department stores led the pack, with visits to the segment 102.1% higher than the pre-holiday season average – likely aided by strong Black Friday performances. Other favorite gifting categories, including beauty & self care (72.7%), hobbies, gifts & crafts (60.9%), recreational & sporting goods (55.5%), clothing (41.8%), and electronics stores (32.7%) also received significant traffic boosts. Shopping centers benefited as well with a 24.8% increase in daily visits over the holiday season. Retailers in these segments can capitalize on their holiday popularity and stand out amidst the crowd by promoting their brand early and ensuring their staffing and inventory can accommodate the season’s traffic increases.

The holidays are also a time for entertainment – and purchasing gifts for hosts – which likely helped drive the 48.4% and 41.7% traffic increases at liquor stores and at furniture & home furnishings retailers, respectively. Superstores and discount & dollar stores – with their selection of affordable giftable products and entertainment essentials – also saw holiday-driven visit bumps of 21.2% and 20.2%, respectively. Retailers may choose to highlight seasonal items and hosting-friendly products to increase these traffic bumps in 2025.

Pet stores & services received a smaller (10.0%) bump than the wider retail average – indicating that, although some shoppers buy gifts for their fur babies, pets may not be at the top of most Americans’ gift lists. And visits to the home improvement segment were essentially on par with the pre-holiday period – indicating that the holidays are not the time for extensive home renovation projects. But home improvement chains looking to get in on the holiday action might consider promoting decorations and smaller giftable items in December.

And despite the grocery frenzy of Turkey Wednesday and Christmas Eve Eve, the Grocery segment received a relatively minor holiday boost of 5.0% – perhaps due to holiday travelers skipping their weekly grocery haul. Grocers who lean into prepared foods or pre-packaged meal kits might get an additional bump.

Although the holidays drive retail visit surges across the country, some regions see a bigger traffic bump than others.

In December 2024, almost all 50 states (with the exception of Wyoming ) received a holiday-driven retail traffic boost ranging from a 3.3% (Montana) to a 16.8% (New Hampshire). On a regional basis, the South received the largest increase: The West South Central, East South Central, and South Atlantic divisions received a collective 12.2% increase in daily visits between Black Friday and New Years Eve compared to the pre-Black Friday daily average. (Washington, D.C. saw a slight visit decline of 0.4%, likely due to the many residents leaving the capital for the holiday break.) Retailers in this region may choose to increase staffing and inventory ahead of the 2025 holiday season to handle the increased demand.

Meanwhile, the Midwest region had the smallest holiday-driven traffic spike (9.2%) – despite starting the season ahead of the pack, with the highest Black Friday weekend visit boost. This suggests that Midwestern retailers may have more success with early promotions than with last-minute discounts.

While the holiday season drove an overall retail visit boost nationwide, diving deeper into the data reveals that different retail segments peak at different points of the holiday season.

Most categories – especially the ones that tend to offer steep post-Thanksgiving discounts, such as recreational & sporting goods, department stores, electronics stores, and beauty retailers – received the biggest visit spikes on Black Friday. Retailers in these categories may benefit from promotional campaigns ahead of Thanksgiving to cater to early shoppers and maximize their performance on their busiest day.

Other segments that carry more affordable gifts, stocking stuffers, and food items gained momentum as Christmas approached – with superstores visits spiking on December 23rd and discount & dollar stores peaking on December 24th. These retailers may get even larger end-of-year visit bumps by offering discounts and bundles to last-minute shoppers.

The grocery segment received its largest boost ahead of Thanksgiving, with visits also surging on the days before Christmas as home cooks picked up supplies for the holiday dinner. Grocers who can save their shoppers time during this busy period by offering curbside pickup, pre-prepped ingredients or meal kits, and other conveniences may see particularly strong performances in 2025.

Calendar shifts also play an important role in shaping holiday shopping patterns. Last year, Super Saturday and “Christmas Eve Eve” – each a significant milestone in its own right – coincided on December 23rd, 2023 to create a supercharged shopping event that generated massive visit spikes at retailers across categories.

But in 2024, when the milestones occurred separately, important differences emerged between retailers. Gift-shopping destinations like Macy’s, Nordstrom, and Best Buy saw bigger visit spikes on Super Saturday, while retailers like Target, Walmart, and Costco – carrying both gifts and food items – saw visits surge higher on December 23rd. Dollar Tree, a prime destination for affordable stocking stuffers, also experienced a more pronounced visit spike on Super Saturday.

Predictably, this year’s pre-Christmas milestones generally drove smaller individual visit spikes, as shoppers spread their errands across a longer period. But the stand-alone Super Saturday on December 21st 2024 also allowed consumers to prioritize gift-shopping on Saturday and shop for groceries and last minute stocking stuffers on December 23rd – benefiting certain retailers.

Nordstrom, for instance, saw visits soar to 215.9% above the chain’s 2024 daily average on December 21, 2024 – surpassing the 196.2% increase recorded on December 23, 2023. Macy’s also experienced a slightly higher Super Saturday visit boost this year. Next year, retailers can expect another spread-out pre-Christmas shopping period, with Super Saturday falling on December 20th, 2025 – five days before the holiday. Gift-focused retailers can leverage this timing by ramping up promotions in the run-up to Super Saturday – or by enhancing offerings on December 23rd to capture more late-season shoppers.

Big box retailers like Target, Walmart, and Costco, conversely, can double down on December 23rd or amplify earlier deals to capture a larger share of Super Saturday traffic. And retailers across categories can benefit from the more extended last-minute shopping period by implementing multi-day sales and promotions that encourage repeat visits and drive traffic throughout the week.

Turkey Wednesday – the day before Thanksgiving – is traditionally the grocery sector’s time to shine. And this year didn’t disappoint: On November 27th, 2024, visits to traditional grocery mainstays like Kroger, Safeway, and H-E-B shot up by a remarkable 66.9% to 79.2% compared to the 2024 daily average. And on December 23rd, foot traffic to the chains rose once again, though somewhat more moderately, as shoppers geared up for Christmas celebrations.

But the holiday season stock-up, it turns out, is about more than just food. Whether to help smooth out the rough edges of family interactions or to take celebrations to the next level, consumers also make pre-holiday runs to liquor stores. On Turkey Wednesday, leading spirit purveyors outperformed traditional grocery stores with epic 140.1% to 236.5% visit spikes. And the day before Christmas Eve was an even bigger milestone for the segment, with foot traffic skyrocketing by a staggering 153.6% to 283.8% above daily averages.

Ethnic supermarkets – chains like El Super and Vallarta Supermarket – also thrived on these traditional pre-holiday grocery store milestones. But like liquor stores, they saw bigger visit spikes on December 23rd, as customers likely sought out ingredients for their festive holiday dinners.

Grocery stores seeking to maximize the power of these pre-holiday milestones in 2025 could enhance their liquor selections and launch targeted promotions in the lead-up to both Thanksgiving and Christmas.

Dining venues are also impacted by the rhythms of the holiday season – but each segment within the dining industry follows its own unique seasonal trajectory.

Visits to the fast-casual, coffee, and fine-dining segments increased the week before Thanksgiving, with fast-casual and coffee visits peaking on Wednesday and fine-dining peaking on Thanksgiving day. Both coffee and fine-dining chains also received a small traffic bump on Black Friday, with coffee traffic likely aided by consumers looking to refuel during their shopping.

But beginning in mid-December, the fine-dining category pulled ahead of the other dining segments, picking up steam as the month wore on before peaking on December 23rd and 24th. And while traffic predictably declined on Christmas Day, the drop was less pronounced than for the other analyzed segments. Fine dining then resumed its strong showing on December 26th, maintaining elevated visits through the following days, potentially reflecting its appeal as a festive holiday dining destination for families.

Coffee chains and fast-casual restaurants also enjoyed moderately elevated December traffic, with smaller visit spikes on December 23rd. Traffic to both segments then slowed during the holiday – though coffee chains continued to see higher-than-average foot traffic on Christmas Eve – before tapering off as the month drew to a close.

Looking ahead to 2025, each dining segment can take steps to maximize its holiday impact. Fine dining chains can attract more special-occasion celebrants with unique holiday-themed menu items – paired with targeted promotions that make its premium offerings more accessible to families. Meanwhile, fast-casual and coffee chains can capitalize on high-traffic days like December 23rd by catering to the needs of busy holiday shoppers – extending operating hours and offering streamlined ordering and pickup options.

The 2024 holiday season proved strong for most retail categories, with each retail category displaying a different holiday visit pattern. This year’s calendar layout also presented a unique advantage, with a longer stretch between Super Saturday and Christmas compared to last year.

By analyzing 2024 holiday regional visit trends, understanding the role that each year’s specific calendar configuration plays in shaping consumer behavior, and identifying the unique retail milestones for each chain and category, retail and dining stakeholders can refine their strategies and make the most of the 2025 holiday season.

Placer.ai observes a panel of mobile devices in order to extrapolate and generate visitation insights for a variety of locations across the U.S. This panel covers only visitors from within the United States and does not represent or take into account international visitors.

Professional sports are big business – the industry is valued at nearly $1 billion in the United States alone. And beyond the economic impact of actual ticket sales and stadium and sponsorship gains, major sporting events can have significant impacts on local industries such as tourism, dining, and hospitality. Cities hosting sports events tend to see influxes of visitors who boost tourism, spend money at restaurants and hotels, and create ripple effects that benefit entire local economies.

The 2024 Copa América, typically held in South America but hosted in the United States this year, provides a prime example of the effect sports tourism can have on local economies. The games kicked off in Atlanta, Georgia on June 20th, 2024, before moving on to other host cities and boosting hospitality traffic along the way.

This white paper dives into the data to see how the games impacted hotel visits in cities across America – and especially in Atlanta. The report uncovers the hotel tiers and brands that saw the largest visit boosts and explores visitor demographics to better understand the audiences drawn to the event.

The Copa América took place in June and July 2024, with fourteen cities – mainly across the Sunbelt – hosting games. Thousands of fans attended each event, driving up demand in local hotel markets.

Arlington, TX, saw the largest hotel visit bump during the week it hosted the games, with hospitality traffic up 23.0% compared to the metro area's weekly January to September 2024 visit average. Orlando, FL, too, enjoyed a significant visit spike (22.1%), followed by Kansas City, KS-MO (17.4%).

The Atlanta metropolitan area, for its part, also saw a significant 11.0% increase in hotel visits during its hosting week compared to the city’s weekly visit average.

The Copa América games attracted fans from across the country – from as far away as Washington State and New Hampshire, as well as from neighboring states like Florida. On the day the tournament began, 26.1% of the domestic visitors to Atlanta’s Mercedes-Benz Stadium came from over 250 miles away, up from an average of 19.7% during the rest of the year (January to September 2024). These out-of-towners likely had a significant impact on Atlanta’s local economy – through spending on accommodations, dining, and entertainment.

During the week of the Copa América game, all of the analyzed hotel types in Atlanta received a visit bump. And while some of these visits were likely unrelated to the game, the massive scale of the event means that a significant share of the visit growth was likely driven by out-of-town soccer fans. Analyzing these patterns Atlanta can provide valuable insights for hospitality stakeholders looking to attract attendees of major sporting events.

Upper Midscale hotels saw the biggest boost during the week of the event, with visits 20.8% higher than the weekly visit average between January and September 2024. Midscale and Upscale hotels also experienced significant visit increases of 15.8% and 14.0%, respectively. During the same period, visits to Luxury hotels grew by 9.0% and Economy Hotel visits rose by 7.0% compared to the January to September 2024 weekly average. Meanwhile Upper Upscale Hotels received the smallest boost, with visits up by 2.9%.

Judging by these travel patterns, it appears that most Copa América spectators prefer to stay at Midscale, Upper Midscale, or Upscale hotels during the trip.

While Upper Midscale Hotels in the Atlanta-Sandy Springs-Alpharetta metro area generally experienced the biggest visit boost during the Copa América, visit performance varied somewhat from chain to chain. TownePlace Suites and Fairfield Inn, both Upper Midscale Marriott properties, saw increases of 27.5% and 25.3%, respectively, compared to their January to September 2024 weekly averages. Other chains in the tier also enjoyed visit boosts – visits to Home2 Suites by Hilton and Hampton Inn – both Hilton chains – jumped by 17.3% and 17.4%, respectively, during the same period.

The popularity of these Upper Midscale hotels may be driven by a multitude of factors. Some, like TownePlace Suites and Home2 Suites offer kitchenettes, something that may appeal to visitors looking to save by preparing their own meals. Others, such as Fairfield Inn and Hampton Inn which offer more locations closer to the stadium may attract visitors that prioritize convenience.

Layering the STI: PopStats dataset onto Placer.ai’s captured market can provide insights into Copa América attendees by revealing the demographic attributes of census block groups (CBGs) contributing visitors to the Mercedes-Benz Stadium. (The CBGs feeding visitors to a chain or venue, weighted to reflect the share of visitors from each one, are collectively referred to as the business’ captured market.)

During the Copa América opener,Mercedes-Benz Stadium drew visitors from CBGs with a median household income (HHI) of $90.0K – well above the national median of $76.1K and similar to the median HHI during the Taylor Swift concert ($90.6K). The stadium’s trade area median HHI was even higher during the Super Bowl ($117.9K).

This visitor profile suggests that Copa América attendees – along with guests of other major cultural and sporting events – often have the means to splurge on comfortable, mid-range hotels for their stays. As Atlanta gears up to host the College Football National Championship in January 2025, the 62nd Super Bowl in February 2028, and the MLB All Star Game in July 2025, along with a host of smaller-scale events – the city can draw on historical data from past events, including the Copa América, to better understand the needs and preferences of stadium visitors and plan accordingly.

And although Upper Upscale hotels generally experienced relatively subdued growth during the Atlanta Copa América opener, some Upper Upscale properties – including Marriott’s Autograph Collection Twelve Downtown, saw visits jump. Visits to the hotel were up 19.7% during the week of the Copa América compared to the January to September 2024 weekly average.

The Twelve Downtown has become a popular lodging choice for major events in the city, likely due to its proximity to Mercedes-Benz Stadium. (The hotel is located just over a mile away from the stadium). During the Super Bowl LIII five years ago, the Twelve Downtown drew 27.9% more visits than its weekly average for January to September 2019. And during the 2023 Taylor Swift concert, the hotel saw a 25.5% visit bump.

A closer look at the median HHI of the hotel’s captured market during the three periods reveals that, despite each event attracting visitors from varying income brackets, the median HHI of visitors to the Twelve Downtown remained stable. Visitors to the hotel between January and September 2024 came from trade areas where the median HHI was $76.2K, not far off from the median HHI during the 2019 Super Bowl ($75.4K), Taylor Swift’s 2023 concert ($80.6K) and the Copa América ($76.7K).

This stability suggests that, regardless of the event, hotels attract a specific visitor base. And understanding the similarities within the demographic profiles of likely hotel visitors during different events will be key for hotels at all levels seeking to capitalize on the economic opportunities created by major local events.

The Mountain region offers employment opportunities, affordable housing, outdoors recreation, and a relatively low cost of living – which could explain why these states are emerging as major domestic migration hubs. Idaho, Nevada and Wyoming in particular have consistently attracted inbound domestic migration in recent years, as Americans continue leaving higher density regions in search of greener – and calmer – pastures.

This report uses various datasets from the Placer.ai Migration Trends Report to analyze domestic migration to Idaho, Nevada, and Wyoming. Where are people coming from? And how is recent migration impacting local population centers in these states? Keep reading to find out.

Idaho emerged as a domestic migration hotspot over the pandemic, as many Americans freed from the obligation of in-person work relocated to the Gem State. Between June 2020 and June 2024, Idaho saw positive net migration of 4.7%, more than any other state in the U.S. (This metric measures the number of people moving to a state minus the number of people leaving – expressed as a percentage of the state’s total population.) And between 2023 and 2024, Idaho remained the nation’s top domestic migration performer (see map above).

Diving into the data reveals that though people moved to Idaho from across the U.S., most of Idaho’s influx over the past four years came from neighboring West Coast and Mountain States – especially California. Former residents of the Golden State accounted for a whopping 58.1% of inbound migrants to Idaho over the analyzed period.

California’s position as the top feeder of relocators to Idaho during the analyzed period may come as no surprise, given the state’s recent population outflow and the many former California residents who have settled in the Mountain region. But Washington, Oregon, and Nevada – where inbound and outbound migration remained relatively even in recent years – have also been seeing shifts to Idaho.

Idaho has a lower tax burden, robust employment opportunities, and greater overall affordability than its top four feeder states. So some of the recent relocators likely moved to the Gem State to enjoy better economic opportunities while staying relatively close to their states of origin. And these recent Idahoans may be reshaping Idaho’s demographic and economic landscape in the process.

Most inbound migration to Idaho is concentrated in the state’s metro areas, with Boise – the capital of Idaho and the major city closest to California – consistently absorbing the highest share of net inbound migration.

But recently, other CBSAs have emerged as key destinations for new Idahoans. The location of two emerging domestic relocation hubs in particular suggests that many new Idaho residents may be looking to stay close to their areas of origin: Coeur d’Alene, located near the border with Washington, attracts its largest contingent of new residents from the Spokane, WA metro area, while Twin Falls’ top feeder area is the Elko CBSA in northern Nevada.

Twin Falls in southern Idaho has a strong job market – and has received a substantial share of inbound domestic migration over the past three years. Coeur d’Alene is also flush with economic opportunities, and after declining steadily for several years, the share of relocators heading to the metro area increased to 20.7% between June 2023 and 2024.

The chart above also reveals that the share of inbound migration heading to Boise declined slightly between June 2023 and June 2024 – following a period of consistent growth between June 2020 and June 2023 – even as the share of migration to Coeur d’Alene ballooned. This may mean that, although the state’s largest metro area may have reached its saturation point, other areas in the state are still primed to receive inbound migration.

While Nevada is losing some of its population to nearby Idaho, the Silver State is also gaining new residents of its own: Between September 2020 and September 2024, the Silver State experienced positive net migration of 3.3%. And the data indicates that many new Nevadans are choosing to settle in the state's rapidly growing suburban centers.

Zooming into the Las Vegas-Henderson CBSA reveals that much of the growth is concentrated outside the main city of Las Vegas. Instead, the more suburban cities of Enterprise, Henderson, and North Las Vegas received the largest migration bump – with Henderson and North Las Vegas’ population now surpassing that of Reno. And while year-over-year migration trends suggest that the growth is beginning to stabilize, Enterprise and Henderson are still growing significantly faster than the CBSA as a whole – indicating that the suburbs continue to draw Nevada newcomers.

Analyzing the inbound domestic migration to Enterprise – one of the fastest growing areas in the country – may shed light on the aspects of suburban Las Vegas that are driving population growth.

Many new Enterprise residents moved to the city from elsewhere in Nevada, while most out-of-state newcomers came from California or Hawaii – mirroring the migration patterns for Nevada as a whole. And according to the Niche Neighborhood Grades dataset, Enterprise is a good fit for retirees and young professionals alike, with the city ranking higher than its feeder areas with regard to a range of factors – from jobs and commute to weather.

Like with migration to the rest of the Mountain region, domestic migration to Nevada – particularly to suburban areas like Enterprise and Henderson – is likely driven by newcomers looking for more economic opportunities along with higher quality of life.

Wyoming – currently the least populous state in the country – is another Mountain region state where inbound migration is driving up the population numbers. But in the Cowboy State, urban areas – as opposed to suburban ones – seem to be the main magnets for population growth.

The Cheyenne, Wyoming CBSA – home to Wyoming’s capital – is the largest metro area in the state. And analyzing the CBSA’s population trends over the past six years reveals a recent shift in Wyoming’s inbound migration patterns.

Cheyenne’s population is mostly suburban, and the CBSA’s suburban areas remain popular with newcomers – suburban Cheyenne has also seen steady population growth since January 2018. But when the CBSA became a popular relocation destination over the pandemic, many newcomers to the Cheyenne region chose to move to metro area’s more rural areas: By April 2022, Cheyenne’s rural population had jumped by 10.8% compared to a January 2018 baseline, compared to a 5.9% and 3.9% increase in the CBSA’s suburban and urban populations, respectively.

As the country opened back up, however, the number of rural Cheyenne residents dropped back down – and by September 2024, Cheyenne’s rural population was only 0.1% bigger than it had been in January 2018. The population growth in suburban Cheyenne also slowed down, with the September 2024 suburban population numbers more or less on par with the April 2022 figures.

Now, Cheyenne’s urban areas have overtaken both rural and suburban areas in terms of population growth: In September 2024, Cheyenne’s urban population was 9.4% bigger than in January 2018, compared to 5.2% and 0.1% growth for the suburban and urban areas, respectively.

Despite the growth in Cheyenne’s urban population, the suburbs still remain the most populous – as of September 2024, 71.2% of the CBSA’s population resided in suburban areas. But the continued growth of Cheyenne’s urban population may reflect a rising demand among Wyomingites for amenities and economic opportunities unavailable elsewhere in the state, mirroring the trend in Idaho’s urban CBSAs such as Boise and Coeur d'Alene.

Cheyenne’s urban growth could be partially due to shifts in migration patterns. At the height of the pandemic, most newcomers to Cheyenne were coming from out of state, perhaps drawn by the quiet and spaciousness of rural Wyoming. But since 2022, the share of migration to Cheyenne from within Wyoming has grown – coinciding with the population increase in its urban areas and suggesting that Cheyenne's amenities are attracting more residents statewide.

This growing intra-state migration to Cheyenne’s urban areas underscores the city’s evolving role as a hub within Wyoming, appealing not just to newcomers from outside the state but increasingly to Wyoming residents seeking the benefits of a more urban lifestyle relative to the rest of the state.

The Mountain States are solidifying their status as key migration hubs in the U.S., driven by economic opportunities, affordable living, and lifestyle appeal. Between September 2023 and September 2024, Idaho, Nevada, and Wyoming all experienced significant population growth due to inbound domestic migration. In Idaho, newcomers from neighboring states are boosting the population of the Gem State’s major metro areas. Meanwhile the Cheyenne, Wyoming, CBSA is emerging as a focal point for intra-state migration, with urban Cheyenne seeing particularly pronounced growth. And in Nevada, suburban hubs like Henderson and Enterprise are welcoming new arrivals seeking a balance of suburban comfort and economic potential. With the cost of living continuing to increase – and the Mountain region offering something for everyone through its various states – Idaho, Nevada, and Wyoming are likely to remain top migration destinations in 2025 and beyond.